Projects involving large capital expenditures, such as the development of oil or natural-gas fields, power plants, and metal-ore mines, have become significantly more challenging in recent years. First, they have become larger and more complex. Demographic shifts and the industrialization of large developing economies have led to greater demand for energy and raw materials, and thus for increased production. Second, these resources are increasingly sourced from less accessible parts of the world, often in emerging markets, where business operations face unique challenges. In addition, extremely promising markets attract multiple competitors, further raising development costs at a time when credit is less available than in the past. Finally, dramatic swings in commodity prices affect the economics of large-project development.

These changes are not going away. Investment in large-capex projects is expected to increase dramatically in the coming years, requiring greater coordination among a larger number of market participants. (See Exhibit 1.) As a result, any problems that occur during development—such as delays, cost overruns, and quality issues—have a correspondingly larger effect on the financial performance of these companies, as well as on engineering, procurement, and construction (EPC) contractors and engineering, procurement, and construction management (EPCM) contractors.

In response, companies have sought to implement quality control programs, to issue more frequent project-status updates, and to transfer a larger component of the risk to outside contractors. While such measures can help, they are superficial and ultimately insufficient, because they do not address the core need for a new approach to project management.

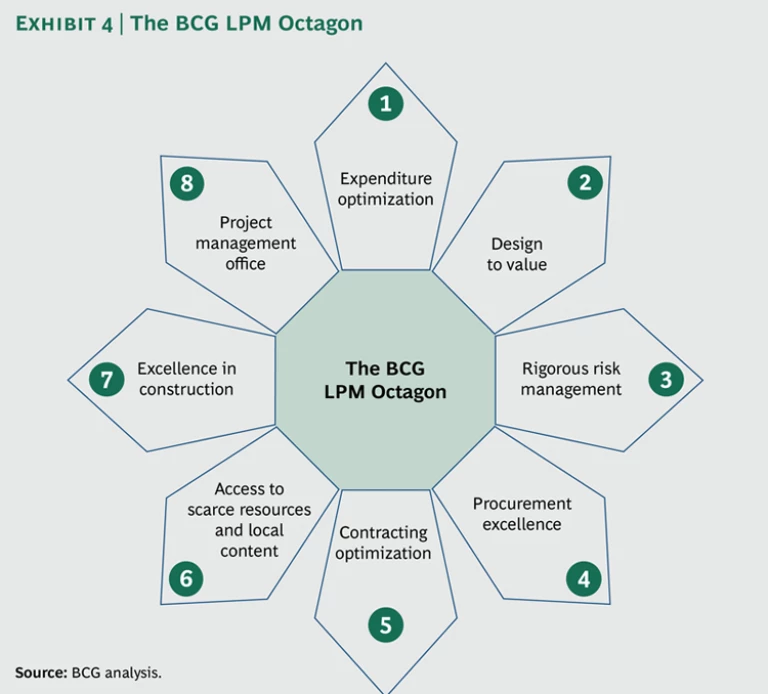

The Boston Consulting Group has developed a more comprehensive approach—the BCG LPM Octagon—which comprises eight key levers that companies can pull to fundamentally improve large-capex-project management. These practices can help companies ensure that their large projects are completed on time, on budget, and within expected quality parameters.

An Increasingly Challenging World for Large-Project Management

Each of the factors driving these changes in large-capex management merits a closer look. As noted above, demographics are one key element. With world population projected to reach 7.7 billion by 2020 and global GDP growing by 4.2 percent per year, according to the U.S. Energy Information Administration, demand for basic commodities like oil, gas, minerals, and power will continue to increase. Demand for aluminum, for example, is expected to grow more than 10 percent each year over the next five years, and demand for natural gas is estimated to increase at 2.4 percent per year through 2020. Crude-oil demand is projected to rise from approximately 80 million barrels per day to 85 million. More than half of the crude-oil and gas capacity projected for 2030 has yet to be discovered, let alone developed, which will require an annual investment of $455 billion over the next 25 years to ensure supply.

Such expansion may seem outsized, but it is in line with the growth of these sectors over the past decade, during which the slowdown of the 2008 to 2009 financial crisis was merely a short-term disruption. Capital expenditure in the global mining sector grew 40 percent per year from 2003 to 2008, dropped almost 8 percent in 2009, and quickly bounced back to previous investment levels a year later. Investments in refining have grown 5 percent per year since 2003, reaching $34 billion in 2010. All these growth rates are in excess of local—and global—GDP expansion.

