Mineral exploration is in crisis. Despite a tenfold increase in spending from 2002 through 2012, the number of discoveries has remained flat. Many observers lay the blame for this decline in productivity on a belief that the low-hanging fruit is gone. Today’s explorers must literally and figuratively dig deeper.

Despite huge advances in exploration technology, productivity is waning: Why is the industry still falling behind in exploration performance? Are microlevel concerns—matters of leadership, management approach, talent management, or even culture—causing the exploration drought? What should explorers do about this now that budgets have been halved over the past two years? To better understand the forces underlying the crisis, The Boston Consulting Group began by interviewing six of the world’s best-known “explorationists.” We asked them, What do you consider the secrets to your success? What do you perceive as the impediments, at the company and industry levels, to exploration performance today?

The explorationists we interviewed were unanimous in their conviction that the discovery of ore bodies is not a mystical art. Nor does it require an investment of vast sums such as those spent by mining companies in recent years. To these legends of exploration, successful discovery is about leadership—in the field and the boardroom.

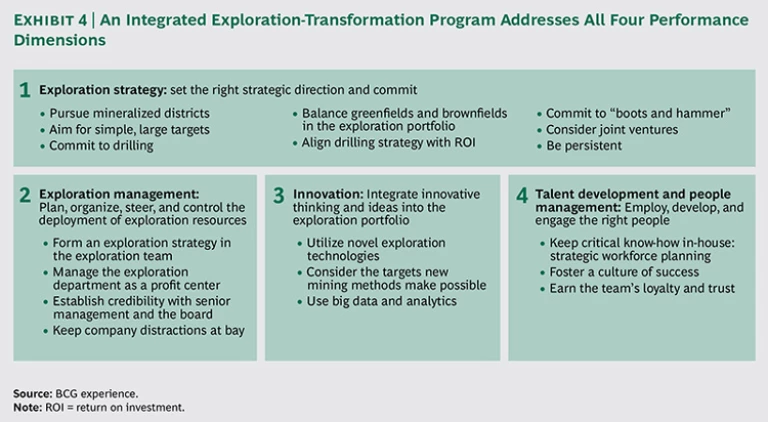

The experiences and collective wisdom of these legendary explorationists provide real-world lessons and guidance in the four critical areas that govern success: exploration strategy, exploration management, innovation, and talent development and people management. Their insights reveal ways that exploration leaders can do more than just resist management pressures: they show how exploration leaders can earn permission from senior managers and directors to build a path to success over time—even with no previous history of success.

In addition, we consider how best to apply the lessons to transform exploration, developing a framework that can help companies align exploration activities with their strategic role in the corporate portfolio. The framework offers a holistic and systematic way to help individual companies revive their exploration performance—and the industry as a whole to reverse the worldwide slump. Exploration may not look like a priority nowadays, and it may even be the first victim of cost cutting. Yet the miners who are first to apply these lessons—building world-class exploration capabilities and investing in a countercyclical way—will be rewarded with disproportionate returns while others struggle to replace depleted reserves.

The Crisis in Exploration: A Snapshot View

In mining, exploration is the foundation of all value creation. It identifies new ore bodies for development, replenishes reserves depleted through production, and replaces those rendered uneconomic by falling commodity prices. Even companies that choose to grow by acquiring ore reserves rely on the exploration success of other companies.

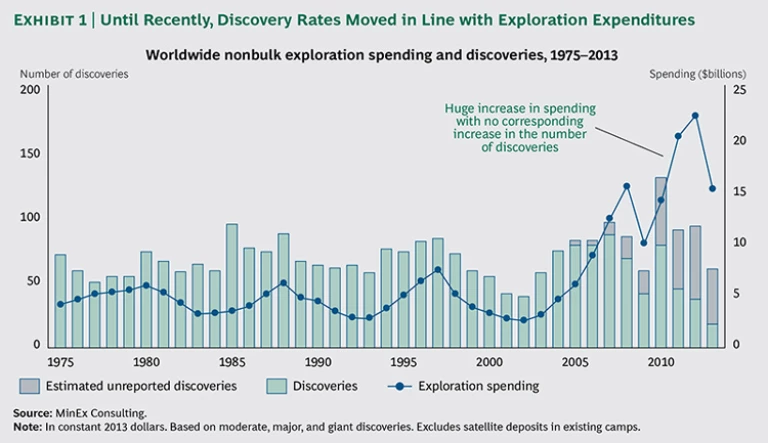

Yet global exploration performance has been in decline over the past decade. According to MinEx Consulting, since mid-2005, exploration spending has climbed sharply, reaching an all-time high in 2012 of $23 billion. Despite the increased spending, there has been no corresponding increase in discoveries. (See Exhibits 1 and 2.) Indeed, from 2010 through 2013, the annual number of nonbulk discoveries is estimated to have declined by almost half, even after adjusting for discoveries yet to be drilled out. This discovery deficit follows a 30-year period (1975–2005) during which the number of discoveries closely tracked exploration spending. Since 2012, exploration spending has dropped by half, even as the industry remains plagued by low productivity.

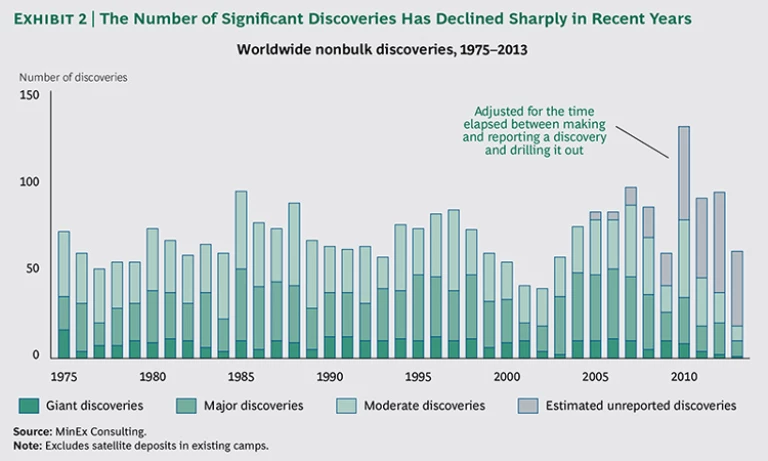

As Exhibit 2 shows, breaking down recent discoveries by size reveals an even more alarming trend. The number of giant discoveries, which historically have accounted for the vast majority of the world’s metal supplies, has tapered off to only one or two per year despite the massive increase in exploration spending from 2010 through 2012. The number of major discoveries has also dropped sharply, underscoring the worsening of exploration performance around the world. Even if some recent major discoveries ultimately mature to giant status, major discoveries on the whole will still have declined significantly.

