Sustainable aviation fuels (SAFs) have massive potential to decarbonize the commercial aviation industry, but most players can do more to capture that opportunity. Despite recent growth, the industry is not on track to meet the International Energy Agency’s (IEA) 2030 SAF needs under its Announced Pledges Scenario aimed at keeping global warming well below a 2°C rise above pre-industrial levels.

To identify the challenges and opportunities related to SAF adoption, we recently surveyed more than 500 executives at approximately 200 companies across the global aviation ecosystem. Our sample included aircraft and engine OEMs, system and component manufacturers, airlines, lessors, and SAF project developers—the majority from North America and Western Europe but covering other regions as well. Among the key findings:

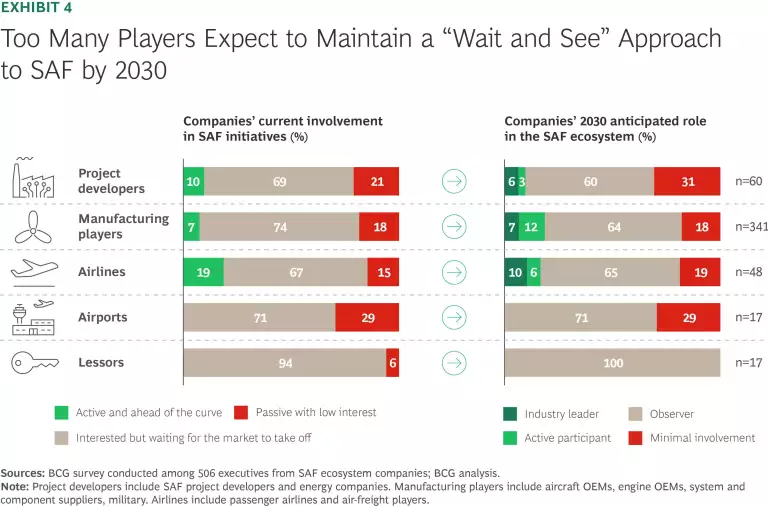

- Roughly two-thirds of companies across the value chain are taking a measured approach to SAF, and most anticipate being an observer, rather than a market leader, by 2030, signaling a need for greater ambition.

- Aircraft OEMs and project developers are investing a higher share of revenue to develop the SAF market, with airlines and lessors investing less.

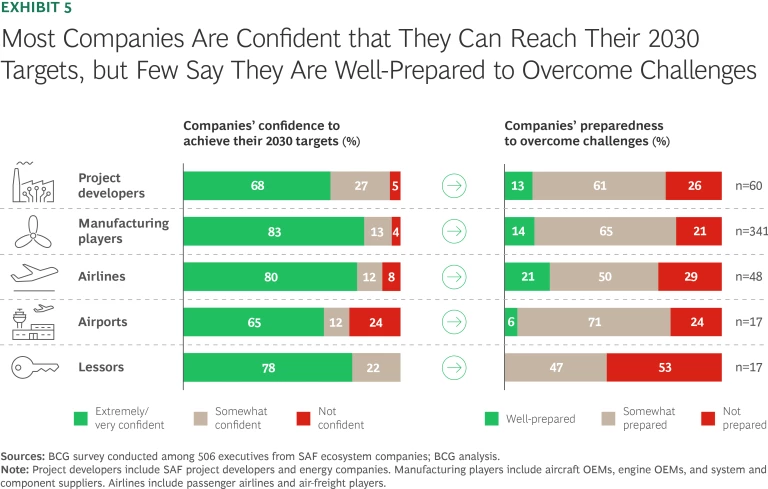

- Eighty percent of companies say they are confident they can achieve their 2030 targets, but only 14% feel well-prepared to overcome challenges along the way.

- The lack of a clear business case for expanding use of SAF is the biggest barrier to investment.

Critically, the results also point to specific recommendations for stakeholders across the aviation value chain to make faster progress on SAF adoption. A common thread is the need to create a virtuous cycle in which regulatory and voluntary SAF demand increases supply and vice versa. Decarbonizing commercial aviation is a massive challenge; the industry is tightly integrated and currently oriented around fossil fuels, and no individual segment wants to take the lead on SAFs without knowing that others will join them. Success will require coordination among many moving parts in the aviation ecosystem. By working together, all participants can create a stronger business case for future investment in SAFs, and ultimately for cleaner skies.

