Stubbornly high inflation and rising interest rates meant 2023 proved to be more challenging for UK businesses than expected. As we head into 2024, low growth is anticipated despite an expected drop in inflation and interest rates.

Our second annual ‘State of UK Business’ survey from our Centre for Growth – a broad and comprehensive survey of over 1,500 UK business leaders – digs into exactly how the UK’s most senior business leaders are feeling and what their businesses are planning at a critical time for the UK economy.

This year’s results show that, despite continued difficulties, there is emerging optimism amongst business leaders. Not only are 80% confident about their own businesses’ prospects this year, but half (51%) believe their profit will increase in 2024 – 13% of whom expect increases of 10% or more. More than three-quarters (80%) think the UK business environment will be the same or better by the end of the year, too.

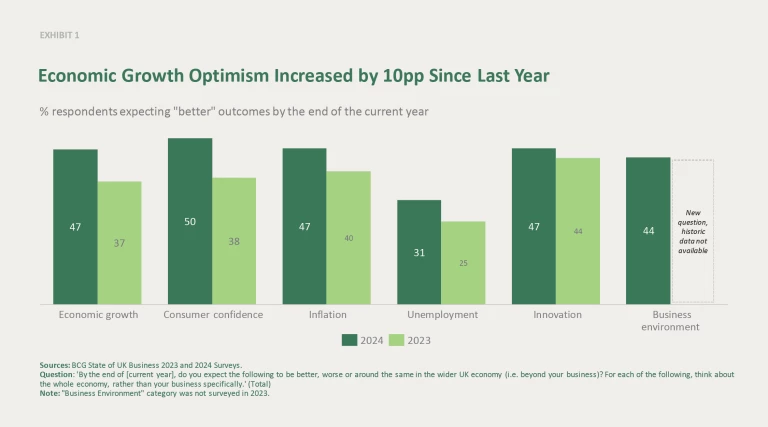

We also found significant increases in business leaders’ views on economic growth, consumer confidence and inflation compared to this time last year. Such optimism is not to be underestimated in these economic times.

Of course, this is in the context of a continued weak economy. So, it’s not entirely surprising we also find that 51% of business leaders still expect a recession this year. This number is down, however, from last year when 75% expected a recession.

Even in this context and amid cost-of-living pressures, 60% of leaders think customers will buy more products from their businesses this year. Only 21% expect customers to switch to less expensive products or services.

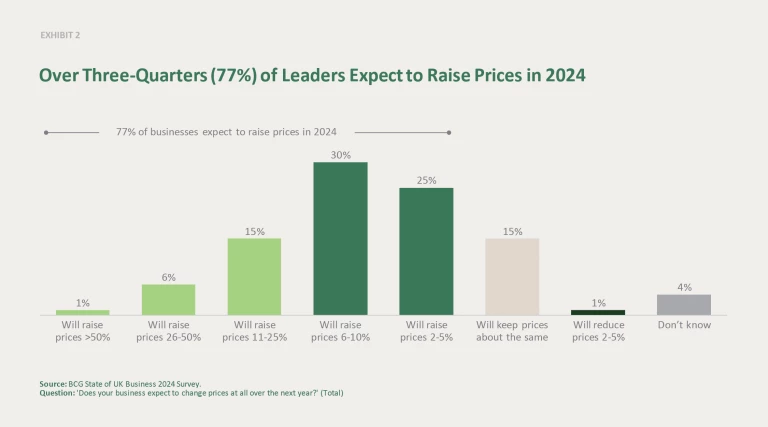

The increase in broad positivity and a belief that consumer demand will be resilient this year does have knock-on impacts, though. Over three quarters (77%) expect to raise prices in 2024 – with over half (52%) saying they will do so by 6% or more, and 22% by 10% or more. This is surprising, given that inflation is expected to head towards 2% this year. Our respondents seem to think that inflation and, by extension, interest rates may not come down as quickly as expected this year and that the path won’t be straightforward.

The prevailing narrative has been that the bulk of price rises have now been made, and the rate of increase will slow in 2024, easing inflationary pressures.

Interestingly, we found that 90% of businesses that raised their prices by 10% or more last year expected to raise their prices again this year. Nearly two-thirds (61%) say they expect to raise prices by 10% or more again, suggesting that more increases are in the pipeline. As was the case in 2023, raising prices was the top action leaders expect to take in the next six months. We also saw an 8pp increase from last year in the share of leaders (37%) who plan to cut discretionary costs in the next six months.

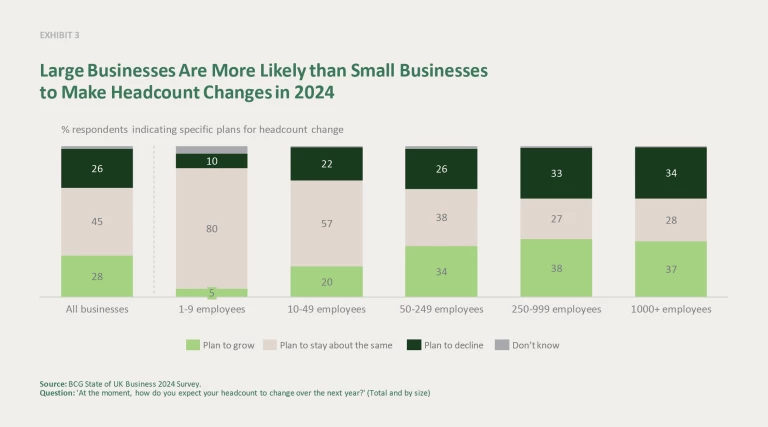

In 2023, our survey accurately predicted that the labour market wouldn’t loosen as many anticipated. This year, we expect much of the same.

