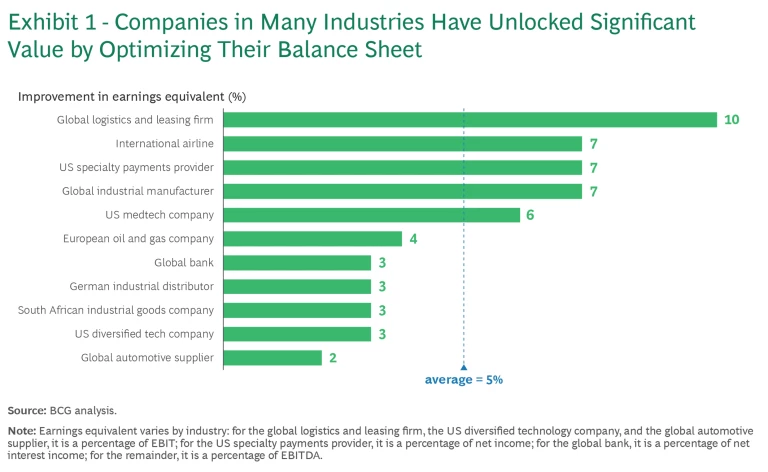

Many companies launch big transformations aimed at improving performance, but they may be overlooking a simpler way to unlock hidden profits: optimizing the balance sheet. In our experience, cleaning up the balance sheet can improve earnings by 5%, on average, and by as much as 10% for some companies. (See Exhibit 1.)

Balance sheet initiatives can be complex, but a pragmatic approach focuses on net working capital as a jumping-off point. This allows companies to free up cash to fund their transformation journey, log early wins, and build momentum for a more comprehensive performance improvement. In the current environment, optimizing the balance sheet is not just an opportunity, it’s an imperative—because once again, cash is king.

Increased Costs in Three Areas

CFOs and treasurers at many organizations face a dilemma. Elevated uncertainty in the global economic and geopolitical environment means that companies are being more cautious. Average US corporate cash holdings today are almost 20% of total assets. At the same time, the higher cost of capital is forcing companies to be more judicious in their use of balance sheet resources. Each net new dollar of capital, be it cash or working capital, may cost up to twice as much as it did only a few years ago. In addition, many treasury teams and CFOs across industries face major funding and cash needs in three main areas.

GenAI and Technology Spending. Generative AI, while still in its early stages, is continuing to drive spending. Forrester predicts that corporate spending related to GenAI will grow at a compound rate of 36% over the next five to six years—over and above typical increases in tech spend. Moreover, we expect an uptick in AI-related M&A, with many legacy players looking to acquire the latest capabilities. This spending growth creates an imperative for companies to maintain strong balance sheets with adequate, cost-effective funding that can be deployed quickly.

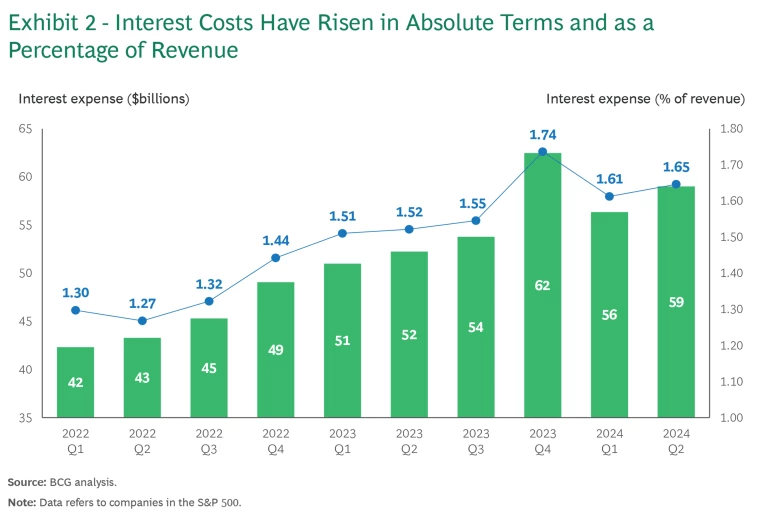

Higher Interest Outflows. The rise in interest rates has driven significantly higher interest expenses across industries—compounded by “cheap debt” rolling off the balance sheet and being replaced by new debt at higher rates. An analysis of nonfinancial S&P 500 companies shows that interest expense as a percentage of revenue grew from 130 basis points in the first quarter of 2022 to 165 basis points in the second quarter of 2024, representing more than $15 billion in additional outflows. (See Exhibit 2.) Given this increase—and the likelihood of interest rates continuing to remain elevated, despite some nominal cuts—ensuring a low cost of funds is vitally important.

