The energy industry is starting to wake up to the risks and rewards of intellectual property (IP). This awakening, ongoing for several years, has accelerated, driven particularly by explosive growth in the extraction of challenging reserves in upstream oil and gas as well as a changing competitive landscape that has disrupted the broader energy industry.

Reserves from shale, tar sands, and deep water were once considered too expensive to extract. But rising energy prices and new technologies, such as hydraulic fracturing, or fracking, and deep-water-drilling methods, have changed both the economics and the dynamics of the industry. BP, for example, recently set the record for deep-water-drilling depth, surpassing Royal Dutch Shell, which has long promoted itself as the innovation leader among large, integrated oil companies.

These changes are occurring against the backdrop of long-standing tensions within the oil and gas industry. Historically, integrated oil and gas companies provided the capital and managed the risks associated with large energy projects but delegated significant portions of equipment ownership, product development, and operational support to oil-field-service companies, their key service suppliers. Many oil-field-service companies have thus been positioned to develop substantial patent portfolios—a strategic advantage that they have used, in the past 10 to 15 years, to supplant integrated oil companies in some markets, where they have dealt directly with national governments to develop and produce simpler, lower-risk reserves.

The oil and gas companies responded by boosting their R&D spending and innovation to stay relevant. From 2002 through 2011, for example, the top ten oil and gas companies increased their spending on R&D by nearly 10 percent annually in real terms. In The Boston Consulting Group’s recently released list of the The Most Innovative Companies 2013 , three oil and gas companies ranked in the top 50: Shell at 26, Exxon Mobil at 40, and BP at 44.

Meanwhile, competition has been mounting. The Chinese government, for example, is fostering homegrown innovation and encourages patenting through tax incentives. From 2006 through 2010, Chinese oil and gas companies cumulatively boosted R&D spending by 29 percent annually and upstream patenting activity by 66 percent annually. In downstream, the Chinese energy conglomerate Sinopec is amassing a large patent portfolio, at home and abroad.

Efforts to protect IP in oil and gas through patents, trade secrets, and other means have clearly increased. Globally, patent activity in the rapidly changing upstream sector, which includes exploration and production, rose by nearly 20 percent per year from 2009 through 2012. In the downstream sector, which encompasses traditionally IP-intensive businesses such as refineries, patent activity remained constant over that time period.

The strategic sands of the industry, in other words, are shifting. Innovation, not just risk management and capital, will drive oil and gas companies’ future success and shape their relationships with national oil companies and oil-field-service companies.

Similar forces are at work in the broader energy industry, far afield from oil and gas. The electric-utility industry, for instance, has become a hotbed of innovation. Smart networks and devices are replacing the “dumb pipes” of the past. Innovations in photovoltaic and storage technology have the potential to change the competitive landscape and break apart the utility value chain.

The opportunity to marry big data with the traditional utility infrastructure—and enter customers’ homes—has drawn outsiders, such as Cisco Systems, General Electric, IBM, and SAP, to the utility industry. These companies are accustomed to competing on the basis of IP and innovation. Like the Chinese national oil companies, they are acting as catalysts to an electric-utility industry that needs to get its IP house in order.

Six Habits of IP Winners

How can energy companies embrace the competitive challenge of IP? Because few energy companies excel in this area, one of the best ways is to understand how IP winners from outside the sector handle these activities.

We recently benchmarked 26 companies and interviewed their senior IP executives. Of the participants, 9 hailed from the technology, consumer, and pharmaceutical industries and are considered leaders in generating value from IP. (For a case study of one of the more advanced companies in terms of IP, see “IP Shines Bright at Philips.”) The remaining 17 were oil and gas and utility companies. This benchmarking exercise revealed six broad habits that distinguish IP high performers from the rest and thus yielded guidelines that energy companies can use to improve their IP game.

