When people think “robots,” they often envision vaguely humanoid sci-fi-movie beings with strange speech patterns. But today’s state-of-the-art robots are a far cry from that outdated stereotype. And they are showing up for work. Increasingly flexible, responsive, sensing—even humanlike—robots are beginning to augment and replace labor in a wide range of industries: a megatrend that is transforming the economics of manufacturing and reshaping the business landscape.

Already used to fight wars, remove dangerous land mines, and fill customer orders, robots can also clean, dance, and play the violin; assist with surgery and rehabilitation, bathe elderly patients, measure and deliver medication, and offer companionship; and provide disaster relief, report the news, and drive cars. In short, robots can perform quite a few of the jobs that humans currently do—often more efficiently and at a far lower cost.

Because robots can sharply improve productivity and offset regional differences in labor costs and availability, they’ll likely have a major impact on the competitiveness of companies and countries alike. For instance, countries with a greater number of robotic programmers and robotic infrastructure could become more attractive to manufacturers than countries with cheap labor. Changes such as these will fundamentally alter the competitive dynamics of the global economy.

Despite the potentially far-reaching implications of this trend, few companies have thought about how the next generation of robotics will affect their workforce, operations, business models, and competitive position. And even fewer have considered which approach to embracing robotics will deliver the most sustainable advantage.

Tracking the Megatrend

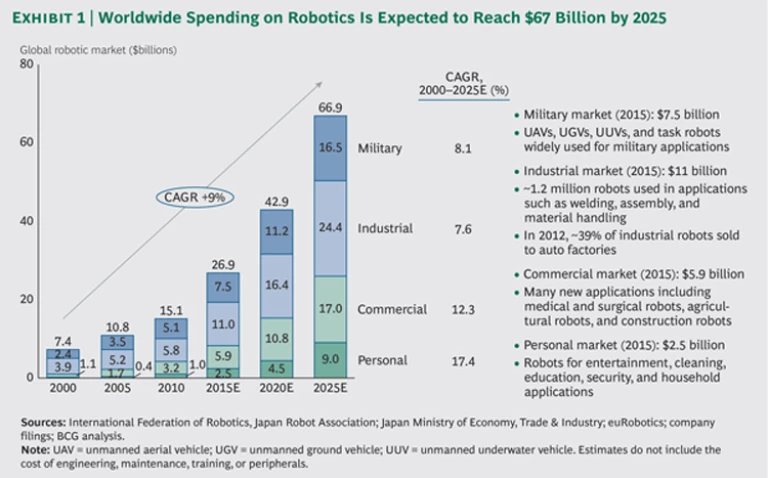

The size of this coming wave of robotics is staggering: spending on robots worldwide is expected to jump from just over $15 billion in 2010 to about $67 billion by 2025. (See Exhibit 1.) Driving this growth is a convergence of falling prices and performance improvements. The cost of high-quality robots and components is dropping rapidly, while CPUs are getting faster, and application programming is getting easier. As robots become cheaper, smaller, and more energy efficient, they gain flexibility and finesse, increasing the breadth of potential applications.

Initially, robots were used mainly for dirty, dull, repetitive, or dangerous tasks that did not require high precision, such as painting car doors or spot welding. Today’s robots, by contrast, are moving into a new range of precision applications far beyond the manufacturing realm. For instance, they’re enabling food processors to make products untouched by human hands. At Sweden-based Charkman Group, robots slice and pack high volumes of salami, ham, turkey, rolled pork, and other cooked meats. At the heart of the line is an intelligent portion-loading robot that can handle 150 picks per minute across multiple sizes and types of meat.

The fact that robotics and automation are crossing price, performance, and adoption thresholds is a clear indication that the robotic megatrend is growing in relevance and a tipping point may be near.

Where is demand coming from today? “Robot density,” a metric indicating the number of robots per 10,000 manufacturing workers, is currently highest in South Korea and Japan. Approximately, 40 percent of the industrial robots used today are in the automotive sector, in which robot density already tops 1,000 in five countries—Japan, France, Germany, the U.S., and Italy. But demand for automation isn’t limited to developed economies. China is the fastest-growing market for imported industrial robots, likely due in part to the country’s realization that it can no longer compete on low-cost labor alone.

But another factor may be fueling demand: analysts expect the workforce growth rate to decline worldwide, and China, Germany, Japan, and South Korea will be particularly affected. No wonder growing numbers of countries are looking toward the future and turning to automation of everything from industrial and agricultural production to human caretaking.

In fact, as robotic technologies advance and their potential to affect more and more industries increases, the main factors holding back future adoption rates may be the concerns of politicians, the public, labor unions, and regulatory agencies, as well as human comfort levels at having robots drive our cars, care for our parents, and displace current workers.

