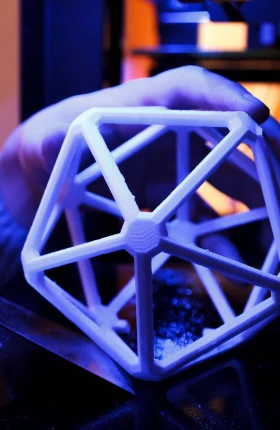

Almost daily, new and innovative biomedical uses for 3-D printing (also known as additive manufacturing) are reported. Scientists are exploring, for example, how to use 3-D printing to produce microrobots that deliver medicine inside the human body, how to create a skin-like material—complete with hair follicles and sweat glands—for skin grafts, and how to print human organs from living cells for transplants.

A growing portion of these news reports are no longer about inventions that are coming but about technology that has arrived. A man in China received a 3-D-printed elbow joint after suffering a major work-related injury. Surgeons in Wales used a 3-D printer to reconstruct the facial bones of a man injured in a motorcycle accident. And a baby in the U.S. is thriving with a 3-D-printed splint that props open his windpipe so he can breathe.

Some health-care sectors are already experiencing the impact of 3-D printing. Dentistry and orthodontics are two examples. More than 19,000 metal copings (used to create crowns and bridges) are now produced on 3-D printing equipment every day. Approximately 17 million clear aligners are created on 3-D printers each year. Audiology has seen even more sweeping changes. Approximately 90 percent of all hearing aids now sold in the U.S. incorporate patient-fitted shells that are produced by 3-D printers.

According to Wohlers Report 2014, biomedical applications now account for about 14 percent of revenues for companies that provide 3-D printing equipment, materials, and services worldwide, and there is an expanding ecosystem of enabling services—such as 3-D imaging, scanning, design, and modeling—that facilitate the preprinting, printing, and postprinting processes.

The health care industry offers numerous opportunities for 3-D printing for several reasons.

- The root cause of a number of health conditions stems from biomechanical issues, such as broken bones, aging joints, and misaligned spines. These issues can be difficult to remedy because each person’s anatomy is uniquely shaped and a one-size-fits-all splint, implant, or back brace may not be optimal. A 3-D-printed product can be custom designed to fit any anatomy, however. And 3-D printers can deliver products with novel designs that are much more intricate than those manufactured using traditional methods. Furthermore, 3-D printers can produce products that do not require expensive retooling.

- Flexible, semirigid, and bioresorbable (capable of being absorbed by the body) structures that are difficult to manufacture through traditional means—yet are critical for repairing complex and delicate organs and structures, such as the heart, valves, and blood vessels—can be readily produced on 3-D printers.

- Manufacturing biomedical products at or close to their point of purchase or use could pave the way for innovative point-of-care solutions—ones that could be particularly relevant in emerging markets with no established distribution networks and populations in remote locations.

Although there are many promising benefits of and emerging applications for 3-D printing, much uncertainty exists about its potential growth in and effect on the health care industry. Will 3-D printing be confined to niche markets or break out to become a game changer?

In this article, we analyze the potential growth and size of the market for 3-D-printed biomedical products, highlight the health care sectors most likely to be affected by 3-D printing, and recommend next steps for health care players. Like all disruptive innovations, 3-D printing presents both risks and opportunities for incumbents. The time for health care companies to weigh the ramifications for their business is now.

Where 3-D Printing Is Heading

Industry analysts agree that 3-D printing is a fast-growing, multibillion-dollar market, but the projections for market growth across industries vary widely, with estimates ranging from $9 billion to $21 billion by 2020. To make these projections, analysts have assessed market growth from the supply side—by evaluating the companies that sell the printers, materials, and services. If we flip this analysis on its head and, instead of focusing on sales of 3-D printing equipment and services, concentrate on the end-use demand for 3-D-printed products, we get a much clearer picture of where this market is heading.

