With demand and regulation forcing the global shift to green trucks, manufacturers must develop new strategies to survive. The first step: convincing fleet operators and creating the charging infrastructure.

Change is unfolding at electrifying speed in the commercial vehicle industry, driving truck manufacturers the world over to transform themselves—quickly. Even before digital connectivity and autonomous driving technologies trigger tectonic changes, the launch of zero-emission vehicles is likely to disrupt the sector in the near future, over the next five to 10 years. Regulatory changes in most countries, the increasing competitiveness of “green” powertrains, and rising awareness of the implications of climate change are accelerating the industry’s migration to emission-free trucks.

It’s critical for medium- and heavy-duty vehicle manufacturers, as well as fleet operators, to manage their transition to a future powered by zero-emission engines, but it won’t be easy. Most incumbents face the dual challenge of ensuring that their existing businesses remain profitable even as they tackle the investment-heavy challenges of developing electric powertrains. A recent global study by BCG suggests that commercial vehicle manufacturers and fleet operators, as well as their ecosystem partners, would do well to buckle up, understand the road ahead, and use four new strategic levers to thrive sustainably tomorrow.

The Future and Its Drivers

Back-to-back crisis years, because of the COVID-19 pandemic and the global semiconductor shortage, have affected both the demand for, and the supply of, commercial vehicles. But several factors—the jerky return to economic normalcy last year, the growth of e-commerce, and the impending investments by several governments in infrastructure and supply chain development—returned global vehicle sales to their traditional levels in 2021. The recovery was driven mainly by the Chinese market, with Europe and the US still suffering from the pandemic-induced recession.

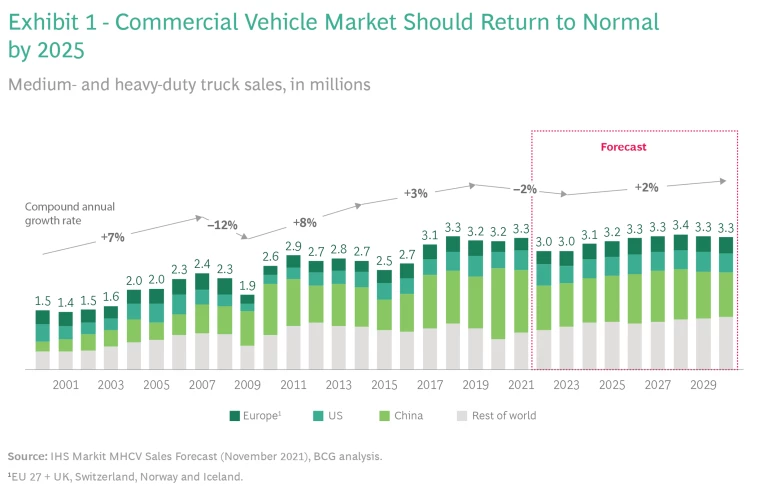

Although the industry appears to be lumbering down the road to normalcy, commercial vehicle sales are likely to reach pre-COVID-19 levels only by 2025. According to projections, global sales of medium- and heavy-duty commercial vehicles will cross 3.3 million units a year by 2030, a compound annual growth rate of 2%. Of that number, 1.1 million vehicles will be sold in China, 500,000 in the US, and 400,000 in Europe—the world’s three biggest markets. (See Exhibit 1.)

Economic policies and business economics soon will turbocharge the adoption of electric trucks in the world’s largest markets.

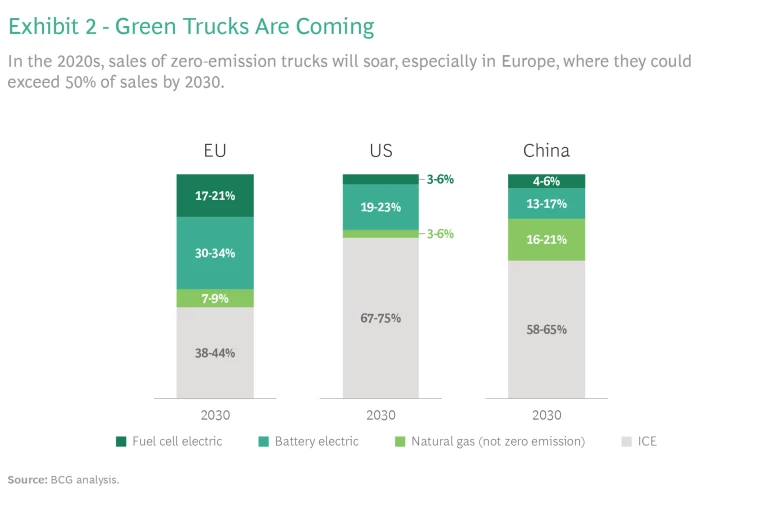

Importantly, economic policies and business economics will turbocharge the adoption of electric trucks in the largest markets. Sales of battery electric and fuel cell electric commercial vehicles will grow in all of them soon, according to our study, rising first in Europe and the US, followed by China. (Battery electric vehicles (BEVs) use only rechargeable battery packs, with no secondary source of propulsion. Fuel cell electric vehicles (FCEVs) use a fuel cell that generates electricity using oxygen from the air and compressed hydrogen—sometimes in combination with a small battery, or supercapacitor—to power its motor.)

