The intensifying competition between rising emerging-market companies and established multinationals remains at the top of the agenda for CEOs. Challengers not only are radically disrupting a wide range of industries but also are increasingly becoming global leaders themselves. This article is part of a new report, Dueling with Dragons 2.0: The Next Phase of Global Competition , that analyzes the sea change under way in the global automotive-supply, construction-equipment, and chemical industries and the implications for both multinational corporations (MNCs) and emerging-market players (EMPs). The report, along with its recommendations, is based on comprehensive quantitative and qualitative research that included interviews with more than 100 executives and industry experts in China, India, and Latin America.

We found that even though the nature and competitive landscape of these three businesses vary significantly, MNCs in each industry are facing urgent challenges to their leadership from EMPs. Key executives from both MNCs and EMPs expect that competition will further intensify in all three industries. Improving global competitiveness, therefore, must be a top priority of CEOs.

The construction equipment market nicely illustrates the overall development of the global economy: revenue growth and competitive advantage have been heavily influenced by demand in rapidly developing economies.

The Current Landscape: Challengers Are Closing the Gap

During the first few years of the 2000s, the emerging-market boom in infrastructure, housing construction, and mining led to an explosion in demand for construction machinery. In China, for example, the business experienced annual growth of more than 25 percent from 2007 through 2011. China alone accounted for more than one-third of the $108 billion global construction-equipment market at the height of the boom, in 2011. The major developed markets, by contrast, were heavily hit by the global financial crisis. Sales contracted by 30 percent in the U.S. and Japan and by 40 percent in Western Europe during that period. EMPs rode the demand growth in their home markets to catapult up the ranks of top construction-equipment manufacturers.

The EMPs, however, have been feeling the impact of the chillier economic climate in many emerging markets during the past two or three years much more strongly than their MNC counterparts. Demand in China dropped by almost 40 percent from 2011 through 2013, leading to declines in revenues of 20 to 40 percent for leading Chinese players. Many are fraught with overcapacity and are losing money heavily.

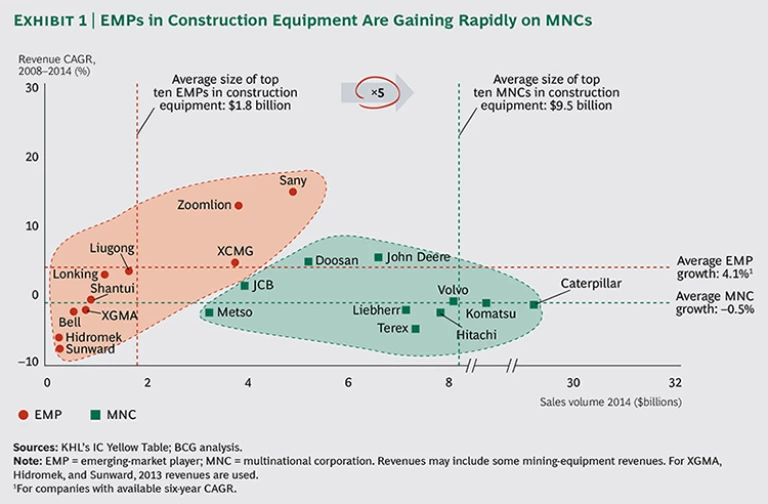

Despite the headwinds at home, however, the largest EMPs—Zoomlion and Sany of China—have now reached about $5 billion in annual revenues, making them bigger than such longtime incumbents as Metso and JCB. (See Exhibit 1.) The top Chinese players have continued to expand their foreign-market forays, which they had initiated late in the previous decade.

As a first step, the Chinese players have typically been achieving organic growth by exporting to other emerging markets. XCMG has enjoyed substantial success in Latin America, for example, with a landmark order worth $750 million from the Venezuelan government in 2012. The company subsequently invested close to $200 million to set up a manufacturing plant in Brazil in an effort to solidify its market position in Latin America.

