The consumer packaged goods (CPG) industry is in the midst of a major transformation driven by changes in technology and dramatic shifts in consumer preferences. At the same time, the pressure to keep costs low and operate more efficiently has never been so intense. CIOs in the CPG industry need to successfully navigate these turbulent forces to position IT as an enabler of business value within their companies.

To understand how the IT function in CPG companies is responding to the ongoing technology and industry transformation, The Boston Consulting Group and the Grocery Manufacturers Association (GMA) conducted extensive benchmarking on a variety of strategic IT topics. This report is based on a survey of 37 CPG manufacturers in the U.S. and Europe, conducted in the first half of 2015, and supplemented by interviews with more than 15 CIOs of participating companies. It also draws on BCG’s experience working with many of the leading CPG manufacturers and retailers globally.

While the research was conducted collaboratively by BCG and GMA, BCG is wholly responsible for all analyses, conclusions, and recommendations.

Consumer Packaged Goods: An Industry in Transformation

For much of the past quarter century, CPG has been a highly profitable industry, marked by consistent growth and rapid expansion into new markets. But the industry is experiencing an era of unprecedented change as multiple shifts in market dynamics happen all at once.

Consumers are adjusting their buying habits, abandoning retail stores for e-commerce—and advertisers are following them online. What’s more, consumers are demanding insight into the provenance of products, resulting in pressure on global supply chains to become more transparent.

The surge in digital consumers has generated a rich source of revenues and data, but to harness customer dollars and meaningful insights, companies need strong e-commerce, online-media, and data-analytics capabilities.

Amid the changes, however, some pressures remain constant: the need to cut costs and boost efficiency is unrelenting.

Shifting Consumer Preferences

As consumers shift their buying habits—purchasing more goods online and demanding transparency into the sourcing of products—CIOs are playing a greater role than ever before in building the brand and growing the business.

Declining Retail-Store Traffic. For many retailers, November and December are the most profitable shopping months. However, data collected during these months from tracking devices at large U.S. retailers and shopping malls shows that retail foot traffic dropped 25 percent from 2011 to 2013. With in-store traffic declining, companies are looking for ways to improve the effectiveness of in-store selling through innovative trade promotions, pricing optimization, and other strategies. As a growing number of consumers shop in stores with mobile devices in hand, powerful opportunities exist to increase in-store, impulse purchases. (See The Growth of the Mobile Internet Economy, BCG report, February 2015.) As a result, technology-enabled innovations are expected to fuel much of the growth in CPG—presenting an opportunity for CIOs to step up as partners to the business in driving revenues and profitability.

Greater Demand for Authenticity and Traceability. Consumers are demanding more transparency into the provenance of products. Particularly in the food industry, concern over artificial additives, growth hormones, genetically modified organisms, and unethically sourced products has skyrocketed. And many companies have taken notice. Bumble Bee Seafoods offers a “Trace My Catch” feature on its website that allows consumers to track the origins of their tuna—all the way back to the boat from which the fish were caught. Panera Bread recently announced that it will drop 150 artificial colors, preservatives, and additives from its menu items. General Mills will be removing all artificial colors and flavors from its cereals and fruit-flavored snacks.

While the food industry has become a magnet for this type of attention, other CPG segments hear similar feedback from consumers. A wide selection of brands—from cosmetics to fashion apparel—are under pressure to demonstrate that their practices do not harm animals or exploit workers. To protect their brands, executives are working closely with CIOs to improve supply chain visibility.

A Digital Storm

As e-commerce, online advertising, and data analytics have taken hold, companies have heightened expectations of what technology can do to fuel the business and create value. CIOs are feeling the pressure to keep pace with these rapid market and technology shifts.

The Shift Toward E-Commerce. E-commerce penetration has reached 8 to 20 percent in many CPG categories, such as personal care and pet products. And consumers have come to expect 24-7 service, whether on their desktop, tablet, or mobile device. CPG companies have an opportunity to substantially enhance their influence and impact by providing great content online and building direct relationships with customers. Many are in the process of building e-commerce capabilities and attempting to increase the quantity and effectiveness of online promotions.