From the Factory Floor to the Personal Realm

Robotic applications have evolved over time. Historically, robots were used in manufacturing largely for repetitive tasks that require speed, strength, and moderate precision, such as material handling and processing, welding and soldering, and assembly. With their growing computing power and the development of miniature precision sensors, robots are moving from making cars to driving them. As they become more affordable and application programming becomes easier with more sophisticated user interfaces, robots are making small-batch production economically more feasible, because line changeovers are much faster. Given that product life cycles are getting shorter and just-in-time manufacturing helps minimize the need for inventory, robotic flexibility and responsiveness are important benefits. And since many of the new robots have multiple arms, they can multitask with ease—and without losing focus. In the Netherlands, Philips uses 128 robots to make razors. The only humans are the nine workers who perform quality checks.

Robots can also do without lighting, heat, air conditioning, supervision, food, and bathroom breaks. As a result, “lights out” manufacturing plants that offer significant cost and energy savings are emerging. At some factories, robots are even building other robots, producing about 50 robots per 24-hour shift and operating unsupervised for as long as 30 days at a time. Clearly, the robotic megatrend is fundamentally changing the economics of manufacturing.

Industries with complex supply chains may also benefit from robotics. Consider, for instance, how robots might automate mine-to-port operations. Automated drilling and haulage from the mine would reduce the need for workers in remote locations, increase safety, and improve asset utilization. Driverless trains might transport the loads to ports, where robotic operators would load the ships using sensors such as visual and thermal cameras and lasers. The whole supply chain might be managed remotely from a control center that would manage end-to-end logistics, optimize operations, and minimize waste. Rio Tinto, a global mining-and-metals company, is already exploring these possibilities with its Mine of the Future initiatives, and it is realizing safety, efficiency, and productivity gains. The same concepts might be applied to the supply chains of other industries.

Nonindustrial applications are also emerging, changing competitive dynamics in sectors such as retail. For instance, Amazon.com, the world’s largest online retailer, paid $775 million in cash in 2012 to buy Kiva Systems, which makes warehouse robots. Small, fast, and flexible, these robots are constantly in action, moving large merchandise lots from shelves to the packing and shipping areas. Once a Kiva customer, Amazon acquired the robot maker to improve the productivity and margins in its massive network of warehouses and fulfillment centers. The move has helped Amazon maintain its low-cost advantage and stay a step ahead of the competition by providing a key advantage: the ability to offer one- and two-day guaranteed delivery for a wide range of goods. The company recently announced plans to increase the number of Kiva robots from 1,400 to 10,000 by the end of 2014, which could cut fulfillment costs for an average order by 20 to 40 percent. If Jeff Bezos has his way, robotic delivery drones will be next.

Megatrends affect different industries in distinct migration waves over time. For instance, e-commerce started with travel, books, and music, and then rapidly expanded into virtually every other product category and industry. The same dynamic is beginning to play out in the field of robotics. As prices come down and new performance thresholds are crossed, robots are migrating from industrial and military uses to the personal-service realm, taking on the roles of caregiver, security guard, and companion. Honda is investing in robots that will provide assistance to people such as the elderly or disabled who have mobility problems. In 2000, the company unveiled ASIMO (the acronym for Advanced Step in Innovative Mobility), a sophisticated humanlike robot whose wide range of motion allows it to run and climb stairs.

