BCG’s 2024 Global Investor Survey—fielded following the US elections—finds investors optimistic about the economy and capital markets over both the next twelve months and the next three years, but at the same time expecting relatively modest returns. Worries about inflation and interest rates are easing, but concerns related to the impact of geopolitics on corporate and market performance are on the rise. In this environment, investors want companies to pursue a thoughtful corporate strategy that focuses on value creation.

This article highlights key findings of the survey. The slideshow provides a more detailed picture of the results.

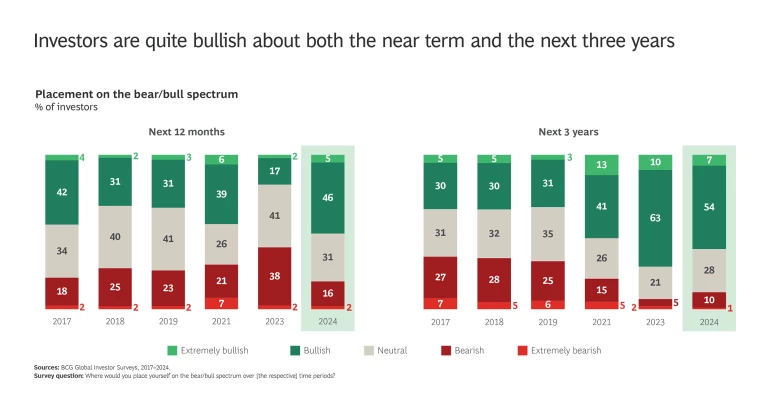

Investors are quite bullish regarding the next three years—and are much less concerned about the short term than they were in our February 2023 survey.

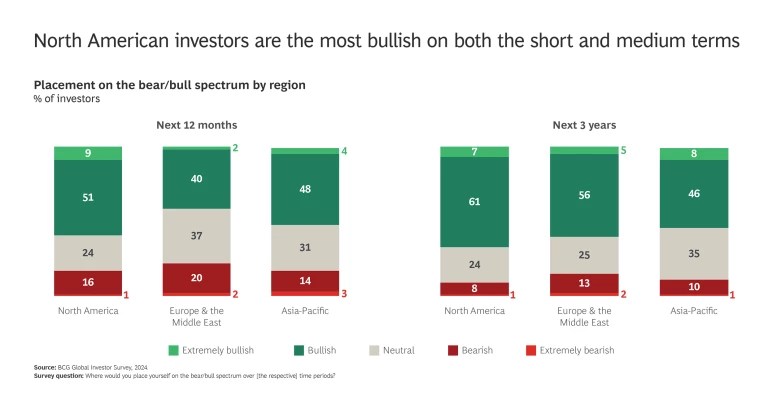

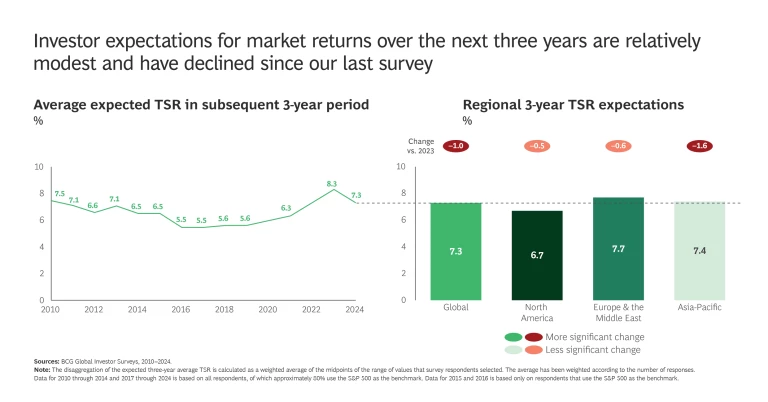

Nearly two-thirds (61%) of respondents are bullish for the next three years—the second highest level in the history of the survey—and 51% are bullish for the next twelve months, the highest since 2013. (See “About the Survey.”) Across regions, North America (NA) leads on this metric, with 68% bullish for the next three years and 60% for the next twelve months. Europe and the Middle East (EME) ranked the lowest on bullishness for the next year at 42%, while Asia-Pacific (AP) is least bullish for the next three years at 54%. Despite their positive outlook, investor expectations for average annual total shareholder return (TSR) for the next three years are relatively modest at 7.3% globally, a full percentage point lower than in our prior survey, perhaps because some of their enthusiasm is already baked into today’s elevated valuations. That said, it is still the third highest return expectation in the 13 editions of our survey going back to 2009.