Growing Share of Online-Media Spending. Consumers are spending more time online, so advertisers are spending more money online. Online media is taking share from other types of media at remarkable speed. Worldwide Internet advertising spending in 2014 was 24 percent of total advertising spending and is projected to grow to 32 percent by 2017, with growth in mobile advertising responsible for the bulk of this increase. Internet advertising already dominates some important consumer markets, including Australia, Canada, and the UK. By 2017, online advertising is also expected to dominate markets in Germany and China, two of the world’s top five

Rise of Data Analytics. Many executives know that strong data analytics can help the business gain insight into consumer preferences, inform the development of next-generation products, and deliver more-effective marketing strategies. But companies that embrace big data must do so with their eyes wide open. Businesses have to rethink how they access and safeguard information, how they interact with consumers holding vital data, and how they develop new skills to manage new technologies. They may need to embrace new partnerships, new organization structures, and even new mind-sets. (See Enabling Big Data: Building the Capabilities That Really Matter, BCG Focus, May 2014.) Few CPG companies have a strong data-analytics framework in place. But with the explosion of technological and digital innovations entering the marketplace—and irrevocably altering consumers’ purchasing habits—CPG companies need to make data analytics a priority.

Relentless Cost and Efficiency Pressures

Although growth is top of mind for CPG companies, cost reduction and efficiency remain key priorities. A number of participants in this year’s benchmarking survey—including Campbell Soup Company, Danone, General Mills, Heineken, Henkel, The Hershey Company, Kellogg Company, and Procter & Gamble—have publicly disclosed their cost-reduction efforts, and some have implemented “zero-based budgeting” systems for IT, in which IT budgets are built from scratch each year rather than through annual increases to existing allocations. As a result, CIOs must deal with close scrutiny of IT costs and demands for greater IT efficiency.

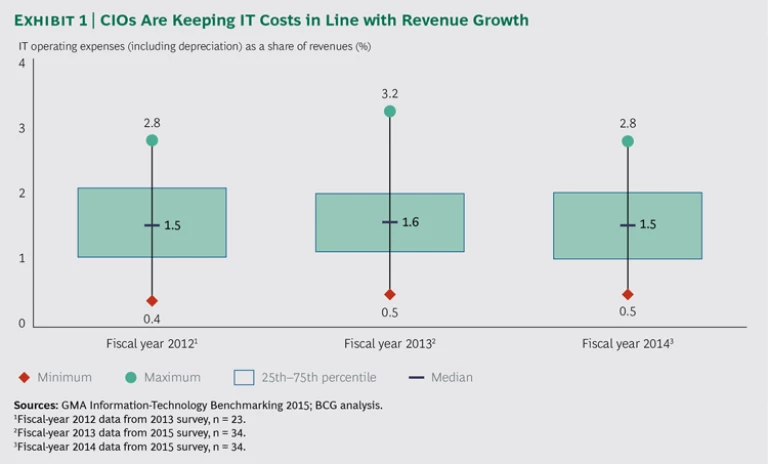

IT spending as a share of revenues has remained flat across the CPG industry for many years. (See Exhibit 1.) Accordingly, CIOs seeking to innovate and invest in new capabilities must do so by reshaping their existing cost structures to free up funds. In short, CIOs are being asked to do more with the same funding.

A Question of Strategy: How Much to Spend on It?

CIOs say that a variety of factors drive IT costs at their companies. Some companies are dealing with fragmented application landscapes. Others are burdened by high depreciation from prior capital investments. Poorly structured outsourcing contracts can also lead to high costs owing to overspecified service levels, inadequate governance, or unfavorable terms and conditions. Geography matters, too—companies with IT employees based in high-cost cities must accommodate higher salaries while those with cross-border operations must deal with greater complexity.

Faced with those cost drivers—as well as shifts in consumer behavior, the increasing move to digital, and ongoing cost pressures—companies must make strategic choices about their IT spending.