Worldwide, these factors have resulted in major capex projects becoming larger and more complex. (See Exhibit 2.) The average costs of investment in mining projects more than tripled from 2005 to 2010. Greater project size significantly increases on-site management challenges—larger numbers of players participate, structures are more sophisticated, and engineering sites are more spread out. The incorporation of more-sophisticated technologies into the project portfolio—such as 3G nuclear plants, deep-sea oil rigs, and offshore wind facilities—compounds these challenges, making outcomes far more uncertain.

This effect is particularly pronounced in developing countries with a large concentration of new projects and in remote locations with limited access to experienced partners. As resources are increasingly sourced from such markets and become more difficult to secure, project owners are experiencing a greater need for developers and contractors with a good understanding of local authorities, regulations, content requirements, and stakeholder needs.

In extreme cases, individual markets have become overheated. For example, both Australia and Brazil have experienced large-scale increases in the mining and oil and gas sectors. (In Australia, mining investments in 2011 were as much as 80 percent higher than in 2010.) In both markets, developers are seeking to increase the scope of their operations, and there are a finite number of contractors, builders, and engineers capable of handling such projects.

As size, complexity, and logistical challenges mount, financing becomes more difficult as well, since these projects require higher levels of investment. For example, launching a new aerospace program can cost up to $15 billion, while the full development of a liquefied-natural-gas project can cost up to $40 billion, including successive increases in capacity. Capital expenditures already represent a significant part of companies’ revenues, ranging from an average of approximately 6 percent over revenues at chemical companies to almost 20 percent in the mining sector. This number is only likely to grow, given the expansion in project scope and size.

Such financing challenges have been exacerbated by the financial crisis, which limited the availability of credit—or made it available on much stricter terms. As a consequence, developers are seeking new ways to optimize investments, putting more cost pressure on the whole value chain. At the same time, high volatility in commodity prices has disrupted the balance of the value chain, cyclically shifting power between developers and contractors, affecting the procurement strategies of all parties, and driving up overall risk.

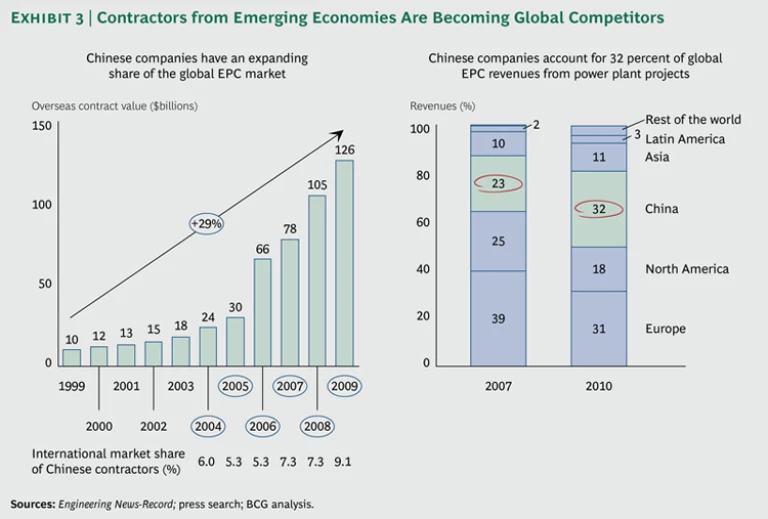

On the contracting side, a new group of EPC competitors from emerging economies is upending the competitive landscape. (See Exhibit 3.) Chinese equipment companies in segments such as coal power, boilers, and conventional steam turbines now supply more than 50 percent of global demand, while in sectors such as wind onshore they have increased their global share by 15 percentage points, to 25 percent, in just four years. South Korean EPCs are also very active and becoming more competitive globally, particularly in the power, oil and gas, and petrochemical sectors. In response, traditional contractors in these sectors have been forced to revamp their cost structures in order to remain competitive. Moreover, Western developers are not always able to exploit this downward price pressure from new players, as they often don’t have a clear picture of the new entrants’ capabilities and the quality of their products.

Many companies have responded to these challenges by implementing measures such as quality control programs, more frequent status reports, increased pressure on suppliers, and detailed project-deviation assessments. They also try to transfer a larger part of the project risk to contractors through restrictive contract conditions. However, these measures often fail to deliver their expected benefits. In some cases, they are not systematically enforced. In others, companies take significant action only after a project has experienced serious delays or costs have so far exceeded the initial budget that the company’s financial condition is affected. In many cases, the company is simply unaware that there is an underlying need to implement systemic changes.