EMPs have had trouble trying to go the organic route to seize share in Western markets, where customers value branding, quality, and established distribution systems much more highly. There are opportunities for inorganic growth, however, because of the financial distress of some Western players. For these reasons, several leading EMPs have made substantial inroads in developed economies through acquisitions—making more than 20 significant acquisitions of incumbents in mature markets since 2010. For example, India-based Tata Hitachi Construction Machinery (formerly known as Telcon but now majority owned by Hitachi, with a minority stake held by Tata) acquired nationally dominant Spanish players Lebrero and Serviplem in 2008 and 2009, respectively, quickly giving the company a strong footprint in Europe.

A similar pattern occurred in the concrete pump industry when, within a few years, many of Europe’s leading suppliers were taken over by their Chinese competitors. (See “How Chinese Companies Took Over the Concrete Pump Market.”) Many EMPs have also entered into joint ventures with MNCs, exchanging local market access for the latest technology. China’s Liugong Machinery, for example, has made extensive agreements with Cummins, a leading U.S. diesel-engine manufacturer, as well as with Scandinavian equipment-maker Metso for crushing and screening technology. The piecing together of critical technology through different joint ventures has rapidly accelerated the ability of EMPs to catch up technologically.

HOW CHINESE COMPANIES TOOK OVER THE CONCRETE PUMP MARKET

Until about a decade ago, midsize European companies, such as Putzmeister and Schwing Stetter, were the technology leaders in the global concrete-pump business. They not only dominated Western markets but also had strong positions in emerging markets.

European companies began losing ground to Chinese companies during China’s construction boom in the first decade of the twenty-first century, when China accounted for more than two-thirds of global sales of concrete pumps. The financial crisis of 2008 was the turning point: sales in the West ground almost to a halt. As a result, Putzmeister’s revenues dropped from more than $1 billion in 2008 to just $440 million in 2012, when the company was sold to China’s Sany. Schwing, Putzmeister’s main competitor, was soon acquired by XCMG, also based in China. The chief goal of the Chinese challengers was to gain access to the market leaders’ technology and customers. Already in 2008, Zoomlion had bought Cifa, a leading Italian manufacturer. So, within a few years, the global concrete-pump business was solidly under Chinese ownership.

It will take time to determine how well these acquisitions succeed. As of yet, Sany has not fully integrated Putzmeister. Rather, Sany is following a dual strategy: Putzmeister products are sold in its traditional strongholds in the West, while in other markets, Sany products are featured. In China, which still accounts for a huge portion of global sales, products from both brands are offered.