IP Shines Bright at Philips

Royal Philips was awarded its first patent in 1906, but it was not until 2000 that the Dutch electronics company started to really unleash the potential of its IP. Philips Intellectual Property & Standards (IP&S) was born in 2000 as an independent business to coordinate and activate IP practices at the global company.

Prior to the creation of IP&S, the IP function was largely reactive, processing patent filings and responding to business requests but not shaping the IP agenda. Today, IP&S employees are integral to teams that are evaluating potential M&A deals and overall R&D strategy.

IP&S was the brainchild of Ruud Peters, the executive who has always run the 500-employee operation (and recently announced his retirement). Early on, Peters recognized that the IP function needed to work seamlessly with the business units. Consequently, the organization of IP&S mirrors the businesses units it serves, with dedicated management and business-intelligence teams for each Philips division. These teams work closely with their business colleagues to make investment decisions, conduct market analysis, and scope the technology and IP landscape.

IP&S members meet with top business executives and scientists to ensure that the R&D labs are producing technologies that are aligned with corporate strategy. In their interactions, they try to speak in the language of business, building financial models that convey the value of IP in nonlegal and nontechnical terms. All senior members of the team have been trained in communications, accounting, and financial skills.

Peters himself reports directly to Philips’s chief technology officer but has dotted-line relationships with the chief executive of each division and Philips’s CFO and CEO.

The first three habits address a company’s ability to generate commercial and competitive value from IP. Taken together, these habits help IP winners convert innovation into commercial advantage. The remaining three habits relate to the efficiency and effectiveness of the IP function in capturing IP’s value—cost, speed, quality, and market share. This second set of habits, although familiar to business executives, are not always applied to IP.

A Laser-Like Focus on Value

IP winners are able to put a price on the value generated by their IP and innovations. They quantify not just licensing revenues but indirect sources such as the price premium built into a product through innovation and the ability to win business and exclude competitors. Many of them have built businesses dedicated to licensing. They understand how their IP contributes to their bottom line and success in the market, and they can convey that understanding in language that the C-suite understands.

Our benchmarking study revealed that many energy companies currently do not fully create value from IP in these ways, especially upstream. Oil and gas companies develop fields by integrating a mix of technologies and mechanical systems, many of which are often provided by oil-field-service companies. Their focus is on excellence in extraction more than on revenue generation from IP. They are often willing to forgo the upside of IP in order to win business and work with the strongest suppliers, especially on difficult projects.

As a result, oil and gas licensing is often a niche business, although the occasional one-off sale can be sizable. In 2003, for example, Shell sold Weatherford its solid expandable tubular technology, which is used in challenging drilling situations, for $140 million.

Many oil and gas companies could be doing more to extract value from their IP. During our research, we heard of several instances in which important technology was made available to a company’s partners without full recognition of the value that was given away.

Some companies, however, are aware of the value of their technology and are using that value to their advantage. In challenging operating environments, such as deep water, oil companies want to receive top treatment from oil-field-service companies. One oil executive argued that he would rather share IP in a deep-water-drilling project to ensure that his company’s oil-field-service partner sent the “A” team than be protective and work with the “B” team.

This sort of calculation makes sense if it will help generate higher yields, greater efficiency, or other quantifiable goals, but not if it is done without concern for the consequences. It is a strategy that mirrors creative value-generating models used by IP winners outside energy. For instance, Intuitive Surgical, a medical-device-and-service company, licenses its IP to support development partnerships. In these arrangements, securing the freedom to operate and a market presence may matter more than the licensing revenues.

The Freedom to Operate

IP winners vigilantly protect their freedom to operate. They constantly analyze the IP portfolios of their competitors and of patent-assertion entities, or “trolls,” to minimize both their risk of infringement and the need to pay licensing fees. IP winners also buy important IP assets as a defensive measure, and they enter into partnerships or licensing agreements to ensure that they have the right to deploy key technologies.

In recent years, tools and approaches for mapping and understanding patent portfolios—from semantic clustering tools for clarifying underlying technology themes to network analysis and visualization tools for better understanding of patent citation networks—have become more sophisticated.

