Three-quarters of the 1,500 global senior innovation executives we surveyed in 2014 reported that innovation is among the top three priorities for their companies. And 61 percent indicated that they are spending more on innovation this year than in 2013. While these numbers are largely consistent with those for 2013, important differences emerge when we look behind the averages at individual industries and countries. Notably, we see sharp shifts in the innovation stance of specific industries, a big change in the industry mix, and a heightened priority on innovation in rapidly developing economies (RDEs).

The Most Innovative Companies 2014

The Most Innovative Companies 2014

Despite Sectoral Shifts, Innovation Remains a Priority

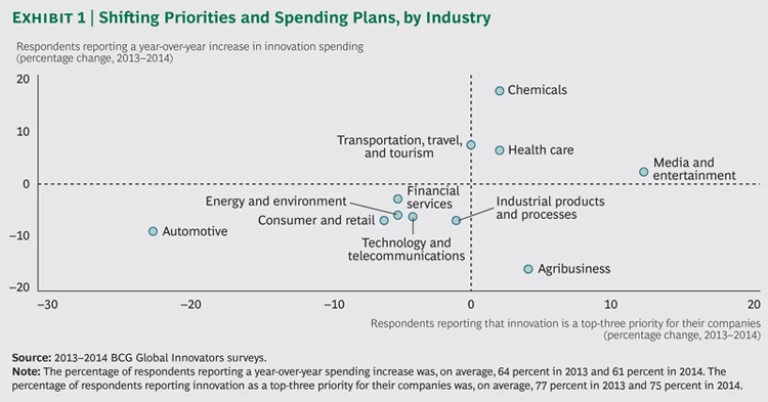

Overall, we saw only a 2 percentage point decline in the priority of innovation from 2013 to 2014—and a 3 percent decline in the proportion of respondent organizations that are spending more on innovation in 2014 than in 2013. But several sectors showed bigger shifts. (See Exhibit 1.)

The biggest shift is in the automotive industry. Automakers reported both a 26 percent decline in innovation priority (from 84 percent to 62 percent) and the second-largest drop in the intention to spend more (from 71 percent to 62 percent). They also showed the most pronounced single-industry falloff among all the industries represented in the list of 50 most innovative companies. (See the section “The 50 Most Innovative Companies: Automakers Downshift.”) Cost cutting has reemerged as an important priority—even at the premium end of the market—as many automakers seem to be concerned that innovation alone will not preserve their margins.

Agribusiness companies are trying to do more with less. Increases in innovation as a priority (from 72 percent to 76 percent) and plans to decrease spending (only 40 percent are planning an increase, as opposed to 56 percent in 2013) suggest that more companies in this sector are tightening their focus and putting their money where they see potential. By contrast, chemicals showed a modest uptick in priority (from 84 percent to 86 percent) backed by a big increase in spending intentions (74 percent plan to increase spending compared with 57 percent).

Other industries hewed closer to the averages. The number of respondents in the technology sector assigning innovation a top-three priority at their companies fell modestly from 84 percent to 80 percent; in consumer and retail, the same figure declined from 82 percent to 76 percent. Spending plans in both sectors showed declines as well. While health care shows a strong upward trend in priorities and investment spending, it remains below average in the priority attached to innovation and in spending plans. Across all industries, the portion of innovation spending allocated to radical or major innovations and advanced technologies is fairly constant, at about 60 percent.

Long-term advantage and current competitive advantage continue to be the primary goals for innovation investment, with three-quarters or more of respondents focused on these objectives. Approximately half of all respondents said that innovation in new products and technology platforms would have the biggest impact on their industries over the next three to five years, but the percentage targeting these two areas show declines from 2013: 41 percent, down from 47 percent for new products; and 34 percent, down from 45 percent for technology platforms.

