Business leaders can no longer rely on a tailwind to boost growth. They face encroaching constraints on all fronts: trade wars are eroding the globalization premium businesses have enjoyed over the past 30-plus years; the era of essentially free capital, which Western firms had enjoyed for more than a decade, has ended; and, with the ongoing demographic shift, automatic population-driven growth is no longer a given in most of the developed world.

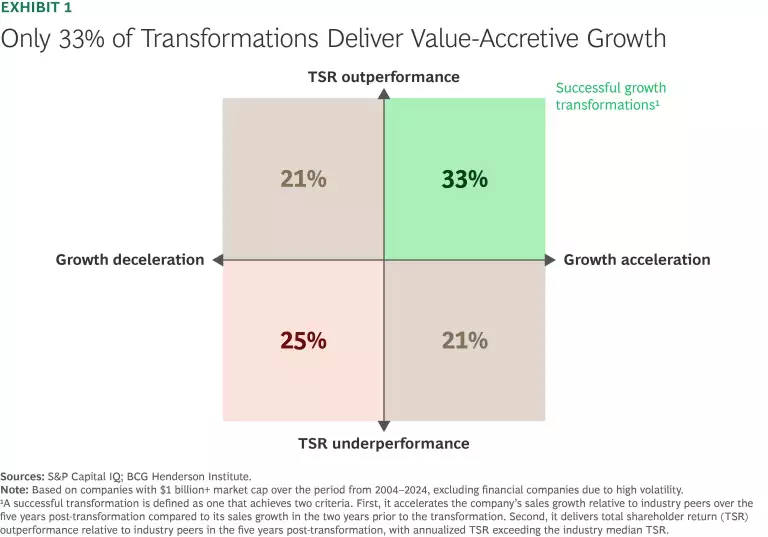

Consequently, in the first quarter of 2025, GDP growth forecasts were revised downward for the US and EU. Achieving growth in this environment will require a dedicated effort—a growth transformation. Unfortunately, such transformations have low odds of success: our analysis of 1,700 transformations globally over the past 20 years shows that only about one-third accelerate growth in a value-accretive way. (See Exhibit 1.)

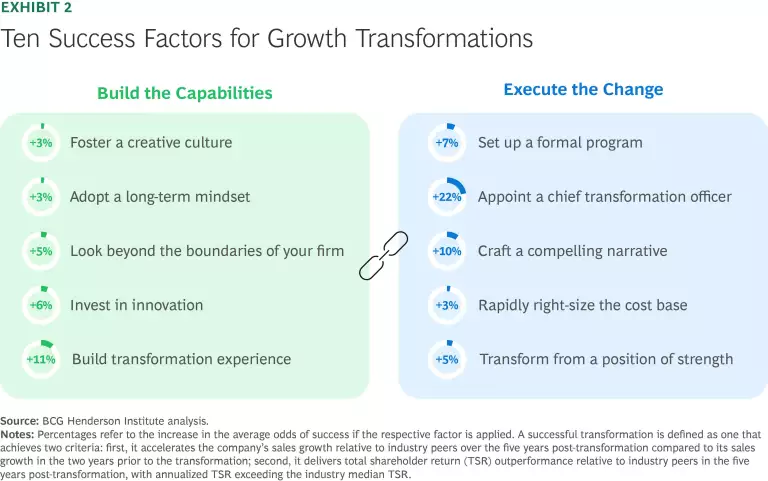

Successful growth transformations tend to share some common factors, our research shows. (See “The Ten Success Factors.”) Companies that deployed five or more of these key factors saw nearly double the success rate compared to those that applied none.

