In 2020, sales of battery electric vehicles (BEVs) in both China and Europe accounted for about 5% of passenger cars sold, while US sales were at 2%. Fast-forward to 2024 and BEV market share in China has surged to approximately 27%, Europe has stalled at 13%, and the US continues to lag at just 8%.

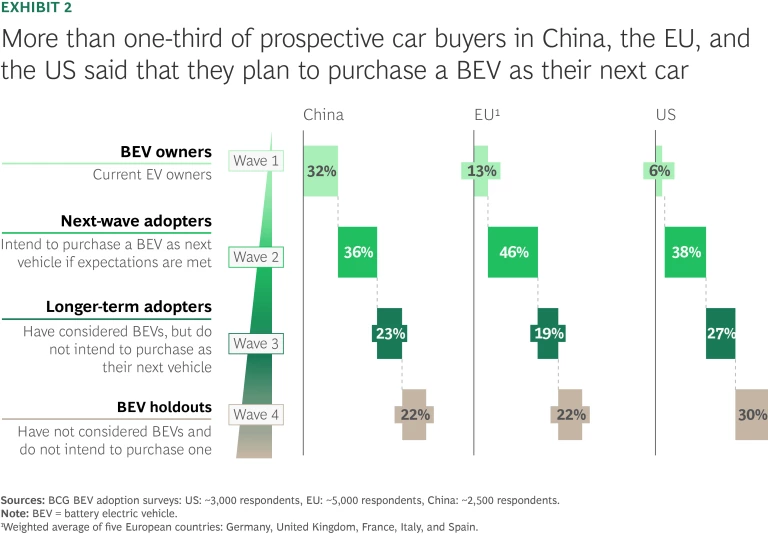

The reasons for this BEV sales divergence are well understood. Chinese industrial policies provide support for startup automakers and offer direct consumer incentives to purchase an electric vehicle. There are indirect incentives as well, including significant expansion of the public charging infrastructure and home charging being relatively inexpensive, particularly when compared to the EU and the US. (See Exhibit 1.)

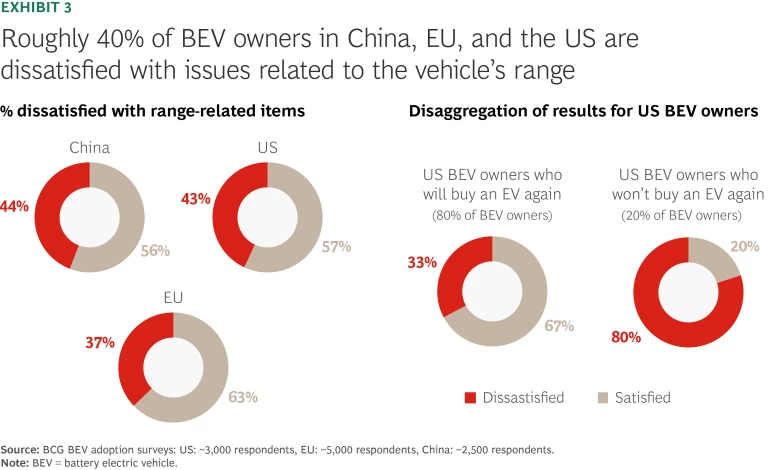

It is less clear whether EU and US automakers can take lessons from China’s higher EV sales to amplify purchases in their respective home markets—or whether the regional disparities suggest they should try another path. To better understand the distinctions among the markets and to derive possible takeaways from the situation in China, BCG surveyed over 10,500 consumers in total across China, the EU, and the US who were intending to purchase a vehicle in the next 12 months. Three similarities among the regions emerged. (See Exhibits 2–4.)

Subscribe to our Industrial Goods E-Alert.

- More than one-third of respondents intend to purchase a BEV. Despite the current significant differences in market share, there is the same level of interest in buying a BEV in China, the EU, and the US. This is encouraging for Western automakers, as it implies that there is still further growth potential for BEV market share if customer expectations for price and performance can be met. (See BCG articles, “ Can OEMs Catch the Next Wave of EV Adopters? ” and “Europe’s High-End Buyers Rethink EV Ownership.”)