Drivers of “Frugal” Versus “Full” Spending

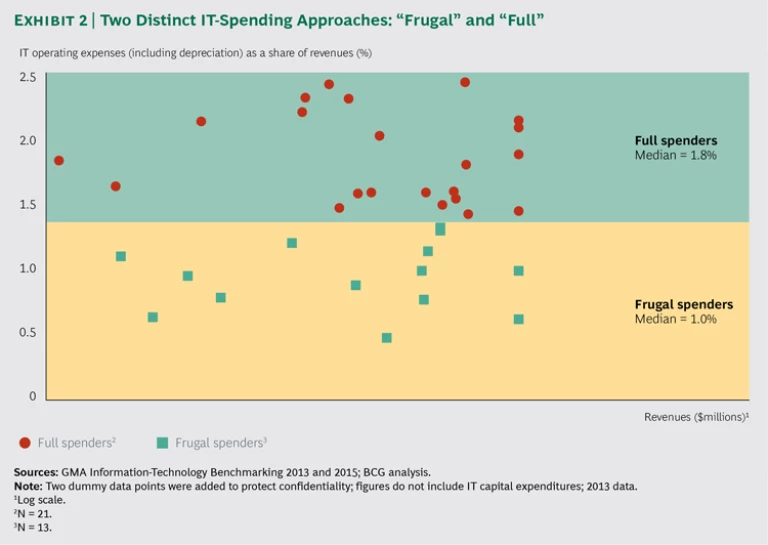

The 2013 benchmarking report identified two distinct IT-spending approaches. (See The New Mission for IT in Consumer Packaged Goods, BCG report, December 2013.) “Frugal” spenders make do with IT budgets ranging from 0.4 to 1.5 percent of revenues. “Full” spenders operate with IT budgets as high as 2.8 percent of revenues. Frugal and full spenders revealed fundamentally different perspectives on IT spending. Frugal spenders typically operate in companies that have a low-cost mind-set or that prioritize other business investments (such as M&A) over IT. They also, for example, limit IT services to a smaller share of company employees and take a conservative approach to new-technology adoption.

The 2015 benchmarking results confirm the two IT-spending approaches identified in 2013. (See Exhibit 2.) We had fewer extreme outliers, at both the high and low ends. As a result, median IT spending for the two groups shifted slightly, from 0.7 percent of revenues for frugal spenders in the last survey to 1.0 percent in 2015, and from 2.0 percent of revenues for full spenders to 1.8 percent today. The difference in numbers across years can be attributed, at least partially, to a different mix of participants.

The 2015 benchmarking study looked at more than two dozen variables, including number of ERP instances, extent of outsourcing, average compensation, and cloud adoption. Building on findings from the 2013 survey, we identified three additional levers consistently used by frugal spenders to keep IT costs low:

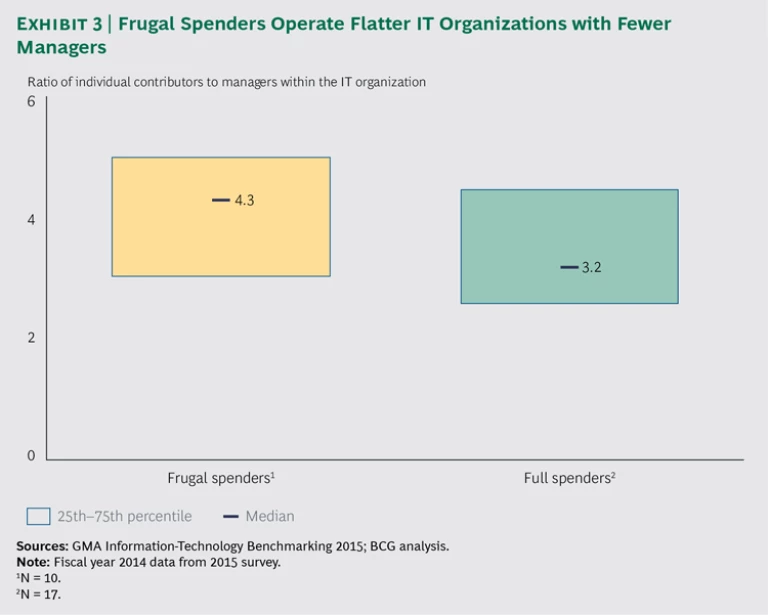

- IT Manager Span of Control. IT manager span of control is determined by calculating the ratio of individual contributors to managers within the IT organization. Frugal spenders operate flatter organizations, employing fewer managers and thereby keeping costs down. (See Exhibit 3.) In flat organizations, employees can work independently and gain a broad range of skills, enabling quicker information flows and faster decisions. By contrast, full spenders employ a larger percentage of managers, creating more organization layers and higher costs.

- Critical-System Recovery-Time Objectives (RTOs). The analysis also compared recovery time targets for critical-system outages and found meaningful differences in companies’ tolerance for critical-system outages. Frugal spenders are willing to trade the risk of user dissatisfaction and operational downtime for lower overall spending. They are comfortable with a median recovery time of 18 hours, and they typically devise manual work-arounds to keep the business running during major system outages. Full spenders, which prioritize rapid recovery, have robust systems in place to achieve a median recovery time of 6 hours. These rapid-recovery standards necessitate greater investment in disaster recovery equipment and services and, consequently, higher IT costs.

