At a time when companies in all sectors are struggling to find growth, emerging markets offer a massive opportunity—provided that companies have the skill to capture it. These markets are home to more than 4.3 billion people, accounting for half of global GDP growth over the past ten years. The challenge? Getting products into consumers’ hands. The go-to-market approach for emerging markets can be dizzyingly complex, with fragmented distribution and a wide range of retail formats and channels—from big-box stores to independent mom-and-pop outlets. For that reason, consumer companies that want to tap into this growth opportunity need to first develop a winning GTM strategy.

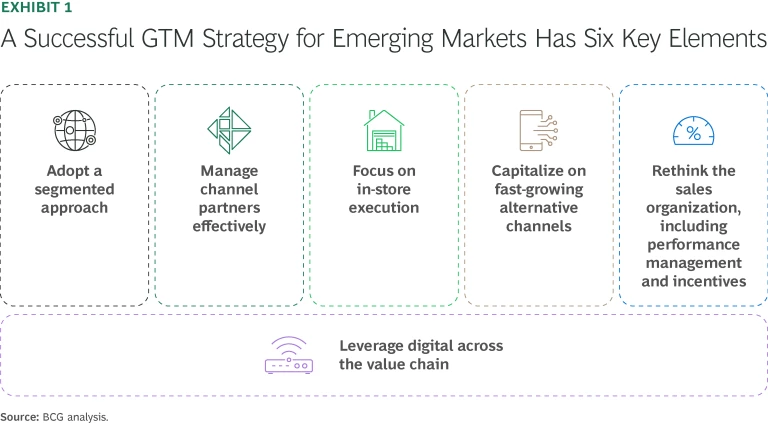

Our experience supporting companies in emerging markets around the world indicates that success requires focusing on some key priorities, including strong market segmentation, in-store execution, and solid collaboration with channel partners—all supported by a digital backbone.

It’s a big challenge, but it offers commensurate rewards for the companies that get their GTM approach right. In the fast-moving consumer goods category, for example, our analysis found that companies in India and Southeast Asia with mature GTM strategies outperform laggards by about 4% in compound annual revenue growth and 6% in profit growth. These companies have learned that the right GTM strategy can drive profitable growth—unlocking the inherent potential of emerging markets.

Steep Barriers in Reaching Consumers

In developed markets, consumer companies benefit from streamlined logistics and mature retail formats. In emerging markets, those attributes can be rare. Companies that want to grow in these markets need to overcome significant hurdles to reach consumers.

- Fragmented Channel Structure. The network of disparate channels includes small, informal retailers such as mom-and-pop stores and kiosks, as well as hypermarkets and an ever-growing number of online-only formats and players. The Philippines has 1.4 million stores across seven different channels, with new formats like discounters emerging. India has more than 15 million stores selling fast-moving consumer goods and 1 million in other categories (such as building materials).

- Small-Scale Retailers. Limited storage capacity and volume—the average retailer has sales of $3,000 to $4,000 a month—necessitate frequent restocking and leave many retailers unable to invest in a wide range of products; this, in turn, restricts the market penetration of consumer companies.

- Gaps in the Skills of Frontline Staff. Sales representatives often have limited skills and experience—many do not have a college degree—and teams experience attrition rates as high as 30% a year.

- Constant Innovation. The GTM challenges in emerging markets hinder companies from developing a single approach that they can rely on for the long term. Instead, large incumbents must constantly compete with—and sometimes co-opt——innovative bottom-up solutions. Even today’s most successful GTM strategy will likely need to change tomorrow.

Six Keys to a Winning GTM Strategy in Emerging Markets

These are steep challenges, but they’re not insurmountable. To grow in emerging markets, consumer companies need to adapt their GTM approach by focusing on six key elements. (See Exhibit 1.)

1. Adopt a Segmented Approach

Markets can vary widely, with consumer profiles ranging from price-sensitive to brand-conscious shoppers. There can also be significant untapped demand in many smaller cities and rural areas. Companies therefore can’t apply a one-size-fits-all GTM approach. Instead, they need to segment it for individual markets—for different consumer profiles, geographies, and products—and adapt their product lineup, pricing, and distribution strategies accordingly. For example, a leading cosmetics company in Southeast Asia offers premium skin care products in hypermarkets and more affordable alternatives through convenience stores.

Likewise, an Indian food manufacturer started as a B2B supplier, providing high-quality sauces and dressings to fast-food giants in order to develop brand credibility. Today, more than 90% of its revenue comes from direct sales to retail customers. That success is a result of the company’s microsegmentation of more than 700 cities, which it categorized by consumer demographics and behavior—including social media activity. The company initially targeted health-conscious shoppers and sold through premium supermarkets in select cities. But it also forged strategic partnerships with leading e-commerce platforms like Amazon and BigBasket, making its products easily accessible to a tech-savvy, urban consumer base in midtier cities.

