Corporate transformations are ultimately judged by their impact on shareholder value. Investors expect a measurable link between a transformation’s effects and the profit and loss (P&L) outcomes that drive their investment returns. When cost savings and other benefits do not materialize in the bottom line, investors demand answers from company leaders. With scrutiny now at an all-time high, failing to deliver on a transformation’s promises can erode market valuation and weaken C-suite credibility.

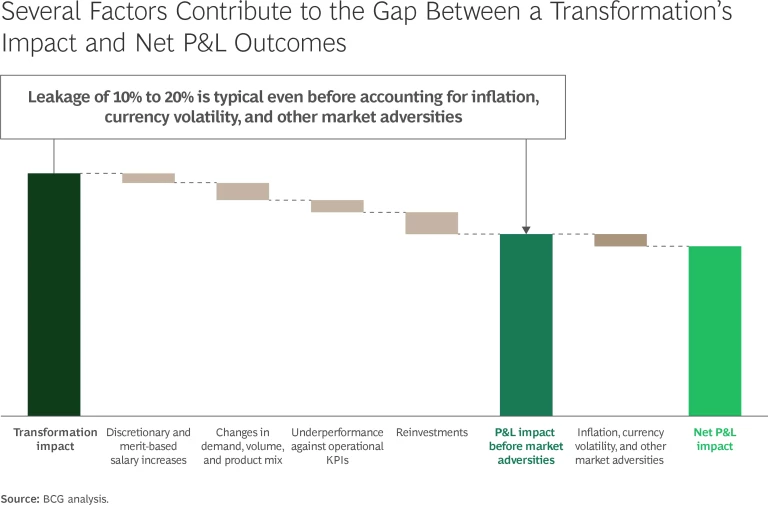

Yet even well-planned transformations face a sobering reality: some of the expected financial impact is lost before it reaches the bottom line. This “leakage” is caused by wide-ranging business factors external to the transformation program, such as price and wage increases, demand fluctuations, underperformance against operational KPIs, and reinvestment decisions. Even before currency volatility, inflation, and other market adversities are taken into account, these factors typically reduce realized P&L savings by 10% to 20%. While some erosion is unavoidable, disciplined financial oversight can help mitigate much of it.

For CEOs, CFOs, chief transformation officers (CTOs), and other C-suite executives, managing leakage is a fundamental financial capability that drives executional certainty and determines the success of transformation initiatives. Addressing leakage early, embedding disciplined execution, and setting realistic targets with a buffer can help organizations avoid or absorb setbacks. To bridge the gap between transformation impacts and net P&L outcomes, leaders can take some critical actions that enable precise tracking, drive accountability, and foster a value-driven culture.

Why Transformation Impact Fails to Reach the P&L

As executives seek to change their business through a transformation program, they must also contend with headwinds from macroeconomic pressures and internal challenges. These external and internal forces can create a gap between the projected financial impact set out in the transformation plan and the actual results that materialize in the P&L statement.

A transformation’s projected impact is based on assumptions about volume, pricing, and operational efficiencies. However, the net impact—the portion that ultimately reaches the P&L—can be lower owing to various forms of leakage. For example, the anticipated impact from a renegotiated vendor contract may be eroded by inflation, changes in product mix, or shifting demand. Operating model changes and organization redesigns may not deliver the savings expected if delays, rehiring needs, or reinvestments in strategic projects or growth are greater than expected. Similarly, efficiency-driven cost reductions may fail to fully materialize because of macroeconomic developments or internal organizational constraints.

Investors closely scrutinize financial results for signs of program leakage. For example, a recent investor report cited “doubts over the achievability of net productivity savings” as a key concern. It noted that despite reported improvements, some expected impacts had not reached the P&L bottom line.

At the same time, companies must acknowledge that a gap between a transformation’s impact and net P&L outcomes is inevitable. Organizations that manage this well analyze the drivers of the disparity and ensure accountability across different levels. By maintaining end-to-end visibility of the transformation’s impact on P&L, the CEO, CFO, CTO, and other leaders can proactively mitigate leakage and ensure better decision making at all levels.

Subscribe to our Business Transformation E-Alert.

A Closer Look at the Sources of Leakage

Leakages in transformation programs are not one-time effects; they are recurring impacts that vary across transformation types, value levers, and business units. The extent of leakage depends on organizational context and external market conditions. The link between transformation impact and P&L results is typically assessed at the portfolio, business unit, or functional level. As shown in the exhibit, several factors contribute to transformation leakage.

Discretionary and Merit-Based Salary Increases. Rising costs from discretionary and merit-based salary increases can erode the expected benefits of a transformation. In operating model transformations or organization redesigns, companies may decide to raise salaries companywide in response to cost-of-living increases or implement merit-based salary increases to retain specific employees, outpacing initial assumptions about workforce cost reductions. At one company, annual wage inflation of 5%—higher than the Consumer Price Index—combined with merit-based wage increases significantly raised organizational costs in the years following a reorganization, partially offsetting its benefits.

Changes in Demand, Volume, and Product Mix. Fluctuations in customer demand, sales volumes, or product mix can undermine projected savings. This often occurs when transformation initiatives target gross margin improvements through sourcing, procurement, or packaging. For example, a consumer goods company experienced a shift toward lower-margin products, reducing the profitability of its sales mix and diminishing the expected impact of cost-saving initiatives. Additionally, volume declines may challenge efforts to optimize procurement costs or leverage economies of scale, widening the gap between the transformation’s impact and P&L savings.