About the Survey

Approximately 90% of the survey respondents are portfolio managers and buy-side analysts. They cover a broad spectrum of investing types and styles, including value, income, growth at a reasonable price, and core growth. Approximately 90% of the respondents said that their typical investment horizon is longer than one year, and 64% said that it is longer than three years.

Investors are not blind to the possibility of a market decline and see the market as being overly optimistic on many issues.

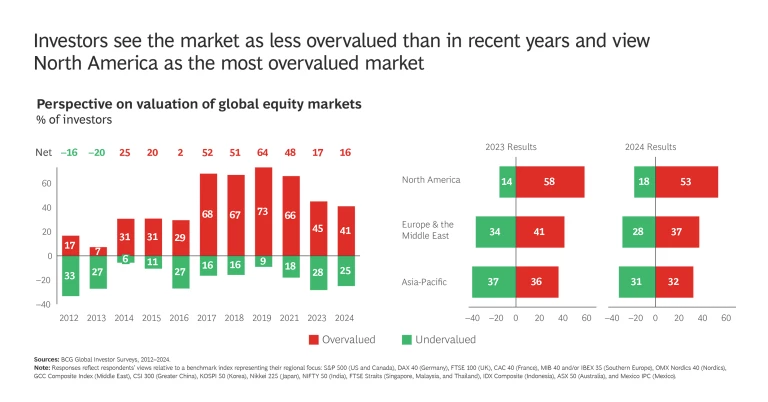

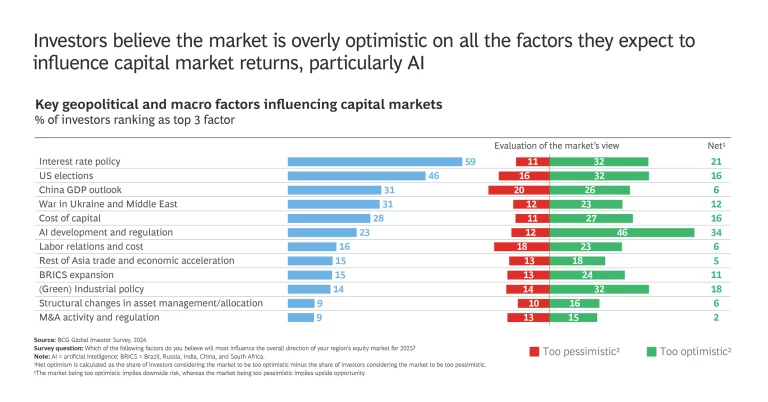

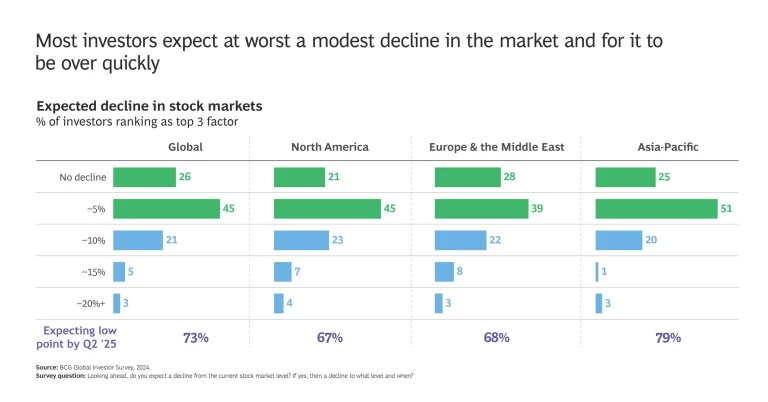

When considering the possibility of a market decline within the next three years, investors believe it will be modest—with a near majority expecting a decline of 5% of less. They also expect it to be over quickly, with nearly three-quarters anticipating either no decline or for the low to be reached by the end of the second quarter of 2025. And while 75% of investors see the equity markets as either fairly valued or overvalued, only 17% view it as overvalued by more than 10%. That said, investors think that the market is currently overly optimistic in several areas, first and foremost on the impact of AI, where 46% feel that market is too enthusiastic. Three factors are tied for second place in investor’s perspectives on excess market enthusiasm: interest rate policy, the policies of the incoming US administration, and green industrial policy—all coming in at 32%. Concerns about market exuberance appear to be most pronounced in NA, where more than half of investors consider the market to be overvalued, which is consistent with their more subdued three-year market return expectations of 6.7% average annual TSR for the S&P 500.

