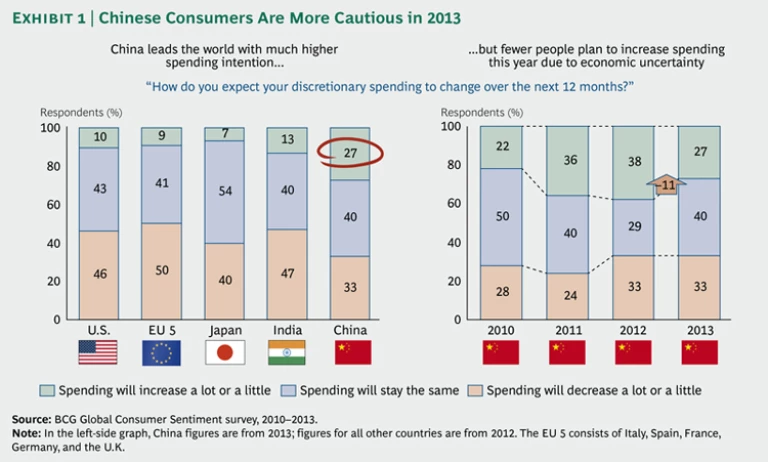

Just as China leads the world in economic growth, consumer optimism in China is stronger than in the rest of the world. Our latest consumer-sentiment survey, conducted by BCG’s Center for Consumer and Customer Insight, found that the percentage of Chinese consumers who intend to spend more in the coming year is three times higher than it is in the U.S., Japan, and the major European

However, with the recent slowdown in China’s previously hyper-fast economic growth, Chinese consumers have become more cautious. (See Exhibit 1.) While 27 percent of Chinese consumers plan to spend more in 2013, that is an 11 percent drop from last year’s 38 percent.

After nearly ten consecutive quarters of declining GDP growth since historical highs in 2010, China’s growth has waned from the double digits to, most recently, less than 8 percent. As a result, Chinese consumers no longer retain the same optimism of years past. Last year, close to half of consumers said that the economy would improve within the next 12 months; this year, the percentage dropped to 38 percent.

Some Skepticism—for Now

Consumers are tightening their belts, but their decreased spending should not be taken as a sign of financial strain. Our survey found that very few consumers think they will earn less in the future, nor do they worry about losing their jobs. The majority—nearly 60 percent—are spending less in order to save more. The household savings rate in China reached a historic high of 38 percent of disposable income in 2012, compared with 23 percent ten years ago, yet consumers still feel this isn’t enough. Only 22 percent said their current savings meets their expectations.

Chinese consumers save in order to be cautious, but China’s relative lack of a reliable social-welfare system also makes them concerned about supporting their children and elders. The one-child policy has played a role as well. Most married breadwinners have no siblings and frequently have the sole responsibility of taking care of two sets of parents—and sometimes four sets of grandparents. In China, aging parents often move into their adult child’s home, or else they expect that their child will buy them a home. Families might also assume that adult children will help support extended family. Younger kids can be a source of pressure as well, especially in larger cities, where many Chinese feel they must supplement their child’s education with tutoring and pricey extracurriculars to help with admission to a competitive university.

The desire to buy a home is the other top reason consumers give for saving. Those who do not own homes are more conservative spenders: 34 percent said they will spend less in the next year, compared with 27 percent of those who do own homes. But housing prices are notoriously high in China and have been rising again. As of April 2013, a 100-square-meter apartment in Shanghai averaged $452,000, while average household income was just $21,000 per year. This means it would take more than 20 years—without any spending at all—to afford a new apartment. Though the government instilled new housing policies in March to cool the housing market, the uncertainty surrounding rising prices combined with new policies have further dampened spending intentions.

Long-Term Optimism Remains

The Chinese may be cutting their spending somewhat, but consumerism still reigns overall in China. The current dip in sentiment is short term. Our survey did not reveal a great deal of pessimism regarding the country’s long-term economic development; only 11 percent of our respondents agreed that “the economy will not improve for the next several years.” An overwhelming number of respondents said that they see consumption as a positive factor—a sign of progress in society and in the culture at-large. More than half agreed with statements such as “spending and buying are good for our culture and progress”—up 22 percent from last year.