The Future Landscape: The Bid for Leadership

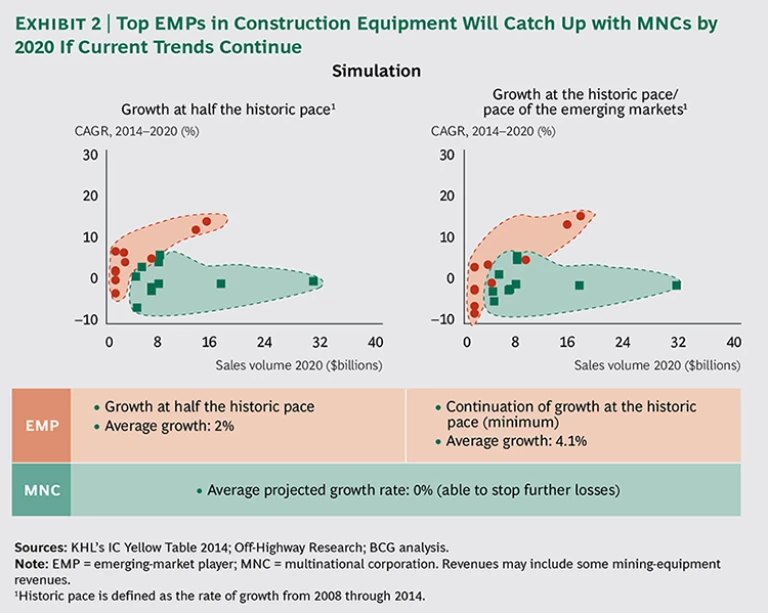

Top industry executives interviewed by BCG believe that, in the short term, the construction equipment business will see a bit of a slowdown in the further expansion of EMPs. In particular, Chinese companies have recently curtailed their expansion plans as they wrestle with slower growth at home. After they restructure, however, challengers from China are expected to renew their attack on the home markets of MNCs. According to our simulations, the top construction-equipment EMPs will catch up with the top MNCs in size by 2020 if they continue to grow at the same rate. (See Exhibit 2.) In four years or so, three of the world’s five largest construction-equipment manufacturers could be based in emerging markets if these companies continue to grow at their current rates. Also, if China gets serious about its goal of consolidating some industries, executives say a Chinese construction-equipment giant could begin approaching the size of Caterpillar and Komatsu, the current global leaders.

Many of the executives we interviewed—including those from rental companies that are large buyers of construction equipment—said that they think the construction equipment made by EMPs is catching up to that of MNCs in terms of mechanical performance and reliability. The recent acquisitions of Western technologies will accelerate this trend even though, as most executives believe, operations have not yet been well integrated into those of the new owners. The fact that both MNCs and their challengers buy many key components, such as hydraulics, from the same suppliers makes it even easier for EMPs to close the technology gap. The threat to MNCs, of course, will vary by product category: experts expect that mini-excavators or light cranes will be among the first construction-equipment products with which EMPs will be able to attain a truly global leadership position.

Winning Globally in the Construction Equipment Industry

The cooling of the building and mining booms in emerging markets gives both MNCs and EMPs some time to improve their competitive positions as they gear up for the next wave of growth in construction equipment and for renewed battles in developed markets.

Key Strategies for MNCs

The shifting competitive landscape requires MNCs to adjust their strategies for products and technology, operations, and go-to-market approaches.

Products and Technology. The following are the key findings from our interviews:

- Focus on innovations that create real customer value. As the technology gap closes and EMPs slowly build up their sales and service footprints in Western markets, even some traditional customers will be likely to settle for EMPs’ construction-equipment products, which are “good enough” and sell for significantly less than MNCs’ products. To counter this threat, MNCs should use their edge in R&D to develop a new value proposition for their customers. Digital technologies are expected to become particularly important. Construction equipment often sits idle on a site for a considerable amount of time as other steps in the construction process are being completed. Digital devices that enhance the integration of machines across the site offer significant potential for reducing working capital—and thus costs—by allowing for better work-site coordination and improved safety. Other digital technologies that enable construction equipment owners to track emissions and peak performance, identify maintenance needs, and better manage their fleets will further increase productivity and reduce the total cost of ownership of an individual machine. (See “Komatsu: Leveraging Digital Technologies to Stay Ahead.”)

KOMATSU LEVERAGING DIGITAL TECHNOLOGIES TO STAY AHEAD

Komatsu has a long history of digital innovation, realizing early on that information technology would be key to unleashing the next wave of improvement in productivity and cost-effectiveness in construction equipment. Komatsu has pioneered the use of remote equipment monitoring, which reduces unplanned downtime and enables more efficient servicing. Komatsu was also the first supplier to feature autonomous haulage systems—which reduce the need for personnel—for the mining industry. And it has developed solutions for bulldozers that require less training for operators. Each of these offerings decreases the capital costs and operating expenses for Komatsu’s customers.

Komatsu has been a leader in helping customers optimize their operations on a more holistic level, which goes beyond the use of individual pieces of machinery, as well. In 2014, Komatsu formed a joint venture with GE Mining that aims to increase the productivity of entire mining operations. In a similar vein, in January 2015 Komatsu launched a new IT-based offering that seeks to help customers improve operational efficiency through 3-D modeling of construction sites and the optimization of workflows.

If successful, these efforts will enable Komatsu—as well as competitors that follow a similar path—to make the transformation from a supplier of machinery to a supplier of efficiency-enhancing solutions to its customers.

