As millions of households in China and India rise in affluence to join the middle class over the next decade, they will demand substantially greater quantities of everything associated with the “good life,” including food, cars, electronics, high-quality health care, and clean, safe water. In both countries, people are changing their diets to include more dairy, fresh vegetables, nuts, and, in China, high-protein foods, including chicken, fish, pork, and beef. This tremendous surge in consumption will present remarkable new economic prospects—but also significant potential second-order consequences.

The $10 Trillion Prize

At The Boston Consulting Group, we estimate that from now through 2020, per capita income in China and India will nearly triple, and together the two countries will boast some 2 billion economically able consumers. These newly enfranchised families are building bigger houses with modern amenities and seeking apartments in high-rise towers in a growing number of densely populated cities. In both countries, people continue to want more—and better—and their lifetime consumption patterns are undergoing a radical evolution. We estimate that a child born in China in 2009 will consume on average 38 times more over his or her lifetime than one born in 1960. In India, a child who entered the world in 2009 will consume on average approximately 13 times more than one born in 1960. We’re confident that by the year 2020, consumers in the two countries will collectively spend at least $10 trillion per year.

Consumption at a Price: The Boomerang Effect

While this powerful wave of future consumption will offer unprecedented business opportunities across numerous industries and product categories, it is also likely to provoke a number of second-order consequences not just in China and India but worldwide. One of the most profound of these is what BCG calls the boomerang effect: as consumers in China and India become better off, they will, over time, drive huge new demand for globally traded commodities such as corn, fertilizer, copper, cotton, steel, cement, oil, gas, and electricity. This year-on-year stepped-up demand will, in turn, boomerang across the globe, in many cases, driving demand for supply-constrained commodities and pushing up the prices of these commodities, as well as products derived from or dependent on them. Of course, within any given month, demand will be mercurial and, hence, difficult to predict, as huge blocks of Chinese and Indian consumers purchase more—and then less—of various goods derived from, or requiring, specific commodities. These vast ebbs and flows of new consumption, in turn, will dramatically affect the fate of Western producers of these commodities (and the goods that require them). In supply-constrained markets, prices will swing wildly as a function of month-to-month import changes, inventory fluctuations, and new production capacity. Such rampant price volatility will challenge industries and consumers alike.

Companies that use these commodities will need to add to their skill sets. They will need to learn to use a range of substitute materials and develop an ability to change prices quickly to maintain margins. They will need to learn how and when to stockpile inventories and will need to have insight into the direction, speed, and duration of price spikes.

Consumers will need similar skills. Imagine a typical middle-class U.S. family of four today enjoying a Sunday dinner of roast beef with vegetables, salad, milk, and butter-pecan ice cream for dessert. If four servings of each item currently cost a total of $27 ($9 for the roast beef, $4 for the vegetables, $4 for the salad, $4 for the milk, and $6 for the butter-pecan ice cream), the very same meal, in 2015 could very well cost upwards of $52. Specifically, our research shows that if consumption of chicken and pork (the raising of which requires huge amounts of corn, soybeans, and amino acids as feed) and pecans (which are now a New Year’s delicacy in China) continues to accelerate in China and India, middle-class households in the U.S. and Europe will face a blinding threat: higher food prices in real terms and flat to declining incomes.

On average, U.S. incomes have stagnated during the past decade, and we predict that between now and 2020, real income in the U.S. will grow at a compound annual rate of only about 0.4 percent. It’s unlikely that a family who can scarcely afford a $27 roast-beef dinner today will be able to pay $52 for it just three years from now.

Competition for Crops and Resources Will Lead to Price Inflation, Shortages, and International Conflict

The supply of most crops, including corn, is inelastic in season—the crop planted is the crop available. The math is simple: in any given year, the agriculture industry can supply any crops only to the extent that it is able to make productive whatever arable acreage it has available then. Productivity is largely a function of rainfall and other weather conditions.

When supply remains flat—or falters—and global demand increases, prices rise quickly. Indeed, over the past five years, the price of a ton of corn in the U.S. has risen at an adjusted CAGR of more than 11 percent. The price of a ton of soybeans has risen 15 percent during the same period.

We believe that demand in China and India (and throughout the rest of the world) for these and other such crops will create new fault lines—and significant potential for global agriculture and water wars. Our analysis shows that by the end of the current decade, the percentage of global GDP claimed by China will grow by 4 percent and that claimed by India will grow by 1 percent. This growth is driven by capital investment, education, and expanding worker skills in China and India. By contrast, we estimate that during the same period, the U.S. share of global GDP will shrink by 3 percent. (See Exhibit 1.)

