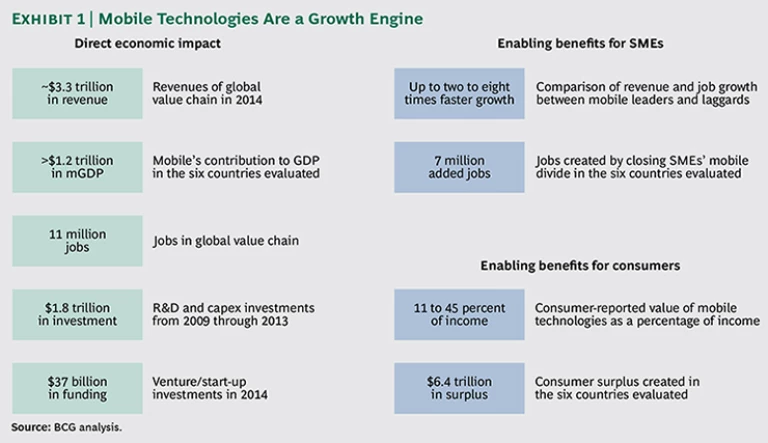

Globally, mobile technology has emerged as a primary engine of economic growth, stimulating enormous private-sector spending in both R&D and infrastructure, and profoundly changing daily lives—everywhere.

Dramatic performance improvements in mobile communications standards have propelled mobile to become the fastest adopted technology of all time.

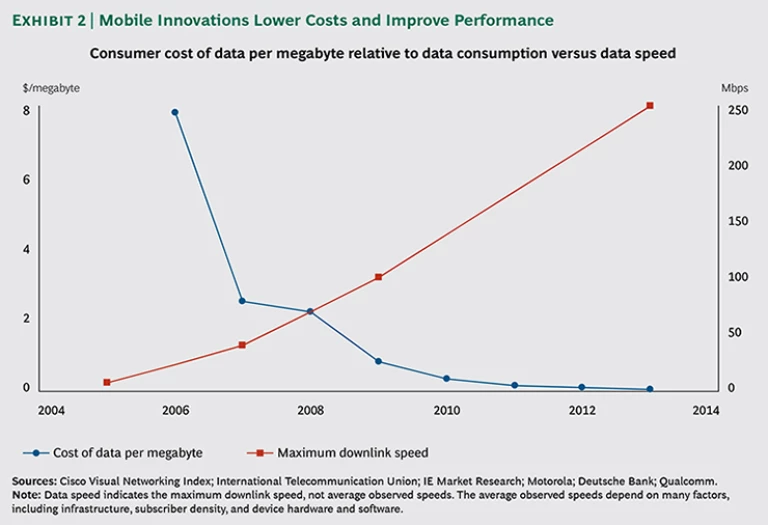

- User costs have plummeted. The average mobile subscriber cost per megabyte decreased 99 percent between 2005 and 2013. Smartphones are now available for as little as $40.

- Mobile network infrastructure costs have also fallen dramatically, while performance has soared—a 95 percent cost reduction (per megabyte transmitted) from second generation (2G) networks to third generation (3G) networks, and a further 67 percent drop from 3G to fourth generation (4G) networks.

- Mobile data-transmission speeds have skyrocketed: 4G networks offer 12,000 times faster data-transmission speeds than 2G networks.

- Consumer adoption of 3G and 4G standards has outpaced that of all other technologies, growing to nearly 3 billion connections in less than 15 years, and projected to exceed 8 billion connections by 2020.

- Effective industry-driven collaborations to solve technical problems, set standards, and license intellectual property have been key enablers in this revolution.

Mobile is connecting and empowering consumers—everywhere.

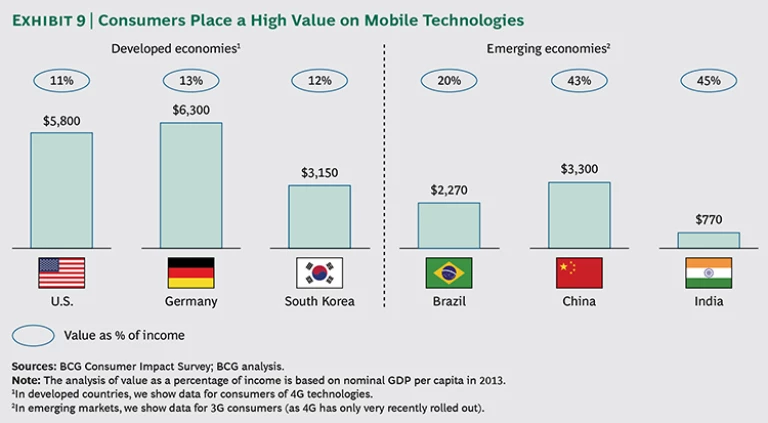

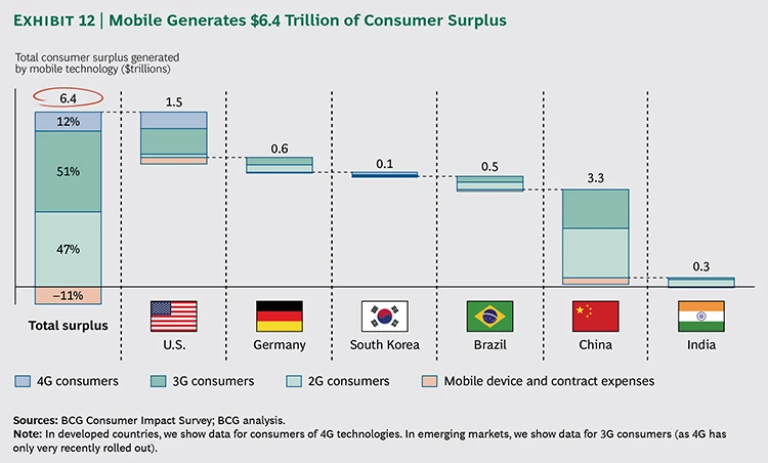

- Consumers derive enormous value from mobile. Our research across six countries—the U.S., Germany, South Korea, Brazil, China, and India—reveals that the value consumers place on mobile technologies ranges from $700 to $6,000 per user. The data show an aggregate annual consumer value for mobile technologies of $6.4 trillion across the six countries, above the cost of the devices and services.

- This aggregate consumer surplus from mobile technologies exceeds the GDP of every country in the world except for the U.S. and China.

- Mobile is especially valuable to emerging market consumers. In China and India, the consumer-reported value of mobile exceeds 40 percent of average income.

- The market demand for continued innovation and investment is clear: 90 percent of 3G and 4G consumers report they want even faster data speeds, more coverage, more battery life, and many other improvements. With global data usage doubling every year, if this trend continues, data traffic will be 1,000 times greater within a decade. New technologies will be required to accommodate this expanding demand.

- Consumers expect that mobile will continue to improve and transform their lives, delivering a broader range of services that will connect them with everything, everywhere.

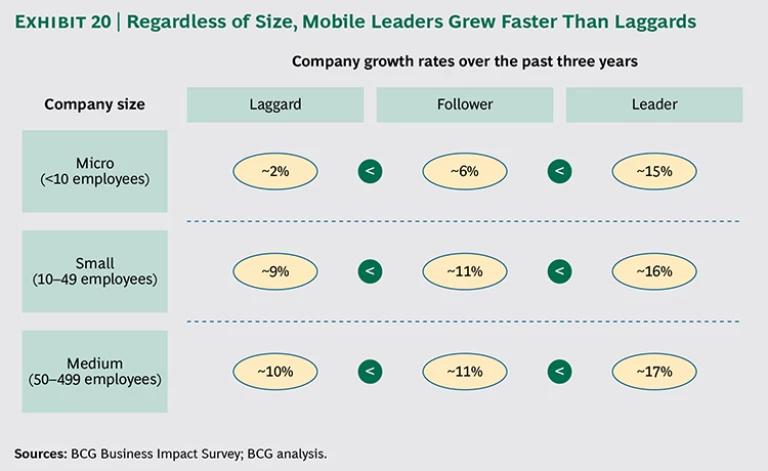

Small and medium-sized enterprises (SMEs) that adopt advanced mobile technologies are the fastest growing.

- SMEs that are mobile leaders are winning. Typically, the 25 percent of SMEs that use mobile services more intensively see their revenues growing up to two times faster and add jobs up to eight times faster than their peers.

- The mobile laggards among SMEs have revenue growth and job creation that substantially lag behind the leaders. With fewer plans to invest in mobile, these SMEs are at risk of being left further behind.

- SME mobile leaders in emerging markets are leapfrogging older generations of technology still widely used in developed markets. The share of mobile leaders in Brazil, China, and India exceeds that in the developed countries examined.

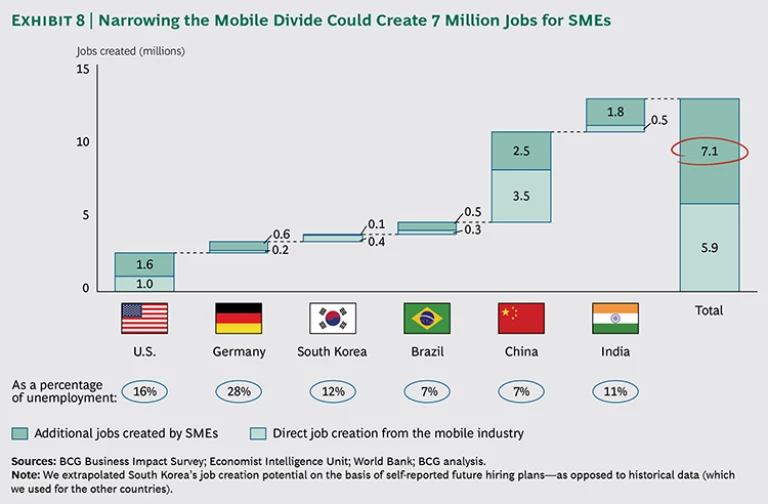

- Greater mobile adoption by SMEs can create jobs. If more SMEs expand their businesses at the rate of the mobile leaders, 7 million more jobs could be added in the six countries evaluated.

Mobile technologies are fueling economic growth, driving recovery from the global recession.

- The mobile value chain generated almost $3.3 trillion in revenue globally in 2014 and is directly responsible for 11 million jobs.

