When the next several quarterly sales forecasts look disappointing, senior executives under pressure to deliver need effective short-term solutions, not long-term strategies. With a quarterly horizon, there’s not enough time to develop entirely new products, new customers, and new markets. One way to generate an immediate but sustainable revenue boost is simply to focus on getting more from the current customer base, product and service offerings, and sales organization.

We often find that these existing assets are underproducing and have significant untapped profit potential. However, it is not always apparent how to make these assets more productive, and we frequently see scattered initiatives to improve performance. Such efforts tend to fall short and typically turn into the “flavor of the month.” We have worked with a number of clients to implement a focused, low-risk, cost-effective approach—which we call sales activation—that can quickly deliver significant, sustainable results. For instance, the three companies profiled below have increased their revenues by 10 percent or more by pursuing the sales activation approach. Sales activation focuses on a handful of high-impact initiatives and rapid execution for a quick turnaround in performance.

Three Steps to Activation

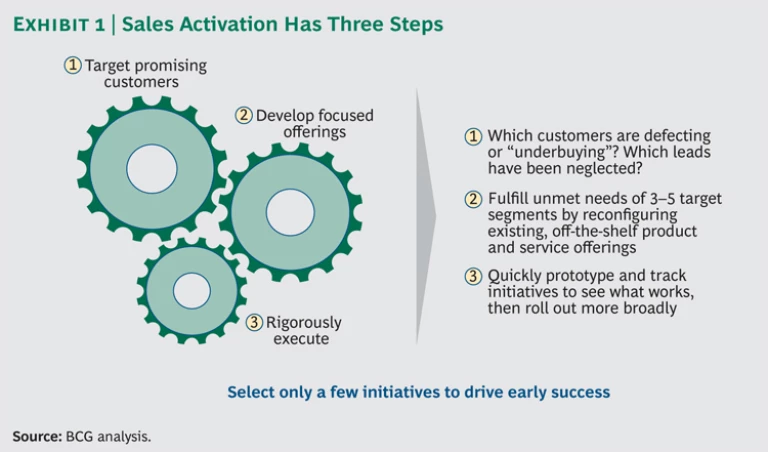

Sales activation has three basic steps. (See Exhibit 1.)

Target the most promising customers. An analysis of the purchase patterns of existing customers can identify not only who is “underbuying”—or even defecting—but also neglected leads that haven’t been pursued. Existing sales data usually reveal a range of opportunities to activate dormant customers. We have found that it is critical to select only three to five target customer segments to prevent the effort from collapsing under its own weight.

Develop focused offerings for each target segment. For each of the three to five target customer segments, determine their immediate unmet needs, such as better product information, greater technical support, or more delivery options. Then, meet those needs by using off-the-shelf elements of your company’s existing product offerings. This may require making adjustments to pricing, service, delivery channels, sales approaches, or contact frequency. The goal should not be fundamental innovation but rather a repackaging of existing product or service offerings to fit segment-specific needs and expectations. Develop a handful of high-impact initiatives related to each target segment.

Rigorously execute—and track results. Rapid prototyping and close monitoring of the chosen initiatives will reveal what works in the marketplace and what doesn’t. Start with pilot initiatives in one or two representative or important regional markets. If the changes involve repackaged product or service offerings, make sure that your sales reps are adequately trained. Not every pilot will be successful, and that is okay—but those that show promise warrant a rapid, company-wide rollout.

The key is to learn from mistakes and move on. In our experience, successful companies typically test three to six pilot initiatives. Too few experiments, and the odds of success are low; too many and it may be hard to determine what’s working. Better to have fewer cycles of testing, learning, and improving—and give each cycle the attention it requires.

Sales Activation in Action

The following examples explore the experiences of three companies that pursued sales activation efforts tailored to their specific circumstances—and achieved significant revenue gains. Each example emphasizes a different lever of the sales activation approach: identifying and managing leads; working with intermediaries; and improving customer contact.

Identifying and Managing Leads

A global automobile manufacturer was experiencing weak sales in its European dealer network. Management suspected that salespeople were relying on discounting instead of working aggressively to follow up on leads. Previous analysis indicated that a disciplined approach to identifying and managing leads would pay off in short order.

