There’s gold at the end of the personalization rainbow. To get it, retailers need to focus on the customer experience, technology, and operating models.

Remember two years ago, when it seemed as though everything in an entire store was 40% off? As the COVID-19 crisis hit and some categories faced massive supply shortages, retailers pulled back on promotions. Today, many retail businesses are reimagining how to offer value in the post-pandemic world. At the same time, inflationary pressures are forcing them to increase everyday prices. Successful players will use a nuanced approach that differentiates price increases by customer segment, purchase context, and product category.

In this new reality, we believe that expanded use of personalized offers is an imperative. Thanks to vendors’ openness to changing inefficient promotional schemes and the availability of the right data, technology, and processes, the next three years will see leading retailers shift from mass promotion to personalized offers at scale. Our analysis finds that redirecting 25% of mass promotion spending to personalized offers would increase return on investment (ROI) by 200%, leading to a top-line growth opportunity of more than $70 billion annually. With supplier negotiations for 2022 underway at most retailers, now is the time to act.

However, high returns are not assured. Success requires integrating personalized offers seamlessly into the customer experience. Fortunately, off-the-shelf technology is now available to automate much of the effort. Retailers also need an operating model that allows them to centrally orchestrate the optimal mix of customer investments across categories and channels.

Personalized Offers Drive Value in the New Reality

The pandemic has massively disrupted consumers’ purchasing habits, leading them to try new sellers and brands and significantly altering how they shop and think about the value they receive. These sea changes give retail businesses a once-in-a-lifetime opportunity to reset their approach to promotions and align investments (both type and level) with a more effective customer strategy.

The reset is happening in the context of rising inflation. As some prices soar across the value chain, retailers have been compelled to pass along higher costs to consumers to preserve their margins. US consumer prices, for example, rose more than 5% between the summer of 2020 and the summer of 2021, the biggest increase since the height of the global financial crisis in September 2008. Inflation in the UK has increased for four months in a row and is now at its highest level in three years. Because customer segments have different price sensitivity, a one-size-fits-all price increase will not work; retailers need to de-average their promotional approach more than ever.

Against this backdrop of disruption and inflation, retail businesses need to think holistically about the types of investments they make to gain customers and generate value. The main types—pricing, mass promotions, loyalty programs, and personalized offers—comprise an interconnected “value investment portfolio” from which they select and blend investments to optimize ROI. (See Exhibit 1.) The allocation of funds among these investments affects customer perception of value as well as the economics of an offering.

Brick-and-mortar retailers typically concentrate a large share of their spending on promotions, with a poor average return. But leading companies have seen tremendous impact by using an analytical engine, powered by artificial intelligence , to optimize spending across an array of customer investments. By creating common metrics for effectiveness, they can compare the incremental return from various approaches in equal terms. They then apply the insights to effectively reallocate spending. In our experience, retailers achieve a massive step-up in efficiency when they reassign funds from areas that are less relevant to customers or do not deliver strong ROI into those that drive a higher perception of value and/or greater returns. The optimal mix can be different for different product categories. For example, everyday low pricing might work best for some categories, while promotions work better for others.

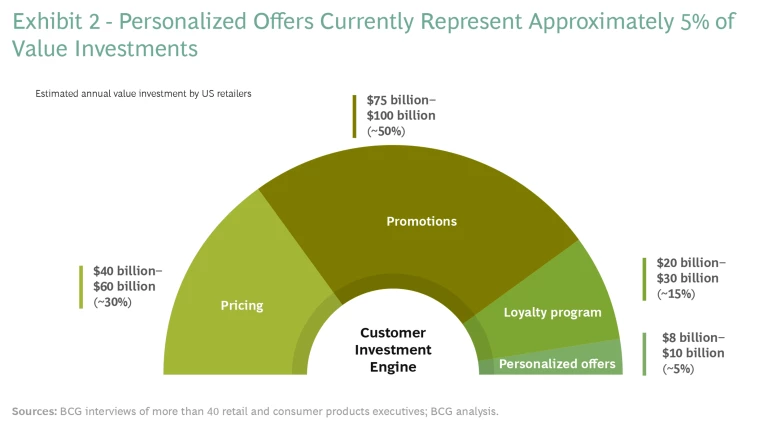

Vendors and US retailers currently spend only about 5% of trade and shopper marketing on personalized offers. That share should be at least 25% overall—and at least 50% in some categories.

As retailers reallocate funds, they should prioritize shifting from mass promotions to personalized offers. Vendors and US retailers currently spend $140 billion to $200 billion in trade and shopper marketing (excluding advertising), yet they spend only about 5% of that amount on personalized offers. (See Exhibit 2). We believe the share of spending on personalized offers should be at least 25% overall and at least 50% in some categories.

By now, most retailers have piloted personalized offers. Some have scaled them up significantly, proving their effectiveness. In most categories, based on our experience with close to 100 BCG clients across industries, the effectiveness of personalized offers is at least twice that of average mass promotions. As noted, shifting to personalized offers at scale would generate top-line growth of more than $70 billion in increased revenue annually for first-mover retailers.

Leading Retailers Show the Potential

Leading retailers that have redirected their investments to personalized offers are seeing the benefits across categories and moving from piloting to scaling. Starbucks, for example, has long been public about the benefits it realizes from personalized offers. It has discontinued mass promotions (such as Happy Hour and Treat Receipt); instead, it emphasizes gamified specials tailored to each Starbucks Rewards member. The scaling up of such offers has resulted in sustained 8% year-on-year growth in member spending and fueled comparable store sales growth for many years.

