In today’s omnichannel world, consumers have many more ways to learn about and purchase products and services—such as through websites and social media, in a store, and on a device while on the go—than they have had in the past. With so many channels, platforms, and devices to get right, companies frequently struggle to coordinate and prioritize the many different ways that customers interact with brands. Worse yet, they have difficulty defining the right metrics to measure success.

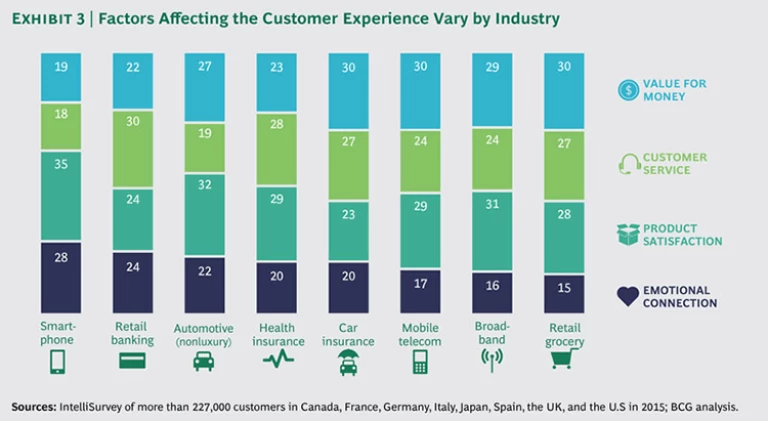

The good news is that companies can assess and improve their customers’ experience through a simple yet powerful indicator that BCG has found to be one of the best predictors of business performance: word-of-mouth recommendation, or brand advocacy. The better the experience, the more customers will talk about it with the people they know—while the worse the experience, the more they will spread the bad news. Our research has found that four aspects of the customer experience have an impact on brand advocacy: value for money, customer service, product satisfaction, and emotional connection.

To holistically measure word-of-mouth recommendation, companies can use BCG’s Brand Advocacy Index (BAI), the only measure of customers’ experience that is highly correlated with growth. BAI measures customer experience by means of actual recommendations—not just good intentions—among customers, noncustomers, and former customers. It asks simple yet powerful questions, such as “Have you recommended the brand, and why?”

For this year’s report, we used BAI to measure the experiences of more than 227,000 customers—roughly double the number of customers surveyed in our previous report—with 650 brands in eight countries and seven industries. (See Fueling Growth Through Word of Mouth, BCG Focus, December 2013.) Our survey revealed the companies whose customers’ experiences have earned them the strongest word-of-mouth recommendations. (For a list of the top brands by BAI, see “The Most Recommended Brands 2015”)

Our survey also revealed the sources of growth as a result of good customer experience. We know that people who have excellent customer experiences become strong advocates for a brand, spend significantly more, and are much more loyal than customers who have poor experiences. Companies in every industry can use these insights to improve their customers’ experience and thereby generate significantly higher growth.

How the Customer Experience Fuels Growth

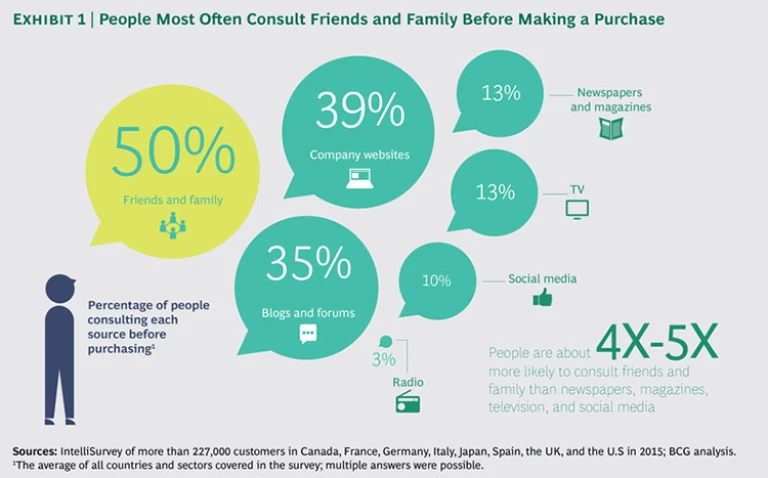

Customers spread the word about their experiences—whether positive or negative—far and wide among people they know. Those opinions matter a great deal. Direct word-of-mouth recommendations from friends and family are by far the most important source of information for customers thinking about buying a product or service: such brand advocacy is about four to five times more influential than the more indirect recommendations associated with newspapers, magazines, television, and social media, for instance. (See Exhibit 1.) These results are consistent across countries and industries.

