Many insurance companies are tapping into large, fast-moving, complex streams of big data and applying advanced analytical techniques to transform the way they do business. But in the life insurance industry , using big data seems to be low on the executive agenda.

Life insurance companies are taking a backseat approach to big data for many reasons. Perhaps the most important is that these companies have little available data to begin with. This is partly because they have limited interactions with customers and partly because a company usually does not get much additional data from a customer once an application for a life insurance product is completed. What’s more, the data itself often involves significant issues of privacy, including health, behavioral, and lifestyle information that can be highly sensitive and, in some countries, tightly regulated. (See “ Data Privacy by the Numbers ,” BCG slideshow, February 2014).

Yet after conducting a comprehensive survey of the industry, we have found that forward-thinking life-insurance companies are overcoming these challenges through four growth strategies. Some are using big data and advanced analytics to improve business processes and expand into new markets, thereby generating significant revenues and profits. Others are building long-term, trusted relationships with customers. These insurers are offering valuable new or improved products and services in exchange for personal data that customers provide voluntarily. The new offerings may help clients improve their health or may provide access to insurance for people who are considered risky or expensive to serve.

The landscape is changing. Companies that get ahead of these shifts will discover new opportunities for efficiency, growth, and innovation.

Life Insurers Can Profit from Big Data in Four Ways

Big data and advanced analytics can help insurers gain access to a great deal of information that consumers might be persuaded to share—if the companies craft the right incentives, add value, and create an easy platform for engagement.

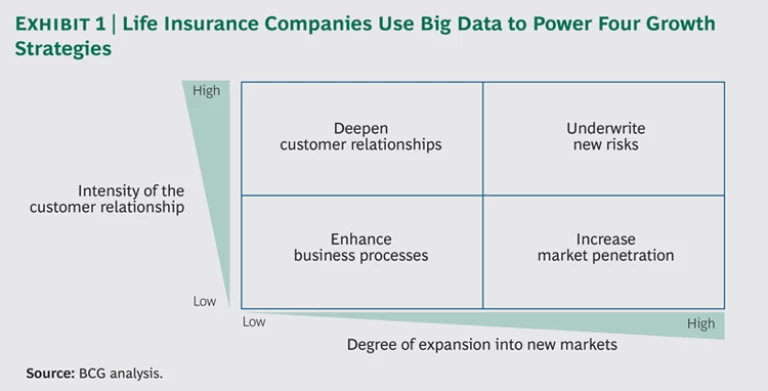

We have observed that the four growth strategies have two dimensions: the intensity of the customer relationship and the degree of expansion into new markets. The first dimension allows companies to grow by selling more products to each existing client and by increasing loyalty. The second dimension fuels growth by broadening the client portfolio—that is, by selling to new clients. (See Exhibit 1.) Several leading insurers around the world are currently exploring these approaches, in some cases building partnerships that are beginning to transform the way business is done.

Enhancing Business Processes. Big data and advanced analytical tools and techniques are already boosting operational performance significantly. Some companies, for example, have generated an increase of 5 to 15 percentage points in the placement rate, which measures how many people purchase a policy after beginning the application process. Other companies have reduced the length of the application process from weeks to hours.

In underwriting, some insurers are improving risk assessment during the underwriting process by including more relevant big-data variables in existing analytical models. Aviva, for example, has experimented with selectively replacing costly and inconvenient medical exams with predictive modeling of risk based on enhanced data. A study of 60,000 Aviva applicants found that nontraditional data was as effective in identifying potential health risks as blood and urine tests.

In distribution, companies are improving agent recruiting and retention by developing predictive models to identify, select, and retain the best sales performers. In near real time, these companies track metrics such as early customer-lapse rates, disclosure rates (how much information an agent is able to obtain from an applicant), and average policy size. They also design incentives on the basis of these indicators in order to move performance in the right direction. What’s more, they provide agents with advanced sales-support tools. For instance, MassMutual Financial Group has developed a mobile app that highlights the customers who are most likely to buy a policy. The system has increased placement rates by 5 percent in 18 months.