Companies need to segment their GTM approach for different consumer profiles, geographies, and products and adapt their product lineup, pricing, and distribution strategies accordingly.

2. Manage Channel Partners Effectively

Channel partners play an important role in providing local-market access, enabling consumer companies to reach scale more efficiently. For example, general-trade partners service the small mom-and-pop retailers that make up 80% of sales in many emerging-market product categories. These entities have on-the-ground relationships and provide services like taking and fulfilling orders from retailers and providing credit.

For consumer companies, it’s crucial to establish the right criteria for channel partners, including size. Channel size is determined by the market potential of each specific geography and the partner’s expected ROI. Companies also set baseline requirements for each partner’s infrastructure in terms of sales manpower, capital deployment, warehouse capacity, and other factors.

In addition, top players shape their incentive structure to reward performance. Multiple models exist, but leading companies link up to 50% of overall incentives to sales targets, product mix, and market expansion. Many companies absorb the cost of the channel partner’s sales team to exert greater control over the frontline sales function.

One of the world’s largest consumer goods companies built a best-in-class channel strategy by deliberately focusing on single-tier distribution, with more than 80% of sales coming through either direct or tier-one distribution partners. As part of that approach, the company reduced its channel partners from about 1,000 to fewer than 500, which increased the revenue of remaining partners and made the company more attractive to work with.

3. Focus on In-store Execution

Retailers are the touchpoints through which consumers come to know a company’s products. Given the fragmented nature of retail in emerging markets, best-in-class companies run structured programs to improve their front-end execution with retailers.

Again, segmentation is critical. Companies need to differentiate among retailers by type, size, and other factors and then align their front-end service approach to each segment. Market data is critical. For many product categories in emerging markets, companies have limited information about performance or consumer behavior. Leading companies invest to build retailer databases and continually enrich them over time. They also invest in tech solutions that their channel partners can use to bill retailers, and they integrate data from distributors that use other billing systems.

Companies need to differentiate among retailers by type, size, and other factors and then align their front-end service approach to each segment.

For example, a leading fast-moving consumer goods company in India has about 10% of its retailers tagged as A-class—a group that contributes 30% of overall sales, 50% of premium product sales, and more than 70% of sales of newly launched products. Sales reps make more frequent visits to A-class retailers, maximizing sales across the portfolio, especially for premium products.

In addition to segmenting, companies invest to make their products more visible and accessible. For example, leading global makers of fast-moving consumer goods run large-scale “perfect store” programs across India, as well as in growth markets such as Indonesia, the Philippines, and Thailand. In these programs, companies invest in store infrastructure, including display setups, coolers, and, in some cases, live promoters to up-sell their products. A Southeast Asian manufacturer of consumer goods classifies the top 15% of retail locations as A-class stores and services them twice a week. These stores—which have four times higher sales volume than other locations—are prime candidates for the rollout of perfect-store programs.

4. Capitalize on Fast-Growing Alternate Channels

In many emerging markets, new channel formats that have developed to address retailer pain points or to offer greater convenience to consumers have quickly captured a significant share of sales. Examples include the following:

- Quick Commerce. Online-only players that focus on speed and convenience are gaining share in many markets. In India, platforms like Blinkit, Swiggy Instamart, and Zepto allow customers to order products through a mobile app and receive delivery in as little as ten minutes.

- Business-to-Business E-commerce (eB2B). Portals and applications replace in-person sales reps, leading to better service for retailers.

A leading snack foods company in India launched a differentiated portfolio to address impulse and binge consumption through quick commerce. It developed multi-occasion packs for individuals, multipacks for at-home occasions, and combo packs. This approach enabled the company to derive a larger share of revenue through quick commerce than through other e-commerce channels.

Because new channels are constantly emerging, companies need to be agile in order to leverage these developments and adapt their GTM approach accordingly. This mindset must be in place across commercial teams, the product portfolio, and potentially even the supply chain.

5. Rethink the Sales Organization, Including Performance Management and Incentives

Given fragmented channels and lower sales throughput per retailer, consumer companies need to tailor their sales organization to the needs of individual markets. That creates the following priorities:

- Determine the right mix of internal and external sales teams to cover territories efficiently. External teams are typically sourced through either channel partners or a third-party provider.

- Augment traditional sales responsibilities with other market-building activities, such as influencer management, trade marketing, and business development. For example, a leading electrical company in India has a 100-member influencer management team that engages with electricians and contractors to drive product demand among end users.

- Balance physical and digital touchpoints to reduce the cost to serve. A top-performing consumer company in Southeast Asia segmented its stores by sales volume. Lower-volume stores are served twice a month, once with a physical visit from a sales rep and once virtually.

