As the world struggles to recover from the lingering recession, Greece faces particularly severe financial problems. To pay off its onerous debt, even after the partial bailout by Europe’s banks, Greece must grow its economy, which has been shrinking—a problem made worse by the downturn. Attracting more investment and preventing capital from exiting the country are two critical ways to help reverse this trend and improve Greece’s overall competitiveness.

Attracting foreign direct investment (FDI) is always important for a country’s economic health—especially during times of crisis and even more so for Greece, whose economy has been traditionally fueled by private and public spending and consumption rather than savings and investment. FDI creates new jobs, increases capital, contributes tax revenues, spurs growth, attracts innovation, and helps develop and retain workers. Even more important: the impact of foreign investment goes well beyond the initial dollar amount. For instance, a €0.5 billion investment in luxury hotels, golf courses, conference center, spa, and sports facilities aimed at increasing tourism has translated into an estimated 0.1 percent of Greece’s gross domestic product (GDP) per year during construction—an annual contribution that should continue in the years of operation that will follow.

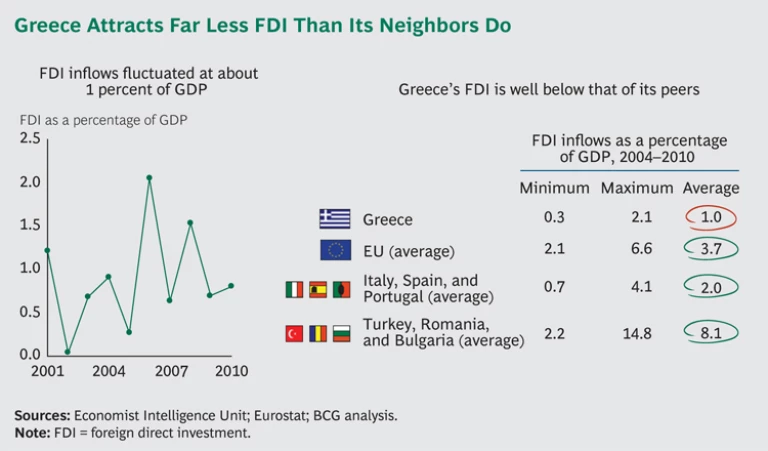

But inward FDI as a percentage of Greece’s GDP averaged only about 1 percent from 2004 through 2010, far less than that of its neighbors—an indication that Greece has not fully utilized this powerful economic lever. (See the exhibit “Greece Attracts Far Less FDI Than Its Neighbors Do.”) A more acute short-term risk with long-term implications, however, is the outflow of capital as a result of the crisis. For these reasons, attracting new capital inflows while retaining current levels of FDI must be a top priority for Greece.

Creating an FDI Strategy

According to research conducted by The Boston Consulting Group, Greece must attract approximately €36 billion in FDI to help fuel its recovery. An FDI strategy that targets both privatization and new “greenfield” investments in key sectors could produce as much as a 1.5 percent increase in GDP. Sectors with traditionally limited FDI penetration—such as tourism, transportation, utilities, construction, and health care—present opportunities for potentially high returns.

To attract more investment, however, Greece must become an easier place to do business. The country has some critical strengths that should make it appealing relative to its neighbors. Chief among these are its infrastructure—its roads and ports are in very good shape—and its high-quality workforce. Unfortunately, however, Greece’s current business environment is considered unattractive by potential investors. Too much bureaucracy, inconsistent tax policies, and a rigid labor market make it a challenge to do business there. Correcting these problems—and creating a better climate for foreign capital—will be an important step toward the country’s eventual recovery and future growth.

A number of other countries have made major strides in attracting FDI by reducing tax and bureaucracy problems similar to those that have plagued Greece. In 1998, for instance, South Korea enacted a policy that called for disbanding any bureaucratic procedure that wasn’t absolutely needed. To put teeth into that new policy, the country set up a reform committee that reported directly to the prime minister. Within five years, FDI in South Korea had increased by 250 percent. Singapore’s government sharply improved its business environment by replacing slow, manual administrative processes with a 24-hour online system. Now, instead of having to deal with limited service hours, long lines, and frustrating delays, new businesses can get information, register, and incorporate online. And it’s no longer necessary for them to hire service companies to manage the process.

Recommendations for Greece

On the basis of our research and analysis, we have determined that Greece could create a friendlier business environment and sharply increase FDI by taking action on three fronts:

- Fixing the Basics. To make it faster and easier for companies to do business in Greece, the country must streamline its bureaucratic processes and create a tax system that is more predictable, transparent, and efficient. A “justify or abolish” policy for all existing regulations would be a good start. Moreover, replacing manual processes with an electronic system would streamline interactions with public agencies and minimize corruption. Streamlined judicial proceedings that convey a sense of consequence for tax evasion are paramount. Other key goals should include a revamped tax system that is simpler, more predictable, and more efficient; an outreach program (“Invest in Greece”) that forges stronger ties with international investors, local companies, and expatriates; and faster, fairer civil judicial processes.

- Promoting Industrial Growth. Greece must present potential investors with a clearer value proposition relative to neighboring countries, going beyond its natural competitive advantage in the area of tourism. Because tourism is so important to Greece’s economy, the country must define a future vision of the country as both a travel destination and a key player in the health tourism industry, while protecting and promoting its cultural assets. It is also critical to support other high-priority industries, such as health services, agriculture, and shipping. Ways to do this include supporting local farmers with technology, business, and marketing support; promoting shipping education; and aiming to become Southern Europe’s primary transportation hub through ongoing infrastructure development and logistical planning.

- Strengthening the Workforce. A continuous supply of skilled, flexible workers is essential for attracting and retaining FDI. In addition to improving worker productivity and keeping salaries at reasonable levels, Greece must ensure excellence in its universities by linking funding to clear performance targets and by being more effective at matching graduates with job market needs. These actions will also help attract foreign students. Moreover, the country can encourage university-based research clusters by streamlining the regulations needed for public-private collaboration.

Greece’s economic problems developed over time, and it will take time to fix them. But if the country takes these recommended actions, it will become far more attractive to foreign businesses and investors. Higher levels of foreign investment will contribute to GDP in the near term and increase the competitiveness of the country’s industrial base in the medium term, providing a foundation for long-term growth—and a more prosperous future.