Over the past five years, the nondurables sector has delivered strong value creation, thanks to the global economic recovery and a growing middle class of consumers in many emerging markets.

In 2015, The Boston Consulting Group conducted its annual study of the total shareholder return (TSR) of nearly 2,000 publicly traded companies in 27 industry sectors, of which 88 were in the nondurables sector. (See Value Creation for the Rest of Us , the 2015 BCG Value Creators report, July 2015.)

During the five-year period from 2010 through 2014, the nondurables companies in the sample returned an annualized TSR of 16%.

While the value-creation performance of the nondurables sector was strong in absolute terms, it was not as robust as last year’s performance. Nondurables companies typically experience lower peaks and more shallow valleys compared with other consumer sectors. They are defensive investments that hold up during market corrections and are then overtaken during the subsequent recovery. Characteristically, the nondurables sector performed better than other consumer sectors during the financial crisis, but those sectors have rebounded more strongly since then.

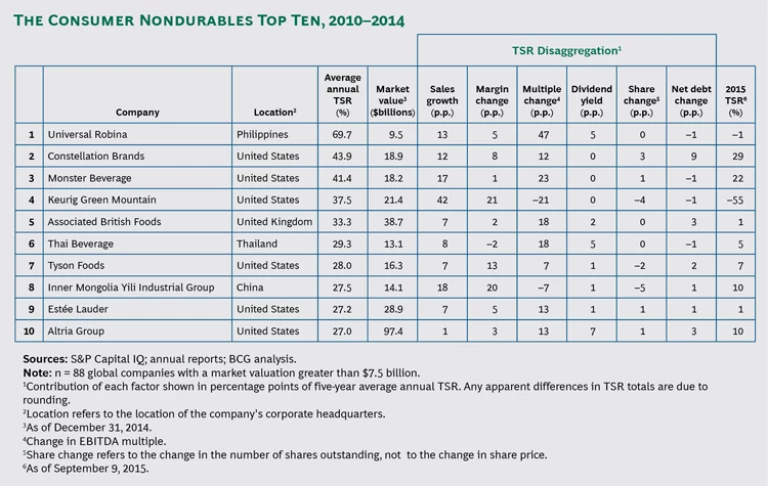

Looking at the top-ten nondurables companies, some clear themes emerge. (See the exhibit, “The Consumer Nondurables Top Ten, 2010–2014.”) First, most are continuing to increase their sales growth while also improving margins, primarily through cost-cutting efforts. Second, as the global economy continues to gain momentum following the recession, valuation multiples are increasing as well, leading to a significant TSR contribution: seven of the top ten generated double-digit value creation from improved multiples. Finally, most of the top ten are creating value via free cash flow as well. These are high-margin, brand-driven companies with strong balance sheets, and as their performance continues to improve, they are deploying substantial cash to increase dividends, buy back shares, and reduce net debt.

Four Potential Paths to Value Creation

The performance of the top ten companies indicates some avenues that other nondurables companies can use to create value in the next several years. Significantly, these are the same paths we identified last year, indicating that value creation is not a fad but instead relies on long-term aproaches that don’t change from year to year.

Balanced Winners. Many nondurables companies create value largely through a balanced approach that emphasizes sales growth combined with improved margin performance. These companies have strong brands and go-to-market strategies to drive superior top-line growth while also relentlessly focusing on efficiencies across the value chain. As a result, balanced performers are rewarded with expanding valuation multiples as investors gain confidence in the companies over time.

For example, Constellation Brands, second on this year’s list, generated value through five of the six possible TSR levers. The company—a US conglomerate of beer, wine, and spirits brands—originally owned a 50% stake in Crown Imports, a beer importer. Constellation acquired the remaining half of Crown’s US business in 2013, giving it control over dominant brands such as Corona, Modelo, and Pacifico, which Constellation has continued to grow.

The company has also rolled out new beer products, completed a wine acquisition, and appointed a chief growth officer, which indicates how seriously it treats revenue performance. But Constellation also drives value through reductions in debt—more than any other company in the top ten—and share buybacks. In addition, the company recently announced its first dividend.

Smart Acquirers. M&A can transform a company’s operations by giving it immediate access to strategically complementary segments. Nearly half of the top ten companies have made large acquisitions in the past several years, using their strong cash reserves to tap into new sources of growth, generate structural advantages (such as market consolidation, increased scale, and improved costs), or both.

For example, Tyson Foods (seventh on the list), bought Hillshire Brands for $8.55 billion in 2014, the biggest deal ever in the meat industry. Similarly, Estée Lauder (ninth) recently ended a five-year buying freeze, purchasing four high-end niche brands—Glamglow, Le Labo, Editions, and Rodin—to round out its portfolio and give the company a stronger position among high-margin, luxury consumers.

Innovators. Through innovation, companies can develop new products and features and better meet consumer demand. For example, Monster Beverage, third on this year’s list, consistently innovates both in the US, where the company is based, and in emerging markets. As a result, it has been able to diversify from its flagship Monster brand of energy drinks into a wide variety of line extensions. Forbes magazine recently included Monster Beverage among the top 15 most innovative companies of 2015.

Emerging-Markets Superstars. Three of this year’s top performers are in emerging markets. The biggest value creator overall was Universal Robina, a food conglomerate based in the Philippines. The company has a strong presence in several other fast-growing Asian countries, including Vietnam, and it benefits from selling products in categories that are expanding rapidly, such as coffee and snack foods. Universal Robina also has a knack for adapting its major brands for local markets through spin-off products. The company closed a major acquisition by buying New Zealand–based Griffin Foods for $609 million. Although the company is new to the top ten this year, it finished first, with an annual average TSR of 69.7%. In addition to strategic M&A and strong operational performance, Universal Robina benefited from several banks initiating coverage of its stock from 2010 through 2014, raising its profile among institutional investors.

Also worth noting is that many emerging markets, particularly in Asia, experienced a sizable correction in 2015. This is not a surprise given the rapid economic expansion in the region over the past decade. The cause of the correction, China’s devaluation, was a necessary adjustment for the financial markets—not an omen of a more profound economic crash. Longer term, the growth prospects of the nondurables sector in Asia are still strong. But investors and management teams need to steel themselves for increased volatility as these corrections play out.

The Continued Growth Imperative

Over the past several years, we have observed a noticeable trend in which several large multinational nondurables companies, outside of the top ten, have launched significant cost-cutting initiatives. Much of this activity has been spurred by the success of Brazilian investment firm 3G Capital in the nondurables sector. The firm has conducted a series of high-profile mergers and acquisitions, mostly in the consumer-packaged-goods industry, to form larger entities, such as AB Inbev and Kraft Heinz. The firm has been extremely successful in making targeted acquisitions, improving operational performance, capturing synergies, and applying a relentless discipline to cutting costs.

3G’s experience confirms that margin improvement can lead to huge gains for shareholders, especially in the short term. While efficiency should be an important component of most value-creation paths, we still strongly believe that top-line growth is critical for long-term TSR performance. It’s important for nondurables companies to maintain their focus on building brands and innovating, even as pressure mounts to control costs and investments to improve the business. As this year’s crop of top performers shows, nondurables investors require steady, consistent approaches to value creation, and they will reward companies that can deliver over time.