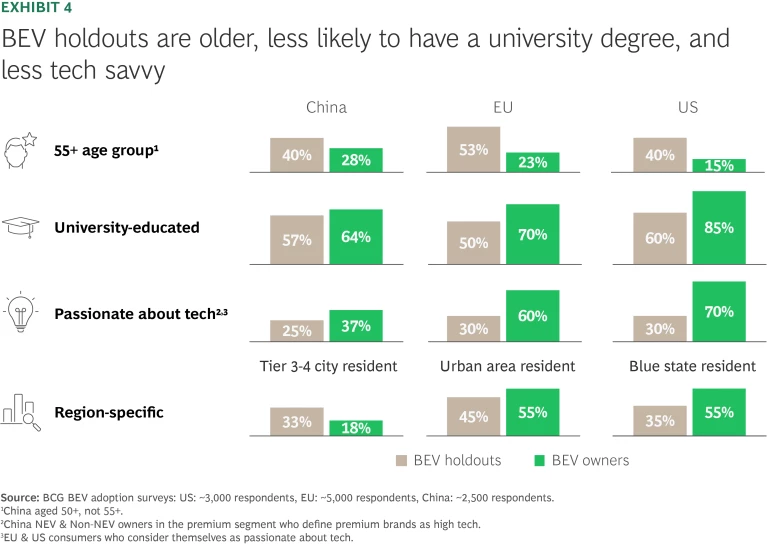

- Approximately 40% of current BEV owners in each region are dissatisfied with range-related issues. These issues include overall mileage on a single charge, public charger access, and the time it takes to recharge. Perhaps most troubling, 80% of US owners of battery electric vehicles who indicated that they would not repurchase a BEV said that range-related items were a concern. For Western OEMs, this simply reaffirms that understanding and satisfying target BEV customers’ price point and performance expectations—in both absolute terms and relative to internal combustion engine (ICE) vehicles—are critical for new model launches.

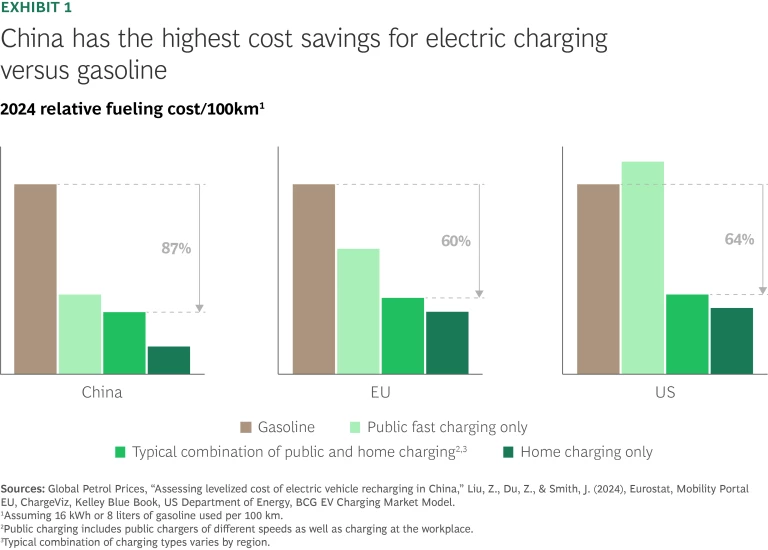

- BEV holdouts are older and less passionate about technology. For Western OEMs, these holdouts will continue to comprise a large portion of their sales, so it is essential to not alienate these traditional consumers even as OEMs continue in their pursuit of increased BEV sales.

