Over the past five years, the travel and tourism sector has delivered strong value creation worldwide, thanks to the global economic recovery and increasing travel by people in emerging markets.

In 2014, as in past years, The Boston Consulting Group conducted an annual study of total shareholder return among 1,620 publicly traded companies in 26 industry sectors, of which 68 were in the travel and tourism

Overall, from 2009 through 2013, the travel and tourism companies in our sample returned an annualized TSR of 20 percent. The sector ranked fifth among the five groups of consumer companies studied—fashion and luxury, consumer durables, retail, and consumer nondurables were the other four—and fifteenth among all 26 industry sectors. (For an overview of the performance of the five consumer sectors, see “ Rising Volatility, Growing Opportunity ,” the BCG 2014 Consumer Value Creators Series, December 2014.)

The market has been rewarding travel companies—and companies in every sector—that show strong top-line growth. Seven of the top ten value creators in travel and tourism delivered double-digit sales growth from 2009 through 2013. (Notably, these ten companies delivered stronger value creation than the top ten in any other industry sector, making them the “best of the best” in this year’s overall analysis.) In part, that growth came from a rebounding economy; the starting point for our five-year analysis period followed immediately on the darkest days of the financial crisis, and the global equities market has rallied significantly since then.

But travel and tourism companies have also benefited from increasing travel in developing countries. As a result of that macroeconomic trend—which is likely to continue for the foreseeable future—investors have bid up shares of companies in the sector; expansion in valuation multiples was the major driver (after sales growth) of value creation in the five-year period analyzed.

In addition, the 68 travel and tourism companies in our sample showed some of the highest variability in performance among all 26 industry sectors. This reflects the wide range of business models in the sector, including gambling and entertainment companies, cruise lines, airlines, and online travel agents. It also reflects the many evolving trends that are affecting travel and tourism, including demographic shifts in emerging markets, changing consumer behavior in favor of digital channels, and new business models. The result is a highly dynamic marketplace—and correspondingly high variations in the value returned to shareholders.

Trends Among the Top Performers

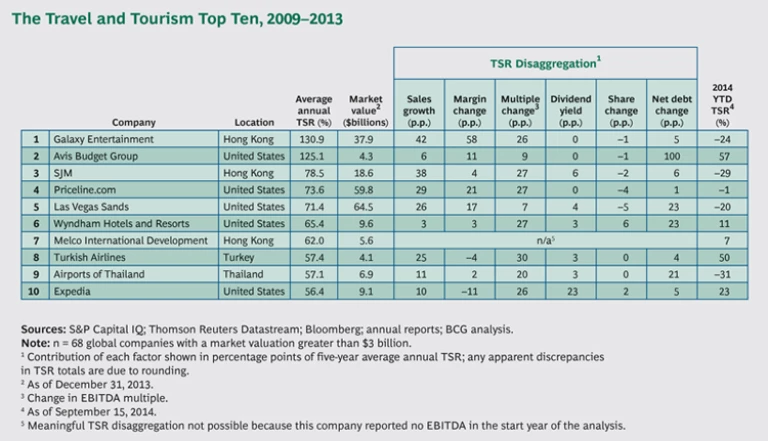

A closer look at the top ten companies reveals several notable trends. (See the exhibit.) First, four of them are gambling and entertainment companies with operations focused in Macau, including the top performer, Galaxy Entertainment, which returned an annual average TSR of 131 percent from 2009 through 2013. All four companies—which are among just six that have been awarded gambling licenses by the Chinese government (a change from the monopoly license system that was in place before 2002)—have built large casino complexes that are catering to the rapid growth of Chinese high rollers and, increasingly, Chinese middle-class gamblers on day trips. Over the past several years, Macau has facilitated this expansion through land reclamation. It is this growth that is fueling value creation, with Hong Kong-based companies like Galaxy and SJM (ranked third among the top ten) building new facilities and the market rewarding them with higher valuation multiples. U.S.-based Las Vegas Sands (ranked fifth) has also benefited from this growth, with the bulk of its business outside of the U.S. in Macau and Singapore (itself a growing gambling hub). Las Vegas Sands returned an average TSR of 71 percent a year during the period we analyzed.

