Digitally driven economic growth continues to be one of the few bright spots in a sluggish global economy. Reducing or eliminating numerous factors that inhibit online interactions and exchange could cause this growth to be even faster and could have an even bigger impact. To better understand these sources of “e-friction” and how they constrain economic activity, the Internet Corporation for Assigned Names and Numbers (ICANN) commissioned The Boston Consulting Group to prepare this independent report. The results have been discussed with ICANN executives, but BCG is responsible for the analysis and conclusions.

Origins of e-Friction

Restrictions on international trade inevitably make both sides poorer, Adam Smith declared in The Wealth of Nations in 1776. His observation holds true today, even though Smith could not have imagined the industrial, communications, and digital revolutions that have shaped the intervening two and a half centuries.

The digital revolution has substantially redefined trade in less than two decades, and it continues to be a huge driver of economic activity today, as the developed world slowly emerges from recession and red-hot growth cools in developing markets. By 2016, the Internet economy will have expanded to $4.2 trillion in the G-20 economies. If it were a national economy, it would rank as one of the world’s top five, behind only the U.S., China, Japan, and India, and ahead of Germany. It contributes 5 to 9 percent to total GDP in developed markets; and in developing markets, the Internet economy is growing at 15 to 25 percent per year.

The digital revolution has been a true revolution—propelled for the most part by consumers and forward-looking businesses that have recognized and made the most of the Internet’s potential for societal improvement and wealth creation. They have been able to do so because they faced few restrictions or constraints. A single set of technical rules and protocols enabled anyone who could get online to trade goods, services, ideas, and information with anyone else—anywhere. No tariffs, taxes, or technology controls (other than limits to access) slowed things down. The Internet put a limitless array of products, services, and information at consumers’ fingertips and enabled businesses—with minimal investment—to reach new markets and customers. It both created its own world of trade—think Amazon, eBay, Alibaba, and Rakuten—and vastly accelerated traditional economic activity by enabling more connections, interactions, and transactions, inexpensively and with little regard for physical distance or national borders. It also forever changed the dynamics of interaction between citizens and their governments.

Inevitably, however, as the digital economy has matured, sources of friction—new and old—have taken hold, constraining free exchange and slowing growth. Companies find, for example, that they don’t have the necessary information- and communications-technology (ICT) skills to take full advantage of their e-commerce potential. Small businesses looking to expand online are confronted with data security issues that were not problems in the offline world. The lack of bank accounts and credit cards or the inadequate availability of capital takes on heightened significance as the euphoria of early adoption develops into the steadier business of building the Internet’s range and impact into harder-to-reach locations and demographic and economic sectors. Incumbent players, under threat from new technologies, sometimes look for policy or regulatory assistance to protect their turf. Developing markets face particular challenges and opportunities, given that the Internet can drive both online and offline growth.

Most of these sources of friction are found at the national or local level. They are related to infrastructure, access, cost, and outdated regulations; they are the result of the inability of consumers and businesses to get online and engage with content effectively because of inadequate education, training, or resources; and they are imposed by governments in the form of restrictions on certain forms of content. Some sources of friction are more fundamental in nature than others.

As the Internet has come to play an increasingly prominent role in more and more aspects of economic and social life, it has ignited a debate in many countries over the extent to which certain elements of digital infrastructure, commerce, discourse, and interaction should be brought under greater government control. Some are even talking of the need to turn certain elements of the Internet inward, for example, by determining the location of key servers and routing personal data with greater consideration for national or regional boundaries.

There is potential for fragmentation at multiple levels in how, and by what rules, the Internet is governed. The hierarchy includes the equipment and connections that carry Internet traffic; the protocols that determine how the traffic is routed; issues directly affecting how businesses, consumers, and others interact online; and the current—and highly important—hot-button public-policy questions related to privacy and data protection. Precisely because the Internet is a global network of networks (and the only one we have), the potential is significant at all of these levels for uncoordinated policy to add major new sources of friction.

This report examines the current sources of “e-friction” that can prevent consumers, companies, and countries from realizing the benefits of the online economy. It attempts to assess the breadth of factors that inhibit the growth of the Internet economy and to quantify, on a country-by-country basis, their extent, their impact, and their cost. The free exchange of goods, money, and ideas has enriched individuals and societies since mankind’s earliest days. (See “The History of Trade: Increasing Wealth by Overcoming Barriers.”) Helping countries identify areas of strength and weakness can suggest potential policy responses.

THE HISTORY OF TRADE: INCREASING WEALTH BY OVERCOMING BARRIERS

Since the first time that one collection of goods, a bunch of berries, perhaps, was exchanged for another—a handful of nuts?—trade has been the single greatest creator of wealth in human history. From these small beginnings, trade—and particularly international trade—has had to overcome multiple sources of friction to become the dominant economic force that it is today.

The development of trade is the story of facilitating interaction and reducing costs, thanks to the elimination of all manner of barriers. Most recently, in Bali, the World Trade Organization reached its first comprehensive agreement to simplify the procedures for doing business across borders. History teaches a few lessons as well. Today’s fiber-optic cables trace the trade routes of old. (See the exhibit below.)

In ancient times, travel was difficult, laborious, and dangerous, limiting trade to rare and expensive goods whose resale value justified the expense, work, and risk of transporting them. As trade routes improved and transportation technologies advanced, risk and costs plummeted, and the quantity and diversity of goods soared to include even the most mundane (and, sometimes, surprising) items. Nations have come to recognize the value of trade and reduced or eliminated the tariffs that inhibit it. Advances in technology—steamships, railroads, shipping containers—have helped overcome physical distances and enhance efficiency. The telegraph and the telephone facilitated dealmaking and arranging logistics. Today, the U.S. exports waste to China, where it is recycled for use in carpet manufacturing. The resulting rugs are imported by—you guessed it—the U.S.

The Internet is the latest step change in the expansion of trade. The Internet can almost entirely eliminate transportation costs and risks in the exchange of information and services. The sheer volume of transactions—never mind such constraints as distance and complexity that can now be overcome in their execution—would have been inconceivable even a decade or two ago. Yet, the potential of the Internet to expand trade further—and to continue to create wealth—remains substantially untapped.

A second major benefit of the Internet, as with any network, is difficult to measure in hard economic terms. The integration and interaction of participants on the Internet enable the easy exchange of ideas, information, friendship, and fun—in this case, without regard for physical location. The addition of each new participant or group of participants to the network expands the potential benefit for the others, because he, she, or they bring new sources of ideas and information to the party. The potential for commercial exchange—trade—is one key benefit, but only one. Marco Polo transported exotic spices from the East, but he also carried stories and experiences of peoples and cultures that enthralled his fellow Europeans as much as the goods in the holds of his ships. The sources of e-friction (as well as the potential for Internet fragmentation) undermine these benefits just as they do e-commerce.

