This article is part of a series examining the competitive outlook for key global process industries and how they can prosper in an uncertain future.

Recent geopolitical developments —including the turmoil in global trade created by US tariffs on specific countries—are injecting fresh uncertainty into an industry already under scrutiny due to its environmental footprint. These forces are causing companies to adopt defensive, short-term behaviors: they are insulating margins, re-engineering around trade barriers, and optimizing for supply resilience rather than long-term transformation. In this article, we explore how packaging companies can look beyond the current market uncertainty to position themselves for success in a five- to ten-year horizon.

Today, the North American packaging landscape is being buffeted by forces that are both structural and disruptive. Even while the conditions for a potential tipping point leading to a more circular, lower-impact packaging industry are quietly coming together, sustainability is slipping further down the C-suite agenda. We believe the North American packaging industry stands at a fork in the road. (See “The Future of Process Industries.”) On the one hand, companies can choose reactive strategies that double down on legacy substrates and short-term cost containment. On the other, they can select proactive moves to build resilience, invest in innovation, and prepare for the likely long-term shift toward sustainability that could rewire the market in the years to come.

To help industry players navigate this juncture, we explore the megatrends shaping the future of packaging in North America—and how companies can position themselves to lead, not just adapt.

The Future of Process Industries

Each article in the series will examine the nature of the new business reality faced by a particular process industry and how the coming changes will drive technological progress, redefine the industry’s cost structure, and reshape its competitive landscape. The goal: to provide industry leaders with the data and guidance needed to ensure that their companies can thrive in the coming years.

Megatrends Will Reshape North American Packaging

We believe five megatrends—caused by structural, long-term micro- and macro-economic changes—are set to reconfigure North America’s packaging industry and drive technological innovation over the next five to ten years. Traditional criteria such as cost and performance will continue to matter. But packaging decisions are increasingly being shaped by a more complex set of factors—some of which are pulling in opposite directions.

In some instances, for example, manufacturers are likely to weigh one criterion against another when making decisions about packaging materials. Consumers are “not going to pay more [for sustainability],” former Unilever CEO Hein Schumacher said at a recent industry forum. “What we need to do as companies is to innovate with our increased knowledge of sustainability. Products have to be functionally superior but, at the same time, address sustainability priorities.” Similarly, tariff-driven cost and supply chain pressures can disproportionately impact packaging substrates that are more reliant on cross-border trade, despite benefiting from tailwinds caused by other megatrends.

Geopolitics and Trade

Shifting global trade relationships and changes in trade-related policies are set to have a material impact on North America’s packaging industry. While the eventual tariff outcomes remain in flux, it’s clear their impact on global trade would be lasting and significant and would reshape the cost calculus for packaging materials. Further, the global trade order will continue to see growing protectionism and regionalism for years to come. These measures are pushing companies to diversify supply, substitute substrates, and re-evaluate packaging choices.

Convenience and Mobility

North American consumers continue to prioritize convenience. The popularity of on-the-go lifestyles and the pressure to squeeze more leisure and work into the same amount of time are increasing the demand for portable and convenient packaging formats (including resealable, single-serve, and ready-to-use products) and resulting in downsizing (smaller average unit sizes, often leading to an overall increase in packaging demand).

E-commerce

With the continued growth of online shopping, packaging must serve dual roles: protection during transit and an extension of the brand experience. These roles are driving interest in simplified, sturdy, and increasingly sustainable formats that reduce over-packaging and improve unboxing experiences.

Health and Wellness

As consumers become more health-conscious, they are choosing better-for-you products, creating shifts in product choices (e.g., fresh produce over prepackaged foods). At the same time, packaging must safeguard product integrity, especially for food, supplements, and cosmetics. This requirement increases demand for better barrier properties and reduces demand for packaging materials seen as potentially contaminating (e.g., due to microplastics).

Sustainability

Sustainability remains high on the agenda for many global brands—given regulatory action and infrastructure investment in Europe and other parts of the world. In the US, state-level legislation, rising consumer awareness, and innovations in recyclable mono-materials and bio composites are building momentum. Across most substrates, we see a move towards lightweighting (reduced packaging weight) and increased use of post-consumer recycled content as input. The challenge for packaging players remains aligning functional performance and cost with environmental benefits at scale.

Subscribe to our Industrial Goods E-Alert.