However, changes in the product mix can also have a financial upside. If demand for higher-margin products increases, the P&L impact may exceed initial forecasts, delivering greater than expected profitability gains.

Underperformance Against Operational KPIs. Underperformance in execution can weaken savings realization. In one case, a productivity improvement initiative achieved only 80% of its targeted savings owing to operational inefficiencies. Improvements, such as a step change in overall equipment effectiveness (OEE), are often expected to drive workforce efficiencies. However, leakage frequently occurs when these gains fail to translate into actual savings.

Reinvestments Outside the Transformation. For C-suite leaders, reinvestment decisions are among the most consequential tradeoffs affecting a transformation. Strategic reinvestments and shifting business priorities can dilute or delay a transformation’s immediate financial impact, creating tension between short-term P&L delivery and long-term competitive advantage. In many cases, cost savings and efficiencies are intentionally redirected toward high-growth initiatives, digital acceleration, capability-building efforts, or other big bets.

Although these reinvestments strengthen future competitiveness, they also push out the visible financial benefits of a transformation, leading to investor skepticism and the perception that savings have not been fully captured. This challenge is particularly pronounced in industries such as pharmaceuticals, technology, and fast-moving consumer goods. In these sectors, reinvestment in R&D, digital transformation, sustainability, and supply chain resilience often takes precedence over immediate cost savings.

Inflation, Currency Volatility, and Other Market Adversities. Factors beyond a company’s control—such as inflation and foreign-exchange volatility—can erode a transformation’s bottom-line impact. Inflationary pressures often exceed initial forecasts, diminishing actual savings. In one manufacturer’s cost-out program, for example, rising raw-material costs and unexpected inflation reduced anticipated savings by 3%, forcing additional cost-cutting measures.

Five Actions to Maximize a Transformation’s P&L Impact

Leaders must take a disciplined approach to ensure that a transformation’s benefits fully materialize in the P&L. Gaining clarity into how transformation efforts drive financial performance enables more informed decision making, stronger accountability, and sustained results. Leaders should begin developing this understanding early in the transformation, as the necessary infrastructure and mechanisms take time to build and embed within the organization.

Five key measures can help organizations minimize leakage and build long-term financial resilience.

Partner with finance to build a methodology and set targets with a buffer. The transformation office must work closely with the finance function to define how transformation impacts are tracked, allocated, and sustained. Establishing clear financial controls upfront and setting expectations early facilitate a structured approach to monitoring financial results and minimizing leakage. In particular, setting realistic targets with a buffer at the start of the program provides a safeguard against unforeseen fluctuations, ensuring that any gaps between the transformation’s impact and P&L outcomes are proactively managed.

Build infrastructure to track net P&L delivery. A robust financial tracking system is essential, but its real value comes from fostering collaboration across functions to systematically review the monthly P&L impact. While this process can be complex, it is critical to understanding how transformation efforts translate into bottom-line results and ensuring that the projected savings materialize.

To address this complexity, organizations often assess P&L impact at the portfolio, business unit, or functional level. For example, a consumer goods company tracked actual P&L results against forecasts monthly at the portfolio level, allowing the transformation’s leaders to course correct and ensure that it remained on track.

A structured approach—monitoring underperformance against annual plan targets, for example, and identifying deviations in efficiency improvements—can also help in addressing potential leakage before it has an impact on financial results. For example, a manufacturing excellence and productivity program used OEE and waste reduction KPIs to flag risks before they affected the P&L, allowing for timely corrective action.

Cascade awareness throughout the organization to drive accountability. For transformation efforts to deliver lasting financial impact, awareness of the gap between impact and net P&L results must be embedded in the organization. Teams at every level should understand why this gap exists, what drives it, and how their actions influence financial outcomes.

For example, a manufacturing company strengthened collaboration between operations and finance by fostering open discussions and awareness about the financial impact of its transformation initiatives. The improved coordination and understanding that resulted allowed teams to proactively adjust strategies as needed.

Align incentives with transformation objectives. Performance incentives should be directly tied to transformation goals. Incentive structures should not only reward execution but also encourage leaders and teams to drive measurable financial results.

By aligning incentives with net targets in the realized P&L impact, rather than with gross transformation targets, organizations can motivate employees to take ownership of sustainable financial performance. This means shifting from traditional transformation metrics to a focus on how well teams close the gap between projected and actual outcomes, ensuring that the impact is fully captured and does not erode over time.

Embed a value-driven culture to sustain impact. Sustaining a transformation’s bottom-line impact requires a behavioral and mindset shift that encourages teams to take ownership of financial outcomes. The company’s leaders should reinforce this culture by serving as role models, setting clear expectations, and embedding value realization into daily decision making. Tying a transformation’s success to how people think, act, and are rewarded will ensure its long-term sustainability.

C-suite leaders are responsible for ensuring that the impact of a transformation fully materializes in the P&L. Investors expect measurable financial results, and failure to deliver promised savings can undermine valuations and reputations. As part of a comprehensive approach to driving executional certainty , disciplined financial oversight is a critical enabler for turning ambitious targets into tangible business outcomes. To unlock a transformation’s full value, leaders must embed financial discipline at every stage, proactively managing leakage that erodes impact. Now is the time to take decisive action to bridge the gap between forecasts and outcomes, strengthen accountability, and ensure that transformation efforts drive sustained financial success.