To protect their freedom, IP winners manage their portfolios strategically. They file defensive patents to counter possible infringement claims, for instance.

In short, they live by the motto “no surprises.”

The best energy companies pursue this same strategy, with some variations. Many of them understand their IP position relative to their competitors and vendors—but not all do. One major oil company invested well over $500 million in custom development in a remote location only to discover that a rival was preparing to assert an IP claim, leaving the company no choice but to abandon its investment.

An Eye on the Future

IP winners use their IP to shape the future to their advantage. They form alliances and partnerships and seek to influence technological developments by participating in standard-setting bodies or selectively making their technology available to others in the industry.

IP winners anticipate technological and innovation trends. They conduct landscaping and scenario-planning exercises. They seek to understand the moves of competitors and try to anticipate the direction and future of technological developments.

This analysis feeds overall corporate strategy, which in turn animates IP strategy. These winners also turn their gaze inward and vigorously review their IP portfolios and innovation agendas.

With the pace of innovation in the energy industry rising, the ability to anticipate the future is especially important. Many of the new technologies, such as rig automation and real-time measurement and data analysis, originated outside the industry. Other new technologies can be commercialized only when companies collaborate. Last year, for instance, Chevron and Total partnered with Schlumberger to develop an advanced reservoir simulator that predicts the flow of oil, water, and gas through porous rock in order to locate new reserves. Total provides engineering, Chevron brings its expertise in reservoir management, and Schlumberger is responsible for software development.

Companies that shape the future can own the future. For example, Canadian oil-sands company Cenovus Energy developed the SkyStrat, a drilling rig that can be transported by helicopter to remote regions. The rig minimizes wilderness destruction and reduces costs by avoiding the need to cut roads. The company has made the technology available to its competitors through Canada’s Oil Sands Industry Alliance, a group of oil and gas companies that have agreed to share technologies that preserve the environment. The SkyStrat is burnishing Cenovus’s reputation as an innovation leader, an environmental steward, and a responsible corporate citizen.

A Lean and Focused Organization

The IP functions of IP winners are set up to generate value. They can demonstrate their ability to cover their costs several times over through licensing, risk mitigation, price premiums, and other measurable yardsticks. In these companies, the IP function is viewed as a strategic partner of the business units, not merely a cost center.

These IP functions are effective in part because senior executives pay attention to the appropriate issues. Rather than delegating IP to the legal team, they, for example, actively participate in IP and innovation reviews to ensure that innovation activities are aligned with strategy. IP winners review their IP portfolio regularly, as frequently as quarterly, using an established methodology, and engage in a deeper review every year or every other year.

A Premium on Speed

IP winners are quick to file patent applications when they have inventions worth protecting. One leading U.S. oil company, for instance, is creating metrics for its IP legal team that focus on speed.

The emphasis on speed has taken on an added urgency in the U.S., where, starting in March 2013, patent applications are awarded to the first to file, no longer to the first to invent. This change harmonizes U.S. patent policy with that of the rest of the world.

IP winners do not just file quickly. They also actively manage their patents through the application process. Patent offices are weighed down with a heavy influx of applications. It pays to be the early bird and the squeaky wheel.

The IP-benchmarking study reveals mixed results for speed at oil and gas companies. IP winners and oil-field-service companies generally filed within 12 weeks of invention, whereas integrated oil companies took 12 to 24 weeks, and independent and national oil companies lagged behind at 24 to 48 weeks.

An Emphasis on Quality over Quantity

Companies that are strong at managing their IP assets are more successful than their competitors at winning approval for their applications, securing patents more than 60 percent of the time. They control a disproportionate share of the IP within their industries, measured not necessarily by raw numbers of applications and claims but by breadth and depth of coverage. Shell, for instance, has long been a leader in amassing influential upstream patents, particularly in oil shale and other unconventional reserves, though Exxon Mobil and Chevron have been catching up.