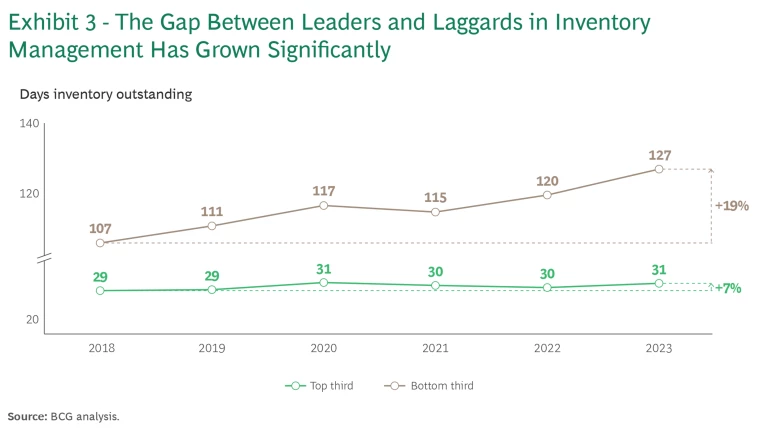

Lingering Impact from Pandemic-Related Disruptions. The pandemic resulted in significantly elevated inventory levels across many industries, as managers sought to hedge against supply chain disruptions. Our analysis of over 20,000 companies in the Americas, Europe, and Asia-Pacific shows that while the strongest organizations have managed to bring down these levels to the prepandemic norm, days inventory outstanding remains elevated at many companies—and the gap is growing. (See Exhibit 3.) Working capital optimization—particularly with respect to inventory—thus remains a highly pertinent area of focus.

Common Challenges

Many finance and treasury teams recognize the need to optimize the balance sheet, yet they find it difficult to make progress. The barriers that companies typically face fall into three categories.

Governance, Steering, and Strategy Challenges. Some organizations lack a clear sense of what the “right” balance sheet and capital structure looks like. Even those that have such an understanding may not ensure accountability and clear roles and responsibilities in balance sheet steering. Frontline business teams often have limited awareness of balance sheet constraints—or incentives for change. And senior leaders often don’t put the right governance in place to address balance sheet risks.

Process Challenges. Even companies that want to improve may not know which processes to prioritize. Some apply a siloed and piecemeal optimization approach, with different groups working in isolation and at cross-purposes. Shared service centers and businesses don’t clearly allocate responsibilities for improving balance sheet performance. Those that launch more integrated programs don’t have rigorous measurement mechanisms in place to gauge their progress.

Tooling and Analytics Challenges. Tools such as dashboards, data-driven analytics, reporting systems, and simulation capabilities are increasingly available to support companies in optimizing the balance sheet. GenAI is making these tools more sophisticated and valuable. For example, companies can leverage unstructured and distributed data to handle tasks such as drafting personalized dunning letters or clearing disputed invoices. Yet many companies still rely on highly manual processes, leaving them stuck in firefighting mode rather than making more strategic optimization decisions. In addition, the forecasting and measurement approaches used by business units can sometimes differ from those used by finance and treasury.

Stay ahead with BCG insights on risk management and compliance

A Pragmatic Approach

Because the challenges are substantial, companies cannot take on all of them at once. Instead, they should be pragmatic and adopt a tactical, incremental approach, starting with the most accessible lever. They can then unlock capital to fund more comprehensive measures, while building experience and momentum along the way.

Consider your working capital usage. Focusing on accounts receivable and accounts payable is often a good way to start optimizing the balance sheet and putting tangible wins on the board.

The pitfalls on the accounts-receivable side are often simple and process oriented but still a significant drain on cash. Small individual improvements such as the following can add up to significant value:

- Resolving billing process issues that create delays in invoicing customers

- Enforcing payment terms to reduce collection delays

- Realigning standard payment terms to market (which also reduces credit risk)

- Incorporating cost of capital as a standard consideration when sales teams are negotiating bespoke payment terms

On the accounts-payable side, the challenge is often laxity in controlling vendor payment terms. As a starting point, consider the following:

- Minimizing or eliminating early payments to vendors, unless justified by discounts

- Incorporating the cost of capital when negotiating payment terms with vendors or when evaluating and executing existing discounts

- Instituting a regular process to review and restructure payment terms over time

These measures are only a starting point; strong controls on accounts payable and accounts receivable, backed by rigorous processes, clean data, and aligned incentives for key personnel, are key to avoiding common pitfalls and reducing working capital consumption. (See “The Power of a Working Capital Control Tower.”)

The Power of a Working Capital Control Tower

In addition, best-in-class players are now using GenAI and predictive analytics to further optimize their working capital usage. Use cases include automated yet customized follow-up on collections, insight and trend generation across specific supplier and customer payment patterns, machine learning-based collections forecasts for target setting, and expedited invoice processing and payment workflows.

