Return on equity in the global wholesale-banking industry has sharply declined since the precrisis years, from 17 percent in 2007 to 12 percent in the first half of 2013. Industry revenues

Current Clients Can Generate Strong Revenue Growth

According to our research, more than 95 percent of revenues for the typical wholesale bank—including annuity business (such as in securities servicing) and new-flow business (such as in capital markets)—comes from current clients every year. Given this trend, many banks tend to take a largely passive, sometimes neglectful approach to seeking further revenue growth from these clients. Taking the view that the greatest opportunity must lie elsewhere, they spend a disproportionate amount of time trying to attract new business and create new products.

Two key factors, however, make a solid case for paying more attention to current clients. First, as wholesale banks well know, new clients (like new products) take a good deal of time to develop and onboard before they start generating substantial revenues. Second, and even more important, is the fact that—despite widespread belief to the contrary—most wholesale banks’ share of wallet with any of their large clients rarely rises above 15

The potential to gain a larger share of wallet is clearly enormous. But succeeding will require a highly disciplined approach. The first step in the journey is to truly understand why raising share of wallet with existing clients has been so difficult for wholesale banks in the past. In our view, many banks have fallen into several bad habits:

- Adopting an “RFP” Mentality. Too many wholesale banks are not proactive in assessing client needs or figuring out how to meet them. Instead, they adopt a reactive mindset, waiting for a request for proposal (RFP) to arrive. Such an approach leaves little room for banks to differentiate themselves, one result being that they end up competing on price in their proposals.

- Pushing Products, Not Providing Advice. A good number of wholesale banks purely push products without the customized advice that creates the solutions that clients seek. The truth is that more and more clients want a true

advisor3 3 BCG interviews with wholesale-banking clients. , not just a bank with a vendor mindset. - Focusing on the Short Term. All too often, relationship teams are incentivized to focus on immediate-term sales. They are insufficiently trained to take a holistic, long-term view of the client relationship.

- Capturing Insufficient Intelligence. Wholesale banks rarely attempt to rigorously calculate their clients’ total wallet or their own share of it. In a sample of banks that we recently interviewed, most relied on guesswork, underestimating the former and overestimating the latter by 30 to 50 percent.

Nonetheless, despite these common pitfalls, we have seen through our client work that most wholesale banks have valuable attributes that they can leverage to reverse old ways of doing things and expand their share of wallet with current clients.

Using Data, Analytics, and Advice to Make a Difference

Most wholesale banks sit on a wealth of proprietary data that can help them be strategic rather than just transactional in their sales approach. Such data provide insight into clients’ unmet needs and can offer a way to quantify benefits and demonstrate a solution-oriented mindset.

Moreover, in volatile economic times such as these, customers are eager for expert advice and are more willing than ever to collaborate proactively with their banks. In our conversations with banking clients, we have learned that they greatly value institutions that truly understand the challenges they face and that are willing to partner with them in thinking things through. In such a cooperative setting, pricing becomes an input to finding the right solution, not the key driver of the client’s purchase decision.

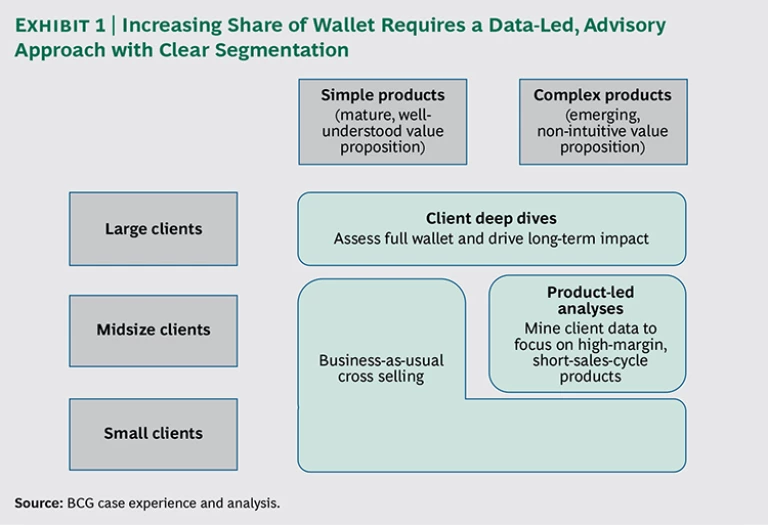

Indeed, banks typically do have direct access to the top decision makers and influencers at client companies. The key dilemma, however, is figuring out how best to approach these executives. Our experience working with wholesale banks shows that a data-led, advisory approach—tailored to different client segments and product types—can lead to meaningful engagement with existing clients that ultimately leads to a greater share of wallet. (See Exhibit 1.)

