During the more than six years that I had the privilege of being CEO of Siemens Healthcare, I witnessed up close just how attractive a business health care is. Name another sector in which such powerful demographic, economic, and cultural forces are fueling rapid growth. The heaviest users of health care services—the elderly—are becoming an ever-larger portion of the world’s population. Global wealth is increasing, allowing millions of people in the developing world to spend more on health care than ever before. Even in the developed world, where the high cost of care remains a hot issue, people are becoming a lot more conscious about their health and more willing to invest in maintaining it. These and other trends have made health care a remarkably resilient industry, even in times of recession.

And yet no CEO of a traditional health care business today can be entirely confident that his or her company will be able to take advantage of all this opportunity. Parallel to its global growth, the health care sector is going through a complex and multidimensional transformation. Heretofore distinct boundaries between sectors—payers, providers, pharma, and medtech—are blurring as the industry becomes a more integrated system. New competitors, from small start-ups to large IT companies, are entering the health care space, posing new competitive challenges to traditional players. Disruptive innovations are upending traditional business models. The ways in which payers finance health care and providers deliver it are changing, with big implications for how drug and device makers design and market their offerings. New markets in the developing world with unfamiliar competitive dynamics are increasingly driving change in the sector.

To navigate this tsunami of transformation, health care CEOs—and especially those in the medtech sector, with which I am most familiar—can’t afford to be complacent. They need to be planning today for how their companies will react and adapt to four major industry-changing trends: disruptive technological and scientific innovation, the new focus on health care value, the increasing scarcity of medical specialists, and the more central role played by emerging markets in driving industry innovation.

Disruptive Innovation

These days, everyone in the business world is talking about disruption. In health care, however, disruption isn’t just a buzzword, it’s a daily reality.

Disruption is driven partly by technology. Take, for example, the impact of new applications that leverage the growing computing power of cheap consumer electronics. In China today, you can buy a wireless ultrasound probe online for about $1,200 that runs off an app on your iPad. The device is so easy to use that you don’t need a trained clinician to record and store images or upload them to the cloud and send them to any expert in the world.

Such developments threaten to wreak havoc in the market for medical devices. Traditionally, device companies have succeeded by offering expensive, special-purpose machines, sold at relatively high margins and protected from competition by patents and regulatory classification as approved medical devices. Today, however, new players are exploiting new technologies to enter the medical-device market, offering low-cost solutions that established health care players will be hard-pressed to counter. Whether an electronic device to improve hearing is classified as a hearing aid or as headphones may not make much difference to consumers—so long as it helps them hear better. And although the technology in both devices may be quite similar, the price difference is enormous. Which type of device would health officials, looking to rein in rising costs, be more likely to support?

Recent breakthroughs in medical science constitute another source of disruptive innovation. Take, for example, the way that advances in genotyping and the wide availability of gene sequencing are inaugurating a new era of so-called precision medicine. A small start-up by the name of deCode Genetics has collected detailed genetic and medical information from some 500,000 individuals worldwide. More than 150,000 are citizens of Iceland, about 2,600 of whom have volunteered to have their full genomes sequenced. Since all Icelanders are closely related, deCode now has the ability to extrapolate from its data and accurately estimate the DNA makeup of nearly all the country’s 320,000 citizens.

The massive dataset compiled by deCode, combined with the high-quality care provided by the Icelandic universal health care system, makes it possible to conduct very large-scale studies of virtually any common disease. For instance, the company has identified the roughly 2,000 people in Iceland who have a mutation of the gene BRCA2, which greatly increases the risk of developing breast or ovarian cancer. Local health authorities and deCode are now debating whether to warn these people so they can take preventive action.

Although the ultimate impact on clinical practice of this kind of scientific innovation is not yet clear, it’s a good example of where medicine is headed: massive datasets, supported by a big-data IT infrastructure and focused on analyzing diseases across entire populations. In the US, for example, President Obama recently announced a $130 million initiative at the National Institutes of Health to assemble a giant database of genetic and other medical information from more than a million volunteers. And as gene sequencing becomes widely available, new companies, such as Molecular Health Technologies, are creating disruptive business models that leverage all this data to create products that radically improve the prevention and treatment of cancer and other diseases.