Strong Growth in SAF Production—But More Is Needed

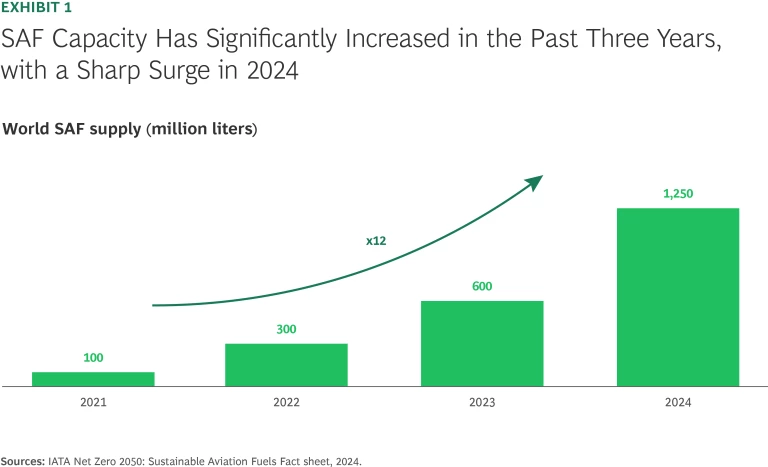

In relative terms, SAF production is growing fast. Over the past three years, supply has increased 1,150% worldwide. (See Exhibit 1.) This remarkable surge has been driven by supportive policy frameworks, expanding corporate commitments, and early investments among early adopters, signaling a strong push to decarbonize aviation.

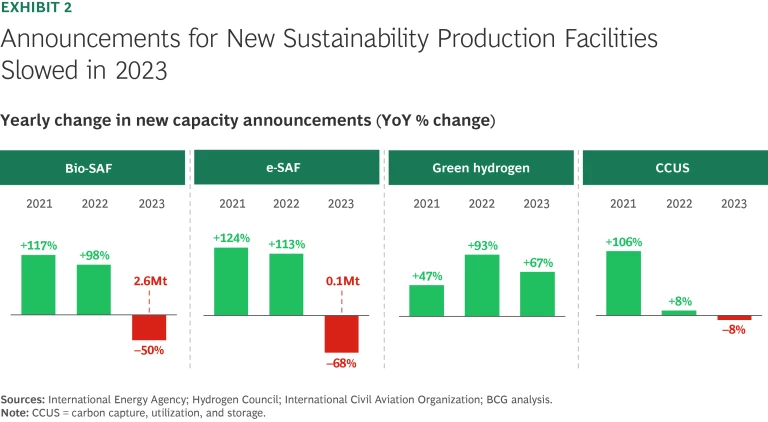

In absolute terms, however, the picture looks different. The dramatic increase in supply occurred against a very small base. SAF represented just 0.3% of global jet fuel production in 2024, according to the International Air Transport Association (IATA), and new production capacity is slowing. Project announcements for new SAF facilities declined 50% to 70% from 2022 to 2023, due primarily to economic uncertainty and higher energy and operating costs that squeezed company margins. (See Exhibit 2.)

While there is some renewed momentum in 2024 and 2025, the IEA’s 2030 production objectives for the two main types of SAF needed to stay on a well-below 2°C path are unlikely to be met.

- Bio-SAF (produced from natural oils or biomass) has emerged as the preferred technology for many market players due to its relative maturity, lower costs, and quicker deployment timelines. Supplies of bio-SAF are projected to reach 9 to 12 million tons by 2030 and exceed the regulatory-driven demand (including ReFuelEU mandates of about 3 million tons in 2030), but they will likely fall 30% short of IEA’s 2030 well-below 2°C objectives.

- e-SAF (produced from a thermochemical process involving carbon and hydrogen) is potentially more transformative, but also more complex and costly to produce, with technologies at earlier stages of maturity. Supplies of e-SAF are also projected to fall at least 45% short of 2030 well-below 2°C IEA needs.

This shortfall is compounded by the sluggish pace of project approvals, with fewer than 30% of SAF initiatives reaching a final investment decision (FID). Given that facilities typically take three to five years after being funded to start producing at-scale, the risk of failing to meet 2030 targets is mounting.