- Develop a competitive middle-market offering. The middle market for construction equipment, which constitutes the bulk of demand in emerging markets, is often underserved by MNCs and offers considerable opportunities for growth—if MNCs can build the right offering for these very price-sensitive customers. For example, such customers are often willing to compromise on comfort features for their personnel, such as adjustable seats, air-conditioning, or optimized noise levels. But it’s not all about stripping down products. Products to be used in hot and humid climates, such as in India, may require more powerful water-cooling systems than similar products to be used in Europe. The UK’s J.C. Bamford Excavators (commonly known as JCB) illustrates a successful midmarket expansion. The company has made India its largest single market by heavily localizing its business and adapting its product portfolio to local needs—for example, by introducing a sturdier wheel loader with a stronger axis and improved brakes to handle the specific requirements of Indian construction sites.

Operations. The executives we interviewed identified the following priorities:

- Build local production and distribution partnerships. Partnerships can help MNCs quickly acquire links in local value chains by providing access to production facilities, suppliers, and sales and service networks that otherwise would be difficult to develop from scratch in an emerging market. Not surprisingly, then, many MNCs already have partnerships with local players in emerging markets. Caterpillar, for example, has entered into more than half a dozen major joint ventures with different partners in China for different purposes, from equipment and component manufacturing to after-sales services. The experts we interviewed believe that partnerships will become even more important for MNCs for two reasons. First, as demand continues to shift to emerging markets, MNCs will need to set up more local operations. Second, as EMPs mature and grow, they will become more formidable competitors in their home markets. That will make cooperation an attractive alternative to competition. The inherent difficulty lies in the fact that, in any given competitive environment, almost any strong partner is also a potential future competitor. We found in our extensive research that one key to a successful partnership is to acknowledge these conflicting interests and construe the partnership accordingly.

- Become more cost competitive. Core MNC markets in the West are expected to stagnate or grow very slowly for years to come, and prices are likely to come under pressure as EMPs increase their presence in these markets. MNCs must handle this pressure on profitability with efficiency programs that include the entire value chain. Hitachi, for example, has laid out a comprehensive, two-step transformation of its construction-equipment business that spans six years and aims to improve profitability by about 8 percentage points through 2016. We believe that many companies need to think boldly about these types of restructuring efforts.

Go-to-Market Approach. One winning strategy emphasized by executives is for MNCs to expand value-added services. Most MNCs have invested significantly in the ability to provide the full range of high-value-added services to customers. Executives believe that this will remain key to helping them differentiate themselves and protect key accounts. In particular, MNCs should focus on a value proposition that considers the total cost of ownership over the lifetime of a product, not just the initial investment. For example, they should further push their offerings of equipment financing, training for the best use of machines, fleet management, insurance products that protect the value of equipment, and relocation services for when equipment needs to be dismantled, transported, and reassembled.

Key Strategies for EMPs

To compete with MNCs on the global stage more effectively, EMPs need to revamp their strategies for products and technology, operations, and go-to-market approaches.

