Of all the challenges faced by the Blue Cross and Blue Shield Plans, few are as significant as the likely mergers of the big US health care companies.

Players such as United Healthcare, Anthem, and Aetna (“the Nationals”) have grown substantially through acquisitions and will continue to do so if the proposed Cigna and Humana mergers go through as planned. These mergers will produce tough competitors with diversified portfolios, sturdy balance sheets, greater scale, and advanced capabilities, including consumer engagement, provider collaboration and informatics, population management, and digital channels.

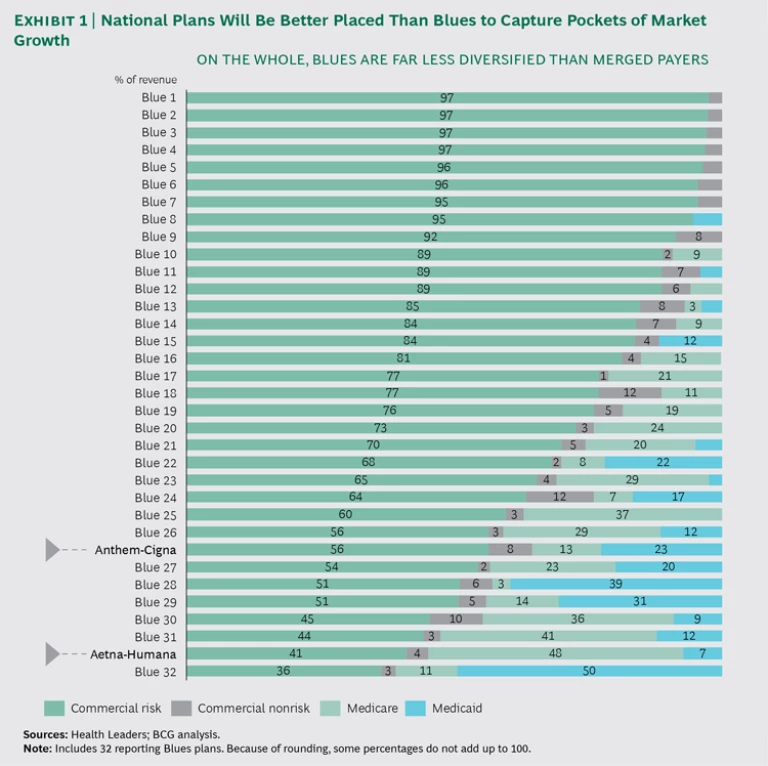

With few exceptions, the Blues are less diversified than the Nationals, more focused on slower-growth commercial risk segments, and they have less capital to invest in new capabilities. Yes, their strong, entrenched local relationships, brand, and other advantages will remain relevant going forward. But the Blues will need to act assertively to maintain market relevance and a competitive financial footing in light of the Nationals’ pending mergers. Assuming that the Aetna-Humana and Anthem-Cigna deals are signed later this year, these plans will enjoy advantages over Blues in three main areas.

To begin with, the merged Nationals will benefit from cost synergies. The new plans have promised a 7% to 8% reduction in sales, general, and administrative (SG&A) costs—equivalent to $1 billion to $1.5 billion—which corresponds to a drop of $2 to $4 per member per month. In addition, these players will likely gain share in local markets and win new negotiating power with local providers, which could enable them to secure more competitive rates and ultimately lower medical costs. Second, the National plans will benefit from stronger balance sheets, helping them to invest in new initiatives and capabilities. For example, consolidation will make it easier for them to invest in best-in-class medical management approaches to improve member health outcomes. Third, the National plans will be better placed to capture pockets of market growth. (See Exhibit 1.) One prominent scenario: an Aetna-Humana combination will be geared for big wins in the high-growth government market.

