Mobile connectivity, the proliferation of technologies, and the rise of advocacy and social marketing all add fuel to the digital fire as worldwide e-commerce doubles to $1.5 trillion in annual revenues by 2015. The third article in our series on the digital revolution in retail and consumer goods examines how retailers can respond to the sea changes underway—as well as those on the horizon. (See the first two articles in the series: “Digital’s Disruption of Consumer Goods and Retail,” November 2012; and “Secrets of Online Marketplaces,” December 2012.)

Pinterest boards, QR code walls, showrooming, mobile couponing, pop-up shops, mobile apps, Tweet Mirror, Facebook walls, digital circulars, augmented reality, flash sales—it’s a digital jungle out there for retailers today. As consumers embrace new technologies and services, companies find it difficult to stay current—and harder still to determine where and how to invest their budgets. It’s all too tempting simply to jump on the next new thing (and the next and the next), just in hopes of keeping pace.

We suggest retailers take a deep breath and a big step back. While many new technologies have merit, true digital transformation starts with the basics: a well-defined strategy rooted in a firm understanding of consumer needs, a clear competitive differentiation, and sound economics. Online-only retailers have built their businesses around digital (and increasingly around mobile) technologies, and they have advantages that brick-and-mortar and click-and-mortar companies (models that integrate offline and online presences) cannot duplicate. But the click-and-mortar approach has its own ace to play—the power and reach of omnichannel interaction.

Consumers still can’t touch, hold, try on, or taste a product online. The Internet cannot provide the immediate gratification of instant ownership. Indeed, a number of online retailers have responded to these limitations by opening real-world stores, among them Kiddicare and Screwfix in the U.K. and Bonobos in the U.S. There are major opportunities for retailers to rethink category management—including promotion, pricing, distribution, advertising, and point of sale—for an omnichannel world. While every strategy is unique to the business it drives, we see a series of factors that all retailers need to consider. This article provides a roadmap for those looking to navigate the digital forest.

E-Influence Remakes the Consumer Purchasing Funnel

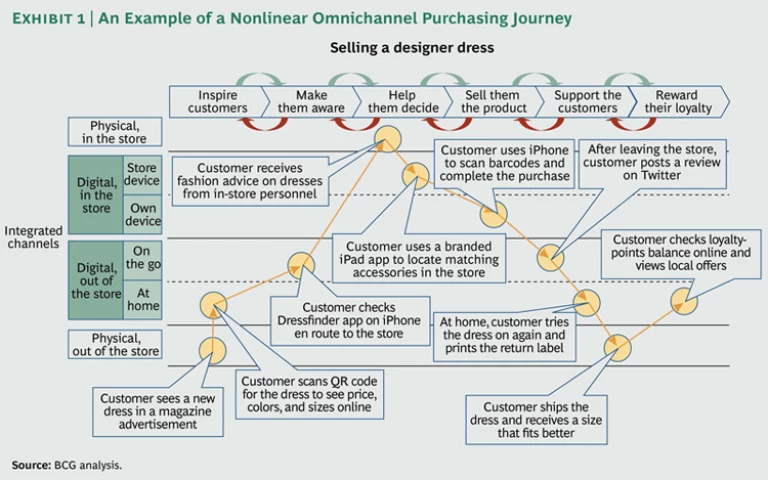

Purchasing has long been more journey than event. In today’s omnichannel world, the journey has more stages than ever, with the customer deciding not only where, when, and what to buy, but which channels to use and the role each will play. The linear route through the classic purchasing funnel has morphed into a fluid and dynamic process as boundaries between marketing and selling online and offline blur—and often disappear entirely. (See Exhibit 1.)