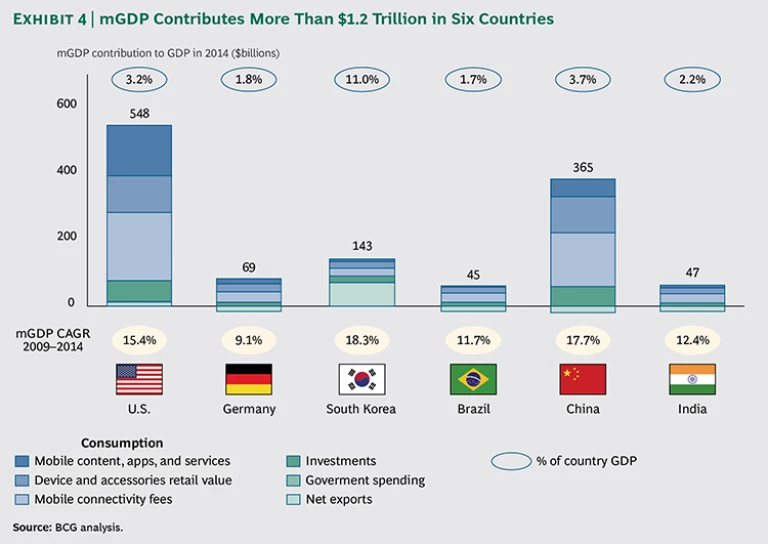

- Mobile is an engine of economic prosperity. In the six countries evaluated, mobile contributes more than $1.2 trillion in GDP. This equates to between 2 and 4 percent of each country’s GDP, and 11 percent in the case of South Korea.

- The rapid growth of mobile is poised to continue. Across the countries evaluated, mobile’s share of GDP is growing at a 10 to 20 percent annual rate and can continue or even accelerate as consumers and businesses continually discover new applications for ever more advanced mobile technologies.

The mobile industry has made massive investment in new infrastructure and R&D.

- Companies in the mobile value chain invested $1.8 trillion in infrastructure and R&D from 2009 through 2013, relying almost exclusively on private-sector funding.

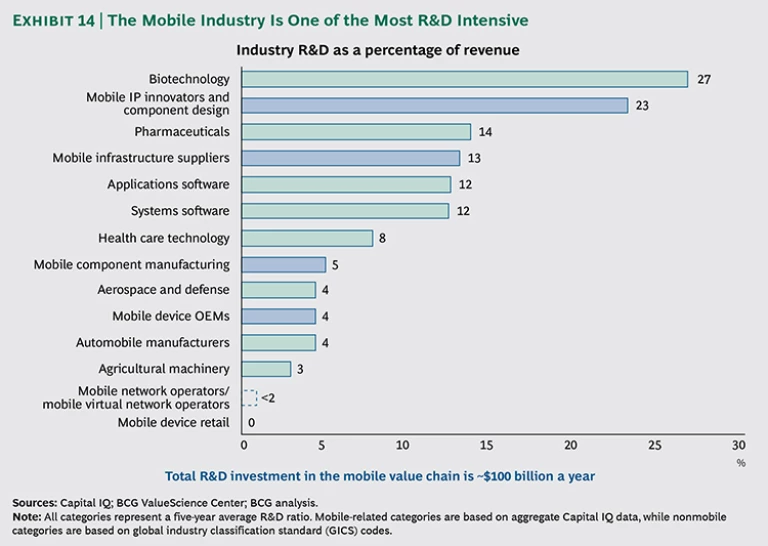

- Core technology (2G, 3G, and 4G) innovators take enormous risks by spending heavily on research and development with no guarantee of return on investment. Companies focused on mobile’s core technologies invest a larger share of revenue (21 percent) in R&D than those in any other industry except biotechnology—and more than companies in all other R&D-heavy industries, such as pharmaceuticals (14 percent).

- Licensing of core technologies within the mobile industry is essential to its rapid and cost-effective advancement. Clear and cooperative licensing arrangements make it possible for companies across the value chain—and thus consumers and businesses—to access the most advanced technologies.

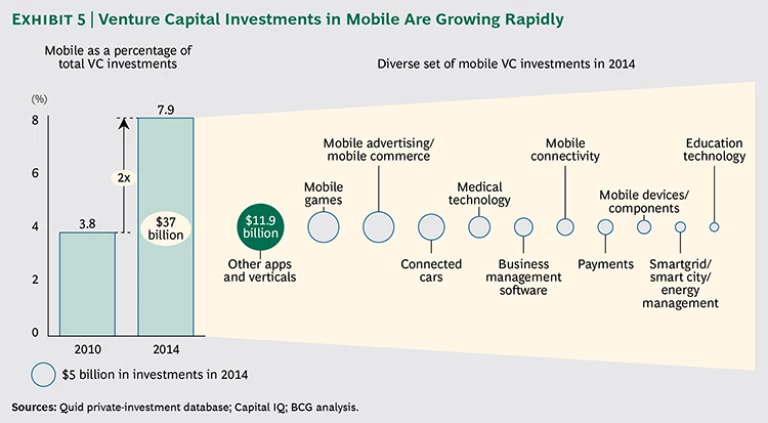

- Many new and start-up companies are entering the mobile sector. In the past five years, venture capital (VC) investments in mobile have doubled as a percentage of total VC investments, reaching almost 8 percent ($37 billion) in 2014.

To ensure that the mobile revolution continues and expands, policymakers must support an environment that fosters innovation and investment. Future growth of mobile depends on continuing the policies that enabled the industry to get where it is today.

- Strong patent protection is needed to encourage large and risky investments in mobile technology innovation.

- Market-driven licensing is vital in order to ensure that technology innovations can be widely shared with others in the industry.

- Industry standards are required to solve the industry’s most complex technology problems through open and meritocratic processes.

- Continuous allocation and availability of additional radio spectrum, especially more licensed spectrum, is needed to keep pace with consumer demand.

- To reap the economic benefit of fifth generation (5G) networks and beyond, mobile players will need to invest approximately $4 trillion in R&D and capital expenditures by 2020.

- Weakening patent protection, intervening in the industry-driven standards-setting process, or curtailing technology licensing will jeopardize the future of mobile.

The Mobile Technology Revolution

Mobile technologies have transformed the way we live, work, learn, travel, shop, and stay connected. Not even the industrial revolution created such a swift and radical explosion in technological innovation and economic growth worldwide. Nearly all fundamental human pursuits have been touched, if not revolutionized, by mobile. In less than 15 years, 3G and 4G technologies have reached 3 billion subscriptions, according to Ericsson, making mobile the most rapidly adopted consumer technology in history.

Just as the rise of the Internet in the late 1990s was marked by explosive growth and aggressive innovation, the shift toward mobile is reshaping the economic landscape once again. Mobile is not just an industry in and of itself. It is also the foundation upon which an impressive array of industries—new and old—have taken root and flourished.

ABOUT THIS REPORT

Mobile communications are the most rapidly adopted consumer technology in history. Globally, mobile technology has emerged as a primary engine of economic growth, stimulating enormous private-sector spending in both R&D and infrastructure, and profoundly changing daily lives—everywhere.

To assess the global economic impact and implications of mobile technologies, Qualcomm commissioned The Boston Consulting Group to conduct an independent study. The work included extensive research in six countries and consultation with numerous independent experts. BCG is wholly responsible for all analysis and conclusions included in the report.

By mobile, we refer to all technologies that enable voice and data services via cellular connectivity, including second generation (2G), third generation (3G), and fourth generation (4G) networks. With each leap forward in the core technologies, new digital services come online with the potential to transform fields that have massive social and economic impact, such as health care, finance, and education. Indeed, for consumers, small and medium-sized enterprises (SMEs), and the economy as a whole, mobile is a global success story. Revenues across the mobile industry have grown at 13 percent year on year since 2009—more than twice the rate of the global economy over the same period.

Recent advances in core mobile communications technologies have driven tangible improvements in user experience and access costs, leading to rapid adoption of devices. Consumers and businesses are discovering new ways to use mobile at an astounding rate, and mobile devices have a stickiness unlike any other consumer commodity (save the necessities of food and clothing). Users cite the profound impact that mobile has had on commerce, health, and public safety, as well as communication with friends, coworkers, and other social circles. The idea of leaving the house or traveling for business without a mobile phone is unthinkable for an ever-increasing number of users.

Mobile technologies are also fast becoming a growth engine for SMEs. Mobile is sparking entrepreneurship in both the developed and emerging world. It has also enabled myriad innovative business models that have helped SMEs compete on an even footing with much bigger companies. (See Exhibit 1.)

The Mobile Value Chain

The transformative effect of mobile has been made possible by an enormous investment from a myriad of players within the digital space: innovators for the core communications technologies, component designers and manufacturers, original equipment manufacturers (OEMs), infrastructure suppliers, mobile network operators, content providers, mobile app developers, and device retailers. The mobile value chain spans continents, binding together key players in a manner that is at once deeply collaborative and fiercely competitive. And the value chain for mobile technologies is only becoming more international as countries such as China, India, and Brazil begin to take broader roles in technology innovation, device manufacturing, and application development.

Each generation of mobile technologies takes years of fundamental research to develop in international standards-setting bodies, with the complexity of requirements increasing monumentally for each new generation. (See “Moving the Industry from 2G to 3G to 4G.”) These enormous investments have been fueled by policies and frameworks that incentivize innovation—including strong patent protection, licensing models that provide wide access to core technologies, and industry-driven standards. The development of technology standards, in particular, has driven the mobile industry forward. Companies across the mobile value chain need a solid foundation upon which they can implement new or upgraded products and solutions, whether they are designing compatible components, rolling out expensive infrastructure, or developing new content, apps, or services. By defining an industry standard and making it widely available through licensing, mobile players can develop infrastructure, products, and services with confidence that the core technologies are stable and universally accessible. This reduces risks associated with capital investments, so mobile companies can scale up faster, which in turn boosts consumer adoption and usage.

MOVING THE INDUSTRY FROM 2G TO 3G TO 4G

Consider the innovation required to move the industry from 2G to 3G to 4G.

Most 2G phones support only one core technology (for example, GSM or CDMA) and can only be used for voice and text messaging. The Internet connectivity is barely fast enough for casual users and insufficient as the primary Internet portal for professionals.

The arrival of 3G phones increased speeds dramatically and frequently supported multiple core technologies (such as WCDMA or CDMA2000) in order to enable global roaming. These next-generation devices incorporated location-based services through GPS, were compatible with Wi-Fi networks and Bluetooth, enabled picture sharing, and supported low-definition streaming video (albeit slowly at first).

