Fixed-mobile bundles have taken off with force in countries such as France, Portugal, and Spain, where market penetration already exceeds 50%; however in other countries, such as Italy and the UK, these bundles are just emerging. To understand the phenomenon and consumers’ preferences, The Boston Consulting Group conducted a survey of household heads in 18 countries globally. Across all of these countries, consumers want the convenience and flexibility of buying fixed and mobile services from the same operator. Fixed-mobile convergence (FMC), in other words, is a global consumer trend.

Operators that fail to offer convergence to consumers will pay the price, typically by losing market share. At the same time, operators must be smart about how and what they bundle.

Simple price discounts, or what we call “stupid discounts,” are a losing bargain. They destroy value for operators and do not enhance the user experience. Although consumers ask for discounts, more than anything else, they really want fast speeds for fixed and mobile services, generous data packages, and rock-solid phone services. These are features that can be creatively bundled to generate value, both for consumers and operators.

What Consumers Want

Many insights emerged from our groundbreaking study. (See “FMC Global Insight Survey.”) Here are three.

FMC Global Insight Survey

The FMC Global Insight Survey is the most comprehensive study that BCG has ever conducted of consumer preferences and expectations for fixed-mobile convergence. The survey covers 18 countries1 globally and more than 24,000 household decision makers. In addition to the broad themes covered in this article, for each nation the survey delves into several other topics, such as those that follow:

- The awareness of fixed-mobile offerings in the market

- The reasons that consumers would switch to a fixed-mobile bundle

- The satisfaction of consumers with their current fixed-mobile bundle and the reasons they would switch to a competitor

- The level of discounts consumers expected in bundles

- The most important features parents seek in purchasing a phone plan for their children

- The number of SIM cards per household

The survey can be used to understand best practices across countries, the nuances of individual markets, and the specific challenges operators may face in introducing or revising fixed-mobile bundles.

1.The nations are Austria, Belgium, Brazil, Canada, Denmark, Finland, France, Germany, Italy, the Netherlands, Poland, Portugal, Spain, Sweden, Switzerland, Turkey, the UK, and the U.S.

Fixed-mobile bundles are popular with consumers. Regardless of how popular fixed-mobile bundles may currently be in their home country, consumers want these products.

In 13 of the 18 countries surveyed, more than 60% of household decision makers already were interested in or already had a fixed-mobile bundle. In Germany, for example, only 8% of households currently had a fixed-mobile bundle but a whopping 64% of households were interested in one. Denmark was the only country where less than one-half of the households were interested in fixed-mobile bundles.

This popularity helps explain the recent decisions by Telecom Italia and A1 Telekom Austria, for example, to follow the global trend and create fixed-mobile bundles. And it also helps explain the consolidation occurring in the European telecom market. In the past two years, for example, mobile operator Vodafone has bought fixed assets in Germany, Greece, and Spain.

The lesson for operators in relatively “immature” markets is clear: convergence is coming. As the U.S. pop star Jackson Browne sings, “Don’t think it won’t happen just because it hasn’t happened yet.”

High speeds and flat rates matter most. In real estate, it is often said that the three things that matter most are “location, location, location.” The corollary for fixed-mobile packages is fixed speed, mobile speed, and flat rates for mobile calls, according to the survey. These were the three features consumers want most. Consumers, in other words, want core telecom services more than bells and whistles.

These findings are remarkably consistent across all of the surveyed countries. High fixed-download speeds, for example, ranked first in 11 out of the 18 countries and were among the top three in 16 of the 18 countries.

At the other end of the spectrum, consumers were much less entranced with the video and content features that many operators have started to offer. For example, access to premium content, such as football, sports, and movies, ranked thirteenth overall out of 14 options and no higher than ninth in any country. The number of high-definition channels ranked twelfth overall. Apparently, consumers still prefer buying TV, video, and other entertainment services à la carte.

The least important fixed-mobile feature is the inclusion of mobile video access with a TV subscription, a feature that ranked no higher than eleventh in any country. This result is at least somewhat surprising given the amount of current attention the news media pay to mobile video offerings at present.

The features household decision makers care about most mesh closely with a new approach to bundles that we call “positive discounting.” Historically, telecom operators would combine their existing fixed and mobile plans and offer the package at a discount. The consumer did not receive any benefit other than this discount. These offers tended to result in unnecessary churn and price wars that eroded margins. Even the operators that picked up market share with fixed-mobile bundles from their pure-play competitors saw little net revenue gain.

By using positive discounts, however, operators can combine their fixed and mobile plans and avoid price erosion by limiting discounts to additional services purchased by consumers. So, for example, an operator might offer incentives for adding SIM cards, data plans, and other revenue-generating features. The idea is to make it easy and affordable for users to bring more devices, more users, and more usage onto the provider’s network.

