Mobile health—the use of mobile applications and devices to deliver medical information, access or record data, or provide clinical services—has the potential to revolutionize patient care. From tracking fitness achievements to allowing real-time remote consultation services with physicians, mHealth gives patients and providers better access to essential health information.

The underlying drivers of mHealth adoption are strong. The rapidly increasing availability of mobile Internet and the widespread use of inexpensive delivery devices, such as smartphones and data sensors, provide a solid foundation for growth. At the same time, the trend toward value-based health care has the potential to reward mHealth solutions that deliver superior outcomes and lower costs and that measure the outcomes of other products, such as pharmaceuticals.

But a great deal of innovative thinking will be required by stakeholders at the intersection of health care and mobile technology to make this promise a reality on a broad scale. To date, only a few devices or apps have succeeded commercially in the launch phase—and it is still not clear whether these promising products will drive sustainable revenue growth in the long term. Companies face challenges in designing products that easily fit into the user’s routine, that provide a benefit for which key stakeholders are willing to pay, and that can be integrated within the existing health-care infrastructure. Companies that succeed in mHealth over the long term will not only create innovative products but will also develop innovative business models—ones that combine unique offerings, viable revenue models, and robust stakeholder ecosystems.

In doing so, these companies will ensure that mHealth solutions achieve their commercial potential in addition to enhancing care. Although the challenges to commercialization may seem daunting, industry players can overcome them through well-designed, collaborative business models.

Perpetual Promise, but Profitability Is Elusive

Stakeholders are justifiably enthusiastic about the opportunities arising from mHealth. Companies in several key industry sectors have the greatest opportunity to capture value by commercializing mHealth, and many are already experimenting with mHealth solutions:

- Biopharmaceutical companies can use mHealth technologies to reduce costs (for example, by conducting clinical trials remotely) and to generate new sources of revenue through improved compliance (for example, by providing innovative packaging that reminds patients when to take their medication).

- Medical-technology companies can provide the technological backbone for mHealth by developing solutions to patient care, such as pacemakers that communicate with mobile devices or blood glucose monitors that transmit data to physicians, as well as by using mHealth solutions themselves to test product efficacy.

- Providers can develop innovative ways to manage care and facilitate communication with patients and among physicians—for example, by expanding remote-consultation services into hard-to-reach areas.

- Payers can encourage adoption of mHealth by reimbursing users for applications that reduce costs and improve patient outcomes.

- Telecommunications companies can provide the communications infrastructure for mHealth and enable expansion into adjacent health-care services, such as digital imaging.

As noted, however, mHealth has had few sustained commercial successes to date, and the market is still far from reaching its potential despite high levels of investment and excitement. The gap between the current market size and five-year projections is significant—in the tens of billions of dollars, according to

Yet companies shouldn’t wait for the ideal policy environment to take shape. There is ample room to succeed in the short term—with the right business model. The core technology required to support mHealth largely exists today in the form of smartphones and related devices. And there are already bright spots in the regulatory landscape, which are creating pockets of opportunity for companies able to exploit them. For instance, some U.S. states are working to develop favorable standards of care that include reimbursement for mobile offerings.

Most important, while examples are rare, some companies have managed to achieve early success despite an imperfect regulatory environment. For example, WellDoc’s BlueStar “mobile prescription therapy” provides diabetes patients with evidence-based, real-time feedback when they use their phone, PC, or tablet to input information about their medications, glucose level, diet, and activity level. BlueStar also provides clinical-decision support to patients’ physicians so that treatment changes can be optimized. Some payers have agreed to reimburse the product in a manner comparable to a monthly drug prescription. However, the jury is still out as to whether these solutions will be able to generate revenues over the long term.

Thus, a significant opportunity exists, but capturing the prize won’t be easy. To achieve broader success in mHealth, companies must build on existing technologies and bring them to market using breakthrough business models. And they will need to convince investors and internal stakeholders of the long-term business case for mHealth to ensure sufficient investment to build and scale the business.