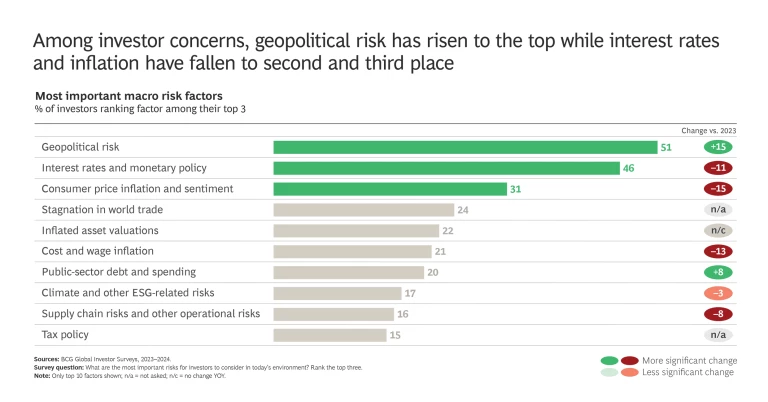

Investor concern over interest rates and inflation has declined significantly.

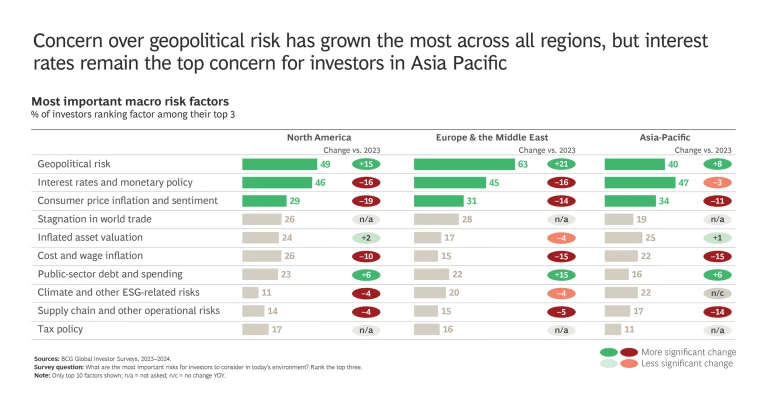

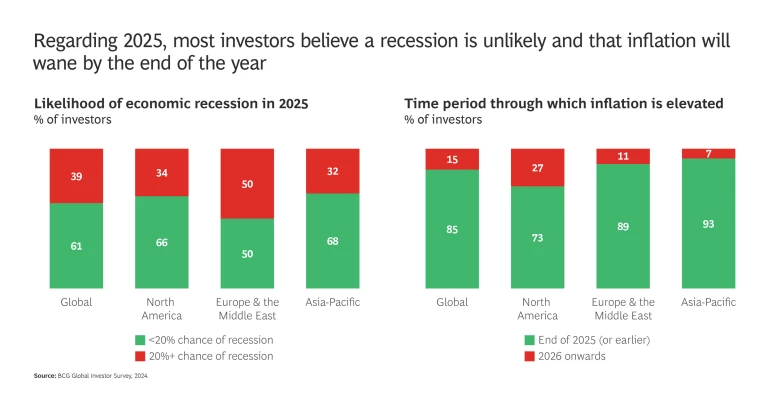

In the prior edition of the survey, when asked to name the top three risks investors should consider, interest rates and monetary policy topped the list and consumer price inflation came in second. In the latest survey, interest rates fell to second place overall, declining 11 percentage points to 46% of investors (except in AP, where it remained in first place)—and inflation fell to third, declining 15 percentage points to 31%. Overall, 85% of investors expect inflation to wane by the end of 2025. Moreover, they see a recession in 2025 as low probability with 61% globally rating the chance for recession at 20% or less. EME investors are split on the recession question with half rating the probability of a 2025 recession at 20% or above, a significant improvement over their perspectives in the last survey.

Globally, geopolitical risk has become the top concern for investors.

Geopolitical risk was cited by 51% of all investors among their top three risks—more than any other factor—an increase of 15 percentage points from our last survey. Looking regionally, it also increased more than any other factor, jumping 15 percentage points in NA, 21 percentage points in EME, and 8 percentage points in AP. These results are not surprising since at the time of our last survey, while war was already raging in Ukraine, the conflict in the Middle East had not yet erupted. And it should be noted that navigating geopolitical risk demands a different mindset for leaders.