Because of the importance of small and midsize enterprises to so many economies worldwide, we’ve also taken an in-depth look at the impact of the Internet on the performance of SMEs. Throughout the world, SMEs are responsible for a large portion of economic activity and are the primary drivers of job and GDP growth. Since the recent recession, many countries have struggled to create jobs and stimulate strong economic growth. Our research suggests that greater use of the Internet could boost both growth and employment.

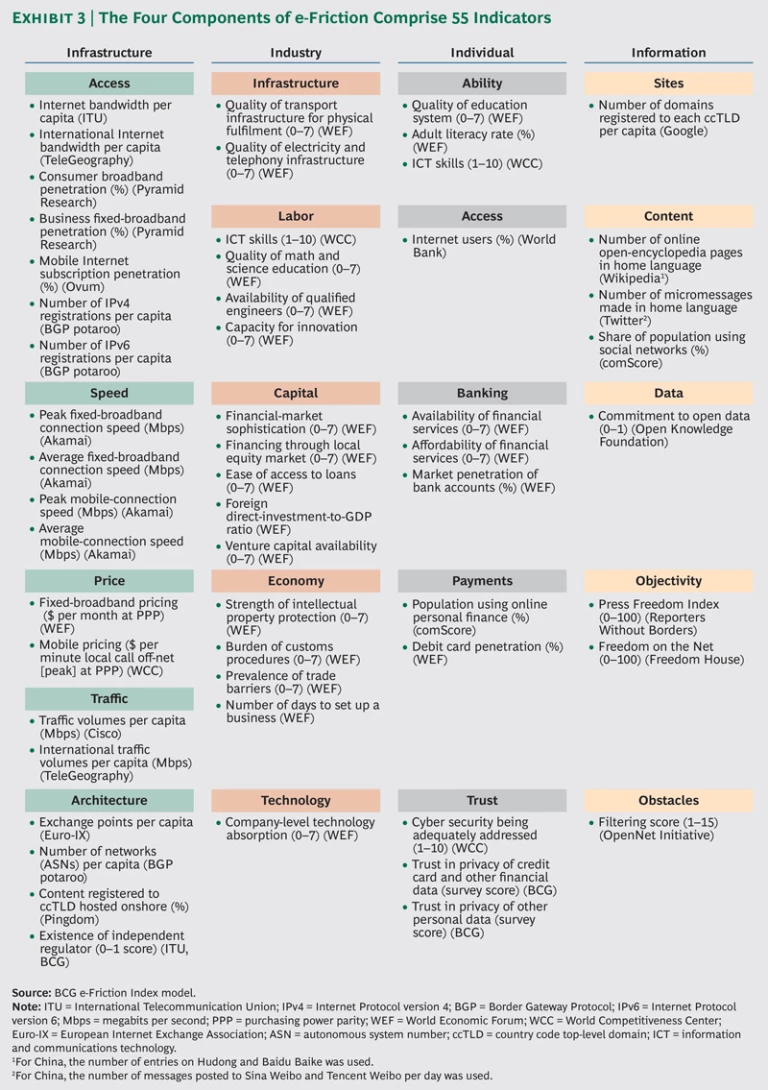

We have identified a healthy number of e-friction indicators—55 to be precise—that unhealthily inhibit online activity by consumers, businesses, and governments themselves. Their impact varies. But by measuring, weighting, and combining them into a single set of scores, we can present an assessment of the overall e-friction that countries may face in developing their own Internet economies and participating more fully in global economic life on the Internet.

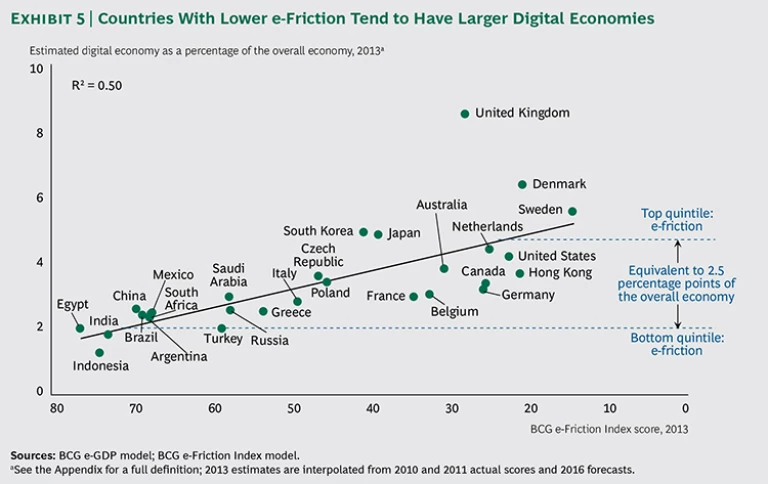

The digital economy accounts for a larger share of the overall economy in low-friction countries than it does in high-friction countries. The difference is about 2.5 percent of GDP. Although there are many reasons for this discrepancy, high-friction countries can start closing the gap by identifying and addressing the sources of e-friction. This has the potential to add significant value to their economies.

Adam Smith observed, and history has shown repeatedly, that reducing economic friction to facilitate trade produces huge benefits for both countries and their citizens. In the following pages, we present an analytical framework for assessing the impact of e-friction. The purpose of this report is to make it easier for those with an interest in the health and growth of the online economy, such as policymakers and businesses, to “grease the wheels” by reducing the friction that affects today’s Internet economy.

The State of e-Friction Around the World

We define e-friction as the factors that can inhibit consumers, businesses, and others from fully participating in the national—and the international—Internet economy.

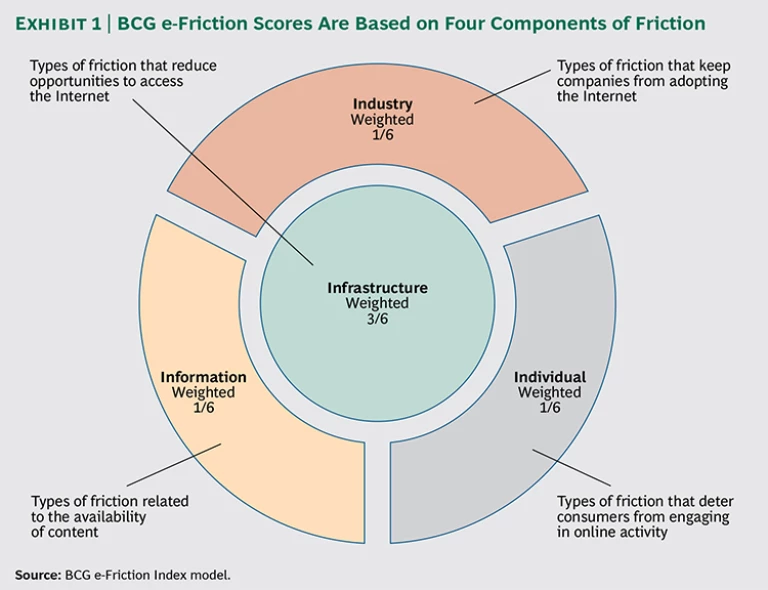

The BCG e-Friction Index assesses 55 indicators of friction that inhibit Internet use. We have grouped them into four components: infrastructure-related friction that limits basic access; industry sources and individual sources that affect the ability of companies and consumers to engage in online transactions; and information-related friction that involves the availability of, and access to, online content. (See Exhibit 1.)