These similarities are instructive, but two critical differences offer insights that point to crucial strategic considerations for Western automakers:

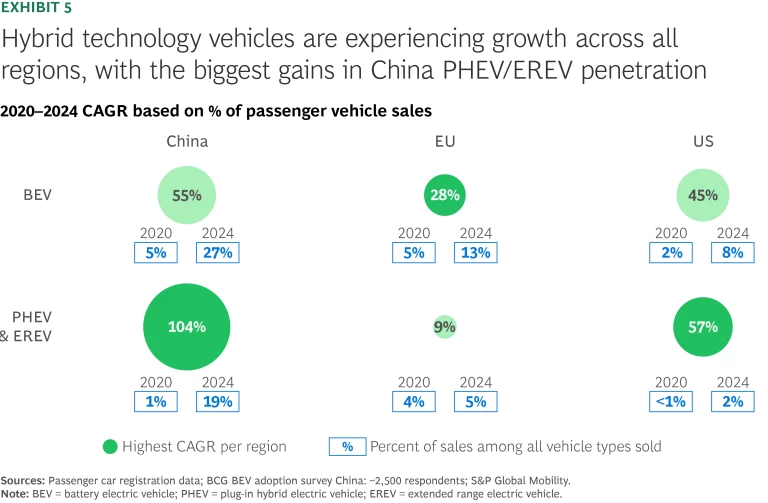

In China and the US, plug-in hybrid electric vehicles (PHEV) and extended range electric vehicles (EREV) have the highest sales growth rates. But in the EU, the highest growth is in BEVs. In China, BEVs still lead in market share among new energy vehicles (NEVs)—an umbrella term for vehicles with some form of electric power—but alternative EV technologies that provide greater range, including PHEVs and EREVs, are gaining in popularity. (See “Glossary of Electric Vehicles.”)

Our China consumer survey found that PHEV/EREV customers typically own only a single vehicle and rate “value for money” as the top reason for selecting their cars. PHEVs/EREVs are therefore logical choices for these customers, because they save money on their daily commutes compared to ICE vehicles given the lower costs for electricity compared to gasoline. And on longer trips, PHEV/EREV drivers avoid the charging inconvenience that they would have with a BEV. Given these advantages, PHEV/EREVs have seen a compound annual growth rate (CAGR) of approximately 104% in China between 2020 and 2024 (vs. 55% for BEVs). This trend is similar in the US—albeit on a very small base, and the gap in growth rates is less extreme. In the EU, this trend is reversed; BEV sales are up 28% in that period vs. only 9% for PHEV/EREVs. (See Exhibit 5.)

This higher growth rate for non-BEVs in the world’s two largest auto markets, in conjunction with range dissatisfaction for BEVs, is noteworthy for Western OEMs. It indicates that EV alternatives, particularly PHEVs and EREVs, will likely play a greater role going forward in the US and, before long, in the EU. However, this assumes no major step changes in battery technology, nor any large-scale policy shifts that are unfavorable to PHEVs and EREVs relative to BEVs. For example, Norway has reduced incentives for PHEVs and reintroduced certain taxes for PHEVs that BEVs are exempt from. With this assumption, we estimate that all alternative EVs, including PHEVs and EREVs as well as hybrid electric vehicles (HEVs) and mild hybrid electric vehicles (MHEVs), will account for approximately 60% of market share in the US and approximately 40% in the EU in 2030. Indeed, there are already signs that this shift is underway, as sales of alternative EVs in both the US and EU grew by approximately 3 percentage points in 2024 while BEV market share remained flat.