Finally, in marketing, companies are using advanced analytics to better model both the likelihood of customers buying a product and the risk of customers cancelling coverage. These companies are also enhancing lead generation and qualification. One global insurer in Asia generates high-quality new prospects for its sales operation through predictive modeling of data from a retail banking partner. The insurer’s advanced algorithm analyzes information about customers’ previous insurance purchases, age, gender, income, assets, and length of relationship with the company to compile a list of millions of sales prospects with higher propensities for buying life insurance. The company expects this new source of leads to constitute 10 to 15 percent of total qualified leads in the future, representing an important source of growth beyond the saturated market of traditional, branch-based customers.

Increasing Market Penetration. Some companies are expanding into new markets with leaner, faster underwriting processes powered by big data and advanced analytics. They are even automating underwriting processes to lower costs, when relevant. This allows insurers and intermediaries to serve new market segments in a profitable way.

Consider, for example, how companies have sometimes been hesitant to sell to the middle market, often defined in the U.S. as households with annual incomes of $35,000 to $100,000. The contracts have traditionally been regarded as too time-consuming to underwrite, and the commissions they produced were too low. Yet the middle market represents billions of dollars in potential annual premiums and serves as a bridge to sales of other financial products, such as annuities. Automating the underwriting and distribution processes for this segment reduces costs and allows companies to profitably sell products with lower margins.

SCOR Global Life, for instance, offers a real-time, fully automated underwriting solution called Velogica, which helps life insurers in the U.S. create affordable products for the largely underserved middle market. Decisions are communicated to an agent in less than a minute in 90 percent of cases, and fewer than 5 percent of applications require human intervention. A rules engine collects and automatically processes external data from sources such as the MIB Group, motor vehicle reports, and prescription databases. More than 1.3 million applications have been underwritten to date with the system.

Deepening Customer Relationships. A few companies are using big data and advanced analytics to extend their offerings with trust-based services that increase the intensity of the customer relationship, gaining mutual benefits for customers and insurers. In exchange for providing more data to insurers, customers receive a product that offers more than simple peace of mind and protection. Companies can also include services that influence behaviors and help people make life-extending changes.

These approaches get around the significant information asymmetry in the life insurance business. Insurers often do not know much about a customer’s health over the life of a policy, and as a result they lack information about the evolution of the mortality risk. Policyholders, on the other hand, often know a great deal—but may not be willing to share it.

Consider how Discovery has circumvented this problem with a wellness and loyalty program called Vitality. Customers who subscribe to the insurer’s program enter information about their lifestyle and health-related behaviors, receive an annual health check, and take other tests to assess exercise, eating habits, and stress levels. Based on their participation in the program and changes they make to their behavior, customers receive Vitality points that they can redeem for discounts at a range of health, fitness, shopping, and leisure-activity partners. Customers who maintain their healthy habits also receive markedly better pricing on the company’s insurance products as an added incentive to sustain their prevention practices.

Customers benefit from discounts, rewards, and a personalized program to improve their health. Insurers gain by receiving a great deal more data to better select risks and generate higher retention and loyalty. And society is well served by the reduction of negative behaviors that account for the vast majority of expenditures related to health.

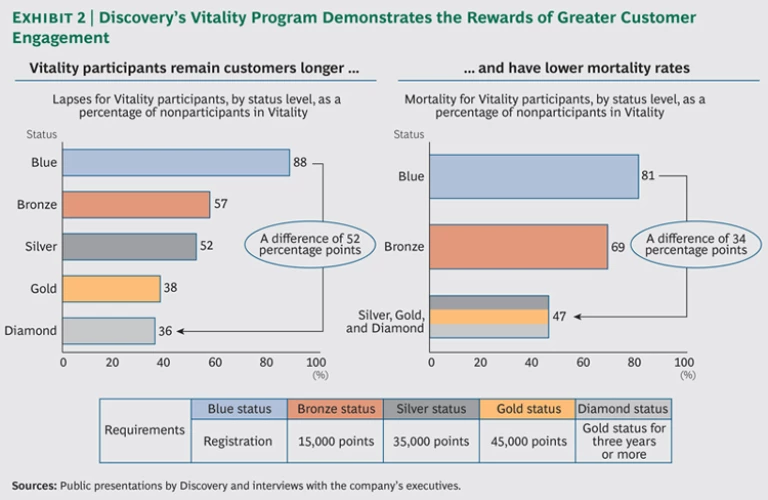

Discovery estimates that it has achieved a reduction in lapsed policies of as much as 52 percentage points and a reduction in mortality of as much as 34 percentage points for most active participants in the program. (See Exhibit 2.) In addition, the company estimates that Vitality has increased operating profits by almost a full percentage point. The program recently expanded beyond its original base in South Africa through partnerships with major insurance companies, such as Prudential in the UK, Humana in the U.S., Ping An Insurance in China, and AIA in Singapore and Australia.

