Better health care for women is good business.

Caring for women’s health extends far beyond maternity, sexual, and reproductive issues. The full scope includes other common conditions that affect women exclusively, differently, or disproportionately, such as menopause, osteoporosis, Alzheimer’s disease, and cardiovascular issues.

One or another of those conditions affects every woman in the country, but today much of the care falls short:

- Only one in four women treat symptoms related to menopause.

- Women account for eight of ten people with osteoporosis, yet more than two-thirds of women with the condition remain undiagnosed.

- Women make up two-thirds of the population with Alzheimer’s disease, yet one in three are never diagnosed, and one in five are diagnosed but never treated.

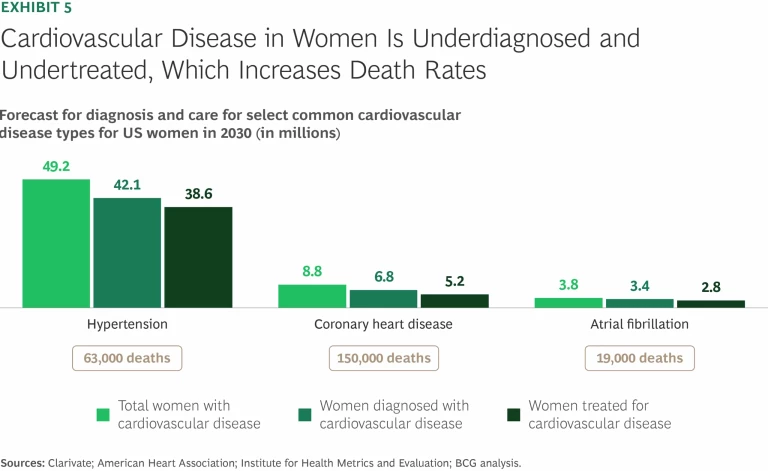

- Cardiovascular disease is the leading cause of death for women but remains underdiagnosed and undertreated, which worsens outcomes.

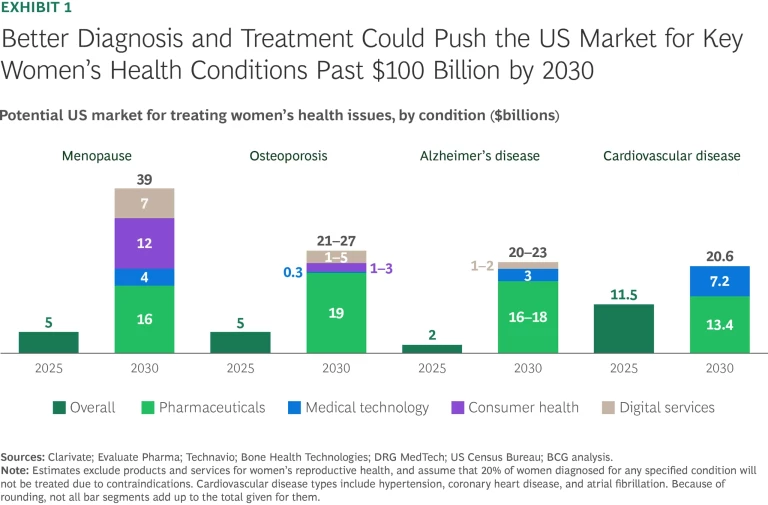

The persistent levels of underdiagnosis and undertreatment have created a massive gap in the health care market for US women. The opportunity to expand that market by addressing the gaps is also huge. According to new BCG research, proper screening and better care for US women for these four common conditions represents an opportunity of more than $100 billion. (See Exhibit 1.)

Innovations in diagnostics could expand the potential market further, as could better treatment for other common conditions that affect women’s health—including autoimmune diseases and mental and metabolic health issues, to name a few.

Like diagnosing a patient, capitalizing on the opportunity requires a thorough understanding of the dynamics associated with specific health conditions and the ability to pinpoint issues that have limited growth of markets for their diagnoses and treatment. It also requires companies to innovate to make up for decades of underinvestment.

Stay ahead with BCG insights on the health care industry

Sizing the Market for Improving Women’s Health

To begin to understand the potential market value of improving health care for US women, we zeroed in on four common conditions: menopause, osteoporosis, Alzheimer’s disease, and cardiovascular disease. For each, we identified and analyzed the barriers to better diagnosis and treatment. We looked at how the prevalence of each is likely to change in the future. We also assessed how proper diagnosis and treatment—according to already-established guidelines—could increase the size of markets for related pharmaceuticals, medical technology, consumer health products, and digital services.