The 50 Most Innovative Companies: Automakers Downshift

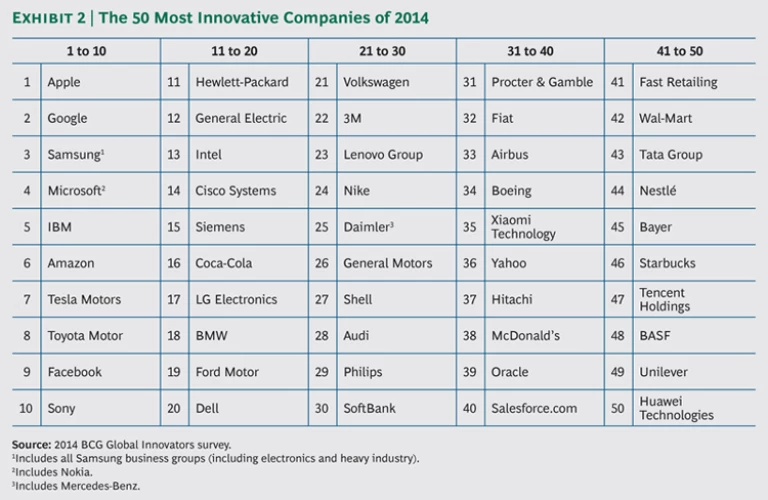

The Boston Consulting Group has explored the state of innovation through nine surveys since 2005. As in past surveys, the 2014 results reveal the 50 companies that executives ranked as the most innovative, weighted to incorporate relative three-year shareholder returns, revenue growth, and margin growth. For the second year in a row, we asked respondents to identify up-and-coming companies at which innovation is driving rapid growth. (See the Appendix .)

BCG’s 2013 list of the 50 most innovative companies contained an unprecedented 14 automakers, including 9 in the top 20. This year, only 9 auto companies are included in the top 50 list, and only 4 ranked in the top 20. (See Exhibit 2.) Among those that made the list, only 2—both of which were new to the list in 2013—increased in ranking: Tesla Motors jumped 34 places to number 7 and Fiat jumped 11 places to number 32. Perhaps Tesla’s more disruptive, breakthrough entrance has raised the innovation bar for automakers—and thus changed respondents’ perceptions of what constitutes innovation in the automotive space. And Fiat may be benefiting from its reemergence as a global brand and its bold acquisition of Chrysler.

The 2014 top-50 ranking shows a high degree of consistency with previous years. Four of the top 5 companies return, with IBM edging up one place to take Toyota Motor’s spot at number 5. Seven of the top 10 and 14 of the top 20 companies are the same. Most of the churn is a result of the drop in automakers. All of the top 5 spots, 7 of the top 10, and 21 of the top 50 are occupied by technology and telecommunications companies, the most since 2010. Consumer industries, capturing 10 of the top 50 spots, represent the second-largest share. Apple leads the list for the tenth year in a row, and Google and Samsung once again alternated places at numbers 2 and 3. Only three new companies joined the list—Xiaomi Technology, Hitachi, and Salesforce.com. In addition to Tesla and Fiat, Cisco Systems (14) and Siemens (15) made double-digit leaps in position.

We asked respondents again in 2014 to name up-and-coming companies—companies that are still relatively young or have yet to reach the scale of the top 50 global giants but are nonetheless making themselves known for innovation. There was 50 percent turnover on this list, with only four companies returning from 2013: WhatsApp, Square, Rakuten, and Xiaomi Technology. (Xiaomi Technology is the only company to be regarded as a top innovator and an up-and-comer.) The 2013 up-and-comers all leveraged mobile platforms in one way or another; this year’s list comprises more varied innovators: consumer products, auto, media, and big-data companies. Only half are based in the U.S., down from 60 percent in 2013. Two are from China, two from Japan, and one from India. None is based in Europe or South America. (See Exhibit 3.) Two, WhatsApp and Oculus VR, are in the process of being acquired by Facebook.

RDEs Raise Their Game

The 2014 innovation survey shows that companies in RDEs are particularly aggressive pursuers of innovation, perhaps because they see a need to catch up with competitors from more developed markets. Almost three-quarters of companies in RDEs expect to increase spending on innovation next year, compared with only 57 percent of companies in developed countries. In our survey, a majority of strong innovators from the BRIC nations—Brazil, Russia, India, and China—currently generate more than 20 percent of their sales from new products and services created within the past three years. These companies generally believe themselves to be both stronger innovators and more disruptive when compared with their counterparts in the developed world.

Chinese companies are particularly focused on innovation and are seeking to create an innovation-supportive environment. They tie compensation to innovation results, and intellectual property (IP) is an increasingly important topic. They are concerned about speed to market and want to incorporate more consumer insight into the innovation process. The heightened attention may be partly a result of a 2012 government directive that defined seven initiatives for state-owned enterprises to boost their innovation capabilities—for example, concentrating on fundamental and advanced R&D, strengthening platforms for technological innovation, and striving for key technological breakthroughs. BCG also predicted early in 2013 that a wave of Chinese innovators would soon hit the world scene and disrupt sectors as diverse as construction equipment, machine tools, auto parts, trucks, medical devices, and nuclear power. (See “ The Next Wave of Chinese Cost Innovators ,” BCG article, January 2013.)

Although companies from all countries said that new products and technology platforms are important to their future, companies in RDEs are targeting business model innovations more actively.

Despite the high priority and increased spending on innovation, one troubling fact stands out: results may be elusive. The vast majority of executives, 70 percent, said that their companies’ innovation capabilities are only average—and 13 percent see them as weak. When we talk with executives around the world, however, the aspiration to raise their innovation game is nearly universal. They ask, how does my company break through?