Lay out a clear set of balance sheet principles. With stronger capabilities in place to manage net working capital, companies can start to set broader goals for optimizing the balance sheet. Doing so involves the following considerations:

- Desired leverage and/or credit rating

- A view on how to fund the business: which types of funding are acceptable and to what extent companies should diversify funding sources

- The right use of cash—held or returned to shareholders

- Risk appetite

- Additional preferences or strategic priorities for the business

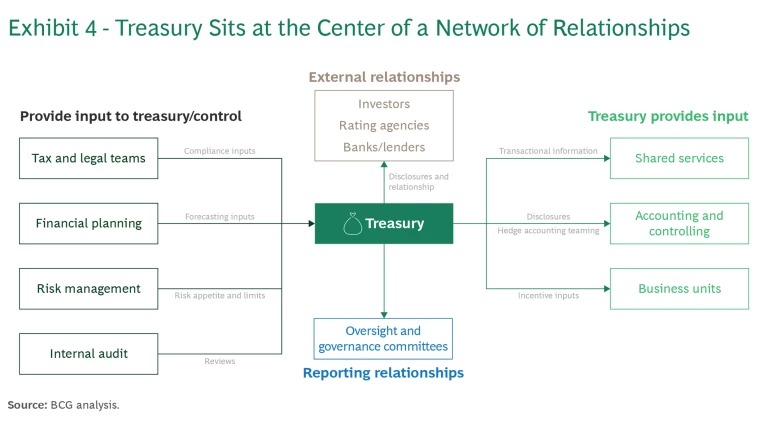

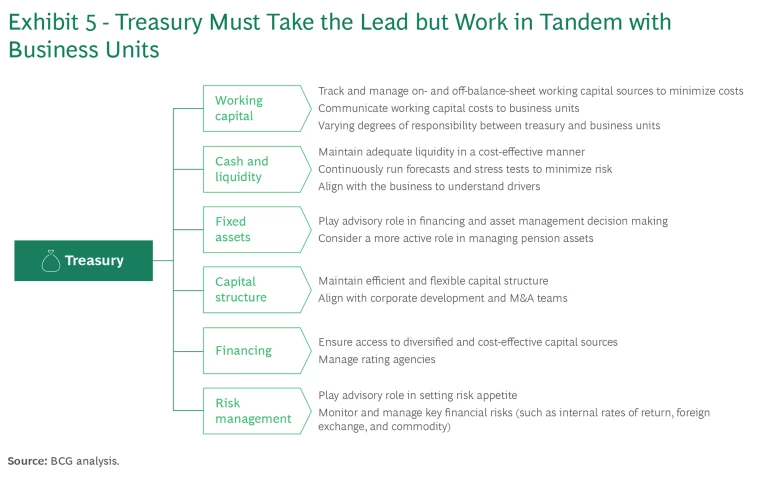

Define clear ownership and accountability. Once companies set principles and establish priorities to optimize the balance sheet, they need to determine who will implement these changes. That will typically entail rethinking processes, redefining roles, and changing the day-to-day work of teams. Treasury is often at the center of balance sheet steering and optimization, with many other stakeholders providing input and leveraging outputs. (Exhibit 4 shows a typical organizational structure.)

It's also critical to stipulate how treasury and finance can work with other parts of the business to drive optimization on an ongoing basis. (See Exhibit 5.)

Key Success Factors

Simply embarking on an optimization exercise does not guarantee success. In our experience, the following factors are crucial to ensuring a successful outcome across the board.

Executive Involvement in Decision Making. The balance sheet is too important and intertwined with the overall business for its management to be completely delegated to treasury teams. While the treasury team must handle day-to-day management and be available for decision-making support, C-suite involvement (beyond just the CFO) in major decisions is critical. At best-in-class companies, the executive team regularly considers the balance sheet when making key steering decisions in line with enterprise strategy.

Whole-Company Approach. Optimization of the balance sheet by transactional finance teams (such as accounts receivable and accounts payable) alone is not likely to result in success. Sensitizing and incentivizing other parts of the company around balance sheet metrics—for example, considering cost of capital when negotiating payment terms with customers—is important to maintaining a cost-effective balance sheet in the long term.

Automation and Technology. Treasury and finance teams cannot effectively drive optimization if most of their focus is on highly manual, operational activities; automation and standardization of reporting and monitoring mechanisms are crucial to ensuring strong long-term outcomes.

Today, a robust balance sheet is a necessity. While many companies have taken initial steps toward this goal, few have adopted a truly holistic approach—meaning that they are letting significant value leak away. By applying our pragmatic, three-step approach, companies can build stronger balance sheets, set the right financial parameters for their goals, and capture significant gains in performance.