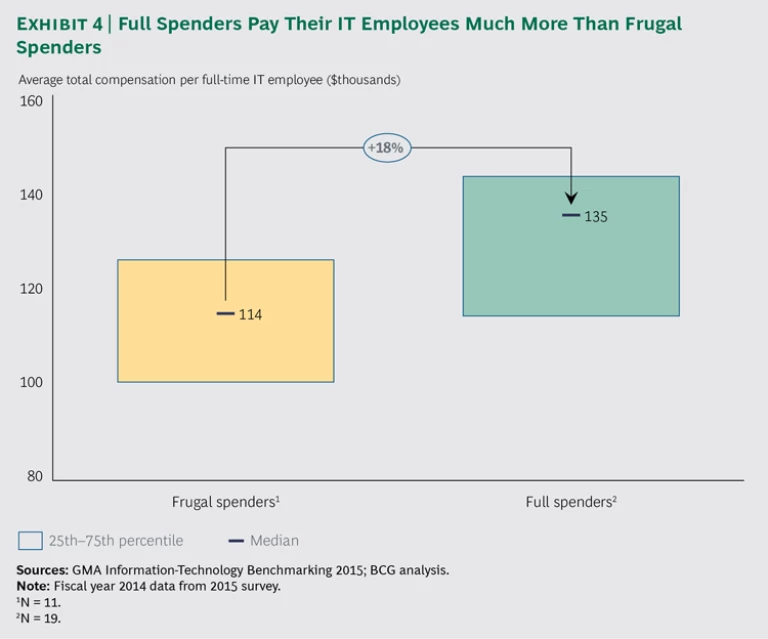

- Average Compensation per IT Full-Time Employee (FTE). Average compensation looks at the total annual IT payroll divided by the total number of full-time IT staff. The analysis revealed that full spenders offer considerably higher compensation on average—approximately 18 percent more than frugal spenders. (See Exhibit 4.) One reason, of course, is that full spenders employ more managers as a share of their total IT staff. Additionally, they are more likely to hire specialized employees, such as data scientists and cloud architects, whose skills command higher salaries. This approach has the advantage of equipping full spenders to tackle the challenges presented by the storm of digital changes confronting the industry; however, in some cases, it can also suggest a suboptimal resource mix with staff in high-cost locations. Frugal operators, on the other hand, have a low-cost mind-set, which limits what they offer by way of compensation.

In addition, we uncovered one seemingly counterintuitive finding. It would be reasonable to assume that companies spending more on IT would employ more IT resources, but this was not the case. Companies just made different choices on where to focus their budgets. Some companies with a very low head count operate expensive IT-outsourcing contracts, which can lead to high costs overall. Conversely, some companies with a high IT head count are able to develop and support in-house applications at a lower cost than outsourcing.

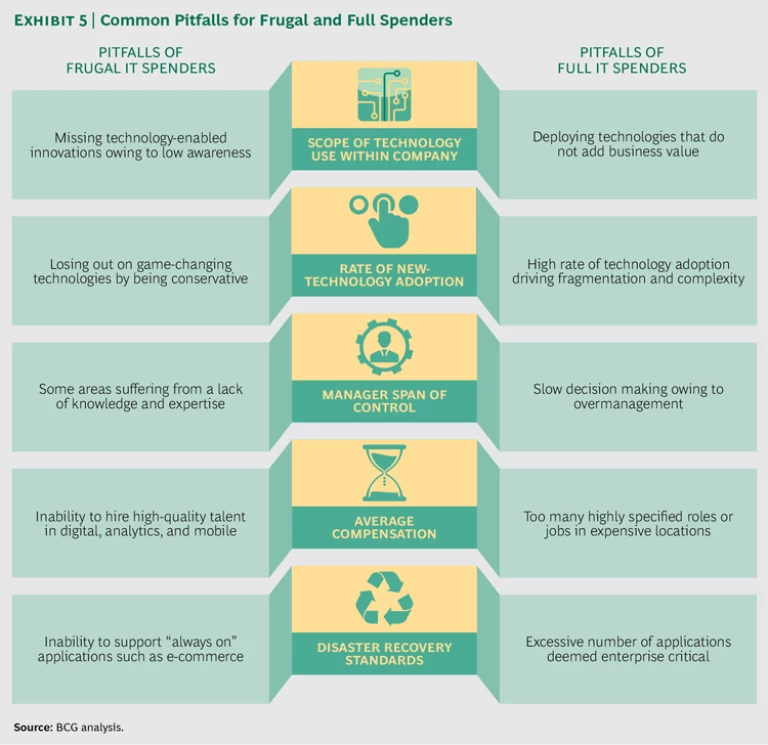

Although the frugal- and full-spending approaches are rooted in fundamentally different business strategies, CIOs following either approach should be careful to avoid the common pitfalls of their respective strategies, as shown in Exhibit 5.