Global economic uncertainty has further compounded these challenges, pushing companies to prioritize cost management and supply chain resilience over long-term investments in sustainability. Legislative delays have also hindered progress. In the European Union, for example, final SAF eligibility criteria under the ReFuelEU Aviation initiative and clarifying implementation timelines were delayed, slowing new project announcements. In the US, uncertainty around key incentives like clean-fuel credits has similarly raised concerns about the reliability of regulatory-driven demand.

Subscribe to our Industrial Goods E-Alert.

Key Survey Results

The results of our survey indicate substantial levels of uncertainty and hesitancy among industry leaders, presenting challenges to reaching 2030 targets. Respondents also see carbon pricing playing a role in the transition to SAF.

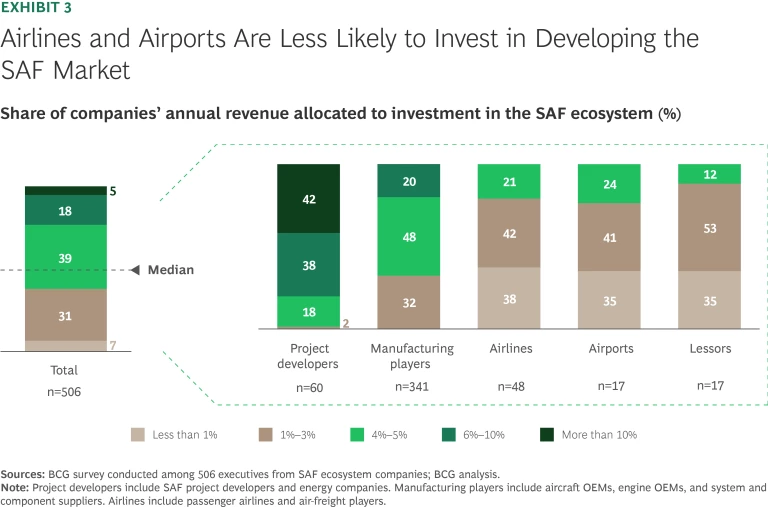

Investment levels have been uneven, with no clear market orchestrator.

Overall, about half of commercial aviation players now allocate more than 4% of their revenue or budget allocations to SAF investments. But some segments are ahead of others. Project developers and aircraft and engine manufacturers have led the charge, channeling significant resources to develop the market. (See “Aircraft OEMs Are at the Forefront of SAF Adoption.”) In contrast, airlines and airports, constrained by tighter financial margins, have invested just 1% to 3%, often prioritizing aircraft fleet renewal over riskier SAF projects. (See Exhibit 3.)

Aircraft OEMs Are at the Forefront of SAF Adoption

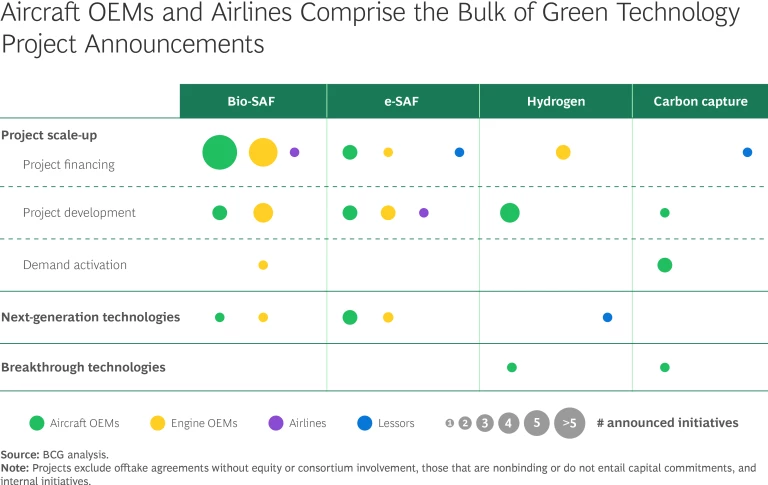

SAF production. Airbus has announced several investments, including a $200 million project alongside Qantas in Australia and a partnership with Oman on an e-SAF hub. Meanwhile, Boeing has notably invested in Wagner Sustainable Fuels to support the development of its Australian facility and partnered with SkyNRG, investing in its production unit in the US.

Emerging SAF technologies. Airbus is exploring methanol-to-jet fuel with HIF Global and testing SAF technologies in India.

New decarbonization technologies. Boeing has committed to 60,000 metric tons of CO₂ removals from Equatic, while Airbus secured 400kt of CO₂ removal credits from 1PointFive.

