Whether you ask a company’s CEO or its investors, they’ll likely identify revenue growth as the single biggest driver of corporate profit and shareholder value.

Over the long term, revenue growth powers 75 percent of total shareholder return (TSR) for the upper-quartile value creators of the S&P 500. Even in the short term, growth accounts for nearly a third of TSR for these outperformers—double the boost from improving margins or cash flow. A growing business also empowers employees, attracts top talent, and helps fund expansion, transformation, and more growth.

Growth is an imperative. But it needs to be profitable growth—and that is not a given.

In the recent era of uncertainty and financial constraint, many companies have focused on efficiency. They have energetically cut costs, even in the “ go-to-market ” commercial functions crucial to driving revenue—sales, marketing, pricing, branding, and customer insight. These companies have achieved productivity gains, but they’ve reached the point of diminishing returns. We’re learning again that we can’t cut our way to growth.

A small set of successful companies are taking a different path. They are transforming their commercial functions and capabilities to create an engine of short-term revenue growth and long-term profit. They are doing so with little risk. These near-term victories are “self-funding” the creation of strategic capabilities.

These leading companies are taking advantage of what The Boston Consulting Group calls the “Go-to-Market Revolution.”

The Go-to-Market Revolution is a wave of technological and customer-driven change that is altering the level of sophistication with which companies deploy their commercial capabilities. This new era hasn’t altered the fundamentals required for go-to-market excellence , but it is creating new possibilities. It is taking what is now possible—the current state of the art in commercial functions—to the next level.

Three tides of deep-rooted change are driving the revolution. The first is the dramatic shift, in almost every industry, of what BCG calls customer pathways—the ways customers learn and communicate about products and services on the path toward a purchase. Second, technology and advanced analytics are providing new tools for sales and pricing teams, marketers, and researchers. Third and finally, companies now navigate a globalizing world that requires most of them to compete in new markets, often against unfamiliar rivals. (See “A Revolution Driven by Three Tides of Change,” below.)

A REVOLUTION DRIVEN BY THREE TIDES OF CHANGE

The rich opportunities—and the perils of failing to act—emerge in the details of the three historic and concurrent tides of change driving the Go-to-Market Revolution.

Customer Pathways

The first tide is the rapid recent evolution of what BCG calls customer pathways. The ways consumers learn about and buy products have shifted dramatically and quickly, triggered by changes in technology, communications, and media.

The media once presented a landscape of force-fed information, dominated in the U.S. by the three major television networks, radio, billboards, and a handful of print publications. That has evolved into a customer-driven universe of Internet connectivity, Web searches, cable channels, peer-review marketing, and mobile devices and apps.

Consider some specific examples of disruption and change driven by the shift in customer pathways:

- The insurance and travel industries have shifted almost radically from agency-driven channels to online in less than a decade.

- The great majority of today’s purchases of durable goods are researched online before customers buy.

- Peer-review customer ratings are posted online for nearly every consumer product in the world.

- Mobile devices enable location-specific shopping—and marketing.

- Google users now conduct more than 115 billion searches a month, creating personal search histories that determine the customized ads that Google’s algorithms serve them. As a result, Google’s ad revenues now surpass those of all U.S. print publications combined.

The customer-pathway revolution has affected every industry—across both the consumer and business-to-business sectors. In the new environment, developing deep customer understanding and a consumer-centric view is the bedrock of success.

It is a more transparent world. Customer trust is a critical source of sustained competitive advantage, and it needs to be managed as a line activity. Brands must be backed by high-quality products and authentic corporate missions. Marketing teams must be capable of managing greater personalization and faster feedback loops.

Advanced Data and Analytics

The second driver of change could be called the go-to-market arsenal. It is the rapid and transformative evolution of “smart” data, advanced analytics and modeling, and other tools capable of increasingly sophisticated approaches in segmenting and analyzing information and reaching customers. The data revolution has transformed business sectors, from retail to financial services. For example, one vehicle company in India was able to map more than 95 percent of all its potential customers in the country—who bought what and where—in less than three months.