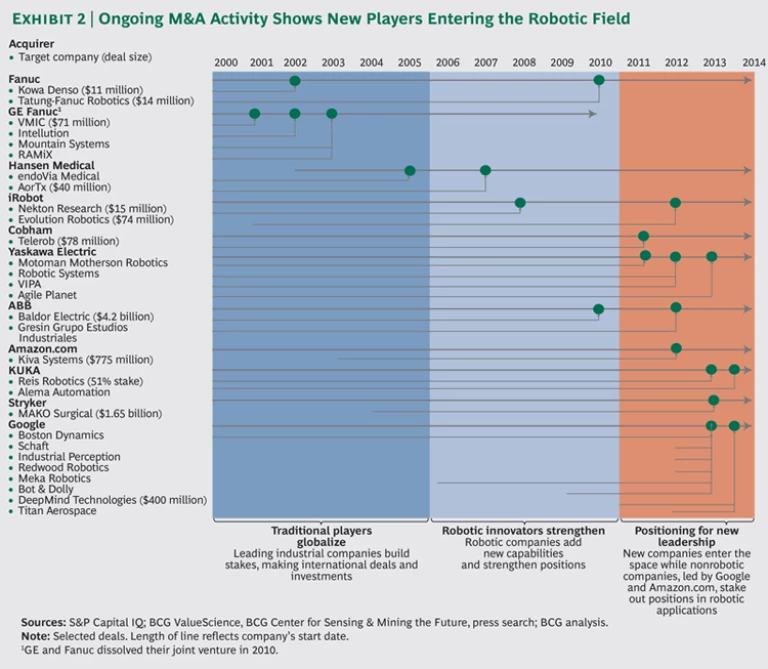

Agricultural robots, or agbots, are being designed to pick fruit and vegetables, to minimize harvest time pressures, and to prepare for the day when labor laws make it tougher to get large numbers of migrant workers to help with harvesting. Tracking M&A activity related to robotics shows that new players are entering the field. (See Exhibit 2.) For instance, Google has bought more than eight robotic-related companies in the last year, prompting speculation about its plans for the future. The Google car, which drives itself and has a virtually unblemished safety record of 700,000 accident-free miles, is approved for use in the states of California, Florida, Michigan, and Nevada. Inventions such as these hold enormous promise for the elderly and handicapped—not to mention improving the safety of our roads and the ease of our commutes.

Capitalizing on Robotics

Robots can fundamentally change how work gets done. They can match human performance and even improve upon it in many areas. To prepare for and profit from the robotic megatrend, companies can start by identifying the following:

- Areas of Operations with High Labor Costs. Robotics can provide cost-saving alternatives in many areas and complement human workers in others.

- Tasks That People Can’t, Won’t, or Shouldn’t Do. Some jobs are too hazardous, unpleasant, or difficult for human beings—no matter how high the pay. Other tasks are just too mindless, repetitive, and boring. Robots can liberate workers from hazardous or unappealing jobs.

- Human Skill Gaps. In Japan, developers are exploring ways robots might provide nursing and elder care. Other scarce and needed skills and capabilities that robots can offer—such as data mining, rapid analysis, and super speed or strength—exist at levels not present in human beings.

- Mission-Critical Applications. Tasks that demand exceptional precision, flexibility, or speed—such as electronic-chip production—or that require maneuvering in small spaces lend themselves to robotics.

- High Complexity. The global nature of business has given rise to convoluted supply chains and vast supplier networks. Robotics offers a way to centrally manage and execute complex logistics and to customize products for different markets and even for individual customers.

Strategic Considerations

Just as robotics will mature at different rates in different sectors, the implications and recommended actions will vary by business and industry. Still, the rise and expanding reach of this megatrend raises a set of strategic considerations.

Operational Flexibility and Financial Rigidity. The speed and shorter changeover times of today’s robots can radically increase the flexibility and productivity of manufacturing and nonmanufacturing operations alike. But this benefit comes with the potential cost of decreased financial flexibility. When demand slackens, workers in many markets can be furloughed, laid off, or moved to other assignments, but debt payments on financed capital equipment such as robots are due each month if the equipment is not liquidated. It’s important to understand all the financial trade-offs.

Minimal Efficient Scale and Operating Architecture. The greater efficiency and speed of robots can change the calculus on decisions related to production facility size and footprint. For instance, it may make sense to have robot-enhanced plants close to local markets so that products can be finely tailored to local tastes; or to set up large robotic plants in countries with cheap energy, since labor costs and availability will be less critical; or to locate facilities in areas with strong cadres of expert workers and engineers who could partner with robots to drive advantaged economics; or to create a hybrid network that could be optimized for high-volume items in a few gigantic plants, while addressing the particular needs of high-value segments locally. Some companies are even splitting production into two shifts: daytime human and nighttime robotic or automated production runs, the latter requiring no on-site supervisors and the attendant overtime costs.

First-Mover Advantage. Companies need to anticipate the robotic tipping points in their sector and move decisively. The cost advantage conferred by robotics will be whittled away as adoption becomes widespread. First movers will, therefore, capture a disproportionate share of the high margins that accrue to successful early adopters. This point is particularly true for companies that purchase and employ off-the-shelf robots.

Couture Versus Ready-to-Wear. It may be possible to extend the competitive advantage of robotics by taking a proprietary, “couture” approach. Instead of purchasing off-the-shelf robotic applications that competitors also have access to, some forward-looking companies are investing in bespoke sensor and control-system technologies specifically tailored to their operations. Customized solutions such as these can fundamentally disrupt an industry’s dynamics and provide a long-term source of differentiated value. And they also represent a largely untapped opportunity for sensor and control system companies to partner directly with end users.

These four issues suggest a larger point: leaders must explicitly consider the capabilities and economics of robotics when making a broad range of strategic and operating decisions related to staffing levels, manufacturing footprint, facility location and size, and other aspects of the business model. Companies that fail to stay abreast of the robotic megatrend risk making suboptimal choices—and ceding the competitive high ground to rivals.

The megatrend toward mobile, autonomous, multipurpose, and bespoke robotics is gaining traction much more quickly than most corporate executives realize. Forward-looking businesses are already exploring ways to incorporate robotics along the value chain to reduce costs and improve performance. But perhaps the greatest promise lies with the power of robots to transform a company’s value proposition—and fundamentally change the competitive dynamics of an industry.