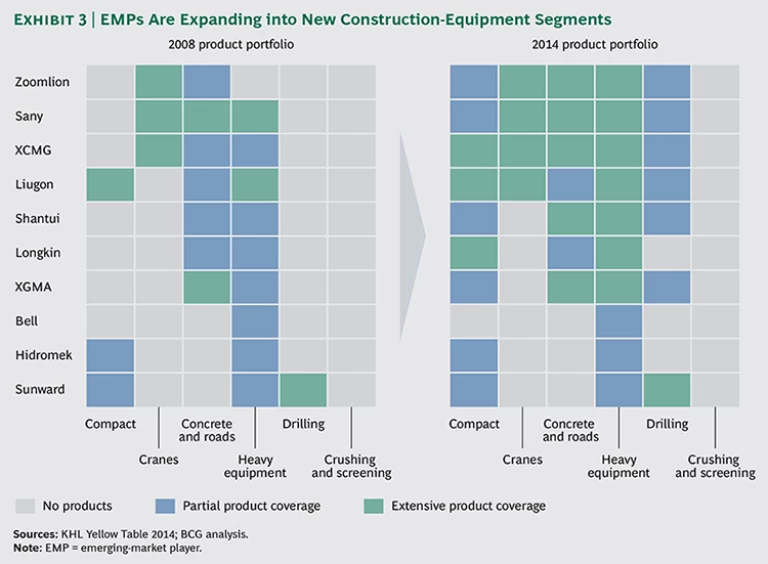

Products and Technology. The executives we interviewed cited increasing innovation as a top priority. EMPs have already significantly enhanced their product portfolios over the last half decade or so. (See Exhibit 3.) They should continue to invest aggressively to further close the gap in terms of performance and quality. EMPs particularly need to catch up in engine technology and make sure that they can fully comply with Western emission standards if they wish to stay in the game and expand their global reach. The U.S. norms for hydrocarbon and nitrogen oxide emissions, for example, are 0.6 grams per kilowatt-hour in the 130 to 560 kw engine class, which is more than ten times stricter than the standards in China. It is no surprise that Chinese players are only just beginning to offer compliant products.

Operations. The following key strategies emerged from our interviews:

- Improve efficiency. The main advantage for EMPs today is cost. As in many manufacturing industries, however, this edge is shrinking as costs in emerging markets rise disproportionately and as MNCs increasingly localize in emerging markets. The current overcapacity of many EMPs adds to their inefficiency. They will therefore need to focus more on streamlining their operations. China’s XCMG, for example, has introduced a central IT platform to handle its entire supplier management, a measure that the company says has reduced procurement costs by 20 percent.

- Get basic business capabilities and processes right. During the years of rapid local growth, EMPs often did not have sufficient time to develop adequate internal processes and structures, such as for control or people development. Global expansion inevitably increases the level of complexity in an organization, which makes such capabilities much more valuable. According to the experts we interviewed, EMPs would do well to invest in these basic capabilities before taking on the next chapter in their growth story, even if the move seems contrary to their highly entrepreneurial culture.

Go-to-Market Approach. Executives strongly advised EMPs to expand their footprints in developed markets. EMPs should develop a greater on-the-ground presence and localize their operations in developed economies to expand their businesses. This is especially true for sales, distribution, services, and support, given that Western customers place a high value on the wide availability and breadth of those capabilities. Services can deliver much higher margins to EMPs than typical construction-equipment sales can. Again, partnering may be critical. Sany, for example, is partnering in the U.S. with GE Capital to offer comprehensive financing solutions to its customers. In addition to expanding the service portfolio, the partnership provides the EMP with trustworthiness and brand value.

The massive shift in global demand from developed to emerging markets in the latter half of the first decade of the 2000s essentially brought about a split in the world market for construction equipment. EMPs, mainly from China, have gained significant share in emerging markets, while the developed world is still largely in the hands of Western MNCs. But this is hardly a steady state: MNCs will need to mount a new attack on emerging markets because they represent the most promising sources of growth. For their part, EMPs will strive to make further forays into Western markets. Both players will need to up their games to pursue their strategies successfully.

Winning the Next Phase of Global Competition

As a result of our extensive work with leading companies on their globalization strategies and the findings from this study, we have defined a three-step approach for companies to succeed in the quickly changing global competitive landscape. (See Exhibit 4.)

Step One: Specify the Challenge. Most companies today take stock of market developments and key competitors in their regular strategy and planning processes. We have found, however, that these standard processes often fall short of establishing a commonly shared opinion when it comes to the opportunities and risks of globalization. Also, the remarkable speed with which new competitors from emerging markets have arrived on the scene requires companies to maintain extensive intelligence on their competition. Many organizations have found it useful to track in detail the development of their top 20 or so competitors regarding major wins, investments, partnerships, and geographic footprints.

