Acquisitions are a vital component of growth for many businesses. Yet a high proportion of deals fail to deliver value. Why? A common reason is that, because of time pressures and complexity, many companies struggle to integrate fully after the deal. Synergy targets that were so enticing in the run-up to the deal melt away under the realities of meshing two often very different organizations in a short time.

Most executives are quite aware of how to integrate properly. They are also ready to devote resources to making sure postmerger integration (PMI) gets the attention it requires. Yet during the stresses of the actual integration, they find that their organizations lack the ability to follow through. The trouble is not in any specific area but rather a multifaceted weakness.

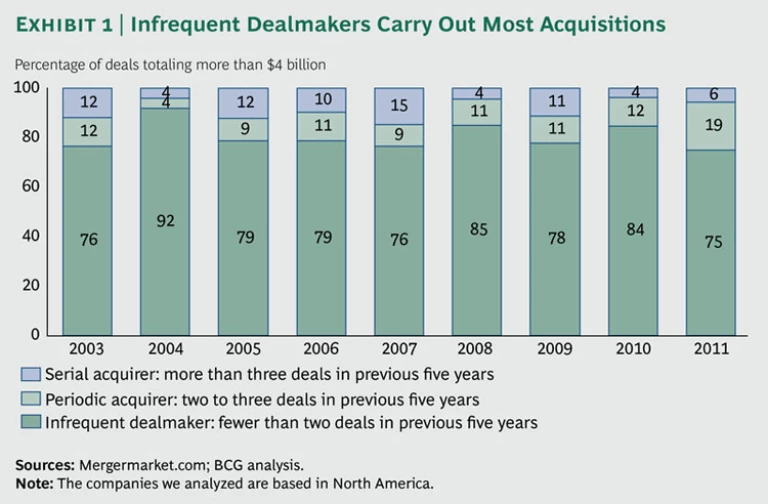

For the vast majority of companies, acquisitions are infrequent events. (See Exhibit 1.) Most companies respond by reallocating resources and building or hiring temporary capability to handle integrations on an ad hoc basis.

Some companies, especially those whose strategies lead to more frequent acquisitions, are choosing to build more of this capability on a permanent basis in-house. They have trained people, designed processes and templates, and set up structures, moving beyond the common ad hoc approach. They have consolidated and spread the specialized PMI knowledge held by some people to the wider organization. But building these capabilities can be time consuming and difficult. Serial acquirers will most likely have the necessary commitment, experience, and ongoing incentive to overcome these hurdles. Others will need to be clear in advance about what it will take.

We have observed two principal models used by companies that choose to build a more lasting integration capability. (See Exhibit 2.)

- Tandem PMI Enablement: Boosting integration capabilities immediately before, during, or just after an acquisition. Here the difficulty is to make the capabilities broad and flexible enough to handle a variety of integration types.

- Standalone PMI Enablement: Boosting integration capabilities independent of an actual deal. The challenge here is to make the capabilities concrete and compelling enough to be sustainable.

Both approaches to building integration capabilities have merit. It is important that leaders fully understand the dynamics of tandem and standalone PMI enablement before committing to either one.

This report, the sixth in The Boston Consulting Group’s series on PMI, concentrates on the two different models used by companies in building capabilities for integration. Drawing on BCG’s extensive experience with clients in this area, it describes the models used as well as the challenges involved.