Menopause

Menopause is a natural life stage for women that is defined by the absence of menstrual periods for 12 consecutive months. Symptoms occur across three stages that, back to back, can extend up to 10 or 15 years: perimenopause, menopause, and post-menopause. Most women experience at least one symptom of menopause during each of these stages, including hot flashes, night sweats, mood swings, hair and skin changes, joint pain, and anxiety.

Today, only a quarter of women with menopause-related symptoms use prescription or over-the-counter products and medications to address at least one of them. Multiple factors contribute to this undertreatment, including a lack of education about menopause in medical schools, historical stigma associated with menopause, and wariness toward some potential treatment options, such as hormone replacement therapy (HRT). Many women go untreated because they view discomfort associated with menopause as normal, or because they don’t realize that symptoms such as mood swings and anxiety may be menopause related or that effective treatments exist.

These barriers to treatment explain why the current US market for menopause-related products and services is relatively modest, less than $5 billion. For perspective, that’s about the same size as the US market for fertility services, which caters to a substantially smaller population of women (12% of women ages 19 to 45).

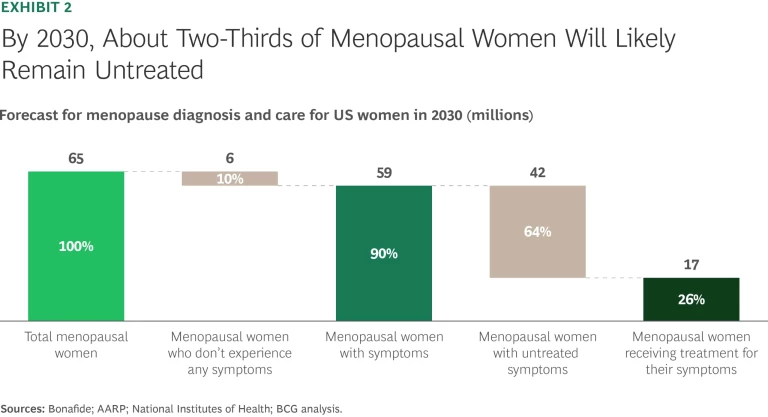

The low adoption rate of treatments for menopause symptoms also suggests that there may be a significant untapped market nationwide. By 2030, about 65 million US women will be in one of the three stages of menopause, roughly 35% of the women in the country. If current treatment rates don’t change, the vast majority of these women won’t seek help for their symptoms. (See Exhibit 2.)

If all women with moderate or severe symptoms were to get treatments that better address their needs, the potential US market for menopause-related care could increase eightfold by 2030, to more than $40 billion. Within the overall market, the opportunities can be divided into four main categories: $16 billion for pharmaceuticals, including HRT and vasomotor medications; $12 billion for consumer health products; $7 billion for symptom trackers, telehealth, and other digital services; and $4 billion for wearables and other medical technology.

Consumer health and digital services providers are beginning to act on the opportunity. Oura, the smart ring manufacturer, provides customers with information on how perimenopause might affect their sleep, mental health, and cardiovascular risk factors, based on data accumulated and analyzed from 100,000 users.

Venture capital investors are beginning to fund digital services for menopause symptom treatments. Investors have poured $100 million into Midi Health, a virtual clinic that offers personalized treatment plans for menopause symptoms and telehealth visits. According to the company, more than 90% of its patients experience improvements in their symptoms within two months of their first visit.

Meanwhile, employers are starting to recognize the need to provide menopause support to their workforce. A recent survey found that 18% of companies plan to offer menopause benefits in 2025, a substantial jump from 4% in 2023. Extending benefits to cover treatment of menopause symptoms could help open the door to new products and care models.

Osteoporosis

An estimated one in four US women will develop osteoporosis, a condition that weakens bones and increases the risk of fractures. About one in two women over 50 with osteoporosis will suffer at least one broken bone because of the disease. Osteoporosis has no visible symptoms, which contributes significantly to the its underdiagnosis and undertreatment.

Leading US scientific organizations and expert medical groups recommend routine osteoporosis screening for all women who are 65 or older. Routine bone-density screenings are even more critical for women who have already had a fracture, as they are twice as likely to develop another one.

Most women who are at risk for osteoporosis aren’t screened, however, because the logistical, financial, or social barriers are too high or because their health care provider doesn’t recommend it—even though the tests are covered by Medicare. A Medicare data analysis found that fewer than 10% of women who are covered by Medicare and develop an osteoporosis-related fracture receive an osteoporosis evaluation within the next six months.

