Operations teams at health care payers have long faced pressure to cut costs. But more recently, there’s been a twist. These teams are increasingly being asked not only to trim expenses but also to boost their performance and improve the customer experience at the same time.

Many operations teams lack the capabilities they need to meet these demands. The focus on cost cutting has limited investments in technology and expertise, impacting operations’ ability to stay up to date.

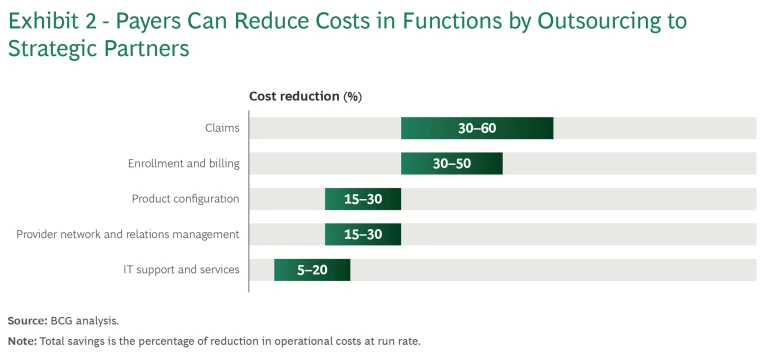

However, payers can advance their capabilities while continuing to closely monitor costs. Business process outsourcing (BPO)—the subcontracting of business processes to vendors—is a way for payers to quickly gain access to advanced platforms and solutions that use AI and automation to elevate operational efficiency and innovativeness. And by entering into strategic partnerships with BPO vendors, payers can craft customized solutions and save 15% to 40% across functions in their middle and back offices and in IT, depending on the starting maturity.

To partner effectively with BPO vendors, payers should take three steps: evaluate processes to pinpoint key improvement opportunities; bundle processes to identify, engage, and manage vendors; and re-evaluate in-house technology to determine if it can support process excellence.

Evaluate Processes

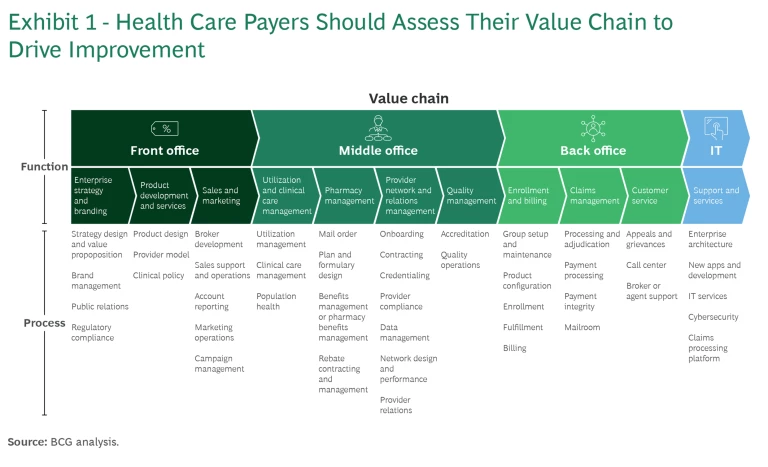

Before meeting with BPO vendors, a payer should develop a near-term and a longer-term plan for improving the processes across its value chain. To begin, a payer should understand the current costs for each function. (See Exhibit 1.) Then a payer should evaluate the processes through five lenses:

- Strategic Value. Assess which processes are the most valuable, either because of their strategic importance—for example, how they affect the risk adjustment strategy—or because of their impact on the member or provider experience.

- Digitization. Determine which processes are the most important to digitize and which have automation, robotic process automation, and generative AI (GenAI) already embedded.

- Information Flow. Ascertain who is responsible for various data interfaces, and consider the risks (in areas such as compliance, cybersecurity, and information security) that outsourcing these interfaces could introduce.

- Human Involvement. Discern how full-time equivalents are deployed for each process, how much human judgment is required, and how many touch points with members and providers are needed.

- Work Allocation. Assess the insourcing-outsourcing mix and to what extent it can be adjusted considering, for example, the legal or contractual restrictions that exist.

By evaluating processes through these lenses, a payer can identify and prioritize the most important opportunities for improvement while ensuring compliance with contractual and regulatory requirements.

Bundle Processes

After zeroing in on its chief improvement opportunities, a payer should look across its value chain, determine which processes will be kept in-house, and bundle the remaining processes into logical units of work that could be performed externally by a single vendor.

For example, a payer may create a claims-and-configuration bundle that includes sales support and operations, account reporting, configuration, processing and adjudication, mailroom, and claims processing platform. Or a payer may group onboarding, contracting, credentialing, provider compliance, data management, and provider relations into a provider operations bundle.

Bundling makes it easier for a payer to identify and engage vendors. To make outsourcing work, though, a payer must closely manage them.

By organizing processes into bundles, a payer can pinpoint its needs and identify vendors that have the capabilities to meet them.

Identifying and Engaging Vendors. To identify the BPO vendors that are best suited to improve processes and provide a competitive advantage, a payer must determine its specific needs and requirements. For example, a payer should isolate the capabilities it needs to make enhancements to key processes. It should also figure out the optimal mix of larger vendors that can provide end-to-end capabilities and smaller vendors that offer specialized, best-of-breed solutions. By organizing its processes into bundles, a payer can more easily pinpoint its different needs and requirements for different processes and identify vendors that have the necessary expertise, technologies, and capacity.

Bundling can also inform a payer’s engagement approach. By looking at bundles of processes, a payer is better able to determine, for each bundle, the appropriate length of its outsourcing contract, the terms, and the level of service. Bundling work for a bid can improve the negotiation process as well. Bundling lets prospective vendors see data synergies and ways to reduce operational handoffs. And when vendors can increase their efficiency, they are more open to lowering costs.