And while total spending is down, consumers are becoming more sophisticated shoppers by better optimizing their budgets. A tremendous 80 percent of consumers are buying fewer but higher-quality items. One year ago, shoppers were more likely to save money by trading down to more affordable brands or by cutting brand name consumption altogether. This year, that group is 20 percent smaller. Shoppers are more inclined to go out of their way to hunt out deals—by searching more on the Internet, for example. What’s more, the intention to trade up remains at about the same level in 2013 as it was in 2010 and 2011—even among people who plan to cut their spending.

Brand names of good repute, as well as products and services associated with health (such as baby, skin care, and nutrition items), are well-poised to benefit from these evolving spending habits; they rank as the top-two motivators for trading up. Quality scandals are still rampant in China, even for some previously trusted international brands, and consumers are paying attention. (See Navigating the New Consumer Realities , BCG report, June 2011.)

Food and beverages marketed as healthful continue to enjoy higher-than-average trade-up intentions. This includes organic foods, tea, dairy products, fresh foods, and juice. Consumers also said they’ll spend more on items related to personal and family well-being, such as all-natural products, clothes and shoes, cosmetics, hair and personal care, mobile phones, and baby food. Meanwhile, consumers will cut their spending in areas they consider to be superfluous, such as luxury goods, jewelry, restaurants, chocolate, toys, and foods perceived as unhealthful, such as soda, alcohol, and frozen foods.

Lower-Tier Cities Waver but Remain a Bright Spot

The impact of the downturn is playing out differently in lower-tier cities (tiers 4 to 5) than in higher ones (tiers 1 to 3). Until recently, coveted middle-class and affluent consumers (MACs) in smaller cities were relatively immune to the economic crisis owing, among other reasons, to their lower cost of living. Their optimism made them the most attractive consumer segment in the country, as detailed in Big Prizes in Small Places (BCG report, November 2010).

Now, the tide has begun to turn. The decline in optimism in large cities is bottoming out. Consumers in smaller cities, however, are finally feeling the effects of the domestic slowdown—in fact, its impact is more noticeable in lower-tier cities—and the mood has altered. After having expressed ultra-high levels of intended spending and plans to trade up, the optimistic sentiment of small-city MACs has dropped by double digits this year. This change is driven by a number of distinctive small-city features:

- More Entrepreneurs and SMEs. Entrepreneurs and small and medium enterprises (SMEs) benefited from China’s earlier investment-led economy, which included significant fixed-asset-investment (FAI) growth. In the past, FAI was growing 10 percent faster in smaller cities than in big ones and was the key driver for local economic development. In recent years, FAI growth has declined steeply nationwide because of structural changes in China’s economy. That decline took longer to reach lower-tier cities, but the drop was much more sudden and drastic. Since there are more entrepreneurs and SMEs in smaller cities, this has had an especially strong impact on the economic outlook there and, in tandem, the confidence of these cities’ MACs.

- More Civil Servants. China’s smaller cities have a much larger percentage of MACs who work in the public sector—41 percent, compared with 27 percent in big cities. This makes them more sensitive to policy changes. In particular, many have been hit hard by government anticorruption campaigns in the wake of the leadership transition last spring. Since corruption in China often involves wining and dining government officials, the sternly enforced campaign had an immediate negative impact on bulk purchases at hotels, restaurants, and entertainment venues as well as on individual consumption. Some of our survey respondents said they have seen event, banquet, and hotel bookings drop by as much as one-half or two-thirds. And one city-government worker we surveyed said that the reduction in vouchers and gift cards he has received is equivalent to one-third of his salary.