The Shift to Value

In addition to these technological and scientific innovations, the industry is being disrupted by a major shift in the social expectations surrounding health care. The old fee-for-service model of care delivery, with individual clinicians making decisions about what kind of care to deliver and receiving payment according to the number and type of tests they order or procedures they perform, is being challenged by a new paradigm. Increasingly, health care is conceived of as a value-added service, in which clinical interventions are evaluated and reimbursed depending on their contribution to improved health outcomes. (See Competing on Outcomes: Winning Strategies for Value-Based Health Care , BCG Focus, January 2014.)

The value paradigm is partly driven by efforts to control rising health care costs. As health spending as a percentage of GDP grows across the world, payers (whether public or private) are devoting more and more attention to maximizing the “bang for the buck” of their investments in the health care system.

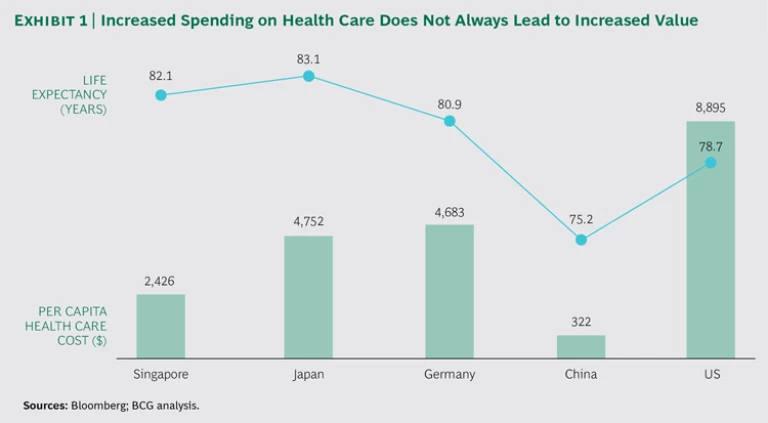

But costs are not the only issue. In recent years, the focus on value-based health care has received a strong impetus from the growing realization that even when a society spends more on health care, it does not necessarily benefit from corresponding improvements in health. (See Exhibit 1.) Japan, for instance, spends a little more than half the amount on health care per capita that the US does. Yet average life expectancy in Japan is about four and a half years longer than in the US. Some health economists have even argued that fee-for-service reimbursement has led to an explosion in medically unnecessary procedures that do not improve health outcomes.

The focus on value is transforming how societies view the purpose of the health care system and how payers reimburse for health care services. The delivery of health care is no longer viewed as an unambiguous social good; it’s an investment—and one that both policy makers and payers are evaluating in terms of the ratio of cost to clinical value delivered. This trend is exacerbated by the aging of society and the resulting need for older workers to work longer and continue contributing to the economy; investments in keeping an aging population healthy and productive are a direct contribution to GDP. According to the new value paradigm, what matters—and, increasingly, what gets reimbursed—are not the discrete diagnostic tests or procedures that clinicians conduct but the ultimate health outcomes delivered to the patient.

Paying for outcomes rather than for procedures sounds like a simple change. It seems logical that people would be willing to pay more for the services of clinicians, hospitals, and provider networks that deliver the “best” outcomes. But difficult issues will have to be resolved before the industry shifts completely to the value paradigm.

Some of these issues are technical. Determining which practitioners and clinical interventions are delivering the best outcomes will depend on developing detailed standards for what constitutes a good outcome in each of the major disease groups (the global standard sets developed by the International Consortium for Health Outcomes Measurement, or ICHOM, is one example). It will also mean putting in place an IT infrastructure to collect the data and developing methodologies to compare the data on a risk-adjusted basis. (See “ How to Define Health Care Outcomes ,” BCG article, September 2015.)

Other challenges are ethical or even legal. When health care investment is directed to treatments that have been statistically proven to improve outcomes in aggregate, the focus becomes the health of a given population (for example, all the sufferers of a particular disease) rather than the health of a particular individual. How to manage the tension between population-based treatment protocols and the needs of the individual patient as perceived by his or her physician?