In Europe, about 32% of new commercial vehicles sold in 2030 will be battery electric and 19% will be fuel cell electric, while the corresponding numbers in the US will be 21% and 4%, respectively, and in China, 15% and 5%. By 2030, zero-emission commercial vehicles will capture a 28% share—or 500,000 units—of the European, American, and Chinese markets combined, marking the beginning of an unprecedented global shift to green vehicles. (See Exhibit 2.)

Two forces, which are mutually reinforcing, are driving the adoption of green powertrains.

Green regulations. At the macro or policy level, both the European Union and the US are trying to tighten regulations on commercial vehicles powered by internal combustion engines and incentivize the adoption of zero- and low-emission trucks.

The European Green Deal announced in December 2019, for instance, seeks to tighten Europe’s 2030 target for greenhouse gas emissions to 55% of 1990 levels. In the case of trucks, we assume the EU will adopt rules like those for passenger vehicles and vans, aiming for a 50% reduction in emissions by 2030 compared to 2021.

Starting in 2025, every European truck manufacturer will have to meet the target for emissions from all the new trucks registered in a calendar year as well as the stricter norms that will take effect in 2030. The silver lining is that the new regulations will offer incentives for making and buying zero-emission vehicles as well as the flexibility to balance the emissions of different vehicle types in each manufacturer’s portfolio.

The Biden administration has unveiled ambitious new rules for vehicles from the model year 2023. If enforced long-term, they could cut about one-third of the carbon dioxide produced every year by the United States.

On the other side of the Atlantic, in August 2021, the Biden administration unveiled ambitious new rules for vehicles from the model year 2023 that if enforced long-term could cut about one-third of the carbon dioxide produced every year by the United States. However, most of the changes are regulatory, rather than legislative, which means that everything the Biden administration has announced could be reversed in the future by another government with different goals.

Meanwhile, 15 American states, led by California, are trying to restrict the use of trucks with internal combustion engines. In November 2020, they announced floors for sales of zero-emission vehicles by every manufacturer. These state-level actions likely will result in a steady increase in demand for zero-emission vehicles regardless of the national political climate.

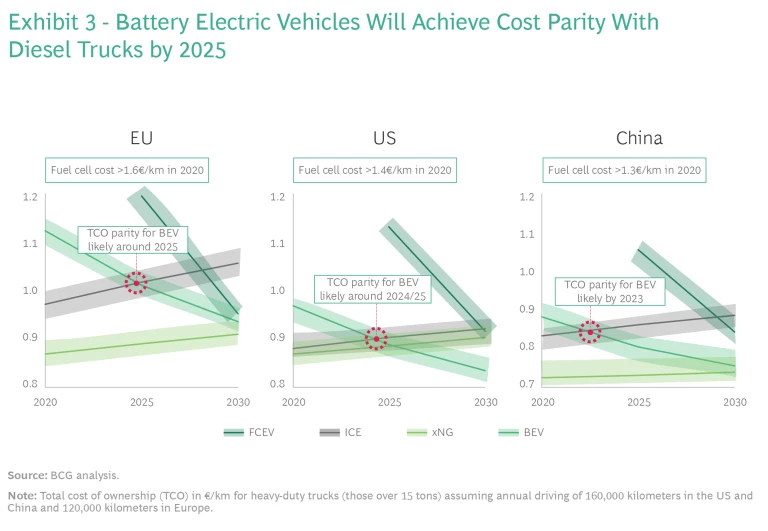

Economics. At the micro or buyer level, the use of zero-emission vehicles by fleet operators is nearing a tipping point. The total cost of ownership for battery electric vehicles will attain parity with that of conventional vehicles soon, between 2023 and 2025, and fuel cell electric vehicles should follow suit between 2028 and 2030. (See Exhibit 3.) In an industry where margins have always been wafer-thin, electric powertrains must become cost competitive if fleet owners are to adopt them.

