The payments and transaction-banking businesses are evolving at a dizzying pace. The advance of digital technology, the entry of nontraditional players with compelling value propositions, and changing preferences in the way consumers pay for goods and services in their everyday lives have considerably disrupted the industry landscape.

Which direction will consumer payment habits take in the future? How fast will people and businesses adopt the latest digital technology and leave traditional payment methods behind? How can banks not only handle the arrival of new digital players but also use their own vast infrastructure and customer knowledge to remain competitive in the shifting market climate? Will joining forces with nontraditional players, rather than treating them as adversaries, prove to be a more profitable path forward? These are among the most pressing questions of the moment.

One industry characteristic that has not changed is that payments and transaction-banking businesses remain critical elements of the banking industry and the global financial-services landscape. Because they are a critical source of reliable revenues and a linchpin of customer relationships and loyalty, their importance will continue to grow. But competition will intensify. In order to stand out in a very crowded field, payments players must differentiate themselves digitally, refine their customer-centric strategies, and raise their execution skills. Above all, they must listen to the customer’s voice and react accordingly.

In the thirteenth edition of The Boston Consulting Group’s Global Payments report, we offer a comprehensive regional overview of the industry. We discuss the findings of a recent BCG survey of nearly 5,500 consumers in four countries—France, Germany, the U.K., and the U.S.—that we conducted with three goals in mind: discovering why the adoption of digital payments has been relatively slow to date; identifying current consumer needs, preferences, and pain points in payments; and formulating the actions that banks can take to unlock the potential of consumer digital payments. (See " Unlocking the Potential of Consumer Digital Payments .") We also take a detailed look at the wholesale transaction-banking industry, specifically focusing on how banks can beef up the treasury and trade services that they provide to their clients. (See " Bolstering Treasury and Trade Services in Wholesale Transaction Banking .") In preparing these articles, we have for the fourth consecutive year collaborated with SWIFT, the global provider of secure financial-messaging services.

This year also marks the second edition of BCG’s Global Payments Model Interactive which explores how regions and segments of the payments market will shift from year-end 2014 through 2024. This feature provides extensive global detail, including interactive charts on the volume and value of noncash transactions as well as on revenues.

In the Global Payments model, payments revenues include direct and indirect revenues generated by noncash payment services (excluding interbank transfers). They are the sum of the following:

- Account revenues: spread income on current account balances (also known as checking or demand-deposit accounts) and account maintenance fees

- Transaction revenues: transaction-specific revenues on cards (interchange fees, merchant acquiring fees, and currency conversion fees for cross-border card transactions); fees per transaction on a percentage or fixed basis for noncard payment types; fees for overdrafts and nonsufficient funds; and monthly or annual card membership fees

- Credit card spread (net interest income) and penalty fees

Retail payments are transactions initiated by consumers, and wholesale payments are transactions initiated by businesses or governments.

As always, our aim in Global Payments 2015: Listening to the Customer’s Voice is to provide institutions that are active in the payments and transaction-banking businesses with a clear understanding of the fundamental changes shaping the industry, as well as to offer recommendations on which specific actions should be taken by various types of players in order to achieve or maintain market-leading positions. Today more than ever, no institution can afford to stand pat.

Global Overview: Disruption and Opportunity

Payments and transaction-banking businesses will face both significant disruption and immense opportunity over the next decade, with some $900 billion in industry revenue growth up for grabs through 2024. The disruption will have many sources, among them regulatory measures that adversely affect price realization and the customer experience, as well as new market entrants that are gaining traction by leveraging advanced technology to solve pain points and offer creative value propositions. The principal opportunities lie in continuing to capture the migration from cash to electronic payments, adapting to the new digital world, delivering innovative value-adding services, and effectively serving the unbanked and underbanked.

A Dynamic Arena

Transaction banking remains a dynamic arena on a global level, as evidenced by the significant amount of venture capital—roughly $76 billion—that has gone into payments-related businesses since 2010. Moreover, large technology companies are investing heavily in the payments space, ushering in a new world of digital payments as well as spawning a herd of new competitors (and potential partners) for traditional players. Among the primary drivers of change will be digital payment solutions that can be used across different point-of-sale (POS) channels (such as in-store, browser, and in-app), new payment rails that deliver so-called instant payments, and perhaps cryptocurrencies and blockchain technology.