The Price of Running IT for a Global Company

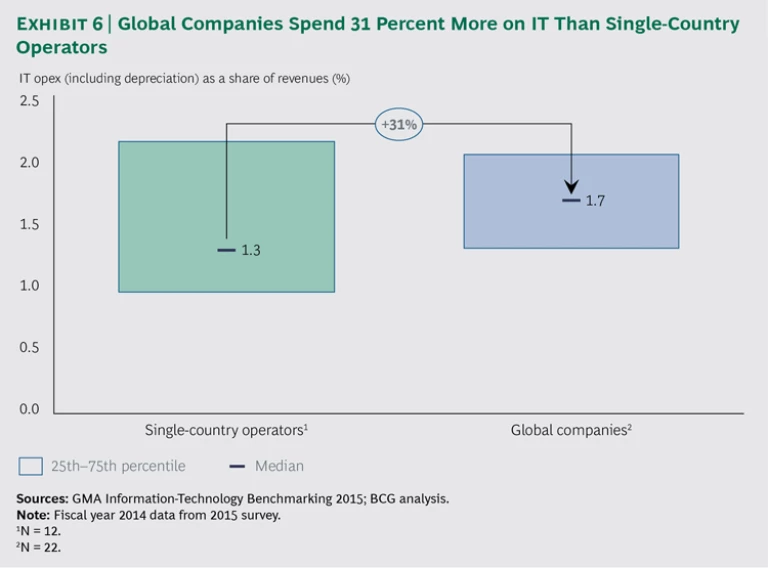

Thirty-seven companies participated in the 2015 benchmarking survey, including companies with revenues in the tens of billions of dollars and far-flung operations in nearly every country. Other participants—mostly smaller businesses—operate in a single country, most of them in the U.S. While large, global companies have complex and diverse IT needs, they have an advantage in that they can obtain the best prices from vendors and employ IT staff in lower-cost locations. But the scale benefits of being large and global don’t generally outweigh the costs of their highly complex IT needs. In fact, median IT spending at global companies is more than 30 percent higher when indexed against revenues than at single-country operators. (See Exhibit 6.)

Global companies operate broadly scoped IT budgets, provide IT services to a large share of company employees, and mandate rapid RTOs for critical enterprise applications. These costs overwhelm the one key advantage that global companies have over single-country operators: the ability to reduce average compensation per IT employee by hiring from low-cost regions.