Three Key Barriers to Commercializing mHealth

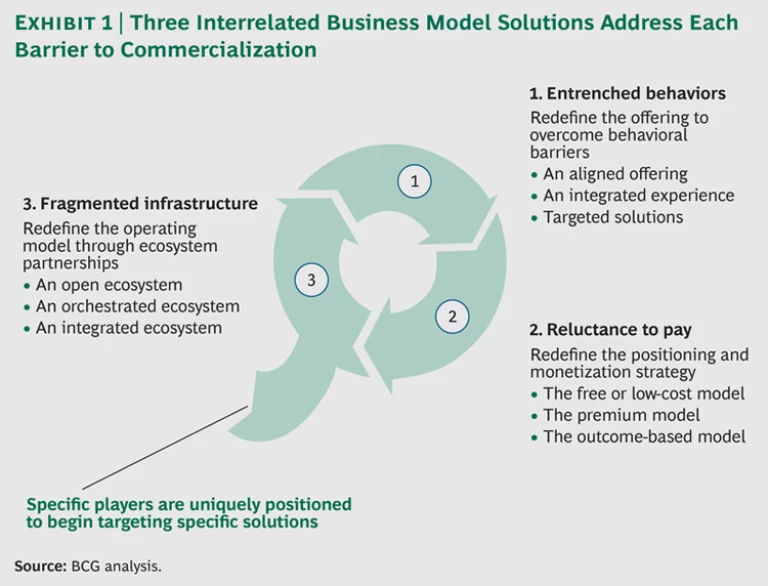

Developing an effective mHealth business model will require a structured approach in order to overcome significant barriers to commercialization. To aid mHealth solution providers in their efforts to develop innovative business models, we have synthesized these challenges into three main categories.

-

Entrenched Behaviors. Adopting mHealth solutions often requires substantial disruptions to existing behaviors and workflows. Mobile health players therefore need to understand the behavioral barriers that might prevent each type of user from adopting mHealth.

- For health care providers, new technologies will need to be designed around the current workflow practices of physicians, nurses, care coordinators, and others. These providers are already inundated with patient data; new technologies will be needed that deliver information quickly and in an easily digestible format.

- For patients, uptake of new technology will hinge on having incentives to take a more active role in their own care, such as by pursuing health and wellness activities, maintaining a journal to record data, or using tools that allow for remote diagnosis.

- It will be crucial for mHealth solutions to engage informal caregivers, such as family members, in addition to patients themselves.

- Reluctance to Pay. Industry stakeholders should assess potential ways to overcome users’ limited willingness to pay for mHealth solutions. Some payers and consumers remain skeptical that the benefits will outweigh the costs. Payers continue to demand a strong business case for reimbursing mHealth applications and devices. And, while consumers have demonstrated an openness to paying for health and wellness devices and apps, this needs to be extended to clinical devices and apps as well.

- Fragmented Infrastructure. Mobile health players should consider the options for a collaborative business ecosystem that overcomes competing objectives. To date, uncoordinated efforts among mHealth solution providers have resulted in a fragmented landscape and infrastructure characterized by lack of interoperability across mHealth devices and conflicting incentives among key stakeholders. To be useful to health care providers, data must be accessible through a robust ecosystem.

Each of these challenges has a corresponding solution relating to the mHealth offering, the monetization strategy, and the operating model, respectively. Together, these three solutions form the basis for successful commercialization. (See Exhibit 1.)

Solution 1: Redefine the Offering to Adapt to Users’ Behavior

The entrenched behaviors of patients and providers represent formidable barriers to mHealth adoption. But the developers of mHealth solutions can address these barriers through innovative offerings. The key is to think strategically about which behaviors are critical to address and how to do so.

Several approaches have proved successful across industries. (See “Solution 1 in Action.”) Mobile-health-solution providers should consider the following options:

- Align an offering with existing behaviors.

- Combine multiple offerings into a single, integrated experience.

- Design targeted solutions to facilitate changes in customer behavior.

SOLUTION 1 IN ACTION

Solution providers across industries are redefining mHealth solutions to overcome behavioral barriers.

An Aligned Offering. Royal Philips and Accenture Technology Labs have demonstrated a proof of concept to improve surgical procedures with the use of Google Glass. Google Glass can connect to Philips’ existing IntelliVue patient-monitoring solutions and display the patient’s vital signs, potentially allowing surgeons to view patient data without turning their heads to look at a monitor. This use of Google Glass could also provide a way for physicians to monitor patients when not at a computer terminal. This is a prime example of how mHealth solutions can potentially improve medical care without disrupting the existing practices of the health care provider.