In this new and difficult environment, effective large-capex-project management is a crucial capability. The eight levers of the BCG LPM Octagon, which are described in detail below, can greatly improve the way that project owners and EPC/EPCM contractors manage their projects. (See Exhibit 4.) Collectively, they can help companies improve overall performance and develop their large-capex projects at lower cost while meeting stringent quality requirements and complying with tighter schedules.

1. Minimize Capital Expenditure Requirements

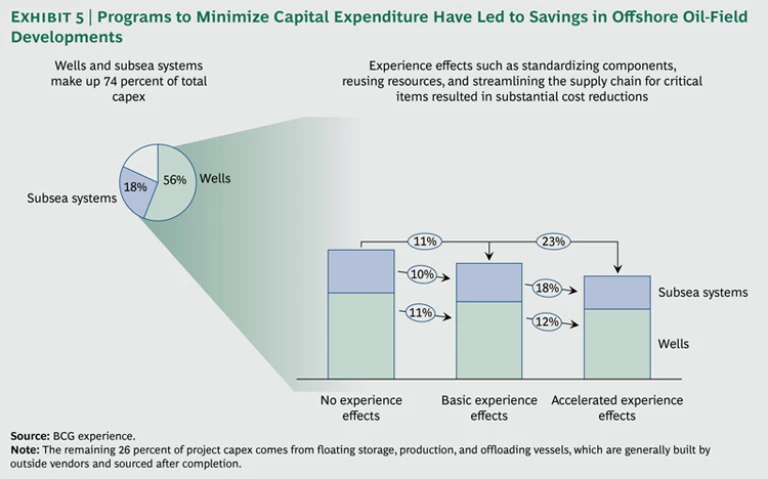

Minimizing capital expenditure can significantly reduce the overall risk of individual projects. The entire organization should develop a cost-focused culture, adapting capex requirements and understanding the principal drivers of capital costs. In addition, companies need an effective monitoring system to help consolidate results, perform sensitivity analyses on potential approaches, and systematically collect best practices. This is an ambitious undertaking, but the results justify the effort—successful minimization programs can reduce capex requirements by 10 to 25 percent. (See Exhibit 5.)

In our view, there are six complementary principles of successful capex reduction:

- A Cost-Focused Culture. Challenge the project’s scope and specifications in its earliest stages—bringing to bear a deep understanding of cost components, user requirements, and competitors’ best practices—in order to identify potential savings.

- Learning Effects. Capture experience effects by standardizing and repeating processes and designs at both the component and project levels.

- Scale Effects. Optimize project size to capture the impact of scaling components and projects. The reductions in investment requirements can be significant: one power-generation company identified capital reductions of approximately 35 percent by optimizing scale in one of its projects.

- Supply Chain Optimization. Adapt the supply chain (for example, in make-or-buy decisions and choice of supplier location) to more effectively meet the company’s needs.

- Convoy Effect. Understand the impact on costs of developing similar projects consecutively or in the same location.

- Location and Technology Effects. Understand the potential impact of future technologies and locations on the overall cost of the project or program.

2. Design to Value

The second lever applies primarily to EPC/EPCM contractors. In the current context of increasing complexity and competition, contractors and equipment providers must ensure that their offers are aligned with actual client needs and are available at the lowest possible price. It is therefore critical to thoroughly understand the client’s value requirements. For example, some clients are focused primarily on the initial investment, while others may consider long-term costs (factoring in both initial construction and lifespan maintenance). Still others may seek reliability and plant availability over cost considerations. In all three cases, the contractor must understand the developer’s value targets and propose a technical design that hits those targets. A design-to-value approach can reduce costs between 10 and 15 percent for existing products; in new equipment, up to 50 percent of costs can be avoided before they are even incurred.

There is a second component of the design-to-value principle: contractors must evaluate their own internal operations to ensure that they are as cost efficient as possible. This is increasingly important for incumbent players, which are facing increased price competition from operators in low-cost countries. In the U.K., for example, EPC contractor prices for most power-generation technologies are projected to fall significantly through 2020, as Western operators are forced to reduce costs to match the offerings from new global challengers. This cost gap can be significant—up to 25 percent in the unit costs of coal power plants in 2010.

At the same time, these new EPC challengers must be willing to expand out of their home base in order to better understand customer requirements and translate them into technical specifications. In particular, they need to face the perception gap and adapt their offer to meet stringent quality requirements without losing their cost advantage.

For all competitors in the market—incumbents and global challengers alike—four principles can help in pulling the design-to-value lever:

- Value-Based Offer. Understand clients’ key purchasing criteria and design projects to meet their needs.