The cost of capturing, storing, and rendering data into decisions is falling rapidly. Increasingly, companies are leasing space in the cloud—using services like Amazon’s Redshift—as the cost per terabyte plunges. Cheap and effective data manipulation is leveling the playing field for smaller companies. It is revolutionizing sales force deployment, customer segmentation, product promotion, and return on marketing investment.

Consider one example: In times of slow growth, successful companies satisfy the specific needs of each customer. By catering to much smaller segments, through mining data, companies can discover hidden pockets of growth in richly diverse markets.

The concept of segmenting markets by geography or customer type has been around for decades. What’s different now is that digital and mobile technologies allow access and analysis of enormous quantities of sales and marketing information at a more microscopic level than ever before. Companies can quickly and inexpensively gather data from the field without an army of IT specialists and data experts.

One consumer goods company, for example, hired 4,000 part-timers to input on their Android phones the sales and retail data from hundreds of thousands of retail outlets in Southeast Asia. The company then carved an area it had treated as two large regions into more than 1,500 segments. Deploying the data with mobile sales-force tools enabled incremental growth of more than 10 percent.

Global and Emerging Markets

The final driver of the Go-to-Market Revolution is globalization, which creates two fundamental commercial challenges.

First, globalization has changed the competitive landscape in every market. The rise of globalization has opened labor markets and expanded offshore production, resulting in lower product costs in developed countries even as it destabilized brands and prices. Globalization is also ushering foreign competitors to the doorstep of domestic businesses. It is shortening product cycles and speeding shifts in consumer tastes. Go-to-market strategies need to adapt to these dynamic market conditions.

Second, globalization in emerging economies has been accompanied by rapidly expanding wealth. Consequently, emerging markets represent a huge source of growth. The challenge is this: most companies have commercial capabilities in emerging economies that are less sophisticated than those in established markets. Accurate data can be scarce, rendering marketing ROI calculations difficult. Distribution channels are a mix of modern options—such as mobile—and Old World.

And the recipe for commercial success differs significantly by country. Winning in India and China may require fundamentally divergent approaches. To succeed, companies must create emerging-market commercial capabilities that are as sophisticated and promising as the growth opportunity.

The resulting shifts are profound, and they’ve accelerated in the past couple of years. As one business leader put it: “If you are doing things the same way you did them three years ago, you’re almost certainly doing something wrong.”

The three tides of change have contributed to the disruption and heightened competitive pressures that affect virtually every global industry today. At the same time, they have bred a new and dynamic commercial environment. For business leaders with ambition and foresight, the Go-to-Market Revolution offers a multitude of fresh opportunities to attract and engage customers and to drive growth and profitability.

A Self-Funding Go-to-Market Transformation

A go-to-market transformation aggressively retools a company’s commercial functions—sales, marketing, pricing, branding, and customer insight—to exploit the new possibilities while navigating a fast-moving landscape. It adapts processes to changing customer pathways and needs, prepares the company to face new global markets and competitors, and arms its go-to-market teams with the latest and most effective technology.

