In 1989, when Chrysler was fighting for its life, its president of operations, Bob Lutz, and its vice president of procurement, Tom Stallkamp, brought in 25 of the company’s biggest suppliers and asked for their help in reducing costs. “All I want is your brainpower, not your margins,” Lutz told the suppliers. Buyer-supplier collaboration caught on at

Collaboration programs that succeed on anything like SCORE’s scale are more the exception than the rule. A survey of senior purchasing executives by The Boston Consulting Group and the Procurement Leaders Network in early 2013 showed that while most companies pursue some sort of collaboration with their suppliers, only about two in every five programs follow standardized approaches. As a result, most programs focus narrowly on operational efficiency, leaving opportunities like shared innovation, speed to market, and improved quality unexplored and their associated benefits unrealized.

Interest in collaboration is not in question. Across industries, approximately 85 percent of buyers segment their suppliers to identify prospective partners. The collaborative relationships that result cover 40 percent of all expenditures and 24 percent of all suppliers. But this relatively high level of attention doesn’t mean all procurement executives are happy with the results. One in three is not satisfied with what the collaboration program has achieved. (See Exhibit 1.)

Companies see supplier collaboration programs as a way to improve performance in multiple areas. Cost savings is by far the most common goal, cited by 77 percent of procurement executives. The next most-common goals are innovation, higher quality, and increased efficiency, cited by 46 percent, 34 percent, and 33 percent of procurement executives, respectively.

In return for suppliers’ participation in collaboration programs, most buyers (74 percent) offer them an increased share of the company’s business. A smaller percentage pursue deeper relationships that include technical advice (offered by 47 percent of buyers) and joint investments (offered by 28 percent). Relatively few buyers (about 15 percent) share revenue or profit with their suppliers.

The near-term cost focus means that most collaborative programs target some area of operations—typically, the supply chain (62 percent of programs) or manufacturing (47 percent). Buyers’ marketing, sales, and business-development functions are brought into collaborative supplier relationships less than a third of the time.

It is certainly possible to use supplier collaboration to help with product development and innovation.

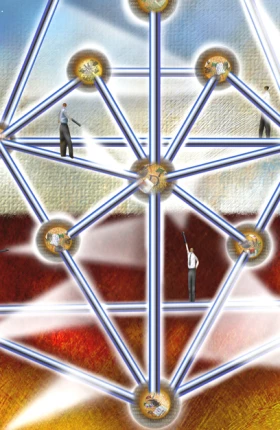

Companies have an opportunity to use their collaborative programs with suppliers to remake themselves as extended enterprises, a model in which their own and their suppliers’ activities are so tightly aligned that it becomes hard to tell where one company ends and the other begins. In theory at least, a company that approaches this ideal can become more innovative and efficient, avoid major supply-chain disruptions, and eliminate overlapping expenditures (including in R&D).

For example,

Earmarks of the Best Collaboration Programs

The best buyer-supplier collaboration programs focus on five elements: segmenting the supplier base (with the goal of identifying suppliers that could become strategic partners); building the capabilities needed to partner effectively; finding incentives and benefits that are shared and that can generate momentum; taking a structured approach to the design of the program; and implementing and managing the program for the long term.

Segment the supplier base to identify strategic partners. There is a reason why companies are selective in choosing suppliers for collaboration programs: not every supplier justifies the investment. For instance, with nonstrategic suppliers in competitive supply markets, there’s no reason to devise a special collaborative approach; companies should leverage the competitive tension in the supply market to secure the highest value. But with more strategic suppliers—those that represent a significant part of a buyer’s spending in some area or that provide special value from the customer’s perspective—a partnership starts to make sense. Indeed, economic impact and perceived customer value are the two primary calculations companies must make in determining whether and how to partner with their suppliers. (See Exhibit 2.)

One leading North American retailer takes a unique approach to segmenting its suppliers. The retailer asks its most strategic suppliers (roughly 10 percent of its base) to participate in a supplier forum. The forum’s participants, including Procter & Gamble, Kraft Foods, and Sara Lee, work with the retailer to come up with ideas and practices to improve the way its supply chain functions. After they have been vetted, the new practices are extended to the whole supplier network.

Build the right capabilities and organization. In order to create successful collaboration programs, most organizations have to develop new capabilities. One of the most important of these is cost engineering, a way of analyzing suppliers’ products and processes to gain insights into the economics of the extended enterprise and identify opportunities for improvement. Quality management is another critical capability; it focuses on quality issues across the supply chain and covers both products and associated services. Other capabilities include trend scouting, which pertains to identifying new technologies and supply options as they emerge, and supplier development, which, by enhancing suppliers’ capabilities and improving their processes, can help get products to market more quickly. Finally, there is partnership influence, by which the organization gets multiple suppliers to work together to improve the performance of critical components or subsystems.

To lay the groundwork for these new capabilities, some organizational adjustments are typically needed. For instance, the trend-scouting capability shouldn’t reside solely in the procurement department; it needs to be set up with ties to marketing and R&D. A project structure should also be in place to manage the boundaries between procurement, R&D, and production. Finally, the quality assurance function may need to be expanded.

Align benefits and incentives. One of the obvious challenges for collaboration programs is getting suppliers to participate in them. Companies sometimes undermine their own chances of a partnership by being overly cautious about sharing information. A core requirement for successful collaboration is trust—a willingness, on the part of both buyer and supplier, to share information. In addition, strategic suppliers are strategic for a reason; they have their own market power and may be skeptical about what’s in it for them. This means that many suppliers can’t be coerced into a collaborative partnership; they must be persuaded. The carrot—additional business, technical advice, a way of streamlining processes—is often more effective than the stick.