Financing for industry-wide initiatives. Airbus is the anchor investor of the SAF Financing Alliance, contributing $200 million to fund mature projects.

Too many players are in “wait and see” mode.

Among respondents, about two-thirds say they are interested in SAFs but waiting for the market to take off. (See Exhibit 4.) More alarming, a similar share anticipates being an observer in the SAF ecosystem in 2030. Only a small subset of players has shown active leadership, and this trend is unlikely to shift without significant incentives or mandates. The lack of bold, coordinated action risks exacerbating the current shortfall, leaving the industry reliant on reactive responses to regulatory changes.

Individual organizations may not realize the scope of the challenge ahead.

Our results also show a stark gap between confidence levels about sustainability and preparedness to meet those goals. Among respondents, 80% of companies are confident that they can achieve their 2030 SAF objectives. Yet only 14% feel well-prepared to overcome challenges along the way. Airports and lessors are particularly lagging, with just 6% and 0% readiness, respectively. (See Exhibit 5.) This lack of preparedness among key stakeholders threatens to undermine the industry’s ability to close the SAF supply gap and meet decarbonization goals.

The lack of a clear business case is a major obstacle to greater investment.

SAF production costs and prices remain the top obstacles, cited by 52% of SAF

Economic effects compound the challenge. For example, low voluntary demand on top of ReFuelEU mandates—combined with increased co-processing by project developers—led to a circumstantial oversupply of bio-SAF in late 2024, which has lingered into 2025. Although demand is expected to catch up by 2030, this imbalance may continue to impact prices and compress project margins in the near term and further discourage project developers and financiers. The challenge is even greater for e-SAF, given its higher costs and earlier-stage technology.

Financing challenges are also exacerbated by the widespread use of non-binding memoranda of understanding (MoUs) rather than firm, long-term off-take agreements. At the same time, technology cost curves indicate that SAF will likely continue to carry a price premium over conventional A1 jet fuel well beyond 2030, perpetuating the cycle of limited adoption, constrained investment, and delayed scaling.

Industry players say that carbon pricing could spur adoption.

Outside of regulatory mandates, the industry sees carbon-pricing as a potential solution. By placing a financial cost on the externalities of fossil fuels, carbon pricing schemes could reset the economics of SAF versus conventional jet fuel, making SAF investments far more attractive. Considering other industries that are already under carbon pricing schemes and the potential industry-wide development of this mechanism for airlines, carbon pricing could stimulate voluntary demand for SAF by aligning economic incentives with sustainability goals, creating a more robust foundation for long-term investment.

SAF Is Ready to Take Off

Despite the challenges highlighted in our survey, the long-term momentum for structural change in the aviation industry remains strong. European regulators set the first tranche of SAF mandates at the beginning of 2025. As interest rates stabilize and inflation normalizes, product costs will decrease. Additionally, substantial policy momentum is building, with key legislative frameworks finalized in 2024 across Europe, North America, and South Asia.

- In the European Union, the Renewable Energy Directive has clarified criteria for certain types of renewable fuels, while the Corporate Sustainability Reporting Directive requires companies to establish robust climate transition plans.

- In the United States, the Federal Aviation Administration Reauthorization Act, passed in May 2024, introduces enhanced funding and policy measures to support SAF infrastructure and research.

These developments can accelerate the aviation industry’s decarbonization journey by improving market liquidity and boosting investor confidence. But industry stakeholders must also take action to capitalize on improving market conditions.

A Roadmap for Collaboration

Achieving 2030 SAF goals to keep warming well below 2°C will require overcoming key adoption challenges through ecosystem-wide collaboration. Unlike other industries like steel, where fierce competition often hinders collaboration, the commercial aviation sector’s integrated structure offers a unique opportunity to drive transformational change through collective action.

Specifically, greater SAF adoption requires creating a virtuous circle between demand and supply. Stronger and more predictable demand for SAF, anchored by firm off-take commitments, will improve the business case for project developers and financiers to invest in new facilities, thus increasing supply and advancing production technologies. As supply goes up, pricing comes down, which will further stimulate demand.

To create this dynamic, stakeholders in commercial aviation should focus on four catalytic, collective actions—two focused on demand and two addressing supply. Together, these actions can have an impact far exceeding what any individual player could achieve on its own.

Demand side: Aggregate demand.