Several factors will improve green vehicles’ cost competitiveness soon. Regulation is likely to increase the cost of diesel over the next decade to a level that cannot be offset by the development of more efficient engines. And battery costs will fall to under $100 per kWh by 2030, which suggests that battery electric vehicles will outperform diesel in almost every market. Even green hydrogen, which is hardly available today, could start retailing for $5 per kilogram by 2030 due to technological developments as well as scale, making the use of fuel cell batteries financially viable. And in markets like the US, governments will provide tax credits to make it cheaper for companies to build electric trucks and for operators to buy them.

Together, these developments will result in battery electric and fuel cell electric vehicles gaining market share, with battery electric vehicles increasingly used on short-haul and regional routes by 2025 and fuel cell electric powertrains used on long hauls by 2030. While the economics of fuel cell electric vehicles in Europe and China will be comparable to those of conventional powertrains by 2030, it likely will happen later in the US, where diesel costs are lower than in most other countries. Thus, as stated earlier, the zero-emission vehicle adoption rate could rise by 2030 to as much as 51% in Europe, 25% in the US—more if new policies force a bigger shift—and 20% of all new vehicles sold in China.

Three Scenarios for Three Markets

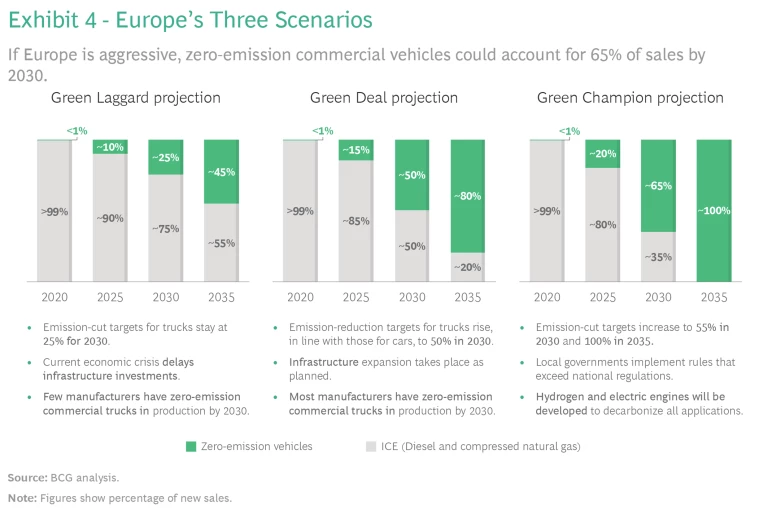

To roadmap the dynamics of demand in the world’s biggest markets, BCG drew up three scenarios for each: The Laggard, Target, and Leadership scenarios. (See exhibits for the detailed forecasts.)

If Europe can deliver on its Green Deal, with emission-cut targets rising to around 50% in 2030, the demand for green trucks will rise to as much as 50% of all the new ones sold.

Europe. Europe could turn into a green laggard if its targets for reducing vehicle emissions stay static at 30% in 2030. In that worst case, the demand for zero-emission powertrains will rise from 1% in 2020 to just 25% in 2030. If Europe can deliver on its Green Deal, with emission-cut targets rising to around 50% in 2030, the demand for green trucks will rise to as much as 50% of all the new ones sold. The continent could even stay the green champion by increasing its emission-reduction targets further. The demand for zero-emission trucks would then shoot up to 65% by 2030, and 100% of all the new commercial vehicles sold by 2035. (See Exhibit 4.)