Such developments will dramatically change how consumers and businesses select payment-related services (and credit products), how they transact, and how they engage with their providers.

Looking ahead, it’s clear that the nimblest stakeholders—those that are quickest to adapt their business and operating models to the shifting landscape—will seize the bulk of the $900 billion revenue-growth prize to be captured over the next decade. Also critical to winning will be a customer-centric strategy, one that truly grasps customer needs, expectations, and pain points, and addresses these issues efficiently and effectively.

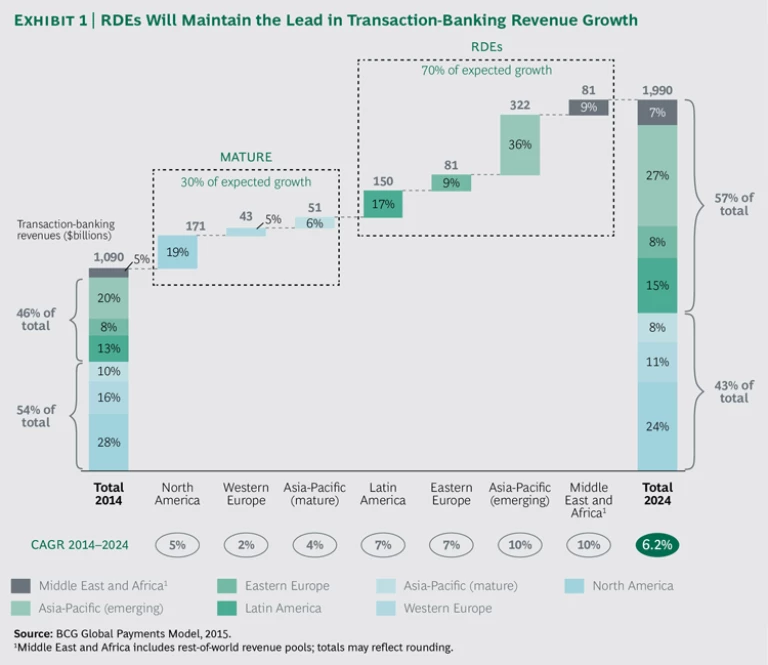

Revenues. In 2014, global transaction-banking revenues were nearly $1.1 trillion, or about 27 percent of total global-banking revenues. (See Exhibit 1.) By 2024, they are projected to reach nearly $2 trillion, with growth driven by a combination of account revenues (40 percent), transaction revenues (34 percent), and nontransaction card revenues (26 percent; these include monthly or annual fees, credit-card net interest income, and other types of fees). Transaction revenues are being propelled by rising transaction values and volumes—fueled by macroeconomic growth, migration from cash to e-payments, and broader financial inclusion—which in turn are helping to offset falling revenues per transaction in many regions. Moreover, all variables in the account-revenue equation—the number of accounts, account balances, and spread income—are increasing, driven by positive macroeconomic and interest-rate trends.

Varying Growth Patterns. It’s no surprise that rapidly developing economies (RDEs, also commonly referred to as emerging markets), most of which are moving toward higher rates of financial inclusion and greater migration from cash to e-payments, are enjoying stronger growth in all metrics than are mature markets. They will continue to do so. Compared with a year ago, however, retail (consumer-initiated) payments revenue growth in RDEs has been slowed by softening macroeconomic drivers such as GDP and per capita income.