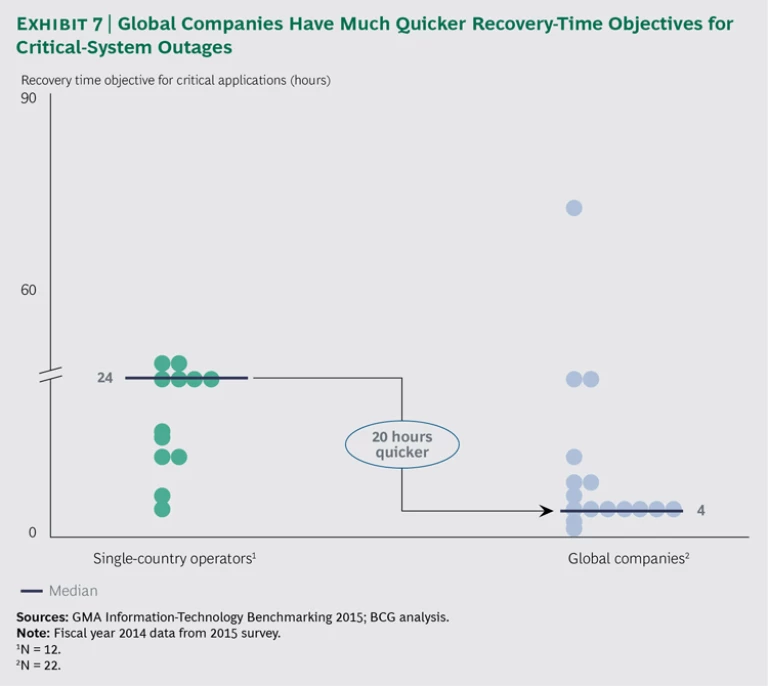

- Critical-System Recovery-Time Objectives. Global companies have significantly more-stringent requirements than single-country operators. (See Exhibit 7.) Businesses with global supply chains and IT applications that support 24-7 operations cannot afford any extended outages. Rapid recovery requires automated, continuous data backups and redundant systems ready to take over should primary systems fail. Supporting this model may require tens of millions of dollars in incremental infrastructure costs. To avoid these high costs, single-country operators use manual work-arounds to keep the business running during major system outages, and such procedures are inherently easier to execute and coordinate in a single country. (For a look at the decisions of one single-country operator, see the sidebar “Unlocking Savings Through Recovery Time Trade-Offs.”)

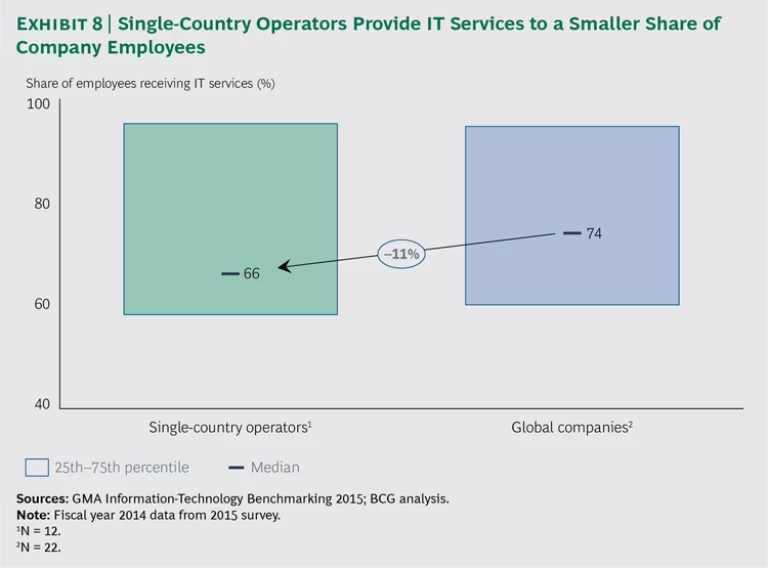

- Share of Employees Receiving IT Services. Certain IT services such as software licenses, outsourced help-desk services, and onsite support vary in proportion to the number of end users. Accordingly, companies can—on the basis of their spending mind-set—determine the extent to which they offer these services. Single-country operators tend to ration IT services, providing support to a smaller share of company employees than global companies. (See Exhibit 8.) Global companies, on the other hand, provide IT services to a higher percentage of employees.

- Scope of the IT Budget. Scope refers to the share of technology capabilities and services used across the company that are funded by the IT department. Nearly all IT departments cover core infrastructure costs, such as data centers, telecommunications networks, laptop computers, and productivity tools like Microsoft Office. Beyond these basics, however, the data shows that global companies fund a greater share of costs for business-focused IT capabilities, such as e-commerce, consumer website development, marketing and social-media software, and software-as-a-service subscriptions. Single-country operators support fewer IT capabilities than global companies, and they may also be making “shadow IT” investments (spending on IT outside of the IT budget in other parts of the business, such as marketing). When portions of IT are managed outside of the CIO’s realm, it limits the company’s ability to execute a comprehensive IT strategy.

- Average Compensation per IT FTE. The analysis showed that global companies pay their IT staff 18 percent less on average than single-country operators. Global companies can save money by hiring in regions where salaries are lower. Single-country operators, by contrast, are limited to the talent pool in their home country, reducing opportunities for low-cost IT staffing.

UNLOCKING SAVINGS THROUGH RECOVERY TIME TRADE-OFFS

Companies can make outage-recovery-time trade-offs to unlock savings.

The CIO of one U.S. CPG company that participated in this year’s survey established a recovery time objective of 120 hours for critical systems—by far the longest across all survey participants and five times the 24-hour median of single-country operators.

The CIO presented the company’s executive management team with two options: deploy high-cost infrastructure to ensure rapid recovery or accept a slow but much lower-cost solution.

Executive management agreed to the latter approach. They ensured that plant managers and other key operational leaders established detailed manual procedures to take orders and to manufacture and ship products in the event of an extended system outage.