Given the sometimes volatile and difficult-to-forecast developments in global markets, it is very important to form a common vision of what the industry will look like in three to five years. This requires an understanding of the areas for action. What are the fundamental trends in demand, for example, regardless of economic or political turmoil in some countries? How does a company compare with its competitors? What will be the next breakthrough in technology? How are regulations likely to change? This vision should guide efforts in the second step of the process and the big bets a company takes.

Step Two: Define a Winning Mix of Strategies. In this article, we have outlined the most common areas requiring action by MNCs and EMPs in the construction equipment industry.

At the most basic level, MNCs must first defend the core—their home markets and the global premium segment—by reinforcing strengths such as technology and customer proximity. Second, they must expand their business model to tackle EMPs on their home turf. Because we believe it is helpful to think about both targets from three angles—products and technologies, operations, and the go-to-market approach—we have offered our analysis from those perspectives.

Depending on the industry and the specific position of a company within it, the relative importance of these three levers varies greatly. We strongly recommend taking a holistic view, because many companies find that they need to undergo a transformative approach that comprises a wide range of diagnostics and change measures in all three categories to address their globalization challenge.

EMPs typically enjoy the benefits of a relatively low cost position and a growing home market. However, it has been our experience that during the phase of hypergrowth, many EMPs are not able to build the organizational and technological capabilities that they need to continue their global expansion. On the basis of our broad experience in working with emerging-market challengers, we have defined a dedicated, comprehensive approach that enables an EMP to go global. The global Challenger to Leader Program covers four areas and ensures that they are aligned with the company’s globalization agenda:

- Global DNA: vision, culture, and master strategy

- Global People and Organization: leadership, talent management, organization, and governance

- Global Go-to-Market Model: product strategy, sales approach, partnerships, and stakeholder management

- Global Operations: global footprint, innovation, and operations model

Step Three: Prepare for Change. We see two key enablers of a successful globally competitive strategy. One is to properly align organization and governance structures. Adjusting key performance indicators and defining the right balance of decision authority between headquarters and country operations are two important issues that must be resolved.

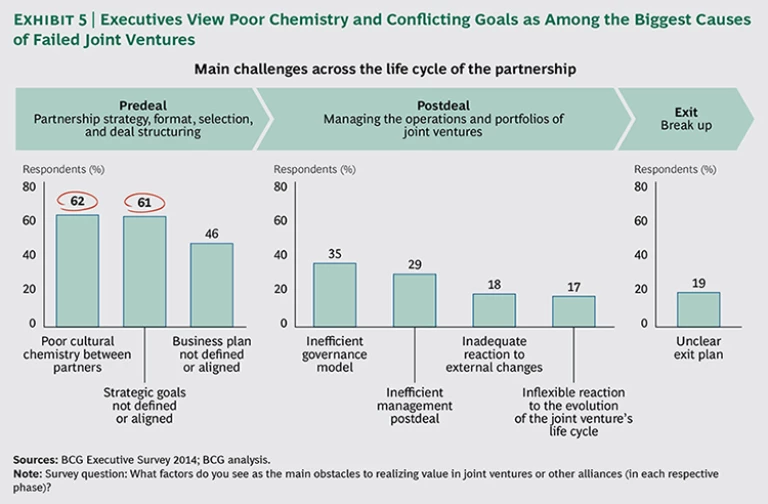

The other key enabler centers on partnerships and joint ventures, which many companies will find are key elements in their strategy mix. A recent BCG study on mergers and acquisitions revealed that the vast majority of executives are disappointed by the performance of their cross-border joint ventures. (See Getting More Value from Joint Ventures , BCG Focus, December 2014). The analysis identified several critical measures that can help avoid such disappointment. (See Exhibit 5.) They include ensuring that there is cultural chemistry between partners and that there is alignment on strategic goals and business plans, including a clear process for when business plans are not met along the way. Other measures are a sound governance model and an exit plan.

Globalization will continue to bring significant shifts to the construction equipment industry—and undoubtedly to many more. But despite these shifts, most of the executives we surveyed agreed that for the well-prepared company—whether from the developed or the developing world—the globalized market offers much more opportunity than risk.