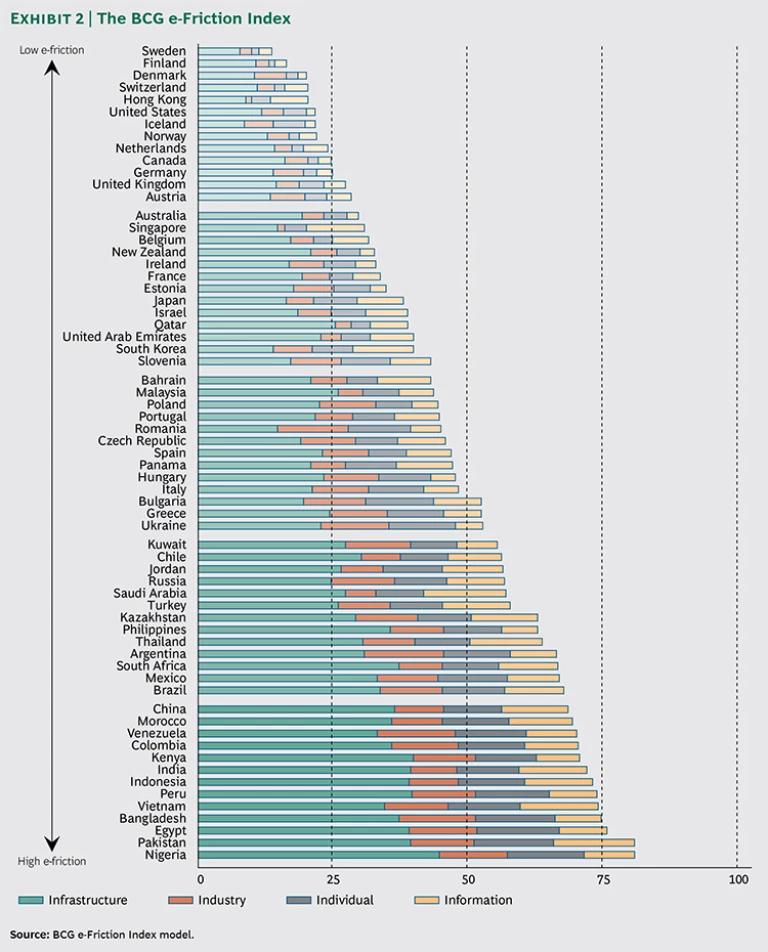

No economy is entirely frictionless, of course, and sources of friction evolve over time, but a hypothetical country that comes out on top on all 55 friction indicators in our index today would score 0; one that ranks last across the board would score 100. We scored actual countries against these baselines. With an e-friction score of 14, Sweden’s Internet economy has less e-friction than any other country; Nigeria, at 82, has the most of the 65 countries covered. (See Exhibit 2.)

The difference between the top and the bottom is wide. The countries in the top quintile—those with the lowest e-friction—tend to earn good scores across all four components of the index: strong infrastructures and supportive business and regulatory environments have created vibrant Internet economies. The Nordic nations are leading examples. The high rankings of Switzerland, the Netherlands, and Singapore reflect their international connectedness; they are all long-standing open-trade economies. At the other end of the scale, problems related to basic access, price, and speed—common in developing economies—are widespread, as are shortcomings related to capital, labor, and consumers’ ability to conduct business online.

By far, the most significant sources of friction are related to infrastructure factors—access and cost, for example. If access is thwarted by inadequate or expensive infrastructure, consumers and businesses cannot realize any benefits from being online. For this reason, this component receives three times the weighting of the others and accounts for half of the overall index. But this is not the whole story. The remaining half of the index is divided evenly among the other three components: industry, individual, and information. If these friction sources prevent businesses and consumers from using the Internet infrastructure to conduct trade, then there is no online economy.

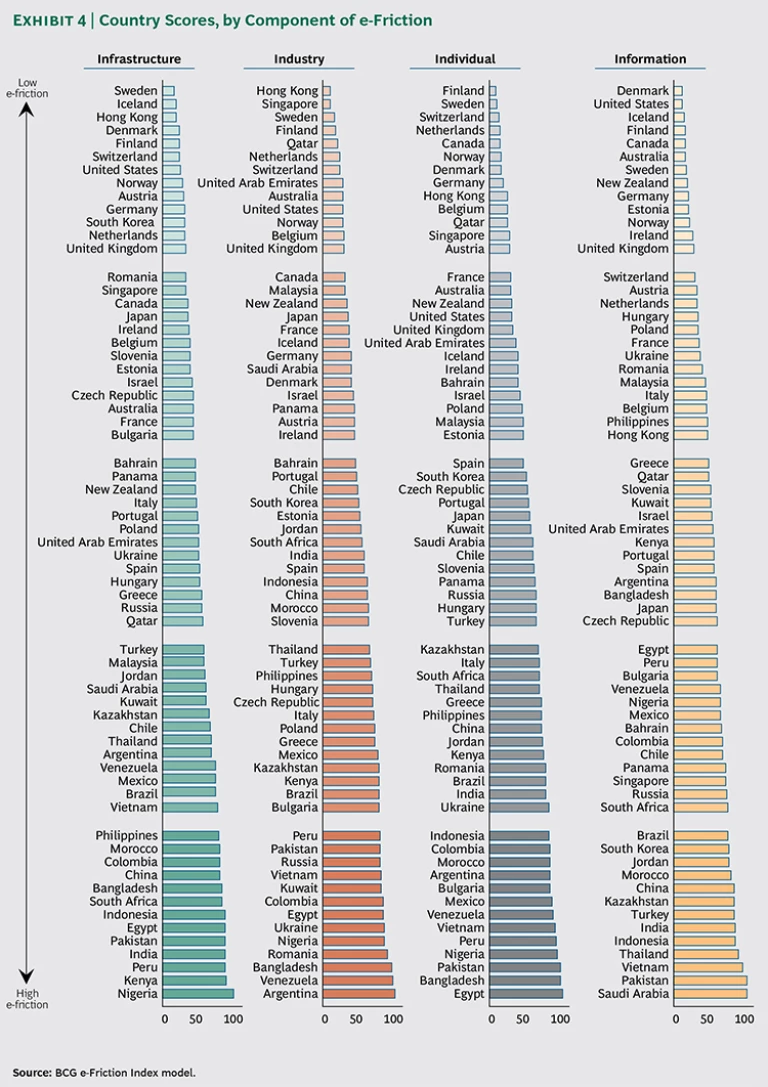

The 55 indicators are interrelated and work together to determine the overall friction affecting the digital economy of a particular country. (See Exhibit 3.) Each country can gain an understanding of how it compares with neighbors and competitors by assessing its rankings across the different types of friction. (See Exhibit 4.) It can thus determine where its efforts to eliminate sources of friction might best be aimed.