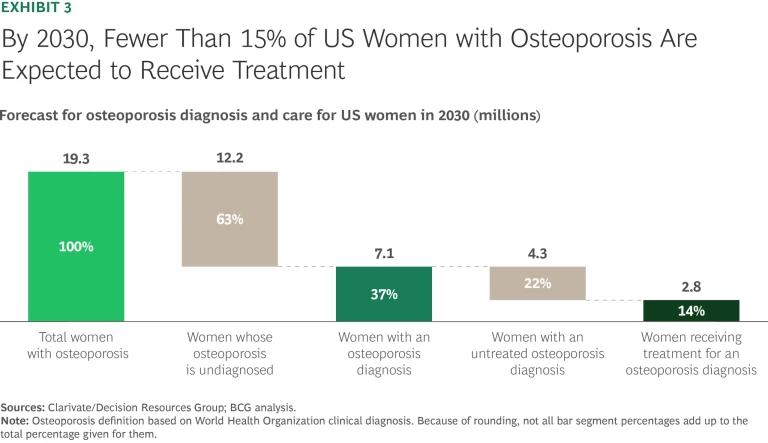

The number of US women with osteoporosis is projected to increase to 19 million by 2030. If current care patterns persist, we estimate that 63% of women with the condition, about 12.2 million people, could go undiagnosed. Another 4 million could be correctly diagnosed but left untreated, pointing to significant unmet needs. (See Exhibit 3.)

Increased screenings would result in more women being diagnosed and treated, which would enlarge the market for existing products. Our analysis indicates that the market for osteoporosis products and services could increase four- to fivefold, from $5 billion today to $21 billion to $27 billion by 2030. The opportunity has four components: $19 billion for pharmaceuticals, $1 billion to $3 billion for consumer health products; $1 billion to $5 billion for symptom trackers, telehealth, and other digital services; and $300 million for wearables and other medical technology.

Some health care providers now offer more proactive osteoporosis care. Health systems such as Geisinger and Kaiser Permanente have developed fracture liaison services programs that include bone evaluations and personalized bone health plans. The long-term management that fracture liaison services facilitate helps lower overall costs and has become the gold standard for preventing secondary fractures.

Rapid advances in AI-enabled imaging techniques could lead to earlier diagnosis of the condition for some women, and could streamline osteoporosis detection. For example, in 2024, the US Food and Drug Administration approved an AI-based software tool from 16 Bit Inc. that uses standard x-rays to prescreen people for low bone mineral density.

Alzheimer's Disease

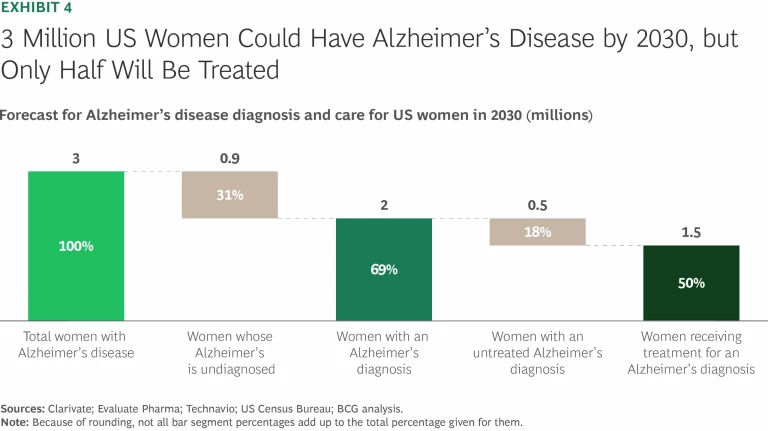

Women account for nearly two-thirds of the US population with Alzheimer's disease, a degenerative brain disorder characterized by dementia symptoms that worsen over time. One in three US women with Alzheimer's disease are never diagnosed, and another 20% are diagnosed but never treated.

By 2030, if current treatment levels don’t change, we estimate that 1 million US women affected by the condition will be undiagnosed and another 500,000 will be diagnosed but not treated, a major shortfall in meeting the population’s needs. (See Exhibit 4.)

One reason that women aren't diagnosed earlier is that medical providers rely on a cognitive test as a proxy to screen for the disease’s progress. Estrogen, a hormone that is a key factor in the female reproductive system, protects cognitive function, so women perform better on cognitive tests even if their Alzheimer’s disease has progressed to a significant level. This circumstance helps explain why women are often diagnosed at a later stage of the disease, when disease-modifying therapies (DMTs) and other treatments are less effective or may not be prescribed because they could do more harm than good.

If all women with Alzheimer's disease were diagnosed at an earlier stage—in line with when men are diagnosed—and more were treated according to clinical guidelines, we estimate that the size of the treatment market would increase tenfold, from roughly $2 billion today to more than $20 billion by 2030.

Earlier diagnosis would pave the way for more US women with Alzheimer’s disease to be treated with DMTs rather than solely for their symptoms. If that increase came to pass, it could expand the overall size of the market for pharmaceutical-related treatments to as much as $16 billion to $18 billion. That number doesn't include additional contributions that could come from future breakthroughs in biopharmaceutical treatment. Our analysis suggests that earlier diagnosis would expand the size of markets for other Alzheimer’s products and services as well, including to $3 billion for wearables and other medical technology, and to $1 billion to $2 billion for telehealth and other digital services.