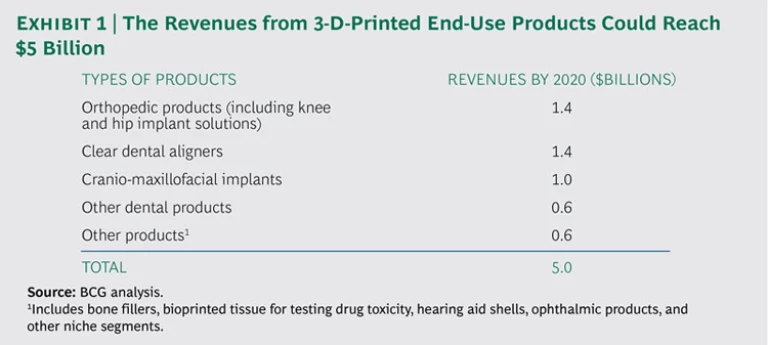

To gauge end-use demand, we interviewed experts from leading medical-technology companies, providers of 3-D printing systems, start-ups, and academic institutions. We also developed a market growth model that projects future revenues from biomedical products that are manufactured using 3-D printing. Our model tracks many applications that are expected to create end-use demand for 3-D-printed products in the midterm, including knee and hip implant solutions, dental screws and abutments, long-term dental temporaries, dental implant suprastructures, clear dental aligners, bone fillers, bioprinted tissue that can be used to test the toxicity of drugs in development, custom surgical guides, and cranio-maxillofacial (CMF) implants.

On the basis of our analysis, we expect that revenues from 3-D-printed biomedical products could reach $5 billion by 2020. (See Exhibit 1.) Clear aligners, an established 3-D-printed orthodontic application that has been around since the late 1990s, will continue to be an area of major growth. Clear aligners are currently the only example of what we would call a killer app—a product that persuades medical professionals to switch to a 3-D-printed application because patients highly value the product and buy it in high volumes or because the product requires customization that is not well suited to traditional manufacturing. With no other killer apps on the horizon, the overall commercial opportunity for 3-D-printed products in health care would likely be limited in the near future.

However, in the next five to ten years, we expect that orthopedic and dental products, biological scaffold materials, and bioprinted cell culture and tissue will have a moderate but meaningful effect. And biomedical companies have extremely robust product pipelines and rapidly maturing R&D, which have the potential to increase exponentially the long-term end-use demand for 3-D-printed products. In particular, the significant amount of R&D that is currently being conducted in the areas of tissue engineering, innovative pharmaceuticals, microfluidic chips, and diagnostics could boost the market for 3-D-printed biomedical products over the long term.

The Future Is in the Platform

Although 3-D printing earned its stripes as a rapid-prototyping tool, the technology’s greatest potential lies in the industrial end-product space. (See “ Why Advanced Manufacturing Will Boost Productivity ,” BCG article, January 2015.) A small number of equipment manufacturers dominate the marketplace today, with Stratasys and 3D Systems controlling approximately 75 percent of the market, followed by about 35 smaller players. Although their business models have historically been focused on the sale of printers, materials, and services, a competitive advantage will come from building a platform that enables other businesses across the 3-D printing ecosystem to connect and flourish.