Infrastructure Friction

The sources of infrastructure friction include those that prevent users from readily accessing the Internet, such as fixed- and mobile-broadband connections, bandwidth speeds, and pricing, as well as factors related to architecture, such as the number of networks, Internet service providers (ISPs), and Internet exchange points (IXPs)—the data centers where networks connect and exchange traffic. Many countries do not have their own domestic IXPs, which slows speeds for users and raises prices. Mexico is one example. Much of its content ends up being routed through the U.S., limiting the consumer experience and making it more difficult for local ISPs, which are unable to exchange content domestically, to develop a competitive Internet offering.

Given this component’s 50 percent weighting, a country’s ranking in the infrastructure component has the biggest impact on its overall standing in the index. The Nordic countries rank high for this component, along with other Western European nations, the U.S., and several developed Asian economies. Multiple countries from the former Eastern Bloc, including Estonia, the Czech Republic, Bulgaria, and Slovenia, also earn good infrastructure-friction scores: they have made a priority of building out their Internet infrastructure in recent years.

For countries at the other end of the spectrum, development of Internet infrastructure falls mostly in line with broader development indicators. It should be noted that in many less developed markets, however, the measures of mobile-Internet penetration (mobile subscriptions per capita, for example) perform much more strongly than fixed-line indicators because, as has been well documented, these countries tend to have “gone straight to mobile.” The higher rankings of countries such as South Africa, India, and Indonesia on noninfrastructure components of friction indicate that addressing infrastructure issues could have a big impact on reducing overall e-friction.

Industry Friction

Industry-related sources of friction—such as workforce ICT skills, trade barriers, access to capital, and the strength of intellectual property protection—hold back successful online business operations. The strongest performers are countries with well-developed markets for international trade and a domestic business environment that fosters innovation and creativity. Open economies with traditionally liberal attitudes to trade perform well on this score. For example, Singapore and the Netherlands—both nations with long histories of trade—continue to rely heavily on international trade to complement local specialization. The United Arab Emirates and Qatar score well on this component also. Other countries in the top quintile, such as the U.S. and the U.K., have highly advanced financial markets. Conversely, while several of the lower-ranking countries are big exporters of natural resources, their local business infrastructures are not as developed as their energy capabilities. In other low-ranking nations, burdensome customs procedures and restrictive import and export policies hold back online trade.

Individual Friction

These sources of friction obstruct consumers’ interaction with the Internet economy. They include ICT literacy and access to and affordability of financial services. The prevalence of online payment systems, a big e-commerce enabler, and the level of trust consumers have in how personal data will be used on the Internet are key indicators for consumer-related friction.

Top performers include countries with a combination of high rates of access, literacy, ICT skills, and trust, as well as highly developed banking and payment systems. As we have written elsewhere, we expect the trust factor to be an increasingly significant point of friction in determining the extent of consumers’ use of

Lack of literacy and consumer trust hurts lower-ranking countries, which tend to perform badly across these subcomponents. Education and ICT skill development are long-standing issues in developing economies, with implications that extend well beyond online interaction. Internet-based learning and training programs are beginning to have an impact, but they lead to a chicken-and-egg question: Do people need to learn to get online or get online to learn? Similarly, the development of mobile banking and payment systems in countries such as Kenya are making the first serious inroads into long-standing problems of access to financial services.

Information Friction

To measure information-related friction, we looked at the volume of content available in the local language (using such proxies as online open-encyclopedia pages created in the local language and volume of local-language micromessaging), the commitment to Internet openness and press freedom, and obstacles to accessing certain types of content. Again, the Nordic countries rank high; they are both big content creators and proponents of openness in the exchange of ideas. Those nations that screen content or block access in certain areas fall down in the rankings on this score.

The Economic Impact of e-Friction

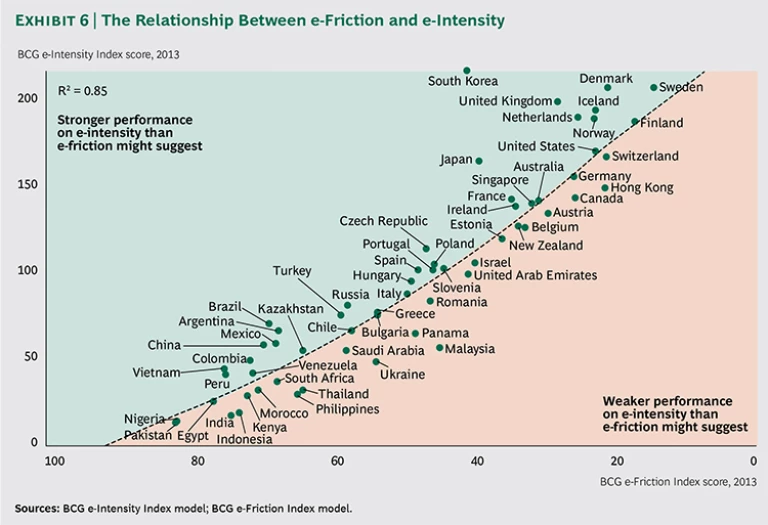

Our analysis found a significant correlation between low e-friction and high

Some highly developed trading economies score well for both e-friction and e-intensity even though they earn lower scores for the information component of e-friction.

Sharp eyes will note a few outliers. South Korea, for example, has an active digital economy and tops the e-intensity rankings as a result of its strong performance on the measures of enablement and expenditure. However, the same country sits in the second quintile for e-friction. While South Korea’s Internet culture is exceptionally mature and vibrant, it also tends to be relatively insular, with low international traffic volumes per capita and a very high proportion of domestically hosted content.

The U.K.’s enthusiastic embrace of e-commerce contributes to its active online economy. Some retail chains in the U.K. are even foregoing brick-and-mortar stores entirely. Grocery “dark stores” cater exclusively to the delivery of groceries purchased online, and many large general-goods retailers are moving toward the maintenance of their online presence only.

With low e-friction but only moderate e-intensity, Malaysia may be a case of a country in transition. Malaysia’s weakest performance is on the infrastructure score: it falls into the fourth quintile, compared with the second quintile on each of the other three components. However, given a regulatory mindset that favors a frictionless Internet economy—and business and consumer environments capable of fostering it—Malaysia’s e-intensity score will likely improve dramatically in the years to come.

