Life insurers in Germany are in a bind. Their traditional products, which guarantee a return, are unprofitable in today’s low-interest-rate environment. But German consumers still demand those products; guaranteed policies account for more than half of new business in the private segment. As a result, insurers are relatively inexperienced with offerings that could help restore profitability.

We recently surveyed 1,000 German consumers to assess their willingness to experiment with risk, reward, and security. We probed their receptivity to mutual funds and other riskier offerings, and to products that provide assurances—rather than guarantees—of solid, steady, long-term performance.

German consumers, we found, prefer traditional guaranteed products but may be willing to forgo some level of guarantee for the potential of a greater reward. People under the age of 45 are more willing to invest in riskier offerings, but Germans as a whole have little appetite for products with assurances, despite the success of such products in the UK and elsewhere. Germans think of them as “half pregnant,” offering neither a rock-solid guarantee nor the potential upside of riskier products.

These findings have huge implications for German insurers:

- Guaranteed products are here to stay, so insurers need to improve profitability by trimming guarantees and radically reducing costs.

- Insurers have an opportunity to offer nonguaranteed investment products to young consumers, but competitors such as mutual funds, banks, and other asset managers have much deeper experience in this area.

- In creating new offerings, insurers need to research German consumers’ particular preferences rather than simply introducing products that have been successful in other markets. Insurers must also educate distributors and consumers about the benefits of new offerings.

- Insurers have the asset management skills, brand strength, and distribution networks to adapt to a nonguaranteed world, but they must improve their cost structures, digital capabilities, and sales force effectiveness.

The profitability of German life insurers depends on successfully navigating this unfamiliar territory.

The Big Picture

For decades, insurers everywhere have relied on guaranteed savings products, which offer the high, stable returns that appeal to people looking for good yields and security upon retirement. Those days are dwindling. Falling interest rates and rising capital requirements are forcing insurers to consider other offerings.

In some markets, nonguaranteed products have met with success. The Global Absolute Return Strategies Fund offered in the UK by Standard Life Investments, for example, sets a nonguaranteed target return of 5 percentage points above the six-month London Interbank Offered Rate. From 2008 through 2015, the fund exceeded that target each year. Assets increased from £1 billion in 2008 to £26 billion in 2015, despite annual fees exceeding 1.5% for retail investors. The fund takes both long and short positions globally and invests judiciously in derivatives to generate returns and minimize risk.

Swiss Life Premium Immo, another successful product without explicit guarantees, invests in commercial real estate in Switzerland and projects annual returns of 3% to 4% after fees. Investors, who tend to be affluent individuals over the age of 50, view the investment as an attractive alternative.

In Germany, Allianz and AXA have introduced so-called hybrid products, such as Allianz’s Perspektive, a policy that offers a lower guarantee (limited to 100% of paid premiums) in return for the potential of a higher return. The policy is yielding 0.3 points more than a traditional guaranteed product—which is respectable, given current interest rates. The insurer sold more than 130,000 of the policies from 2013 to June 2015.

Returns Versus Guarantees

Against this backdrop, we wanted to test the willingness of German consumers to move away from traditional guaranteed products. The survey found that most people approaching retirement want lower risk and a higher guarantee. But there are pockets of long-term investors who are more willing to take on risk: 23% of respondents said their primary reason for saving was to increase their wealth.

In the survey, we evaluated the preferences of consumers by forcing them to choose among products with different risk, reward, and guarantee profiles. Respondents had no access to financial advice when making their selections. The products we asked them to evaluate included the following, in increasing levels of risk and return:

- A policy that guarantees 100% of initial capital and projects returns of 2%—similar to the Perspektive policy

- A real-estate fund that invests in first-class commercial property and projects returns of 4%

- An asset allocation fund that deploys sophisticated tools, such as dynamic portfolio rebalancing and hedging, and projects returns of 4%

- A family of more than 100 mutual funds that allows customers to diversify their investments and expects to yield returns of 5%

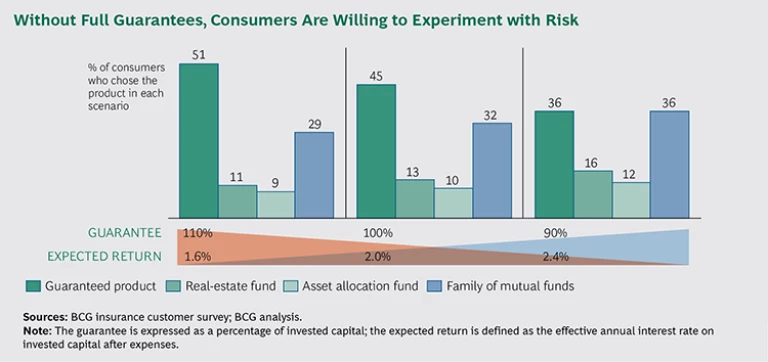

The second and third products do not offer explicit guarantees but provide a reasonable assurance of returns. Only 13% of

respondents chose the second, and 10% opted for the third, suggesting that most consumers are interested in explicit guarantees or would purchase such products only through a financial advisor.

The guaranteed product and the family of mutual funds both had strong followings: 45% of respondents chose the former, and 32% chose the latter.

We also offered different versions of the guaranteed product in order to test consumers’ willingness to forgo a portion of their guarantee in exchange for a higher return. When the guarantee was reduced to 90% of paid premiums, the guaranteed and fund family products were equally popular—each had a 36% share. (See the exhibit, “Without Full Guarantees, Consumers Are Willing to Experiment with Risk.”)

Brave New World

German insurers are entering a new world. As long as interest rates stay low, the traditional fully guaranteed product will be under siege. Guarantees in life insurance are not dead, but they cannot survive in their current form. They are too generous and too costly.

The good news is that Germans want to save for the long term. For more than 50% of survey respondents, a long-term goal, such as retirement or wealth creation, is their most important savings goal. To serve those consumers, however, insurers must understand their needs, segment product offerings, and create new distribution models.

Guaranteed products and plain-vanilla mutual funds are relatively simple and address the needs of knowledgeable consumers. They should be delivered not through agents or financial advisors but directly through digital, self-help, or automated channels. Those new channels can also improve the customer experience, especially for younger people.

More-sophisticated products, especially those that play with various risk-return profiles, require more education for consumers. They need to be delivered through more-expensive advisory channels. But even in this segment, distribution costs must be watched closely.

Insurers need to improve the effectiveness of their sales force and adopt more efficient multichannel approaches. In doing so, insurers must distinguish between the cost of the advice customers require and the operational inefficiencies of the agent network. (See “The Recipe for Success.”)

For insurers used to working through commission-rich networks of agents and financial advisors, the transition will not be easy. This is unfamiliar territory. The German insurers that are excited rather than frightened by the landscape will prosper.

THE RECIPE FOR SUCCESS

To restore their profitability, German insurers should focus on three areas:

Customers’ Needs. Design products that appeal to people on the basis of their age, wealth, guarantee preference, and channel preference.

Distribution Capabilities. Develop a network of agents who understand how to educate consumers about new insurance products; build direct digital channels to deliver simple products and products for informed consumers.

Cost Control. Limit guarantees, sales commissions, and operating expenses to sustain product profitability.

That finding suggests several opportunities for insurers. First, they can improve the profitability and attractiveness of guaranteed products, as Allianz has done with Perspektive. By lowering guarantees, insurers reduce the capital intensity and improve the potential return of those products. Second, in a world of lower guarantees, insurers can broaden their appeal by offering riskier products, such as the fund family. Third, they can take advantage of flexibility in product design to create an offering that lets customers choose their own levels of guarantee and risk.