Yet another major leap occurred from 3G to 4G technologies. 4G has enabled dramatic improvements in capacity and cost. With 4G technologies, it is common to watch full-length, high-definition videos via mobile, take video conference calls, make mobile payments via near-field communication (NFC), control devices in cars and homes via mobile, and switch seamlessly from 4G to Wi-Fi networks without interruption. These functions rely on completely new technologies that were not a part of the previous generation of mobile phones, and required more costly R&D investments than the preceding technologies.

The standardized core technologies have delivered major advances in capacity, while network and device costs have fallen sharply. (See Exhibit 2.)

- 4G technologies have enabled a 12,000-time improvement in capacity relative to 2G, with maximum download speeds of 250 megabits per second (Mbps), as opposed to 20 kilobits per second (Kbps) for 2G.

- The cost of network infrastructure per megabyte fell 95 percent from 2G to 3G, and 67 percent from 3G to 4G.

- The global average cost of mobile subscriptions relative to maximum data speed has decreased 99 percent or about 40 percent annually between 2005 and 2013.

Smartphones have become much more affordable. Approximately 30 percent of all units sold cost less than $100, and some sell for as little as $40, according to International Data Corporation (IDC). These falling prices have encouraged usage to shift from a limited pool of luxury consumers to billions of mainstream users. This robust growth in bandwidth, combined with falling costs, has spurred extensive follow-on innovations, resulting in the tremendous variety of new entrants and applications that exist today.

Looking Ahead to 5G and Beyond

As we look ahead to fifth generation (5G) networks and beyond—which promise to deliver more bandwidth and higher data rates, support the Internet of Things, and dramatically increase the numbers of connected devices—we anticipate a reinvention of communication, content, and services on a global scale.

While the mobile value chain is healthy and robust, the things that make it thrive must be nurtured. Many policies currently in place actively sustain the innovation and interoperability needed to stitch together the platforms and networks that make up the global telecommunications industry . As mobile continues to expand its reach, policymakers must continue to support an environment of innovation across the entire value chain.

The Global Economic Impact of Mobile Technologies

Mobile technologies are a critical driver of the world economy, generating global revenue of almost $3.3 trillion. (See Exhibit 3.) The mobile revolution has accelerated innovation worldwide, boosting global GDP and creating new jobs across a vast array of industries.

- Mobile is directly responsible for 11 million jobs worldwide, and the indirect impact far exceeds this number.

- More than two-thirds of mobile industry jobs are high-value, knowledge-economy jobs, such as innovation research, component and device design, and app development.

In the midst of the global economic downturn, mobile has been a beacon.

The mobile value chain extends across continents, bringing with it a boost to national economies around the world. A smartphone sold in Germany by a South Korean vendor, for example, involves coordination among many economies. The technology inside this smartphone is likely developed among the U.S., several European Union (EU) countries, South Korea, and China. Components are likely produced in some combination of the U.S., South Korea, Japan, and Taiwan, and assembled in China. Likewise, the network infrastructure—such as base stations, which are critical to the operation of this smartphone—was likely produced in Asia and uses patented technology largely developed in the U.S. and Europe.

The mobile revolution has generated enormous investments in R&D and infrastructure worldwide.

- Companies in the mobile industry invested $1.8 trillion in capital expenditures (capex) and R&D from 2009 through 2013.

- Over the past five years, total investment in mobile technologies has exceeded investment in pharmaceuticals and biotechnology combined.

- Mobile communications infrastructure is one of the only infrastructures that relies almost solely on private investment (unlike, for example, bridges, roads, airports, water, and sewage).

In the six countries we analyzed—the U.S., Germany, South Korea, Brazil, China, and India—combined mobile GDP (mGDP) contributes more than $1.2 trillion to overall GDP. (See Exhibit 4.) These six countries account for 47 percent of global GDP. To isolate the growth of mGDP from overall GDP, we used an expenditure-based approach that assesses consumption (consumers purchasing mobile devices and services and engaging in mobile commerce), investments in mobile technologies, government spending, and net exports of mobile technologies (a country’s contribution to the worldwide mobile economy).

South Korea, the U.S., and China are among those nations with the largest mobile contributions to GDP. Net exports (the difference in value between exports and imports for a given country) have had a dramatic impact on mGDP in certain countries. For nations with high production relative to domestic consumption, such as South Korea, exports are a major, if not the main, driver of mGDP. Countries with the strongest mGDP also tend to have unique capabilities within the highest-value portions of the mobile industry—intellectual property (IP) innovators, device manufacturers, and component designers—enabling high net exports. South Korea’s high mGDP, for example, is due to its major role in producing and exporting essential mobile products and components.

In the six countries surveyed, mobile typically accounts for 2 to 4 percent of each country’s GDP, with a compound annual growth rate of 10 to 20 percent. In the U.S., the 3.2 percent of GDP related to mobile exceeds the GDP of such essential industries as entertainment, transportation, automobile, hospitality, and agriculture.

A strong area of growth in mobile technologies will come from app developers, who are pioneering new ways to use the cheap and abundant bandwidth provided by the most advanced mobile standards. Important advances in mobile connectivity, geopositioning, and multimedia technologies have inspired new apps that transform the way we communicate (Twitter, WhatsApp), travel (Google Maps, Uber), make purchases (Yelp, Square), discover new music (Shazam, Spotify), and share memories (Instagram, Snapchat)—wherever we are. For apps to continue this growth, more innovation in core communications technologies is needed, as each major technological advance enables new waves of capabilities. According to Kevin Systrom, CEO and cofounder of Instagram, “The one thing that would keep us back is the ability to get data to the phone quickly and reliably. It needs to be fast and seamless—consumed instantly.”

Three Economies Driven by Mobile

Countries reaping the greatest rewards from the mobile economy—for example, South Korea, the U.S., and China—have all followed their own unique paths to success.

South Korea. South Korea has quickly become the world’s most advanced mobile economy, having embraced 3G and 4G since their onset. Mobile represents 11 percent of the country’s GDP, valued at $143 billion. South Korea is a leading actor across all phases of the mobile value chain, particularly in its high-value segments such as design and production of devices and components. A strong focus on R&D and bold investments in nascent technologies, such as semiconductors in the 1980s and Code Division Multiple Access (CDMA) two decades later, helped South Korean players take the lead in design and manufacturing operations. Two of the leading smartphone OEMs—LG and Samsung—are based in South Korea. These companies have managed to transition from low-cost products to premium, cutting-edge products, contributing exceptionally high value and building a strong global brand. By participating at such a fundamental level in the value chain, South Korea has become a highly successful net exporter, with exports of devices and components significantly exceeding imports in overall value.

The U.S. The U.S. is a major contributor to core segments of the mobile value chain, with companies like Qualcomm innovating in core communications technologies, Apple leading in OEM, Google with the most widely used smartphone operating system (Android), and Facebook as one of the most popular global apps. As a strong player in mobile innovation, the U.S. gained a leadership position in 4G technology. U.S. app developers have generated an array of new businesses. The U.S. has the largest absolute mGDP of all countries studied. Mobile’s contribution to U.S. GDP is currently 3.2 percent ($548 billion) and expected to reach nearly 5 percent by 2020.

China. In emerging markets, China has led the way in embracing mobile. (See the sidebar “Alipay Leads the Way.”) With China’s wide deployment of affordably priced 2G and 3G services, Chinese consumers have benefited greatly from mobile technologies. In 2012, China became the world’s largest smartphone market.

ALIPAY LEADS THE WAY

E-commerce and (more recently) m-commerce have taken off in China. With $295 billion in e-commerce revenues in 2013 (up from $74 billion in 2010), China has surpassed the U.S. to become the world leader in e-commerce. By 2015, mobile commerce in China is projected to reach $41.4 billion, accounting for 8 percent of all its e-commerce, according to KPMG.

The explosion in Chinese m-commerce is due in large part to Alipay, a mobile payment system that enables consumers to make payments anytime, anywhere. With 190 million active users in 2014, up from 100 million in 2013, Alipay has become China’s number one mobile payment tool, according to The Wall Street Journal.

Alipay currently dominates consumer e-commerce in China and is becoming a major force in the Chinese economy. With 300 million account holders, Alipay is believed to have processed more than $500 billion in digital payments last year, helping Alibaba capture 80 percent of all online transactions in the country.

Many of these transactions are managed through a single mobile app: Alipay Wallet. With this smartphone app, users take control of many activities traditionally handled by banks, such as opening an interest-bearing money market fund account, adding or withdrawing funds from the Alipay account, paying bills, and transferring money. It also allows users to make offline purchases from vending machines and brick-and-mortar stores.

By building trust among users through the escrow payment model (the funds will not be released to the seller until the buyer has received the products and is satisfied with them), facilitating quick and easy payments while on the go, and virtually eliminating the need to carry cash, Alipay and Alipay Wallet have helped ignite e-commerce and m-commerce across China. In the words of one Alipay customer, “80 percent of all my online transactions are done through Alipay.”

Mobile represents 3.7 percent of China’s GDP, with a 17.7 percent compound annual growth rate from 2009 through 2014. China has become a highly competitive place into which to import and assemble components into finished products, allowing the country to tap into its strong manufacturing base. China has been gaining market share in higher value areas, with the success of companies in the device space (such as Lenovo and Xiaomi) as well as telecom equipment manufacturers (such as Huawei and ZTE). Lenovo’s recent acquisition of Motorola has further strengthened China’s capabilities in mobile innovation. Also, China is now home to more inventors in mobile technologies than any country other than the U.S. and South Korea. China is also seeing the rise of a vibrant app community, with approximately 1 million people working in this high-growth field—more than twice as many as in the U.S.

The Ripple Effect

Mobile has been a driving force in the success of some of the world’s most valuable companies: 6 of the 25 most valuable companies in the world are participants in the mobile value chain—Apple, Google, China Mobile, Alibaba, Facebook, and Verizon. In the smartphone era, these six companies have grown their revenue, on average, 35 percent annually. Facebook alone grew 78 percent year-over-year between 2009 and 2013, with mobile currently representing 88 percent of its user base (of which 60 percent are mobile-only users) and accounting for approximately 66 percent of its revenue. All are major players in the mobile economy and have benefited tremendously from advances in the core technologies that enable mobile communications. Mobile is also driving intense innovation in the start-up community as well—7.9 percent ($37 billion) of all venture capital (VC) funding in 2014 was invested in mobile start-ups, up from 3.8 percent in 2010. (See Exhibit 5.) Mobile’s share of VC investments is more than double its share of GDP, indicating the critical role that innovation plays in mobile and highlighting the industry’s prospects for growth.