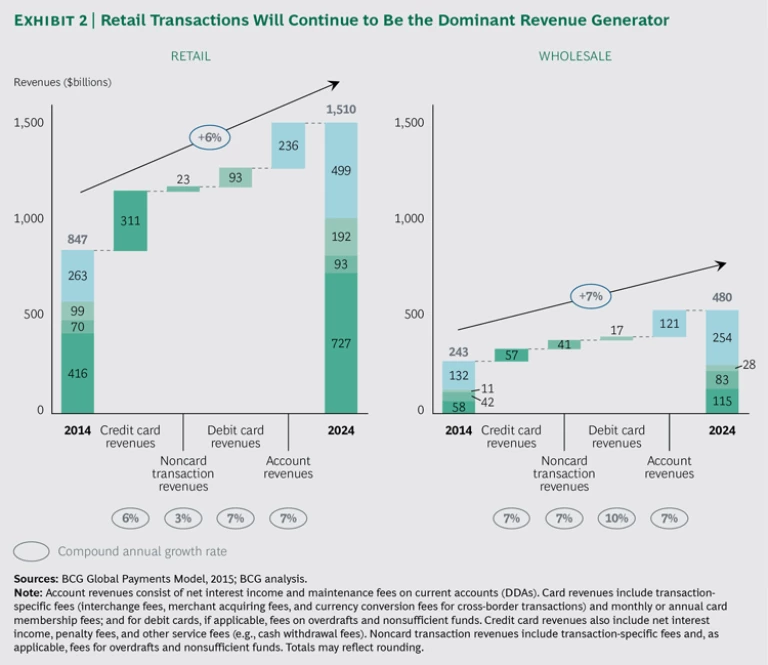

Retail and Wholesale Payments Differences. Although retail payments accounted for a small fraction of global transaction values in 2014 (11 percent), they generated 78 percent of total payments revenues and will account for a projected 73 percent of total revenue growth through 2024. The revenue mix will shift slightly toward account revenues. Wholesale (business- and government-initiated) payments are projected to post stronger annual revenue growth, at a CAGR of 7 percent compared with 6 percent for retail payments, with account revenues generating just over half of that growth. (See Exhibit 2.) Higher wholesale growth is being driven by stronger credit-card and other transaction-revenue expansion, owing to lighter price pressure than in retail.

Regional Retail Trends

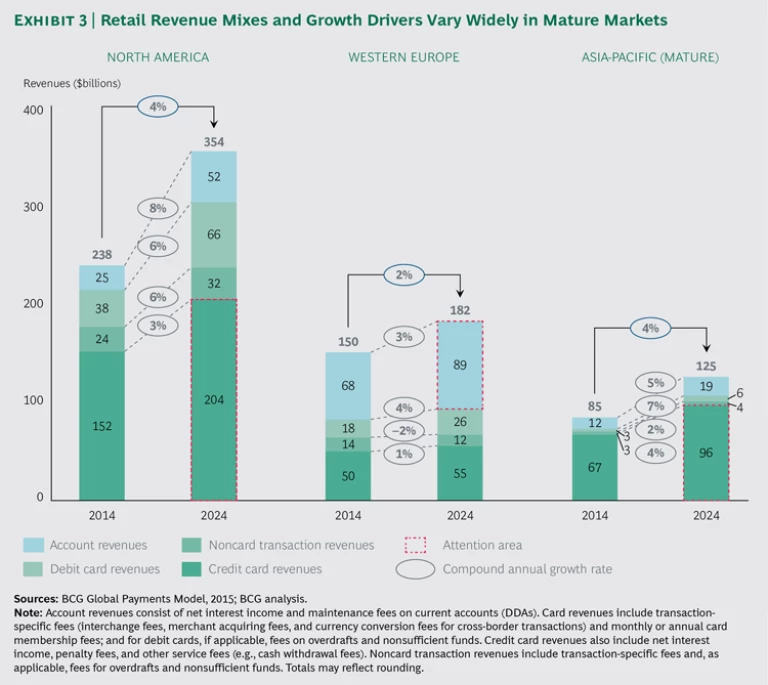

There are significant differences in retail payments trends across regions. The greatest diversity is found among mature markets, where revenue mixes and growth drivers differ considerably, although impediments to growth are similar. (See Exhibit 3.) Indeed, most mature markets are grappling with modest macroeconomic growth, regulatory pressure on prices, and persistent flat yield curves.

Nonetheless, some bright spots for revenue growth can be found in mature markets. In North America, for example, credit cards continue to be a highly attractive business and will be the key revenue battleground. In Western Europe, where card revenues have been sharply reduced by regulation, the keys to growth include rethinking daily-banking value propositions and improving price realization to raise account revenues. In mature Asia-Pacific markets, banks should focus on a current-account and credit-card strategy aimed at capturing the ongoing migration away from cash.

North America. North America remains the largest payments and transaction-banking market globally, generating $238 billion in total retail payment revenues in 2014 (28 percent of the worldwide total), with a projected CAGR of 4 percent through 2024.

Credit cards are the dominant revenue engine in the U.S., representing 60 percent of retail payment revenues in 2014. Moreover, credit cards generate the highest return on assets across U.S. retail financial products (close to 2.5 percent, with home-equity loans ranked second at 1.2 percent). Demand deposit account (DDA), debit card, and noncard transaction revenues accounted for the remaining 40 percent. Credit cards are also the lead revenue generator in Canada.