Underwriting New Risks. A handful of companies are on the leading edge, using big data and advanced analytics to underwrite entirely new risks that previously could not be covered profitably and to increase the intensity of the customer relationship. Life insurers used to assess health risks just once, at sign-up, asking questions about lifestyle behaviors linked to a higher risk of mortality. Now, trusted insurers can access data regularly volunteered by high-risk customers in exchange for insurance that had at one point been unaffordable or unavailable.

AllLife provides affordable life and disability insurance to policyholders who suffer from manageable diseases, such as HIV and diabetes, and who agree to adhere to a strict medical protocol. Patients get monthly health checks and receive personalized advice on managing their conditions. With the client’s permission, data is pulled directly from medical providers. If a client does not follow the treatment protocol or discontinues treatment, benefits or coverage can be lowered or cancelled after an initial warning. The company assesses its risk every three to six months, rather than just once.

Clients who have participated in prevention programs have boosted their health and lengthened their life expectancies. Six months after enrollment, the immune systems of HIV patients, for example, improved by 15 percent on average—even without treatment. At the same time, AllLife benefits when clients take voluntary measures to reduce their risk and increase the flow of health information to the insurer.

The company is growing at an annual rate of 50 percent and aims to insure 300,000 HIV patients by 2016. An investor claims that AllLife’s model is highly profitable and that the company’s risk is not much higher for HIV clients than it is for clients who do not suffer from these diseases.

How Life Insurers Can Get Started

These strategies demonstrate that policyholders are indeed willing to share personal data with insurers in exchange for improved customer relationships, lower pricing, richer rewards, or previously unavailable or unaffordable coverage. When insurers add voluntary data from risk assessments (such as health exams) and nontraditional data sources (such as behavioral or unstructured data), they can significantly reduce the information asymmetry that exists between themselves and their customers. They can also open up vital new pathways for growth.

Companies can enhance their ability to generate competitive advantage from these strategies with the following actions.

Start with data-intensive business processes that have clear business potential. In the short term, insurers should focus on the “moments of truth” that occur in situations where companies already have a lot of contact with clients, such as underwriting, claims, and fraud detection. (See “Big Data: The Next Big Thing for Insurers?” BCG article, March 2013.)

Develop proprietary data. In an industry with limited information, the only way to build long-term advantage is to develop one’s own data sets. For instance, automakers using telemetric data from customers’ cars have built a unique value proposition that will be hard to displace. (See “Telematics: The Test for Insurers,” BCG article, December 2013.) Some insurers may gain an advantage working on their own, as Discovery has done. Others, depending on their size and existing capabilities, may need to rely on partnerships to some degree.

Break down information silos. Traditionally, analytical expertise has resided in the actuarial department. But it now often resides in other departments as well. The ideal team should be able to cooperate across departments and should include marketing, actuarial, claims, data science, and legal functions. In some cases, companies may need to give an executive responsibility for exploring new avenues of product design and risk assessment through big data and advanced analytics.

Build trust through mutual benefit. In such a heavily regulated industry, companies must create trust with both consumers and regulators. Insurers must demonstrate how greater access to personal data produces clear advantages for both consumers and society through new products and services. (See The Trust Advantage: How to Win with Big Data , BCG Focus, November 2013.)

The truly transformative potential of these strategies will take time to play out. Over the long term, these approaches will open up important avenues for growth and innovation for companies willing to experiment now.

Insurers that excel at these and other strategies to intensify the customer relationship and move into new markets will catch up to—or even surpass—more nimble companies that are already in the game. They will win the best clients, reduce risk, increase loyalty, and create more opportunities to cross-sell products and services.

The rest will risk falling behind or ceding the most attractive customer relationships and emerging markets to others.