Part of the decline in exploration performance is the result of cyclical increases in exploration costs during the resource boom from 2005 through 2010. During that period, the cost per meter of a diamond drill hole in many countries more than doubled.

In addition, throughout the industry it has been widely believed that most of the easy pickings—the world’s outcropping and shallow ore bodies—have already been discovered. This belief has prompted a shift to deeper, more costly exploration efforts. (See “Spending Trends and Facts.”)

SPENDING TRENDS AND FACTS

According to research from MinEx Consulting, modern explorers overall have been spending lavishly, but in three key regions, expenditures have dropped considerably:

- Exploration spending reached an all-time high in 2012.

- From 2002 through 2012, annual global-exploration spending grew nearly eightfold, from $3 billion to $23 billion, but dropped dramatically by the third quarter of 2014.

- Since the mid-1980s, exploration for gold has accounted for the greatest percentage of total spending. In 2013, it represented 33 percent of the total.

- Since 2000, exploration spending for bulk minerals has experienced a major increase, representing, as of 2013, 25 percent of the total.

- China spends more than any other country: 17 percent of the total as of 2013.

- Regionally, Latin America spends the most (22 percent), followed by Africa.

- The combined exploration expenditure of Canada, the U.S., and Australia has fallen by half over the past 20 years.

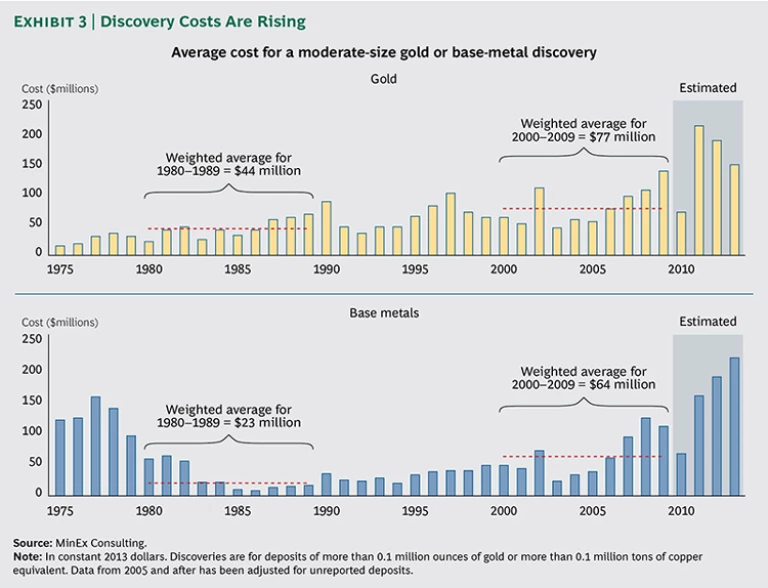

Although more money is being spent, fewer large discoveries are being made today than in the previous quarter century. MinEx calculates that the weighted average cost of base-metal discoveries nearly tripled, from $23 million from 1980 through 1989 to $64 million from 2000 through 2009. (See Exhibit 3.) And since then, exploration performance has continued to deteriorate.

Deteriorating exploration performance is a concern. Mineral discovery, especially in greenfield settings, is the only source of high-value deposits that can pay a company’s way through most parts of the commodity cycle. This reality was masked for most of the past decade by the resources boom. In the high-price environment, brownfield exploration of previously discovered, lower-quality deposits seemed like a viable strategy. But the downturn in prices for iron ore and many base metals has shown that this is not a sustainable business model. The discovery of high-value deposits is crucial to the future of the mining industry. But success is more elusive than ever before.

Poor results destroy value—and not just at the company level. As the quality and quantity of reserves diminish, metal markets become imbalanced and prices can rise sharply, affecting both economic growth and jobs. The global market for zinc, the fourth-most-used metal (after iron ore, copper, and aluminum), is an unfolding case study in the macroeconomic effects of exploration failure. The last major discovery of a primary zinc deposit was almost a decade ago at Hackett River in Canada, and six of the ten largest zinc mines and undeveloped deposits resulted from discoveries in the 1970s or earlier. Major mines, such as Australia’s Century mine, are reaching the end of their life, and with global consumption forecast to rise by 4.5 percent annually until 2020, zinc stocks are expected to fall to critical lows by 2019.

Recently, BCG interviewed six of the world’s most illustrious mineral “explorationists”—those responsible for such monumental finds as Minera Escondida in Chile, Oyu Tolgoi in Mongolia, and Olympic Dam and Cadia in Australia, as well as those with stellar records of serial discovery. (See “Meet the Exploration Legends.”) We asked them why exploration was suffering today: Was it a matter of geology? Industry economics? Macroeconomic forces? Investor attitudes? Or was it about internal factors, such as corporate culture, strategy setting, or even talent management? Which forces exerted the greatest impact? They offered their views on the keys to success—keys that largely transcend market conditions and business cycles—along with recommendations for how mining companies might recapture exploration success.

MEET THE EXPLORATION LEGENDS

The six titans of mineral exploration BCG interviewed for this report were responsible for such major finds as Minera Escondida in Chile, Oyu Tolgoi in Mongolia, and Olympic Dam and Cadia in Australia. Some of them boast several major discoveries.

Graham Brown

“In a lot of bigger organizations, exploration becomes about process, and that has nothing to do with discovery. It becomes about managing rather than leading.”

Graham Brown’s teams are widely regarded as the world’s most successful base-metal explorers of the past decade, with discoveries throughout Asia, South America, Africa, and Europe. Brown joined Minorco as chief geologist in 1994. After the company merged with Anglo American in 1999, he filled a succession of senior exploration-management roles, including head of base-metals exploration in 2005 and group head of geosciences and exploration in 2009.

Douglas Kirwin

“The better geologists are the ones who have seen the most rocks.”