For example, a payer wanted to better manage its complex product configuration and claims processes end to end without compromising the outcomes. The payer looked holistically at its processes and bundled certain work to inform its conversations with an incumbent claims processor. The vendor agreed to not only provide the platform and apps but also host the processes in its cloud and supply the IT labor needed for maintaining the tools. The payer leveraged the expanded scope of the work to secure an improved level of service and, importantly, lower rates, making it possible to invest in in-house technologies.

The same payer took a different approach to engage a BPO vendor for its enrollment and billing operations. In this case, the payer invited several leading vendors to submit proposals. To win the contract, the vendor needed to have advanced digital capabilities as well as process expertise in both commercial and individual operations. In addition, the vendor needed to be able to move the payer to a newer platform when one emerged.

Managing Vendors. Traditionally, payers have not treated BPO vendors as strategic partners, so vendor management and governance have not been top priorities. But payers can benefit by acknowledging vendors’ importance and adopting a vendor management model that gives vendors visibility into payers’ long-term goals. Vendors can then innovate in tandem and build mutually beneficial capabilities.

Strong vendor management is critical when the smooth operation of a business is at stake.

Strong vendor management is critical when the smooth operation of a business is at stake. A payer must continuously oversee vendors and their technology to ensure that issues can be quickly identified and remediated. Without strong vendor management, the risk and cost of performance issues—such as a lower star rating, friction with providers, and unhappy members—is too great.

The most successful vendor management operating model for BPO vendors is the hub-and-spoke model. The hub is a vendor management organization that sets the guardrails and standard processes that all vendors must follow regardless of their task or function. The vendor management organization is also responsible for ensuring that vendors deliver on their service-level agreement (SLA). The spokes are the functions that one or more vendors may manage.

An effective vendor management operating model ensures that a payer follows best practices. For example:

- Contracting. Contract terms are clearly defined and tied to continuous improvement and innovation, and rewards are linked to performance.

- Engagement. Forums on strategic objectives and performance (such as quarterly business reviews) are held regularly so that the top vendor and payer executives can engage one on one.

- Quality. Mechanisms are put in place to identify and address issues that may negatively impact quality or the member and payer experiences.

- Innovation. Vendors cocreate with the payer to meet critical needs on an ongoing basis by pursuing innovation continuously.

Re-evaluate In-House Technology

To partner effectively with BPO vendors, a payer needs to understand how its internal technology stack, in combination with its vendors’ capabilities, can enable process excellence. Here are a few key questions to answer:

- Architecture. What tool set is used across the value chain, what capabilities are available and what ones are actually used, and how fragmented are the solutions?

- System Integration. What types of automation and reconciliation technologies are used to connect various IT systems and software applications?

- Digital Assets. Which digital assets are used, who owns them, and how do they support the value proposition for members, providers, and regulators?

- Infrastructure. How is the IT infrastructure managed and supported, how much of it is customized, and what is the extent and nature of the technical debt?

It’s also important to envision the desired future state: how is the technology landscape likely to change over time and, therefore, what capabilities—apps and platforms, hosting, and infrastructure—may be needed to enable robust processes. A technology roadmap would then be designed to support these needs in a way that ensures the current solutions are scalable.

Getting the Most from Strategic Partnerships

By engaging BPO vendors as strategic partners, payers can improve their processes dramatically and quickly in addition to reducing their costs. (See Exhibit 2.) While payers’ operations and goals vary, all health care payers should pay special attention to three areas to benefit from strategic partnerships:

Ensuring Cross-Functional Involvement. Each function in the value chain has vital expertise and, therefore, needs to have a seat at the table when a payer is reviewing the potential opportunities to improve processes and developing a near-term and a longer-term partnership plan.

Specifically, the middle- and back-office functions (which have expertise on operational processes) and the IT team (which oversees systems, data flows, and tech capabilities and includes product managers) need to be involved.

- Balancing the Current Reality with Future Goals. It’s important not to let old technology define new decisions about processes and vendors; the goals of the future state should be driving these decisions. But payers also need to be realistic: given that technology changes are slow and costly, it’s important to develop a near-term and a longer-term improvement plan that is feasible and affordable.

- Managing Risk Adequately. Compliance requirements, data privacy issues, and cybersecurity threats are increasing. AI and GenAI are also posing challenges. As BPO vendors play a larger and larger role in managing processes, it will become much more critical for payers to have robust governance in place.

Some payers are already finding success with strategic partnerships. A regional payer with multiyear operating losses and significant technology debt decided to outsource some core processes. Led by the operations team, representatives from HR, IT, compliance, and procurement worked together to shape the improvement plans. After assessing its current processes and costs and identifying four process bundles, the payer identified market-leading vendors that could provide the needed capabilities and set up a vendor management organization to ensure that vendors meet certain quality standards. Rather than outsourcing all the work at once, the payer did it in phases so that it could evaluate vendors’ performance before implementing the next phase.

The health care payer expanded its outsourcing in claims management, customer service, enrollment and billing, and provider network and relations management from less than 50% to 80%, and ultimately to 100%. Among other capabilities, the new partnerships provided access to automated claims processing (which greatly improved the member experience and lowered costs by as much as 60% in some functional areas, with an average of 15% across the entire portfolio) and automated provider credentialing (which accelerated the credentialing process and reduced costly errors).

The member experience is rapidly becoming a key differentiator for payers. But despite the pressure to improve it and gain competitive advantage, payers must also maintain their focus on trimming expenses. Payers that use BPO and embrace strategic partnerships to improve their processes can not only outpace the competition but also do right by their members in the long run.