In today’s world, nothing is certain but death, taxes, and the growth of data. The quantity of information generated from the dawn of time until 2003—some 5 exabytes, according to Intel—is now created every two days. Businesses have long understood that there is value—somewhere—to be extracted from this burgeoning volume of data. And increasingly, they have been able to get at it more efficiently and cost effectively. Yet for all their enthusiasm for “big data,” most companies are only scratching the surface of the opportunities that await them. They are analyzing data for insight—an important, value-generating strategy, to be sure—but have yet to exploit the truly transformative role that big data can play in how and where they do business.

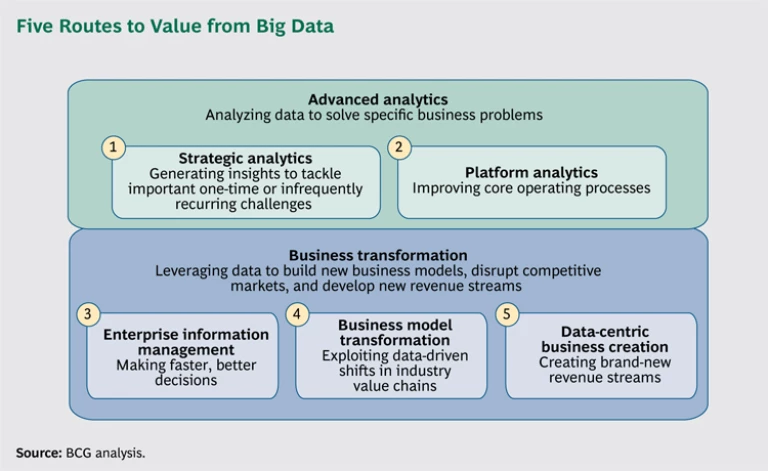

The companies that get ahead will be the ones that see and seize the full range of opportunities that big data offers. We envision five major applications: generating new business insights; improving core operating processes; enabling faster, better decision making; taking advantage of changing value chains; and creating new data-centric businesses. Not all of these opportunities will be relevant to every business, but most companies can benefit on multiple fronts. For those that do, the prize won’t be just a competitive advantage but, potentially, the ability to reshape the competitive landscape.

Seeing the Big Picture on Big Data

Views on big data have shifted recently for many companies. Skeptics who saw an overhyped route to riches—having been burned, perhaps, by their own costly, complex, and ultimately disappointing efforts to turn data into dollars—are increasingly becoming believers. They’re no longer asking whether big data can generate value for them but how it can do so.

Why the change of tune? Data processing and storage costs have decreased by a factor of more than 1,000 over the past decade. Powerful analytical techniques have emerged. And new technologies like Hadoop and MapReduce mean that data no longer have to be stored in rigidly structured form to be processed (a costly, labor-intensive proposition). Now information can reside in whatever form it naturally takes—from Facebook posts to audio recordings of customer service calls—in geographically dispersed data centers or in the cloud.

Insights that would have stayed buried just a couple of years ago can now be uncovered routinely and often relatively easily. Businesses understand this. In 2013, big data is forecast to drive $34 billion in IT spending, according to Gartner. And the initiatives are growing more sophisticated and more widespread. At Chevron, an in-house analytics platform mines seismic data for insight into where oil and gas deposits may be located—helping the company focus its drilling efforts and its spending. In New York City, where there are some 1 million buildings but only 200 building inspectors, analytics enable the city to pinpoint those structures most likely to be at risk—increasing the efficiency of its inspectors fivefold.

Indeed, the ability of advanced analytics to address high-priority challenges is so great that we advocate its rapid deployment. (See “How to Get Started with Big Data,” BCG article, May 2013.) Instead of remaining on the sidelines, brainstorming grand strategies, businesses need to get started, get experience, and get results. At the same time, however, they need to understand that what they’re doing—and the payoff they’re seeing—is only the beginning.