- Optimized Technical Specifications. Identify the specifications driving cost and price for clients, simplify them while maintaining performance and quality standards, and redefine them for future projects. For example, a power equipment vendor avoided overspecification by applying market standards and reduced component prices, generating savings of roughly 20 percent on total cost of ownership. Combining this principle with global sourcing initiatives can yield greater impact.

- Standardization and Modularization. Standardize designs for components that can be used on multiple projects. Contractors can achieve scale effects with procurement volume for these components, replace unique designs with proven ones, and reduce delivery times and overall complexity.

- Upgraded Existing Designs. Modify initial designs to reach incremental new targets of cost, quality, and/or operability by applying new technologies, involving suppliers in project/product development, and collaborating with suppliers from low-cost countries.

3. Apply Rigorous Risk Management

As the risks of large-capex-project development grow, a comprehensive risk-management program becomes ever more crucial for project owners. In order to be successful, programs should apply a tiered approach that assesses projects at three levels:

- Strategy Level. Design strategic positioning for all capital expenditures aligned with the company’s financial objectives and capabilities. Draw clear guidelines that define acceptable levels of exposure to risk, and define portfolio policies aligned with this strategic vision (such as the maximum size of projects, capital expenditure per year, and other metrics).

- Portfolio Level. Regularly evaluate the portfolio to differentiate value-adding projects from value-destroying projects. A clear ranking according to risk and value will help optimize investment decisions and improve the company’s pipeline by identifying the best option to follow in each situation—for example, whether to exit the project, address unacceptable factors, optimize performance, or continue with the project.

- Project Level. Exercise ultimate control over project risks even when an EPC/EPCM contractor is in charge of implementation. This entails understanding risks at each step in the project, classifying them by severity and likelihood, determining options to mitigate each risk, and implementing a forward-looking reporting system to proactively intervene.

4. Develop a Procurement Excellence Program

In many companies, the procurement function is poorly integrated into project processes. As a result, these companies lack a strategic focus on each category of goods procured and cannot effectively assess procurement performance. Substandard procurement can have cascading ramifications on a project’s timeline and costs, because a single critical category of goods not delivered in time (or not of acceptable quality) can delay an entire project for months.

Category optimization is the single most relevant means of improving procurement performance. It should be based on a deep knowledge of procurement categories and spending levels by category; the procurement function should be involved early on in order to define a sourcing strategy before the budget is committed. For example, a recent collaboration with a top-five global mining company helped cut the procurement budget by more than 10 percent, thanks to the appointment of project procurement managers and the installation of tracking mechanisms across a $45 billion project pipeline.

Seven principles can help companies optimize procurement:

- Supplier Management. Systematically assess and classify current and potential suppliers, improve the quality of key suppliers, deepen relationships with top performers, and consolidate supplier bases.

- Bundling. Establish transparency in internal purchasing across projects and locations in order to identify bundling options that can be awarded to the best suppliers. Establish global tenders and master agreements to capture scale.

- Global Sourcing. Source from low-cost countries to capture major cost savings. Some difficulties may arise (such as inferior technologies or a lack of after-sale services), but these can be addressed through supplier development and collaboration programs. Global sourcing must be closely linked to standardization and modularization of designs and components in order to achieve the level of scale that makes it cost effective.

- Demand Management. Adjust procurement quality to the project’s real requirements, and understand changes in category demand to more effectively negotiate with suppliers. For example, a mining company noted that a significant time lag existed between increases in commodity prices and subsequent increases in the price of earth-moving equipment. By altering the timing of negotiations to capitalize on this lag, the company identified a potential capital savings of 8 to 12 percent.

- Process Excellence. Optimize costs over the entire life cycle of a project, factoring in not only product prices but also the total cost of ownership. A power generation company that used this approach—evaluating the total cost of primary and secondary equipment and of consumables and spare parts—saved 8 to 14 percent in the life cycle costs of key equipment.

- Standardization. Bring specifications closer to commercial standards across projects, and maximize the sharing of items among projects and products.

- Make or Buy Decisions. Externalize products or services to optimize costs. Estimate cost reduction potential per category given the company’s current position and future goals, taking into account future demand volumes that could lead to scale or learning effects.

In applying these principles, companies should establish key performance indicators to regularly monitor the performance of the procurement function and identify areas to improve. The most relevant KPIs include identified or realized cash savings per category, the contribution of savings to earnings before interest and taxes, procurement budget by category, and the number of suppliers accounting for 80 percent of spending.