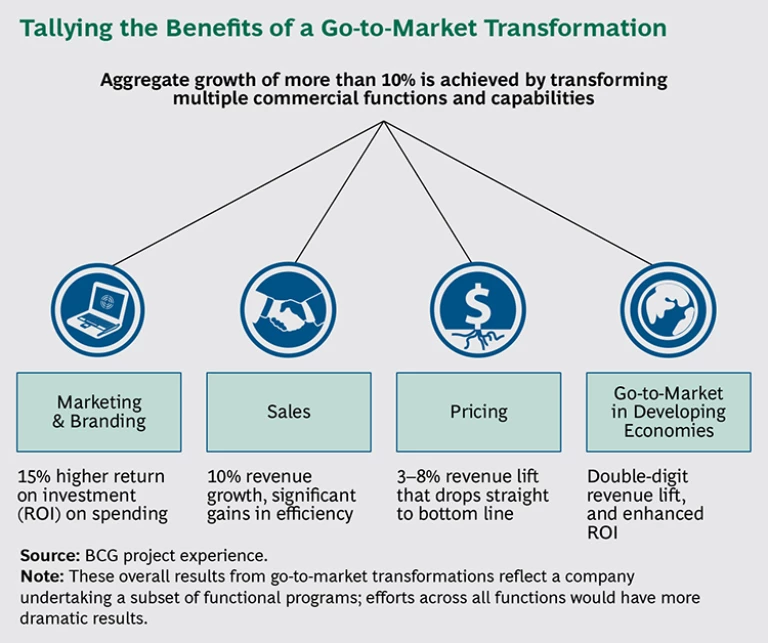

There is a rich prize for leading-edge adopters that ride the wave. Through comprehensive go-to-market transformation, companies we know are able to capture 10 percentage points or more of incremental growth. Some expand margins by 5 points or more. Every commercial area has the potential to contribute significant growth and margin. (See the exhibit “Tallying the Benefits of a Go-to-Market Transformation.”)

Go-to-market transformation is a particularly potent lever for growth because it exploits tactical, short-term victories to fund broader commercial transformation over the medium term. For example, one company started with a sales force effectiveness program that drove more than $20 million in near-term value—an early success that energized the organization and created a financial foundation for a broader go-to-market transformation. From such beginnings, the ambitious company funded a larger set of programs, which in turn produced a step-change in both commercial capabilities and value delivery.

This transformational approach contrasts with conventional attempts to adapt through continuous improvement—a recipe for simply keeping pace with market growth. Our view is that, for most companies, the current scope of change in the commercial landscape is too disruptive for incremental change to be effective. Maximizing value requires an aggressive and dedicated response.

Commercial transformation has a confirmed record of success in generating growth for a broad range of companies worldwide. They include a global manufacturer of mobile handsets, a European gas and energy utility, a U.S.-based retail bank, retailers, postal operators, and media companies.

The resulting revenue benefits are powerful in today’s era of difficult growth, when even modest revenue growth can create substantial shareholder value. Mature companies that increased their top line by just 2 percentage points or more delivered shareholder returns 40 percent higher than the market average.

Growth Zealot or Go-to-Market Laggard?

Your company can ignore the potential benefits of the Go-to-Market Revolution, but it can’t avoid the perils of failing to take part. The gap between capability leaders and laggards is growing.

If you are prepared to be a zealot for growth, here is a sample sequence of actions and best practices to consider.

- Start with vision and ambition. Does your company currently have the vision to transform your go-to-market capabilities? Do you have the ambition to increase your top line 10 or 20 percent beyond current projections in the next few years? A necessary first step is helping your leadership team understand the opportunities inherent in the Go-to-Market Revolution.

- Undertake a quick initial diagnostic step. Map how your customers’ purchase pathways have changed. Assess your commercial capabilities: marketing, pricing, sales, branding, and insight. Determine where you stand compared with best-in-class competitors and identify which commercial functions offer the greatest near-term opportunity.

- Tailor a series of programs to build capabilities and improve performance simultaneously. For example, start with a high-impact pricing initiative. Some leading companies we know have begun with a pricing program that added tens of millions of dollars to the bottom line. Simultaneously, the programs have funded development of new pricing tools and capabilities, such as sophisticated discounting, mobile technologies, and advanced analytics.

- With initial success in place, expand your efforts rapidly. For example, launch a program that boosts marketing effectiveness—such as a brand advocacy campaign. Then launch another—such as a sales-activation initiative—to equip your sales force with a technical arsenal of twenty-first-century tools.

Make no mistake, you may need several waves of activity to meet your objectives in each commercial discipline. Indeed, achieving your overall profit and strategy goals will take years, not months. If it’s done right, however, the journey will be self-funded. What is more, every growth gain and each advance in capabilities can create a reinforcing cycle of improvement for the entire enterprise.

Crucial to success in this endeavor is capable executive leadership. Company leaders must be committed to guiding and supporting the transformation across all three tides of change that drive the Go-to-Market Revolution: the new and uncharted pathways your customers are taking to discover and purchase your products; the evolution of data, advanced technologies, and analytics that can re-arm your commercial teams; and the rise of emerging markets, which brings new growth and also new global competitors.

These are real challenges. For the bold, though, they present powerful paths to competitive advantage.

The growth zealot must be a leader—able to inspire executives, managers, and employees; capable of transforming the whole by reinventing its parts; and committed to forging a new commercial future for the enterprise.