An Integrated Experience. Kaiser Permanente has launched an app for Android and iPhone that provides users with a single interface to access their electronic health records securely through their phones, as well as send e-mail to physicians, schedule appointments, refill prescriptions, and locate KP medical facilities. The app eliminates the inconvenience of working through multiple interfaces to access the comprehensive data and services required by the patient. And it allows authorized family members caring for a loved one to access this information as well.

Targeted Solutions. Epocrates has developed the medical app that is most used by U.S. physicians, primarily on iPhone and Android mobile devices, at the point of care. The free Epocrates Rx app allows physicians to quickly find information on branded, generic, and over-the-counter products, including prescribing and safety guidelines and drug-drug interactions. A premium version of the app, Epocrates Essentials, provides concise disease monographs and diagnostic tools, including tips for interpreting lab results. The app targets a specific physician need—the ability to call to mind specific diagnostic and prescribing information—and meets that need by consolidating and interpreting a large amount of information that is typically not easily searchable via a single access point.

An Aligned Offering

The most straightforward option is to minimize the additional effort required by users and align the offering as closely as possible with existing behaviors and workflows. This requires analyzing the daily routines of patients and providers, identifying potential pain points resulting from the introduction of mHealth offerings, and developing solutions designed to minimize those pain points.

For providers, the major pain points relate to managing and interpreting massive amounts of patient data (from electronic health records and other sources). Physicians typically have only a few minutes to engage with a patient, so mHealth solutions must present patient data in an easily digestible format. Mobile health solutions must be integrated into providers’ routines—the less change that is required to incorporate the product, the more likely it is that providers will use it.

For patients, the most significant pain points relate to providing the data required to make mHealth applications work. To overcome them, mHealth solution designers can pull three key levers, ideally in combination: automate data collection, educate patients about how providing the necessary data will benefit them, and elicit the help of family members and other informal caregivers.

An Integrated Experience

Users will likely interact with a number of different mHealth devices and applications—potentially across multiple platforms. There are, for instance, tens of thousands of health-related applications available on the iPhone app store today.

This points to the option of combining multiple offerings into a single, integrated experience, from a “must-have app” that combines the functionality of multiple apps to a hardware platform that connects a diverse set of modular, interoperable devices. Or, to benefit providers, this option could mean developing a single interface that synthesizes data from multiple sources—for instance, blood sugar readings from one device and weight measurements from another.

Combining multiple offerings in such a way can dramatically reduce the time and effort required to manage the flow of information across different mobile applications.

Targeted Solutions

While the approaches described previously can help minimize the behavioral changes required of patients and physicians, some change is inevitable—and can be quite significant in the case of certain mHealth applications. For these, mHealth solution providers have the option of offering targeted services that make the transition to mHealth as easy as possible.

This option is clearly appropriate in serving providers, who will have to manage large amounts of data and navigate new remote-diagnosis guidelines in a mobile world. Providers of mHealth solutions, such as telcos, could provide physicians with data management services. These could handle the flow of information and filter out all but the most important pieces of data, which could then be presented in easily digestible summaries. Biopharma and medtech companies could also consider developing online decision tools to help support remote diagnosis, which is another time-consuming task for physicians.

The key will be for telcos, biopharma companies, and medtech companies to expand their roles along the value chain, within the constraints of legal guidelines.

Getting Started

All stakeholders have a role to play in overcoming behavioral barriers, but telcos and biopharma and medtech companies are in the best position to build the required solutions. Telcos have a deep knowledge of networks and data management, while biopharma and medtech companies have proven experience in influencing physician and patient behavior. And these stakeholders also have a vested interest in how the solutions are built. Biopharma and medtech companies will want to design their products to operate within new diagnostic algorithms and rules, and telcos will want to build strong ties with providers, physicians, and patients to gain a foothold in the market.

Solution 2: Redefine the Positioning and Monetization Strategy

For many mHealth solution providers, the greatest challenge is not in getting patients and providers to use mobile devices and applications but in generating a viable revenue stream from their use. Indeed, both payers and consumers have so far shown only a limited willingness to pay for mobile health.

To be sure, the public sector has a role to play in ensuring that mHealth solutions receive adequate reimbursement; this is especially true in countries with single-payer health systems. But the private sector also has a significant role to play in determining the optimal way to position and monetize mHealth offerings.

Consequently, there is a need for viable revenue models. Three distinct models have helped other industries overcome similar limited willingness to pay. (See “Solution 2 in Action.”) Mobile-health-solution developers should consider the following options:

- Develop a free or low-cost offering and monetize it through other means.