Buyers must find incentives powerful enough to motivate suppliers. For instance, in Chrysler’s SCORE program, suppliers were obligated to pass on only 50 percent of their savings to Chrysler; the rest they could keep. In other cases, buyers may contribute investment capital to help a collaborative program get off the ground. When this happens and the outcome is successful, a supplier may end up with an improved technology, process, or cost structure that can help it with a range of customers, not just with the buyer that made the investment. Buyers should demand a lot of their suppliers, but if they also treat them fairly, it sets a tone of mutual interest that makes the relationship far more productive.

Follow a structured approach to program design. Collaboration programs are often viewed skeptically by both the internal organization and the supplier base. It is important to build credibility for the program at the senior level and within the organization. This requires discussing the opportunities created by the program with the supplier’s top managers and committing to joint next steps. The CPO should clearly articulate the benefits of the program to all parties. Early communication from the upper levels of the buying organization, and strong support from corporate leadership (for instance, the CEO), are critical in mobilizing the internal team and persuading suppliers to develop a shared vision for these relationships.

A catalyst approach can be used to jump-start the process. This begins with both the buyer and the strategic supplier separately collecting information that can help identify areas of joint opportunity. With that homework done, the two companies meet to figure out how they might jointly reduce costs, improve quality, increase innovation, reduce waste, and improve cycle times. Over a period of a few months, the buyer teams and suppliers generate ideas, evaluate them, prioritize them, agree on the ultimate value and how it will be shared, and set an implementation plan. Catalyst sessions are intended to challenge—the dialogue should be open and no ideas should be off the table.

Once the initiatives have gotten off the ground, a program management office should be used to ensure consistency across initiatives, share best practices across initiative teams, and keep procurement executives apprised of progress. The program management office should also track all initiatives to make sure they are proceeding according to plan.

Implement and manage the program for the long term. Implementing a collaboration plan is complex. Change management is critical. There needs to be movement from the typical buyer-supplier relationship toward a dynamic of greater trust, more information-sharing, and enhanced transparency. Conversations must shift from What’s in it for me? to What’s in it for us? This can only happen if there are enabled and accountable leaders, an engaged organization, and a clear governance structure. There also need to be clear objectives, key actions associated with each objective, and agreed-on KPIs.

How the KPIs and key actions work together can be illustrated by an example. Suppose an office-machine-equipment company wants to reduce the time required to introduce new products. Its key actions might involve moving a strategic supplier’s engineers into its own R&D facility and training them. The most relevant KPI in this case would be time to market. In return for helping the buyer reduce its time to market, the supplier might get a guarantee that only its parts would be used in the buyer’s new products for a specified period of time.

In addition to this list of best practices, partnerships have other success factors, including analytical rigor and a clear definition of roles. (See below.)

Additional Factors That Help Partnerships Succeed

Buyers that forge successful partnerships are realistic about what these initiatives require. Five factors in particular are important to remember.

- Sufficient Time and Resources. Companies often underestimate the investment that’s required. More resources deliver more benefit more quickly.

- Stakeholder Engagement. Collaboration doesn’t work without people. Procurement departments must involve the necessary decision makers from both organizations and get them to support the effort.

- Analytical Rigor. Supplier collaboration programs are data heavy. A considerable amount of information must be gathered and analyzed if the right decisions are to be made.

- Clear Definition of Roles and Accountabilities. The cross-functional (and cross-company) nature of these initiatives allows them to leverage many different types of expertise and is a big part of their power. But it is also a potential source of confusion and bureaucracy. It must be clear who has final decision rights, particularly in situations where different stakeholders are lobbying for different options.

- Sustainable Improvements. Many companies find it difficult to maintain momentum after they’ve achieved an initial success. To keep this from happening, the programs should be refreshed regularly so improvements can continue. Also, rigorous tracking of initiatives is critical to ensure progress.

Getting Started

Any number of developments might set the stage for launching a buyer-supplier partnership program. One automobile company approached BCG at a time when the costs of cars’ interiors were going up and there was no way to pass them along to consumers. Another company, in the financial services industry, wanted to escape what it saw as a worsening cycle of increased media spending and diminished results.

One common thread at these companies was that they were facing challenges that could be addressed with the help of one or more suppliers. The other common thread was that neither had much experience in applying a partnership approach to problems.

We did the necessary preparatory work to get the buyers and their suppliers focused on the right things and then used catalyst sessions to help them generate ideas and share insights and data. We found ways to create incentives for the suppliers, even in situations where they were going to end up with less revenue. And we set up management structures that let our clients know what they were going after and how to measure it—and that let them make corrections when the results differed from their expectations.

In the end, the automobile company cut 66 percent from the per-unit cost of an interior-lining product. The financial services company improved the results of its media-buying efforts while reducing expenditures by 30 percent.

At most companies, buyer-supplier collaboration programs are at a relatively early stage—they aren’t mature. But this is an opportunity more than a problem. Changes in technology, an increasingly flexible supply base, and a growing awareness of the possibilities of the extended enterprise are giving buyers a chance to get a much bigger payback from their partnering initiatives. Partnerships present procurement executives with a chance to lower costs, be more innovative, and help their companies get better products into the market more quickly. They will be an increasingly important part of the formula for winning in the future.