Evolving Substrates in a Changing Market

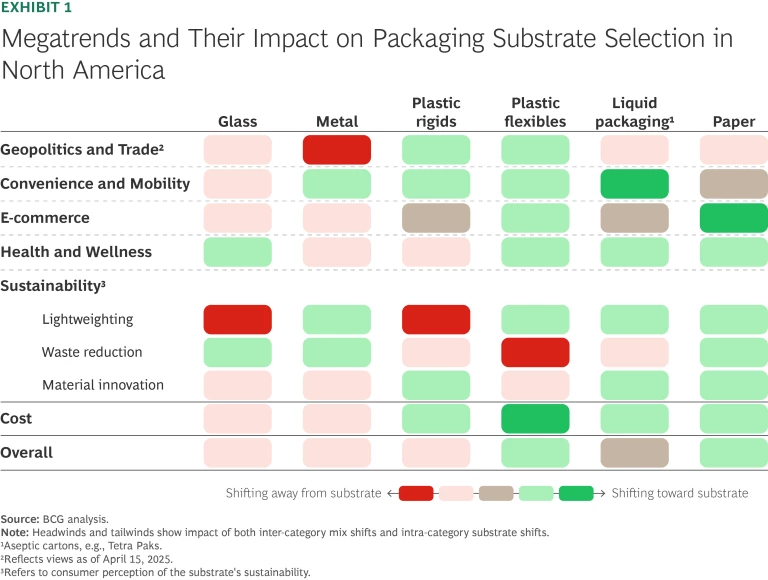

To understand how these megatrends are affecting packaging decisions, our team conducted in-depth quantitative modeling of over 350 product categories and 50 packaging types in 8 end markets. Coupled with our deep expertise in climate and tariff legislation, this allowed us to map the impact of the key trends on all major packaging substrates.

We found that paper and flexible plastic emerge as winners, with most trends acting as tailwinds supporting adoption. Innovation that delivers improved, cost-competitive barrier technology at scale will be key in determining whether the adoption of paper accelerates, particularly for food and beverage applications. Plastic, especially flexible plastic, continues to win based on cost and functionality considerations despite sustainability-related headwinds—with lightweighting and the move towards recyclable mono-material applications easing some sustainability pressures.

By contrast, the growing consumer perceptions of canned food as being less healthy and the impact of volatile metal prices (further exacerbated by tariffs on steel and aluminum imports), are two headwinds that are likely to restrict the use of metals-based packaging. (See Exhibit 1.)

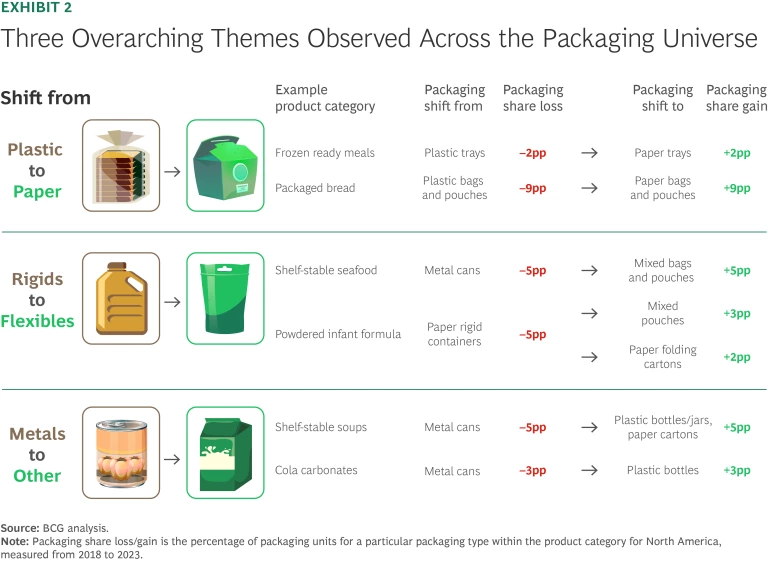

Taking a 10,000-foot view, some overarching themes emerge because of the combined impact of these forces. We see a long-term trend of paper taking share from plastic and, within plastic materials, plastic flexibles capturing share from plastic rigids. In addition, metal looks set to lose popularity in favor of other substrates. (See Exhibit 2.)

Despite headwinds, plastic is still going to remain a leader. Virgin polymers remain cheap due to supply surges, while recycled content is often limited and more expensive. In terms of its versatility, plastic is still unmatched—providing a wide range of applications, especially for food and beverage packaging.

There are other reasons why plastic-based solutions continue to be leaders in the region. For starters, sustainability arguments are not always clear cut. While customers often perceive plastic packaging as more damaging to the environment than glass or metal packaging solutions—because of its persistence in the environment, low circularity rates, and microplastic pollution—its carbon footprint is often lower than paper and can be multiple times lower than glass or metal (depending on the number of times the glass or metal packaging is reused).

We have also seen a widening disparity between how North America and Europe regulate the use of plastic in packaging. For instance, the European Union’s new

Packaging and Packaging Waste Regulation

(PPWR) introduces rules related to recyclability, biodegradability, and single-use packaging; sets minimum requirements for recycled content in packaging; and shifts the responsibility for handling waste generated by packaging towards producers. By contrast, the US federal government has been far slower to regulate packaging (and looks unlikely to follow the EU’s example), with regulatory initiatives driven by individual states.

Navigating Geopolitical Disruption: Tactical Pressure vs. Strategic Priorities

The US administration’s implementation of tariffs on imported raw materials may lead to sharp cost increases across the substrate landscape. Intended to bolster domestic production, tariffs have the potential to add significant complexity and cost to packaging supply chains.