As this global snapshot demonstrates, the mobile value chain has generated enormous economic and social benefits for both developed and emerging markets. Mobile commerce creates a ripple effect that spreads throughout the global economy.

Case Study: Flipkart Sidesteps the Desktop

For the majority of Internet users in India, mobile devices are their primary portal to the online experience. Only about 5 percent of users in India own personal computers. (By comparison, PC penetration in the United States and Japan has reached 90 percent or more.) According to Unitus Seed Fund, 34 percent of people in India access the Internet exclusively through mobile phones. Mobile penetration in India is expected to reach 953 million subscriptions by 2015, up from 507 million in 2009. In light of the strong disparity between PC and mobile usage in India, some companies have crafted their business models to capitalize on the mobile revolution.

Flipkart, India’s largest e-commerce marketplace, caters to the huge numbers of people in India’s towns and cities who rely on mobile devices for commerce. Consumers can use the Flipkart app to search, share, compare prices, and shop from thousands of third-party vendors in more than 70 categories (including clothing, appliances, and power tools)—generating major purchasing power for customers previously unable to access the Internet.

More than 10 million people in India have installed the Flipkart app. Mobile traffic growth for the app is twice that of PC-driven traffic growth, and over 50 percent of the company’s traffic comes through the mobile app and the mobile website. Flipkart anticipates that mobile commerce through the app will constitute more than 75 to 80 percent of all user traffic in India by 2016.

Growth Engine for SMEs

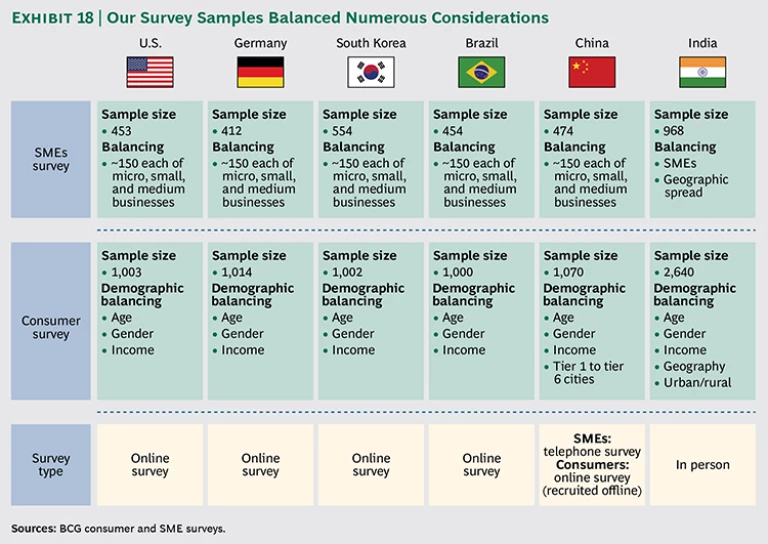

Because SMEs are the principal growth drivers of so many economies around the world, the research for this report included a comprehensive study of the relationship between SMEs’ adoption of mobile technology and their performance. We surveyed approximately 3,500 SME decision makers in the U.S., Germany, South Korea, Brazil, China, and India—six of the world’s largest and most diverse economies—and took an inventory of their companies’ mobile adoption levels. We focused on mobile technologies used for marketing and sales (such as mobile apps) and those used for operations (such as mobile data collection or fleet management). (See our detailed survey methodology in the appendix .)

In many economies, SMEs are responsible for up to 65 percent of all jobs, according to the Organization for Economic Cooperation and Development. Due to the importance that SMEs have in the economy, we examined the practices that set SME mobile leaders apart, and we assessed the sizable potential opportunity for national economies through increased SME adoption of mobile technologies.

In both developed and emerging markets, we found that mobile has been widely adopted by SMEs. Of the small businesses we surveyed, 90 percent report that their top managers use mobile devices regularly. And 50 to 70 percent of these companies pay for the cost of mobile devices and/or service costs for their employees. But while SMEs report high levels of adoption, they vary widely in their level of engagement. Whether in emerging or developed markets, SMEs that have embraced advanced, data-driven mobile capabilities have fared better than their peers.

Leaders and Laggards

For a subset of SMEs that we call mobile leaders, mobile has proven to be an enormous boon. These companies stay ahead of mainstream mobile adoption, riding each new advance to improve productivity and efficiency in operations, connect with new customers and markets, and compete with much larger players. Mobile leaders employ the full range of available tools, such as basic productivity tools (voice, text, and email), operational tools (real-time job tracking or mobile data analytics), and sales and marketing tools (mobile-friendly website or company apps). These mobile capabilities allow them to be more innovative and, in some cases, fundamentally transform the way they operate.

At the other end of the spectrum there are mobile laggards. Mobile laggards generally have low levels of technology adoption and limited mobile presence. Laggard SMEs have not yet integrated well-established tools into their business models, much less explored the benefits of more sophisticated technologies, such as a mobile app or mobile data-capturing tools.

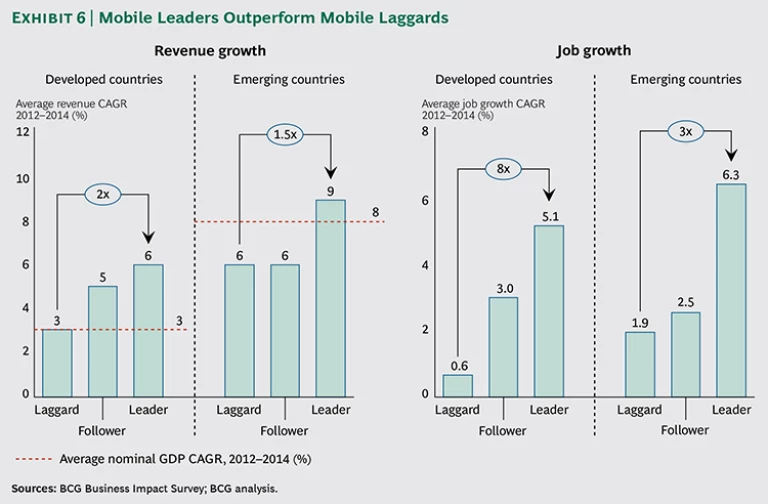

According to our research, approximately one-third of SMEs fall into the category of mobile leaders, and these leaders are demonstrating exceptional performance relative to both followers and laggards. (See Exhibit 6.) (More precise definitions of these terms are provided in the appendix .)

- Mobile technologies level the playing field, often allowing mobile leaders to grow faster than the economy as a whole.

- Mobile leaders have grown revenue up to two times faster than laggards and have added jobs up to eight times faster over the past three years.

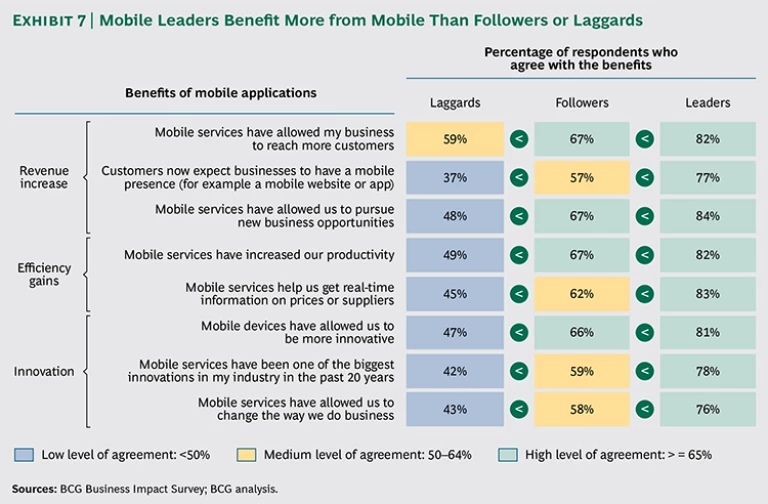

Mobile leaders report much greater benefits than laggards in terms of increased revenue, efficiency gains, and innovation. This is due, in part, to the fact that mobile leaders can reach more customers and engage with them through additional channels, increasing opportunities for marketing and sales. Leaders also use devices to increase productivity, through on-the-go mobile data capture, dashboards that share real-time information, enterprise apps, and other applications that smooth operations. (See Exhibit 7.)

SMEs in emerging markets have benefited enormously from mobile and have a higher percentage of leaders overall than their counterparts in developed markets.

- In Brazil, China, and India, 25 to 30 percent of SMEs surveyed are mobile leaders, as opposed to only 14 percent in Germany.

- Approximately 75 percent of emerging market SMEs surveyed report that mobile has helped them grow revenue, become more efficient, and be more innovative (compared with only 50 percent of SMEs in developed markets).

Many factors contribute to the higher number of mobile leaders in emerging markets than in developed markets. For many consumers in emerging countries, mobile is their only portal to the Internet, making it more crucial for SMEs to create a strong mobile presence. Likewise, mobile is truly transformational—allowing emerging market SMEs to leapfrog an entire generation of technology and directly develop business models or operational tools for mobile platforms. Without complex legacy systems requiring integration with mobile technologies, these SMEs have an easier path to embracing mobile. Finally, mobile has served as a great leveler for SMEs, allowing smaller players to compete on an even footing with larger enterprises. Apps developed by solo entrepreneurs or small businesses can stand toe-to-toe with apps created by technology giants like Apple and Google.

Benefits of Narrowing the SME “Mobile Divide”

The “mobile divide” between leaders and laggards—that is, the difference in growth associated with a disparity in mobile adoption—is poised to increase going forward. According to our research, approximately 60 percent of mobile leaders report that investing in mobile is a top priority compared with only 15 percent of mobile laggards. Most SMEs report that having a mobile presence is quickly becoming a must-have to attract customers, but a significant portion of small businesses are falling behind.

Narrowing the divide could be especially important in countries like South Korea, where SMEs have struggled to compete against large conglomerates in recent years. Because access to mobile technologies is a powerful enabler of economic and social development, it is essential that the divide between mobile leaders and laggards be narrowed.

In the six countries evaluated, closing the mobile divide among SMEs could add 7 million jobs over the next three years—more than the total number of mobile value chain jobs in these countries. It could also increase GDP growth by 0.5 percentage points and help reduce unemployment by more than 10 percent. (See Exhibit 8.) In countries like Germany or the U.S., where high unemployment has been a problem over the past five years, closing the mobile divide could help reduce unemployment by as much as 15 to 30 percent.