Nearly three-quarters (73%) of businesses expect to maintain or increase their headcount in 2024. There is some variation across business sizes, too, with large businesses more likely to either increase or decrease headcount. This suggests that, whilst demand for workers may stay strong overall, there is likely to be slightly more churn this year than last.

Over one-third (38%) said hiring was neither more nor less difficult than last year. Interestingly, nearly as many business leaders said it was easier (28%) as said it was harder (25%) to hire staff than last year. This runs slightly counter to the broad narrative of a much softer labour market this year, in which you might expect a larger increase in the number of leaders saying hiring is easier.

Skills shortages continue to impact business leaders’ ability to recruit. More than one-quarter (27%) ranked it as their top barrier to recruitment, this rises to nearly half (44%) for public sector companies.

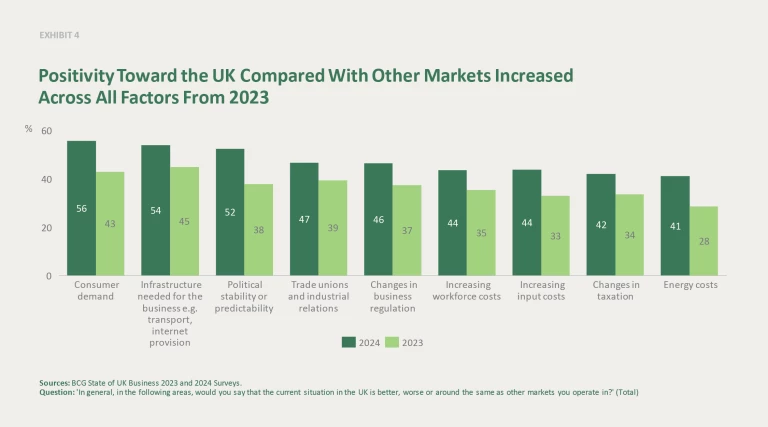

Despite the challenges of 2023 and a general election looming large, business leaders feel significantly more positive about the UK’s position compared to that of other countries. Among leaders whose businesses operate in other markets, 56% thought customer demand was better in the UK, closely followed by infrastructure needed for business such as transport and internet provision (54%), and political stability (52%).

Across all metrics, more leaders thought the UK fared better than other countries this year compared with 2023. We see the largest increase in political stability, which rose by 14 percentage points this year. This speaks to a broad feeling of increased stability across the political spectrum compared with that of the past few years – especially surprising given that election years are normally a time of increased uncertainty.

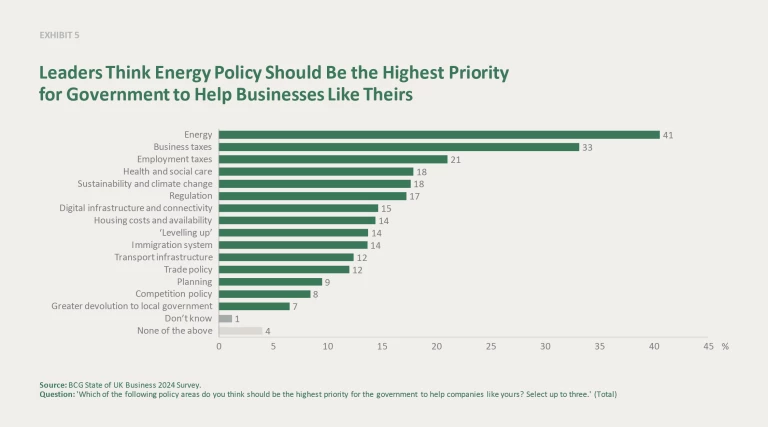

With an election on the horizon, understanding business leaders’ priorities is more important than ever. When asked about the next three years, business leaders said they expect to be most affected by high energy prices (41%), slowing of the UK economy (36%), and global economic conditions (26%). Somewhat unexpectedly, higher interest rates and costs of capital came in below these, with around a quarter (24%) of leaders saying it would have a large impact on their business over the next three years.

Despite energy prices falling somewhat out of focus in the broader narrative, our findings show that they remain very much front-of-mind for UK business leaders. This result highlights just how much the cost of doing business has increased, and the fact that, while electricity prices have come down, they remain twice what they were a few years ago.

Business leaders told us that energy (41%) should be government’s top policy priority to help businesses, followed by business taxes (33%) and employment taxes (21%). Greater devolution to local government ranked lowest (7%).

Given the pressures on businesses, it's no surprise that leaders are focused on policies that may help them retain or regain their margins.

When we asked leaders which specific policies would be good for the UK economy broadly and for businesses like theirs, their responses told us they tend to think various tax reforms will have the most positive impact.

Most favoured was reducing VAT, with 34% of leaders saying it would be good for the economy and 33% saying it would be good for businesses like theirs. Reducing the main rate of corporation tax to 15% ranked second, with 32% saying this reduction would be good for the economy and 29% saying it would also be good for businesses like theirs. Just under one-third (31%) think simplifying the tax system would be good for the economy, and a quarter (25%) think it would also be good for businesses similar to theirs.

As was the case last year, no single policy stands out, though, highlighting the challenge any government faces when developing economic policies.

Although many of the same pressures remain and the cost of doing business is unlikely to materially fall in 2024, business leaders’ optimism speaks to the UK’s ongoing economic resilience.

Our report suggests the UK economy may prove stronger again this year than many expect, albeit from a low base and in the context of a long-term economic malaise. The knock-on impacts of this improved economic outlook may be inflation being more stubborn and interest rates reducing at a slower pace than expected.

About Us

BCG's Centre for Growth brings together ideas, people and action to drive the UK forward. We work with our global expert network to identify transformational opportunities, connect key decision-makers and build coalitions for change. We offer long-term strategic insight, extensive cross-sector expertise, platforms for dialogue and bias to action.