Many senior executives view dividends as a low priority on the strategic agenda. They’re wrong. The unique set of circumstances that made dividends unfashionable during the long bull market of the 1980s and 1990s is fast disappearing. In the current economic environment, dividends are an especially important lever for generating above-average shareholder returns.

That’s not to say that every company should increase its dividend yield—or even pay dividends at all. But every company should revisit its dividend policy. Doing so can greatly improve the strategy debate among a company’s senior managers—whether they ultimately decide to increase the company’s dividend or not.

Why Dividends Are Back in Fashion

In the recent bull market, the practice of returning cash to investors through dividends was easy to dismiss. One familiar disincentive was the double taxation of dividends according to U.S. tax law. Another was the fact that as executives were compensated increasingly through stock options, they were better off using excess cash to repurchase shares (thus raising the value of options) rather than returning that cash to investors through dividends.

Trends in the financial markets also discouraged dividends. With average total shareholder return(TSR) running in the high teens, a dividend yield of even 3 or 4 percent was a relatively minor contributor to achieving above-average TSR. And in a market environment characterized by high and rising valuation multiples, many managers believed that returning cash to investors through dividends actually depressed investors’ returns. Worst of all, since investors seemed to value growth exclusively, dividends were often seen as a de facto admission that management had no growth agenda and couldn’t find attractive ways to reinvest in the business.

How times have changed. Regardless of what happens to the dividend provisions in the Bush administration’s tax plan, three facts illustrate how dividends have become much more critical.

First, it has become increasingly clear that the combination of low dividend yields and high capital gains in the 1980s and 1990s was quite unusual. In fact, nearly half the historical market return has been from dividend yields. Over the last 70 years, for example, the annual TSR of the U.S. equity markets has averaged about 10 percent—about 4 percent of which has been provided by dividend yields. If future average TSRs are closer to the 10 percent long-term average, then dividend yield will become a much more important contributor to TSR than it has been in recent years.

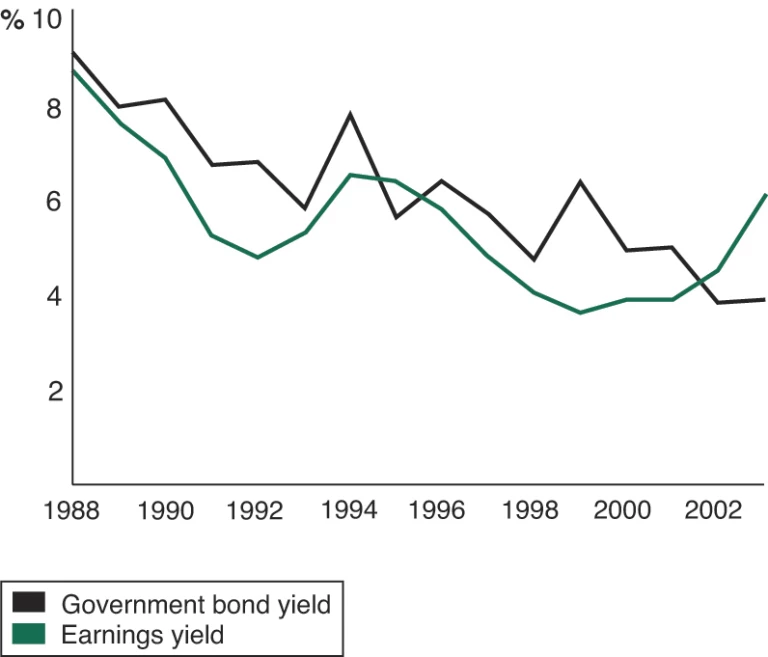

Second, lower valuations, interest rates, and growth expectations have dramatically shifted the tradeoff between yield and growth. Consider what has been happening to earnings yield (the ratio of earnings to stock price), which represents the dividend yield of a 100 percent payout of a company’s earnings per share (EPS). Over the last two years, the earnings yield of the S&P 500 has risen above the yield of U.S. long-term government bonds by more than 2 percentage points—a performance that has not been matched in a long time. (See Exhibit 1.) As one leading institutional investor put it recently, “When the dividend is safe and you’re getting more yield than from governments, you get the underlying business for free.”

Third, investor confidence has been shaken by the many accounting and governance scandals of recent years. Unlike accounting measures such as EPS, dividends are paid in cash. They can’t be faked. Thus, they send an unambiguous signal about real performance and management’s commitment to shareholder value.

Empirical evidence reinforces the central role of dividends. Those companies that have raised their dividends significantly in recent years have seen their stock prices increase as a result. Since the beginning of 2001, a dozen companies in the S&P 500 have raised their dividends by 20 percent or more. On average, the stock of these companies has outperformed the market by 2.7 percent in the ten days after the announcement. Such an increase may sound small. Nevertheless, it represents tens to hundreds of millions of dollars of value creation per company and about one-fifth of the typical annual market return.

Recent empirical research also strongly indicates that higher payout ratios do not reduce corporate growth. In fact, companies with higher payout ratios have significantly higher long-term growth in earnings than companies with lower payout ratios.

When to Increase Dividends

So does all this mean that every company should increase its dividend payout? Not necessarily. The logic for whether a particular company should raise dividends—or even pay them at all—depends on its situation. Four circumstances in particular should compel a company to think seriously about increasing dividends.

The business portfolio has low returns or low growth. Reinvesting earnings (by not paying dividends) is implicitly a way of raising equity capital from investors in order to spend that cash in the business. But when reinvestment means committing capital to increase share in lowgrowth, low-return businesses, investors would much prefer to receive the cash as dividends.