Generally, there seems to be a trend among IP winners to reduce the number of patent applications so that they can focus on the more important ones. By focusing on quality over quantity, aligning patenting with corporate strategy, and carefully selecting jurisdictions, companies can achieve substantial savings in filing costs.

One international oil company in the benchmarking study has created a dashboard that tracks the costs and value created by IP. The dashboard adapts to the needs and circumstances of different business units and focuses on IP quality and business-unit satisfaction in addition to traditional quantitative and cost metrics. Such a simple display of information can go a long way toward creating momentum to drive IP strategy and practices.

The Components of the IP Wheel

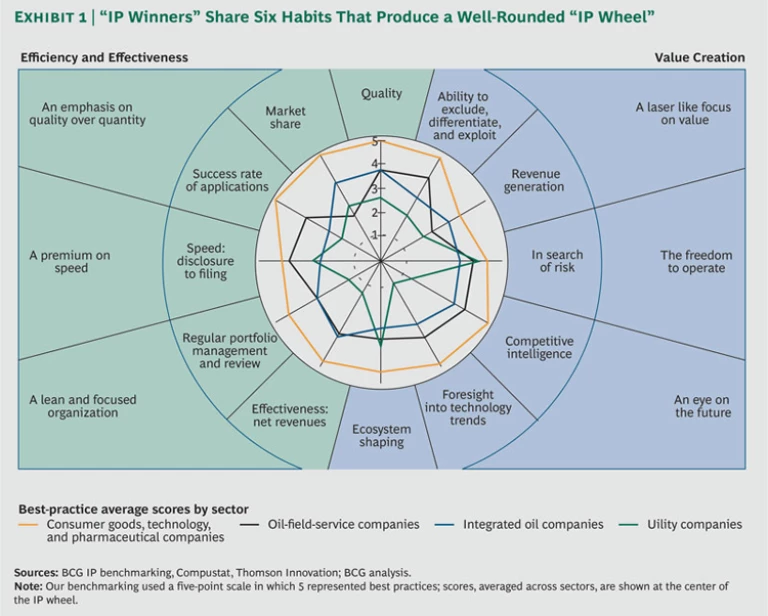

Collectively, the six habits make up what we call the “IP wheel,” which further refines the habits to 12 traits. (See Exhibit 1.) The more habits and traits a company possesses, the better off it is. Such companies are “well rounded”—and a well-rounded IP wheel allows companies to move quickly and efficiently in pursuit of their IP strategies.

While having a well-rounded IP wheel is in general a good thing, even more important is having an IP wheel that is aligned with your overall business strategy. Licensing, for instance, may be a huge source of value for some companies—but for others licensing may squander competitive advantage. Oil-field-service companies often make a deliberate choice not to create direct IP revenues, for instance.

For some energy companies, a particular technology may be so critical to their success that they are willing to spend liberally on just a few key patent applications. Their IP market share may be low and their cost per patent may be high, but in such a case a lack of uniformity in their IP wheel would be a desired, not detrimental, feature.

A look at electric utilities suggests that they are weak at creating lean and focused IP organizations. But this is likely a strategic vulnerability, not a strategic choice.

With the entry of companies from outside the industry that are sophisticated about IP, traditional utilities need to improve on this dimension, or they will lose their dominant position. Utilities still own access to consumers, but in large, rapidly changing sectors such as smart homes and smart grids, outside disruptors such as General Electric, Siemens, SAP, and IBM are beginning to compete more directly with established utilities.

Fortunately, it is not too late to start taking IP and innovation seriously. (See “Key Questions to Ask in Order to Evaluate Your IP Function” for a quick sense of how your company is performing.)

Key Questions to Ask in Order to Evaluate Your IP Function

How well does your IP function perform along the 12 traits of the IP wheel? The questions below will give you a sense of where you stand.

A Laser-Like Focus on Value

- Do you know the value that your IP is driving to the bottom line, and are you actively measuring, monitoring, and managing it? Do business units know how much they are spending on their IP and how much value they are getting from it?