The diets of the Chinese, in particular, are indeed changing dramatically. In 1960, people in China relied heavily on rice, and only 4 percent of the daily per capita calorie intake could be attributed to chicken and pork. By 2010, the daily percentage of chicken and pork calorie intake had increased to 19 percent, and our analysis suggests that by 2020, it may be as high as 28 percent. We believe that the roughly 40 billion kilograms of pork the Chinese ate in 2010 will increase by an annual average of 4 percent, totaling more than 60 billion tons by 2020. That will amount to some 215 billion more servings in 2020 than in 2010. Over the same period, chicken consumption will rise by an annual average of 7 percent, amounting to 185 billion more servings of chicken in 2020 than in 2010.

This taste for meat will drive up the demand for corn, soybeans, and the amino acids needed to feed pigs and chickens. For instance, corn-based feed represents 55 percent of the cost of raising cattle for slaughter. Our analysis shows that the retail price of beef today has soared 55 percent from its price of just a decade ago. This means that a Big Mac, which cost around $3 in 2003 and goes for just over $4 today, could, by 2015, easily cost $5—or even more.

For families on a tight budget, such food-price increases will be untenable. In the U.S., the lowest 40 percent of households earn $40,000 or less per year and, on average, spend roughly $3,000 on food. This population is already facing a job squeeze, with unemployment among men lacking a high school education running above 20 percent. If, let’s say, they faced a 10 percent increase in food costs (and that is a conservative estimate, given the possibility of a 50 percent increase in average corn prices over the next ten years), they would have to allocate an additional $300 per year for food: anywhere from a half to a full week’s pay. Suddenly, all kinds of companies will face consumers who, no longer able to afford their products, will start to scrimp, save, and hunt for bargains. Add some government tax increases, and soon you’ll have middle-class consumers even further hobbled by constraints on their net cash income.

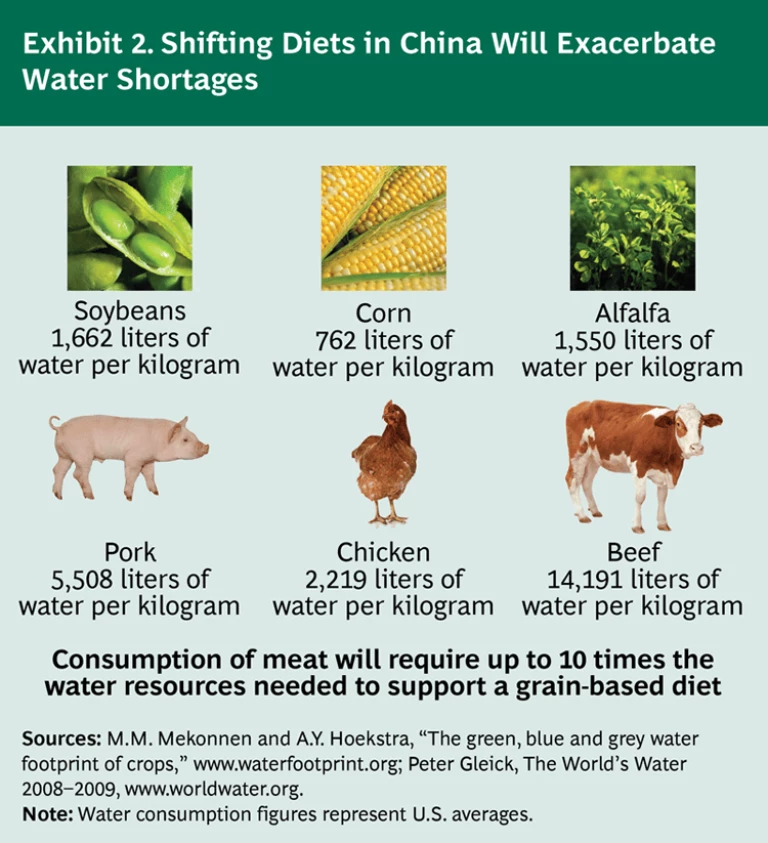

Massively higher consumption in China and India will likely trigger not only highly inflated food prices across the U.S. but also dangerous shortages of key natural resources—especially water. Climate change is already causing droughts in many regions throughout the world: In India, water shortages are acute and prevalent. In China, highly populated cities have become deserts. The droughts are leading to famine and food riots, intensified tensions between China and India, and the risk of outright war over water supply. China’s new meat-rich diet requires huge new quantities of water. (See Exhibit 2.)