The dominant or desired investors are value, income, or individual investors. For these investors, dividend yield tends to be a more critical performance objective than growth. If such investors are a dominant part of the investor base or if attracting such investors is an important part of a company’s financial strategy, then dividends will be a critical driver of TSR.

The company is consistently generating positive free cash flow. Of course, a company shouldn’t increase dividends unless it is able to stick to that commitment over the long term. Paying dividends requires reliable, sufficient free cash flow. Dividends that are not covered by cash earnings and ultimately become funded by increased debt or equity send the wrong signal to investors. So does excess cash flow banked as marketable securities rather than paid out as dividends to investors.

The company’s P/E multiple is low. Many people associate a high P/E with high expected earnings growth. But a low P/E is often not a signal about growth but rather a sign that investors are unwilling to pay much for current earnings. Investors may be concerned about the quality of earnings, their sustainability, or the value of reinvesting earnings in risky or low return projects. Paying out more earnings in dividends can be a way to signal management’s conviction that the earnings are real and sustainable—and force investors to revalue those earnings through the dividend yield.

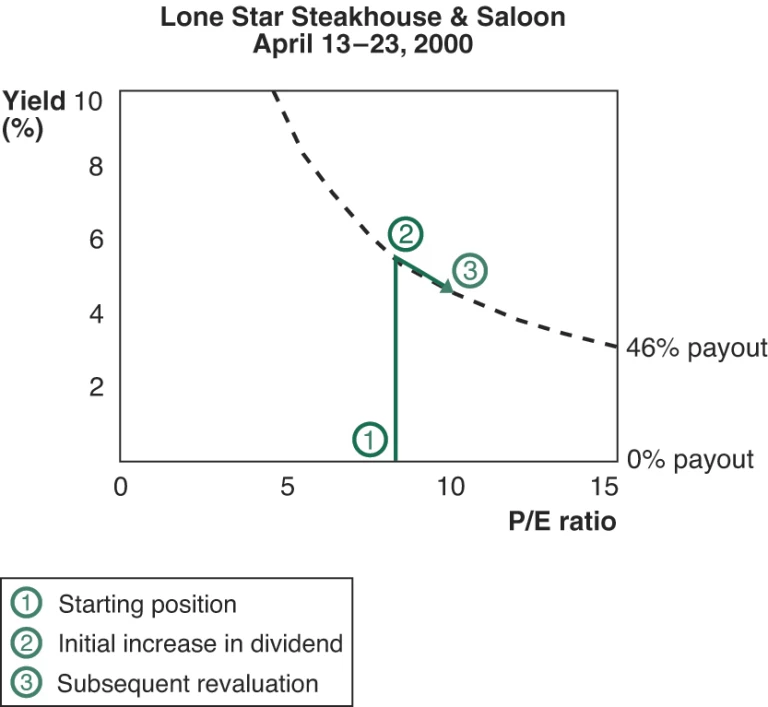

The following example dramatically illustrates how this dynamic works. In early 2000, the restaurant chain Lone Star Steakhouse & Saloon was not paying a dividend and was trading at eight-and-a-half times its earnings. (See Exhibit 2.) On April 13 of that year, the company announced that it would start paying out nearly half its earnings as a dividend, creating a yield of 5.4 percent. Investors found this yield so attractive that they began buying the stock and bidding up its price. Over the next ten days, investors bid Lone Star’s stock and P/E up by 18 percent to ten times the company’s earnings, driving the yield down to a more competitive 4.6 percent. The ultimate impact of the new dividend was to raise Lone Star’s P/E multiple and increase its TSR by 23 percent through a simple change in financial strategy.

How Rethinking Dividends Improves the Strategy Debate

Beyond any reward from increased share prices, however, the greatest value of rethinking dividend policy may be its impact on the quality of the strategy debate inside most companies. This benefit can accrue even to those companies that decide not to change their dividend policy.

The prospect of increasing the dividend payout challenges ingrained but outmoded assumptions, such as “The cash is ours” or “EPS growth is the only route to success.” It forces senior executives to weigh the merits of reinvesting cash flow in order to achieve future EPS growth versus using that cash flow to fund the dividend yield—and to understand how each can affect a company’s P/E multiple.

Such a debate also forces senior executives to take into account the company’s dominant investors and their preferences for dividends, growth, and risk. It challenges executives to align their overall aspirations for the company with realistic, profitable growth and the priorities of investors. Dividend policy also creates healthy competition between internal reinvestment opportunities and the obligation to return cash to owners. And it puts the spotlight on cash-trap business units that are not generating cash today—and won’t be doing so anytime soon.

Finally, dividends create a free-cash-flow requirement that puts useful pressure on internal planning, budgeting, target setting, and incentive processes. Budgets and targets are less subject to gaming and negotiation when there is a fixed commitment to deliver. Risks and contingencies are more likely to be clearly identified and managed. And incentives are more likely to enhance a company’s value-creation performance if they explicitly reward the generation and management of free cash flow. In general, dividends provide a much more effective discipline than share repurchases, which are opportunistic and are not a binding, long-term commitment.

Of course, a company shouldn’t make a decision to increase dividends lightly. It’s a serious commitment. Executives need to assess their ability to sustain that commitment—given the company’s business prospects, the economic environment, and the volatility of its operating model.

The path forward is to insert a simple question into the corporate strategy debate: How would our agenda and our value-creation results change if we increased our dividend payout significantly, either now or over the next three to five years? This question should be developed into a specific corporate strategy scenario that can be compared with other scenarios. The exercise will force executives to develop a more comprehensive fact base and can produce insights and creative options that probably haven’t emerged or been seriously considered in previous discussions. Given the sweeping changes in the business environment over the last two years, thinking differently about dividends is an opportunity that no company can ignore.