Douglas Kirwin led the discovery of Oyu Tolgoi in Mongolia. Among his other discoveries are the Jelai-Mewet and Seryung epithermal deposits in Kalimantan in Indonesia and the Eunsan-Moisan gold deposits in South Korea. Kirwin has 45 years of international exploration experience, largely in the Asia-Pacific region. He held senior positions with Anglo American and Amax during the 1970s and was managing director of a successful international geological consulting firm during the 1980s and early 1990s. In 1995, he became vice president of exploration for Indochina Goldfields and, later, the executive vice president for Ivanhoe Mines until 2012.

Jim Lalor

“Sure, ‘prospectivity’ is important. But access is also important.”

At Western Mining, Jim Lalor led the team that in 1976 discovered the Olympic Dam copper-uranium-gold deposit. Olympic Dam, bought by BHP Billiton in 2005, is the world’s fourth-largest copper deposit and largest single deposit of uranium. In 1961, Lalor, with David Barr, discovered the Koolanooka Hills iron-ore deposit, which WMC developed as Australia’s first mine dedicated to iron ore for export. In 1972, he was appointed exploration leader for the eastern states, including South Australia.

Sig Muessig

“Many very well-known large companies think that if they have good science in the field, they are going to be successful. That is not true. Exploration is a business, not a science.”

Sig Muessig has spent more than 50 years in global exploration, mining, and mining management. He was hired by J. Paul Getty in the late 1960s to establish Getty Mining Company. In 1981, the company (in a joint venture with Utah Mining) discovered Chile’s Escondida mine—the world’s largest copper-producing mine. (The cost of discovery: $3 million.) As the founder of Getty’s exploration group, Muessig discovered significant uranium and other copper deposits, along with substantial coal reserves. In its brief 18-year existence, Getty Mining became the world’s most successful mineral explorer.

Andy Wallace

“I simply don’t understand why companies with somewhat stable cash flow are not investing a good bit of their budget in greenfield exploration.”

A protégé of John Livermore, Wallace worked at Cordex Exploration Company to discover many giant gold deposits in Nevada in the wake of Livermore’s Carlin discovery. These deposits, which included Pinson, Preble, Dee, Secret Pass, and Marigold, established the area as the most prolific gold region in the western hemisphere. The Carlin Trend remains a foundation area for Barrick and Newmont, the top two gold producers. Wallace, currently president of Columbus Gold Nevada and a principal of Cordex, is experienced in every aspect of mine development, including resource expansion, feasibility, engineering, permitting, construction, and production.

Dan Wood

“Too many people think you can discover ore bodies with laptop computers, but all you can do with those is become a very qualified draftsperson.”

Among the most notable achievements of Dan Wood’s 42-year career was leading the team that discovered the Cadia copper-gold deposits in New South Wales, the largest discovery in Australia since Olympic Dam. Wood led several mineral discoveries during his 24 years with BHP Billiton. As the executive general manager of exploration at Newcrest Mining, he led major discoveries of gold and gold-copper in Australia and Indonesia, which catapulted Newcrest to its stature as a major international mining company.

Across the interviews, strong leadership was the unifying theme. Leadership goes beyond personal attributes such as charisma, determination, and drive. It entails bold decision making and judgment that play out in every aspect of planning, execution, and management. Successful exploration leaders not only set the strategy by which the team plays but also strive relentlessly to assemble the team they know they will need to win—the right mix of talent, experience, and youth. They forge a culture of teamwork and, most important, ensure that their team has the confidence and motivation to win. Successful exploration leaders also protect their team members from pressures and other distractions—whether pushback from impatient executives and boards, company developments, or market spasms. They keep their team on track even if wins do not come as quickly as they hope.

As Graham Brown, former base-metals exploration chief for Anglo American observed, “Whether you’re a junior, a midtier, or a major, the big issue is the quality of leadership. If as a leader you can’t convince your board that you need a certain amount of time and a certain amount of money to do what you have been asked to do, then it’s your problem.”

Beyond the personal characteristics of leadership, the exploration legends discussed the ingredients in four critical areas that govern success:

- Exploration Strategy. The strategy is the basic, but often overlooked, set of tenets for success with the drill bit. Exploration strategy encompasses the operational approach to finding ore bodies by, for example, selecting larger deposit styles because they are easier targets or determining the appropriate spacing and number of drill holes or the depth of drilling.

- Exploration Management. The principles companies follow to run the business of exploration effectively include approaches to funding and resource exploration activity, as well as the best ways to establish lines of reporting—and governance that offers adequate checks and balances—without obstructing exploration efforts.

- Innovation. The search for new ideas, approaches, and technologies in exploration targeting includes new techniques for finding and extracting ore. Techniques that reduce exploration and production costs confer competitive advantage.

- Talent Development and People Management. The decisions and actions needed to attract, develop, and retain the right people with the right skills include developing teams that provide a mix of skill, experience, and instinct. The right team should include people who can counter the consensus view and are willing to take risks. It also refers to how the mining company structures its exploration department, including its use of contract geologists.

Clearly, exploration success involves more than just a geologic Midas touch or the most up-to-date cutting-edge drilling technology. It takes a combination of factors that span strategy, management, process, and people. Managing these multiple dimensions successfully calls for a comprehensive approach.

Exploration Strategy

Exploration strategy is, in the eyes of the legends, the foundation of success because of its role in reducing risk. In other words, without the right exploration strategy, a company will either spend too much time and money in the quest for ore bodies or not discover them at all.

Developing a comprehensive strategy requires careful thinking about the goal and identifying the most effective way of achieving it. Investing in exploration without such a plan dramatically increases the odds of failure in the field and risks the loss of support from senior management and the board.

The legends were clear that a sound strategy is far more important than the latest science—particularly computer modeling—which can enhance but cannot substitute for field observation and drilling. Certainly, modeling has its place: it can accelerate decision making and help allocate scarce resources more effectively. Yet it does not always provide the hard data that is essential for mineral discovery. Because modeling can impart the illusion of scientific certainty, it has actually been a bane to exploration.

Collectively, the legends identified eight recommendations that should be part of any exploration strategy. (For facts about recent discovery trends, see “Discovery Track Record.”)

DISCOVERY TRACK RECORD

The past 40 years have been a golden era for discovery, and gold accounts for the highest portion of discoveries.

Moreover, MinEx Consulting reports that the junior companies make the most finds.

- Half of the world’s known major deposits have been discovered since 1972.