For the largest clients, it is important to do a comprehensive analysis across products that includes client discovery, calculation of the total wallet, an assessment of the bank’s competitiveness, and preparation of detailed business cases aimed at capturing the best opportunities for the bank. For midsize clients, it is more effective to do an “opportunity scan” of select, high-margin, shorter-sales-cycle products and then build data-driven business cases. For both segments, it is clearly important to demonstrate to clients how they will benefit. We suggest testing such approaches with well-orchestrated pilot programs ahead of any broad rollout with multiple clients. Pilots also help to establish internal buy-in as sales, relationship, and product teams get to experience firsthand the power of a data-led, advice-driven sales approach. Of course, establishing a robust governance structure to set goals, develop relevant metrics, track progress, and address problems when they arise is also critical.

In summary, any initiative to improve share of wallet should include the following activities:

- Mapping the current client wallet, using internal and external data

- Identifying and vetting opportunities, then building quantitative business cases

- Creating compelling pitches that incorporate key, quantifiable benefits to the client

- Committing cross-functional resources to targeted client opportunities

- Training sales and relationship teams in consultative, advice-driven selling

In addition, wholesale banks will need several core capabilities in order to make the initiative a success:

A Highly Developed Data Repository. The availability of high-quality data is critical to identifying and quantifying opportunities. Most banks have such resources, but the data are typically fragmented and stored in a number of different places. Good data governance and the ability to pool relevant data in warehouses help enormously.

A Strong Analytics Capability. Banks need to harness the data’s potential by looking for patterns that will help them identify unmet client needs and quantify their value propositions. This sort of analysis requires highly experienced personnel who have the technical expertise to mine the data, understand the nuances of the data, and grasp the ways that the data drive business.

An Advisory Mindset. By effectively combining relationship knowledge and analytics, client teams can play the role of advisors, proactively identifying opportunities and challenges in clients’ businesses and offering highly specific advice and solutions.

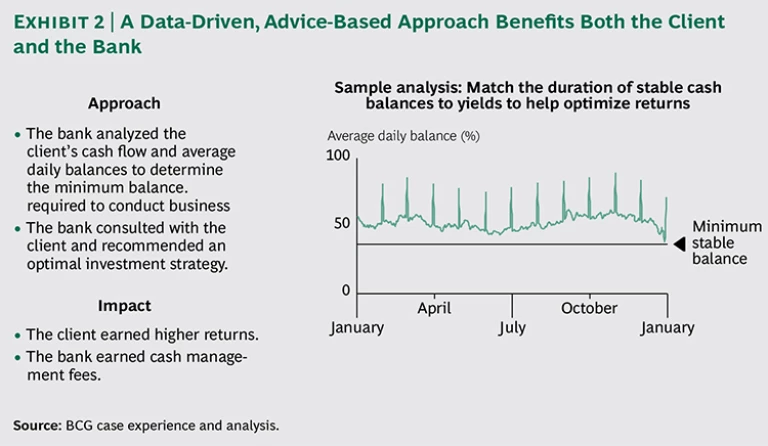

In one case we observed, for example, a wholesale-banking client was having problems determining how to invest its short-term cash. End-of-month balances routinely spiked, and the client ended up not investing fully one-third of its free cash. Using a data-driven, advice-based approach, the bank analyzed the client’s cash flow and average daily balances to determine the minimum amount required for conducting routine business. The bank also recommended an optimal investment strategy for the client. The result was a win-win situation in which the client earned higher returns and the bank earned higher fees by demonstrating the scope of its cash-management capabilities. (See Exhibit 2.)

Of course, success will also require a significant culture change within wholesale banks. As we have seen, they need to move away from product-push mindsets and incentives that primarily reward short-term sales. They need to attract and train the right talent. They need to see “client ownership” in the true sense of the phrase, enabling relationship teams both to play the role of partner and to manage the client P&L for the mutual benefit of the client and the bank. More broadly, we have seen in a number of instances4 that a robust share-of-wallet program can indeed deliver impressive revenue growth of up to 15 percent over a 12-to-24-month period. Such initiatives help deepen client loyalty and improve retention by transforming the bank’s role from that of a vendor to that of a thought partner and advisor.

Ultimately, share-of-wallet programs engender a new, more impactful way of selling.