At the heart of big data lies tremendous potential to transform the way companies operate, driving not only new insights and processes but new business models. Big data can spur innovation and agility. It can lead to new revenue streams—even in areas far removed from a company’s traditional line of business. In BCG’s project work, we are already seeing companies benefit from this broader view of big data. For example, a telecom company is leveraging its mobile network data to offer subscribers one-time, location-based insurance policies. By inferring users’ most likely activity from their location (travel, for example, if the subscriber is at an airport), the company can offer highly relevant—and thus highly attractive—products in real time. This is the sort of outside-the-box—and outside-the-sector—opportunity that can deliver huge value.

Below we look at the five key applications of big data and how some forward-looking companies are already embracing them—transforming their businesses and, in some cases, even transforming industries. (See the exhibit.)

Generating New Business Insights

Most of the advanced-analytics efforts we see have a tactical focus: leveraging data to get a few key decisions right or to solve specific problems (such as where to open a new bank branch or what coupon to send to the smartphone held by a shopper in a store).

The ability to use information in this way has been greatly enhanced by a combination of developments: more data coming from existing and new sources, greatly improved analytical techniques, and lower processing and storage costs. As a result, companies can incorporate data they hadn’t previously used in decision making, such as social-media posts and unstructured data that older tools were unable to work with. This has resulted in better, faster, more actionable insights.

Advanced analytics can be applied to a vast array of situations. Vestas Wind Systems, for example, has been able to tackle an important challenge in the wind energy business: where to place turbines. Precise positioning helps maximize energy output over the more than 20-year operational lifetime of a wind power plant. To home in on the optimal location, Vestas analyzes information from a host of sources: wind and weather data, turbulence levels, topographic maps, and sensor data from more than 25,000 turbines that it monitors worldwide. This process gives the company a competitive edge as it helps its customers maximize their return on investment.

In the financial sector, a client has launched an innovative project that analyzes customers’ transaction data to infer the occurrence of major life events, such as marriage or a new job. These are occasions that can trigger interest in high-value financial products (such as a home mortgage or a joint savings account). If a financial institution can identify these critical moments, it can better match customers with the most appropriate promotions—and, even more significant, establish long-term relationships. Working with our client, BCG developed a targeting model that, in its initial stages of implementation, is proving 2.5 times more effective than existing approaches.

Improving Core Operating Processes

The use of advanced analytics need not be limited to one-time or infrequent tasks. In fact, integrating analytics into everyday processes, or “industrializing” them, can be particularly beneficial, as the insights gained can be applied—automatically, repeatedly, and often in real- or near-real time—in key business functions.

Such platform analytics are still relatively rare. Yet companies that have taken this step have seen some powerful results. Visa, for instance, integrated analytics into its frauddetection processes in August 2011. By March 2013, the system had identified $2 billion in fraudulent transactions—blocking them before money was lost. In the e-commerce sector, Amazon.com uses dynamically generated recommendations—based on each customer’s purchasing and browsing history—to drive an estimated 25 percent of its sales. Banks, meanwhile, are using platform analytics in risk scoring, automatically processing a variety of internal and external data to judge a loan applicant’s credit-worthiness.

The beauty of platform analytics is that it can be incorporated into all manner of processes in a wide range of industries. Some of the emerging uses might seem surprising—far removed from the consumer-related applications most commonly associated with big data. In Italy, a system called redditometro uses advanced analytics to find tax evaders. It looks at data from a host of sources—bank records, credit card transactions, insurance payments, statistical research—to determine an individual’s likely spending and whether his or her tax return matches up.

Platform analytics have also proven effective in facilitating preventive maintenance. By analyzing data—often from sensors implanted in or on critical infrastructure—companies can predict when failures are about to occur and intervene before trouble strikes. In effect, troubleshooting becomes proactive rather than reactive. Advanced analytics can look for patterns—such as in the type and frequency of alerts—that have historically presaged failures. This approach has enabled one of our clients to predict incidents an hour or two before they occur, providing time for effective intervention. As a result, critical operational downtimes have been cut by more than 50 percent.