- On average, a single significant new deposit is found every week, and there are 50 to 60 discoveries made each year worldwide.

- Tier 1 discoveries are rare: on average, there are only two per year.

- Gold accounted for the highest percentage of all discoveries (55 percent) from 1975 through 2013. At 28 percent, base metals were in second place.

- For much of the 1970s, 1980s, and 1990s, major and junior companies shared responsibility for the largest percentage of discoveries.

- Since the mid-1990s, the juniors have consistently outpaced the majors.

- Today, the juniors account for 50 to 60 percent of all discoveries in the western hemisphere.

Pursue Mineralized Districts

Forgo frontier areas that have no definite sign of mineralization. Although synonymous with new frontiers, greenfield exploration does not mean searching in areas that have no clear signs of mineralization and “prospectivity.”

Sig Muessig observed that the odds of exploration success are much better “in the shadow of the head frame.” The best chances for discovery exist in mineral districts or the geological trend of districts, as was the case with Escondida, Muessig’s landmark discovery. Furthermore, a mineralizing event in favorable geology generally creates more than just one ore body.

Aim for Simple, Large Targets

To boost the odds of success, exploration strategy should recognize the importance of working with—and not against—nature. For example, large ore bodies (such as porphyry copper) or tabular deposits (such as sediment-hosted base metals or uranium) are much easier targets than nickel shoots or gold veins. Successful exploration leaders allow pragmatism to govern their exploration strategy rather than succumbing to the temptation to pursue complex or exotic deposit styles.

Commit to Drilling

The odds of discovery are low to begin with, but companies don’t boost them when they minimize their drilling activity to save money. Successful explorers are those who drill the most holes. It only takes being right once. Several legends concur: failure is a certainty most of the time, but it takes only one victory to compensate for many unsuccessful attempts.

In many cases, Andy Wallace observed, discoveries are made precisely because the company is drilling. “Frankly,” he said, “you are often drilling holes for the wrong reason. I’ve found a deposit for the wrong reason. Everybody has—if they are being honest.”

Dan Wood, known for his discovery of the Cadia copper-gold deposits in New South Wales, would routinely warn his board of directors that the only thing he could guarantee was failure. “Occasionally,” he said, “we would get it correct. You only need to be right that one time. So once you have that mentality, you can go and drill a kilometer-deep hole. If it doesn’t make a discovery, that’s okay. It might tell you something. And unless you are drilling, you are not giving yourself a chance.”

Drilling early is as important as drilling often. Today, many companies spend an enormous amount of time preparing to drill, relying on geochemistry and geophysics. Wallace told us, “We always drill within weeks of buying a property. The cost of drilling three or four holes, and getting 3-D information from the drill bit early in the program is actually economical. You can easily spend the same amount of money doing geophysics and interpreting. But with drilling, you get hard data.”

Balance the Proportion of Greenfields and Brownfields

Portfolio diversification may be a basic principle of managing business and financial risk, but it is often ignored as a central precept of exploration strategy. In today’s risk-averse equity-market environment, companies frequently forgo greenfield exploration in favor of near-mine, or brownfield, exploration.

However, the notion that greenfield exploration is more risky than advanced projects in near-mine locations relies on faulty logic. According to Jon Hronsky, chairman of the board of the Centre for Exploration Targeting, many confuse certainty (how much we know about a resource) with risk (the likelihood of a positive return from the investment). As projects near depletion, they, in fact, become riskier than greenfields.

Some companies, according to Hronsky, include “the spending on subeconomic resources that were discovered a long time ago” in their definition of greenfield spending. They do this to bolster resource certainty or to, he said, “find something better—but probably still small—nearby.” If these older assets weren’t “worth developing during what was one of the greatest mining booms in history,” he explained, “then more exploration is not likely to be money well spent.”

The perception of risk in greenfield spending is further clouded by the fact that some explorationists are more talented than others. Simply put, a lot of money spent on greenfield exploration is spent by people with an incomplete understanding of the business.

Striking the right balance of greenfield and brownfield exploration projects is more than just a matter of hedging risk. Both types of exploration are essential for long-term exploration success. A mix of the two creates a diversified project portfolio with different development time lines, as well as different levels of maturity and risk.

A critical aspect of striking the right balance is recognizing the different skill sets that greenfield and brownfield geology require. The greenfield geologist has the more diverse set of skills and knowledge and will most likely serve as the ore finder beyond the near-mine environment. In contrast, the brownfield geologist is good at recognizing a potential mine and reading the nearby rocks that point to other ore bodies. The ability to train and develop geologists across both areas is vital to building a skilled and well-rounded exploration team.

Align Drilling Strategy with Return on Investment

Good explorationists think strategically about every drill hole and find ways to stretch the return from every dollar of drilling investment. Drilling strategy can be as simple as using inclined holes to penetrate targets that are directly beneath difficult surface terrain. Or it might be strongly influenced by the size and depth of a targeted ore body.

For example, historical drilling activity in Australia, North America, and South America has been largely confined to depths of less than 300 meters by a strategic focus on open-pit ore bodies. Now, Wood said, “you have to realize we have probably discovered most of those” locations. It’s better to start with the objective of finding an ore body to be developed as an underground mine and then design an appropriate drilling strategy. New caving methods have transformed the economics of underground mining and make it possible to start development at 2,000 meters. “An ore body,” Wood added, “might be a kilometer or so high, so you have somewhere between 500 and 2,000 meters that is basically unexplored territory.”

Commit to “Boots and Hammer”

Many legends lament the current dependence on computers and modeling—an overreliance that they contend comes at the expense of field observation. Today’s explorationists, according to Douglas Kirwin, have too little reliance on “boots and hammer.” That has been a big factor in reducing the experience and skills of geologists in the field. “It gets back to field experience and looking at the rocks. I don’t think there is any substitute for that,” Kirwin said.

The experts also believe that the fly-in, fly-out way of working has hurt exploration in particular. “It’s fine with mines, but there are a number of geologists out there who would rather go to the bush for four or five weeks rather than ten days on and seven days off,” Brown observed. “That’s the adventure side of the business, and it means they can really get to understand the terrain.”

Consider Joint Ventures

Joint ventures have fallen out of favor at some large companies, and that has hurt exploration, according to Muessig, who credits joint ventures as being critical to Getty Mining’s success. They provide valuable new ideas and represent the fastest entrée into countries where an explorationist or a company has no prior experience. A company that has an existing foothold, Muessig told us, “knows the scene—and the politics.”