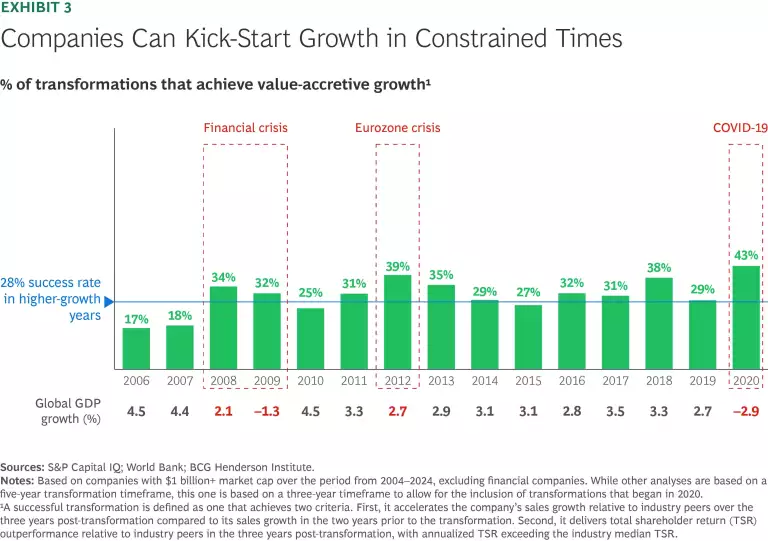

Just as significantly, our research reveals that the current economic environment shouldn’t dissuade leaders. Transforming for growth may seem like an audacious undertaking today—but we’ve found that the success rate for such transformations is actually higher in times of low growth than in other years. The upshot? Company leaders have the chance to turn slowdown into renewal.

Three Paradoxes of Growth Transformation

The very idea of transforming for growth during a slowdown may seem contradictory. But in our research, the companies that succeed in this effort do so by embracing paradox, not avoiding it. At the heart of every successful growth transformation are three such tensions—each one representing a key challenge leaders must reconcile to tip the odds in their favor.

Paradox #1: Creativity vs. Discipline. A successful growth transformation requires fostering an environment that balances creativity with disciplined execution.

In a business context that is not conducive to growth,

innovation is more crucial than ever.

As a result, a successful growth transformation rests on fostering a creative environment. Our empirical analysis verifies this: companies with a more creative

About Our Study

Our analysis is based on approximately 1,700 transformations occurring around the globe in companies with at least $1 billion market capitalization over the period from 2004 to 2020. Transformations were identified by annual restructuring costs in excess of 0.5% of sales.

We define a successful growth transformation as one that both accelerates growth relative to its industry peers and delivers total shareholder return (TSR) outperformance. A company’s growth acceleration is the difference between its industry-adjusted growth rate (IAGR) in the five years after its transformation starts and its IAGR in the two years before its transformation starts. IAGR is a company’s annualized growth rate over a time period, less the median annualized industry growth rate over that same period. TSR outperformance is the annualized TSR that a company delivers in excess of median industry TSR over the five-year period after the company’s transformation begins.

Note that we also assessed success rates based on TSR and IAGR development over a three-year period, finding similar results. In Exhibit 3, three-year period success rates are shown to enable the inclusion of 2020 transformations.

We based the success factors on the literature review and case studies. These factors were translated into quantitative proxies and analyzed using logistic regression, a statistical model that predicts the probability of a successful outcome while accounting for multiple effects. We then converted the resulting log-odds to an adjusted probability rate compared to the baseline average success rate.

While innovation and underlying capabilities such as imagination and creativity seem like messy, unmanageable constructs, the BCG Henderson Institute’s extensive research into these themes shows they can be harnessed systematically: there is no need to hope for inspiration to strike or for a genius to come along and save the company.

One crucial prerequisite to fostering imagination is to look outward—to identify patterns and

anomalies that spark new ideas.

We find that companies that actively look beyond their boundaries—at issues related to their industry,

geopolitics,

macroeconomics, and

sustainability,

rather than merely at their products, processes, and

Consider the path of Brooks Automation. Originally a semiconductor equipment and robotics manufacturer, the company found itself struggling to grow in the early 2000s. Leaders looked beyond the boundaries of the business, studying all the patents that cited Brooks’ patents as well as the patents citing those patents. This analysis revealed previously untapped opportunities in life sciences, where the same precision technologies used to manipulate semiconductors could be applied to handling biological samples in tightly controlled environments. Brooks Automation pivoted toward this new opportunity and eventually became a leader in the emerging biobanking industry.

Fostering creativity is crucial, but growth transformations also require disciplined execution.

A formal program with dedicated governance and

Fostering creativity is crucial, but growth transformations also require disciplined execution.

While ensuring rigor, growth programs also need to foster innovation by allowing space for experimentation and some failures. One way of achieving this is to appoint a chief transformation officer (CTO) with the mission of reconciling discipline and creativity. For example, upon appointing Dominic Cugini as CTO, KeyBank tasked him with digitizing and modernizing the bank’s services using AI— for instance, customer-facing GenAI features—while ensuring rigorous execution standards throughout the digital transformation.