This decision was subsequently put to the test when the company’s primary data center went down for three days. Though the company has daily revenues that exceed $25 million, it experienced a net loss of only $150,000 over the outage period. Although a more robust disaster-recovery infrastructure could have eliminated this loss, the annual ongoing cost of the faster solution would have been upwards of $3 million annually—clearly not worth the benefit.

According to the CIO, “If you do the basics at really low cost, then you can find the money for innovation. But you need to put money in real risks, not in perceived risks. We get by just fine with manual work-arounds and processes in many areas.”

Balancing Spending and Innovation: Defining an IT Operating Position

CPG companies wrestle with two distinct but related questions: how much to spend on IT and what level of innovation to pursue. (See “IT Innovation Leaders in Consumer Packaged Goods,” BCG article, December 2015.) CEOs, CFOs, and business unit leaders know that in today’s changing CPG world, an ambitious innovation agenda requires investments in technology and that a low-cost focus constrains innovation. That said, CIOs are the only senior executives at CPG companies who think about technology on a full-time basis. As a result, they must establish, explain, defend, and execute their company’s target “IT operating position”—that is, the levels of IT spending and IT innovation that are best for the business.

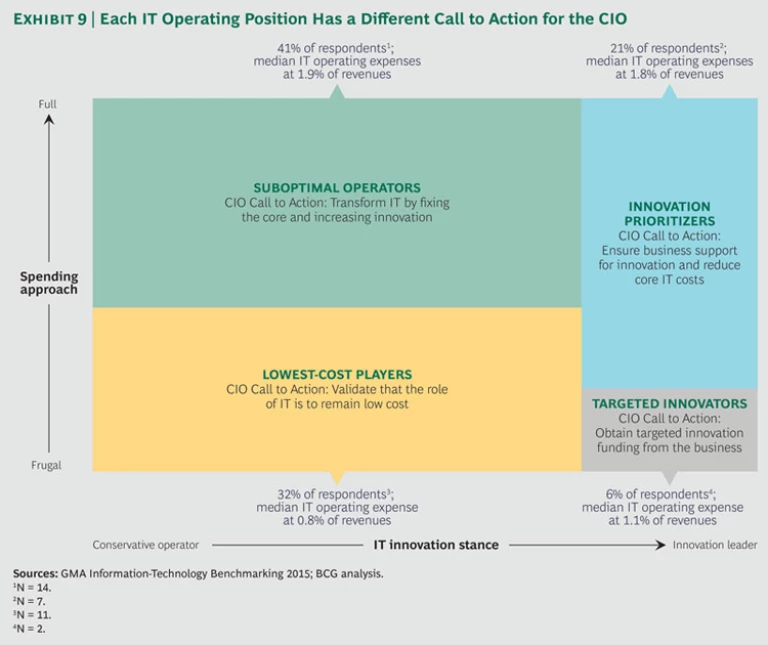

In this year’s study, frugal spenders constitute 38 percent of participants; full spenders, 62 percent. When it comes to innovation, 73 percent operate conservatively, and 27 percent are innovation leaders. On the basis of these findings, we identified four distinct operating positions, each with a different call to action for the CPG CIO. (See Exhibit 9.) On the frugal end of the spectrum, we have the “lowest-cost players” and “targeted innovators”; among the full spenders, we have “suboptimal operators” and “innovation prioritizers.”

For each of the four operating positions, we offer a set of recommendations for CPG CIOs to consider as they craft an IT strategy to meet their business needs.

Lowest-Cost Players

These organizations keep IT costs as low as possible, and the CIO is always on the hunt for savings. Cost reductions may be achieved through staffing decisions (maintaining a flatter organization with fewer managers), vendor negotiations (aggressively negotiating contracts), or technology choices (reducing infrastructure costs, eliminating redundant applications across business units, or taking calculated risks on disaster recovery).

CIOs in this operating position need to consider two things.

First, it may be that their IT costs only appear to be low because certain technology spending—such as app development or social media management—is being funded outside of IT. With the high and growing number of software-as-a-service solutions available today, business units often sign up for subscriptions or work directly with advertising agencies without involving IT.

Second, with competitors possibly doubling down and making big bets on IT, a low-cost focus, to the exclusion of other objectives, may not be strategically wise. CIOs in the lowest-cost operating position should engage their executive management on the sustainability of the low-cost position and determine whether any changes are warranted as the industry continues to change, new technologies become available, and consumer habits evolve.