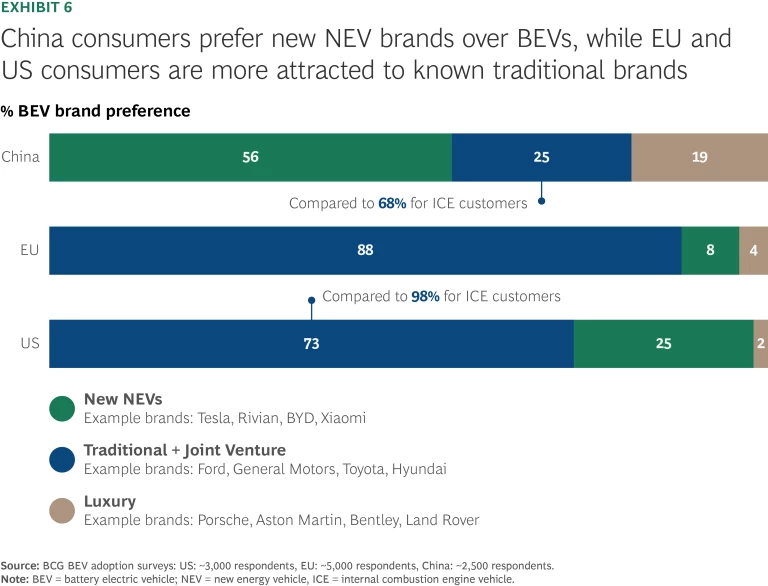

For BEVs, consumers in China favor new NEV brands, while in the EU and US they prefer traditional brands. In China, 56% of consumers said that new NEV startups and self-owned Chinese brands are preferred for BEVs. This group of brands includes technology and consumer electronics giants that have been able to carry-over their strong reputations as digital and innovation leaders to the BEV arena. It is quite the opposite in the US and EU, where traditional brands are still the top option for those intending to purchase a BEV. (See Exhibit 6.) This information is instructive for Western OEMs: They must move quickly to expand desirable NEV portfolios. Otherwise, they could open the door for new entrants to win customers in their markets, as happened in China.

Glossary of Electric Vehicles

Battery electric vehicle (BEV): Fully electric vehicle that is typically plugged in to charge and has no internal combustion engine.

Extended-range electric vehicle (EREV): Charged like a BEV but also has a small internal combustion engine that acts as a generator to recharge the battery, enabling greater range than a BEV.

Plug-in hybrid electric vehicle (PHEV): Charged like a BEV but also has an internal combustion engine that can directly power the vehicle, enabling greater range than a BEV.

Hybrid electric vehicle (HEV): Has an electric motor and battery as well as an internal combustion engine, seamlessly switching between or combining the two for improved fuel efficiency.

Mild hybrid electric vehicle (MHEV): Uses a small electric motor and battery to assist the internal combustion engine, improving efficiency but not allowing all-electric driving.

The Path Forward

Based on the results of our analysis, the successful Chinese BEV market offers three critical insights for Western OEMs to act boldly and quickly.

Use a micro-market approach.

To succeed during the ICE-to-NEV transition, Western OEMs must have a deep and dynamic understanding of their diverse customer segments—who they are, where they are located, and why they prefer specific powertrains. Since different segments may choose the same powertrain for distinct reasons, this understanding must be continuously updated to stay relevant in a rapidly evolving market. Leveraging this insight, OEMs can adopt a micro-marketing approach to effectively target high-propensity customer segments for each powertrain option. This will ensure engagement with the right audiences to maximize marketing ROI, while minimizing the risk of alienating other segments. To succeed, this will require a responsive and collaborative operating model, with a robust

data and technology

foundation.

Expand the NEV portfolio while meeting customer price–performance expectations.

Simply offering more NEV models is insufficient to drive adoption. It is also critical to focus on developing the technology to ensure these models satisfy customer price–performance requirements. To illustrate this, there are roughly 150 PHEV models available in both China and the EU. But in China, large PHEV SUVs that have a stated range of at least 125 miles purely from battery packs of approximately 50 kWh are available—and this level of performance significantly outpaces the range of any PHEVs in the EU.

Further differentiate the level of in-vehicle technology by powertrain.

Given the varying levels of passion for technology among consumer segments, Western OEMs should provide different types of infotainment and other technologies in their NEV vs. ICE vehicles, as has occurred in China. This will require Western OEMs to make thoughtful trade-offs between expected NEV sales uplifts and lower scalability of technology platforms (e.g., advanced driving assistance systems, in-vehicle infotainment).