Confidence abounds as a company embarks on a new, renewed, or expanded IT-outsourcing program. Yet observation suggests that a distressingly high percentage of these initiatives will fail to deliver as hoped, with programs running off the rails for any number of reasons.

We believe it is. Moreover, we believe that a company can proactively identify critical points of vulnerability, allowing it to take preventive measures to maximize its chances of success. The key is to closely examine all relevant variables—and know where to concentrate the company’s focus.

Key Factors in Outsourcing Results

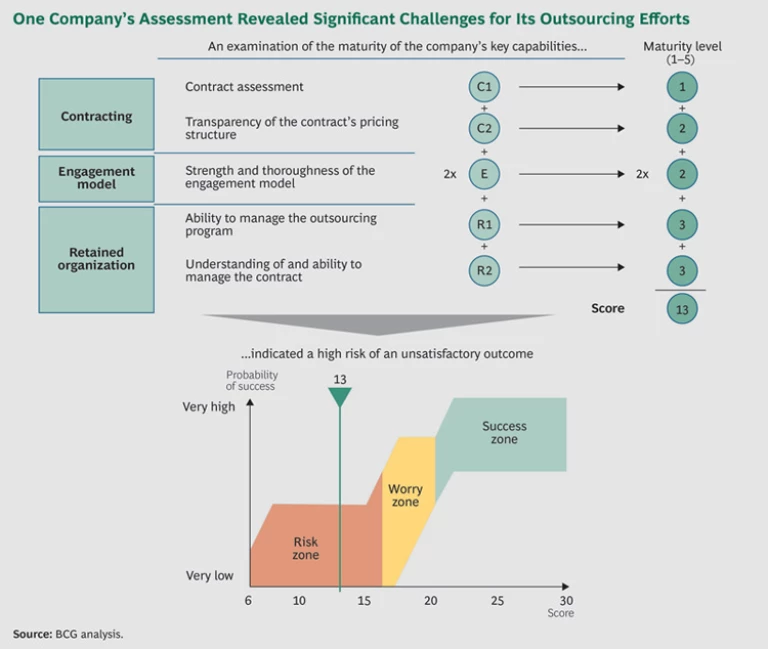

To more thoroughly understand the underlying causes of “value leakage” in IT outsourcing programs, BCG recently studied 40 large, complex outsourcing initiatives in depth. The companies whose efforts populated the sample spanned diverse regions and industries. Their outsourcing programs had been launched with different objectives, targeted a variety of IT functions, and had a range of outcomes. We assessed each program on 25 relevant variables. Respondents were asked to rate the companies’ relative strengths, or maturity levels, for each variable on a scale of 1 to 5, with 1 representing a low degree of maturity and 5 representing a high degree. Then we performed multivariate regression analysis to determine which variables were the strongest predictors of

We identified five variables—related to the contracting phase (C1 and C2), the engagement model used to manage the company’s vendors (E), and the company’s retained IT organization (R1 and R2)—that had the greatest impact on outsourcing outcomes:

- The Rigor of the Contract Assessment (C1). Has the company thoroughly studied and stress-tested the contract prior to signing to make sure it understands the contract’s most critical elements as well as the risks to which it might be exposed under different business

scenarios?3 3 See “ Smart Contracting in IT Outsourcing,” BCG article, July 2013. - The Degree of Transparency of the Contract’s Pricing Structure (C2). Does the contract provide full visibility into actual cost drivers, the source of the vendor’s profits, and the impact of the vendor’s business model on its relationship with the company?

- The Effectiveness of the Company’s Engagement Model in Managing Vendors (E). Does the company’s engagement model incorporate the objectives, KPIs, and metrics needed to guide and gauge vendor performance, and are these indicators fully aligned with the company’s needs and expectations?

- The Retained IT Organization’s Ability to Manage the Outsourcing Program (R1). Does the retained IT organization have the internal capabilities—including those related to strategy, architecture, and planning—to effectively and efficiently manage vendors and all aspects of the outsourcing program? (Companies that outsource aggressively often lose critical in-house capabilities.)

- The Retained IT Organization’s Ability to Understand and Manage the Contract (R2). Does the retained IT organization thoroughly understand the contract, and can it manage the contract effectively at all stages, including implementation and policy enforcement? Is knowledge of the contract passed along effectively from the deal team to those tasked with day-to-day implementation?

To a limited degree, other variables—such as the amount of time spent on the deal-making process, the number of rounds of negotiation, the total value of the contract, the relative size of the company compared with its vendors, and whether the company had a preexisting relationship with a particular vendor (and, if so, the strength of the relationship)—also influenced the outcomes of the outsourcing initiatives we studied. But the five variables we identified had the greatest bearing and, when considered in combination, the strongest predictive value. One variable in particular—the strength of a company’s engagement model—stood out as the single most critical. It also proved the most problematic for companies to get right.

Not surprisingly, the companies we surveyed varied considerably in the maturity level of the five variables. Some organizations had relatively advanced capabilities in contract assessment, for example, while others identified that variable as a decided weakness. But all businesses that had achieved satisfactory results in their outsourcing efforts exhibited a high degree of maturity across all five variables collectively.

Quantifying the Probability of Success

To ascertain precisely where the critical threshold is, we created a single, comprehensive score—based on the formula C1+C2+2E+R1+R2—for each company and mapped the scores against the results of the companies’ outsourcing

Ultimately, we determined that a score of 20 or greater (the “success zone”) translates into a high probability that a company’s outsourcing program will deliver as promised. Companies that fell into this range were strong and well-balanced across all five key capabilities, though most also had specific capabilities they could potentially leverage further to derive even greater value from their outsourcing efforts.

Businesses with scores ranging from 16 to 20 were in the “worry zone,” meaning they had significant room for improvement, with success a possibility but by no means guaranteed. Companies with scores below 16 fell into the “risk zone.” These organizations had major shortcomings and faced relatively high odds of an unsatisfactory outcome.

The results for one company—which deployed a highly outsourced model—are illustrative. (See the exhibit.) Its maturity levels for the five key variables were mixed. Its retained IT organization’s ability to manage the outsourcing program, encompassing governance, strategy, architecture management, and other capabilities, had a maturity score of 3. But the company was less mature on other fronts. Its engagement model for the management of its vendors had a score of just 2—the company struggled to steer its vendors through the use of clear, actionable KPIs, for example, which often resulted in long lead times for deliverables and outcomes that fell short of expectations. The rigor of its contract assessment scored even lower—for example, no formal process was in place for stress-testing the contract prior to signing. The company’s overall score was 13, placing it squarely in the risk zone.

From Assessment to Action

Companies that examine their maturity for each of these five variables and rate themselves accordingly can zero in on potential weaknesses and take corrective action where it matters most. In the case described above, the company decided that it will strive to ensure transparency in its contracts’ cost structures, with full visibility into individual line items and cost drivers. The company will also ensure that its contracts are well-structured and stress-tested in advance and that contract implementation teams are part of the renegotiation process. And it will try to improve its engagement model by defining an overarching service-management framework that delineates specific processes for managing vendors and delivering business outcomes.

We believe that any company involved in IT outsourcing—whether it is considering it for the first time, thinking of renewing or expanding an existing setup, or wishing to assess the health of a program already under way—would benefit from this type of assessment. Companies in our study that fell into the success zone were nearly twice as likely to succeed as those in the worry zone, translating into a far greater likelihood that these high-scoring companies will reap lower costs, better service quality, and improved agility and responsiveness to the needs of their business. To learn more about BCG’s approach or about conducting a self-assessment, visit

http://poss.bcg.com/

.