Be Persistent

In exploration, persistence is a virtue. At a minimum, companies should allow three years for testing a greenfield terrain with confirmed mineralization. Kirwin spent four years exploring in Mongolia before finding Oyu Tolgoi. It took Western Mining (later called WMC Resources and acquired in 2005 by BHP Billiton) five years and 17 drill holes to make an economic discovery at Olympic Dam.

Still, persistence should not trump pragmatism. “Targets can be very difficult to find, but if you don’t offset an aureole soon, you’d better walk away,” Muessig cautioned. Olympic Dam—an example of persistence in the extreme—was, he said, “an anomaly in many ways.”

Exploration Management

Typically, the C suite is the source of decisions regarding the commodities and projects a company pursues. When, however, the head of exploration has a seat at the table, a more informed debate is possible. Company executives become better equipped to resist investor pressures to exit businesses in commodities that have fallen out of favor. At the same time, exploration leaders can gain better understanding of and appreciation for the business and market pressures that executives face daily and must factor into their broader management decisions.

Reclaim the Lead in Developing Exploration Strategy

Good governance requires that senior executives and boards have the final say in exploration strategy. They are, after all, ultimately accountable for the company’s overall performance. But well before the final say, there are ample opportunities to seek the thinking and influence of exploration leaders. Success in the field must be driven, to the greatest extent possible, by the exploration leader.

The exploration leader’s job goes beyond overseeing the technical work. With his or her team, the exploration leader must actively develop the exploration strategy. The leader’s position relative to senior executives and the board should be neither adversarial nor supplicating. Exploration leaders must see themselves and act as the governing voice of exploration, making the strongest-possible case for their thoughtful strategy, while also demonstrating partnership with top leadership.

Consider the approach taken at Western Mining during its heyday. Jim Lalor told us that the exploration team, which had earned the trust of senior management after years of success, had considerable autonomy once senior management had established the budget. Strategy was developed by exploration team leaders in twice-yearly gatherings during which they openly debated and competed for their portions of the exploration budget. Project heads, regional managers, and specialists spent four or five days presenting and debating the relative merits of exploration spending proposals, reviewing such criteria as the size of the targets and their relative risk, the number of drill holes required to establish mineralization, and logistical ease. Everyone had his or her say.

Establish Credibility with Senior Management and the Board

Good geologists, especially the ore finders, know better than anyone else which targets to chase and where to earn the best return on exploration dollars. To have the autonomy to make such crucial decisions, the exploration leader must have credibility. Senior management and the board must trust the exploration leader to make budgetary and operating decisions within his or her department.

“If you don’t have license to operate inside your company, you will never get the budget,” Brown said. If the department is seen as a cost center, it will be difficult to be successful. Funding, he explained, is “discretionary—a bit like research, which can be turned on and off depending on where you are in the commodity cycle. Many exploration companies have folded,” he added, because of that perception.

A solid record of discovery makes the strongest case. It also helps to have someone on the executive team or board with experience in or a passion for exploration. With neither, though, there are several ways exploration leaders can earn the credibility and trust of those at the top:

- Take a portfolio approach to exploration. Create a portfolio with greenfields and brownfields that involve different risks and are at different stages of exploration. Treat exploration, Brown told us, “like a venture capital fund, where money goes in and money goes out when you do deals.”

- Manage the exploration department as a business. Exploration leaders must demonstrate to senior management and the board that they view their activity as a business—and that they understand financial risk. (See “Graham Brown: Run Exploration As a Profit Center.”)

- Hedge the bet by piggybacking on proven entities. Consider what Muessig did when he was hired to create a minerals company—from scratch—for the billionaire Getty Oil family. Everyone at Getty had come from the oil and gas industry, and Muessig understood the importance of making the executive management comfortable with the foray into minerals. “One of the first things I did was to make all of our projects joint ventures with public companies that the executive team knew, companies like Homestake,” he told us.

GRAHAM BROWN: RUN EXPLORATION AS A PROFIT CENTER

“In the past ten years at Anglo American,” Graham Brown said, “we returned $600 million from assets that Anglo didn’t want and delivered a seven-times return on investment from all exploration activities. That meant that I could run exploration like a profit center. It wasn’t a cost center; it was a business.”

When major strategic changes—such as the company’s exit from gold—took place, the exploration department monetized a portfolio of gold assets through joint ventures, royalties, and sales. When the company signaled it wanted to get out of the zinc market, the team sold two zinc deposits in brownfields, generating a couple hundred million dollars.

By treating exploration as a business, Brown said, “you can take advantage of the opportunities rather than seeing them as big challenges.”

Keep Company Distractions at Bay

Several legends observed that many companies fail at exploration because they let their team be distracted by company bureaucracy and administrative requirements. One of the most important tasks of the exploration leader is to protect the team from distractions such as safety audits and the seemingly endless stream of forms that need to be filled out.

It is the exploration leaders’ job to deal with executives, the board, and other stakeholders whose demands can interfere with the team’s work.

Muessig’s approach to keeping bureaucracy at bay is instructive: “Once a year, one of my colleagues and I would sit down with George Getty, the company president, one of his financial people, and a lawyer. I presented our program in a very comfortable, intimate setting. Then, for each program, top management would send us a one-page approval, setting out what we could do, and the budget. That removed an awful lot of bureaucracy. We rarely had to go upstairs to ask questions about [our activities]. We had a written charter, which I negotiated annually with top management. It was a simple, less-than-half-page statement of what we could do and where we could do it. That was very important.”

Innovation

Innovation has always been a source of value creation in the mining and metals industry. Many of the greatest discoveries were not just the result of great fieldwork and exploration strategy; they were also bold new ideas or technology that took explorers to new frontiers.

Today, abundant innovations in technology and process offer more opportunities for exploration than ever before. The digital revolution is transforming the ways miners collect and process geochemical and geophysical data—from prospect scale to global scale. Advances in modeling are helping to unlock the meaning of data, although seasoned explorationists caution that modeling can get ahead of empirical facts and is no substitute for observation.