China has developed a large domestic online-commerce market that is growing at an astonishing rate. Government commitment to advancing inexpensive universal fixed-broadband access, complemented by a culture of shared Internet infrastructure, has contributed to Chinese consumers’ enthusiastic embrace of online commerce. In fact, 80 percent of China’s online trade is classified as

In addition, there are significant differences, particularly with respect to infrastructure, between urban and rural areas in large countries such as China. Could we measure these discrepancies, we would expect to find urban e-friction to be significantly lower. These factors are likely reflected in China’s overperformance on e-intensity compared with its performance on e-friction, which is also driven by its ability to capitalize on its sheer size to overcome friction that would weigh down a smaller nation. Simply put, because of its vast domestic market, China can do things on its own that other economies can’t.

GDP is one measure of economic strength, but many forms of digital activity are not directly captured in this figure. Goods that consumers research online and purchase offline (ROPO) are one example. Other BCG research has shown that ROPO purchases represent approximately 8 percent of consumer spending in the G-20 nations. Indeed, ROPO spending is higher than online retail in virtually all these countries and seems likely only to increase with the growing popularity of mobile apps and mobile shopping. In addition to facilitating consumer-to-consumer commerce and the sharing economy, the Internet is also having a big impact on how enterprises interact with one another. Business-to-business e-commerce is growing fast worldwide. Forrester, a research firm, expects 2013 business-to-business e-commerce sales in the U.S. alone to exceed $550 billion. Low e-friction spurs activity in all of these areas, compounding the economic benefits.

The Impact of e-Friction on SMEs

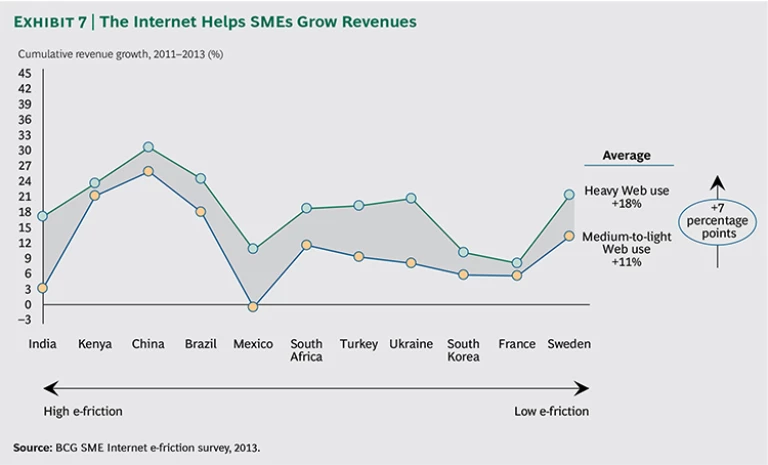

BCG research over the last several years has shown repeatedly that SMEs benefit from the adoption and use of Internet and online tools, especially in terms of revenue growth. SMEs that are heavy Web users grow faster than their counterparts. The research we conducted with 3,250 SMEs in 11 countries for this report showed once again that the Internet is a high-impact technology for

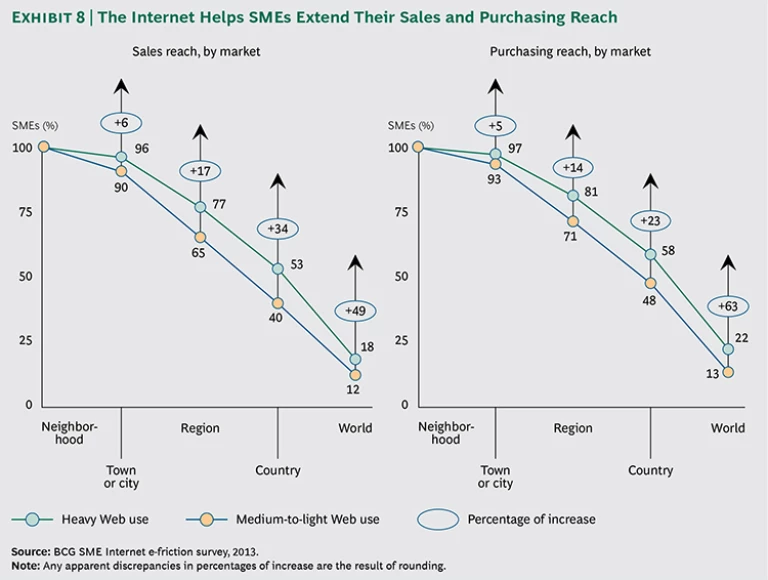

The Internet helps SMEs both sell and buy goods and services more widely, furthering SMEs’ integration into their national and the global economies. Any business that goes online has immediate access to a nearly limitless universe of customers (and potential suppliers) domestically and around the world. SMEs that are heavy Web users are almost 50 percent more likely to sell products and services outside of their immediate region and 63 percent more likely to source products and services from farther afield than are medium or light Web users. (See Exhibit 8.)