5. Optimize Contracting Strategy

Contracting strategies are strongly related to business cycles. In periods of high demand, EPC/EPCM contractors hold the upper hand in negotiations. During low-demand periods, the power shifts to developers, who are able to demand better prices and to transfer a bigger part of the project risk to contractors. However, this shifting dynamic may lead to poor performance and conflicts between players. Instead, developers and contractors should consider long-term relationships that create win-win situations that outlast the business cycle—especially given the current trend toward more complex projects.

Developers need to clearly understand the specifics of the project and the external conditions of the market before designing their contracting strategy. A key question for most Western developers is whether to open the contracting process to challenger EPCs, such as those from China or South Korea. Including these new players in the contracting process will require modifications of traditional project requirements but will also often allow significant cost reductions.

Developing an appropriate contracting strategy for each project involves three steps:

- Identify the project’s scope and value drivers. Set expectations and identify the main value drivers—such as the required execution speed, production targets, and internal personnel available to manage the project—at the project’s earliest stages. Consider overall risk and project size. In the oil and gas sector, for example, full EPC contracts are never signed for projects worth more than $5 billion.

- Analyze external market conditions. Understand the range of contract types available in order to find the one that best fits the project. Assess activity levels in the EPC/EPCM services market, monitor competitors’ contracting trends, and choose between (short term) tactical and (long term) strategic relationships with contractors.

- Define bundling options and contracting guidelines. Identify the packages to be outsourced and the bundling strategy. Bundle either by project phase (engineering, procurement, or construction) to maximize contractor expertise or by project module to transfer more risks to contractors.

In addition to determining the best contracting strategy, developers should select an EPC/EPCM partner using a three-phase process:

- First, they should assemble an initial shortlist of potential partners, considering the quality of engineering services among available contractors, project management/construction performance, regional presence, and technological prowess, among other factors.

- Second, in the RFP phase, developers must focus on identifying the differentiators among bids that could affect their value, such as project calendar, payment plans, insurances and guarantees, and penalties, among others.

- Finally, during the negotiation phase, developers must clarify the conditions of the collaboration in order to avoid potential misunderstandings. These include framework KPIs, final scope, timetables, personnel, services, and remuneration scheme.

6. Secure Scarce Resources and Local Content

Most industrial sectors expect sustained growth in demand over the next decade, and companies are developing a multitude of large projects, often concentrated in the same regions. As a result, companies have to compete for skilled human capital, natural resources, infrastructure, commodities, and critical equipment. Proactively securing access to scarce resources over the medium term in areas where there is a high concentration of projects—and building a sustainable position for the future—is a key differentiator in large-project development.

With human capital such a large challenge, developers must define their labor requirements in the context of a project’s complexity and potential expansion, and they must take steps to address quantitative and qualitative gaps. Specifically, companies should establish a structured workforce-planning model that uses the following best practices in attracting and retaining talent:

- Systematic and proactive recruiting methods

- A staffing model to develop talent and ensure the best use of available resources

- A training plan to develop the skills of existing staff

- Solid career planning to encourage commitment in the workforce

- Strategic alliances with contractors to close talent gaps

Natural resources such as water are an increasingly relevant factor in large-capex projects. For example, ambitious plans to expand uranium production capacity in Namibia have been put on hold owing to insecure water supplies. When analyzing the availability of natural resources, companies must work with local stakeholders, such as governments, communities, and other industries, that have the power to limit access. Resource management should include supply plans to ensure current and future operations at the lowest cost, as well as best practices to reduce consumption and a resource stewardship stance to facilitate negotiations with stakeholders.

Assets such as infrastructure, commodities, and equipment can also play a critical role in a large project’s development. Infrastructure is critical to tapping natural resources—it must be accurately sized through a top-down analysis.

Price volatility and resource availability are the two factors that can have the most substantial impact on a project’s budget and schedule. To understand the company’s exposure to these risks, developers should understand their access to supplies of critical commodities, their negotiating power with suppliers, the availability of substitutes, and the impact of a shortage on the project’s value.

Finally, to ensure that critical equipment is available when needed and without delays, developers should understand the universe of key equipment suppliers—including global and regional players—their prices, and their delivery lead times. The lead time for the delivery of critical equipment tends to be long, especially during demand peaks and when local content requirements affect the market. For example, in the mining industry, a ball mill can take up to 28 months to deliver, while a cone crusher can take 34 months. One potential solution is to optimize equipment sourcing by bundling orders at the corporate level, giving developers more leverage to reduce costs and lead times. This also allows companies to share equipment among projects and reduce demand volatility by considering the entire backlog of projects.