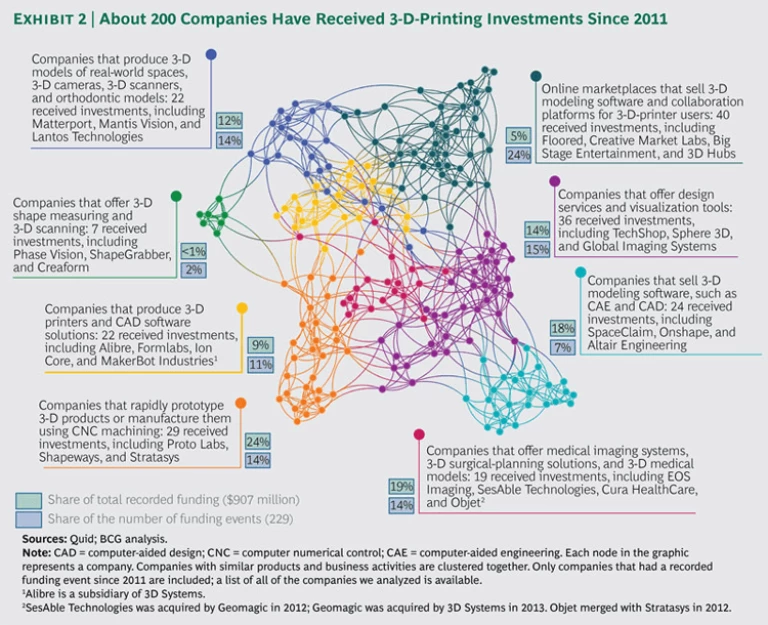

This fact is not lost on the 3-D printing companies or the investors in this space. In an analysis of approximately 200 companies that have received investments for 3-D printing since 2011, we found that a large share of these investments are earmarked for novel and enabling technologies in areas adjacent to the printing process, such as design services, software solutions, and 3-D imaging and scanning. (See Exhibit 2.) This indicates that the end game will be decided by companies that can offer 3-D printing and these services. In other words, the future is not in the equipment. The future is in the platform.

Barriers to Adoption

Like any emerging technology, 3-D printing faces some fundamental barriers to adoption in the health care sector. These barriers include the limitations of materials science; the high costs of 3-D printing, compared with the costs of traditional manufacturing processes, such as injection molding, casting, or milling; quality concerns; and the acceptance by health care providers, payers, and patients.

- Limitations of Materials Science. The primary materials used in biomedical solutions today are polymers, metals (such as titanium alloys that are used for implants), and bioink, which is an “ink” that contains living cells. The variety of available materials and processes will gradually increase as innovators experiment with material and process combinations. A faster and broader adoption of 3-D printing today is hindered by a limited understanding of how the 3-D printing process alters the properties of raw materials and end products. We know how materials that are milled, cast, or forged will respond, but many questions still remain for most materials amenable to 3-D printing. Does the process consistently produce products free of anomalies? How are postprocessing steps affected? What materials and material standards should be applied? With 3-D printer suppliers building real-time monitoring into their systems, government agencies and industry consortia implementing standards and databases of material properties, and users sharing their experiences with the technology, 3-D printing has started to catch up with traditional manufacturing approaches—but it will take time.

- High Costs of 3-D Printing and Raw Materials. Industrial 3-D printers typically cost several hundred thousand dollars, and a few high-end systems cost as much as $2 million. Materials for 3-D printing still carry a hefty markup that can greatly exceed the markup for traditional manufacturing materials. Polymers, for example, typically cost $2 to $3 per kilogram when sold for injection molding, but the cost can be several hundred dollars per kilogram when sold for 3-D printing. Although the costs of printers and materials are high, the costs will continue to fall as suppliers introduce additional materials to the market, printing volumes increase, and existing equipment and material bundles (which typically include a hefty premium) are challenged. But it’s not clear how quickly the costs will fall or by how much.

- Quality Concerns. Unease about the quality and reliability of 3-D-printed products will remain a challenge in the absence of standards, broad experience with the technology, and an intrinsically risk-averse patient and provider community.

- Acceptance by Health Care Providers, Payers, and Patients. Providers want to see that 3-D-printed products have significant value over existing solutions. The benefit of fully customized patient implants, for example, is still up for debate, given that most implant manufacturers already offer semicustomized solutions in different sizes that work well for the vast majority of the patient population. However, these sentiments could change quickly as the technology proves itself on a wider scale. Providers will be the primary gatekeepers, but payers and patients will also weigh whether 3-D-printed products offer clear medical benefits and better outcomes. To truly change the game, 3-D printing will need to alter the standards of care or introduce novel therapeutic approaches with broad applications.

Regulatory concerns have not been a significant hurdle thus far. The U.S. Food and Drug Administration has approved approximately 80 medical devices with parts that were created by 3-D printers. Most devices were approved through 510(k) premarket notifications or emergency-use pathways. The agency plans to release guidelines for 3-D printing in 2015. The new European Medical Device Directive is expected to cover 3-D printing under its “custom-made devices” category, which has a low regulatory burden. Although 3-D printing hasn’t raised any regulatory red flags, this could change if we see a significant uptick in decentralized manufacturing (for example, if hospitals were to begin printing their own implants).

Assess Risk and Seize Opportunities

So what should health care companies do to prepare for the ways 3-D printing may transform their sector? The following checklist identifies the critical steps companies should take to capture value from 3-D printing.