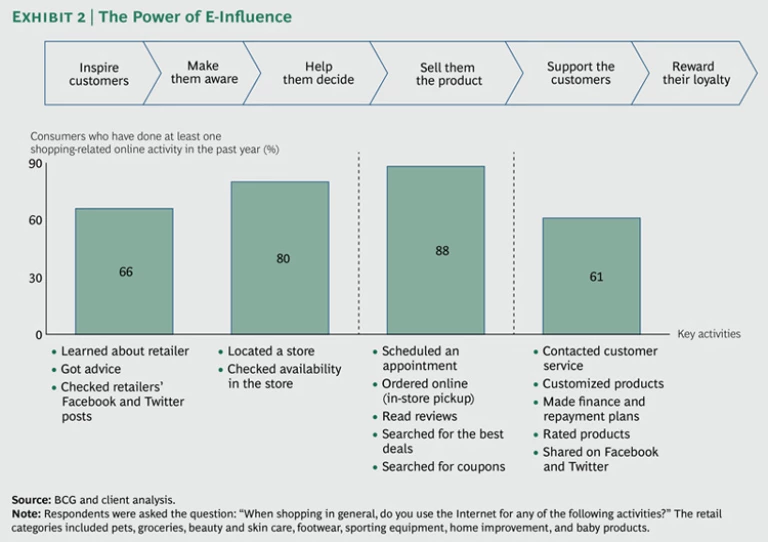

E-commerce statistics grab the headlines, but the biggest change may be the rise of “e-influence,” which takes many forms. (See Exhibit 2.) Regardless of whether consumers place their orders online, they are using digital channels, not only to determine what to buy and where to make the purchase but also to monitor prices (in real time) while they look for the best deal and exchange opinions with friends.

The impact of e-influence in certain sectors—apparel and electronics, for instance—is easy to spot. But even in grocery, a segment in which e-commerce has yet to take a big share in most countries, e-influence has nonetheless become an important tool for shoppers. A hypermarket can attract customers by reaching out to them in multiple ways—making nutritional information available on its website, for example, or providing sophisticated mobile apps with which customers can compile a virtual shopping cart by scanning products at home. Walmart is introducing a mobile app that will allow customers to add gift cards onto their smartphones and “clip” digital coupons. One specialty retailer found that customers using the Web and mobile devices to preshop and prepare lists purchased three times as much merchandise as single-channel, in-store shoppers. The company was able to quadruple online sales as a percentage of total sales, and traffic to stores increased as well.

Defining the Roles of Physical and Digital Channels

Achieving clarity about the roles that various channels play is crucial in creating an omnichannel experience that appears seamless from the customer’s point of view. This can be a complex challenge, though, especially for large retailers with multiple store types and a host of online points of customer interaction.

Clear business objectives cut through the complexity and determine which channels can be used most effectively toward different ends. If capturing a greater share of consumers from the Millennial generation (ages 16 to 34) is your goal, you will want a good mobile app. Half of Millennials use smartphones or tablets while shopping, compared with only one in five non-Millennials. Likewise, a retailer targeting consumers of beauty products should invest in social media. Some 80 percent of these consumers are present on Facebook and more than half read blogs.

Smart retailers also analyze product inventories through an omnichannel lens, deciding, for example, whether the same assortments should be offered online and offline, customizing the right product mix for a marketplace presence, and determining how much overlap to include among channels and what kinds of exclusives work best in each channel. They design relevant interfaces accordingly, optimizing discovery through Pinterest or providing a mobile scan-and-compare capability online.

Managing Economic Realities

Defining consumer journeys and clarifying the strategic role of each channel are important parts of the equation; so, too, is separating the “need-to-haves” from the “nice-to-haves.” This means getting a solid grasp on the economic implications of cross-channel assortment and pricing decisions, options in customer relationship management, and various delivery scenarios.

Making one’s full in-store assortment available through e-commerce might seem desirable, but it can easily undermine profitability. Some products have advantaged distribution economics online while others are cheaper to sell in the store. Winning strategies optimize both. Our analysis shows that it is difficult to make a profit selling online items with price tags of less than $20. The arithmetic becomes more complex, however, when you add in considerations of customer loyalty, overall household economics, and inventory management. Retailers mastering an omnichannel strategy need sophisticated models that take into account all relevant factors, from price and shipping costs to inventory levels and end-of-season discounting.

The trend toward dynamic pricing, driven by online marketplaces, complicates things further. Online players adjust prices multiple times daily, depending on what competitors are doing and how much inventory they have left in stock. Deciding when and where to match prices (online and off) and how to leverage customer-based pricing have become important issues. Successful retailers will set clear guidelines on price matching and when to allow inconsistent pricing or promotions between online and offline channels. They will also seek ways of managing price perception, such as working with suppliers to offer exclusive inventory that cannot be easily price-shopped. We expect to see more and more companies using à la carte pricing to their advantage, borrowing models from other industries such as airlines, which often offer a base ticket price and then charge for add-on services such as checking bags.