Looking ahead, credit-card revenues—now in a favorable point in the economic cycle, with net interest margins relatively strong and charge-offs low—will be driven by cyclical factors, systemic trends, and competitive shifts. The positive environment may turn negative, however, with a steepening yield curve that will push the cost of funds upward, weakening economic growth and increasing charge-offs. Moreover, several systemic trends will put pressure on average interchange income. For example, merchants may campaign for lower interchange rates if fraud losses drop as a result of the migration to EMV, tokenization, and biometric authentication. Furthermore, m-wallets will drive a move from card-not-present to card-present transactions.

In addition, there will be continued power shifts across the value chain. Co-brand partners are already wielding more clout in their negotiations with issuers, increasing their revenue share and lowering the discount rate that they pay on their co-brand cards. Meanwhile, issuers continue to fuel an arms race in rewards, eroding net interchange. It is looking more likely that at least one bank will launch a three-party network, leveraging its issuing and merchant-acquiring businesses and changing the business model to generate a win for all stakeholders.

To overcome such challenges and capture a healthy share of the expected revenue growth, banks in North America need to pursue a multifaceted strategy. First, as top issuers push their own branded cards, achieving excellence in penetrating core DDA customers will be increasingly important. Banks need to leverage their extensive product and channel platforms and broaden their value propositions to consumers, going beyond traditional cross-selling activities and creating product bundles aimed at specific customer segments (such as aspiring homeowners). They also need to offer relevant products based on “trigger” events such as college graduation or the birth of a child.

Second, issuers need to increase the value-adding services that they bring to their co-brand partners. Doing so will require them to contribute to their partners’ overall P&L—not just the card component—and will entail working with their partners on sophisticated marketing efforts to increase loyalty and enhance customer engagement.

Other obvious means of improving retail payment economics involve reducing costs and boosting overall efficiency. Cost reduction opportunities lie in slimming down the organizational structure and implementing lean operations, including optimizing both insourcing and outsourcing. BCG has found that organizational simplification can result in an 8 to 10 percent savings in total costs, and that improving procurement can reduce related costs by more than 20 percent, depending on the issuer’s starting point and willingness to be aggressive.

Clearly, with $116 billion in revenue growth up for grabs over the next decade in North America, there will be numerous competitive battlegrounds. In the short run, one wave of disruption is being generated by mobile payments initiatives, including m-payments at the point of sale, m-commerce, and in-app purchases. Mobile payments—which are unlikely to grow to beyond 30 percent of U.S. retail transactions by 2020 (including card-on-file, POS, and in-app purchases)—will not rapidly replace plastic cards. After 2020, disruption will potentially come from the launch of instant payments solutions and perhaps blockchain technology.

Western Europe. Payments revenues are under structural pressure throughout Western Europe. Indeed, interchange regulation set to take effect in October 2015 will result in an estimated total revenue loss of €5 billion per year for card issuers. We are also seeing a significant reduction in interest margins on current accounts (owing to the continued low-interest-rate environment) with no immediate recovery on the horizon. At the same time, increasing e-commerce activity and the gradual elimination of cash from physical points of sale is fueling growth in payments volumes.

Regulation remains a key theme in European payments, with governments hoping to stimulate further adoption of noncash payment instruments, remove barriers to competition for both banks and other players, and enhance security requirements for both mobile and online payments. Much of this regulation is centered on Payment Services Directive 2 (PSD 2), which aims to spur competition and innovation both through allowing access to customer accounts by third-party payment-service providers and through putting new security rules in place. PSD 2 is set to be submitted to the European Parliament later this year and incorporated into the regulatory framework over the course of 2016.

With the access-to-accounts rule introducing new competition from third-party providers and raising both costs and risks for incumbents, banks should investigate opportunities to strengthen their client relationships through superior interfaces, notably mobile ones, and to introduce value-added services, such as embedding account aggregation into their digital interfaces.