- Position mHealth as superior to traditional health care and earn a premium as a result.

- Tie reimbursement to measurable outcomes.

SOLUTION 2 IN ACTION

Innovative monetization strategies are being deployed to generate revenues for mHealth solutions that apply to a wide range of diseases and patients.

The Free or Low-Cost Model. Electronic health offers examples of successful free or low-cost revenue models with potential applicability to mHealth. PatientsLikeMe is one example; it is a website that serves two functions. It allows users to track their health status, learn more about their disease, and share and connect with patients in similar situations. It also serves as a real-time research platform that delivers insights about patients’ actual experiences with specific diseases. The information that members enter, regarding symptoms, treatment history, drug side effects, and other factors, can be anonymized and sold to pharma companies, medical-device makers, and others to expedite the development of better treatments. This business model illustrates how a free offering can be monetized through alternative revenue sources.

The Premium Model. WellDoc developed BlueStar, the world’s first mobile prescription therapy. This mHealth product is FDA cleared to provide real-time, automated coaching for patients with type 2 diabetes and clinical decision support for doctors. BlueStar is powered by an expert system that analyzes a patient’s data and then provides personalized motivational, educational, and actionable feedback on medications, glucose levels, lifestyle decisions, and standards of care for the self-management of diabetes. Patients can also send to their provider an analyzed summary of their information that includes treatment recommendations mapped to evidence-based guidelines. In multiple randomized, controlled, and published trials, WellDoc demonstrated that both patient and provider behaviors changed, resulting in significant, sustainable drops in blood sugar levels. BlueStar requires a monthly prescription, like a drug, and is therefore marketed directly to physicians as a new class of diabetes therapy. Because of its proven results, BlueStar has become the first mHealth product to be reimbursed through the pharmacy—like any FDA-cleared prescription product.

The Outcome-Based Model. There are few examples of mHealth solutions that directly tie revenues to measurable patient outcomes or cost savings. However, the trend toward value-based health care in the industry as a whole presents a long-term opportunity for mHealth providers to develop outcome-based revenue models. The first step is to demonstrate effectiveness through clinical tests or other means. Some mHealth players are moving in this direction.

One example is the Health Buddy System, which helps patients and providers manage chronic conditions. For the patient, it provides symptom review, vital-sign gathering, and education, coaching, and support of self-management through daily sessions. The health care provider can access a summary of this information, with risk areas preidentified, through a desktop application.

The effectiveness of Health Buddy has been demonstrated in numerous studies. For example, in a recent study with chronic obstructive pulmonary disease patients, Health Buddy (supported by a care coordinator) improved patients’ quality of life and caused a decrease in overall health-care costs. Quantifying patient impact is essential for an outcome-based revenue model. The next step for Health Buddy—and for similar mHealth applications—could be to tie payments to the delivery of these outcomes in order to remove financial risk on the part of consumers (patients, providers, or employers).

When considering these three approaches, it is important to agree on which party will pay—payers or consumers. Each model can apply to both, but in different ways.

The Free or Low-Cost Model

Mobile health offerings often involve multiple elements (think of remote monitoring devices that use data services, or blood glucose monitors that use test strips). This creates an opportunity to provide one of the elements free of charge or at low cost, while generating revenues through the sale of the other elements. In addition, mHealth offerings often generate a wealth of patient data, some of which could be commercially valuable to other health-care companies, presenting opportunities to monetize data within the constraints of privacy and other legal guidelines.

It is important to consider that in health care in particular, free offerings may cause buyers to question the value of the product or service. Therefore, offering a low-cost product or service may be optimal. In either case, however, earning profits from such offerings will require monetizing multiple revenue streams, choosing the right operating model, and effectively conveying the value of the new offering to the consumer or payer.

The Premium Model

Some mHealth offerings deliver objectively better outcomes or lower costs compared with traditional health-care offerings. In these cases, sellers can position the offering as superior and charge a suitable premium.

The premium model would be appropriate in applications where the constant contact enabled by mobile technology offers the greatest benefits, such as in managing chronic diseases. In the case of Alzheimer’s disease, for example, consider the use of real-time tracking of a patient’s location and vital signs, compared with less frequent—but much more expensive—doctor visits. Here, payers would likely view the mHealth offering as delivering better outcomes than traditional approaches.