Given the importance and size of the SME sector, governments that fail to encourage growth among SMEs today will face job stagnation tomorrow. Governments must foster the right conditions in order to fuel the growth of the next billion-dollar enterprises. (See Lessons on Technology and Growth from Small-Business Leaders , BCG report, October 2013.) For these reasons, there is a need for strong policies aimed at tackling the mobile divide head on.

Case Studies: SMEs Seize the Mobile Advantage

To better understand how mobile technologies spur economic growth for SMEs, it is useful to examine how mobile has changed the way small businesses and solo entrepreneurs do business. Below we provide three examples that show how small businesses are using mobile technologies to attract new customers, earn more revenue, and fetch the best prices for their goods.

Crowdsourced Reviews: Leveling the Playing Field for Small Business. Small businesses are constantly looking for ways to set themselves apart from larger competitors. Crowdsourced referral apps like Yelp in many countries, or Siksin Hotplace in South Korea, give small businesses the chance to stand out among their peers (even if their peers have much deeper pockets) and gain customer trust.

In the U.S., 30 percent of businesses report that a large portion of their customers come from referral apps like Yelp. According to a BCG survey of nearly 4,800 small businesses, companies that had a Yelp profile but did not advertise on the site nevertheless reported generating incremental revenues of $8,000 annually from Yelp—a kind of passive halo effect. The return is even more powerful for small businesses that actively shaped their digital presence through advertising campaigns on Yelp. The survey found that those companies achieved an average uplift in annual revenue of more than $23,000. (See “ Unlocking the Digital-Marketing Potential of Small Businesses ,” BCG article, March 2013.) According to Matt Halprin, vice president of business operations and strategy at Yelp, “Around 50 percent of all our searches now come from mobile devices, highlighting the importance of mobile for us.”

Referral apps can be effective for a wide range of small businesses. One dentist we interviewed reported that in a single month more than 1,000 people visited his practice’s Yelp page. A restaurant owner in South Korea uses Siksin Hotplace to optimize his inventory, saying: “There is no turnaround time. If I realize I have too many ingredients for a day, I can offer online coupons for the night in a few minutes. And customers love to use the coupons, not only because these are good deals, but also because they know the food will be great from many reviews from nearby customers.” The transparency and immediacy of feedback, coupled with the ability to refine marketing and promotional techniques to reach nearby customers, make these mobile apps a powerful tool for SMEs.

Mobile Payments: Moving Toward a Cashless Society. Mobile payments have unlocked enormous benefits for microbusinesses, small merchants, and solo entrepreneurs, by enabling easy point-of-service sales. Global mobile payments are expected to reach $630 billion worldwide in 2014, up from $170 billion in 2010, according to Juniper Research. Easy-to-use, low-cost mobile payment solutions (such as Square) allow small businesses to make sales anytime, anywhere. In emerging markets, with high mobile penetration but low penetration of bank accounts, online payment solutions enable many new opportunities for small businesses.

For a taxi driver interviewed in Brazil, mobile payments have not just saved him money, they have increased his sense of security. He uses Cielo, a mobile payment solution, to handle transactions with customers. Before mobile payments, he conducted business with cash only. When he lacked correct change for customers, he sometimes lost revenue. Worse, when he had large sums of cash in his cab, he often felt vulnerable to thieves. He now carries a minimal amount of cash in order to conduct business, which facilitates easy transactions with customers and enhances his sense of well-being on the job.

mFarming: Bringing Mobile into the Field. Mobile technologies are enabling farmers to manage their business better. In India, for example, farmers are often located too far from an urban area for fixed line connectivity, limiting access to information about pests or diseases, soil conditions, or current market prices. mKrishi, a mobile app, enables farmers to receive proactive, personalized crop advice as well as periodic, weather-specific alerts on how to protect against pests or when to harvest. Farmers using the tool have increased their productivity by 15 percent, according to mKrishi. One farmer we interviewed reported that use of mKrishi doubled his tomato yield from 800 crates per acre to about 1,600 crates per acre. Another said, “mKrishi has reduced my costs by about 50 percent.” Noted economist Jeffrey Sachs called mobile the greatest tool for poverty alleviation ever invented. As the world’s population grows, mobile farming technologies will become essential.

Connecting and Empowering Consumers

The biggest winners in mobile are consumers. The global adoption rate of mobile devices has been spectacular, driven by steady technology improvements and lower costs. Mobile devices provide ubiquitous connectivity and an array of applications and services that impact almost every facet of life. Further, in emerging economies, mobile is often the first point of access to the Internet, and therefore opens up a huge range of activities that were previously inaccessible.

Today, nearly half the world’s population subscribes to a mobile service, according to GSMA. While approximately 60 percent of users still have basic 2G connections, by 2020, there will be approximately 2.3 billion 4G connections (25 percent of all mobile connections at that time), dramatically increasing the range of services and value provided to consumers around the world.

To better understand how much value consumers derive from mobile technologies and how they use these technologies, we surveyed approximately 7,500 consumers in the U.S., Germany, South Korea, Brazil, China, and India as part of the research for this report. We used a sophisticated approach to ascertaining the true value that mobile creates independent of what consumers currently pay for devices and connectivity. (See our detailed survey methodology in the appendix .)

Our research shows that mobile technologies are creating immense value for consumers—value that greatly exceeds the cost of owning a mobile device. Consumers worldwide value mobile technologies at 11 to 45 percent of their income—well above what they pay for the service. (See Exhibit 9.)

The Value Consumers Place on Mobile Technologies

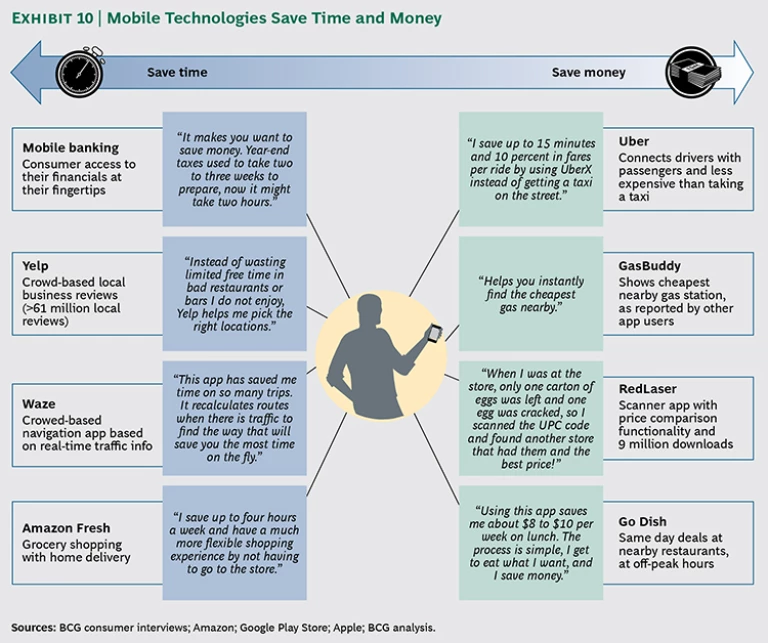

The ways that consumers use mobile technologies vary considerably in developed versus emerging economies. In developed markets, the ubiquitous connectivity makes users’ lives easier through services such as mobile banking, GPS-based mapping, and crowdsourced recommendation apps. With breakthroughs in capacity and data rates, a booming ecosystem of mobile apps has emerged to save consumers time and money while they are on the move. (See Exhibit 10.) Consumers in developed markets value mobile technologies at upward of $6,000 per year, or approximately 12 percent of their income.

In emerging markets, the numbers tell an even more powerful story. Chinese consumers for example, value mobile at approximately 45 percent of their income. For many consumers in emerging markets, mobile phones are their only “connected” device. It provides the chance to live healthier lives, access educational resources, earn a higher income, and create better living conditions. In China, more than half of consumers reported that mobile technologies make them more productive at work and allow them to pursue entrepreneurial activities.

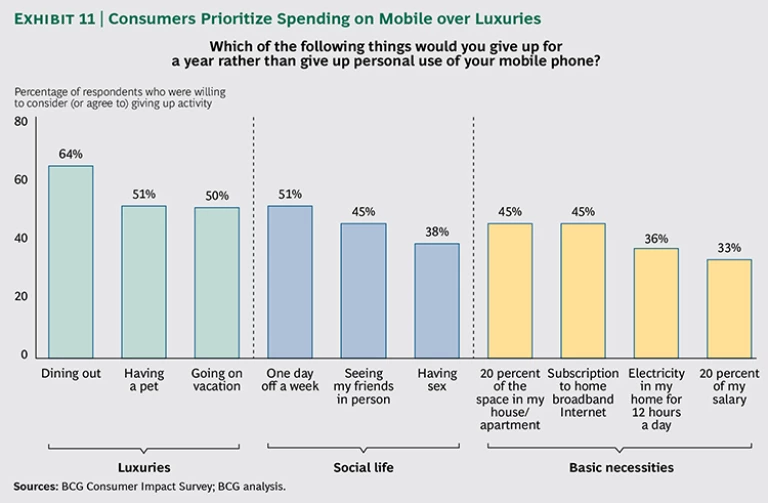

Mobile technologies have become a basic necessity for many consumers. This can be seen in the trade-offs consumers would accept to keep their mobile phones. The majority of people surveyed were willing to give up luxuries (such as dining out or going on vacation) for a year in order to keep their mobile phone. In China and South Korea, a majority of users would give up a subscription to home broadband Internet rather than go without a mobile phone. (See Exhibit 11.)

The benefit consumers receive from mobile technologies can be more fully quantified using an economic concept called consumer surplus—that is, the value that consumers themselves receive, over and above what they pay for devices, apps, services, and Internet access. In the six countries evaluated, mobile technologies have created $6.4 trillion of annual consumer surplus, with approximately 65 percent of that value stemming from 3G and 4G capabilities. (See Exhibit 12.)

- This consumer surplus of $6.4 trillion far exceeds industry revenues across the entire mobile value chain and is greater than the GDP of every country in the world, with the exception of the U.S. and China.

- If 4G services were rolled out to all existing mobile consumers in the six countries analyzed, we estimate an additional $1.4 trillion in consumer surplus, bringing the surplus to $7.8 trillion.

Case Studies: Mobile Changes Lives in Emerging Markets

The following two brief case studies show the benefits that mobile devices deliver across the globe, by empowering women to fight back against violence and improving overall health and well-being.

Fighting Back Against Violence. In India, an app called FightBack allows women to send out a security alert to friends, relatives, and emergency services when they feel threatened or endangered. With the push of a panic button on the smartphone app, an SOS alert is triggered and sent out to a predefined list of six emergency contacts. This instant alert continuously pinpoints the user’s exact location through GPS tracking.

