A building contractor we’ll call Bob meets with a client to discuss ideas for a bathroom renovation. Rather than visiting a distributor’s showroom, Bob uses his iPad to display a 3-D visualization of the client’s bathroom. Bob and the client experiment with options for the colors of tiles, fittings, and sanitary ceramics. Bob uses a smartphone app provided by the producer of these materials to calculate his final price on the basis of the client’s selections. The selections are made within the visualization and automatically transferred to a cloud-based building-information modeling (BIM) platform. The BIM platform places the order with the producer and creates the design plan for using the materials. The producer uses logistics services provided by a major e-commerce company to fulfill and deliver the order. Bob uses the producer’s smartphone app for real-time tracking of his order, which arrives on schedule within the one-hour delivery window he selected. The producer uses the app to send Bob a video that demonstrates the right way to apply the materials. The producer also recommends other building materials on the basis of Bob’s past purchases and current location. Looking beyond today’s purchase, the producer uses the data about Bob’s buying behavior as one of many inputs to refine its commercial strategy.

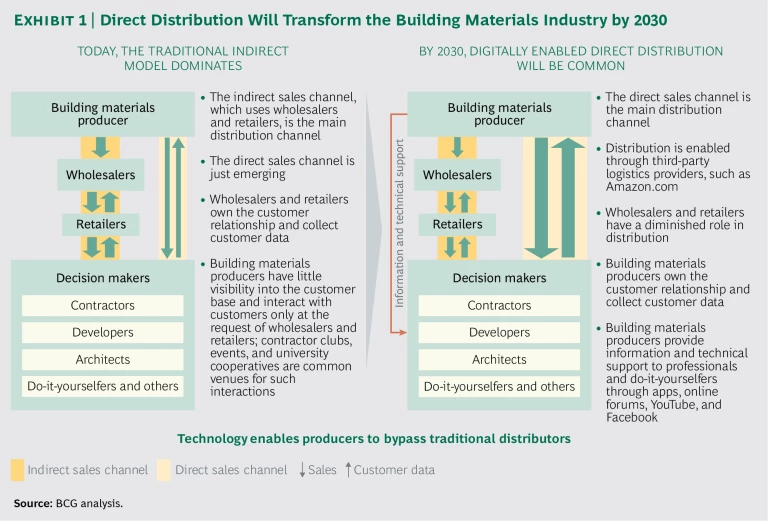

Although much of the technology already exists to make this vision of digitally enabled direct distribution a reality, few building-materials producers have embraced the technology as a means to reinvent the customer journey. Distribution remains rooted in the traditional indirect model in which producers sell building materials to the wholesale and retail distributors that have a direct relationship with contractors and other end customers or decision makers. (See Exhibit 1.) These distributors select the assortment of products offered and provide credit services to customers. In most cases, the distributors are also responsible for delivering products. But, as has happened in other industries that have been disrupted by the digital revolution, this indirect model will inevitably give way to a model in which building materials producers bypass traditional distributors. In this digitally enabled model, manufacturers will sell their products directly to end customers and use third-party logistics services for fulfillment and delivery.

In our view, it is a question of when, not if, this transformation of the distribution model will occur in the building materials industry. And the experience of other industries has shown that a digital disruption can arrive with startling speed. Indeed, top building-materials wholesalers and retailers have already launched digital distribution initiatives to counter the threat of direct distribution by traditional manufacturers in or new entrants to the industry. The early results indicate that businesses and other end customers are interested in purchasing building materials directly through the Web and mobile apps, just as they do other products. This is especially true in some emerging markets, such as Indonesia, where the rate of Internet usage on mobile devices is high among businesses and end customers. Building materials producers should not let distributors capture all of the value arising from this opportunity. Higher margins are only one of the benefits of establishing direct relationships with end customers. Producers would also gain access to a trove of customer data that allows them to develop targeted sales-and-marketing efforts, refine their product offerings, and enhance on-site and off-site support. These applications of data promise to increase customer loyalty and unlock significant growth opportunities.

Building materials producers should take action now to adapt their strategies and capabilities, before the full effects of the digital revolution alter the industry landscape. The first producers to become first movers and successfully adopt a digitally enabled direct-distribution model will gain major competitive advantages. These advantages will arise not only from stronger customer relationships but also from alliances with technology and logistics companies that provide the infrastructure and support for e-commerce and direct distribution. Early movers are likely to benefit from a strong lock-in effect with customers and business partners, which could ultimately threaten the survival of producers that take a wait-and-see attitude.