In these cases and others, the mHealth solution offers a unique and compelling value proposition that warrants a revenue profile at least comparable to that of traditional health-care offerings. To succeed, developers will need to educate patients and payers about these benefits and establish a robust business case to justify higher payments.

The Outcome-Based Model

Providers of mHealth solutions may benefit from following the general trend toward value-based health care and tie payments directly to measurable patient outcomes or cost savings. Doing so will reduce the downside financial risk to payers and consumers, and thereby potentially increase the willingness to pay. Mobile health solutions for weight loss, for instance, could be reimbursed based on reductions in the costs associated with obesity-related ailments. Likewise, tools for managing diabetes could be reimbursed based on reduced hospital admissions or doctor visits.

Regardless of the specific application, outcome-based revenue models will require specific capabilities, such as data analytics, to track patient outcomes, as well as clear alignment with payers regarding reimbursement rates. The first step is to collect data on outcomes and savings; only then can mHealth solution developers begin to transform their revenue models.

Getting Started

All stakeholders have a role to play in shaping the right revenue model by helping to test, document, and quantify the benefits of mHealth. Biopharma and medtech companies are particularly well positioned to create novel funding models. By participating in the development of innovative solutions, these companies can protect their existing revenue streams while building a new one.

They also have a role to play in determining how to position devices across the price spectrum to encourage reimbursement. Coordination with payers and communication with consumers are two key factors in successfully implementing any of these new revenue models.

Solution 3: Redefine the Operating Model Through Ecosystem Partnerships

Although the right revenue model is important, the operating model is perhaps most critical to facilitating the efficient development and delivery of mHealth solutions. As Farbod Hagigi, CEO of ClinicalBox, explains, “Health care is shifting from an operating model that is episodic and fee-for-service to one that is coordinated and utilizes a value-based payment structure. Health care technology needs to mirror this shift by moving past a focus on systems of record, which are merely siloed repositories of health care data, to systems of engagement, focused on care coordination and patient engagement across the value chain. Fostering an interoperable ecosystem based on the principles of modular design will be critical from a business model, innovation, and technology standpoint.” For this to occur, mHealth stakeholders will need to form a robust network of partnerships.

However, such partnerships may be difficult to forge among traditional industry players and new entrants, given the lack of collaboration along the value chain in the past. Developing creative approaches to cross-industry collaboration will therefore be critical to delivering on the promise of mHealth. (See “Solution 3 in Action.”)

SOLUTION 3 IN ACTION

Mobile health players and the communities they serve are beginning to reap rewards from innovative approaches to ecosystem partnerships.

An Open Ecosystem. Continua Health Alliance, an international not-for-profit industry group, is leading the development of global standards to achieve end-to-end, plug-and-play connectivity for “personal connected health”—that is, the use of personal health technologies such as remote monitoring devices and mHealth solutions.

Continua is creating design guidelines and testing tools to expedite the deployment of personal and connected health devices and systems that could dramatically improve health management, clinical outcomes, and quality of life.

With more than 200 member companies, including technology, medical-device, and health-care industry leaders and service providers around the world, Continua is an example of how multiple players across the industry can collaborate to achieve standard design rules. The alliance’s main activities include a certification and brand support program, events and collaborations to support technology and clinical innovation, and outreach to employers, payers, governments, and health care providers.

An Orchestrated Ecosystem. ClinicalBox, a health-care-software company, is using CoordinationBox, its care-coordination and patient-engagement platform, to orchestrate a unified ecosystem that breaks down the barriers that come between mHealth solutions and existing health IT systems (such as electronic health records).

CoordinationBox is able to connect with more than 110 electronic health records and health IT systems deployed at more than 750 health-care facilities across the U.S. New and existing mHealth solutions can connect with the platform using open and secure interfaces. CoordinationBox enables the management of episodes of care for surgical procedures, chronic diseases, and clinical trials.

ClinicalBox matches its technology innovations with an innovative business model that charges end customers for the use of its platform on an episode-of-care basis, allowing return on investment to be matched by improvements in clinical and financial performance.

An Integrated Ecosystem. The U.S. Department of Veterans Affairs is developing telemedicine applications to provide remote consultations to veterans in rural areas.

As an integrated payer and provider, the VA has bypassed reimbursement negotiation, focusing instead on building an efficient remote-consultation offering for its constituents. It has supported this effort by enhancing its IT infrastructure and building its capabilities for maintaining electronic health records.