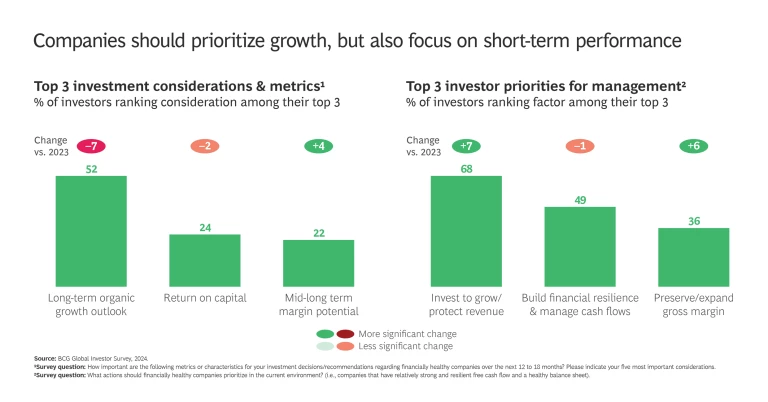

Investors want companies to invest for growth, but also to keep their eyes on the bottom line.

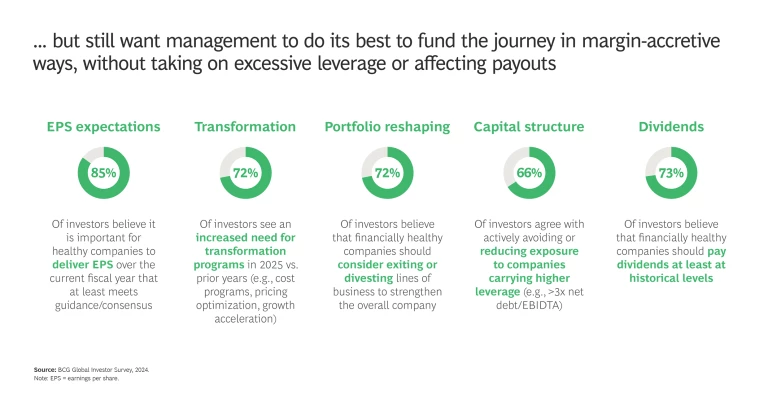

Looking at investors’ recommendations for the types of moves financially healthy companies should make, 68%—more than any other factor—want management to invest to grow and protect revenues. But their second and third most-cited priorities add some guardrails, with 49% recommending building financial resilience and managing cashflows and 36% wanting a focus on preserving or expanding gross margins. Relatedly, 85% of investors expect companies to deliver earnings per share (EPS) that at least meets consensus.

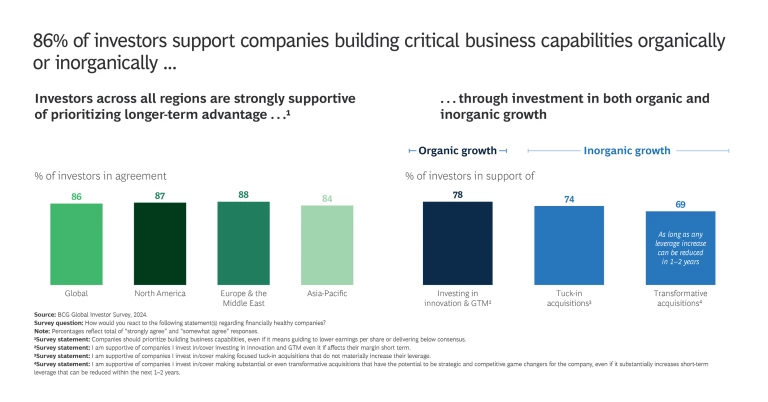

At a more tactical level, investors are open to transformational moves but expect management to deploy capital thoughtfully.

A resounding 86% of investors say they want companies to prioritize building critical business capabilities, even at the expense of lower EPS. And over two-thirds of investors support companies building those capabilities inorganically, through tuck-ins (74%) or transformational deals (69%). However, it’s clear they don’t want companies to mortgage their future, with 66% having reduced their investments in companies with elevated leverage and 73% expecting companies to pay dividends at least at historical levels. Finally, they want management to work harder than ever to generate or free up cash to fund their priorities via divestitures (72%) and transformation initiatives (72%) that lower costs and accelerate growth.

At the end of the day, investors want management to focus on being both a great company and a great stock. This requires a strategy that delivers attractive growth, supported by operational excellence, and a disciplined approach to capital allocation that produces strong and durable financial fundamentals balanced across growth, profitability, and cash generation.