The myriad channels available to retailers require that they develop new customer-relationship-management, marketing, and promotion capabilities. With options ranging from Facebook and YouTube campaigns to investing in sophisticated targeting and retargeting technologies, determining which channels will deliver the highest return on investment becomes ever more important. The following are a few of the best practices we have observed:

- A media retailer that rigorously segments its customer base, defining more than 20 microsegments in order to deliver highly tailored e-mail and Web campaigns

- A luxury retailer launching its new fragrances online first with YouTube videos and messages to its 8 million Facebook fans, resulting in 250,000 samples delivered to prequalified customers

- A specialty retailer using mobile apps targeted at dedicated consumers in its category as a way of developing community and viral marketing—a program that has generated a six-figure membership base with more than half of its members visiting the company’s site multiple times each week

Even more sophisticated forms of targeting will likely soon emerge, including those that use new mobile technologies to reach out to users in real time. Imagine, for example, receiving a message, or even coupons, for an energy drink from Twitter moments after tweeting, “just finished 10-mile run.”

Acquiring the Necessary Internal Enablers

The digital world demands new capabilities and skills—big-data analytics are one example, digital-marketing capabilities are another, and mobile capabilities are a third—as well as rethinking existing functions and programs. Supply chain management, organizational structure and incentives, and performance measurement are three areas especially deserving of near-term attention:

- Supply Chain. Modifications to the supply chain can improve efficiency, customer retention, and product attractiveness—all at the same time. Potential initiatives cover a wide range, including experimenting with automated picking technologies at distribution centers, exploring variations on “click and collect” formats (ordering online and picking up in a store or dedicated facility), and working with suppliers on new online-friendly packaging that emphasizes sturdiness and protection rather than attention-grabbing graphics.

- Organizational Structure. The growth in omnichannel retailing has surfaced a number of pain points in organizational structure. Oftentimes, incentives are structured to optimize single-channel results rather than to drive overall business, and metrics for omnichannel success are not clearly defined or tied to the overall business plan. Legacy systems do not provide one view of customer behavior across channels; in-store and online promotions are frequently out of sync with each other. Many store associates and managers are less prepared for an omnichannel world than are their customers.

Structuring traditional- and digital-commerce teams is an especially tough challenge. As one retail executive put it, “The problem with integrated teams is that the online channel often does not get the attention it needs. The problem with separated teams is that they create inherent conflicts of interest.” One model that many retailers are finding effective is establishing separate teams that are measured against shared objectives and coordinated in such a way as to encourage interaction.

- Performance Measurement. Performance measurement systems need to be updated for the digital world, a fact many companies have been slow to grasp. As retailers move to digital or omnichannel distribution, key performance indicators shift from such long-standing measures as sales per store to economics per customer or household. Retailers can access enormous amounts of data about customer behaviors all along the purchase pathway today. But more information is not better information without the capability to track metrics covering both online and physical channels. A recent survey showed that many European retailers continue to look at such output metrics as net sales and average order value, even in their online operations, rather than the input metrics that truly influence success, such as customer retention rates, Web and mobile traffic volume, time spent on site, and customer conversion.

New technologies and applications are coming to market too fast for companies to be able to assess and adopt each one of them. Companies need to encourage rapid experimentation without fear of failure. A speedy “pilot-learn-adjust” capability is increasingly essential to building digital- and mobile-age organizations. Competing in the omnichannel world may also require partnerships with others in the retail value chain, particularly with manufacturers that face similar threats from the hegemonic rise of marketplaces.

It All Starts with Strategy

As we noted at the outset, it’s easy to lose sight of the forest from the sheer number of trees. But the task does not have to be forbidding. Change takes time, but almost inevitably there are quick wins to be scored while making progress against longer-term strategic goals. Through our work with multiple retailers of varying sizes across many segments, we have found that a thorough diagnosis of the challenges can lead to an effective strategy and multiyear implementation roadmap—taking into account existing assets and capabilities and marrying them to a plan for capitalizing on e-commerce and e-influence opportunities. The real trick is to take that deep breath, approach the forest, and get started.