Worldwide Water Wars

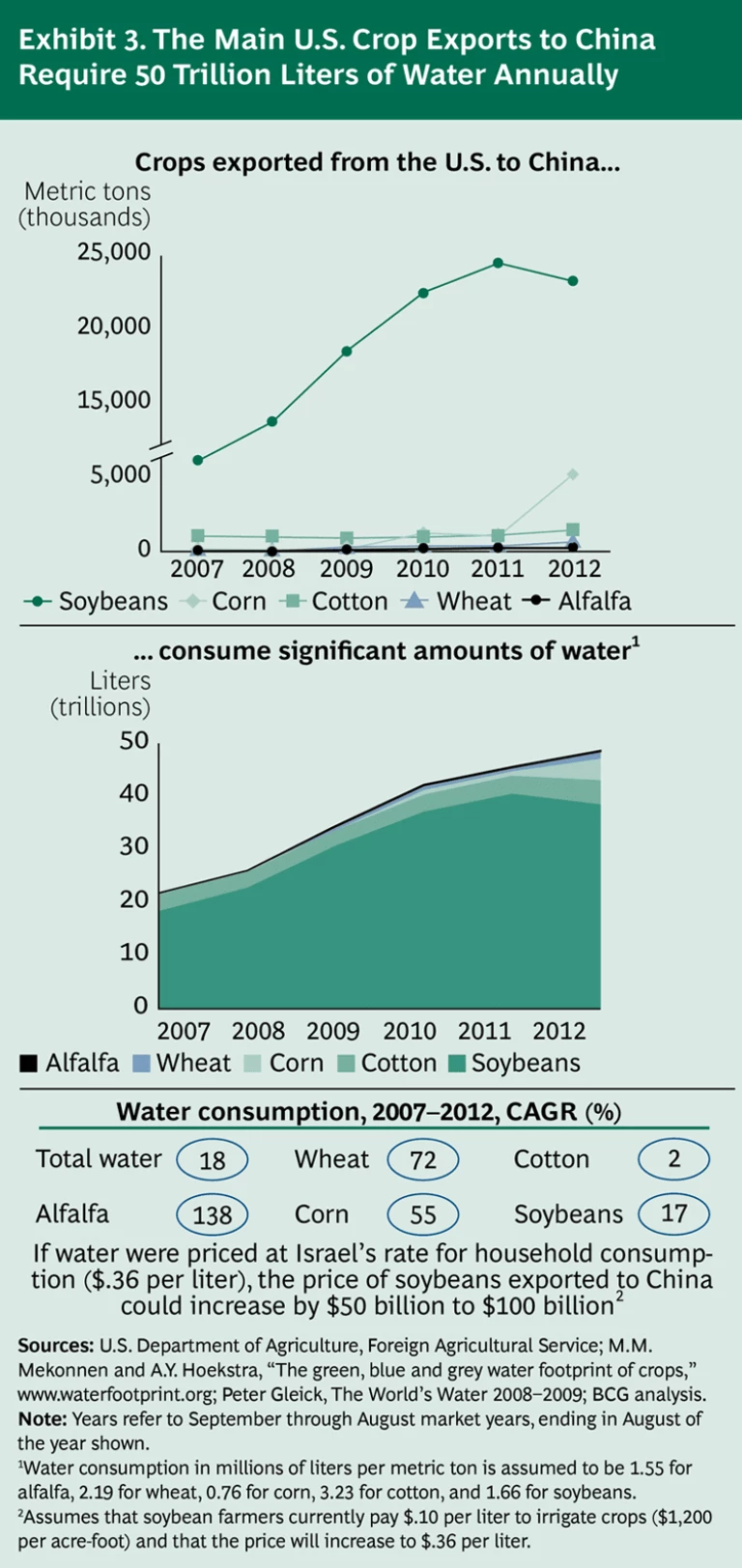

In the U.S., climate change is causing many once-fertile regions to become arid and difficult to irrigate. This, together with enormous exports to Asia of crops such as corn and soybeans, puts the U.S. itself at increasing risk of scarcity of both food and water. From 2007 through 2012, the amount of water required to produce the main export crops for China increased at an average annual rate of 18 percent to some 50 trillion liters of water. (See Exhibit 3.)