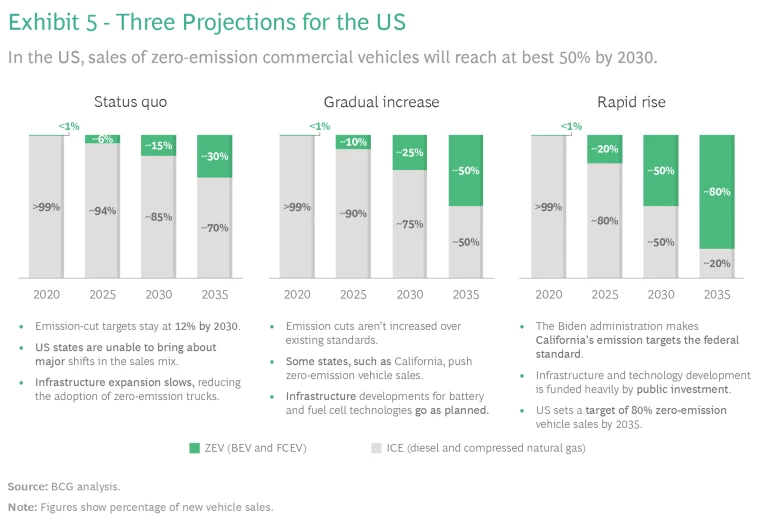

United States. The US could remain a green laggard, with its emission-reduction targets staying at the current level of 12% a decade from now. If that happened, the demand for zero-emission vehicles would rise to just 15% by 2030. Of course, America could gradually step up its emission-cut targets, with several states pushing the use of green trucks, increasing the demand for zero-emission vehicles to 25% by 2030. And the US could become a green champion if the Biden administration, as it promised when it came to power, makes California's emission goals the national standard. That alone would ensure that sales of zero-emission vehicles would top 50% of the US market by 2030. (See Exhibit 5.)

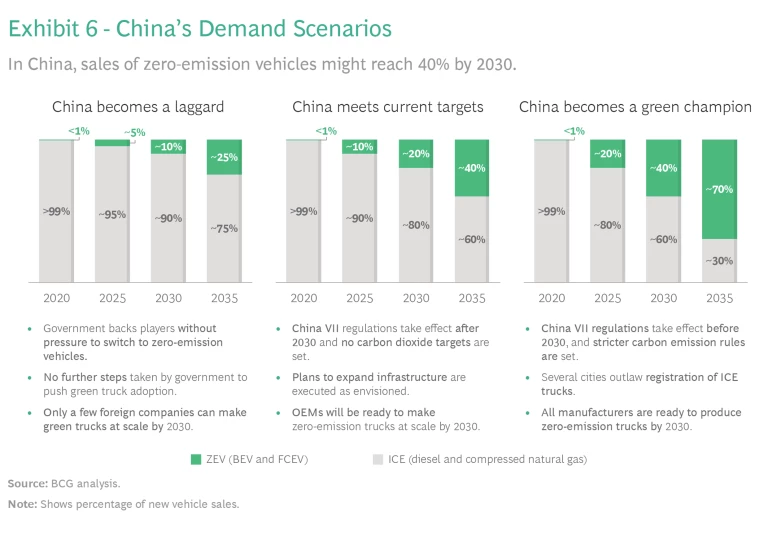

China. If the Chinese government doesn’t push the state-owned manufacturers, which are focused on reducing emissions from their diesel engines, to make more zero-emission vehicles, the latter’s share will rise from the current 1% to just 10% by 2030. China’s carbon emissions won’t peak until the 2030s, so the state doesn’t see the need to cut emissions immediately. Tighter regulations and stricter implementation will cause the demand for zero-emission vehicles to rise to 20% by 2030. Promisingly, there’s been talk about China aspiring to become a green champion by developing a new set of emission regulations. With the country’s truck-makers, such as FAW, already kicking off the production of electric trucks, the demand for them would then rise to as much as 40% of the market by 2030. (See Exhibit 6.)

Four Strategy Shifts

Against this future-cast, commercial vehicle makers in countries all over the world must change gears if they wish to survive. They can jump-start new strategies in four ways.

Accelerate Launches. Electric vehicles will be trucking’s future, but few are available in China, Europe, or even the US at present. That could change. Several commercial vehicle manufacturers launched, or announced plans to unveil, electric trucks last year, some of which may hit the market in 2022. Many incumbents—such as Daimler Trucks, TRATON, Volvo Trucks, PACCAR, and FAW—already have started producing electric trucks. They will be followed by offerings from new entrants such as Lion Electric , Xos, Einride, Nikola, Volta, and the long-awaited Tesla Semi. In fact, BCG’s forecasts suggest that vehicle manufacturers could offer around 50 zero-emission models by 2025, which should result in higher sales.

Commercial vehicle manufacturers have no choice but to prioritize the production of electric trucks and shorten the time it takes to get them to market. They must reduce product development cycles, install new manufacturing capacities, and set up the supply chains for them. Don’t forget, manufacturers can rely on nontraditional suppliers to build electric powertrains, and component prices will fall as higher production generates scale economics.

Several vehicle manufacturers are forming alliances to reduce the excessive costs and risks of entering a new business. For instance, in 2019, IVECO, FPT, and Nikola forged an alliance to develop zero-emission vehicles. Similarly, in October 2020, TRATON and Hino set up a joint venture that focuses on the development of electric vehicle platforms, initially in Sweden and later in Japan. In November 2020, Volvo and Daimler created a joint venture to develop fuel cells for heavy vehicles, with Volvo acquiring 50% of Daimler Truck Fuel Cell.

