The past few years have been some of the most difficult UK businesses have faced. Several overlapping economic shocks have created an incredibly complex business environment. It has never been more important to understand how businesses are responding on the ground to the tests and challenges they face – both for those operating in the policy making world and those running businesses.

The inaugural business survey from BCG’s Centre for Growth , ‘State of UK Business 2023: Squeezed but Still Standing’, is a broad and comprehensive survey of over 1,500 UK business leaders which aims to further this understanding. To do this, it brings together views on the UK’s economic outlook, UK competitiveness, business resilience and barriers to investment, as well as long-term trends impacting businesses from structural labour market changes to the introduction of AI and net zero.

The survey reveals that whilst UK businesses may be squeezed, they’re still standing. Although 75% of business leaders expect a recession in the UK this year, we find several reasons for optimism and plenty of results which challenge the more negative prevailing economic narrative.

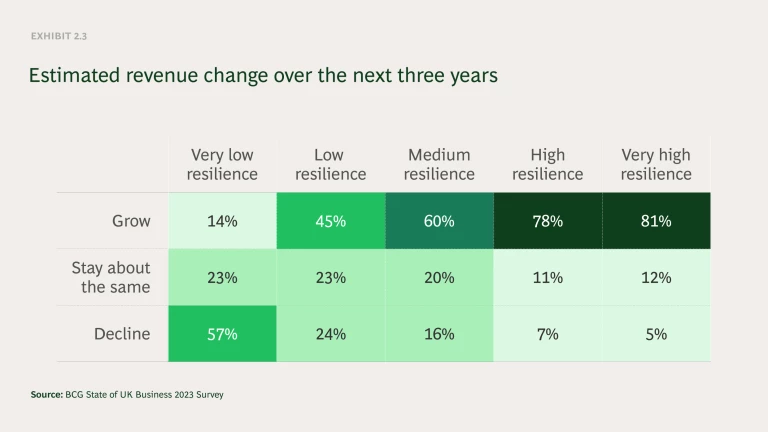

Despite a large majority of business leaders expecting a recession in the UK this year, they are much more optimistic about the medium term. Well over half (61%) expect economic growth to be somewhat or significantly better in 2025, challenging the view the UK is slipping into a medium-term malaise. (See Exhibit 1). Optimism extends to their own business’s prospects too: 63% think their revenue will grow over the next three years, while only 15% expect it to decline.

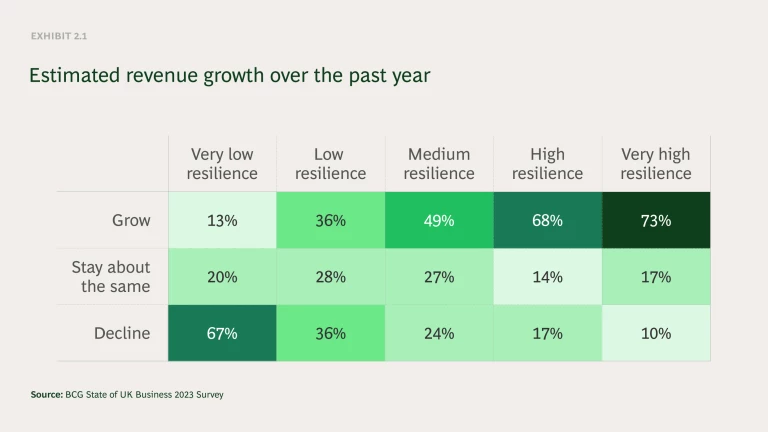

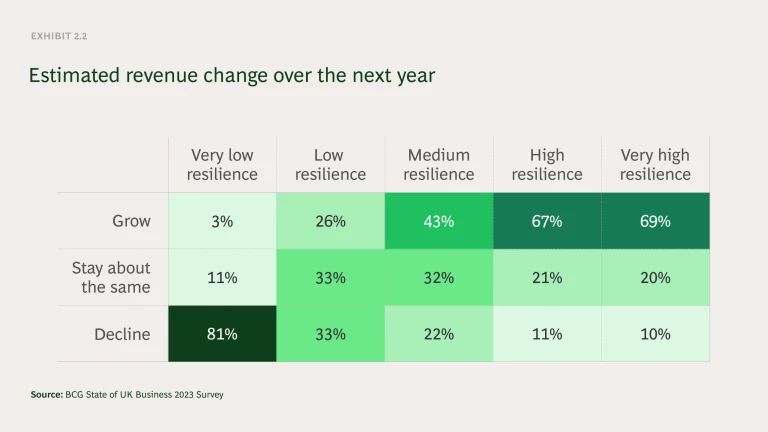

We constructed a bespoke UK Resilience Index to assess businesses' resilience against key metrics. Our index showed that the median business in the UK has a ‘medium’ level of resilience, meaning they were relatively well placed to deal with recent economic shocks and a potential slowdown later this year. Our findings also highlight that there are concrete actions – such as supply chain diversity and flexible working practices which can boost resilience and drive better business performance. We found that businesses that rank higher in our index are positively correlated with much higher revenue growth over the past year and anticipated revenue growth over the next year and three years. (See Exhibit 2 slideshow).