The manufacturer worked with a few motivated dealers to develop a list of customers with growth potential, prioritizing the most appealing customer segments and developing practical offerings to match segment-specific needs. The company then launched five initiatives that could be rapidly implemented. One initiative entailed having telephone reps contact inactive customers who had purchased their last car four to six years ago, offering them a free appraisal of the car they had bought for a potential trade-in on a new car. The names of customers expressing interest were passed on to their nearest dealers. Another effort targeted small businesses whose fleets were not large enough to justify “key account” status but whose needs differed from those of individual consumers. These targets received a special package with volume pricing and service, and those who responded were also referred to local dealers.

Because the dealers were reluctant to release their customer records to the manufacturer owing to privacy concerns, an outside firm handled the records and contacted inactive customers with the appraisal offer. For the small-business initiative, the manufacturer sent a sales coach to each dealer to train salespeople how to identify and approach these target customers. Once the pilot programs began, the manufacturer closely monitored the progress of each initiative, and modified dealer approaches as needed to boost close rates.

The manufacturer’s rigorous attention generated rapid learning along the way and prevented some of the initiatives from fizzling out. At first, for example, most of the dealers in the pilot program ignored the leads from the inactive customer base. The manufacturer had sent leads in the past, but they were generally from untargeted marketing campaigns and yielded very little business—and so the dealers considered them virtually worthless. For the new initiative to succeed, the manufacturer had to prove the relevance of the leads, and therefore invested extra effort in screening them. Having relevant leads to accelerate the sales funnel reinforced the value of the pilot, which demonstrated its impact in a very real and compelling way.

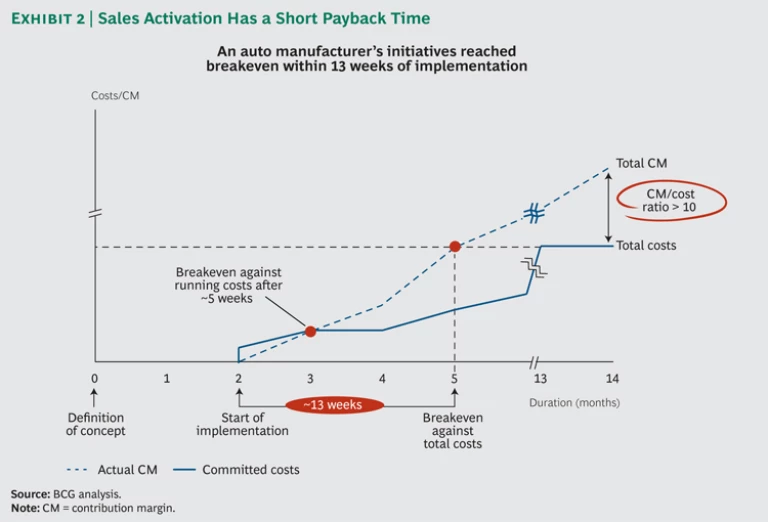

Because of this active engagement and rapid follow-up, the manufacturer was able to quickly determine which pilots were successful. Five months after launching the sales activation effort, and just 13 weeks into the pilots themselves, the initiatives reached the breakeven point. (See Exhibit 2.) The manufacturer then rolled out the pilots to the full dealer network. After 14 months, the initiatives had delivered ten times their total investment and provided the company with a much-needed boost in revenues. The focus on targeted and diligent lead management paid off.

Working with Intermediaries

A global food manufacturer wanted to accelerate growth in Europe by increasing sales to outlets such as convenience stores, gas stations, kiosks, and fast-food restaurants, where shoppers tend to buy takeout food to eat at home. Because consumers’ brand preferences are more heavily influenced at the point of sale in these smaller outlets, a compelling product placement was critical to growth—and required working closely with the independent distributors who supplied these outlets.

One key initiative was to show the distributors how to increase their coverage of the outlets during peak sales times by complementing in-person sales calls with telesales—especially for replenishment orders from the smallest outlets. A review of the market revealed a number of weak distributors that were competent at acquiring new customers during the off-peak seasons but lost momentum and sales volume during periods of peak demand. As a result, the manufacturer was losing “share of stomach” to competing food categories. To increase the retention rate and purchase volume of existing retail customers, the manufacturer benchmarked other companies that excelled at selling to these takeout outlets, such as the larger beverage and snack-food manufacturers.

This analysis led to four sales-activation initiatives. The first involved creating the “perfect store” on the basis of a study of high-throughput outlets which revealed the merchandising and product placement that drive impulse purchases. The second initiative involved introducing the concept of sales cycles to distributors. For each two-month period of the year, the manufacturer defined a set of promotions and sales volume goals, and worked with distributors to align their sales activities accordingly—and to keep the manufacturer’s products “top of mind” when calling on the target outlets.