To help producers capture this opportunity, The Boston Consulting Group has explored the current state of digital adoption in the building materials industry and the important trends that are reshaping the distribution model. Our research included discussions with executives at 20 of the top building-materials producers and distributors and a comprehensive Web survey of more than 100 building-materials purchasers in the U.S. We focused our research on the application of digital technology to the customer-facing stages of the building materials value chain (marketing, sales, and logistics), giving less emphasis to sourcing and production. By applying our findings to develop strategies and capabilities, producers can emerge as the winners in their industry’s new environment.

The State of Digital Adoption Today

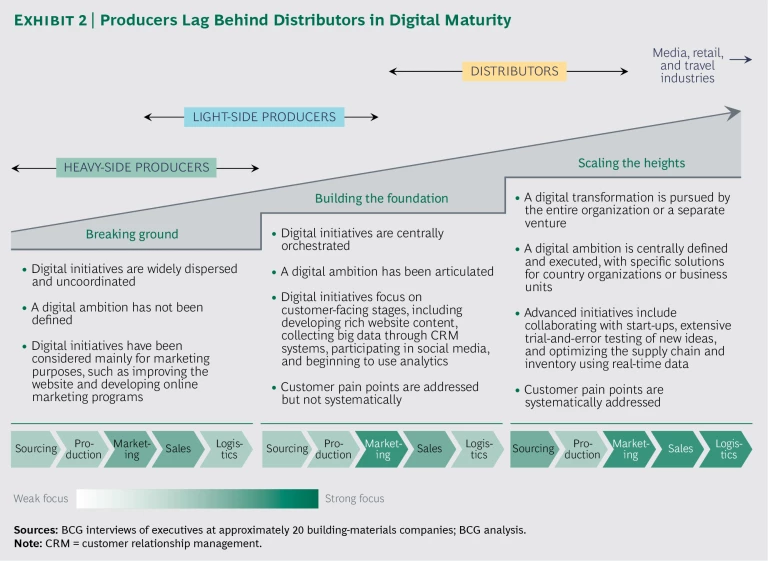

Our research found that building materials companies have reached one of three stages of a digital transformation. (See Exhibit 2.) Heavy-side producers (those in the aggregates, ready-mix concrete, cement, asphalt paving, and construction industries) are at the earliest stage of the transformation. Light-side producers (makers of concrete products, wallboard, insulation, bricks, tiles, pipes, and glass) are at the earliest or middle stage. Distributors (wholesalers and retailers) have reached the middle or advanced stage. However, even the most digitally advanced building-materials companies lag significantly behind companies in industries such as media, retail, and travel.

Breaking Ground. Companies at the earliest stage of the transformation are pursuing only a few uncoordinated digital initiatives and have not defined a company- wide ambition for the use of digital technology. The main focus of these companies has been on digital implementations in marketing, such as incorporating basic e-commerce features into their website, providing intranet communication tools, and developing online marketing programs. These companies have not explored which “pain points” along the customer journey could be addressed by digital initiatives.

Building the Foundation. At the next stage, companies have articulated a digital ambition and begun to centrally coordinate digital initiatives. They have moved beyond undertaking basic digital initiatives in marketing to addressing the pain points for all of the steps in the customer journey. These efforts include developing rich website content, collecting and structuring big data by implementing advanced customer-relationship-management systems, and participating in social media. These companies have also taken initial steps to apply analytics to big data.

Scaling the Heights. When building materials companies reach the advanced stage, the digital ambition has become integrated into the organization’s DNA. In some cases, a separate venture has been created to carry out the digital transformation and systematically address pain points along the customer journey. Although the digital ambition is centrally defined and implemented, specific programs are tailored to the country organizations or business units. Advanced initiatives typically include collaborating with start-ups, extensive trial-and-error testing of new ideas relating to apps and mobile devices, and optimizing the supply chain and inventory through the use of real-time data. These companies typically still have opportunities to make more extensive use of big data and advanced analytics, however.

So far, distributors are the only building-materials players to reach the third stage of digital maturity. They have been motivated to aggressively pursue a digital transformation because they see that a strong e-commerce offering is essential to maintaining customer loyalty and growing revenues. Distributors’ digital transformation has occurred rapidly. Fletcher Building, for instance, recently launched an independent digital-innovation lab, only a few years after its first digital initiative.