7. Ensure Excellence in Construction

Large projects are, in essence, all about construction. But because all projects are unique, they often lack the systematic defect-prevention measures and lean process planning that can be found in other sectors involving more repetitive production, like the automotive industry. Developers and contractors must seek to reduce waste, errors, and nonvalue-adding activities that significantly affect costs and project schedules.

To achieve construction excellence, companies should aim to attain a lean construction flow within the project. Three key principles can help.

The speed-based scheduling management principle aims to create a constant work flow without bottlenecks or wait times.

- System Speed. Divide construction work into sections and subsections that are small enough to be controlled in short cycles. Sequence the work units in each subsection to avoid bottlenecks and wait times, and delineate the work sequence in detailed plans, schedules, and charts. The final production plan should allow for daily controls, so that any deviations can be rapidly identified and corrected.

- Required Capacities. Harmonize effort and capacity—such as the number of workers assigned to each task—at the subsection level in order to support the selected system speed (higher speed will require more capacity). Share the production plan with subcontractors in order to proactively integrate them into the planning process. Align external partners to clarify interfaces and obtain their input in order to optimize the plan.

The pull principle applies the lean concept to the logistics chain to create a stable and efficient material and resource flow. It ensures that all the required resources are provided on demand and to required quality standards.

- Materials Planning. Classify materials according to the lead time and delivery method (just in time, just in sequence, or others). Link the flow of materials to the overall production plan, assigning an order signal in the production timeline depending on the lead time of the particular material. Create an availability board—updated daily—to monitor the status of materials for the next five days.

- Materials Provision. Link the logistics sequence to the production sequence by consolidating information on what material is needed, how much, and in what phase of construction. Use a commissioning system based on pull-demand management to automatically identify material restock needs without risking out-of-stock materials.

- Materials Disposal. Organize waste disposal processes to reduce costs and help protect the environment.

The zero-defect principle addresses quality by stabilizing and optimizing processes.

- Gate Cycles. Define a clear control process based on review gates after each section of the project is completed.

- Operational Quality. Use KPIs to measure on-time or delayed performance, quality (defects and rework indicators), and the degree of subcontractor compliance with other agreement terms. For management purposes, aggregate operational KPIs and follow them during the production plan steering sessions.

- Self-Contained Sequence Control. Implement mutual control between work units via review gates at the beginning of each work unit within the subsection to detect defects early and correct them immediately.

8. Set Up a Project Management Office

Large projects require strong leadership and proactive management. At many companies, project management efforts often fail for several reasons. Leaders may not completely understand complex projects, or they may lack the preparation and determination necessary to effectively oversee their development. Some companies approach projects as a series of individual initiatives executed independently, without the required upfront coordination and planning.

In our experience, these issues can be addressed by implementing a dedicated program/project management office (PMO). The PMO’s role can vary from facilitating the process to assuming full leadership of the project’s development. Currently, 29 major companies are applying BCG’s PMO approach to 50 programs, registering a value in excess of $25 billion in 2010. A well-structured PMO should cover three essential aspects of project management:

- Project Governance. Explicitly articulate the structure of the project’s governance, detailing the roles of the steering committee, executive sponsors, and individual business units. This requires that the PMO have adequate visibility and authority over all corporate functions involved in the project.

- Process Design. Define all the major elements of project development, including human resource requirements, action plans, key metrics, and reporting systems.

- Project Execution Control. Identify, evaluate, and solve key implementation issues on the basis of reports submitted by project teams. Act as a main hub for addressing these issues. Supervise single teams, help build consensus among teams, and prepare status reports for executive-level decision making.

Effectively managing large-capex projects in today’s uncertain environment—with costs, complexity, and risk increasing, financing drying up, and resources becoming harder to secure—is a significant challenge. The BCG LPM Octagon can give project owners and EPC/EPCM contractors a clear edge.

These eight levers can yield significant results. For example, a well-executed contracting strategy can reduce the total construction cost of a coal power plant by 25 percent. Excellence in construction practices can eliminate approximately 50 percent of the wasteful activities of a construction site. A procurement excellence initiative that systematically optimizes procurement categories can save 8 percent of total costs initially and an additional 2 percent in each year that follows.

All eight levers require the organization to focus on performance and to implement control mechanisms to oversee the development process. Through the correct use of these eight levers, large-project management can be the successful and profitable enterprise that companies envision.