Some heads of leading consumer-packaged goods (CPG) companies have already signaled they are considering a shift in the types of packaging materials they use. “If aluminum cans become more expensive, we can put more emphasis on PET (plastic) bottles,” Coca-Cola CEO James Quincey said during a recent earnings call.

The new tariffs are creating tactical pressures that dominate the agendas of packaging companies. Many companies are focused on the continuity of supply, cost recovery, and product reformulation to mitigate the impact of tariffs, often at the expense of focusing on a long-term transition to lower-impact, sustainable packaging. The result: a delay in sustainability-led transformation, even as expectations from external stakeholders—including customers, consumers, and regulators—continue to increase. (See “A Sustainability Tipping Point Is in Sight, But It’s Not Guaranteed.”)

For BCG’s latest thinking on the rapidly evolving geopolitical landscape, please refer to the BCG Center for Geopolitics.

A Sustainability Tipping Point Is in Sight, But It’s Not Guaranteed

- Critical mass of state-level regulation. States including California and Colorado are enacting Extended Producer Responsibility laws that, like the European legislation, will make producers responsible for environmental impacts across the product life cycle. If other large US states follow suit, companies would be incentivized to pivot towards sustainability—or face immense operational complexity selling different variants of products across different states.

- Collective industry action. Just as industry-wide sustainability initiatives have transformed other areas of the economy, CPG companies could start to collectively adopt green packaging standards. Such a move would precipitate non-linear demand for sustainable packaging solutions.

- Breakthroughs in barrier and recycling technology. The physical limitations of paper are one of the biggest factors preventing it from becoming a significant alternative to plastic. Cost-competitive innovations that enable paper packaging to provide a barrier to oxygen, light, and microbes equivalent to that of plastic, while remaining recyclable in the paper stream, would be a major boost for sustainability. Similarly, breakthroughs in advanced recycling and mono-material films, which can lead to a step change in the recycling rates for plastics, would also provide a great impetus to sustainability in packaging

What we need to do as companies is to innovate with our increased knowledge of sustainability. Products have to be functionally superior but, at the same time, address sustainability priorities.” — former Unilever CEO Hein Schumacher

Strategic Imperatives for Packaging Players: Thriving Amid Disruption

Disruption is increasingly the norm in North American packaging. To win in this environment, packaging companies must do more than manage risk. They must be prepared to pivot across multiple scenarios and invest in the capabilities that will define leadership over the next decade. We recommend that industry players take the following actions to come out on top.

Future-proof the product portfolio.

To stay competitive in a rapidly changing market, packaging companies must develop a granular understanding of end-consumer trends and how these shifts influence demand across their downstream subsegments. This includes monitoring changes in consumer behaviors and patterns, sustainability expectations, regulatory developments, and shifts in product formats. By analyzing these trends, companies can build a forward-looking view of both risks and growth opportunities within their portfolio. This insight would enable them to proactively adjust their offering—doubling down on high-potential areas while gradually phasing out exposure to segments likely to contract, ultimately helping to build a more resilient and future-ready business.

Build supply chain agility and resilience.

To reduce costs, companies must strengthen their supply chains. With tariffs expected to drag on margins for North American packaging converters, to create resilience players can strive to increase domestic sourcing, design an agile network strategy optimized for proximity to sources of material supply and customers, or re-engineer products to avoid inputs that lack domestic sources or are USMCA

Strengthen margins with smarter pricing models.

To protect their margins from the growing volatility of raw material prices and the potential impact from tariffs, packaging players should take a deeper look at their commercial and pricing models to identify their risk exposure and explore pricing structures (e.g., tariff pass-through clauses, shorter contract durations, index-based pricing) that allow them to share the burden of tariffs and input price volatility with their customers.

Lead with sustainable and collaborative product innovation.

Packaging converters (which transform raw materials like paper, plastic, or foil into finished packaging products like boxes, pouches, or bottles for consumer goods) should enhance their sales and marketing capabilities to collaborate more closely with consumer goods manufacturers—especially to drive adoption of sustainable packaging and shared recycling infrastructure through pricing strategies, support, and shared value. To lead, companies must invest in R&D with a balanced portfolio that spans core, adjacent, and breakthrough innovations in sustainable materials and design. Companies need to actively monitor their M&A target pipelines and balance innovative established players with upstarts that are active at the vanguard of innovative and sustainable packaging and potentially disruptive material innovation.

Watch the Noise, Bet on the Signal

The geopolitical shocks facing North American packaging companies are real—and may feel existential. But they are not the whole story. Beneath the volatility, long-term trends toward sustainability, circularity, and consumer-centered design continue to advance.

The companies that thrive will be those that remain flexible in the face of near-term shocks—while building the capabilities to lead in a fundamentally reshaped industry. By acting now, packaging leaders can navigate disruption, shape the substrate transition, and align with the forces that will define the next era of packaging.

The authors acknowledge the contributions of their BCG colleagues Ryan Jones, Aaron Ramirez, Natalie Zezza, Lucia Iglesias, Duc Anh Phi, Abenezer Awlachew, Devika Puri, and Josh Blum.