Although its overall health has improved since the dark days of the financial crisis, today’s retail-banking industry is not yet out of the woods. In developed markets, revenue growth is stagnant (at best), and credit demand is weak—so repricing is a must. The cost of funds is still high, and margins on deposits remain low. In many developed markets, there is an ongoing war for deposits that shows few signs of cooling off as banks try to secure sufficient funding—putting a damper on sales of investment products.

There are further difficulties as well: in many markets, consumer trust in banks remains at its lowest ebb in decades; the cost of risk is still above historic levels; and loan losses have not yet fully abated. Moreover, taking refuge in emerging markets is not a cure-all, because achieving scale abroad is not realistic for most liquidity-starved, capital-constrained Western banks. (See “Navigating a Two-Speed World," below.)

Navigating a Two-Speed World

It is common knowledge that in terms of economic growth, different regions of the world are moving at different speeds. Major mature markets are expanding at a far slower pace than emerging markets—now typically referred to as rapidly developing economies (RDEs). What does this two-speed world mean for Western banks trying to gain a foothold in RDEs?

RDE banks have delivered higher total shareholder returns than banks in developed economies, their success driven by fundamentally healthier profitability and valuations. These banks generate sufficient liquidity domestically and have strong capital bases—even by the stringent standards of Basel III. Their price-to-book ratios are greater than 1, and their return on equity is greater than their cost of equity.

However, many RDE banks remain small. With the notable exception of several major Chinese institutions, few have made it into the ranks of the world’s 30 largest banks. Moreover, although RDE banks are consolidating, there is still room for further concentration. The very real challenge is to create cross-border scale. Unfortunately, few, if any, developed-economy banks can participate in this process.

To be sure, banks in the more developed parts of Asia-Pacific, for example, are aggressively targeting regional growth. And with the ongoing rise of the middle class—whose bankability and overall consumption will increase dramatically in the coming years—the opportunity is significant. According to recent estimates, as much as 35 percent of global consumption will come from RDEs by 2020, up from 25 percent today, and this will translate into higher values per customer. Within the same time frame, banking assets in RDEs are expected to more than double. To capture these opportunities, many RDE banks have been refining and even developing new business models targeted at serving customers who are either new to banking or whose sophistication has increased along with their level of affluence. In doing so, some local and regional banks are now able to offer distinctive value-adding propositions that rival those deployed by global banks.

Still, achieving regional growth will not be easy for banks in RDEs. Stronger, more confident governments are raising regulatory barriers, and many operational challenges remain.

Ultimately, although the fundamentals of winning in retail banking remain fairly homogeneous worldwide, the market context of RDEs requires banks to focus more on local levers. Overall, Western banks attempting to gain a sustainable foothold in RDEs have their work cut out for them. Some first movers have pioneered innovative approaches, with SME and consumer banks leading the way.

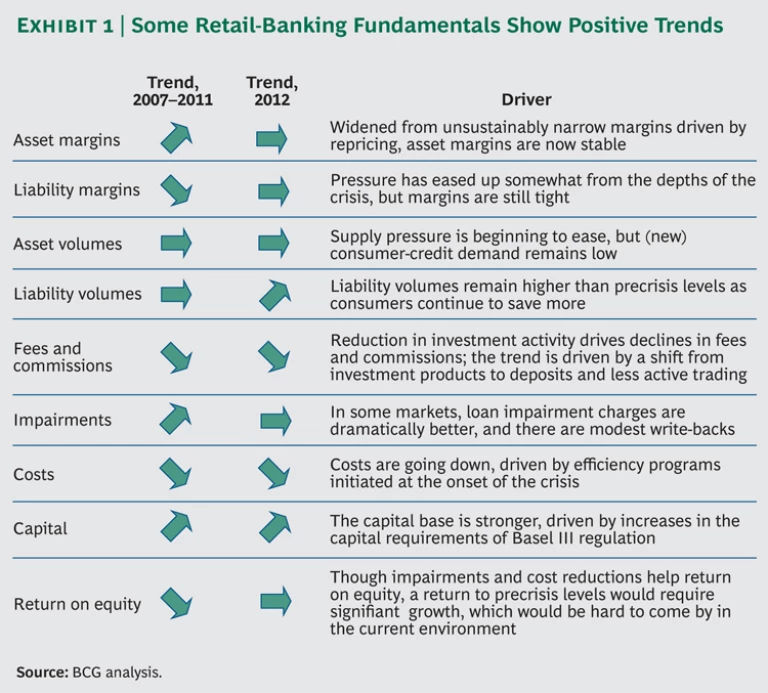

At the same time, the news is not all bad at the aggregate level. Some industry fundamentals—such as impairments and costs—have improved and are now showing positive trajectories. (See Exhibit 1.) In essence, the “new new normal” in retail banking is not totally different from what we have seen over the past few years—but the bar for success is significantly higher, and the margin for error is much narrower. One overarching fact is that being truly customer-centric is no longer a choice—it’s an imperative. Retail banks must focus on customer satisfaction, offer a fair-value exchange, and execute in a truly integrated multichannel mode. They must develop intelligent analytics, a more streamlined product range, and a much simpler industrialized operating model that is run by engaged and motivated people. These are just a few of the elements of a truly customer-centric bank.