Conversations about the customer experience also boost financial performance. Our research shows definitively that brands with high levels of advocacy significantly outperform those that are heavily criticized. In the sample of brands studied, we found that the average difference between the topline growth of the highest- and lowest-scoring brands was 27 percentage points.

Consider, for example, how one company in a traditional industry created an excellent omnichannel experience that resulted in growth that is much faster than that of its competitors. Techniker Krankenkasse (TK), founded in 1884, is the largest health insurer in Germany, and it is growing at a rate of up to 7 percent per year. The company was named the best insurer in Germany by Focus Money magazine for nine years running. TK is the top-rated health insurer on BCG’s list of the most recommended brands, with a BAI of 49 percent—the highest score of any company in the health insurance industry in the countries we studied, and 11 percentage points higher than the second-highest company in Germany. BAI reveals that a key driver for that performance is TK’s attention to customer service. (See “Techniker Krankenkasse: Excelling in a Traditional Industry.”)

TECHNIKER KRANKENKASSE: EXCELLING IN A TRADITIONAL INDUSTRY

Techniker Krankenkasse (TK), a public health insurer in Germany, excels at customer service, one of the four elements of the customer experience that we find heavily influences people’s decisions about recommending a brand. Customer service fuels the highest number of recommendations for TK among all the brands we studied in the health insurance industry.

Historically, TK focused on employees in industries such as automotive, high-tech, and aviation. In the mid-1990s, the market for health care in Germany opened up, and regulators allowed TK to cater to people in other industries. In Germany, public health insurers must all provide the same coverage and services, so to capture market share, they must differentiate in other areas. In 1996, TK’s CEO at the time, Norbert Klusen, began to make significant investments in building the brand. Then, in the first few years of the 2000s, he paired that focus with a centralized, low-cost organizational structure.

The majority of health insurance customers in Germany are typically not in regular contact with their insurers. TK thus differentiates itself with a focus on customer service that is unusually strong for the country’s health-insurance industry. The approach is modeled on that of leading companies in industries such as online retailing and retail banking, rather than on competitors in the traditional health-insurance industry. TK has a relatively small network (200 branches) and emphasizes online and phone contact with customers. The company was the first insurer in Germany to set up a call center and a medical-advice line staffed by doctors, both available 24/7.

The call center aims to answer calls within 15 seconds and has a first-contact solution rate of 82 percent. It uses sophisticated data analysis of its 8 million customer contacts per year to improve health care delivery and increase customer satisfaction. Patients with chronic diseases also highly value its phone-based coaching program, which helps them understand their conditions and make positive changes in their health. TK’s current CEO, Jens Christian Baas, is building up the company’s digital capabilities, exploring opportunities to create long-term relationships with clients through online channels such as e-mail, social media, and apps.

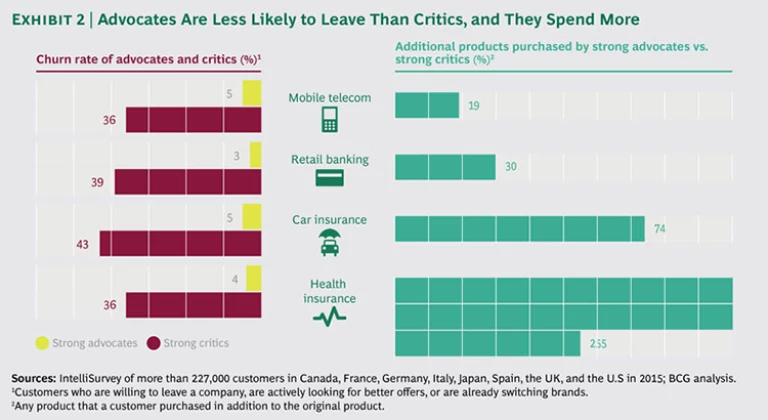

In this report, we have strengthened the proof of BAI’s impact on growth and identified the precise sources of that boost in performance. Our research shows that strong advocates for a brand spend more, as measured by higher rates of cross-selling, larger shares of wallet, and other industry-specific metrics. In car insurance, for example, strong advocates buy 74 percent more products than strong critics. These findings prove that a better experience leads to greater revenues, loyalty, and growth.