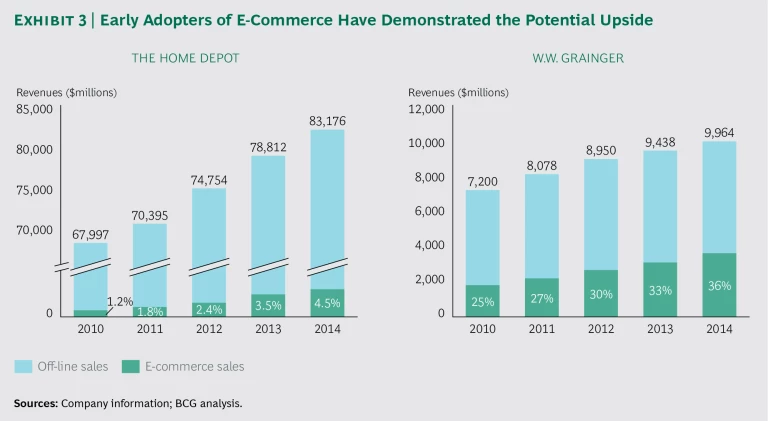

The first companies to use e-commerce to sell and distribute building materials have demonstrated the potential for revenue growth. The Home Depot and W.W. Grainger have each seen a steady increase in e-commerce revenues as a percentage of total revenues in recent years. (See Exhibit 3.) The Home Depot offers more than 700,000 items online, compared with 35,000 in typical stores. Customers can pick up their online orders at a nearby store, which has been critical to the initiative’s success. In 2014, the retailer invested $1.5 billion in supply chain and technology improvements to integrate online and off-line sales. W.W. Grainger, which primarily supplies business customers, has also focused on integrating sales through its branches, catalog, website, and mobile app. It has sought to grow its base of business customers by introducing an online inventory-management solution and an app through which customers can make purchases. In the future, we expect that e-commerce sales through initiatives such as these will represent the largest source of revenue growth for building materials companies.

Four Themes Will Shape the Transformation

In our discussions with executives and customers, a consensus emerged that four themes will shape the industry’s digital transformation. Companies will need to develop expertise on these topics and build their capabilities to execute initiatives related to each.

Mobile and Real-Time Information. Through the use of mobile and GPS technologies, producers will be able to give their customers access to information about products and services anywhere and anytime. Leading companies have already launched apps that address the unique needs of builders. For example, W.W. Grainger’s KeepStock Secure app helps customers replenish stocks of products when they’re at a job site and don’t have access to a desktop computer. The app allows customers to order items by scanning bar codes on labels and has an automated reordering feature. Companies have also introduced apps that allow customers to track orders and deliveries using GPS-based updates.

The use of mobile and GPS technologies will be particularly important in emerging markets, where mobile devices are the primary way businesses and customers access the Internet. PPC, a leading supplier of cement in southern Africa, has launched an app that provides a product catalog, a store locator, a tool for determining the quantity and cost of products required, and updates on promotions.

Examples from other industries point to the disruptive potential of mobile technology. Consider how Uber has disrupted the taxi industry in New York City. During the past two years, it is estimated that Uber has taken away approximately 2 million rides from traditional medallion taxis in the city’s central business district. And the total number of trips in medallion taxis declined by 10 percent in the first half of 2015, compared with the same period in the previous year. Not surprisingly, the value of a taxi medallion license has dropped steeply, from $1.3 million in 2013 to less than $900,000 in 2015.

A Multichannel Customer Journey. Producers will need to serve customers through multiple channels, including physical locations, call centers, the Web, and mobile devices. Companies will be able to gain a competitive advantage by reaching customers through the full set of social media, including YouTube, Twitter, Facebook, Vine, and online communities. Innovative staffing models will allow sales personnel to split their time among several functions, such as interacting with customers face to face, providing remote assistance over the phone or Internet, and creating content for social media.

Quick, Direct Access. Business customers will want the direct sales process to be as easy and fast as their consumer-shopping experiences. To address this need, producers must be able to provide customized content, product offerings, and recommendations and ensure that websites and apps are intuitive to use. Using GPS technology to offer products that are most relevant to customers on the basis of their locations will be essential to simplify the sales process. Producers should also make it easy for returning customers to purchase items quickly, such as by storing billing and shipping details and by automatically populating forms. Leading companies already offer customers simple and fast ways to provide feedback, so that the companies gain a better understanding of how to improve product and service offerings.

BIM in the Cloud. The building information modeling (BIM) platform allows architects and contractors to create digital representations of physical aspects of construction projects. These representations facilitate collaboration and decision- making among stakeholders, including project owners, government agencies, and subcontractors. Cloud-based BIM enables real-time access to these models by organizations anywhere in the world and from various devices, including mobile ones. By facilitating real-time interactions among multiple parties, the use of BIM in the cloud accelerates the planning and execution of project work and helps ensure that the correct materials are acquired. Adoption is expected to increase as these platforms become simpler to use. BIM has already become standard for some government projects in Denmark, Finland, Norway, South Korea, and the UK, with strong growth among projects to construct health care facilities, infrastructure, and large sports arenas. For building materials producers, the adoption of BIM increases opportunities for sales, because the use of cloud-based platforms makes it even easier for customers to order products directly from them.