But eventually such issues will be resolved. After all, the waste and high cost of the current system raise moral and ethical questions of their own. If the demand for health care and, therefore, the overall costs of the health system continue to go up, there will be no way to allocate finite resources other than by taking a value-added approach.

What’s more, the new focus on health outcomes, combined with so-called companion diagnostics—information provided by medical devices that helps optimize the safe and effective use of a drug or biological product—is stimulating a massive shift from experience-based to evidence-based medicine. In the process, care delivery is becoming a learning system in which practitioners systematically assess therapeutic interventions and learn which ones work with which patients in which situations. The result: better quality and more efficient and effective care.

The shift toward value, however, will force all the traditional players in the industry to redefine their business models. Pharma and medtech companies will have to justify their expensive drugs and diagnostic devices in terms of the improved outcomes they deliver. Some players—for example, Fresenius and Gambro in dialysis—are already moving in this direction, even to the point of offering value-based payment models.

Markets Without Customers

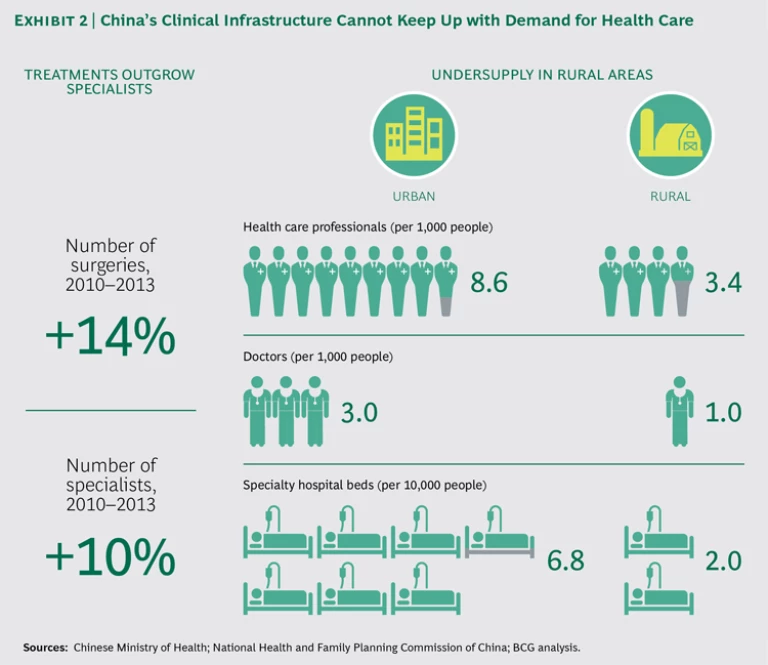

A third factor driving health care transformation is less obvious: the increasing scarcity of health care specialists, especially in the developing world. Take the example of China. Due to the increasing wealth of its large population, demand for health care in China is exploding, and the country is training more and more doctors as a result. However, the rate of growth in demand is so rapid that the clinical infrastructure cannot keep up, especially in rural areas where access to medical care has always been difficult. No matter how fast China educates a new generation of doctors, the nation will suffer from a chronic undersupply for years to come. (See Exhibit 2.)

That puts traditional medtech companies in a paradoxical situation. On the one hand, the growth in demand presents huge opportunities. But the typical products or services that they are selling assume the existence of a broad infrastructure of medical experts. Most medical devices today are designed to be operated by—and sold to—highly trained specialists: laboratory physicians, radiologists, cardiologists, and urologists, not to mention the various experts who are trained to operate sophisticated medical machinery. In the absence of such specialists, companies face a situation where they have a market but no customers.

This represents another challenge to the traditional business model of “specialized products for specialized physicians.” What China really needs is an alternative to the current high-cost, one-size-fits-all infrastructure characterized by expensive, specialized diagnostic devices and expert-driven care delivery. This alternative will most likely feature cheap, easy-to-use electronic devices with a high degree of machine intelligence (for the automated interpretation of clinical data) that are connected to a global network for rapid sharing with remote specialists and statistical analysis of aggregated data. But this alternative care-delivery model requires entirely new clinical practices focused on efficient cooperation and knowledge sharing, new ways to design and sell medical devices, and new price points that are significantly lower than those of traditional, specialized medtech equipment. Eventually, someone will build businesses around this new model—but will it be the traditional players?