A company’s BAI also predicts whether customers will stick with a brand or leave it. A company’s strong advocates have much higher levels of loyalty. For example, 39 percent of the strong critics of retail banking brands were thinking about leaving the company, while only 3 percent of the strong advocates were considering doing so. Thirty-six percent of the strong critics of health insurers were thinking about leaving, compared with only 4 percent of strong advocates. (See Exhibit 2.)

What’s more, we have found that once a customer leaves a brand, word of mouth often doesn’t stop. Thirty-seven percent of all former customers continue talking about their experience with a brand—almost half of them negatively—after they have left. By contrast, 54 percent of current customers talk about the brand, but only about 6 percent do so in a negative way. Results vary by market and industry, especially in the smartphone and nonluxury automotive industries, where former customers remain highly vocal. Industries with contractual relationships—such as mobile, broadband, and retail banking—often feature higher levels of critics than other industries, such as automotive and retail grocery.

When companies lose customers because of a negative experience, they lose both the direct revenues from those customers and the indirect revenues that result from strong negative advocacy. This reinforces the imperative of providing excellent customer experiences and preventing good customers from leaving.

The Aspects of the Experience That Matter to Customers

In addition to understanding how advocacy fuels growth, we now understand the precise rational and emotional factors that shape the customer experience. The mix of the four dimensions we have identified—value for money, customer service, product satisfaction, and emotional connection—can vary widely by industry and segment. (See Exhibit 3.)

In retail banking, for example, the personal service that customers receive at branches traditionally plays a major role in the overall experience. But some online-focused institutions, known as direct banks—which have the highest BAIs in the retail banking industry in most countries—have been disrupting the industry with a customer experience that emphasizes value for money and a mostly online experience. For example, Boursorama Banque is the top retail bank in France on our list of the most recommended brands. Its BAI of 55 percent is a full 24 percentage points higher than the second-highest bank. Banking is not usually considered a fun experience. But Boursorama shows how, even in a traditional industry, a direct bank can make the experience as fast and painless as possible, giving people something to talk about. (See “Boursorama Banque: Succeeding as a Digital Upstart.”)

BOURSORAMA BANQUE: SUCCEEDING AS A DIGITAL UPSTART

Boursorama leads the retail banking industry in value for money, one of the four elements of the customer experience that we find heavily influences people’s decisions about recommending a brand. Value for money—the primary reason for the bank’s high BAI score—fuels the highest number of recommendations for Boursorama in the retail banking industry across all the countries we studied. Backed by parent company Société Générale, Boursorama offers a full portfolio of retail banking products and focuses on a more affluent segment of the market. Still, it heavily promotes itself as the least expensive bank in France, displaying fees prominently. Many of its services are free.

Boursorama also scores high on customer service relative to others in the retail banking industry. The bank has created a strong culture of putting the customer first, looking for inspiration outside the banking sector. It selects employees on the basis of their customer centricity and people skills, and it trains them in the day-to-day requirements for their jobs. Employees receive incentives that are based on such aspects of the experience as waiting time, customer satisfaction, and service levels—not on selling additional products or generating higher fees. “Clients buy products,” says Marie Cheval, chairperson and CEO of Boursorama. “We don’t sell products.”

The bank has a relentless focus on efficiency to minimize the time that customers spend on banking. It constantly looks for ways to speed up the self-service process—reducing the number of questions that customers are asked and the documents that they have to send—with the goal of keeping customers mostly online to reduce call center costs. “We feel the clients even though, as a direct bank, we never see them,” says Cheval. “If they are not happy, they call us, which costs us more money.”