Alternatively, operators can provide additional services to consumers for free that they would otherwise need to pay for, such as calls between members of the same household or higher download speeds. By offering such services that incur little cost, operators sweeten their bundles, with little downside for themselves.

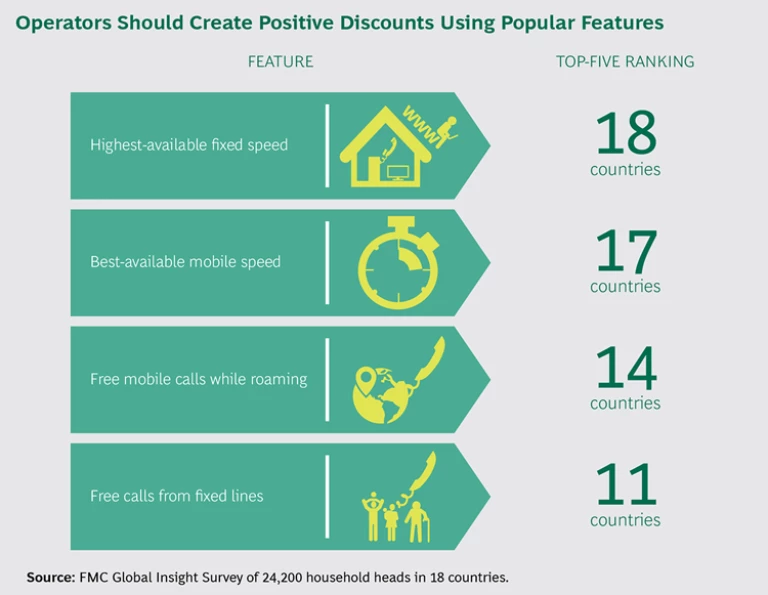

We asked survey respondents to identify the features that they would most like to receive as a freebie. The most preferred benefits were again core telecom features—the best-available fixed and mobile speeds as well as worry-free calling at home and abroad. However, not all markets are created equal, and packages need to be designed accordingly. (See the exhibit.)

In Germany, for example, flat fixed rates are an obvious choice to include in a bundle since heads of household rated it the most important feature. In most other markets, flat fixed rates are only of low to moderate importance.

Consumers prefer fixed operators. Household decision makers said they were more willing to buy a fixed-mobile bundle from their current fixed supplier than their mobile provider. Although it’s a close call in countries such as Portugal, Sweden, and the U.S., consumers in all 18 countries prefer doing one-stop shopping with their fixed, rather than their mobile, operator.

In Portugal, Vodafone has experienced this consumer preference firsthand. From the end of 2012 to the second quarter of 2015, its mobile-market share declined from 39% to 31% as it fought off fixed-mobile competition from incumbent Portugal Telecom’s MEO brand and NOS, a cable operator that acquired the number-three mobile operator in 2013.

Many cable operators in Europe are also taking advantage of this consumer preference. In Spain, for example, Jazztel, a supplier of fixed services, and ONO, a cable operator, disrupted the market by becoming mobile virtual-network operators (MVNOs) and taking share from traditional mobile operators with heavily discounted mobile offerings. ONO was ultimately acquired by Vodafone and Jazztel by Orange.

Despite consumers’ preference for fixed operators, mobile operators can still get into the fixed-mobile game. In the Netherlands, KPN has successfully rolled out two fixed- mobile brands by taking advantage of its ability to offer more mobile services and by creating attractive bundles for families, which tend to be loyal customers.

How Operators Should Respond

The survey findings suggested several likely developments—and the approaches that current operators should take. Here are three.

Consolidation will continue. Fixed and mobile operators will keep merging. These newly integrated operators will quickly offer fixed-mobile bundles. In designing these new offers, it is critical that operators focus on positive discounts rather than on stupid ones.

Fixed operators are in positions of strength, but all operators must evaluate their positioning. Fixed-mobile convergence is easy to promise and difficult to profitably deliver. Although integrated operators may have a head start, fixed players can play catch-up by becoming an MVNO. Even mobile-only providers can play a “household focused” game. Regardless of the starting point, however, operators often struggle with providing seamless sales and services across all channels, an integrated go-to-market approach, and rigorous financial and operational tracking.

Value creation needs to be at the core of fixed-mobile offerings. Recent history shows that fixed-mobile convergence destroys value when operators chase market share and engage in price wars single-mindedly. By simultaneously focusing on overall industry-value potential, the needs of the market, and internal return-on-investment benchmarks, operators can surge ahead of their less-thoughtful competitors.