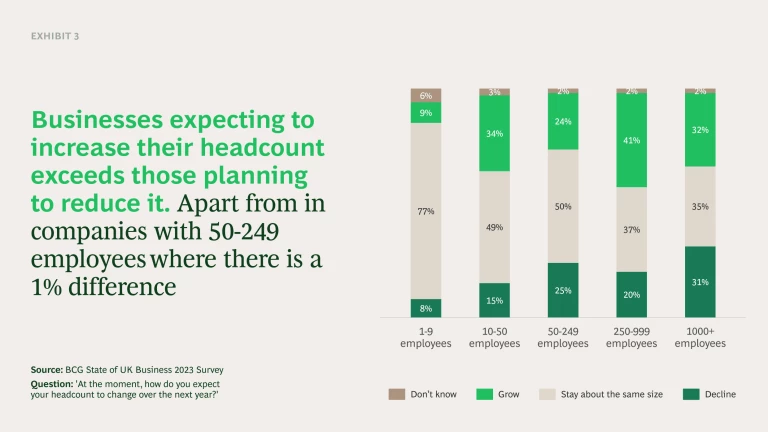

While the Office for Budget Responsibility and the Bank of England expect the unemployment rate to approach 4.5% at the start of next year, up from 3.7% currently, our findings suggest firms may not be quick to turn to laying off workers. (See Exhibit 3). In fact, over three-quarters (77%) of senior leaders said they expected their headcount to either stay the same or grow over the next year, well exceeding those who expect it to reduce (20%).

The oft repeated view that people need to get back to the office or that remote working harms productivity does not chime with the views of the large and representative group of business leaders we surveyed. Only 8% of business leaders said the move to remote working has had an overall negative impact on staff performance. We also found nearly a third (29%) of business leaders said they had hired purely remote workers in response to labour shortages.

There is also optimism amongst UK businesses around the potential benefits from wider use of AI, with 48% of business leaders saying they think that AI will have a very or somewhat positive impact on their business in the next year, rising to 59% in the next five years and 64% over the next 20 years.

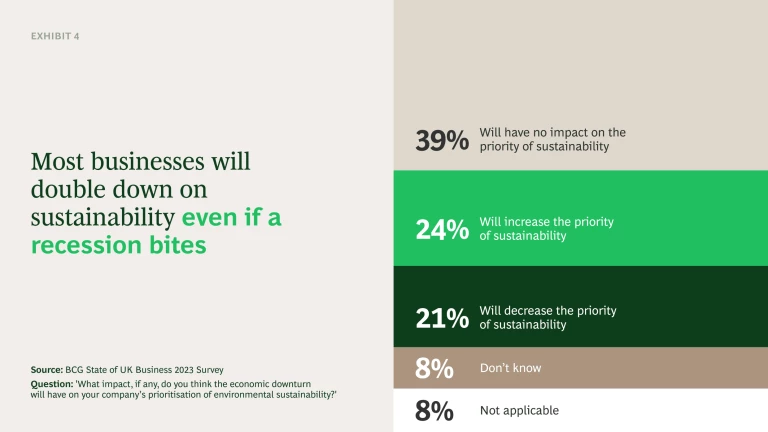

Finally, 63% of leaders say that an economic downturn will either increase their company’s prioritisation of environmental sustainability or have no impact. This compares to 21% who say it would decrease their prioritisation of sustainability. This is despite 60% of leaders acknowledging this will increase their costs over the next five years. In other words, business leaders are committed to pursuing sustainability and net zero priorities even though they’ll be costly. (See Exhibit 4.)

Of course, things are far from universally positive. The survey also highlights several potential areas of vulnerability for UK businesses.

Despite expectations of a recession in the UK, only half (52%) of business leaders said their business had made plans, with smaller businesses in particular looking unprepared. This highlights a regular theme within the survey – that small and to some extent medium sized businesses are struggling in the face of a variety of economic shocks and feeling squeezed from all sides. They may well be seeking further support from the government at the Spring Statement.

While businesses were reasonably good at assessing their own resilience, some leaders at the lower end of the scale tend to overstate their resilience. Leaders in half (51%) of the businesses that we ranked as having low resilience considered themselves to be somewhat or very resilient. It is crucial that leaders have an accurate understanding of a business’s vulnerabilities and resilience to prepare and respond to economic pressures when needed.

Although inflation is expected to quickly fall this year, 56% of business leaders say they will continue to increase prices over the next six months. This finding holds across all sectors and businesses of all sizes and hints at the stubbornness of inflation.

Only 8% of business leaders said the move to remote working has had an overall negative impact on staff performance.

When we asked business leaders about policies the picture becomes less clear. Almost half of business leaders (46%) believe that energy should be one of the government’s top three policy priorities. Reinforcing that the cost burden of energy remains top of mind and will need to be a policy focus, particularly in the long-term context of net zero. But when we specifically asked business leaders which policy changes would have the most positive impact on their business – there was no clear consensus. This highlights the challenge in making policy to support businesses across the economy in the current environment. Those that ranked highest were focused on boosting businesses margins, such as tax reductions and simplifications, but none achieved support from more than a third of business leaders.

Overall, our findings present a much more nuanced picture of business outlook in the UK than is often assumed. UK businesses are in many cases quite resilient. They are optimistic about the future, expect their revenue and headcount to grow and they’re committed to investing in AI and sustainability despite a looming downturn. Where there are gaps, our research highlights that there are concrete steps businesses can take to drive real improvements. UK businesses are squeezed but they are still standing, and in many cases looking optimistically to the future.

About Us

BCG's Centre for Growth brings together ideas, people and action to drive the UK forward. We work with our global expert network to identify transformational opportunities, connect key decision-makers and build coalitions for change. We offer long term strategic insight, extensive cross-sector expertise, platforms for dialogue and bias to action.