Convince Customers. Most fleet operators aren’t willing to invest in electric trucks yet, mistakenly believing that the total cost of ownership is too high. According to BCG’s 2021 truck customer survey, 84% of heavy-duty vehicle buyers in Europe don’t expect to buy electric trucks for their fleets in the next 10 years. Their concerns extend from the prices of electric vehicles and their range to uncertainty about the charging infrastructure, charging times, and resale values.

Most fleet operators aren’t willing to invest in electric trucks yet, mistakenly believing that the total cost of ownership is too high.

While the prices of electric trucks are higher than those of standard ones, they will save fleet operators money in the long run because of much lower maintenance and fuel costs. But since electric trucks will cost two or three times more than conventional ones, most fleet operators will buy them only if they are needed to meet stricter environmental regulations. In other words, the green laws must tighten to the point that they implicitly mandate the use of zero-emission trucks.

Manufacturers must overcome formidable barriers before they can get fleet operators to adopt electric trucks. They must start by educating would-be buyers about the capabilities of zero-emission trucks, show how they can be integrated into various aspects of fleet operations, and demonstrate that electric trucks’ ownership costs are lower than ICE-powered ones.

Create Infrastructure. Battery electric trucks will require substantial amounts of electricity because they’re heavier than light-duty trucks, pull bigger loads, and operate for longer periods. The energy use of medium- and heavy-duty electric vehicles can range from 0.8 kWh to 2 kWh per mile, compared to 0.2 to 0.4 kWh per mile for light-duty vehicles. The size of the battery packs will increase charge times. To charge a 1,000-kilowatt battery, for instance, a supercharger (with an average 120 kilowatts of charging capacity) would take about eight hours. By 2030, even at the current rate of adoption, electric trucks’ annual electricity consumption will equal that of 50 million households.

Currently, there’s little charging infrastructure available for medium- and heavy-duty commercial vehicles in the world. In the US, the Biden administration’s recently passed Invest in America Act provides $7.5 billion to build a national network of charging stations. They will have non-proprietary charging connectors and accept all payment methods. A second spending bill, expected to move through Congress in 2022, will include more spending on electric vehicles, incentives, and the charging infrastructure, with the administration planning to invest $174 billion to set up 500,000 charging stations across the country. Most of that would be for passenger vehicles, so the private sector would have to develop the charging infrastructure for electric trucks.

Typically, this infrastructure for electric trucks will be needed in truck depots, along highways, and at rest stops, loading points, and transport hubs. Manufacturers will be expected to offer depot-charging solutions, so they will have to create ecosystems. In Europe, creating the charging infrastructure likely will be a combined effort by manufacturers, so joint ventures to build a network of fast charging stations along highways are forming. For instance, Volvo, Daimler, and TRATON have agreed to operate a commercial vehicle charging network in Europe. The goal is to install 1,700 charging points in five years, with the three-way venture likely to start operations by the end of 2022.

Develop New Business Models. For decades, truck manufacturers have stuck to the traditional business model, which focuses on the production and sale of vehicles as well as a limited number of services such as financing, leasing, after-sales service, and used vehicle sales. In the future, these profit pools will, at best, stagnate even as competition increases, while new revenue sources will emerge for those that are looking for them.

To facilitate the transition to electric vehicles and still remain profitable, truck manufacturers will have to offer customers the charging infrastructure as well as deploy usage-based sales models, which will become part of their core business. Other service-oriented businesses around autonomous driving fleets and recycling batteries may also emerge by the end of this decade. By tapping into these new revenue pools, truck makers will be able to boost profits in the long run and improve on today’s single-digit margins.

After decades of trying to optimize the performance of internal combustion engines, commercial vehicle makers finally have no choice but to switch strategies. Many start-ups are poised to enter the zero-emission vehicle business, threatening the incumbents’ leadership. After all, electric trucks are easier to manufacture than traditional ones, since electric powertrains need fewer moving parts than internal combustion engines. Moreover, the incumbents have created extensive supply chains that the new entrants, who are more familiar with electrical and electronic technologies, can tap into for mechanical components and sub-assemblies.

If the incumbents wish to survive, they must speed the development of zero-emission vehicles and scale their production, so existing customers turn to them for a new generation of vehicles. Forging supplier relationships with digital hardware and software firms will be as important as building engineering capabilities. In addition, the leaders will have to develop new service- and customer-oriented business models, for which they will need to strike novel partnerships.

In 1896, when Gottlieb Daimler invented the first truck, he named its rear-mounted, four-horsepower, two-cylinder internal combustion engine the Phoenix. More than 125 years later, the world’s commercial vehicle industry will now have to learn to survive without the internal combustion engine and rise—with green powertrains—like a phoenix from their past.