Beyond its immediate benefit of helping to protect women who are exposed to violence, the app also has far-reaching effects within the broader community. For example, it provides an interactive map of all locations in which alerts have been issued. This information has helped police officers to identify “hot spots” where women feel threatened on the streets, and that information has been used to improve safety in these areas.

Treating Disease and Saving Lives. In emerging economies, mobile health (mHealth)—the use of mobile applications and devices to deliver medical information, access data, or provide clinical services—offers basic health-care services to patients that might otherwise go untreated. According to TechChange, access to mobile technologies is growing much more quickly than access to traditional health care services. People in emerging countries account for 80 percent of worldwide mobile subscriptions, but they have an average doctor-to-patient ratio of 1:250,000; in light of this situation, mHealth represents a new effective way to bring health care to more people.

Swasthya Samvedana Sena, an initiative in India, uses mobile technologies to improve maternal health. Frontline health-care workers in multiple regions across India use mobile tablets to educate pregnant women and new mothers on a wide range of topics, including women’s health, pregnancy, labor, contraception, government services, postnatal care, and HIV. According to one beneficiary, “Visits by the doctors have now decreased thanks to the education provided by this service.”

More Innovation Is Needed

Despite the tremendous impact that mobile has already delivered—or perhaps because of its tremendous impact—businesses and consumers still want more. We found that 90 percent of the 3G and 4G consumers who participated in our survey are eager for advances above and beyond the currently available mobile technology.

Fundamental innovation is required to boost speed, extend battery life, and strengthen connectivity. More network rollouts are needed to deliver better service to more consumers at lower cost. The next generation of technologies cannot get here fast enough for those who are accustomed to always-on, instant access to everything.

Core technology improvements and more reliable connections have led users to engage in increasingly data-intensive activities on their mobile devices. This, in turn, places additional strain on capacity. Between 2013 and 2018, global mobile data traffic is expected to increase elevenfold, reaching 15.9 exabytes per month by 2018, according to Cisco. That is three times faster than fixed Internet protocol traffic. Mobile data speed is also expected to increase dramatically.

Many of these breakthroughs will require continuing up-front investments in R&D by the industry. Our analysis has identified several key enablers that have fostered innovation and investment in the mobile industry, including strong patent protection (in order to incentivize risky, up-front investment in innovation), industry-driven standards (in order to solve complex industry challenges), and the allocation of additional spectrum (in order to keep pace with consumer demand and support the ever-increasing array of new mobile devices, applications, and services).

The Enablers of Mobile Innovation

Mobile has grown faster than any other industry in history, but it is still in its early days. New applications and services are spreading rapidly, drawing consumers deeper into the mobile economy each year. 5G is coming, bringing with it a variety of new mobile capabilities. Some have already begun, such as the Internet of Things—machines or devices that communicate directly with other machines or devices. By connecting billions of devices and trillions of sensors, the Internet of Things has the potential to revolutionize consumers’ interactions with nearly every industry. (See the sidebar “Getting Smarter: The Internet of Things.”) Other capabilities have yet to be dreamed up by the innovators of the world.

GETTING SMARTER : THE INTERNET OF THINGS

The smartphone industry has already revolutionized the global economy, but this phenomenon represents just the beginning. By 2020, the Internet of Things is expected to rival the smartphone industry with revenues in the trillions.

The Internet of Things is changing the relationships between consumers and the myriad objects all around them. Equipped with sensors, objects can interact autonomously with their environment or be controlled remotely by the user. Cars can communicate with other vehicles, elevators can monitor their own safety, packages can be tracked as they move from one location to the next, home appliances can be turned on or off remotely. These new features are helping people be safer, save money, conserve resources, and simplify their lives.

The number of connected devices is growing rapidly. According to Cisco, there were 500 million connected devices in 2003 and 12.5 billion in 2010, and these numbers are expected to rise to 50 billion in 2020.

While the Internet of Things has great promise, important technical and policy challenges must be addressed for it to reach its full potential. First, explosive growth in the number of connected devices will put a heavy strain on existing communications infrastructures. Second, new technologies must be developed to support connectivity for highly mobile objects (such as planes or cars) and extremely remote objects (such as oil pipelines). Finally, if we want to achieve a truly global Internet of Things, common standards of communication need to be established among all of these connected objects so they can communicate and “understand” one another.

For mobile to continue its upward trajectory, conditions must remain ripe for innovation. In order to set an effective policy agenda, it is critical to understand the key enablers that have empowered the mobile industry to become a center of global innovation and economic growth in the first place.

There is no single answer, as not all players in the mobile ecosystem thrive on the same model of innovation. As we have described before, the mobile ecosystem can be viewed as a value chain—a series of players that work together to enable smartphones and other devices to exist. At the consumer end of the value chain we have a rapidly proliferating universe of mobile applications and services, created by content developers, software companies, start-ups, and others. In the middle are the manufacturers of components, devices, and infrastructure. Underlying all of this, we have the creation of core communications technologies, without which the industry could not begin to function. All links within the chain are essential, and depend upon one another to thrive, but they rely upon varying innovation models.

App developers, for example, thrive on staying agile and capitalizing on trends. A developer can build an app in days or weeks on a minimal budget, go live, and make changes on the fly. The market, made up of millions of small businesses, has succeeded beautifully through individual experimentation and trial and error.

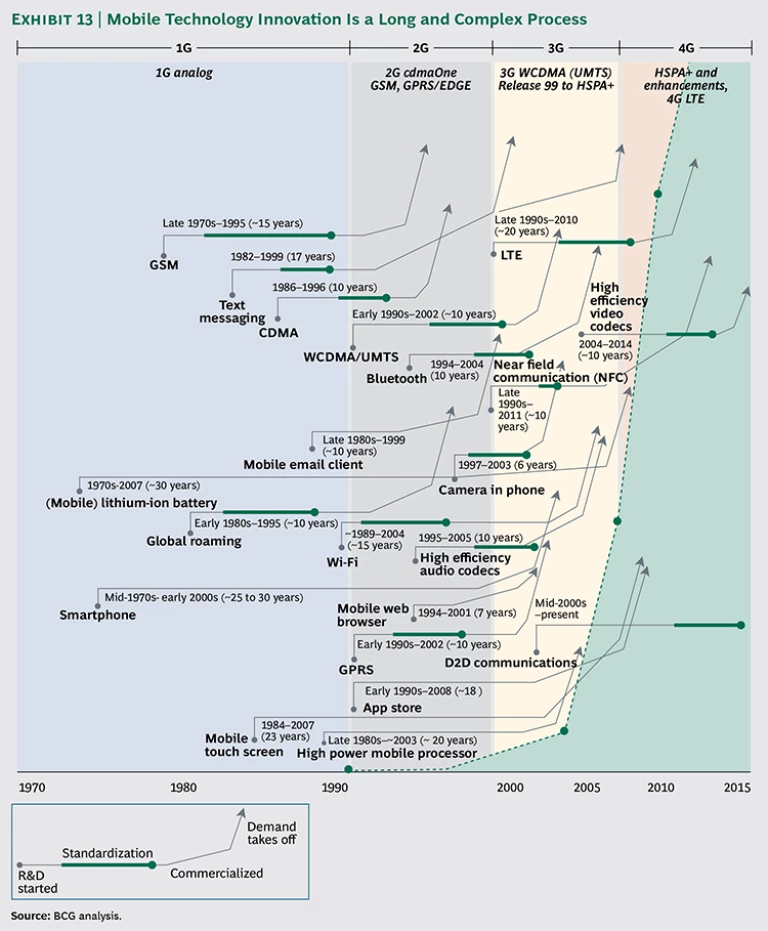

In contrast, core mobile technologies developed through industry standards follow an entirely different trajectory. These fundamental technologies are developed through decades of research, typically by a relatively small number of companies, without certainty that they will be adopted. For example, during the development and roll-out of 4G, two technologies competed for prominence in the core technology space: LTE and WiMax. A small number of companies invested enormous resources into these two 4G technologies. After nearly a decade of competition to best address the core technology needs in the marketplace, LTE has achieved significantly wider adoption and commercial value than WiMax. Such significant up-front investments in R&D push the industry forward, but the companies responsible assume significant risk with no certainty of return. Exhibit 13 details the long and uncertain process many technologies, including those built into standards, have followed on the path to widespread adoption.

Fundamental Enablers of Growth in Mobile

BCG analyzed the critical factors that have contributed to mobile’s phenomenal success worldwide. Based on this analysis, we identified seven key enablers that have spurred growth throughout the mobile industry. Because two of the enablers—IP frameworks and standards-setting—are less frequently addressed in the literature, we focus significant attention on them here; however, all seven enablers have given rise to mobile’s success.

Strong IP Frameworks. The 3G and 4G technologies driving today’s mobile devices are the cumulative result of thousands of technological innovations over the past four decades. Tomorrow’s cutting-edge core technologies will be based upon research that began ten or more years prior to commercial launch. For example, the research behind text messaging began in the early 1980s. More than 15 years later, text messaging became widely commercialized.

The innovation model used by developers of core technologies is very much akin to the model used by pharmaceutical companies. Large and long-term investments in multiple technologies may lead to a single widely commercialized product (while numerous R&D projects never make it to commercialization). Nonetheless, R&D investment in mobile technologies continues to accelerate, reaching almost $100 billion annually, and growing at a rate of 9 percent year-over-year since 2009. Companies developing IP in mobile technologies invest more as a percent of revenue in R&D (23 percent) than any other industry, except biotechnology (27 percent). This includes traditionally R&D-heavy industries such as pharmaceuticals (14 percent). (See Exhibit 14.)

The development of core technologies requires both strong IP protection (including patent protection to incentivize innovation) and licensing to ensure broad access to these enabling technologies. The core technologies are the oxygen within the mobile ecosystem: fundamental to life, invisible to the user, and necessary for all other functions to continue. The licensing model ensures that patented technologies are universally available while providing a mechanism to compensate innovators (through licensing revenue), thereby encouraging additional investment in next-generation technologies.

The current patent framework has proven to be highly effective at incentivizing mobile innovation and investment. According to the World Intellectual Property Organization, mobile patents have grown from virtually nonexistent to almost 400,000 families (that is, a set of patents covering one invention in multiple countries) since 1985, representing 6 percent of total patent activity (total patent activity is measured as mobile’s share of Patent Cooperation Treaty applications).