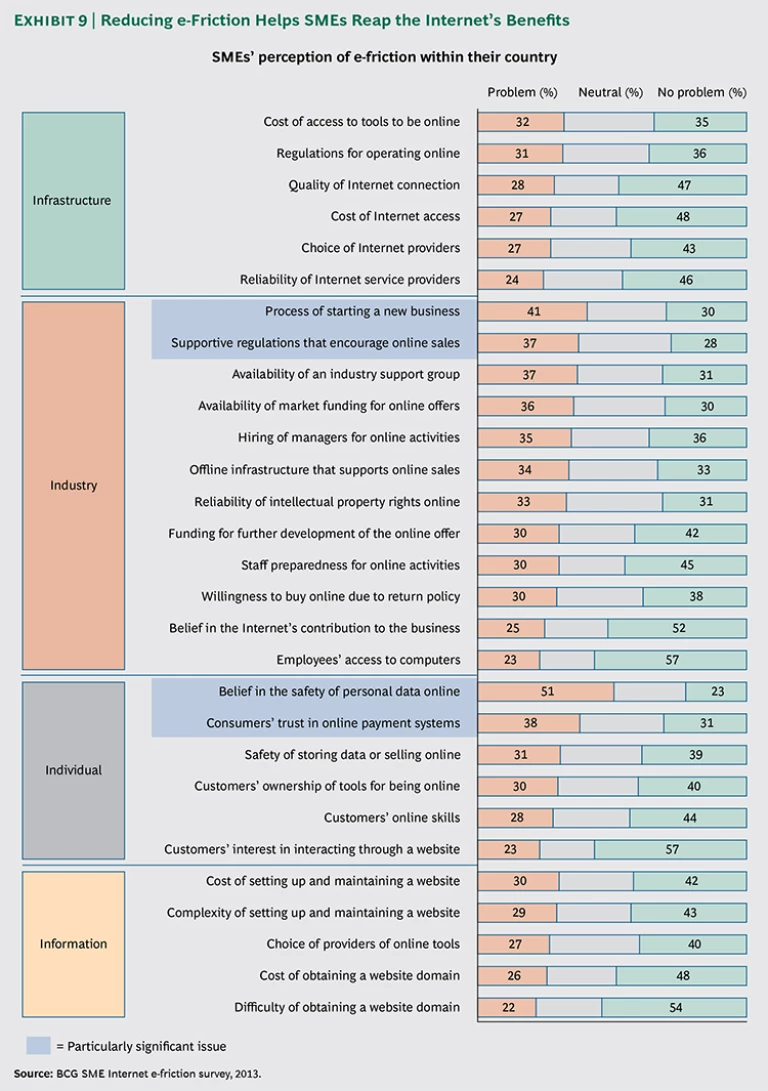

However, SMEs encounter a range of friction types that slow or prevent them from fully exploiting the Internet’s potential. Their biggest single concern is the protection of consumer data online—a prevalent issue for consumers as well and one that needs to be addressed on a global basis. (This topic is addressed in the next chapter, “ Smart Policy (and Policymakers) Can Reduce e-Friction .”) Furthermore, many SMEs are concerned about the process of starting a new business, trust in online payment systems, and regulations that affect online sales. Structural issues, such as cost and connection quality, are also of concern in some markets. (See Exhibit 9.)

SMEs in high-friction countries generally lag behind SMEs in low-friction countries in their level of Internet adoption and use. But once online, SMEs in high-friction countries are enthusiastic about the benefits and seem as quick as SMEs in low-friction countries to adopt even sophisticated online tools. Online SMEs in all countries report major benefits from the Internet in distribution, marketing, and the range of products they are able to stock and sell. They also place a high value on websites. (See “SMEs Ramp Up Online.”)

SMES RAMP UP ONLINE

In our conversations with SME owners and executives, we are repeatedly struck by how innovative businesspeople who are dealing with limited financial and human resources, especially in emerging markets, find solutions to all manner of problems to keep their companies growing and moving forward. More and more, these solutions are Internet based. Here are three examples.

Dowhile. A South African graphics and Web design firm, Dowhile started in a Soweto shack with no Internet connection. The company’s work was done offline and uploaded using a connection at a Web café, says owner and founder Dennis Ngwepe. The young startup marketed its services through pamphlets and word of mouth.

Having moved to an office in Johannesburg, the company now has a low-speed Internet connection that enables it to maintain a website and conduct online marketing. It also uses the Internet for training. “Having an Internet connection also means learning on demand and for free with tutorials, as opposed to paying for offline classes as we did every week before,” Ngwepe says.

He attributes 100 percent of the company’s recent growth to being online, but he thinks that the company has not achieved its full potential because of prohibitive costs. Dowhile can’t afford a high-speed broadband connection, and the slow speed of its connection means that it cannot make use of applications such as remote working, cloud sourcing, real-time video conferencing, and Internet telephony. Ngwepe is hoping that the cost of broadband will drop so that he can continue to expand his business online.

Sonitus Engenharia. This Brazilian automotive-engineering company attributes about 30 percent of its growth to modernization and organization that have resulted from the implementation of online tools. A customer-relationship-management program, as well as related tools to increase the quality and efficiency of processes and communications, has facilitated negotiations and transactions with both clients and suppliers. The full impact of these tools, however, relies on overcoming some staff skepticism—an inevitable challenge when some employees have been with the company for its full 27-year history. Training is essential to support the transition but is constrained by a lack of budget and by competing priorities. The company also needs to invest in online data security. Currently, to avoid unauthorized access, Sonitus Engenharia keeps sensitive client data on local computers with no Internet connection. The establishment of a new U.S. office may lead to further investment in online tools.

The main issue is cost. “We are definitely willing to increase the use of online tools,” says Flavio Quintela, sales and management director, “but there’s not enough budget now to invest.”

Systronic. A French supplier to the aviation and space industry, Systronic depends on the Internet to interact with its customers, particularly to exchange product design and development data. Owing to the size and type of files, it is difficult to work with the data offline, but security concerns limit what the company can do and impose complex and strict processes for sending and receiving information. “We would like to give our suppliers access to our stock levels and have access to our clients’ stock levels to create a more efficient supply chain, but for data security reasons, our clients would never give us such access,” Philippe Pernot, the company’s CEO, says. “The capability to share information securely would help us to run a better business.”

Smart Policy (and Policymakers) Can Reduce e-Friction

The Internet presents policymakers with a daunting challenge. Like energy and transportation systems, the Internet is a critical infrastructure with a mighty economic impact that is growing explosively, constantly mutating, intrinsically global, and built on a complex technical core that is invisible to the lay user. All of this makes it hard for the nonspecialist to truly understand all of the key issues and tradeoffs. Many proclaim the need to support the burgeoning Internet economy, but levels of concern around openness and e-friction—and prescriptions on how best to tackle the problems—vary sharply.

History offers some lessons and some answers. In many ways, the development of the online economy mirrors the development of the offline economy; trade on the Internet mirrors the development of trade in the physical world. That said, there are few universal solutions, and determining which steps countries and companies should take depends to a high degree on where they stand today. As our index indicates, the impact of different types of friction varies widely around the world.

Decision makers are, however, far from helpless. Indeed, good policy in a few key areas can have a significant impact on the sources of e-friction and can speed the development of Internet use and individual countries’ Internet economies, just as agreement on critical standards and protocols can enable or cripple new technologies. (See “Standards: The Great Enablers.”)

STANDARDS: THE GREAT ENABLERS

The 2014 World Cup would not be kicking off in Brazil if there were no common set of rules for football. The world’s most popular sport has been played off and on since ancient times, but the game’s popularity was unleashed—and the first international match played—only in the late nineteenth century, when a standard set of rules was finally established.

Efficiency, in an economy as in sport, requires standardization—agreement on interfaces and exchanges and on the way certain tasks, particularly highly repetitive tasks, are accomplished. Without such basic conventions—for example, on which side of the road cars should be driven, measurements, the size of the thread of a screw, the size and shape of electrical plugs and sockets—confusion, if not chaos, would reign. Without a common set of standards and protocols, computers cannot communicate with each other and interact.

A lack of standards hampers efficiency by increasing transaction costs on both manufacturers and consumers. Consider trains that meet at the Russia-China border. Different railway gauges on either side mean that the goods and passengers from one train must be carried by some other conveyance to the other train before their journey can continue. Disagreement among nations on three of the four examples cited above creates friction, adds cost, and slows things down, while broad agreement on screw thread size means that screws can be manufactured in one place and used in another with no worries over whether they will do their job.