- Shorter Wealth History and Weaker Financial Muscle. Although their income levels are similar to those of their peers in bigger cities, small-city MACs tend to have weaker cash reserves and fewer assets because they became wealthy much more recently. (They have been a part of the MAC segment for an average 3.7 years, whereas their big-city counterparts have been there for 5.4 years.) Small-city MACs said that their cash reserves can only sustain them for ten months, half the time as for big-city MACs. This makes them less secure and more frugal. Just 57 percent of small-city MACs said they feel financially secure—a 13-percentage-point drop from last year, and 14 points fewer than their big-city equivalents.

- A Heavier Family Burden and a More Traditional Mindset. The prudence of small-city MACs stems from a more traditional mindset, which means they not only put more emphasis on saving for family-related purposes but also tend to have larger families—a result of having several generations of family living together and, sometimes, of laxer enforcement of or legal exceptions to the one-child policy. (Saving for families is important to big-city MACs, too, but they are also saving with an eye to future big-ticket purchases such as property and cars.) In addition, the cost of supporting children’s education is higher, relative to income, in small cities. This is especially true when small-city children are drawn to larger cities for school or work and have to contend with a higher cost of living. Hence, 47 percent of MACs in small cities cite their children’s education and development as a key motivation for saving, as opposed to 25 percent in big cities. Small-city MACs also have more elders at home, and they face less-robust health-care resources and elder-care facilities. In small cities, 34 percent of MACs said the need to support elders is a key reason for saving, versus 23 percent in big cities.

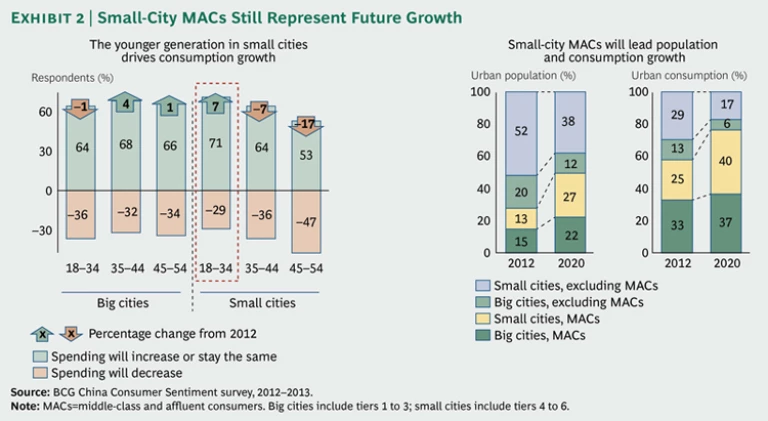

Nonetheless, small-city MACs remain the best drivers of future population and consumption growth in China. At present, their numbers and their spending are smaller than big-city MACs, but by 2020, they will make up 27 percent of the urban population (compared with 22 percent for big-city MACs) and a solid 40 percent of urban consumption (versus 37 percent). Though consumer sentiment among them is down this year, the dip is temporary. In keeping with the pattern already playing out in big cities, sentiment will bounce back once the economy has stabilized.

Moreover, the current spate of pessimism comes primarily from middle-aged and older consumers. Younger generations (ages 18 to 34) have not felt any impact from the downturn at all and consequently are highly optimistic about the future. Their intention to spend has actually strengthened, and they comprise the most attractive segment of all the MACs in cities of any size. (See Exhibit 2.)

Companies wishing to tap into the rising opportunities that exist in lower-tier cities should expand their regional footprints, develop a customized go-to-market strategy for small-city MACs, and think about which value propositions will work more effectively for this market. They should, of course, keep in mind that the message will vary for different categories with different target-consumer profiles. For example, younger MACs are still upbeat, while mature ones are more reserved.

The overall decline in consumer sentiment does not represent the last days of an optimistic China. The future will be more volatile, and we should expect ups and downs in sentiment as the country undergoes a structural transition from investment-led to consumption-led growth. However, a slight increase in short-term pessimism should not be interpreted as headwinds for the long term. Consumerism is still on the rise, and spending is highly regarded as positive and beneficial to society. Though consumers may be choosing to spend less, they have become more sophisticated shoppers, optimizing their spending with a growing focus on quality. And the MAC population continues to grow and evolve, particularly in lower-tier cities, where China’s future consumption-growth lies.