- Are you actively looking for ways to generate additional revenues and value from your IP assets through licensing and other means, and are you creating or acquiring IP accordingly?

The Freedom to Operate

- Are you aware of the threat of litigation? Are you sensitive to paying excessive licensing fees? In the event that your IP is challenged or weak, do you have options, such as using a different technology or cross-licensing?

An Eye on the Future

- Are you constantly scouting the market for intelligence about your competitors’ innovation and IP strategies, and are you identifying gaps in your portfolio and acquiring IP to fill them?

- Are you anticipating technological trends several generations ahead and developing IP strategies to address various scenarios?

- Are you recognized as a technological leader, able to influence or set industry standards and create advantageous partnerships on the strength of your IP portfolio?

A Lean and Focused Organization

- Does the value generated by the IP exceed the costs associated with it? Are you able to quantify this value and articulate it to senior management?

- Do you have a current view of what is in your portfolio? Do you review it regularly?

A Premium on Speed

- Do you have an average time between the disclosure of an invention and patent filing of 12 weeks or less?

An Emphasis on Quality over Quantity

- Is your success at securing patents above 60 percent, does it lead your industry, and is it commensurate with your R&D spending and footprint?

- Does your share of IP within your industry correspond to your market share?

- Does your IP portfolio rank in the top 20 percent of your industry in quality, on the basis of such criteria as breadth of patent claims, number of citations, and other measures?

Three Keys to Unlocking IP Value

Good habits do not just happen, especially at large global corporations. They grow out of conscious and concentrated focus. With IP, this is easier said than done. Many constituents within a company can rightfully claim a piece of the IP puzzle, and given that fragmentation, they sometimes focus on narrow interests rather than the greatest good. Engineers and scientists may want to patent an invention out of pride rather than productive purpose. Business executives may, because of cost considerations, want to avoid filing a patent. And lawyers may seek to protect only the immediate application of an invention and not its full potential.

These tensions are not unique to IP and innovation. But they are exacerbated by another common ailment of corporations: functions at the corporate center are often not managed for value creation. They can be isolated from the businesses that they are supporting and they can pursue cost containment more than strategic alignment.

IP winners have broken out of these traps by consciously following three broad organizational principles.

Elevating IP

IP winners do not treat IP as an afterthought or merely a legal issue. It is front and center in corporate-strategy discussions and in board meetings. Senior leaders recognize and understand that IP is about the freedom to operate and innovate and about establishing market presence, brand strength, and value.

Senior executives need to push the IP agenda hard. At Intuitive Surgical, for example, senior executives attend quarterly IP reviews that cover strategy, tactics, and key patent reviews.

Making IP and Innovation Everyone’s Business

Organization structure and capabilities go only so far in advancing and elevating the IP agenda. The IP function can report to the right person, at the right level of the organization, and be staffed with fully capable lawyers and technology specialists—and still fail to deliver.

IP winners make sure that IP and innovation are everyone’s business. They create processes and mechanisms that slice across organization boundaries and ensure that the IP-function, R&D, and business-unit heads are working closely together on IP and innovation.

This collaboration can be especially challenging at oil and gas companies that have valued standardization and strict execution over the flexibility and creativity that encourage innovation. In today’s competitive environment, companies will need to emphasize all of these values. For example, to achieve profitability at current market prices, oil and gas companies must combine innovation and process so that they can reduce well costs for North American shale gas from $9 million to $3 million.

One of the reasons that collaboration at IP winners occurs is that business units are aware of the cost to use the IP function; in fact, they may actually be paying for it directly. They also frequently track the revenues that their IP and innovations generate from licensing and other activities. At many IP winners, those revenues are passed through to the business that created the IP. “If you’re not willing to take IP to the bottom line, you cannot be very serious about what you’re trying to do,” one energy-company executive told us.

