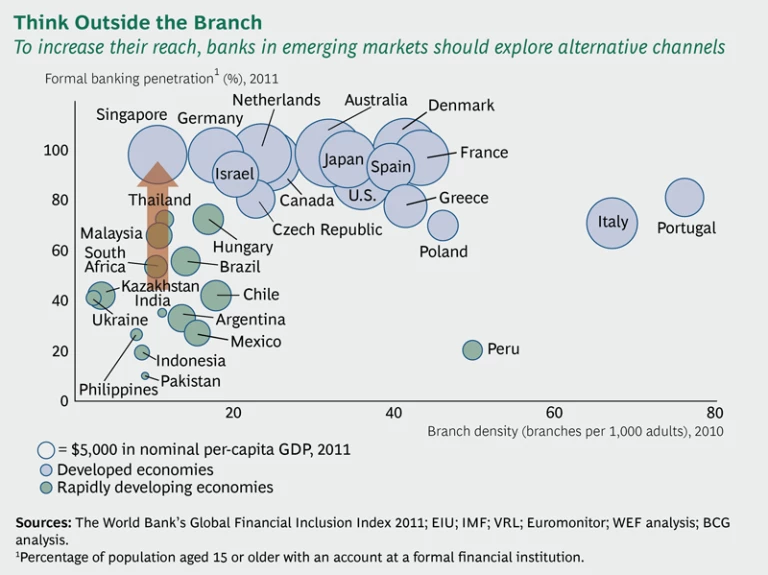

This exhibit illustrates the relationship between branch density and retail banking penetration. The positive correlation shows, not surprisingly, that branch networks are an elemental part of banking. For most customers in most markets, the venerable branch is still the primary distribution channel. But despite their importance—and in many markets, their ubiquity—branches are not the only driver of growth. Singapore, Germany, and Israel prove that it is possible to achieve high penetration without having high branch density.

Alternatives to branch-driven growth are particularly important in emerging markets, according to a report by the World Economic Forum and BCG . Branch networks are expensive to build and maintain. What’s more, they may not be as effective in reaching mass-market customers as electronic channels, which can build on a broad foundation of established users and technologies. Of the nearly 2.5 billion unbanked individuals worldwide, 2 billion have mobile phones. For these customers, mobile technologies such as phones and electronic cards offer perhaps the most convenient, practical way to access banking services.

Partnerships will be critical in making mobile financial services scalable and profitable. One example is the partnership among Banco de Oro, MasterCard, and SMART, a major mobile operator in the Philippines. The SMART Money platform, which offers payment, savings, and loan products, was the world’s first reloadable payment card linked to a mobile phone. It leverages an existing telecommunications infrastructure and MasterCard’s payment network.