Targeted Innovators

With the proliferation of new enterprise-solution vendors and the growing maturity of open-source software, low-cost technologies have become a viable option. As a result, building IT solutions in big data analytics and digital marketing is much less expensive than it was just a few years ago. For instance, instead of an expensive in-memory computing solution to deliver real-time analytics, new technologies allow companies to store transactional data in a low-cost, cloud-based repository for subsequent off-line processing and analytics. Targeted innovators are likely to adopt these low-cost solutions, while maintaining the frugal practices prevalent among lowest-cost players.

Targeted innovators need to ensure strong business support for their innovation projects. At the same time, they need to communicate the limits of this operating position. Targeted innovation based on a small amount of incremental funding can’t tackle big-bet technology investments, such as e-commerce. In addition, IT talent is an especially critical issue for this group. Expertise in new technologies does not come cheap, and CIOs should be prepared to defend payroll cost increases as well as high salaries to fill key roles.

Suboptimal Operators

Leo Tolstoy’s Anna Karenina has a famous opening line: “Happy families are all alike; every unhappy family is unhappy in its own way.” This notion holds true for most suboptimal operators. They share high IT costs and insufficient innovation, but the reasons for the high costs are legion. Companies may be dealing with the consequences of poor IT-infrastructure choices, suffering from fragmented and decentralized staffing, operating with too many disparate enterprise applications, locked into poor outsourcing arrangements, or mired in legacy systems that have not been upgraded for years.

Unfortunately, there’s no magic bullet to address unwieldy costs. Suboptimal operators—especially those with costs above the median for their cohort—would benefit from a systematic cost-transformation program addressing all areas of IT spending; such transformations typically take 18 to 36 months.

At the same time, CIOs in this operating position need to work with executive management to develop a pragmatic innovation agenda and execution plan. Some CIOs may be able to obtain an infusion of funds for innovation, but they should also be prepared to carve out funding from the existing budget.

Innovation Prioritizers

These companies on average spend the most on IT and have successful and high-profile innovation initiatives. Median IT spending for this group is relatively high for the CPG industry (1.8 percent of revenues), which means that CIOs in this operating position run the risk of being perceived as excessive spenders. They must accordingly build and maintain strong business support for their IT-innovation portfolio and ensure that it is considered a critical piece of the company’s overall strategy.

CIOs in this group also need to drive down costs from core IT operations where possible. Ongoing pruning of service levels, costs, and resource allocations will both build credibility for the IT team and free up funding for innovation.

The Road Ahead: A New Way to Deliver IT

The challenges for CIOs trying to manage IT costs while driving innovation have only intensified in recent years. Cost pressures have not decreased, yet the need for technology-driven innovation is even more urgent.

With 41 percent of companies functioning as suboptimal operators—high on spending, but low on innovation—there is much work to be done. To begin, CIOs must determine whether they are satisfied with their company’s current operating position and then engage the management team in a dialogue about how to capture more value from IT projects. Even if money is tight, CIOs can make several “no regrets” moves to improve their operating position:

- Identify levers to unlock savings if needed.

- Align with the business’s leaders on the scope of IT.

- Implement low-cost practices that foster innovation.

- Establish a SaaS agenda, beginning with the back office and moving to business-facing capabilities. (See “Next-Generation IT for Consumer Packaged Goods: Software-as-a-Service and Agile Development," BCG article, December 2015.)

- Determine where, when, and how to adopt agile development.

Although IT budgets have generally remained flat across the CPG industry, companies do not have the luxury of maintaining the status quo. CIOs must embrace new IT capabilities in order to defend their brand and market share. Those who can establish a strong operating position, while continuing to make the right no-regrets moves, will be well positioned for success.

Acknowledgments

First and foremost, we would like to thank the CPG companies that participated in the 2015 GMA Information-Technology Benchmarking Survey.

This report would not have been possible without the dedication of many members of BCG’s Consumer and Information Technology practices, including Brian Atz, Grant Beard, Akash Bhatia, Peter Burggraaff, Greg Clother, Stephen David, Aravind Elango, Ankur Jain, Shining Li, Rose Moore, Shishir Pathak, Stéphane Rouhier, Kabir Sethi, and Yana Topalova.

Our thanks go to GMA senior directors Karin Croft and Patricia Stockton. They were instrumental in helping us to collaborate with GMA’s Information Systems (IS) Committee and connect with the broader GMA membership. Special thanks are due to the members of the GMA IS committee and the subcommittee providing oversight of this project, whose members contributed their time and expertise.