Novel Exploration Technologies

Geochemistry, a longtime primary tool for ore body discovery, is rapidly becoming more powerful. Low-cost, portable instruments can provide real-time data in the field, and even high-end analytical equipment such as the geochronometer is becoming commonplace in labs throughout the world. Researchers are using the wealth of data now available to define geochemical haloes that enlarge the signatures of ore bodies and make it easier to detect them.

The development of geophysical technology that improves the ability to see under cover has for years been a high priority for researchers. Two new noteworthy techniques, 3-D seismology and magnetotellurics, are extending the depths that are accessible by remote sensing from their current limits of about 500 meters to several kilometers.

Having revolutionized exploration success rates in the oil industry, 3-D seismology is now being successfully applied to hard-rock targets. Magnetotelluric methods rely on Earth’s natural electrical, or telluric, currents to measure the electrical resistance of rocks from the surface to depths of hundreds of kilometers. The plummeting costs of data processing, along with the development of sophisticated 3-D modeling techniques, have unleashed the potential of this new tool.

New airborne electromagnetic (AEM) systems are also changing the way explorationists hunt for minerals. AEM uses airborne transmitters and receivers to create a 3-D picture of the conductivity of the subsurface and can quickly cover large tracts of ground. It provides rich information on the likely type of rock units, including highly conductive massive-sulphide minerals.

Drilling Breakthroughs

Drilling is the number-one imperative in mineral discovery. But today, when targets are deeper than ever before, drilling costs are rising, and mineral explorers are forced to pay more for each meter drilled. (See “Digging Deeper.”)

DIGGING DEEPER

Drilling targets today are deeper than ever before, but the costs of drilling continue to climb.

- In Australia, it’s difficult to find deposits—especially gold—under deep cover. That means more meters drilled per discovery.

- For gold, depth of cover is most critical in Canada, the U.S., and Australia.

- For base metals, exploration must go twice as deep as for gold.

- The regions with the deepest deposits are in the U.S. and Western Europe.

New technology under development in Australia could revolutionize mineral exploration by slashing drilling costs by as much as 75 percent. The Deep Exploration Technology Cooperative Research Centre (DET CRC), funded by Australia’s government and the private sector, is developing a coiled-tubing drilling rig that replaces conventional drill rods. DET CRC is also developing “downhole” sensing technologies that provide mineralogy data as it is intersected. Downhole motors will eventually make directional drilling possible and—in conjunction with geochemical analysis of drill cuttings at the rig—will allow explorers to pursue economic mineralization in real time.

New Mining Methods, New Targets

The development of “supercave” underground-mining methods could be a game changer for the exploitation of very large, low-grade deposits. Open-pit mining has traditionally been used for such deposits, but waste-to-ore ratios and capital costs rise sharply as the pit deepens, restricting the maximum economic depth to between 1,000 and 1,500 meters. Supercaves, up to ten times the size of traditional cave mines, offer a competitive alternative for large deposits. They can be mined to depths of 2,000 meters. Within the next few years, it’s possible that that will be extended to 3,000 meters. Supercaves also offer an environmental advantage: underground mining has a dramatically smaller surface impact than open-pit mining.

Supercaves have major implications for exploration strategy because they open up an entirely new field of deep targets, including areas beneath previous exploration and mining activity.

Big Data and Analytics

The resources industries are no stranger to big data: decades ago, their researchers began working with terabytes of data in their search for mineral and petroleum resources. More recently, banking, retail, and other industries have helped pioneer new ways of storing and analyzing data—methods that have powerful applications in the mining industry.

Big data’s potential for uncovering ore bodies was illustrated vividly by an unusual competition launched in 2000 by Rob McEwen, the founder and former CEO of Canada’s Goldcorp. McEwen publicly released all of the company’s data on its high-cost Red Lake gold mine in Ontario and offered a $575,000 prize for the best method for identifying undiscovered reserves. The competition, which attracted more than 1,000 virtual prospectors, was won by a joint entry from two Australian companies, Fractal Graphics and Taylor Wall & Associates. The pair produced a 3-D map of the area around the mine. The map, based entirely on data from Goldcorp’s files, pinpointed 110 new exploration targets, half of which were previously unidentified. When drilled, more than 80 percent of the targets yielded significant gold reserves. McEwen estimated that the Goldcorp Challenge shortened the company’s exploration program by at least two years and resulted in the production of more than $6 billion in gold.

The Goldcorp Challenge jump-started the use of sophisticated modeling, or inversions, to generate 3-D maps of the subsurface. Since then, the cost of accessing and processing geophysical data has fallen dramatically, allowing for 3-D modeling of areas spanning thousands of square kilometers. This regional scale modeling is being led by government agencies to help promote private investment in exploration.

Australia is taking the concept one step further with its Virtual Geophysics Laboratory (VGL), which provides open access to continent-wide geological and geophysical data on the cloud. The VGL reduces from months to hours the time needed to compute a 3-D map of the subsurface. It also represents a remarkably powerful prospecting tool that is available to any explorer—even junior companies.

Talent Development and People Management

Exploration success is a function not of how much a company spends but of the quality and skill of its people. Although this seems axiomatic—and, indeed, most mining executives would no doubt agree with the statement—the reliance on massive budgets and the low success rates suggest otherwise. The view that talent makes the critical difference determines how companies use their people resources. It encompasses every human-capital decision, from compensation practices to whether and when to use contract geologists and from how it manages to how it develops its people.

Which elements of people strategy support successful exploration? The legends identified seven practices.

Recruit and Retain Ore Finders

Ore finders are known for their aptitude for finding ore bodies. Some exploration legends went so far as to claim that the main reason for the declining success in exploration is that companies fail to understand the difference between scientists and ore finders.

Muessig noted that many large, well-known companies believe that good science in the field will lead to successful exploration. But, he explained, “That is not true. Science is an open-ended endeavor to seek knowledge. Many companies will continue doing good scientific work, but because they still don’t get all the answers, they won’t drill that hole that makes a discovery.”

Ore finders, who perhaps represent only 10 or 20 percent of a successful team, have a talent for being in the right place at the right time. Brown observed that many companies fail to recognize that ore finding is a distinct skill. Instead, they regard exploration as just a process. They think, he said, that “if you drill enough holes, take enough samples, and do enough spending, you will be successful. But you won’t.” Companies that excel in exploration, he added, have a culture that encourages and rewards ore finders.

