What was once a niche business has become a driving force in the grocery industry. Responsible consumption (RC) brands—those that use organic, natural, ecological, local, or fair-trade claims to differentiate themselves—are booming in Europe. Even hard discounters are catering to consumer demand with pesticide-free produce and new packaged lines.

What’s more, RC products are upsetting established market shares in the industry. “A” brands—those with the high-volume, quality-oriented products that dominated most categories in the past—are now losing out. Specialty brands and retailers’ private labels are capturing the vast majority of RC sales, and their margins are rising as a result. If A brands can’t maintain their leadership in product and marketing in this surging new area, they may put even their mainstay non-RC products at risk.

Using newly available checkout data, BCG recently completed

The Boom in Responsible Consumption

To get hard facts for our study, we teamed up with IRI, the largest and most authoritative market-measurement provider in Europe. IRI provided data on sales, price per product, and product size, allowing us to understand the volume, growth, and price premiums of RC products in grocery markets.

We focused on sales in three countries—France, Germany, and the UK—that together account for 40% of the population of the European Union. And we concentrated on four popular grocery categories: coffee, fruit juice, hand and body lotions, and household cleaners. We assessed each of the thousands of products in these categories to determine whether they fit into any of the RC categories. To compute growth rates, we looked at annual sales over four years, from 2010 through 2013.

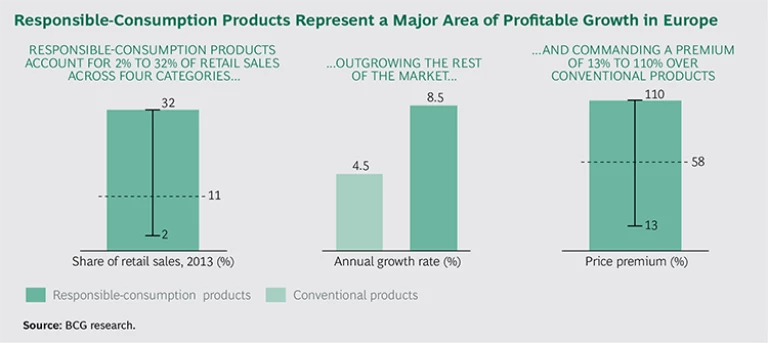

We found that in 2013, RC products accounted for 2% to 32% of total sales in the four categories, for an unweighted average of 11%. (See the exhibit “Responsible-Consumption Products Represent a Major Area of Profitable Growth in Europe.”) More important, the annual growth rate for sales of RC products was almost twice the non-RC rate: 8.5% versus 4.5%. We also found that Europeans are willing to pay a substantial premium—ranging from 13% to 110%, with an average of 58%—for RC products over conventional alternatives.

As for market share, private labels and specialized brands command the lion’s share of RC sales across the four categories: about 40% each. By contrast, A brands have only a 10% share, with the remaining 10% held by smaller, usually local, non-RC brands.

Moving into the Mainstream

RC products are moving into the mainstream in all three of the countries we studied. In France, for example, where prices for organic juice are almost double the conventional version, annual sales have grown by 15%. Retailers and specialty brands account for nearly all of these sales, leaving A brands with a mere 6%. The trend is likely to increase: a separate IRI study of French grocery sales for the year 2014 concluded that sales of organic products rose by 8% while sales of all other products were flat. That growth is remarkably broad: of the 45 grocery categories examined, 43 had rising sales for organic products, while the other two were stable.

Aldi’s experience provides a remarkable example of how RC has shed its niche origins with eco-minded and wealthy consumers. The hard discounter has invested heavily in RC for both its general brands and new organic lines. In coffees, Aldi jumped so quickly on surging demand for fair-trade and organic offerings that its stores have captured 39% of the entire German market—with a 33% growth rate. By contrast, A brands hold only 12% of the RC coffee market in Germany and realize just 9% growth.

Aldi’s push follows aggressive moves in Europe by nondiscount grocers Carrefour, Tesco, Sainsbury’s, and Albert Heijn, which carry RC versions of their private labels at a price premium of 30% to 80%. Umbrella brands, such as Carrefour Bio and Tesco Organic, can be particularly effective once a retailer has a sufficiently wide range of products. Retailers that are capitalizing on the trend and investing in RC private labels are gaining the scale to negotiate ever more-attractive deals with contract manufacturers.

In the UK, the pioneer in overall RC marketing was The Co-operative Food, which has a long-standing mission-driven commitment to local communities and fair trade. Superseding it in recent years has been publicly traded Waitrose, a high-end chain that worked to broaden its supply of organic produce and certify the origin of products bought internationally. Also helping to bring RC fully out of its niche was Sainsbury’s, one of the four big mainstream chains. Sainsbury’s saw an opportunity to differentiate itself as the “supermarket with a conscience,” and it has invested heavily in a variety of areas, most notably fair trade.

The Opportunity for A Brands

There’s still time for A brands to make up for their slow response to RC’s popularity, but they face a challenge. Consumers are buying from specialty and private labels even when the A brands offer RC product extensions. In focus groups, consumers showed greater skepticism toward RC claims by A brands than those by retailers. The A brands’ legacy of powerful positioning around conventional products may now be getting in the way of credible RC offerings. That’s especially true when a well-established brand’s attributes do not seem to support RC claims.

Successful A brand RC products have combined accurate targeting with real credibility. In some cases A brands have done this by developing new brands in-house. But the more common method has been acquisition. Rather than absorb the outsiders into existing operations—and lose their brand credibility—A brands grant their acquisitions a high degree of autonomy. That’s what Coca-Cola did with UK-based Innocent Drinks in the European smoothie market. Unilever did something similar with its Ben & Jerry’s ice cream, which had been available only in the US but now sells throughout Europe. Indeed, Ben & Jerry’s, along with other RC brands at Unilever, is growing at twice the rate of the rest of the company’s portfolio.

Sometimes A brands may be able to shift an entire category toward a responsible position. Starbucks was able to do so worldwide with its fair-trade claim in coffee, a category in which A brands have long been especially strong. The company took advantage of trailblazing efforts by specialty brands such as Cafédirect, a UK for-profit organization (set up in 1989 by Oxfam and two other nonprofits) that still holds a third of the fair-trade market.

Of course, private-label and specialty brands aren’t standing still. With continued growth, RC is likely to become a highly contested arena. Whether you manage an A brand, a private label, or a specialty brand, you’ll need to understand your category and brand realities before making your next move. What are the current RC and non-RC demands? What are the related benefits and product offerings in your target categories? What price points are acceptable, and what volumes are realistic? What are category- and country-specific consumer attitudes toward RC claims? How much credibility does your brand bring to the table—by itself and compared with competing brands? Responsible consumption is one of the rare pockets of growth in European groceries. Getting it right will be worth it.