Another key to current industry trends can be found in the shifting roles of products and channels. Distinct differences have evolved between the “old world” of the precrisis era and the “new world” of today. Consider the following dynamics:

- Holding the main banking relationship with customers was once considered “nice”—but not necessarily profitable. Today, it is retail banking’s sine qua non, anchoring the relationship that provides the crucial foundation for optimizing customer service through prompts, cross-selling, and numerous communications. Best-practice banks have specific definitions of what constitutes a customer’s main banking relationship. For some, the bank must hold the primary current account as well as a mortgage or a savings account. Other banks go further, perceiving only those people who have multiple active accounts and routinely use multiple channels as fully committed customers for whom the bank can provide the best value propositions in a truly customer-centric fashion. This is a high standard—one we endorse.

- Savings accounts could once be counted on to generate wide margins from long-standing customers, with funding an afterthought. Today, savings accounts are primarily a funding vehicle for the asset side of the balance sheet, with profit margins squeezed on both the front and back books.

- Cards and loans were often sold as standalone products or cross-sold to deposit and mortgage customers to solidify relationships—at thin (even negative) margins. Today, they are crucial sources of margin from customers with whom banks hold the main banking relationship.

- Mortgages were once a source of margin on the back book and a game of segments on the front book, characterized by minimal losses as housing prices escalated. Today, mortgages are more a game of microsegments on the front book, constrained by funding and a desire to manage aggregate risk—with wider margins across the book.

Overall, with deposit margins squeezed by low rates (except in some emerging markets), competition increasing, and fees under pressure from regulators, the search for profitability is tilting permanently toward the asset side of the balance sheet. The winners will be those banks that generate sufficient margin on their assets to compete for funding aggressively, that treat their balance sheet as a closed-loop system, and that bring true rigor to risk management.

As for channels, the key will be the ability to provide a truly integrated multichannel offering in a world where banks need to have more high-quality interactions with their customers than ever before.

- The branch—and the face-to-face contact it provides—remains the primary channel for acquiring and deepening relationships, as well as for interactions perceived by customers as complex and difficult to comprehend without guidance. The focus is on high-touch transactions and high-value customers. In overbanked markets, there is a significant opportunity to reduce or change branch density, and as more banks in these areas take action, we will likely see a weakening of the traditional tie between relationship managers and branches. More relationship managers will work remotely, presenting a management challenge for banks: recruiting and hiring people whose skill set fits the evolving role. We also expect to see a much greater variety of branch formats—such as transaction-only, advisory, “lite,” full-service, and flagship—and greater variation in both hours of operation and staffing profiles. The goal is to have the right people in the right place at the right time.

- The online channel has evolved, becoming the primary convenience option that is focused on high-volume activity (such as balance and statement viewing, transfers of funds from one account to another, and simple research). Banks’ online goals include putting forth customized offers and achieving one-click paperless sales, especially for preapproved consumer-credit and savings products.

- The mobile channel provides on-the-go support for simple services and sales, as well as updates, alerts, and prompts leading to one-click fulfilment. Having a strong mobile-banking offering has become a minimum requirement for competitiveness in the industry. Mobile payments are nascent but promising. Overall activity and transactions using the mobile channel are rising sharply.

- The call center is a key onboarding and retention channel and a vital conduit for leads and appointments. It represents the branch outside of branch hours and gives a live voice to digital channels.

- The ATM channel provides 24-7 brand presence on the street, as well as quick and efficient service, especially for cash transactions. Banks are increasingly deploying automated-deposit machines alongside their traditional ATMs.

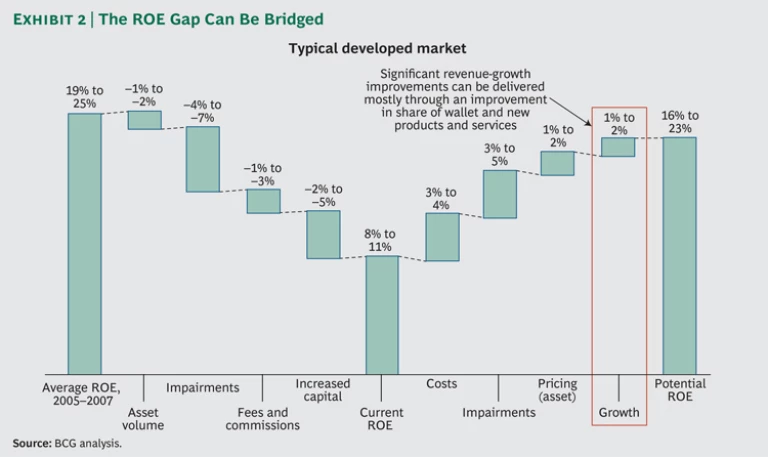

As for return on equity, the industry’s ROE is hovering around 8 to 11 percent in developed markets, a far cry from precrisis levels of around 19 to 25 percent. We believe that the ROE gap can be bridged through a combination of initiatives—including further cost and impairment measures in concert with reductions in the asset intensity of the P&L—leading to long-term ROE in the 16 to 23 percent range. (See Exhibit 2.)

In a broader sense, we also believe that in order to thrive in the new new-normal retail-banking environment, institutions will need to take concerted action on numerous fronts. We think of these actions as the nine keys to success in retail banking.