Long-term, firm demand is essential to de-risk projects, attract investment, and increase production capacity. Mandates will help, but the industry could benefit from a full-fledged marketplace that can consolidate demand, whether from mandates or voluntary commitments, across a wide range of players to send strong demand signals to improve investor confidence and accelerate project timelines. Unlike supply-side factors, aggregating demand is less capital-intensive but plays a crucial role in creating the virtuous circle. Notable examples include:

- Airbus's “book and claim” initiative gives aircraft and helicopter operators with limited SAF access the ability to buy SAF certificates through a centralized registry.

- United Airlines’ Eco-Skies Alliance, which pools demand from over 30 global corporations (primarily corporate travel customers), enables the airline to secure more favorable SAF offtake terms and improve supply reliability.

While these programs are noteworthy, they are also relatively small-scale—serving primarily as a proof of concept and a foundation for more ambitious measures that can help the industry achieve critical mass.

Demand side: Set industry-wide standards for SAF markets.

The nascent stage of the SAF market entails fragmented, peer-to-peer transactions. Standardized frameworks can set consistent standards for SAF—including eligibility, contracting, and trading—leading to a transparent, liquid, scalable market.

- Standards should also set clear criteria for SAF pathways, feedstocks, and decarbonization potential.

- The adoption of common contracting schemes, trading practices, and indexes will simplify deal-making and enhance market liquidity, creating a more attractive environment for investors.

Supply side: Scale SAF projects.

To scale SAF production effectively, industry players must collaborate through consortiums that optimize capex and leverage economies of scale through mega-production facilities. In bio-SAF, numerous jumbo projects have already been announced, notably by Cepsa, Chevron, bp, DG Fuels, and truAlt alongside consortium partners—each targeting an output of several hundred (or even a million) kilotons of production. At the same time, bio-SAF is also more technologically mature, meaning that the cost-reduction potential through scale is lower.

In e-SAF, lower technology maturity and higher risk mean that most announcements have been for smaller projects, each producing a few tens of kilotons per year. Ramping up to bigger projects will require large consortiums bound by joint risk-sharing initiatives that can develop projects on time, achieve economies of scale, advance along the cost curve, and spur greater demand. Executing this kind of project will require a lineup of highly motivated and skilled partners to mitigate risks at every step, along with providing the capital needed.

The need for a bold vision in terms of e-SAF is growing, given that European mandates will require e-SAF as part of the overall jet fuel mix by 2030. Boeing is a good example. The company recently signed a strategic partnership with European provider Norsk e-Fuel to develop one of the continent’s first industrial-scale facilities to produce e-SAF.

Supply side: Collaborate on SAF innovation beyond 2030.

As the market continues to grow beyond 2030, the commercial aviation sector must secure access to breakthrough technologies to sustain momentum, reduce costs, and meet escalating demand. Advancing underfunded areas, particularly e-SAF, will be crucial to scaling non-biomass-constrained, high-performing fuels that align with stricter decarbonization mandates. For example, breakthrough innovations such as advanced carbon capture technologies or methanol-to-jet pathways to produce e-SAF hold the potential to push the cost of SAF closer to that of fossil fuels.

Across all four catalytic actions, success requires that some entity take a leading role in orchestration. Although this could fall to multiple segments in the commercial aviation value chain, we believe that aircraft and engine OEMs are potentially the most likely candidates, as they have the size, financial strength, and credibility that some airlines may not currently have. In addition, they have strong relationships across the value chain (for example, dealing directly with airlines in ways that project developers do not). However, broad progress will depend equally on airlines stepping up as anchor buyers and long-term partners in scaling SAF supply.

Climate change is accelerating, and the aviation industry is not acting rapidly enough. The forecasted uplift in production capacity would be sufficient to fulfill regulatory demand (including ReFuelEU mandates), but there is a real risk of missing 2030 objectives for SAF compatible with a well-below 2°C pathway. As our survey shows, too many stakeholders are hesitant to make significant investments in SAF, primarily due to the lack of a clear business case. This should be taken as a “last call” to accelerate investment, regulation, and market maturation, creating conditions for SAF success that all players in the aviation ecosystem can reasonably accommodate. This is not a challenge that any market participant can solve on its own. Instead, cross-industry collaboration on both the demand and supply side is critical. By working together, the industry can create a more stable voluntary demand for SAF, spurring production and leading to lower costs. In that way, it can capitalize on the decarbonization potential of SAF to create cleaner skies and a healthier future for planet—in 2030 and beyond.