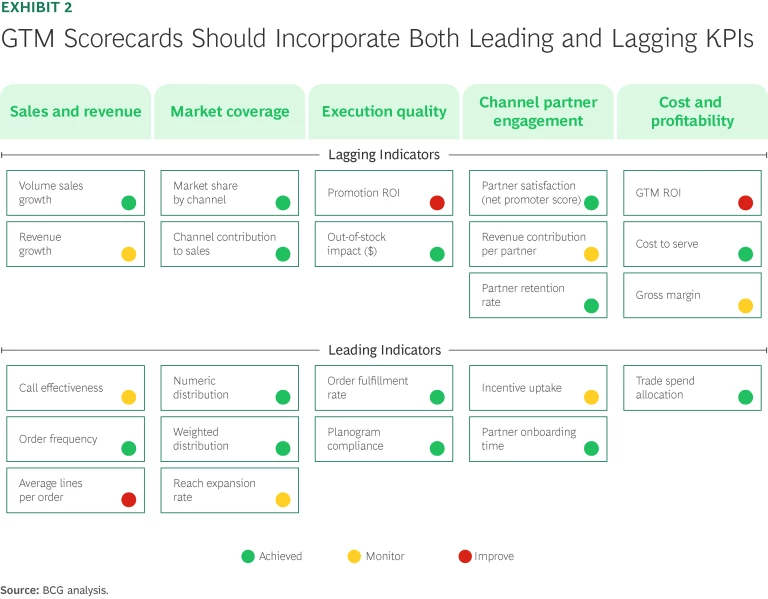

- Track performance over time with a mix of leading and lagging KPIs. (See Exhibit 2 for a typical GTM scorecard.)

6. Leverage Digital Across the Value Chain

Digital is the foundation for the other key elements of a winning GTM strategy. The fragmented channel structure and sheer size of emerging markets require large sales teams working with a huge number of channel partners and smaller retailers. Leading fast-moving consumer goods companies in India can have sales teams of 20,000 employees who engage with more than 3,000 channel partners and 10 million retailers.

For organizations of that size, digital technology is the only way to collect and analyze critical engagement data, improve execution, and use analytics-driven insights to help hit sales targets. Typical GTM use cases for digital include the following:

- For frontline sales reps, mobile apps can help plan the day, identify important points to make in conversations with individual retailers, take orders, and provide performance data for the rep, store, and channel across different time periods. Analytics generate optimal routes and customized offers for each retailer based on past performance, promotions, and other factors.

- For sales leaders, dashboards can aggregate data into a real-time snapshot of performance, along with analytics-driven insights, across all levels of the sales organization.

- For channel partners, applications can provide detailed information on targets, customize offers, assess eligibility for promotion schemes, simulate payout scenarios, place direct orders, and manage loyalty programs.

A leading fast-moving consumer goods company in India successfully rolled out a digital suite with mobile apps for frontline sales teams and analytical engines for managers and leaders, leading to an increase in productivity of more than 15%.

Notably, the investment required to deploy digital has dropped significantly in the last few years, thanks to cost-effective software-as-a-service models. Many solutions can cover key use cases for as little as $7 per user per month, enabling even small companies to capitalize on digital without having to build their own internal tech team.

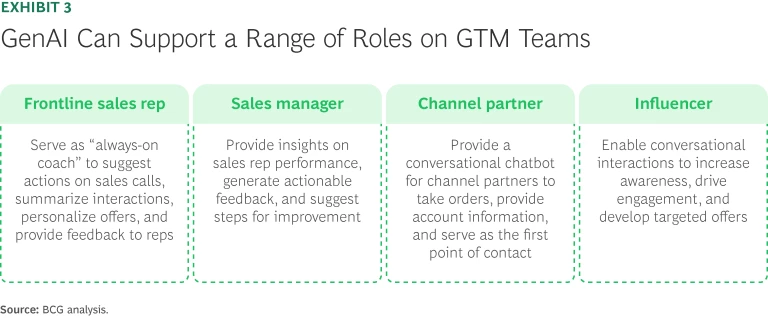

The emergence of GenAI can make digital solutions even more powerful in improving GTM effectiveness. The technology can serve as a virtual sales rep, with conversational chatbots interacting with retailers, taking orders, providing sales data, making personalized offers, and triaging support requests. GenAI can also coach sales reps, with automated nudges and suggestions to improve performance, and provide data-driven insights to sales leaders on hotspot issues and emerging opportunities. (See Exhibit 3.)

Emerging markets are a huge opportunity for consumer companies, but their size and complexity make them difficult to serve. To succeed, companies need to start by developing a GTM strategy that helps them meet the needs of retailers and consumers at a low cost to serve. This is an all-encompassing effort, involving commercial teams along with product design, brand and marketing units, and technology. By focusing on the approach discussed here—which we have implemented firsthand with consumer companies in emerging markets—companies can seize the opportunity and thrive.