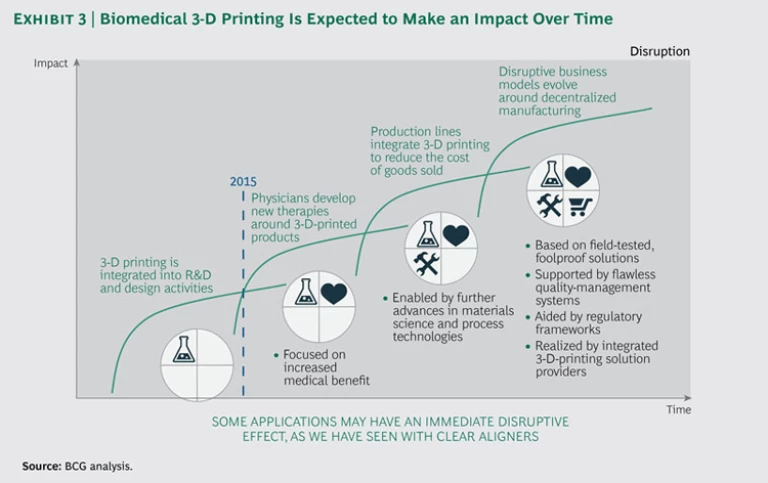

- Engage in scenario planning. Develop forward-thinking scenarios (for 2020, 2025, and 2030) that address the ways 3-D printing has the potential to change specific product segments and business models. (See “ 3D Printing Will Change the Game ,” BCG article, September 2013.) We expect the use of biomedical 3-D-printed products to steadily increase over time. (See Exhibit 3.) But a new fast-track killer app could become disruptive right away. We’ve seen this happen with clear aligners in orthodontics: the end-use demand for a novel therapeutic device persuaded orthodontists to switch to a new manufacturing method and disrupted the traditional business of providing metal braces. Scenario planning helps companies prepare for unexpected events, identify barriers to overcome, and know what it takes to win.

- Systematically assess how to capture value. Think broadly about how 3-D printing could help improve clinical outcomes, accelerate healing and recovery, provide point-of-care solutions, or address previously unmet patient needs. At the same time, analyze products and their supply chain to identify cost savings that may come from using less material, creating less scrap, reducing labor, or lowering tooling expenses. Consider how 3-D printing could lower costs for individual SKUs, high-value parts, and highly customized products.

- Start to experiment. Invest in a 3-D printer to see how it can enhance the product design process. New tools allow people to think differently. During the design process, consider how 3-D printing could support innovative solutions that would be difficult or impossible to implement using traditional manufacturing.

- Engage with potential M&A targets or strategic partners. Screen the innovation landscape for emerging concepts and solutions, assess their probability of technical and regulatory success, and determine their readiness for the marketplace. The window on mergers and acquisitions and strategic partnerships is shrinking, because many of the most innovative companies are getting picked off by first movers. Leading companies are already putting stakes in the ground by making big bets. The cosmetics company L’Oreal recently announced a partnership with Organovo to develop 3-D bioprinted skin tissue.

1 1 “Inside L’Oreal’s Plan to 3-D Print Human Skin,” Wired, May 28, 2015. And Johnson & Johnson Innovation and DePuy Synthes Products are collaborating with the 3-D printing company Tissue Regeneration Systems to help develop patient-specific, resorbable bone implants.2 2 “Tissue Regeneration Systems to Collaborate with J&J, DePuy Synthes,” Xconomy, August 21, 2014. Now is the time to start assembling the required assets and capabilities. - Define a strategy. Depending on a company’s business model, 3-D printing can be a threat or an opportunity. The standard medical-technology product cycle takes 3 to 5 years from ideation to product, but it can take up to 15 years to develop a strong 3-D printing platform. To be competitive, companies must invest now.

As an entire ecosystem accretes around the 3-D printing industry, health care companies have an opportunity to create new products that have never been seen before—and 3-D printing will capture its fair share of the manufacturing landscape. Current 3-D printing technology has the potential to help slash costs associated with product supply chains, overhead, shipping, and facilities; more important, 3-D printing can be used to improve clinical outcomes and increase patient access to care. Forward-thinking businesses are already envisioning innovative models for the design, manufacturing, and delivery of novel, groundbreaking products. Planning today will create a competitive advantage tomorrow.