The bank also stands out for its ability to provide a service that is exclusively online and mobile. It’s the first bank in France to offer a completely online mortgage application, for example. Customers can also take advantage of other innovations for the French market, such as increasing their withdrawal and credit card limits in real time and reporting a lost card via a secure mobile-phone app.

“We align the interests of the bank with the interests of customers—a win-win situation,” says Cheval. “Customers feel it—and they recommend us.”

Value for money, customer service, and product satisfaction are certainly important. They remain the top factors in every industry, and without superior performance on these dimensions, a brand is unlikely to earn customers’ strong recommendations. But we find that once companies master these rational factors, an emotional connection often separates the good from the great. Emotional factors, which vary by industry, can include brand identification, social responsibility, innovation, and trustworthiness.

High performers often score well in both value for money and emotional connection, for example, but an emotional connection is more important—by 13 percentage points—than value for money for advocacy among leading brands.

Top-scoring brands Samsung and iPhone illustrate the power of an emotional connection. When it comes to smartphones, key emotional factors include how much consumers identify with a brand and how much they perceive it to be innovative. For Samsung, value for money fuels recommendations twice as often as for iPhone, but iPhone scores higher on emotional factors. For iPhone, emotional factors can trump lower cost, allowing the brand to charge premium prices. Emotional factors cause iPhone to score higher than Samsung in the U.S., Spain, and Japan, for example.

Trader Joe’s shows how an emotional connection can play a starring role even in a relatively low-tech and store-based industry such as retail grocery. With a BAI of 53 percent, Trader Joe’s is the top retail grocer in the U.S. on our list of most recommended brands. It scored the highest on BAI among retail grocers in the countries we studied, ahead of highly popular brands such as Wegmans and Costco in the U.S. and Esselunga in Italy (each with a score of 50 percent). (See “Trader Joe’s: Leading in a Store-Based Industry.”)

TRADER JOE’S: LEADING IN A STORE-BASED INDUSTRY

Retail grocer Trader Joe’s ranks near the top of its industry when it comes to customers’ recommendations of its products and customer service. But the company leads the pack in terms of customers’ emotional connection with the brand—another dimension of the customer experience that we find can heavily influence people’s decisions about recommending a brand. In fact, an emotional connection is the main factor behind Trader Joe’s high BAI. The company also has the highest emotional-connection levels in the retail grocery industry across all the countries we studied, even though emotional factors tend to rank relatively low for the industry overall. Trader Joe’s experience shows that companies that foster an emotional connection, in addition to performing well on the other dimensions, have an advantage over those that don’t work to create such a connection.

Interestingly, Trader Joe’s high rates of product satisfaction and customer service also fuel some of the highest number of recommendations for the company in the retail grocery industry, showing how the major dimensions of the customer experience reinforce each other. These high ratings could compensate for the relatively moderate influence of value for money on Trader Joe’s BAI.

Trader Joe’s scores high on BAI without competing on four of the top-five key factors that grocery store consumers say are most important to them: convenient location, low prices, good sales and promotions, and one-stop shopping. Trader Joe’s has only 450 stores across the U.S. Its prices are good, but they are not the lowest. It eschews sales, coupons, and promotions. Its relatively small stores have only 2,000 to 4,000 SKUs—of which more than 80 percent are private label—compared with 40,000 to 70,000 SKUs at a typical full-size grocery store, such as Publix or Wegmans. On product dimensions such as high-quality meats, produce, and organic options, Whole Foods beats out Trader Joe’s.

Why, then, did Trader Joe’s rank second out of 68 supermarkets in Consumer Reports’ 2015 rankings and achieve one of the highest ranks in customer experience as measured by two independent benchmarks? How can it produce more sales per square foot than any supermarket chain in the U.S. with at least a comparable number of stores?

Trader Joe’s does this through a selection of simple yet buzz-worthy products and marketing that is aimed squarely at producing an emotional connection with its target segment of educated and adventurous shoppers. The company’s target customer has been described as an unemployed PhD who has the intelligence and education to appreciate the store’s products but not necessarily the budget to buy them at high retail prices.