Innovations in medical technology and digital services could lead to earlier detection of Alzheimer’s disease. Tests for blood-based biomarkers could help predict brain degeneration, which could lead to earlier referrals and interventions. That would be especially helpful for women with known risk factors, such as a family history of the disease. Innovative AI tools could analyze a patient’s medical records to detect combinations of conditions that are known Alzheimer’s risk factors, including hypertension, high cholesterol, and vitamin D deficiency in both men and women, and osteoporosis in women.

Cardiovascular Disease

The term cardiovascular disease encompasses a complex, interconnected set of conditions that affect the heart and vascular system, including coronary heart disease, atrial fibrillation, heart failure, and stroke. Among the common risk factors for cardiovascular disease are high cholesterol (hyperlipidemia), high blood pressure (hypertension), diabetes, smoking, and physical inactivity.

In the US, 45% of women have some form of cardiovascular disease, which remains the leading cause of death and disability for women in the country. (See Exhibit 5.) Despite its prevalence, multiple studies indicate that women with heart conditions are underdiagnosed and undertreated compared to men. The difference stems in large part from the default practice of training health care providers on men’s symptoms, even though women may exhibit different symptoms such as nausea, fatigue, or shortness of breath.

Certain health conditions that affect only women significantly increase their long-term risk of cardiovascular disease. These include pregnancy-related complications such as pre-eclampsia and gestational diabetes, and menopause-related conditions such as postmenopausal hypertension. Care providers don’t routinely monitor these conditions in relation to heart health or ask patients about past occurrences of the conditions that could affect their present cardiovascular health. The American Heart Association only recently updated its cardiovascular disease prevention guidelines to acknowledge that menopause may increase women’s risk of developing cardiovascular disease.

Addressing gaps in cardiovascular disease awareness represents a major market opportunity. If women were diagnosed and treated according to guidelines for three common cardiovascular diseases or risk factors—hypertension, coronary heart disease, and atrial fibrillation—the value of the market would expand from $11.5 billion today to $20 billion in 2030. The breakdown for this increased market value includes $13 billion for medications and $7 billion for medical technology.

In the future, we expect industry players to improve diagnosis and treatment of the disease by combining technological breakthroughs with medical records data and routine health care checkups. For example, new screening tools could enhance results from ECGs, mammograms, and phonocardiograms to detect cardiovascular risk earlier and improve patient outcomes.

How the Health Care Industry Can Grow the Market

Our research confirms that the opportunity to expand the market for women’s health care in the US is vast. To take advantage of it, companies must combine standard best practices for entering a new market or expanding an existing one with careful consideration of the nuances associated with women’s health care. In many cases, they will need to invest in innovation to make up for decades of underinvestment.

First, companies should recognize that the entry point for developing new products and services for women is different from what it would be for the general population because of historical deficits that have led to underdiagnoses and undertreatment of conditions that affect women, and because the industry has commonly seen men and men’s symptoms as the default. As a result, women patients’ awareness of common health conditions and treatment options is low. Foundational research is missing. Providers aren’t properly trained, and payer reimbursements don’t cover all the costs. As they develop new product and market entry strategies, companies must test assumptions about all aspects of the conditions that they seek to improve. They must also understand specific patient needs for new products that they are developing, and identify existing, systemic barriers to effective care.

Second, in light of past decades of underinvestment, companies must innovate to catch up. Because the market’s level of maturity is low, three options can help accelerate such innovation: partnering, buying, and building. Large companies can partner with small businesses that are pioneering new approaches to launch and scale products or services faster. To treat women with menopause-related symptoms, for example, large pharmaceutical companies might team up with existing makers of smart watches, smart rings, or other wearables to gain access to user-based data that could help them identify new treatment methods or care models. Companies can expand into cutting-edge products and services through mergers or acquisitions. For example, a large medical technology company could buy a startup that is working on an AI diagnostic tool to integrate into the acquiring company’s existing imaging product offerings. And companies can choose to innovate on their own, developing new products or service delivery models tailored to women’s needs.

It's past time to close the gap in diagnosis and treatment of health conditions that affect women. Doing so, by providing better access to existing products and services, will create tremendous opportunities—on the order of more than $100 billion. Health care industry players are in a position to create massive value with innovations that improve on what’s currently available.

The authors thank Julie Dethier, Julia McBrien, Isabel Lavin, Gina Liu, Vanessa Wu, Anna Zimmerman, Theo Baïssas, and Joanna DeLorenzo for their contributions to this article.