Aside from heightened competition on digital banking interfaces, we expect digital payment solutions at the point of sale to become a key battleground. Very few banks have managed to successfully launch their own digital-payment solutions, owing to delays in product development or an inability to bring a compelling value proposition to consumers and merchants. The fact that global tech giants such as Apple Pay and Android Pay see Europe as a highly attractive territory will force banks to develop an appropriate strategy. In particular, we expect that banks will cooperate more closely with global card networks to develop and promote credible alternatives to the offerings of digital giants. Such cooperation will require banks to support a higher level of standardization to ensure scale and wider adoption. As a consequence, banks will need to rethink how best to differentiate themselves.

We’re also witnessing greater interest in instant-payment solutions. Many countries—such as the Netherlands, Finland, and Italy—are either implementing or planning to develop a national instant-payment scheme. This trend will gain the most momentum in countries that have a proactive payments regulator, an outdated payments infrastructure, or a critical mass of local banks with real-time accounting systems. Yet despite agreement on a common definition of instant payments by the Euro Retail Payments Board, there has been no clear progress toward a pan-European instant-payment scheme. Although likely to become standard in the long run, the business case for instant payments remains questionable in the medium term. Banks will therefore need to carefully think through the prioritization of their payments investments.

Ultimately, we believe that Western European banks are still competitively well positioned because the accounts and payment services they offer enjoy higher levels of trust than those offered by nonbank players. Nonetheless, banks need to act now on three key levers:

- Rethink daily-banking offerings and execute a fundamental review of pricing structures, considering the financial needs and willingness to pay of different customer segments.

- Beef up digital-banking interfaces in order to be best-in-class relative to local peers.

- Decide on a clearer path for future digital-payments initiatives, such as developing proprietary m-wallets, joining with peers to develop local wallets, or partnering with global card networks or tech giants.

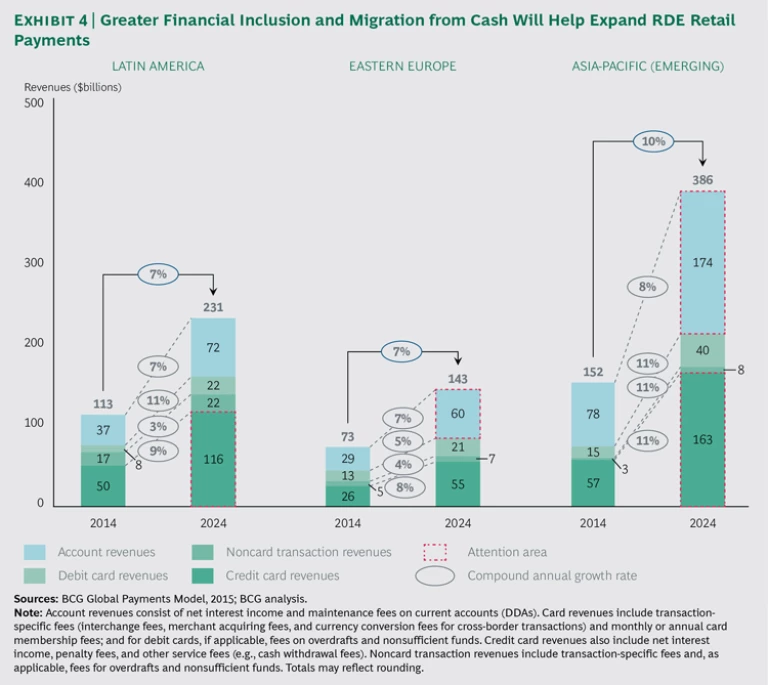

RDEs. Payments-related businesses in RDEs continue to benefit from positive macroeconomic and socioeconomic trends. While many countries have experienced a slowdown in GDP growth, a steady rise in financial inclusion coupled with the push for migration away from cash will continue to generate above-average growth in both payment values and payments revenues. (See Exhibit 4.) Leading the growth will be the emerging markets of Asia-Pacific and Latin America, followed by Eastern Europe.

While the pace of growth will vary across regions, the overall digital future is bright. Ongoing government support, steady investment in payments-related innovation, and increases in smartphone adoption will be key drivers. Both incumbents and new digital-payments players, as well as social media and e-commerce giants, will continue to reshape the payments landscape and ensure the success of new digital platforms.