Five Imperatives for Success

To capture the opportunities arising from digitally enabled direct distribution, building materials producers will need to embrace five interrelated imperatives.

Make digital transformation a C-level priority. Top management must be involved in defining the overall digital ambition and tracking the company’s progress toward achieving it. The head of the digital program should report directly to C-level executives and meet with them regularly (for example, every six weeks) to provide updates and discuss developments. The company’s leadership should commit to hiring digital experts and earmark a portion of the corporate budget specifically for pursuing digital innovation. The CEO should approve the digital roadmap that guides the organization’s initiatives and communicate regularly, through vehicles such as a monthly newsletter and investor presentations, about the importance of digital opportunities. As Clayton M. Christensen observed in The Innovator’s Dilemma, disruptive change within established business models can only succeed if the CEO is fully committed to achieving it.

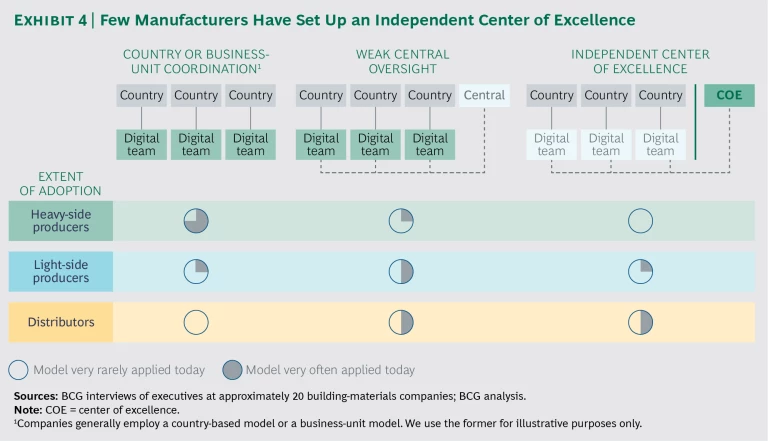

Establish an independent digital unit. To encourage risk taking and independence from country organizations and business units, producers need to establish a center of excellence (COE) to define the digital strategy and manage the digital transformation. The COE should have its own budget and the authority to centrally coordinate the digital initiatives pursued at the country and business-unit levels. The company’s top leaders should explicitly require all stakeholders in the organization to respect the COE’s independence, so that it can fulfill its mandate to advise on digital disruptions, stimulate idea generation, and challenge the current way of doing business. Capabilities to identify opportunities to collaborate with start-ups and universities will also be essential. Some distributors and a few light-side producers have set up a digital COE, while heavy-side producers have not yet done so. (See Exhibit 4.) It is more common in the industry today for companies to establish a hybrid model that entails weak central coordination of digital initiatives that are specific to country organizations or business units. In fact, most heavy-side producers have yet to set up any central coordination of the digital initiatives pursued by country organizations and business units.

Become agile to innovate. Agility is essential for pursuing innovation opportunities. For example, a company can create a separate digital venture, or the marketing function or specific business lines can partner with start-ups to pursue their digital objectives. The company culture must encourage innovation throughout the entire organization, so that it can proactively launch new ideas and respond quickly and effectively to competitors’ moves. The company should search for innovative opportunities continuously and be open to collaborating with start-ups, universities, and venture capital firms. A start-up called Building Radar, for instance, has simplified producers’ research into sales leads by maintaining a global database of construction projects and the related contacts. Producers can use the database to identify projects in the markets they serve and then proactively reach out to the right people at existing or prospective clients to discuss sales opportunities. Producers that look outside the four walls of their organization for such innovative players to work with are likely to capture major advantages as the distribution model evolves.

The COE should serve as the central point of contact for sharing innovative ideas generated throughout the organization, and the company’s top experts should be readily accessible to challenge and prioritize the ideas. The company also needs capabilities to rapidly test ideas using prototypes and to capture feedback from all relevant operational units. Some companies have successfully established a venture capital subsidiary to assess an extensive portfolio of digital opportunities.