The inclination to reduce success to cost-per-target-tested is misguided. Instead, companies ought to refocus on the talent and quality of the individuals and the teams they create for exploration work.

Mentor and Develop Young Geologists

Successful explorers secure the right skills by taking responsibility for developing and mentoring their own people. Western Mining—which discovered Olympic Dam—is perhaps the best exemplar of this practice. As far back as the 1960s, the company was in regular contact with Australian universities, recruiting talented geologists before they graduated. Once these young recruits joined the company, the chief geologist would take them under his wing and actively manage their careers. Working alongside experienced colleagues, the young geologists had invaluable development opportunities in the field.

Western Mining also encouraged its geologists to pursue advanced degrees at universities in Australia and abroad, paying half their salary during their studies. This amounted to a substantial investment, particularly for those who enrolled in three-year PhD programs.

Technology provides new means of accelerating the exploration learning curve for young geologists. Western Australia’s Centre for Exploration Targeting is developing a computer simulation that uses historical activity and real data from previous discoveries to help train geologists in every aspect of exploration strategy.

Strike a Better Balance of Staff and Contract Geologists

Many of the legends believe that exploration performance has suffered as companies have shifted away from mentoring young geologists to hiring contract geologists and retaining staff geologists only for the duration of a project. Kirwin noted, “People today come and go more frequently.” In the past, a chief geologist who had been with a company for 20 or 30 years would have built and nurtured his own exploration team. “That has changed—dramatically,” Kirwin said, adding that he made a point of mentoring the younger professionals in the field: “It’s about sharing experience and knowledge.”

Building an internal team also yields other benefits: loyalty and commitment to the company’s interests. With the deep reliance on consulting geologists, this benefit has largely disappeared. Lalor said, “Most of the money being spent these days on personnel is going to consulting geologists. Their vested interest is in making sure they get well paid.” This can create a conflict of interest, and it can end up reducing the resources available for actual drilling. Western Mining and other explorers of that time operated, Lalor said, “on the smell of an oily rag.” Their primary interest was spending money on the ground to achieve the maximum return on investment.

Companies need to strike a balance. Outsourcing is a valuable lever, particularly for companies in an industry as cyclical as mining. Nowadays, it’s not economically feasible to use only in-house geologists. Companies must strive to keep core process expertise and institutional knowledge in-house, but they should allow themselves the flexibility to tap contract geologists and manage resources most effectively.

Recruit Mavericks, but Be Prepared to Manage Them

Some of the most talented geoscientists in exploration don’t fit the corporate mold, much like the so-called smart creatives in technology and innovators in other fields. As Brown observed, these mavericks are the sources of the innovation and conceptual thinking that often lead to exploration success. But because so many of them are nonconformists—if not outright misfits—exploration leaders must create an environment in which geoscientists can thrive in the corporate setting. Leaders need to nurture mavericks’ passion for discovery and shield them from the constraints of the corporate environment. But leaders must also be prepared to closely manage their activity.

It’s “absolutely vital,” Lalor said, that exploration leaders have the ability to manage teams of people with different personalities.

Mining companies, therefore, might borrow from the talent management playbook of technology and other industries by bolstering recruitment, creating development programs, and instituting the kind of work environment incentives that appeal to younger workers.

Create Employment Stability to Weather Industry Cycles

The reliance on contractors has not only affected the quality of skills. It has created a wider problem that affects the industry’s skill pool. In the past, companies would retain their teams during downswings. That’s no longer the case. For geologists, mineral exploration has become a riskier career choice. It seems that they have two options: either they work for contractors, where employment is uncertain, or they serve as staff at companies that don’t value maintaining an internal team or developing and mentoring their exploration personnel as they once did.

The situation with greenfield gold exploration in the U.S. illustrates the problem well. Wallace explained that inconsistent funding in the western U.S. has all but wiped out a generation of skills. He told us that he knows very few geologists in their late thirties or early forties, and younger people are not entering the business. “It’s difficult for young people coming out of school to get excited about working in exploration geology if their main option is working for a contractor. They can’t secure a stable salary or the usual employee benefits such as health care. From a purely financial standpoint, it doesn’t look very promising.” Wallace used to receive about a dozen résumés a month. “I think I got two résumés last year for the whole year.”

Large and frequent changes to exploration spending are damaging the supply of mining talent, which only creates a vicious cycle. Ultimately, companies bear the cost of this volatility in the form of poor returns from exploration spending.

Other industries are beginning to recognize that shortages and pipeline issues threaten the talent supply, and in turn, their future performance—if they haven’t already begun to feel the effects. It’s time that mining companies acknowledge this problem and adjust their approach so that they can make exploration an attractive career.

Foster a Culture of Success

Creating a culture of success is important in an industry in which it is easy to become discouraged by the infrequency of discovery. Having experienced successful explorationists on the team is important: not only do they help team members learn specific aspects of the job and to understand what it takes to discover, they also help create opportunities for others to learn what success feels like. Brown told us that it’s good to “get young people in the field, maximizing rock exposure time, working on good projects and with experienced explorationists, particularly in the first five to ten years of their career. That’s certainly what worked for me and what worked for many others.” Experienced and successful explorationists also help people appreciate what is necessary for a project to be economically viable and—just as important—help them identify projects that don’t quite cut the mustard.

Keeping an exploration team motivated can be a challenge, given the generally long trajectories of discovery. Long periods of failure can damage morale. In Brown’s view, this is a major (and unrecognized) problem for very large companies, which commonly expect their geologists to find the kinds of deposits that might be discovered only once every decade or so. “As one of those geologists, you could spend ten years doing greenfields all around the world, looking at all sorts of commodities, and all you would ever say is, ‘No. Not good enough.’ How do you ever learn what an ore body looks like if all you ever see is a hill that’s not big enough or a grade that is not high enough?” It can be hard to get up every morning and do your job, Brown added, “if your job is to find the next Escondida or the next Carlin trend.”

On the other hand, scaled-down expectations help fuel motivation and success. Finding a high-grade volcanogenic-massive-sulphide deposit or a bonanza-grade epithermal gold deposit that the company could develop itself or in a joint venture or sell (if it’s not big enough), is, Brown told us, “a good place to be, because you are adding value and providing options for growth. The importance of sharing success stories and exploration history case studies in creating a discovery culture should not be underestimated.”