Trader Joe’s secret is that it treats food like fashion. The company’s buyers travel the globe to bring back minimally processed products that set trends, rather than follow them. Its stores feature distinctive products such as frozen Indian food, Thai lime-and-chili cashews, dried mangos, and inexpensive wines. Simplicity is the key: unlike the typical U.S. supermarket, Trader Joe’s doesn’t carry 40 kinds of nut butters; instead, it has about 10. But all of them are carefully selected to appeal to the chain’s target customer. One of those products is the addictive Speculoos Cookie Butter, which resembles peanut butter and tastes almost (but not quite) like gingerbread. Jars of the top-selling spread reportedly disappear the moment they hit the shelves.

The chain reinforces its homespun brand image by hiring local artists to create signage unique to a given location. An unusual style of customer service also sets the chain apart. For example, managers wear Hawaiian shirts and have titles such as captain, commander, and first mate, which reflect the store’s seafarer theme.

Trader Joe’s stores are so popular that they frequently achieve significant word of mouth before they have even entered an area—despite minimal external advertising, which usually consists of mailing a folksy newsletter to nearby customers. Such positive word of mouth will not surprise anyone who has stepped foot in one of the company’s stores.

How to Improve the Customer Experience

Companies typically have their core product, service, and brand marketing well under control, since these areas lie close to traditional core capabilities. The key challenge today involves managing the increasingly complex, omnichannel customer pathways that define the overall experience with a brand, and then to create positive brand advocacy as a result of that experience.

BAI can guide companies as they pinpoint efforts that will generate a step change in improvement of the customer experience and therefore in the levels of advocacy, loyalty, and—ultimately—growth. Advocacy levels reveal the key sources of growth as well as the underlying reasons for over- or underperformance. This allows targeted interventions and investments to improve a company’s performance compared with competitors.

Companies can take the following steps to improve the overall experience of their customers and to manage customers’ perceptions of, and advocacy for, that experience.

Improve the omnichannel customer experience. The best companies develop a clear vision on the basis of insights about customer preferences. For example, a company may aim to provide personalized and relevant service, enabling customers to perform most operations across all touch points, resolve questions on the first interaction, and learn about the best uses of a product and about available support services.

Leading companies also detail key customer pathways, with a focus on so-called moments of truth, which determine whether a customer will buy a product or choose to switch companies. They recognize that each channel has a defined role at each step on the customer pathway. At any point along the path, a customer may transition seamlessly among channels depending on what’s most convenient. For example, a customer may browse online with a mobile device, receive relevant offers through e-mail, and obtain service and support in a store. Companies can create an attractive business case by optimizing the key pathways on the basis of lifetime customer value and return on investment across channels, with each channel making a clear contribution to the major sources of value in the customer relationship.

Effective companies also create the conditions for success: organizational capabilities, culture, KPIs, processes, and systems. For example, collaboration among channels can be reflected in KPIs, while processes may encourage self-service through online channels. Finally, the best companies develop a transformational roadmap for success, with a clear end point in mind and realistic milestones along the way.

Proactively fuel higher advocacy. Companies with great customer experiences have a clear focus on specific and well-defined target customer segments, whose members share the same values as the brand and are aligned with the brand’s marketing goals. The crucial, most influential advocates—typically only 2 percent of a community—can be found in those segments.

Next, such companies build relationships with these informal opinion leaders that go beyond the transactional. For instance, the most effective companies offer gifts that matter to target customers and increase affinity with the brand without expecting anything in return. This move simultaneously develops an experience that disrupts the status quo and compels people to talk about the brand. In addition, such companies foster ongoing, two-way communications and relationships across online and off-line platforms.

A compelling customer experience separates the winners from the losers in the battle for the word-of-mouth recommendations that generate the most sales. That advantage leads companies to grow faster than those with less compelling experiences.

Companies in any industry can precisely measure the customer experience with BAI. They can then use this knowledge in tangible ways to improve the most important areas of their customers’ experiences. Companies that do this will create lasting reputational advantage.

Acknowledgments

This report would not have been possible without the efforts of our colleagues Jan Cortenbach, Maria Enderiz, Hemant Sangwan, José María Sanz, and David Vigo.