While patent regimes vary from country to country, nations with strong patent protection tend to see more innovation than their counterparts with less robust patent frameworks. IP incentives and protections, as well as support for licensing core technologies, are key to successfully promoting innovation across the mobile ecosystem.

Collaborative Industry Standards-Setting Processes. Standards-setting bodies are tasked to solve the industry’s most complex technology challenges. The 3rd Generation Partnership Project (3GPP)—the primary standards-setting body for 3G and 4G technology standards—unites six telecommunications standards-setting organizations from around the world in a self-driven, collaborative, and meritocratic process. While the standards-setting process has laid the groundwork for mobile’s historic rise, it is not always well understood, even within the industry.

A standard starts out with a clear, bold goal for a future level of desired technical performance. From 2G to 3G, for example, the goal was to increase capacity tenfold. The industry works together to find effective solutions to the technical challenge.

- A work item is proposed around a given challenge, and once it is approved by members, working groups identify industry needs and develop requirements.

- Once consensus is reached on the list of requirements, it is submitted to the system architecture and procedures working groups.

- These groups accept proposals for technologies that fulfill the requirements; proposals are combined and revised over the course of months of research, simulations, and debate.

Companies across the value chain—from component design and manufacturing, to OEMs, to core technology innovators—have the opportunity to contribute to technology solutions and vote on adoption of all proposals. This same process is subsequently carried out to identify the technical protocols associated with each requirement. Once technological solutions have been drafted and specifications agreed upon, they are incorporated into the standard for publication. After publication, the standard can be tested and incorporated into products.

As a point of reference, setting standards for 2G, 3G, and 4G required participation from hundreds of companies all over the world:

- 2G (global system for mobile or GSM). This effort entailed 15 years spent on 2G-related standard releases, with more than 200 companies and 13 countries involved, and took approximately 866,000 person hours.

- 3G (wideband code division multiple access or WCDMA). This endeavor involved 11 years spent on 3G-related standard releases, with more than 300 companies and 39 countries involved, and took approximately 950,000 person hours.

- 4G (long-term evolution or LTE). This undertaking required more than nine years spent on 4G-related standard releases, with 320 companies and 43 countries involved, and took more than 1 million person hours (and counting).

- According to 3GPP, less than 10 percent of participating companies have submitted technical contributions, with the majority of contributions being made by fewer than 15 companies.

- Every year, more mobile companies from diverse regions across the globe participate in the standards-setting process.

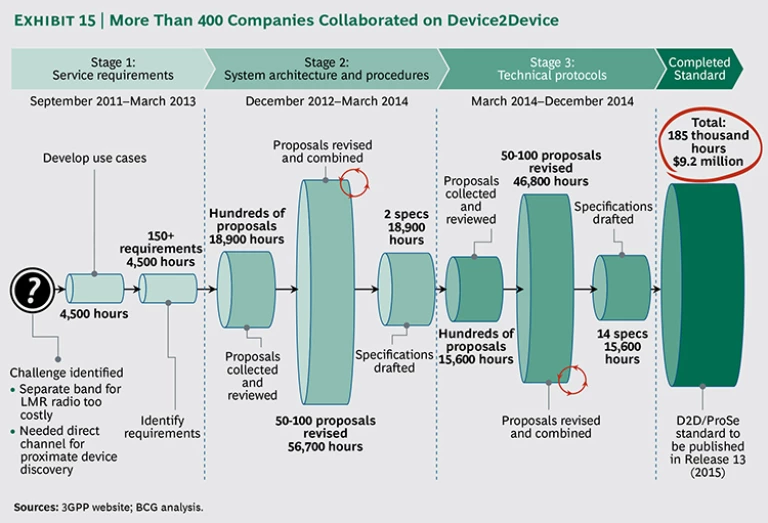

Exhibit 15 illustrates the standards-setting process using one feature within the LTE standard: device to device (D2D) communications. D2D communications—which took 400+ companies nearly 200,000 hours over 3.5 years—only represents 14 out of 492 specifications incorporated into Release 12 of the LTE standard. Moreover, Release 12 is one of five existing releases setting parameters for 4G alone.

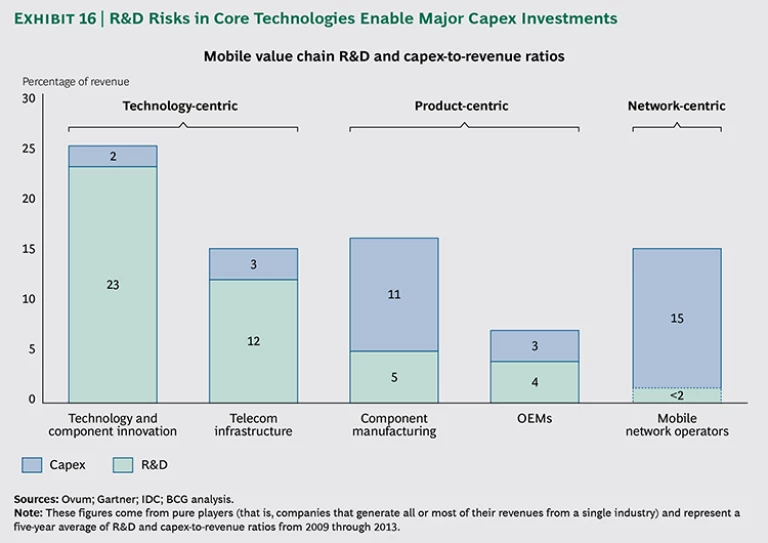

Standards benefit the entire mobile value chain. Without standards, companies that build mobile devices and services would endure significant additional technology risk. (See Exhibit 16.) By setting a standard such as LTE, technology risk is eliminated for thousands of companies around the world. The incredible improvement in performance from 2G to 3G to 4G indicates that the standards-setting process is working.

Because the mobile industry depends upon competing companies sharing IP, the standards-setting bodies have put a licensing model in place. By ensuring that essential technologies can be licensed, new industry entrants can more easily enter the market and compete on an even footing, and consumers benefit through lower costs and enhanced global interoperability. Over the past five years, every segment of the value chain has grown, and competition is increasing over many segments.

- According to IDC, global average selling prices for smartphones decreased 23 percent from 2007 through 2014, while prices for the lowest-end phones decreased 63 percent over this period.

- The number of global OEMs grew from 71 to 172 from 2007 through 2014, with increasingly broad geographic representation, including new entrants from emerging markets such as China and India.

- Three of the top five players in 2007 lost significant market share over the past seven years.

A World Without Standards or Licensing

The mobile industry depends on the streamlined coordination of many innovators to effectively develop the technologies that power mobile. Without clear industry-driven standards, many competing platforms would develop. These competing platforms would splinter off, rather than reaping the combined benefit of all global technologies, and both industry players and consumers would suffer.

In a world without industry standards, the mobile industry’s distinct business models would be disrupted, resulting in several losses in value to industry players:

- Competing platforms would duplicate fundamental R&D, leading to higher development costs for mobile products.

- Innovation would slow without a mechanism to pool and build on the best technologies, decreasing the impact of mobile products and services.

- Companies would have reduced access to the best technologies due to geographic barriers.

- Network operators and device makers would have to bet on one platform—and would likely stick with this platform (due to high switching costs) regardless of its progress.

Each of these factors would translate into even greater lost value to consumers:

- Consumer choice would be restricted to a few incompatible proprietary systems, as opposed to the myriad choices in devices and services available to them today.

- Consumers would have access to less technologically advanced products and services, reducing functionality and decreasing time and money saved.

- High prices for the core technology would be passed on to consumers, limiting adoption, with a disproportionately negative effect in emerging markets.

- Lack of interoperability between platforms, devices, and geographies would hinder access and usage.

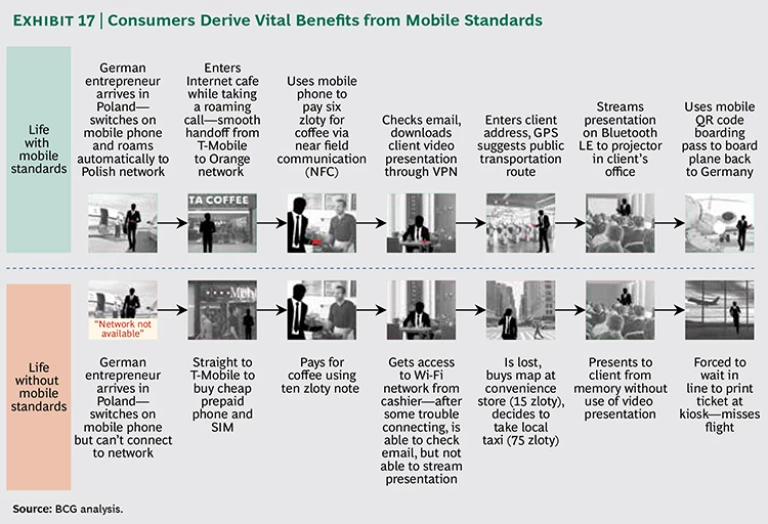

Exhibit 17 highlights many of the often subtle ways in which standards enhance the user experience.

Spectrum Allocation for Mobile Data Traffic. One of the biggest constraints on more mobile data usage is the availability, allocation, and use of spectrum—the bands of radio waves over which data and voice communications (as well as other over-the-air media) travel. Spectrum is a critical resource for mobile networks—without sufficient spectrum, they cannot operate. Core technology companies use spectrum to achieve the greatest capacity and deliver the best user experience.

There are three types of spectrum: licensed for exclusive use, unlicensed, and shared licensed. Although more spectrum of each type is necessary, exclusive-use licensed spectrum is especially critical because it provides absolute protection from interference and is therefore used to deliver wide area, ubiquitous connectivity on an interference-free basis. Fortunately, policymakers around the world recognize the industry’s vital need for this spectrum on a continuous basis, and there are many initiatives under way.

Free International Trade and Capital Flows. Free trade in IP facilitates global adoption of superior technologies. Countries with high import taxes limit mobile penetration and reduce consumer access to the best technologies. Mobile technologies can be used as a tool for economic growth, but only if they can achieve widespread adoption. For example, Ghana has taken a step in this direction with its recent decision to abolish its 20 percent import duty on mobile phones. By eliminating this tax, Ghana expects to reduce handset costs (as taxes make up approximately 35 percent of the cost of a smartphone in Ghana) and increase mobile phone penetration.

Likewise, low-cost manufacturing brings down equipment and device prices for consumers. When barriers to international trade and capital flows are low, customers around the world get the best technologies at the lowest prices.