Top players in the grocery, drug, mass, and convenience sectors are also realizing this opportunity. Recently, a large convenience and drug chain in North America scaled a branded-offer capability that allowed vendors to fund personalized offers at scale. During the pandemic, this enabled a significant shift away from mass promotional funding, as well as helping the retailer to secure incremental funding from several key suppliers. Importantly, the capability generated $100 million in net incremental revenue and increased the number of customers interacting with personalized offers by 50%. Other food and mass retailers, such as a leading US grocer and a big box retailer, are scaling similar programs with their vendors after successful pilots.

The trend is also playing out in Europe. A European grocer, for example, has seen tremendous gains. Historically, it generated approximately 30% of its sales through mass market promotions. The company sought to achieve a significantly higher ROI and turned to personalization . It built a state-of-the-art analytics system to evaluate the true incremental performance of all mass and personalized promotions. It also established common metrics to compare the effectiveness of different types of customer investments in equal terms. By smartly shifting from mass to personalized offers, it boosted margins by more than 200 basis points.

Fashion and apparel is another sector seeing the benefits of this seismic shift. Long addicted to using mass sales events to clear inventory, the industry is now rolling out revamped loyalty programs and using off-the-shelf technology to enable personalized challenge-based rewards (“spend $X, get $Y”). These rewards, often in the form of gift cards, drive incremental purchases for individual customers. Shortly before the pandemic, a $1 billion brand generated $25 million in incremental annual EBITDA using these tactics. Today, personalized offers at scale are allowing other players to win share as the recovery unfolds.

Three Imperatives to Unlock the Value

To maximize value from the shift to personalized offers, retailers should follow three imperatives:

Integrate offers seamlessly into the experience. As a first step, ensure that offers are integrated seamlessly into the customer experience. For example, Starbucks presents gamified, personalized offers when consumers open its app or click on a mobile offer push notification. In contrast, at many grocery and mass retailers, customers must tap through multiple screens to find offers and then “clip” coupons, similarly to how shoppers dealt with coupons in printed mailings decades ago—a clumsy process that discourages customer engagement and limits offer incrementality because only low-margin “coupon enthusiasts” will bother to find the offers.

Success requires integrating personalized offers seamlessly into the customer experience.

Use off-the-shelf technology to automate offers. Off-the-shelf technology can now automate certain steps of the offer optimization process that have traditionally been fully manual:

- Customer data platforms (such as Amperity, mParticle, and Interaction Studio) support offer activation and targeting by enabling better identity resolution (collecting and matching identifiers across devices and touchpoints) and segmentation.

- Offer optimization engines (such as Formation, Eagle Eye, and SessionM) automate the development and targeted deployment of offers.

- Marketing automation platforms (such as Salesforce and Adobe) enable retailers to deliver offers to customers across channels.

- Dynamic templates connected to content management systems generate personalized offer variants at scale.

Retailers’ in-house advanced analytics teams need to build the intelligence layer to enable these solutions. This powers the right technology stack with the necessary customer data and integrates the various solutions into a seamless experience.

Retailers at the forefront can design and launch new offers in less than a week, run multiple experiments per month, and make real-time changes to ongoing campaigns.

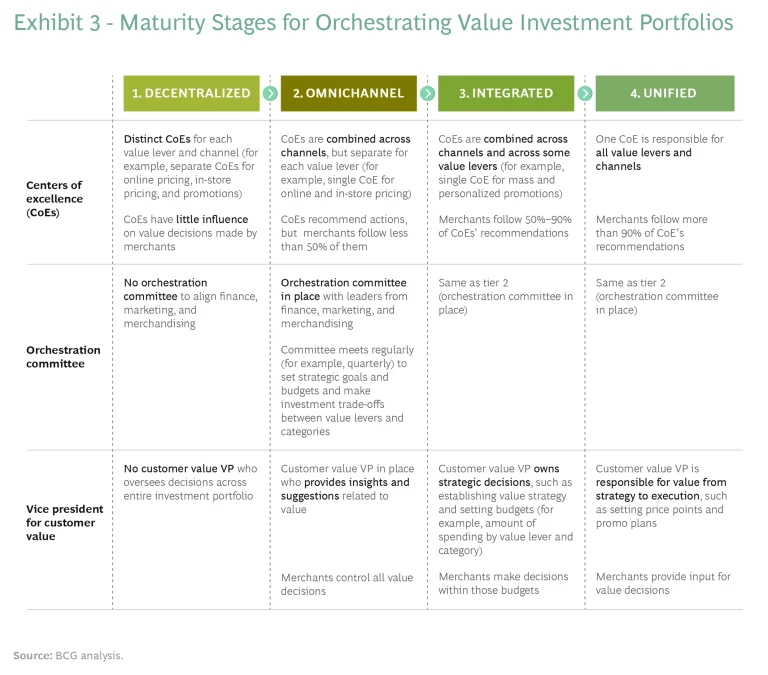

Implement the right operating model. To optimize spending across the entire value investment portfolio, a company needs an operating model that integrates distinct organizational units and processes. This allows it to orchestrate the different investments and decide on the trade-offs among them. There are four stages of organizational maturity with respect to the operating model. (See Exhibit 3.)

The right approach to working within the operating model is also essential. Retailers at the forefront of the trend toward personalized offers have embraced new efforts that feature the use of agile teams and a culture of controlled risk-taking. This allows them to rapidly design, test, and launch personalized campaigns. Leading companies can design and launch new offers in less than a week, run multiple (possibly 100 or more) experiments per month, and make real-time changes to ongoing campaigns.

The shift from mass promotions to personalized offers has been underway for years but is now approaching an inflection point. Disrupted consumer behavior and inflationary pressures will force retailers to reimagine their value strategy. Those that make the required changes to customer experience, technology, and operating models can expect significant financial returns and position themselves to win in this time of uncertainty.