Creating a dedicated leadership position for a growth transformation has further benefits: a CTO can ensure that the change effort follows an overarching strategy rather than being a collection of ad-hoc initiatives. This, for example, was part of the agenda of Danielle Kirgan, the executive in charge of overseeing the transformation of Macy’s, as the retailer sought to modernize its online operations and store

Another important role for the CTO is to add capabilities crucial to transformation success to the leadership team. Empirically, the appointment of a CTO at the outset of the transformation is associated with a remarkable 22 percentage points higher success rate in our

Paradox 2: Vision vs. Foundation. Successfully transforming for growth requires setting out a long-term vision for the firm. But it also means building the foundations in the short term that enable delivery on that vision—by freeing up resources and reducing pressure from stakeholders.

Our analysis shows that adopting a long-term mindset—looking

beyond quarterly results

and toward long-term positioning—boosts the odds of a successful growth transformation by three percentage

But achieving growth requires more than devising promising initiatives. It also means creating the right foundations in the short term: specifically, leaders need to craft a compelling narrative regarding their growth vision for investors. This reduces pressure and ensures management has the support for making potentially fundamental business model changes. Our analysis shows that companies able to convince investors of the

value-creation

potential of their transformations in the first year of their journeys have significantly better odds of

Moreover, leaders need to rapidly right-size the cost base to fund their growth initiatives: our research shows that companies that achieve higher cost efficiency gains than peers in the first year of their change program have a three-percentage-point higher success rate in transforming for

Successful and profitable growth is not only a mindset—it’s also about creating an efficient operating model to support it and to fund the journey.

An example of a transformation that squared the circle of short-term foundation building and long-term vision is that of Delta Air Lines. Emerging from bankruptcy in 2007, the company announced a merger with Northwest Airlines, promising to its investors a more efficient, globally competitive carrier. An integration of the companies’ operations led to the realization of significant cost savings and a healthier balance sheet with more manageable debt levels.

Delta then turned its attention to international expansion and fleet upgrades and an operating discipline to become the most on-time airline in the US—all supporting the carrier in achieving record-breaking profits in 2013 and going from strength to strength in the subsequent years (until the COVID pandemic hit the aviation industry).

Paradox 3: Experience vs. Adaptability. In a turbulent world, transformation needs to turn from a one-time effort into an always-on capability. However, as companies embark on repeated change journeys, they need to adapt their approach to change alongside the challenges they face.

Our research suggests that companies that have previously embarked on a successful growth transformation within our 20-year sample timeframe increase their chances of being successful again by 11 percentage points. This underlines the fact that, just as companies need to transform more frequently to adapt to new realities and to preempt disruption, it’s crucial to create a culture in which change is seen as the norm—like Amazon’s famed “Day 1” ethos.

Moreover, through repeated change efforts, firms can build up a knowledge base of successful tactics that they can use in different situations. This is crucial, as our research shows that different tactics—for example, using incentives, running education programs on the benefits of the change, or relying on social contagion driven by “change champions”—are effective in different situations, depending on the organizational setup and the kind of change being pursued.

As such, companies should be careful to not merely apply the same tried-and-tested approach over and over again but to adapt their approach to change alongside the challenges they are facing.

Our research

suggests that only 20% of firms escape this “success trap”—an overreliance on proven methods—by embracing adaptability in their change strategy.

The Ten Success Factors

In studying the companies that have effectively navigated these three paradoxes, we’ve identified ten distinct factors that consistently drive successful growth transformations. Some factors are prerequisite capabilities—such as fostering a creative culture and investing in innovation—while others fall under the umbrella of transformation execution, such as setting up a formal program or appointing a chief transformation officer. (See Exhibit 2.)

Each of the success factors outlined above, on their own, can improve the odds of running a successful growth transformation. However, our analysis also shows that the effects of these factors are compounding. Transformations that employ multiple success factors—for example, fostering a long-term view and investing in innovation, setting up a dedicated change program, and appointing a CTO—can substantially increase their rates of transformation success. (See the sidebar “Defining the Ten Success Factors.”)

Defining the Ten Success Factors

The success factors are defined as follows:

- Foster a creative culture: Firm earnings calls show above-average mentions of creativity-related terms relative to industry peers in the two years leading up to the transformation.

- Look beyond the boundaries of your firm: Firm earnings calls show above-average mentions of industry, geopolitical, macroeconomic, and other related terms relative to industry peers in the two years leading up to the transformation.

- Set up a formal program: Firm spending on restructuring was greater than 1.5% of sales in the year the transformation started.