Sparking the IP and Innovation Engine

There is not a “right” organization structure to maximize the value of IP. It depends on the diversity of the company’s businesses, the range of its locations, its history, the role of its corporate center, and many other factors. The biggest integrated oil companies—BP, Shell, and Exxon Mobil—have traditionally practiced very different approaches to R&D and IP. BP historically used it as a negotiation tool but rarely retained ownership, for example; conversely, Exxon Mobil historically retained exclusive ownership.

But there is a right approach to ensuring that IP resources are being put into service properly. At IP winners, the IP function generally reflects the business units that it serves. The function has specialists who understand the technologies that are emerging and how they support specific business units and their strategies. These specialists work closely with executives, scientists, and engineers. They are fluent in the company’s strategy and can converse with executives about business goals.

At these companies, the IP function is positioned strategically within the organization, generally at the secondary level, and reporting to the head of R&D, the general counsel, or the CEO.

This is common sense—but it is not commonly put into practice. A company may have organized its IP function before it started viewing IP as a core asset. If so, the capabilities of its IP team and its linkages to the rest of the organization may be out of step with the times.

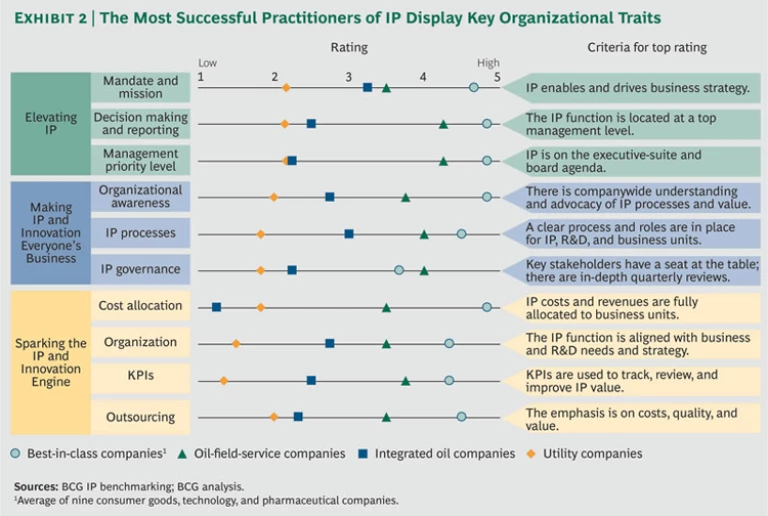

Benchmarking IP Winners—and the Rest

As part of the benchmarking exercise, we evaluated how well companies followed through on specific elements of the three organizational principles, from getting IP on the agendas of senior executives and boards to giving stakeholders a role in decision making to aligning IP with R&D and strategy. (See Exhibit 2.) The same pattern that we saw when assessing the six habits emerged. Within the energy sector, oil-field-service companies performed most strongly, followed by integrated oil companies and then by utility companies.

It is no surprise that there is a strong link between the strength of a company’s IP habits and the strength of its adherence to these organizational principles. This is both an intuitive and a proven connection. You need to do the right things to get the right results. With the exception of an integrated oil company, none of the 26 benchmarked companies demonstrated strong IP performance without also having in place strong organizational support.

In other words, these strong IP performers both recognize the importance of IP as a strategic weapon and have created enabling organizational practices. Many of the IP winners have stumbled upon successful practices through experimentation and necessity. They learned the hard way.

Energy companies that are just now starting to rev their IP engines do not need to go through so much trial and error. They can identify their strengths and weaknesses more easily by comparing themselves with recognized best practices.

But before starting to compare themselves with competitors and other companies, energy companies need to commit themselves to the belief that they are in the innovation business. They can ignore IP only at their peril.

Acknowledgments

The authors would like to thank Vanessa Balouzet, Chau Tong, Christina Royce, Philip Whittaker, Matthew Clark, Nicole Quenneville, and Chris Yellick for their help in the preparation of this publication.