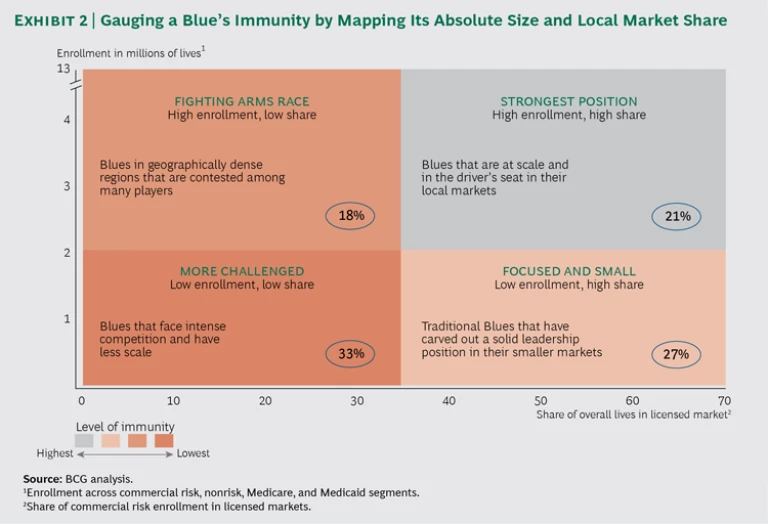

An additional wrinkle is that consolidation is not evenly distributed. Depending on how Cigna and Anthem reorganize their holdings, some Blue plans may face more direct challenges than others. (See the sidebar.)

POTENTIAL RESULTS OF THE CIGNA-ANTHEM DEAL

Not all Blue plans will feel the same impact from the combining of Cigna and Anthem. Much will depend on how the new entity is structured. Currently, Anthem holds the Blue Cross Blue Shield Association (BCBS) license to operate in 14 states, and it cannot compete under the Blue brand in the remaining states, where other companies hold exclusive BCBS licenses.

In addition, all Blue plans—including Anthem—collaborate to cover people at companies that operate across state lines. For example, an employer in Georgia (an Anthem state) may have employees in Florida (a non-Anthem state controlled by another Blue plan). To cover those employees, all BCBS plans coordinate through the BlueCard, a nationally accepted card that gives employees access to Blue providers regardless of the state in which their employer is based. The BlueCard program benefits local Blue plans in that they gain access to more members—giving them more clout to negotiate with providers—and they also generate fees through the arrangement.

The Cigna-Anthem deal threatens both aspects of Anthem’s arrangement with other Blue plans: the degree of competition and the collaboration through BlueCard. There are four possible scenarios:

- No deal. Regulators, some investors, and provider groups may challenge the merger based on antitrust considerations.

- Cigna converts to Anthem. Theoretically, Anthem could convert Cigna to a Blue plan and operate the entire company under BCBS rules. That would mean that Cigna’s business (representing 10% to 15% of combined revenues) would need to be divested to the local Blue plans in many states—a positive development for local Blue plans, which could gain Cigna’s 35 million covered lives, giving them greater clout in negotiating prices with providers. (Alternatively, the BCBS rules could be changed to allow Anthem to compete beyond the 14 states where it currently operates.)

- Anthem converts to Cigna. Anthem could also choose to give up its BCBS license—for a subset of its 14 markets or en masse—allowing it to grow unfettered in the national market. Anthem would lose the advantage of the Blue brand, potentially be responsible for a fee of more than $3 billion1 under BCBS rules, and require a notification period that would give Blues time to react. Even then, the impact on Blues in other markets would be significant. Not only would Anthem be freed up to compete directly against them, but they would lose the Anthem lives in their states currently covered through BlueCard, reducing their fees and their negotiating power with providers. The remaining Blues would need to scramble to find new health plans in those states, in order to continue offering national coverage.

- The new company operates under separate platforms. The most likely scenario is that the company retains both platforms: Anthem in its current 14-state base and Cigna elsewhere. Anthem would likely shift some lives away from Blues and over to Cigna in its nonhome states. But BCBS has rules in place that effectively cap the number that Anthem could switch. (Anthem must keep an estimated 80% of local premiums and two-thirds of national premiums as Blue-branded.)

1. Anthem’s $3 billion fee based on a “reestablishment fee” of $98.33 per member and 28.6 million members as of December 31, 2014.