Implement digital ideas effectively. To capture competitive advantages, producers will need to bring their digital ideas to the marketplace effectively. Leading building-materials companies have already established practices that can serve as inspiration for other companies seeking to raise their game in digitally enabled distribution:

- Cloud-Based Analytics. Saint-Gobain, a global building-materials producer, has conducted a pilot program in Denmark to assess how cloud-based marketing and analytic resources can be used to tailor promotions to customers’ needs. These resources have enabled the company to obtain detailed information about the performance of promotional programs and compare the results with those of similar programs used in the past. The company has applied the insights to better tailor its offerings to specific customer classifications and increase company-wide knowledge about marketing practices. This effort has contributed to a more than twofold increase in the conversion rate for online shopping (from 10 to 22 percent).

- Augmented Reality. To address the disparity that often exists between actual products and the photos that appear on screens, leading retailers, such as Lowe’s, are experimenting with using augmented reality to provide 3-D representations. The technology allows customers to visualize even the complex features of products such as bathroom fixtures. The use of augmented reality “showrooms” promises to increase customer satisfaction and reduce the costs associated with replacing materials that fail to meet customers’ requirements.

- Tracking Technology. Leading heavy-side producers are testing ways to use tracking technology to gain better visibility into the timing of deliveries and respond faster to customer demand. Hines, for instance, is testing technology that allows contractors to track their orders in real time on mobile devices. The tracking system is a single repository for all information relating to truck locations and product specifications. By reducing the need to respond to customers’ requests for information, the program has allowed the company’s sales staff to spend more time on revenue-generating activities. Cemex uses customer data to forecast the areas where demand is likely to be highest during a specific time period. By proactively loading trucks to serve customers in these areas, the company has been able to reduce its fleet size by 35 percent.

Measure the results. Tracking the company’s progress toward achieving its digital goals is essential for determining the return on investments and continuously improving the initiatives. Best practices entail having stakeholders across marketing, sales, and IT agree on a holistic set of digital KPIs linked to broader business goals, such as the growth of sales and profits. By providing insights into how performance has changed over time, these KPIs facilitate the central management and continuous refinement of initiatives that promote specific goals, such as higher conversion rates. Some distributors have made progress toward achieving this level of maturity, but heavy- and light-side players have yet to effectively track the performance of digital initiatives and prove their benefits.

Creating a Digital Roadmap

Taking action to address these imperatives requires a clear roadmap that sets out the responsibilities, milestones, and timelines for achieving the goals of the company’s digital strategy. Creating a digital roadmap entails a multistep process.

Conduct a health check. A company should start by determining where it stands today. A standardized “health check” can be used to both assess the maturity of the company’s digital capabilities and identify gaps relative to those of competitors. The company can gather relevant information by surveying and interviewing key stakeholders in the marketing, sales, IT, and business intelligence functions, as well as leaders of external partners. The company may find that it needs to improve digital capabilities at each stage of the customer journey, such as capabilities to identify customers’ needs at the ordering stage, establish new functionalities at the payment step, or make better use of real-time data to help customers manage their inventory.

Identify potential digital pathways. The health check’s findings should be applied to identify potential opportunities, or pathways, for creating a digitally enabled customer journey. The opportunities to achieve competitive advantages can become evident by identifying customer needs, assessing and benchmarking internal capabilities, and understanding the best-in-class digital offerings of competitors and, even more important, companies in other industries. Using surveys, focus groups, and interviews, the company should gather a fact base that allows it to assess customer segments with respect to their potential value and the benefits that could be unlocked through digital pathways. Discussions with external experts can also aid in understanding which approaches will yield the greatest impact for the company.

Prioritize and closely evaluate selected pathways. The company should focus its efforts on a prioritized set of digital pathways. Pathways should be ranked on the basis of their potential to create value and how well they fit with the company’s other strategic priorities. The company should conduct an in-depth analysis of the top-priority pathways, so as to determine how they can be applied to design the ideal customer experience. The results of this analysis should position the company to select which pathways to pursue first, determine a testing approach and timeline, and create a detailed execution plan.

Develop the roadmap. The execution plan for pursuing the pathways should be set out in a clear roadmap that provides the basis for determining resource requirements (including technology platforms) and establishing the required external partnerships. The roadmap should also apply the results of the health check in specifying the company’s plan for building an organization with best-in-class digital capabilities.

Although building materials producers have thrived in the past by following a conservative strategy that did not chase the latest trends, such an approach could become a recipe for failure in the near future. Simply put, sticking with the traditional distribution model is no longer an option in the digital economy. Even companies that choose not to make the first moves into digitally enabled direct distribution cannot afford to take a wait-and-see attitude. Producers must start taking steps immediately to understand the digital trends and opportunities reshaping their industry and develop digital strategies and capabilities that will allow them to remain competitive in the fast-changing market.