The starting point is to decide on the optimal degree of openness for a particular application. Providers of mHealth solutions should investigate the following options:

- Promote the development of an open ecosystem, involving a wide range of stakeholders, in which each designs a different subsystem while adhering to an agreed-upon set of design rules.

- Play a more active, orchestrating role by tying multiple players into a unified ecosystem.

- Seek to integrate the entire value chain from end to end, and do as much as possible in-house.

Each of these models entails trade-offs. The right choice will depend on the specific mHealth application and the particular industry players involved.

An Open Ecosystem

In an open ecosystem, no one participant controls a majority of the system’s assets. Instead, multiple participants—from within and across industries—combine their capabilities to support a mutual value proposition. Such an ecosystem has the benefit of spurring co-innovation: innovations generated by one set of stakeholders create incentives for innovations to be generated by a different set of stakeholders (as was the case with the Android ecosystem).

The benefits of an open ecosystem, however, should be balanced against the risk of fragmentation (in both infrastructure and incentives) and a reduction in the ability of individual players to capture value in the market. This is especially the case with mHealth because of the variety of stakeholders involved.

To address these risks, it is critical to build the mHealth ecosystem around common platforms and standards. Individual stakeholders—or collections of stakeholders working together—can take the lead. The key is to identify which set of players to involve and to create the incentives for each to contribute.

An Orchestrated Ecosystem

If a more coordinated approach is needed to avoid fragmented standards and platforms, a single stakeholder can structure partnerships, developing and integrating different players into the larger system.

For example, one stakeholder could serve as a point of contact, integrating data output from a range of devices operating on different platforms rather than having each player within the industry agree on a common set of design standards. This player would create a solution that normalizes inputs from multiple mHealth solutions and then transmits data in a single, unified manner to patients, payers, and providers. This would allow individual solution designers to innovate independently, while enabling patients and providers to use the technology jointly.

Regardless of approach, the goals are the same: to identify stakeholders with unique assets and capabilities, and to ensure that they are effectively aligned to form a functional ecosystem.

An Integrated Ecosystem

Leveraging multiple stakeholders—both within and across industries—clearly has advantages, but there are also advantages to owning a larger share of the value chain in-house. By creating their own integrated system, companies can capture greater value. These systems also provide fertile ground for nurturing truly breakthrough technologies.

The implications for mHealth are clear. Device makers, for example, could capture a larger share of value by developing both hardware and software in-house. Large provider networks could create more tailored offerings by internalizing solution development. And all players could build more rapid feedback loops for design based on responses from customers (patients or providers).

Obviously, a more integrated solution has the added benefit of simplifying the process of aligning standards across these processes. That said, making such a model work would likely require companies to build or acquire new capabilities along the value chain. The right approach depends on weighing the related costs against the potential benefits of integration. Huge scale is needed for an integrated system; although companies are already exploring this option, they may need to wait for the market to mature before total integration is feasible.

Getting Started

At this early stage of mHealth’s development, each stakeholder has an interest in finding a seat at the table in order to shape the ecosystem and build upon a set of common and connected standards. All stakeholders have a role to play in building an operating model that enables mHealth to flourish. Although they are not traditional participants in the health care industry, telcos, in particular, are uniquely positioned to act as leaders in developing the backbone or infrastructure for mHealth apps

The Path Forward

No transition as fundamental as this is ever simple. But for stakeholders that seek to achieve long-term success in mHealth, the time has arrived to develop plans that capture the opportunities.