India. Among emerging markets, India stands out for its bold government-led initiatives to promote financial inclusion and digital innovation, which are driving above-average growth in noncash payments. In 2014, India launched a financial inclusion campaign that generated 125 million accounts within six months. In addition, the Reserve Bank of India (RBI) has established new guidelines to license so-called payment banks—institutions whose objective is to improve financial inclusion by providing basic banking and remittance services to migrant workers, low-income households, small businesses, and other underserved sectors. More than 40 entities have applied, including startups and partnerships between leading telcos and banks, and the RBI has “in principle” approved more than 10.

Such initiatives have fueled the strong adoption of digital payments and the rise of new market entrants. Mobile-banking transactions have increased more than threefold over the past two years, hitting 150 million in 2014. And mobile-wallet transactions have overtaken m-banking transactions. Prepaid payment-instruments providers such as Paytm and MobiKwik (which offer m-wallets) have been gaining traction and have motivated banks to invest in their own digital-payment offerings.

China. The payments market in China is still booming, with growth in noncash payment values expected to range between 10 percent and 15 percent annually over the next decade, depending upon the payment type. Debit and credit cards will continue to be major drivers of growth. In 2014 alone, the number of bank cards issued jumped by 21 percent to roughly 5 billion. Mobile-payment values were the hot spot, rising by a reported 134 percent.

The Chinese market is not only growing but opening up as well. In the past, state-controlled China UnionPay was the only player permitted to provide clearing services for renminbi-denominated bank-card payments. But since June 1, 2015, other companies—both domestic and foreign—have been able to submit applications for a clearing-services license.

Nonbank players have made a strong entrance in payments with their e-marketplaces and attendant e-wallets—particularly Alibaba with Alipay and Tencent with Tenpay—and are aggressively trying to extend their acceptance in high-traffic apps (such those related to taxi hailing and online shopping). Moreover, they are encouraging users to link their bank accounts to their e-wallet through special promotions. In 2014, during the Spring Festival, Alibaba and Tencent offered digital “red envelopes” with links to cash coupons worth $97 million and $81 million, respectively, to encourage customers to link their bank accounts.

Looking ahead, there will be several areas of disruption. Smaller cities that are underserved by local banks are prime targets of major nonbank players, which are planning to offer online pay, mobile pay, O2O pay (online ordering with offline service and payment), and other products. China’s central bank recently issued guidelines for transaction limits on online payments, triggering strong debate among banks and nonbanks regarding the impact on growth and innovation. As new regulations reshape the competitive landscape, leading players will likely drive further market consolidation.

Central Europe. In central Europe, Poland stands out for being ahead of the curve in innovating and adopting emerging payments technology. For example, 75 percent of POS terminals support near-field communication (NFC), and NFC transactions represent more than a third of the total for global card networks. Competition among banks to innovate has heated up, with mBank leading the charge and gaining competitive advantage owing to its superior digital customer experience.

In addition, banks are working together to establish a strong digital infrastructure to spur m-payments. A local payment scheme, Blik, initiated by Poland’s six largest banks, was launched in February 2015. The participation of large banks and merchant acquirers means that the scheme has significant adoption potential. In parallel, several Polish banks are piloting the launch of mobile, contactless payment services based on host card emulation.

Latin America. Incumbent banks, which are traditionally slow to innovate, have taken the initiative over the past several years to promote payment electronification and cash substitution, hoping to outcompete new entrants. Examples include m-wallets (such as Stelo in Brazil and Todo Pago in Argentina), the launch of local payments schemes (such as Elo in Brazil), and investments to increase POS penetration—often including NFC. In addition, several governments have been actively promoting e-payments by providing tax incentives, changing regulatory frameworks, and adopting social-transfer e-payments.

One interesting development in some countries is that leading players are leveraging payment-processing platforms owned by bank coalitions in order to develop scalable, systemwide, digital innovations (such as Prisma Medios de Pago in Argentina).

RDE Lessons Learned. One harsh lesson learned by incumbents that did not invest sufficiently in digital payments over the past five years is that new entrants are filling the gaps and gaining traction—in some cases significant traction, as in China. Banks that want to regain or improve their market position and adapt to the new world of digital payments must therefore pursue a multifaceted, customer-centric digital strategy, spanning the front-end customer interface to back-end systems. For example, Axis Bank in India has made significant investments in upgrading its payments infrastructure and improving its ability to innovate and go to market rapidly. Elo in Brazil has excelled in customer centricity by understanding the emerging middle class’s pain points in payments and solving them. In Poland, mBank has reinvented its consumer reward program through digital innovation, with strong results.