Standards are no less essential in the virtual world than in the physical one. Indeed, agreement on the technical protocols governing such matters as routing and encryption makes the frictionless virtual exchange of information possible. The same is true for coordinated approaches to, for example, Internet addresses, domain names, and the tagging of data packets. The value of any network is rooted in the whole’s being greater than the sum of its parts, but this value is realized only when the parts can all function together without friction.

In many areas, the nature of the need can be readily assessed. A committee of the European Parliament, for example, has observed, “Gaps and differences in EU member states’ laws governing online trading or inconsistent enforcement of rules, as well as inadequate digital infrastructure, are preventing EU firms and citizens from reaping the full benefits of the digital single market and causing the EU to fall behind the global competition.” It cites the fact that only about 7 percent of Internet users have placed a cross-border order within the EU. The solutions, likely involving both national and pan-European legislation and regulation, will be difficult to design. But in Europe, as elsewhere, focusing first on the biggest sources of e-friction is the best start.

Infrastructure and Education First

In economies throughout the world, in developed as well as developing countries, availability of affordable speedy online access—meaning the ability to get online and do things quickly and inexpensively—is still the number-one friction point. Countries that fail to address issues of access have little hope of furthering their Internet economies.

Policies that promote investment, especially in infrastructure, are essential. Many economies that rank high on both the BCG e-Friction Index and the BCG e-Intensity Index —Denmark, South Korea, and Sweden, for example—have long had active programs that encourage Internet enablement and engagement. More recently, a number of European countries—among them Estonia, France, Greece, and Spain—have declared Internet access to be a fundamental right of all citizens. Finland has legislated a connection speed of at least 1 megabit per second as every citizen’s basic right. Fiber-optic broadband projects have led to higher-than-average penetration in such countries as Estonia and Slovakia, where rates approach 30 percent, compared with an OECD average of less than 14 percent. As a result, access is much cheaper than in developed nations.

Despite some bright spots, the overall picture in Europe is clouded, especially with respect to mobile communications. By 2014, investments in European mobile-infrastructure equipment will have fallen 67 percent since 2004. European long-term-evolution (LTE) spending per subscriber is half that of Japan and the U.S. No surprise, then, that LTE accounted for less than 1 percent of mobile connections in Europe at year-end 2012, compared with 11 percent in the U.S. and 28 percent in South Korea. The situation is not much better for fiber access. As we have argued previously, without comprehensive reform, the EU’s vision of the Digital Agenda for Europe, meant to boost the economy and “enable Europe’s citizens and businesses to get the most out of digital technologies,”

Several emerging economies are addressing structural e-friction issues—and demonstrating how much impact such efforts can have. Senegal has built a digital-telecommunications infrastructure and a widespread network of “telecentres” and Internet cafés. EASSy, a submarine fiber-optic cable system deployed along the eastern and southern coasts of Africa, went live in 2010 and delivers nearly 5-terabit-per-second access to 21 countries, making it increasingly affordable for Africans to have access to the global Internet. Main One’s cable system, which links West Africa with Europe, was the first submarine cable to bring open-access broadband capacity to multiple countries in West Africa.

In October 2012, Net One launched YahClick in Angola “to deliver an Internet service through satellite at a low price, providing an easy access to all Angolans.” Although Kenya still ranks in the fifth quintile of our e-friction index, fiber-optic connections have brought down prices and expanded broadband access. The country launched its second IXP in 2010. Nearly 12 million of the country’s 40 million people now use the Internet—three times the number in 2009. Kenya’s fast-growing IT sector, nicknamed Silicon Savannah, already accounts for 5 percent of the country’s GDP, and the government has targeted its growth to a 35 percent share.

Smart government policies can help create the kind of economic environment that facilitates greater investment for expanding access and reducing cost. For example, governments can do the following:

- Play an aggressive role in spectrum planning and spectrum usage, the fastest way to drive mass mobile-Internet adoption.

- Take a long-term view on investments in broadband infrastructure—a view based on a clear understanding of how good infrastructure helps increase education levels and drives economic growth.

- Think strategically about how and where to build scale. The natural inclination is to focus on political and financial capitals, but faster growth may result from investing in existing wired hot spots and expanding from this base.

- Regulate deftly. Governments can help kick-start use, but they should be careful not to keep the private sector from taking the ball and running with it.

Perhaps even more than in the industrial era and information age, in the era of the Internet, the economy requires a well-educated and skilled workforce. In the developing world especially, it is essential to establish policies that emphasize education, training, and skill building. Even in many developed markets, training that builds ICT skills is increasingly important. Countries that fall behind in providing educational opportunity are likely to lose out to others in Internet-driven economic growth.

Policymaking at Internet Speed

Digital technology and the economic activity it drives are evolving at speeds that far exceed the ability of traditional policymaking structures and approaches to keep up. Mobile has gone from a nascent to near-dominant online technology in a few short years. Social media barely existed a decade ago. Policy responses that fail to take into account how quickly technologies—and the innovations they enable—evolve can cause friction. Complicating matters further is the fact that the Internet is a global phenomenon, and many of the concerns to which it gives rise are also global in nature. They require some form of global, coordinated policymaking solution.

In developing their own Internet strategies, governments need to follow an adaptive style, relying on experimentation and adjustment, starting with current circumstances, and taking into account national strengths. Adaptive strategy encourages experimentation with different approaches, selecting the ones that appear to work and giving them room to grow in impact. Countries with low e-friction scores have tried out such policies as light-handed regulation or targeted tax incentives, subsequently stepping aside to let the resulting innovations flourish. They have pursued industrial policy that seeks to mimic the rapid innovation cycles of Internet-based business models.

It is just as important that governments set out guide rails—signaling the types of policy that they won’t pursue—so that they can resist political pressures to react. Such “untouchable” areas might include the autonomy of the regulatory system, editorial independence and media freedom, competition and the primacy of consumer interests, and arm’s length public funding for content.

Policymakers can learn from the successes of other countries. They can allow competition among alternative approaches and natural selection, and they can foster the conditions that allow selection to occur cleanly and promptly. Not hampering business startups and encouraging ready access to capital are two examples, as are periodic policy reviews and policy expiration horizons.

Mobile is one example of where an adaptive approach can help in an area of fast-moving advancement. Developing economies in particular are taking advantage of mobile’s rapid growth and the opportunities it offers (along with social media and cloud computing) to leapfrog developed nations. Unshackled by legacy infrastructure or embedded commercial interests, developing economies can take advantage of the next waves of innovation and climb up the digital curve more quickly. (See “Regulating Disruption: Making Real-World Policy at Startup Speed.”)

REGULATING DISRUPTION: MAKING REAL-WORLD POLICY AT STARTUP SPEED

The Internet has not only disrupted existing markets, it has also created entirely new markets, giving rise to important questions related to, for example, regulation, taxation, consumer protection, safety, and privacy. Many of these present new and unfamiliar challenges for policymakers.