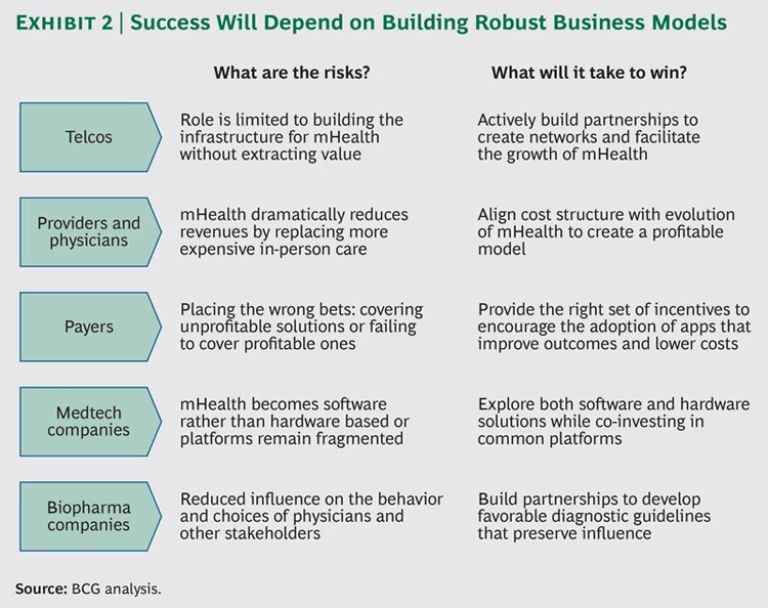

Each stakeholder brings certain critical assets and capabilities necessary for mHealth to grow,. However, each also faces threats that could potentially leave it with reduced economic benefits or even shut it out of the ecosystem entirely. It is still early, however, and players can manage these threats with a proactive mind-set. (See Exhibit 2.)

What are the risks and opportunities for the major stakeholders in the mHealth ecosystem?

Telcos

Telcos face the risk that their role will be limited to providing the infrastructure for mHealth without extracting meaningful value for themselves. Winning telcos will mitigate this risk by building partnerships with powerful stakeholders and helping to design networks and solutions that facilitate mHealth’s growth. Unlike other players in the ecosystem, telcos do not have existing health-care assets to protect. Because they are not playing defense, they have greater freedom to start the process of forming a cross-industry operating model and thereby become essential partcipants in the ecosystem.

Providers and Physicians

Providers and physicians, because they constitute the point of contact with patients, are clearly important stakeholders in a future mHealth system. The biggest risk they face is a dramatic reduction in revenues, because mHealth is a lower-cost way to provide the same level of care. Winning providers will take advantage of mHealth’s evolution to create a more profitable cost structure and improve the quality of care. Accountable care organizations and patient-centered medical homes are already demonstrating a unique way for providers to align their incentives with those of payers. These types of organizations stand to benefit greatly from mHealth.

Payers

Payers face two threats: if they adopt mHealth, their savings may be lower than expected, but if they don’t, they will be at a disadvantage relative to competitors, which may be positioned to realize significant savings. Winning payers will find the right set of incentives to encourage adoption of solutions that improve outcomes or reduce costs. They will manage complexity by setting a high bar for approving funding for solutions. They will also constantly monitor the progress and performance of mHealth apps and change course when necessary. Additionally, winning payers will encourage leading mHealth-app developers to use specific hospital networks as laboratories to experiment with and test new products. Some payers may even go so far as to acquire mHealth solutions and take on the dual role of payer and provider. This will give them access to the most cutting-edge technology and build a spirit of ownership and excitement among physicians in the network, as well as giving them an additional source of revenues.

Medtech Companies

Medtech companies face the risk that mHealth will become software based instead of hardware based. This is happening in the smartphone space, where value is shifting away from devices to operating systems and apps. Medtech companies also need to ensure that their apps are compatible with multiple phones and platforms. Winning companies will build partnerships with telcos and co-invest in building a common infrastructure, while constantly exploring both software- and hardware-based solutions.

Biopharma Companies

Biopharma companies’ biggest risk is that mHealth will reduce their influence over the behaviors and choices of a variety of stakeholders: physicians, patients, payers, accountable care organizations, and integrated delivery networks. Winning biopharma companies will collaborate in creating solutions that improve health care through diagnostic guidelines and algorithms. They will also make smart investments in apps that complement their current drug portfolios. Additionally, biopharma companies can position themselves as the channel to influence physician adoption, serving as intermediaries in interactions between providers and mHealth solution developers.

Ultimately, the winners in mHealth will be companies that approach this technology as an opportunity to redefine the existing health-care business model. They will develop a compelling value proposition that is supported by a sustainable revenue model and strong cross-industry collaboration.

In a perfect world, policies would be modified and all players would adopt the behaviors required for mHealth to flourish. But in reality, there is a clear role for business model innovation. Business model innovation offers guidance to solution providers on how to start participating in mHealth, encourages all stakeholders to get involved, and ultimately improves mHealth’s future prospects.

Before mHealth can revolutionize patient care, industry stakeholders need to revolutionize how they work together.