The Emerging-Markets Game Changer

The more one thinks about how this alternative model of care delivery might work, the more it becomes clear that it will probably not be limited to emerging markets. Instead, such innovative ways of delivering basic care at low cost are likely to be a game changer that will begin to transform health care in developed markets as well.

Imagine the following scenario: in order to serve its citizens in the rural areas of western China, the Chinese government creates a cloud-based health care system with easy-to-use devices that collect and interpret vast amounts of patient data in order to provide the most effective care according to treatment protocols statistically demonstrated to have improved health outcomes. What might be the impact of such a system on the rest of the world, especially the developed world?

It might not trigger a drastic change. But it would offer a model that health care systems in developed markets could adapt and use where appropriate. After all, the growing scarcity of specialists may not be as severe in developed countries as it is in emerging markets, but it is becoming a problem in some fields. In Germany, for example, there is an increasing shortage of radiologists and radiologic technicians.

What’s more, given the cost pressures facing developed-world health systems, the growing imperative to maximize bang for the buck, and the rise of new reimbursement models that pay providers for keeping people healthy rather than prescribing medical procedures, there may well be considerable appetite for at least some version of the Chinese model. Perhaps it will become a niche offering for the low-cost delivery of primary care. The proliferation of cheap, easy-to-use diagnostic devices, for instance, would allow frontline health workers to more efficiently triage patients and would help make the use of relatively rare, highly skilled medical staff more efficient and effective.

The potential consequences of such a development for the health care industry’s product mix are enormous. Over time, key principles from emerging markets—ease of use, good-enough care, connected and intelligent machines—will find their way into established markets. The adaptations will be quiet and incremental—in effect, coming in through the back door. But over time, developments in China and other emerging markets will provide a powerful new model for how the health care infrastructure is designed, how health care is delivered, how medical services are reimbursed, and how the health care industry defines its product offering.

The Double Challenge for Health Care CEOs

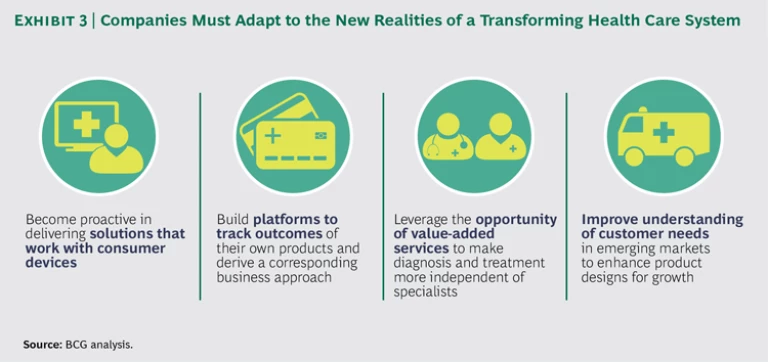

These four sources of transformation present medtech CEOs—and, really, all CEOs in the health care sector—with a double challenge. The first-order challenge is to adapt their business models to the trends described above: to become more proactive in delivering services that work with consumer devices, to build platforms that systematically track the health outcomes associated with their products, to leverage the opportunity of value-added services, and to develop offerings that match the distinctive needs of emerging markets. (See Exhibit 3.)

But even more important will be a second-order challenge: developing strategies that allow their companies to pursue multiple business models aimed at different regions of the world, different consumer segments, and different approaches to care delivery. The days of one-size-fits-all strategy in health care are over. In the future, it’s likely that most health care companies will need to manage multiple business models, not just one. They will have to combine some kind of base offering (designed according to the principles of inexpensive, easy-to-use, good-enough care) with a variety of more complex and expensive value-added modules offering more sophisticated and technically specialized care for those markets where financing and specialist practitioners are available.

Addressing this double challenge won’t be easy. But only when CEOs start doing so will they be in a position to take advantage of the tremendous opportunities in today’s health care industry.