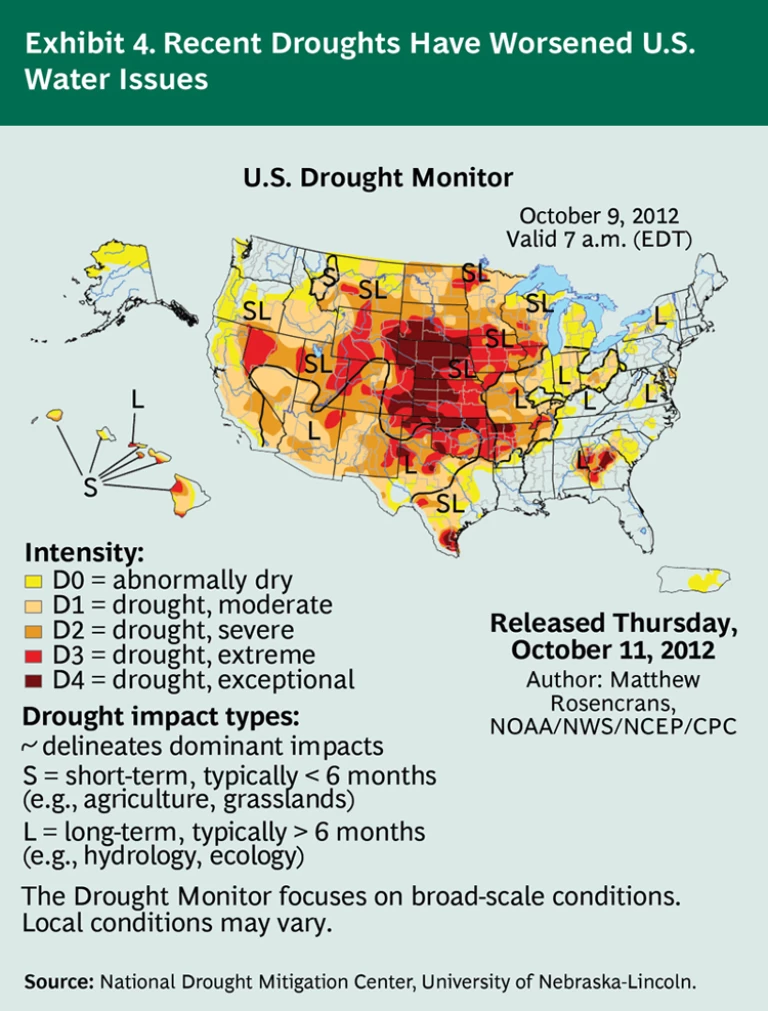

When it comes to water shortages, history offers a painful lesson. From 1931 through 1936, dustbowl conditions caused corn production in the U.S. to drop 30 percent, and prices, over the same period, soared 115 percent. Current drought conditions in the U.S. are worrisome. (See Exhibit 4.)

These conditions could constrain corn production, which, in turn, could cause the prices of staples such as chicken and beef to skyrocket and also cause a dire shortage of water. Unless the world begins to conserve water and finds alternative and better ways to irrigate its crops, the world will likely face water wars. These could be especially fierce in Asia, because China controls a huge proportion of the continent’s water supply, including much of India’s. More than a billion Indian people live in river basins dependent on water from the Himalayas. The Himalayan rivers, which originate in Tibet and flow across Northern China, account for 35 percent of India’s river water. Rivers such as the Ganges are the lifeblood of the region.

The boomerang effect is real. Over the course of the current decade, we will see how the growth in demand from Chinese and Indian consumers translates into greater demand for commodities—and a concomitant squeeze on energy, water, and food supplies. The shortages will have trickle-down effects that will mean higher prices for everything—from cars, motors, and appliances to jeans, T-shirts, and leather shoes.

We believe, however, that these global trends don’t have to end in fewer hamburgers for U.S. consumers or in worldwide food riots. The agriculture and water wars can be avoided, a balance of trade can be achieved, and people everywhere can have the food and water they need to survive—and thrive. If the world is to ensure these outcomes, we will require a revolution in how we produce and sustain agriculture. The impact of such a revolution will depend on serious new investments to enhance water conservation and provide reliable innovations in irrigation, improvements in farming methods, continued consolidation of farms to promote investment in capital equipment, and U.S. government policies that favor robust export growth. Above all, success will take imagination, creativity, investment, and vision.