Success both breeds success within a team and attracts high-caliber geologists to the company. Maintaining a culture of success is a priceless recruiting advantage in an industry that lives or dies by the quality of its people.

Earn the Loyalty and Trust of Your Team

Mineral exploration is a tough business. It is intellectually and physically demanding. Fluctuating commodity prices and volatile markets make it a risky career path. Leaders of global teams have to make many tough decisions. Brown observed, “You have to close countries, change commodities, reduce staff, reallocate budgets. The only way people will put up with having to do so over a period of time is if they respect the reasons.” There are certain decisions that only exploration leaders can influence. When the budget gets cut, a leader must ensure that what remains is spent wisely. Everyone knows that mining is a cyclical business. Good leaders know how to “sell the good news as well as the bad news to the team,” Brown said. “That gives you the credibility and the support that enable the team to stick together through tough times and good times.”

Recapturing the Value in Exploration: An Integrated Approach

How can companies optimize exploration, address the productivity challenge, and ultimately improve the long-term value of exploration? One powerful way is an integrated approach that addresses the four performance dimensions discussed in this report: exploration strategy, exploration management, innovation, and talent development and people management. (See Exhibit 4.)

Such an approach evaluates exploration performance across these critical dimensions to identify the weak links, because, in general, it is the least mature element within an operation that tends to limit overall performance. Following a diagnostic, a company can design and implement targeted interventions that focus on improving performance hot spots. But the most important feature of an integrated approach is that it is holistic. It recognizes the interconnectedness of the four performance dimensions: the ways that decisions and actions in any one area can counteract or augment the performance of the others. Companies can thus prioritize interventions, applying organizational resources in the most judicious and practical way for maximum impact.

Addressing the Four Performance Dimensions

Exploration leaders, together with senior executives and the board, might start with an assessment of the company’s exploration strategy, identifying its strengths, weaknesses, and opportunities for improvement. They could then examine each of the other three performance dimensions to determine how well they support the strategy, use resources to greatest advantage, and advance each other.

In exploration management, for example, leaders might strive to do a better job of integrating plans across time horizons so that the long lead times and budget certainty required by exploration teams are reinforced, not undermined, by long-term planning and budgeting processes. In the short term, leaders might simplify and standardize the interfaces between the exploration team and management to keep corporate distractions to a minimum and allow the exploration team to get on with its job. The exploration team itself might standardize work management to track cost-effectiveness over time. During field operations, the team could boost process stability through rigorous, short-term interval control while drilling. (All of these tactics would also reinforce the profit mindfulness and credibility of the exploration team.)

In innovation, exploration leaders might adopt a comprehensive set of innovations: new technologies (such as directional drilling and real-time downhole sensing), new approaches to ore body modeling, and the use of data and analytics to optimize the benefits of those technologies and methods.

In people management, companies might apply strategic workforce planning to reduce the overreliance on contract geologists, create employment stability to weather industry cycles, and develop young geologists as ore finders. Companies might establish rotation programs to expose geologists to many varied geologies, mineralogy, and ore bodies over the course of their career. A formal training program might teach explorationists what is necessary for a project to be economically viable and—just as important—how to identify and cull leads that are not.

Successful programs emphasize culture and behaviors that enable and sustain improvement within the exploration team as well as among board members. The right exploration strategy—one that views the exploration team as a value creator rather than a cost center—along with a program of targeted interventions can reverse the decline in exploration productivity.

A Boon to the Industry, Not Just to Individual Companies

A holistic program has broader ramifications than the benefits it offers to any individual company. Consider the companies active in exploration today. Junior companies play a disproportionately large role. They account for roughly 40 percent of total worldwide exploration spending and more than half of all discoveries. But they are financially fragile.

In the fourth quarter of 2014, cash reserves among juniors in Australia were at an all-time low (less than $1 million). Moreover, junior companies with low market capitalization—those most at risk of failing—account for 5 to 30 percent of juniors, depending on the jurisdiction. Their precarious financial state threatens existing exploration projects. Should any such companies fail, exploration activity could decline even more. In addition, juniors’ constant need for cash infusions can lead to the very sort of exploration behavior that the legends bemoan: playing it safe and keeping the good news flowing by going back to mature districts.

Think: Countercyclical, Act: Holistic

Despite copious spending over the past decade, exploration efforts have not delivered much of a payoff. Now, every mining company is focused on productivity. As a result, exploration might not look like a priority—it might even be at the heart of cost reductions. This approach, however, will only exacerbate the depletion of resources and reserves that is getting worse by the year.

But mining companies can turn their exploration performance around by acting in a countercyclical way. This means both ramping up exploration spending and—even more important—reconsidering their whole approach to exploration.

First and foremost, companies must evaluate their exploration strategy. A comprehensive exploration strategy should address the balance of greenfield and brownfield targets, pursue simple large targets in mineralized districts, align drilling strategy with return on investment, and commit the business to the task at hand.

Next, companies should assess their management of exploration. They should treat exploration as a business: a profit—not cost—center that continually augments and hones the portfolio of development opportunities. And as the legends reveal, exploration can thrive when it is governed in an integrated way. Leadership is the critical ingredient. Exploration leaders must work with their teams to identify and prioritize opportunities and also partner with senior executives and the board to jointly define a coherent exploration strategy that is mindful of business imperatives and enterprise strategy.

Innovative technologies and methods, when applied in the context of sound management principles and processes, can advance exploration success in a number of ways: in discovery, access, and even decision making.

Finally, managing people and talent strategically is a crucial component of exploration success. It is the linchpin in establishing a culture of trust and success.

When viewed as an indivisible set, these levers—strategy, exploration management, innovation, and people management—can dramatically boost the odds of exploration success. Exploration can once again be the lifeblood of the mining enterprise. As some mining companies struggle to replace depleted reserves, others that are first to apply the lessons described here to build world-class exploration capabilities will be rewarded with disproportionate returns.

Acknowledgments

The authors would like to thank the exploration legends—Graham Brown, Douglas Kirwin, Jim Lalor, Sig Muessig, Andy Wallace, and Dan Wood—and Jon Hronsky for their time and insights, as well as Richard Schodde, managing director, MinEx Consulting, for providing exhibits and data related to exploration trends. They also wish to acknowledge the contributions of their BCG colleagues Matthias Tauber, Andrew Clark, Ross Middleton, and John Slaven.