- Appoint a chief transformation officer: The firm had a chief transformation officer in the role in the year that the transformation started.

- Adopt a long-term mindset: Firm earnings calls show above-average mentions of terms related to long-term mindset relative to industry peers in the two years leading up to the transformation.

- Invest in innovation: The firm had above-average R&D spending as a percentage of sales relative to industry peers in the five years after transformation started.

- Rapidly right-size the cost base: The firm had above-average cost efficiency gains in the first year of the transformation, reducing their cost-of-revenue ratio more than industry peers relative to the pretransformation baseline.

- Craft a compelling narrative: The firm had higher “expectations” share of TSR decomposition in year one of the transformation relative to industry peers.

- Build transformation experience: The firm has had a previously successful transformation in the analysis timeframe (2004 to 2020).

- Transform from a position of strength: The firm was in the top 30% within its industry for TSR performance in the year before the transformation.

Overall, the average transformation success rate increases from 28%—for firms that do not apply any of the factors—to 55% for those that apply five or more factors. Given that less than a fifth of the firms in our sample leverage more than two of these factors in their transformations, there is significant room for firms to set themselves apart from the crowd.

Subscribe to our Business Transformation E-Alert.

Why Now Is the Time to Transform for Growth

There is a final and critical paradox for change leaders to wrap their heads around: periods of low aggregate growth and high economic uncertainty seem to be good times for kick-starting companies’ individual growth journeys.

For example, we found that, of the transformation programs initiated during the financial crisis of 2008 and 2009, 33% achieved value-accretive growth outperformance—exceeding the average success rate of 28% during years of higher aggregate growth in our sample. The contrast is even more stark for the Eurozone crisis (2012) and the outbreak of the COVID-19 pandemic (2020), in which a remarkable 39% and 43% of transformations initiated found success over a three-year timeframe. (See Exhibit 3.)

There are good reasons why initiating a growth transformation may be particularly valuable against a challenging backdrop. For one, crisis periods have a disproportionate effect on long-term performance: our research shows that the gap between winners and losers within an industry widens significantly in times of crisis. As a result, outperformance during recessionary times contributes significantly to overall long-term outperformance.

Such outperformance is driven by growth, with our research also showing that, over a five-year period, more than half of total shareholder return (TSR) can be attributed to sales growth—with investor expectations, cost reductions, and changes in operating margins making up the rest. Over a ten-year horizon, nearly three-quarters of TSR is driven by sales growth. Put differently: growth will get you ahead competitively in times of crisis.

Moreover, growth can bolster resilience, which is particularly valuable in turbulent times. While resilience is traditionally thought of as a defensive, operational strategy, this is shortsighted: investing in modular supply chains and cash buffers is important, but so is the ability to shape the “new normal”—which often emerges after a turbulent period—to your advantage. This is exactly what a transformation aimed at renewing growth is set up to do.

Crisis periods have a disproportionate effect on long-term performance.

There are many examples of this: Chinese marketplace Alibaba, originally focused on facilitating international sales of Chinese goods, launched its domestic e-commerce platform Taobao when the 2003 SARS epidemic ravaged Asia and spurred interest in online purchasing; Taobao is now one of the largest online shopping platforms in the world.

Amazon, after losing more than 90% of its market value during the dotcom crash, initiated its pivot from store to marketplace, opening its platform to third-party sellers in 2001; they now account for about 60% of sales on the platform. Starbucks, facing drastic reductions in store visits due to the pandemic, invested in its drive-through and mobile ordering offerings, which now constitute more than 30% of orders.

Finally, our analyses have shown, time and again, that there is a benefit to preempting the next downturn. Initiating a growth transformation from a position of strength means being better able to shape the journey, rather than having to react to external pressure. Our empirical analysis underlines this: growth transformations initiated while TSR is still ahead of industry averages have a five-percentage-point higher rate of success.

Many of the world’s most valuable companies have taken this to heart and are masters of disrupting their own lucrative recipes. For example, Nvidia embraced tensor cores designed for AI tasks while its core gaming business was still growing; Apple moved to develop its own chips while its collaboration with Intel was still yielding growing market shares in notebooks; and Adobe moved to a cloud-based subscription model for its creative suite while its disk-based sales were still rising.

Growth transformations are hard to get right, but company leaders can tip the scales in their favor by reconciling the inherent paradoxes. And there’s no time like the present.