Take the so-called sharing economy, which allows owners of idle assets, such as spare rooms or unused cars, to rent them to others. This new marketplace, made possible entirely by the online exchange of information, is exploding.

Airbnb, for example, a Web-based service through which users rent rooms in other people’s houses or apartments, lists 500,000 properties in 192 countries and had more than 10 million clients as of the end of 2013. RelayRides provides a similar peer-to-peer marketplace for car rentals. The company claims owners can make $250 a month or more renting their cars when they are not using them.

Numerous other peer-to-peer companies are springing up almost daily in areas ranging from office space rentals to dog walking. Consumers are able to find best-available deals, and the two sides can read about and review one another, reducing transaction costs and information asymmetries inherent in rentals and creating markets where none had existed before. One estimate pegs the value of the consumer peer-to-peer rental market at more than $25 billion.

The appeal of this new model to consumers and small entrepreneurs is undeniable, but so are the myriad legal, regulatory, and policy issues it raises, each one of which represents a point of friction for companies and users. Safety, liability, insurance, taxation, and handling of personal data are just a few of the areas in which questions arise in these new markets. The impact of these businesses on incumbent players, such as hotel chains and car rental companies that are subject to completely different sets of rules, is another.

Current regulatory frameworks, designed primarily for totally different kinds of business-to-consumer and business-to-business markets, do not suit consumer-to-consumer marketplaces—or other newly developing business models. Given the speed at which new markets have mushroomed, it’s hardly surprising that lawmakers and policymakers have been slow to keep up. Uncertainty is a major source of friction: it slows things down. More and more disruptive businesses continue to spring up on the Internet, requiring policymakers to take speedy action to clear up the friction that can result from legal uncertainties and impose a huge drag on innovation in the Internet economy.

Can Consumers Continue to Trust Online Interactions?

Our research into consumers’ attitudes toward doing things online shows that, in many cases, consumers are ahead of both businesses and policymakers in their use of digital and social media and their desire for more, better, and easier digital interaction. We have also found, however, that a significant issue of trust with respect to the use of personal data underlies these interactions. Although the degree of intensity of concern varies by country, this issue transcends national borders. There is a temptation to act locally, but this is likely to create additional significant friction. Because the Internet is a global phenomenon, this is a global issue, and it cries out for a comprehensive, global solution—not a fragmented approach. The need is urgent. If this concern is mishandled, falling trust could have a chilling effect on consumers’ digital engagement.

From a policymaking perspective, we believe that personal data are best viewed as a tradable asset, like water, gold, or oil. And like these assets, personal data must be governed by a set of trading rules that allow for mining, sharing, and utilization. Unlike tangible assets, however, personal data are not consumed when used. Instead, use increases value: new data-mining and big-data technologies are leading to new ways to use and create value.

As a consequence, the approach to establishing trading rules—and the rules themselves—must be different from that for other asset classes. We have argued previously that the rules have to be complex enough to encompass the extensive and diverse ways in which data can be used and flexible enough to adapt to data’s new uses that are being invented almost

Policymakers and other stakeholders need to consider concrete steps that focus on three areas: upgrading protection and security, agreeing on rights and responsibilities for data use on the basis of context, and driving accountability and enforcement.

The Choice for Businesses

Businesses need to make a choice. They can rise to the challenge of a new Internet-driven marketplace—and benefit from the expanded capabilities and higher growth rates that many companies are already achieving. The alternative is to follow in the footsteps of such industries as music and publishing, which held on to outdated business models for too long and are now dealing with competitive environments that have been reshaped around them. (See “The Benefits of Online Marketplaces.”)

THE BENEFITS OF ONLINE MARKETPLACES

Just as electronic networks transformed financial trading in the last quarter of the twentieth century, bringing greater liquidity, lower costs, tighter spreads, and improved access to financial markets, the Internet in the first quarter of this century is giving rise to more open and transparent marketplaces for all manner of goods and services.

Online marketplaces such as Amazon, eBay, Rakuten, and Taobao have taken off in the business-to-consumer and consumer-to-consumer sectors. Financial analysts project Amazon’s 2013 sales will approach $75 billion. On November 12, 2013, China Singles’ Day, sales on Alibaba Group’s two e-commerce platforms, Taobao Marketplace and Tmall, set a one-day record of $5.7 billion (RMB 35 billion). Marketplaces have been slower to gain traction in the business-to-business sector, but that is changing quickly with multiple new players disrupting business supply chains around the world just as they have transformed retail sales.

Marketplaces are successful for the simple reason that they bestow multiple benefits on all participants. Consumers benefit from transparent and dynamic pricing, as well as a nearly infinite array of goods and services that are available from a wide range of vendors at a single location, which reduces their transaction costs. Merchants and manufacturers gain access to new markets and new customers with minimal incremental investment in marketing. Manufacturers have the opportunity to sell direct, many for the first time, eliminating one or two middlemen. Marketplaces themselves benefit from their own sales and from taking commissions earned by providing avenues for others to trade.

So far, marketplaces are principally national trading venues. Amazon operates websites for ten countries (and ships to others), but the amount of truly global-marketplace business is just getting started. Financial exchanges were once limited by national borders, too. Governments were unsure about opening financial-market access to international investors, and incumbent exchanges initially resisted the digitalization and globalization of markets. It did not take long for these friction points to fade. Today, just about any financial instrument can be bought and sold worldwide in an instant.

Similar debates are taking place now with respect to the further digitalization and internationalization of trading in other goods and services. The issues range from the setting of commercial agreements among countries and harmonization of regulatory requirements to tax frameworks for online trade and the creation of digital payment systems that can operate across borders. The transformation of the financial markets in relatively short order demonstrates the massive benefits of reducing such friction points in the Internet economy and allowing global marketplaces to achieve their potential.

For those willing to think big, embrace change, move quickly, and organize differently, there are countless opportunities for reaping the rewards of the Internet’s creative destruction (as defined by economist Joseph Schumpeter rather than by Karl Marx) in industries ranging from health care to retail and consumer goods.

In the best of all worlds, given that the Internet is a global phenomenon, governments and other participants would act in a coordinated manner, working toward international standards when they are called for and toward cross-country agreements to limit intervention when it is better to let the free market do its own work.

This is a high bar, to be sure. Those policymakers who seek to advance their countries’ economies will remember Adam Smith’s admonition about restrictions and seek to facilitate an open and competitive environment that enables everyone to tap into the economic benefits of the Internet.

Acknowledgments

This report would not have been possible without the efforts of BCG colleagues Lauren Daum, Camila Penazzo, and Matthew Richardson. In addition, the authors are indebted to Philip Evans and to numerous other colleagues and external experts for their support and guidance.