The third effort was aimed at strengthening the collaboration between the manufacturer’s field reps and the distributors’ reps, with a goal of improving overall sales coverage and visit effectiveness. This initiative involved dividing responsibilities, allowing the distributors to “own” the smaller retail outlets while the manufacturer’s sales force focused on capturing and activating the larger outlets rather than spending time supervising the distributors. The distributors’ reps were trained in how to execute “perfect capture” and “perfect activation” visits. Clear, complementary roles and incentives were defined to support the effort, and visit frequencies and sales approaches were tailored to the different outlet types. The fourth and final initiative showed distributors how and when to complement in-person sales calls with telesales—again, when taking replenishment orders from smaller outlets during peak sales periods, for instance.

A territory in a large city served as the pilot market for testing the four initiatives. The manufacturer’s reps spent time coaching the distributors’ sales managers, and they jointly defined sales targets and strategies for penetrating new outlets. The manufacturer developed plans and scripts for visits to current customers and potential new outlets. “Perfect store” checklists, daily objectives, weekly result sheets, and monthly incentive scorecards further reinforced best practices and a sense of urgency.

A major goal of the sales activation program was to redirect the field reps from being order-takers to becoming true salespeople. To this end, the program made major changes in compensation plans, increasing variable pay as a percentage of total compensation and placing more pay at risk—with greater upside for superior performance. For example, achieving targets related to “perfect store” objectives would trigger a special bonus, independent of the overall sales achieved by the outlet.

Active week-by-week monitoring and Monday review meetings drove learning and short-cycle improvements, and the program rapidly delivered impressive results. In six months, revenues in the pilot territory increased by 12 percent, at a time when overall sales at outlets with takeout food were down by 6 percent. The pilot has since been extended to multiple regions—and continues to deliver double-digit sales growth.

Improving Customer Contact

A major U.S. automotive service chain was experiencing a worrisome and consistent drop-off in its principal service offering. Franchisees and management cited a host of potential causes outside of their control, such as the tough economy, a category in decline, a growing consumer preference for using car dealers for their service needs, and repair shops that weren’t configured for larger sport-utility vehicles. Despite these very real challenges, there was still an opportunity to increase growth and market share. An analysis of the franchisees and their competitors revealed several best practices in the high-performing shops, and wide variation in adherence to those practices among the company’s shops. In particular, the analysis showed that employee interactions with customers throughout the sales and service process affected conversion and loyalty rates.

The core opportunity was to improve interaction with the customer at each contact point, from the initial call or visit through service execution and even after-service follow-up. For example, during initial customer calls, franchise employees tended to act as passive order-takers rather than trying to understand and focus their sales efforts on the customer’s needs for price, convenience, or quality.

To address these improvement opportunities, the company worked in partnership with leading franchisees to develop best-practice sales scripts and training for each touch point with customers. The scripts trained the staff members to mention the key service elements that customers were known to care about—such as a complimentary ride home after dropping off a car, or physically showing the customer the repair problem. In addition, the company and leading franchisees jointly designed simple ways for franchises to measure improvement in conversion rates, satisfaction, and after-service follow-up. For most, this was the first time such metrics were ever tracked at the shop level. Further, the regional sales managers’ job responsibilities were redesigned to include coaching, reviewing metrics, and working with shop management to improve performance. The training, metrics, and coaching greatly improved customer interactions. In three months, the company was ready to launch a pilot program in a representative metropolitan area.

The efforts paid off. Over the three-month test period, sales in the pilot market rose 11 percent from the previous year, compared with a similar market that grew just 1 percent, mirroring the slow growth of the U.S. economy. Convinced by the progress, the company offered the program to all of its franchises, and within nine months had reversed the sales decline.

Although sales activation has three basic steps, the levers used to drive results must reflect the specific circumstances of the company, as shown in the three examples presented here.

To activate sales in the short term, we have found that the best approach is to focus on and leverage existing customers, products, and salespeople rather than embarking on long-term product-development or restructuring efforts. Although those more fundamental efforts often become complementary next steps to a sales activation effort, they rarely deliver the rapid results that are needed to meet near-term sales targets. Once near-term targets have been met, the additional revenue from sales activation can often fund a longer-term sales-force transformation.

Our clients have found that activating the untapped potential of existing assets is the fastest way to achieve a turnaround in performance. Before investing in more—more product lines, more salespeople, more channels—make sure your company is getting the most from what it already has. Are you ready to activate your sales?