However, year-to-date TSR performance through the first eight and a half months of 2014 suggests that this recent growth burst may be abating. Development on Macau is slowing down—the region’s real estate is finite—and gambling hubs are opening across Asia that Chinese high rollers will be able to access easily.

The second trend is the continued shift of travel bookings to digital channels. Priceline.com (fourth among the top ten) and Expedia (tenth) are now the largest online travel companies in the world. Their holdings include branded online travel agents (such as Expedia.com and Priceline’s Booking.com), as well as metasearch sites (Expedia’s Trivago and Priceline’s Kayak), and the rate of acquisitions is increasing for both companies. Priceline created more value than Expedia during the period 2009 through 2013—an average annual TSR of 74 percent—owing to its greater exposure in international markets. And it is better positioned for future growth as well; digital bookings are less common in developing countries than in mature markets like the U.S., yet they are projected to increase sharply as Internet penetration in those markets catches up.

As to Expedia, despite strong overall value creation, the company has suffered from compressed margins. It was one of only two companies in the sector’s top ten with negative margin contribution to TSR, primarily because of heavy investments in sales and marketing intended to build its brand (especially its mobile app). The company is making a big play in mobile, where companies are still getting established and which Expedia believes is the future of digital travel. Yet the strong prospects for both Priceline.com and Expedia may already be factored into their stock prices; the contribution from investor multiples for these two companies was among the largest in the top ten (27 percentage points for Priceline.com and 26 percentage points for Expedia), a sign that the market is anticipating the strong growth trajectories of both companies to continue.

The third trend is growth in international travel, particularly in emerging markets. Turkish Airways (which ranked eighth among the top ten) has built a strong position operating out of Istanbul, a growing international hub that offers easy access from Europe to the Middle East and Asia, where demand for air travel is increasing. Turkish Airways is following the pattern of the three largest Middle Eastern carriers—Emirates, Qatar Airways, and Etihad Airways—which are thriving not because of a strong home market but because they offer a midway point between the developed markets of Europe and the developing markets of Asia. (Those three airlines are not publicly traded and therefore were not included in our analysis.)

Similarly, Airports of Thailand (ninth among the top ten) is positioning itself as a regional hub in Southeast Asia. The company is building new capacity to meet the growing demand of low-cost-carrier airlines and to capitalize on growing regional tourism—from China and India, in particular. However, recent political instability in Thailand has affected Airports of Thailand’s performance; year-to-date TSR for 2014 was –31 percent.

Avis Budget Group, which ranked second in the top ten, is an outlier in that its TSR performance was not driven by top-line growth, margin expansion, or investor multiples (the biggest contributors to TSR for the other nine top performers). Rather, Avis’s value creation came almost entirely from change in leverage driven by a significant change in market cap. At the beginning of 2009, the company’s market capitalization was $71 million; five years later, it was $4.3 billion, primarily because of a tremendous run-up in the share price. Avis Budget Group was formerly part of Cendant, which split up in 2005 and 2006. During the five-year period of our analysis, the share price of Avis stock rose from less than $1 to more than $40. While the company’s net debt grew nominally during that period, the increase in debt was dwarfed by the expansion in market cap. As a result, the ratio of net debt to enterprise value (a key component of the TSR calculation) decreased sharply, leading to average annual value creation of 125 percent.

Insights for Travel Companies

The performance of these companies offers several insights for management teams in the travel and tourism sector. First, growth is an essential factor in value creation. Second, this growth is coming from outside of traditional markets such as the U.S. and Europe. Although growth in China may be starting to diminish, other markets are gaining momentum. These include countries in Asia besides China and countries in Latin America and Africa, where an emerging middle class is embracing travel. Third, while traditional business models can still be successful in these markets, companies are increasingly shifting to digital technology, and this shift will increase as Internet penetration rises. As a result, companies will need to focus on digital channels in order to get their products to the marketplace. Finally, valuation multiples and margins are key to value creation in this sector—growth alone is not sufficient. Companies need to ensure that they are growing profitably, streamlining their operations, reducing costs, and communicating clearly with their investors.