Healthy Network Operator Environment. Network operators must invest billions of dollars a year to deploy the most advanced technologies. In many parts of the world, these operators struggle to earn adequate returns on their capital investments. Operators and consumers can become ensnared in a catch-22. When network operators make substantial capital investments to meet consumer demand, prices for mobile data plans may rise, as operators seek a return on investment. Conversely, prices will be lower for consumers in areas where network operator investment is lower, but consumers may receive subpar services.

It is in everyone’s interest to ensure that network operators are motivated to roll out 4G capabilities and invest in new platforms in order to support the integration of more advanced technologies in the future. Market structures must strike a balance in order to encourage robust network investments while delivering affordable prices to consumers.

Dynamic Digital Services Ecosystem. The digital services ecosystem is thriving, which drives stronger investment in core technologies and infrastructure. This, in turn, drives additional investment in digital services. At very low cost, application programming interfaces (APIs) place in the hands of entrepreneurs the means to create value—and thereby reduce the cost of innovation by orders of magnitude. The use of open APIs and tools for developers feeds this virtuous cycle.

In addition, a dynamic digital services ecosystem is fueled by highly educated, skilled innovators. To sustain the levels of technological advancement that we have seen thus far in mobile, we must support an environment rich with educational and entrepreneurial opportunities.

Trust and Transparency. The use of mobile devices can create challenges for consumers and others that require fair resolution. One of the most important of these involves data privacy and security and how data are used. We must balance the potential value of personal data with the rights of individuals and societies to determine what are, and are not, legitimate uses of data. (See Rethinking Personal Data: Strengthening Trust , a report by The Boston Consulting Group and the World Economic Forum, May 2012.) Without a sense of trust among consumers, mobile will not live up to its full potential.

Mobile innovators are expected to invest approximately $4 trillion in capex and R&D over the next five years. To maintain the pace of innovation and ensure that the mobile revolution continues to have a powerful economic and social impact, governments and policymakers must take action to stimulate innovation, accessibility, and growth. The right policies can incentivize investment in next-generation technologies (5G and beyond), ensure widespread access to mobile services, and promote adoption among businesses and consumers. As mobile continues to mature over the coming years, we believe these policies will become increasingly critical to the industry’s success.

Big and Making It Bigger

In its brief history, mobile has already had a sweeping impact on the global economy, businesses small and large, and consumers nearly everywhere. As we enter the next stage of the mobile technology revolution, we encourage policymakers to help sustain and foster an environment that will continue to support investment and innovation in mobile technologies.

The policy agenda we recommend focuses on three key goals: incentivize investment and innovation; expand access to services and devices; and promote adoption and usage of mobile technologies.

Incentivize Investment and Innovation

The mobile industry has been propelled by hundreds of billions of dollars in up-front, risky, R&D investments. The following policy recommendations are designed to encourage continued investment in innovation.

Incentivize technology innovators through strong patent protection and market-driven licensing. Technological innovation is research intensive. In order to innovate, compete, and drive the next generation of mobile technologies, companies must invest enormous sums in research and development. Much of this investment is poured into technologies that never reach the market. For those technologies that do, it is critical to have a predictable and market-driven process for licensing IP. As noted earlier in this report, mobile players invested an aggregate of $1.8 trillion in capex and R&D from 2009 through 2013 and are expected to invest approximately an additional $4 trillion between 2014 and 2020. Such heavy, sustained, up-front expenditures require patience, confidence, and a significant assumption of risk.

Policymakers can support these tremendous private investments by ensuring that a robust IP framework is in place to protect patent rights and facilitate market-driven licensing. Weakening patent protection would reduce the incentives currently motivating innovators to develop technologies essential for transition to 5G and beyond. These protections help safeguard hard-won innovations and enable companies to obtain a return on their investment in innovation.

Support collaborative, industry-driven standards-setting. Standards-setting bodies in telecommunications play a vital role within the mobile industry. Industry standards promote interoperability across the entire mobile value chain; reduce technology risk and lower costs for manufacturers and network operators who must commit to emerging technologies; and deliver a frictionless experience for end users.

The mobile industry governs itself through standards-setting bodies and should be encouraged to continue this historically effective self-governance. The private sector has led the way in order to ensure that mobile technologies solve critical industry challenges, function smoothly across geographies, and promote interoperability for all players across the mobile value chain.

Support an environment that fosters experimentation. The proliferation of sensors and connectivity—across devices and machines—will create new consumer and industrial applications that are hard to imagine today. To effectively take advantage of these digital innovations, companies, governments, and individuals need to have an open mind and a bias toward experimentation. Policymakers can support industry-driven standards for complex new technologies—such as machine to machine and the Internet of Things—and avoid unnecessary regulations or policies that limit technological experimentation on behalf of these emerging technologies.

Expand Access to Services and Devices

Consumers in both developed and emerging markets are embracing mobile like never before. To expand access to devices and services, policymakers should take action to allocate additional spectrum, encourage vigorous private investment in infrastructure, and support measures that bolster interoperability.

Ensure that adequate spectrum is available for mobile. The amount of spectrum currently released for mobile communications is far less than that required to support future growth in mobile data traffic. Technology has helped overcome similar constraints in the past, and it will no doubt continue to do so, but governments and operators also need to do more to alleviate issues of availability, allocation, and harmonization that constrain the ability of various participants in the mobile ecosystem to invest in infrastructure and deliver services. (See Delivering Digital Infrastructure , a report by The Boston Consulting Group and the World Economic Forum, April 2014.)

Ensure that levels of regulation for network operators are appropriate. Capital investments in networks are critical to consumer adoption of mobile devices. New infrastructure and network upgrades can spur greater adoption and transform the user experience. It is important that regulation supports the delicate balance of simultaneously encouraging investment among network operators, while also promoting competition to ensure consumer choice and affordable solutions.

Reduce barriers to trade. Tariffs increase prices for imported goods and artificially raise prices for businesses and consumers. Higher prices make imported devices and technologies less accessible to a population. To ensure that businesses have the tools to compete at peak global productivity levels, and that consumers benefit from the most advanced devices and technologies, prices for imported goods should correspond to world market prices. Removing quotas and import taxes, such as tariffs, supports free trade in mobile devices.

Encourage the growth of the digital-services ecosystem. Governments should encourage investment and growth within the digital-services sector. Robust fixed and mobile infrastructure, healthy environments for VC investments, and innovation-friendly business environments are all key factors in a dynamic digital-services ecosystem. In addition, policies that support high-tech education will ensure that highly skilled employees are prepared to contribute to the growth of mobile technologies.

Promote Adoption and Usage of Mobile Technologies

To ensure that the mobile revolution continues and expands its powerful economic and social impacts, governments and policymakers must take action to promote adoption and usage of mobile technologies among businesses and consumers.

Transparent data management and privacy protections. While personal data can be enormously valuable to unlocking economic and social benefits, individuals and societies have the right to determine how their personal data will be used. Without this trust, consumers will be significantly less inclined to use mobile technologies to the fullest extent possible.

Consumer confidence in data protection will be increasingly important in the ever-expanding “smart” society in which personal data are generated and collected by a proliferation of devices and services. Existing policies currently do not address future applications of mobile that are fast becoming a reality. Policies are needed to protect consumer data against intentional or unintentional security breach or misuse.

Experiment with eGovernment and mobile government services. Companies, governments, schools, hospitals, not-for-profits, and nongovernmental organizations, among others, increasingly realize they need to interact with their constituencies—not just online but via smartphones and tablets. Policymakers should encourage policies that promote adoption of mobile devices by these organizations.

The mobile industry stands out and can be a model for other industries for how innovation and market-driven collaboration can lead to massive opportunities for growth and impact.

The impact of mobile is unprecedented. It has lifted the global economy, created millions of new jobs, and changed billions of people’s lives for the better in record time. Mobile technologies have become a cornerstone of the present and future global economy, both as an industry in its own right and as an enabler of opportunities in every sector.

Despite the enormous investments that have already been made in mobile technologies, we are still at the dawn of mobile’s history. For this industry to sustain its extraordinary impact on jobs, economic growth, and technological progress, enormous levels of innovation are still needed. This innovation will drive the next generation of devices, create new growth opportunities for mobile players across the value chain, and ensure that the promise of the mobile revolution is fully realized for SMEs and consumers. Governments have thus far served the mobile industry well by incentivizing innovation and investment. If supportive policies continue, we have no doubt that the mobile revolution will continue, and expand, and drive unprecedented growth for many years to come.

Appendix: Methodology

The following describes our approach to measuring the economic impact of mobile technologies.

Measuring mGDP

BCG developed a comprehensive global production and consumption model for this report, in order to account for the complexity and interdependency of companies across the mobile value chain. For the consumption side, we consider end-user sales of devices as well as intermediary inputs for device production for each country (for example, a device OEM needs components for its device production). For production, we break down the device retail price into discrete categories in order to calculate production along the device value chain (for example, retail markup, licensing, components, and assembly). For each of these steps we conducted a detailed analysis of the manufacturing location in order to attribute the appropriate portion of the value to each country. By assessing production values against consumption values, we determine net exports (or net imports) for each country.

To calculate mobile’s contribution to overall GDP for our six countries, we used the expenditure method of GDP calculation.

Consumption. mGDP consumption includes spending on mobile devices, mobile connectivity services, and mobile commerce. Mobile device consumption includes purchases of feature phones and smartphones, tablets, and related accessories. Mobile connectivity services include spending on mobile data, voice, and text services. Mobile commerce transactions include goods and services sold via mobile devices, content and applications purchased via mobile devices, and mobile advertising spending. However, we do not include transaction values of money transfers via mobile devices (for example, over a banking app on a tablet).

Investments. For mGDP, we consider the relevant investments by mobile value chain participants. These investments include capital expenditures of mobile operators and all other value chain participants (retail and manufacturing of devices, mobile connectivity services, and the app economy). Further, we include investments in spectrum licenses and enterprise mobility investments. As is common practice, we do not include R&D investments.

Government spending. The largest portion of governments’ contribution to mGDP is purchasing devices and providing connectivity services for government employees; these are already covered in our consumption measures. However, governments also contribute to mGDP via individual subsidies and tax breaks for the mobile sector in each country (such as the lifeline program in the U.S.), and this is included in our measures of mGDP as well.

Net exports. Net exports capture the difference between exports and imports. For example, mobile-related products produced in the U.S. but consumed in other countries count toward U.S. GDP. However, products produced elsewhere but consumed in the U.S. do not count and must be subtracted from consumption.