Making Faster, Better Decisions

The availability of accurate, real-time management data is critical to decision making (about where to focus R&D efforts, for example, or how to price new products). Yet at most companies, this information tends to be fragmented across the enterprise, with every department working with its own “version of the truth.” Making matters worse, this information is often out of date by the time it gets factored into decisions—if it gets factored in at all. In many enterprises, a great volume of potentially helpful data—in both structured and unstructured form—is never used. The result: conflicting decisions, untimely decisions, wrong decisions.

Not surprisingly, one of the most promising applications for big data is in enterprise information management (EIM). The idea is not just to collect and process operational data but also to present it in a clear, consistent, readily available manner throughout the organization—improving the speed and the quality of decision making. We see the ideal EIM system as one that combines a single set of data—from sources both inside and outside the company—with intuitive graphic elements like on-screen dashboards. The result is an accessible, uniform, real- or near-real-time view of operations that allows different departments to speak a common language and base their decisions on the same facts.

Taking Advantage of Changing Industry Value Chains

Big data is upending traditional value chains, presenting risks to companies that don’t respond accordingly—and presenting opportunities to those that do. Advanced analytics and new data sources are enabling companies in one sector to play a role in the products and services of other sectors—even ones far removed from their traditional line of business. This is blurring the boundaries between industries and changing competitive dynamics. (See “The Age of Digital Ecosystems: Thriving in a World of Big Data,” BCG article, July 2013.)

Companies that transform their business models in parallel with these shifts will find new doors opening for them. For example, in the home thermostat market—a traditionally staid sector with a small, settled list of competitors— a startup called Nest has been able to challenge the incumbents by introducing a thermostat that employs analytics to learn customers’ preferences and use patterns and adjust itself accordingly. Nest’s novel, datadriven business model enabled it to enter a market long closed off to outsiders.

Yet the payoff isn’t just for new players. For established companies, new data-driven business models can help keep—and even expand— share in an existing market. In the automobile insurance sector, for instance, Progressive uses driving data—collected from a small device customers plug into their car’s diagnostic port—to help calculate premiums based on actual driving habits. Among the data analyzed: when and how far the customer drives and the number of hard brakes he or she makes. Good drivers are rewarded with lower premiums—on average, a savings of 10 to 15 percent. For drivers who have put their Grand Prix dreams behind them, that can be a compelling value proposition.

Creating New Data-Centric Businesses

The large volume of information that companies generate—and the insight it affords— may well have value to other organizations, both within and outside the industry. Social-media sites, for example, often capture data pertaining to users’ preferences and opinions— information of interest to manufacturers that want to focus their product-development efforts and marketers that want to target their product campaigns. Mobile network operators routinely collect subscriber location data—of value to retailers that want to know where consumers are shopping. By making this information available—for a price—companies can develop new revenue streams. While the sale of personal information traceable to specific individuals can raise privacy concerns, companies can greatly reduce sensitivities by aggregating and ensuring the anonymity of data.

BCG is working with a large international bank to create new data businesses by leveraging transactional information—such as credit card activity—captured in the bank’s normal course of business. The idea is to provide companies from different industries with information they can use to perform their own business intelligence. But this is just a start. We envision external sources—such as social-media information—playing a key role in the coming years, enriching the bank’s internal data and further enhancing its value proposition to its data customers.

The Road Ahead

Identifying relevant applications is, of course, just the first step in deriving value from big data. New capabilities, new organizational structures (and mindsets), and significant internal change will also be required. (We will address these challenges in future publications.) But businesses should not underestimate the importance of zeroing in on the right opportunities. They will need to think outside the box, embrace new models, and even reimagine how and where they do business. A culture that encourages innovation and experimentation, and even some radical thinking, will serve this undertaking well— but so will calling in outside help when needed to assess, prioritize, and develop the different routes to value.

Big data isn’t just changing the competitive environment—it is transforming it. Businesses need to change along with it. Seeing where the opportunities lie and creating strategies to seize them will help companies turn big data’s promise into reality—and gain new customers, new revenue, and even new markets along the way.